Once flush with cash, the oil-rich kingdom of Saudi Arabia is now making several moves to diversify its economy — all part of an effort to combat the budget deficit through cuts to spending and energy subsidies as well as sharp increases in fees and taxes.

In recent trips to Asia and Washington, D.C., Saudi royals have worked to woo global investors emphasize economic diplomacy. In May, when the country hosted U.S. President Donald Trump, it announced a $20 billion investment into infrastructure, most of which would be in the U.S.

Further diversification will come via the hotly anticipated Aramco IPO. As part of the Saudi royal family’s recently announced Vision 2030 plan, it will sell shares in Aramco, the state oil company, on international markets. In addition, the billionaire Olayan family is also planning a sale of some local assets, which could be worth as much $5 billion on the Tadawul exchange.

The country is making bold moves, but current macroeconomic conditions ensure it won’t be completely smooth sailing ahead. Below, we examine the challenges and opportunities facing restaurant operators in the KSA in the months ahead:

THE IMF REVISES GROWTH FORECASTS

Recently, Saudi has embarked on an ambitious program to reform its economy. In addition to reining in lavish spending, the country is looking for new sources of funds — in the form of a VAT tax and resources from non-oil investments.

Though the International Monetary Fund had previously predicted Saudi’s GDP growth to be 2%, the IMF revised its forecasts in April, predicting gross domestic product to expand 0.4% in 2017. The revised forecast reflects cuts in government spending, as well as the impact of lower oil production, a downward trend in consumer spend, and an upward adjustment in taxes. The result is that non-oil growth won’t be as strong as it was during periods of strong oil prices.

The IMF remains upbeat about its forecasts for the region, but has cautioned Saudi against tightening its fiscal policy too fast. In May, the lender said rapid cuts to the government’s budget deficit could serve to further damage the economy. Riyadh had pledged to eliminate the $79 billion deficit by 2020, undertaking severe austerity measures last year that affected the take-home pay of two-thirds of working Saudi nationals.

The strategy appeared to work, for a time. The deficit shrank 71%, to $6.9 billion in the first quarter of 2017. However, the austerity measures massively slowed growth in the non-oil economy, to nearly zero. In April, after reports of civil unrest, King Salman bin Abdelaziz reversed the contentious austerity measures and reinstated benefits to civil servants and military personnel.

CONSUMERS ARE STILL CAUTIOUS

The poor economic conditions of 2016 caused a wariness among Saudi consumers, a trend that was particularly pronounced in the F&B and Restaurant & Hotel sectors. In the first quarter of 2017, however, sales recovered — growing 10% and 15%, respectively.

Due to the weak economy, sales have plateaued and the average check has decreased sharply. any seem to be eating at home rather than venturing to restaurants, as grocery spend is outpacing restaurant spend. So far in 2017, the average check at restaurants and hotels is 6% lower than the average grocery check.

Stocks didn’t fare much better. In the first quarter of 2017, no restaurant and consumer stocks saw an increase in price. The Tadawul, however, is at higher levels than it was this time last year (having seen a 25% gain since September 2016) but most of the improvements took place in the final months of 2016.

RESTAURANTS HAVE TURNED TO DISCOUNTING

It appears that some restaurants and hotels have turned to discounting in an effort to combat the slowdown in consumer spend. Since December 2015, Food at Home became 4.6% cheaper in the KSA, while Restaurant and Hotel prices became 1.7% cheaper. Lower prices can also be attributed to a stronger U.S. dollar.

THE IMPACT OF NEW LAWS REMAINS UNCLEAR

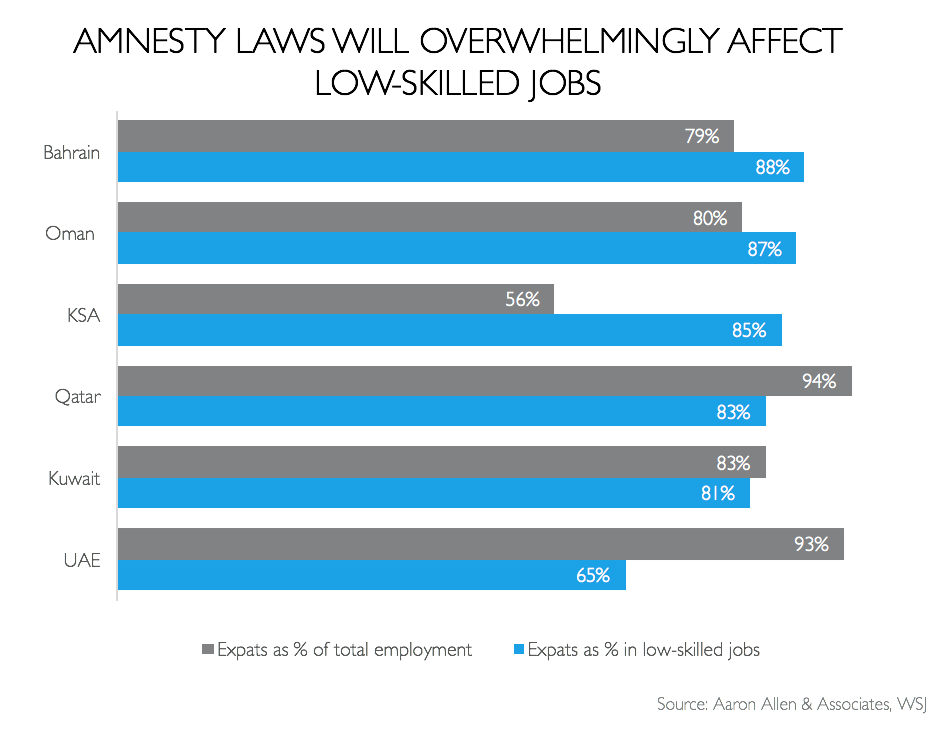

Saudization — the replacement of foreign workers with Saudi nationals in the private sector and the official national policy of the Kingdom — remains a challenge for many businesses in the region, especially those employing low-skilled workers. Overall, nearly 8 in 10 employed workers in the KSA are expats and 85% of those working in low-skilled jobs are expats.

Companies currently pay a levy of SR200 per month per expat employee, but only for those expat employees that exceed the number of Saudi employees. An “expat levy” (to be phased in by 2020) is expected to raise labor costs for restaurants and hotels, and will bring charges of up to SR800 per worker.

Additionally, beginning in March, the country unveiled an amnesty law. The law allows illegal workers to solve their status by approaching the Passport Departments to gain an exemption from the consequences associated with the “deportee fingerprint system” and return to the Kingdom on the condition of pursuing legal methods to gain entry. Amnesty will largely impact low-skilled jobs, like those in the restaurant industry.

Another law expected to directly impact restaurants is the forthcoming soda tax, which aims to curb obesity levels in the kingdom. Saudi Arabia is set to to implement a 50% tax on soft drinks and 100% tax on cigarettes and energy drinks, as of the second quarter of 2017.

SALARY INCREASES SHOULD HELP BOOST THE ECONOMY

Interestingly, the impact of lower oil prices and reduced public spend haven’t been quite as detrimental as many had projected. In fact, most employers are planning for salary increases. A GCC-wide survey of 600 companies found that workers in the Kingdom are expected to get a 4.9% salary increase this year — the highest in the Gulf region.

THERE REMAINS OPPORTUNITY IN THE TOURISM MARKET

There’s been a surge in projects geared toward tourists as of late. There are currently 48 hotel projects underway in Riyadh and 170 hotel projects underway in the KSA, for instance. Still, there’s room for continued growth in the region’s tourism sector. Currently, Food and Beverage tourism spend per visitor currently comprises about 14% of the spend in Dubai and 32% that of Abu Dhabi.

RETAIL CONSTRUCTION CONTINUES TO BOOM

Saudi’s retail sector has been a massive success story in the region. Despite the economic downturn, the KSA’s young population has continued to spend. Add to this the growing population (27 million, 20 million of which are Saudi) and developers continue to see opportunities in the region. So much so, in fact, that in Riyadh, hotel and retail rents are falling due to an increase in the supply of space available for rent.

Overall, growth is expected to pick up in 2018. The IMF forecasts Saudi growth to rebound to 2.3% in 2018 — lower than the lender’s October projection of 2.6%, but still moving in the right direction.

* * *

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 68 countries. Collectively, his clients around the globe generate over $100 billion annually and span six continents and more than 100 countries.