Finding the ideal ratio of franchised to company-owned stores comes down to weighing the benefits and challenges of each path against an operation’s goals. Corporate locations increase revenue, as all sales go directly into the general coffers, but they come with lower margins and higher CAPEX costs. Franchising reduces owned revenue, replacing sales with increased cash flows from franchisee fees, but it moves the costs of maintenance and upgrades off the company’s ledgers and can increase earnings per share.

Fortunately, two of the largest quick-service chains in the world are in the process of refranchising many of their locations, giving us a handy case study for digging into the effects franchising has on restaurant’s earnings per share and revenue.

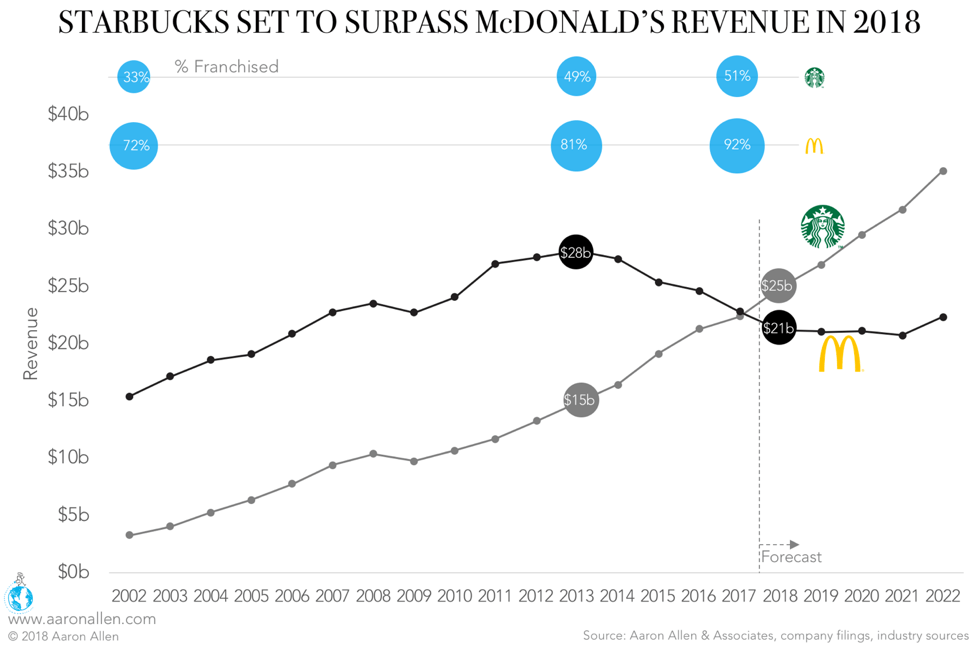

Starbucks Set To Become Highest-Revenue Publicly Traded Foodservice Company

McDonald’s and Yum! Brands (which owns Taco Bell, KFC, Pizza Hut, and WingStreet) are currently transitioning to asset-light (franchise-heavy) business models. Yum!, which had a 77% franchise rate in 2015, is aiming to reach 98% by the end of 2018. McDonald’s, which had a higher percentage of franchise locations in 2015 (81% worldwide), is planning to hit 90% franchised this year.

In contrast, Starbucks has maintained a steady, almost half-and-half mix of company-owned and licensed locations. Consensus projections show the coffee chain will surpass McDonald’s revenue in 2018.

Starbucks’ executive team expects revenue growth over the next two years to reach almost a 10% CAGR, largely as a result of its approximately 2,300 net new locations across the globe. Meanwhile, the company is acquiring full ownership of its joint venture in East China while converting its Taiwan and Singapore markets to fully licensed operations.

These projections depend on steady same-store sales, but revenue growth has been decelerating in recent years, from 17% in 2015 to 11% in 2016 and just 5% last year. Therefore, the projected 9.81% two-year CAGR of sales may be overly optimistic.

In contrast, McDonald’s and Yum! Brands have topline pessimistic outlooks for 2019 and 2020, largely explained by their refranchising efforts. When sales are replaced by rent and franchise fees, revenue decreases but is more stable over time. Franchising can also produce sizeable lump sums: for example, when Yum! refranchised 828 KFCs, 389 Pizza Huts, and 253 Taco Bells last year, it collected pre-tax proceeds of $1.8 billion.

McDonald’s business transformation is larger than just refranchising. Under the expert leadership of Steve Easterbrook, the chain has launched initiatives designed to boost the chain’s profit margins and same-store sales, including all-day breakfast, the $1-$2-$3 value menu, mobile ordering and delivery, and the experience-of-the-future (EOTF) program.

Franchising Boosts Earnings Per Share

In contrast to its -3.9% CAGR revenue projection, Yum! Brands has the most optimistic earnings-per-share forecast of these quick-service chains, with an expected growth rate of 18.24% CAGR from 2017 to 2020.

Just as its diminished revenue comes from the franchising project, so too does its high projected growth. Yum! is using proceeds from its refranchising effort to buy back shares, thereby boosting earnings per share. Over the long-term, a franchised model will improve the company’s margins because it will no longer be responsible for the capital and operating expenses necessary for company-owned locations.

McDonald’s has projected comparatively low earnings-per-share growth over the next three years, at 10.46% CAGR. While refranchising will boost margins, the gains might be offset by increasing labor costs. Also, because McDonald’s is much larger than Yum!, the project will take longer and require more investment to successfully materialize.

McDonald’s has also been buying back shares (12% of its stock between 2016 and 2017), but this is not expected to continue consistently in the future.

Starbucks has more conservative earnings-per-share growth projections: 16.9%, 10.4%, and 12.4% in 2018, 2019, and 2020, respectively, coming out to 13.2% CAGR over three years. We can attribute this slower growth to the company’s aggressive expansion, which could squeeze margins.

Historically, Starbucks EPS projections have closely matched reality: in 2015, 2016, and 2017, expectations were within a percentage point of actual growth.

Interestingly, for McDonald’s and Yum! Brands, experts have consistently underestimated growth: last year, actual growth for Yum! was 11.24% higher than consensus projections. But overall, McDonald’s has consistently achieved the highest EPS relative to its peers with an overall upward trend.

These figures demonstrate that the debate between maintaining company-owned locations and franchising is ultimately a question of priorities. Starbucks’ primarily corporate stores are producing excellent revenue growth, but its margins are tighter, especially as it expands into new markets. In contrast, Yum!’s story underlines the positive effect franchising can have on shareholder value: an almost 20% CAGR over three years is a very attractive stock option.

In this, as in many questions about the restaurant industry, there isn’t just one right answer. The challenge isn’t finding one perfect way, but rather understanding the complexities that come with large chain operations and weighing paths forward against an organization’s goals.