The new normal in the GCC is unsettling.

Collectively holding their breath through the hardships that have beset regional operators beginning in Q4-2015, stakeholders and shareholders alike are growing ever more concerned about when their organizations will bounce back from famine to feast. Slumping sales and falling margins have shaken confidences.

To cope, many organizations are hiking prices, shrinking portion sizes, and putting off necessary repairs and investments. The percentage of revenue that would typically be allocated for marketing and maintenance (3% and 1.5%, respectively) is instead used to prop up the falling rate of profit. These developments testify to the incredible uncertainty and caution in the air.

Adding to this anxiety, leaders are watching their social media feeds fill up with photos of grinning restaurant employees. This corporate version of the Instagram illusion makes it seem like only a few systems are suffering. But these snapshots represent a concerted effort to put happy faces on a difficult situation.

In truth:

- Same-store sales have fallen between 5% and 20% for many operators (though our clients are typically posting increases of 5%–10%)

- Margins, once comfortably above 20%, are falling as a result of growing labor and occupancy costs

- Food prices have been low — though not low enough to offset labor and rent — but they will begin to rise as the price of oil rebounds

- Many operators have successfully negotiated rent reductions in mall locations, but these rates will likely increase as new developments open

- Chains’ strength and market share are increasing, stealing guests from independent restaurants

Beyond these facts and figures are nuanced implications about where the HORECA industry has been and where it’s headed. Our research, combined with ten years’ experience in the region, has shown that at least half of the downturn in performance can be blamed on changes in the market. The other half comes down to mismanagement. Unfortunately, many leaders only seem willing to accept and address the half outside their control. These operations are suffering from a few shared misperceptions:

Stuck in the Past

Stuck in the Past

Change Is Great... You Go First

Change Is Great...

You Go First

Safe Hands, Not Smart Hands

Safe Hands, Not Smart Hands

While the challenges facing the foodservice industry in the GCC are more complex than regional operators have had to deal with in the past, the right strategies can put them on the path for long-term, sustainable growth (check out our Middle East Restaurant Growth insights).

Margins in GCC Decline but Remain Higher than Global Average

It’s time both investors and executive management teams come together to discuss how to optimize their operations in light of the new normal.

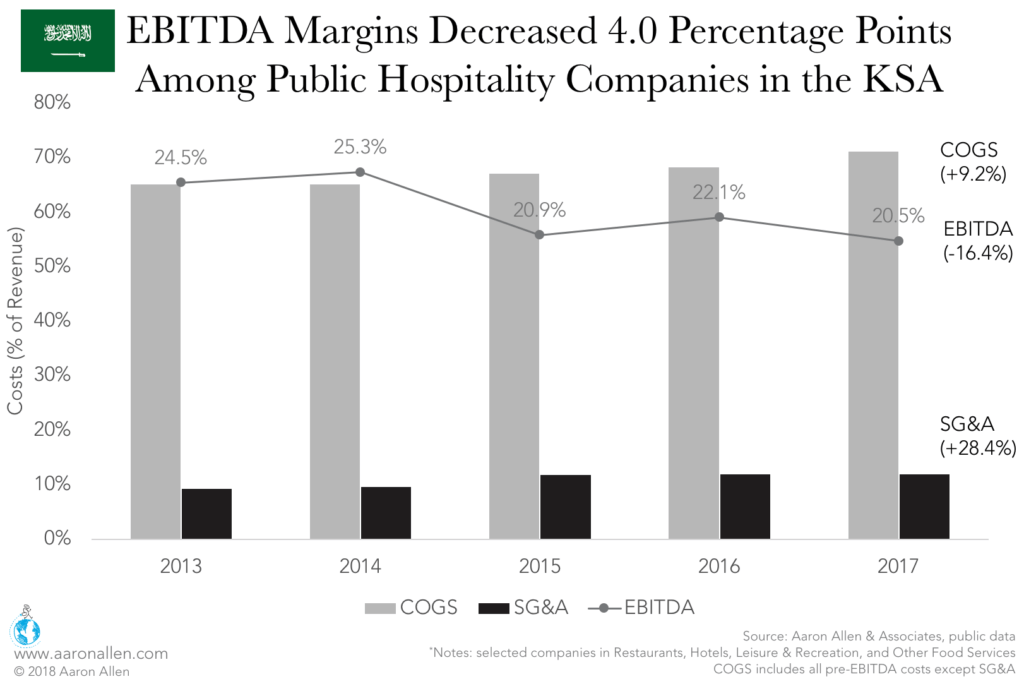

Once, EBITDA margins in the mid- to high twenties were not only frequent, they were expected. No longer (and this has led to disillusionment and an understandable but unnecessary despondence).

Once, EBITDA margins in the mid- to high twenties were not only frequent, they were expected. No longer (and this has led to disillusionment and an understandable but unnecessary despondence).

While MENA may have the fastest falling margins among major foodservice economies around the world, it’s still performing at high levels. Saudi restaurants averaged 20.5% EBITDA margins in 2017 while publicly traded restaurants in the U.S. claimed just 13.3%.

Macroeconomic Conditions Making It Harder to Grab Top-Line Growth

Between 2000 and 2015, GDP growth in the GCC averaged 5.1% annually. This rapid expansion allowed restaurants to capture large revenue growth and margins. However, as growth moderates — GDPs are forecasted to increase by an average of 2.5% until 2023 — disposable income will follow suit. Organic revenue growth through same-store sales won’t come as easily as it did before.

By 2020, the foodservice market in the GCC is projected to add $12b total (~$4b annually). Just under a third of that growth (31%) will go to new units, 5,500 of which are expected to open in the next three years. Another 65% is expected to go to incremental growth, putting same-store sales at 5.1% CAGR.

This may be a conservative estimate, as it doesn’t take into account growing tourism numbers or changing demographics. When considering the anticipated — and desired — increase in visitors, the foodservice market could add an additional $6.4b by 2020. Likewise, the GCC has a very young population: 6.9% are currently between the ages of 15 and 19, likely still living at home with parents. As these young people go to college and start careers, their food consumption patterns will have an incredible impact on the restaurant industry. Young Americans from the same age bracket dine out 20% more than any other age group. If GCC youth share this preference, correctly positioned chains could take advantage of massive growth opportunities.

The macroeconomic forces that are transforming the GCC economies will challenge — and hopefully motivate — foodservice executives. For some, it will feel like the slow, painful end to a boom period, but, for inspired leaders, it will mark the beginning of a more stable future, opening opportunities to win bigger with a more savvy and strategic approach.

Oil Price Declines Tightening National Budgets

The Q4-2015 drop in oil prices has had a profound impact on the region. On the one hand, the 36% decline in price per barrel between January 2015 and 2016 highlighted the urgency of each nation’s economic diversification programs. On the other, it cut into the budgets regional governments had allocated to complete such ambitious initiatives.

As a result, many nations now face deficits. In 2016, the KSA’s deficit reached 17.2% of GDP, but it has since improved to 8.9%. Though oil prices are rebounding — projected to stay above $70 per barrel for 2018 and 2019 — it won’t be enough to cover government spending. According to the IMF, the KSA will need oil prices to reach $88/barrel to break even.

To raise funds, GCC nations have cut subsidies and imposed new taxes. In June 2016, they agreed to implement a 5% Value Added Tax (VAT) on all goods and services and levied specific “sin taxes.” (Among the initial targets, the foodservice industry will feel the effects of the 100% tax on energy drinks and 50% tax on soft drinks.) In the KSA, government non-oil revenues grew by 49.2% in the first half of 2018 (compared to a year before). Most of that growth (83%, or 40.7 points out of the 49.2) is explained by the contribution of taxes on goods and services, including the VAT, “sin taxes,” and oil product fees.

National Leaders Responding to Downturn by Investing in Economic Diversification

Despite these challenges, regional leaders are investing in projects aimed at reducing their nations’ dependence on oil. For Saudi Arabia, much of the growth in the non-oil segment of the economy will come from tourism. The introduction of non-religious visas, the entertainment city Qiddiya, and the end of the ban on movie theaters also offer foodservice operators incredible opportunities.

The UAE has also enacted legislation designed to spark economic growth. In June 2018, it announced reforms (and a $13.6b spending package) that include new residency rules for expats, reductions in electricity fees for factories, and the introduction of 100% foreign-owned companies across sectors.

Across the region, leaders are working to diversify their economies, increase employment and investment opportunities, and push the region into the future. Here are three ways they are changing the business environment:

1. Encouraging Foreign Direct Investment

Many of the reforms GCC governments are introducing are aimed at attracting foreign direct investment. All nations allow up to 100% foreign ownership in certain zones and sectors, and at least 49% foreign ownership across the economy. As of 2017, the UAE had FDI for $10.3b, representing 2.7% of current GDP, and having grown 15% over the previous year.

This increasing openness makes the region more attractive to global restaurant chains and operators, which could pose a threat to domestically owned businesses. New competitors, who may have been studying the market for years in anticipation of such a change, could come out of nowhere, quickly establishing themselves thanks to strategic acquisitions. Western chains may begin directly entering these countries rather than relying on local franchisees; some may even acquire domestic concepts.

2. Building on Strong Tourism Numbers

Many GCC governments are making big infrastructure investments to increase their international tourist numbers. The KSA is expanding both the Grand Mosque at Mecca (to hold 2.5 million worshippers) and the King Abdulaziz International Airport in hopes of welcoming more religious tourists throughout the year. Other projects, like Qiddiya, will attract non-religious visitors. Overall, the Kingdom expects to welcome 30 million tourists annually by 2030. UAE’s Expo 2020 is projected to bring in 17.5 million people, and the country is building hundreds of new hotels (213 to be exact) in order to accommodate the visitors. In Oman, a $35b tourism plan aims to grow tourism to 11.7 million annual visitors in 2040, a 350% increase of 2015’s 2.6 million guests. Focusing on cultural and natural attractions, Oman will likely do well among millennial tourists, who value experience over luxury when they travel.

While the number of visitors is expected to increase substantially over the next five to ten years, these increases will be concentrated in particular areas — and in some instances in specific periods of time — rather than spread evenly throughout the region. For example, those who attend Expo 2020 will spend most of their time — and money — in Dubai. Meanwhile, Abu Dhabi has set its sights on high net worth individuals from China, aiming to attract 600k Chinese tourists annually by 2021, a 265% increase from 2016. A growing number of Indian Muslims are traveling to Mecca for Hajj peregrination.

Foodservice expansion and development plans can get ahead of these developments by zeroing in the cities (and even neighborhoods) most likely to see an influx of visitors. As these new groups of tourists arrive, they will bring with them very different expectations for dining-out experiences. Capturing these traveling guests will require some careful planning backed by solid market research.

Would you like to learn more about how we help clients in the Middle East?

3. Creating a More Independent, Sustainable, and Healthy GCC

As of 2016, the GCC relied on imports for the vast majority (90%) of its food supply. Some projections say that the cost of these imports will double by 2020, reaching $53.1b annually as a result of population growth and climate change. Governments in the GCC are making large investments in hopes of replacing these imports with locally grown food. In July 2018, the KSA’s Ministry of Environment, Water, and Agriculture announced a $200m organic farming plan. The first commercial vertical farm opened in Dubai in late 2017, and a second will launch in Jeddah in 2020.

A move away from import-dependent markets can reduce costs, improve food safety, establish secure supply chains, and keep more consumer spend within the national economy. Further, food independence will have positive effects on health in the region. Obesity rates are going up across the GCC, with more than 30% of residents classified as obese in 2015. The rate of preventable, type 2 diabetes hovers around 20% of the population in the UAE, KSA, Bahrain, Kuwait, and Qatar. These nations all rank among the top 15 countries globally for diabetes per capita. Adding more locally grown food to residents’ diets will improve health outcomes.

While it will likely take five to ten years for these projects to bear fruit — literally and figuratively — they represent incredible investment opportunities for forward-looking foodservice operations — and others — both regionally and internationally.

Rising Costs Contributing to Margins Squeeze

Foodservice operations are facing many of the same challenges as their nations: the downturn in oil prices has cut into their revenue, and costs are continuing to rise.

The three biggest expenses on any restaurant operation’s income statement are food, labor, and occupancy. While food and occupancy costs are fluctuating (favorably of late), the price of labor is going up, especially in nations working to nationalize their workforces.

Food Costs Falling but Will Follow Oil Prices

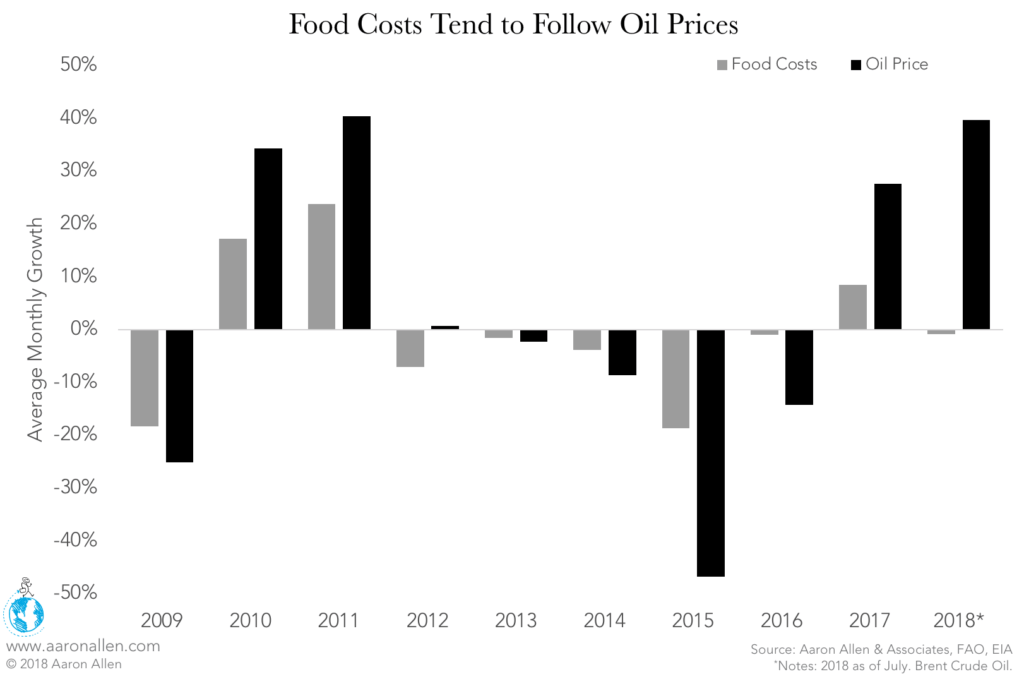

In eight of the last nine years, food costs globally have moved in the same direction as oil prices: rising alongside the price per barrel in 2010 and 2011, then falling (albeit less steeply) in 2015.

In eight of the last nine years, food costs globally have moved in the same direction as oil prices: rising alongside the price per barrel in 2010 and 2011, then falling (albeit less steeply) in 2015.

In 2017, food costs rose slightly, but, in 2018, they’ve fallen behind, with oil prices climbing 40% so far and food prices stagnating. These lower food costs have been offset by rising labor and occupancy costs.

Labor Costs Are Rising

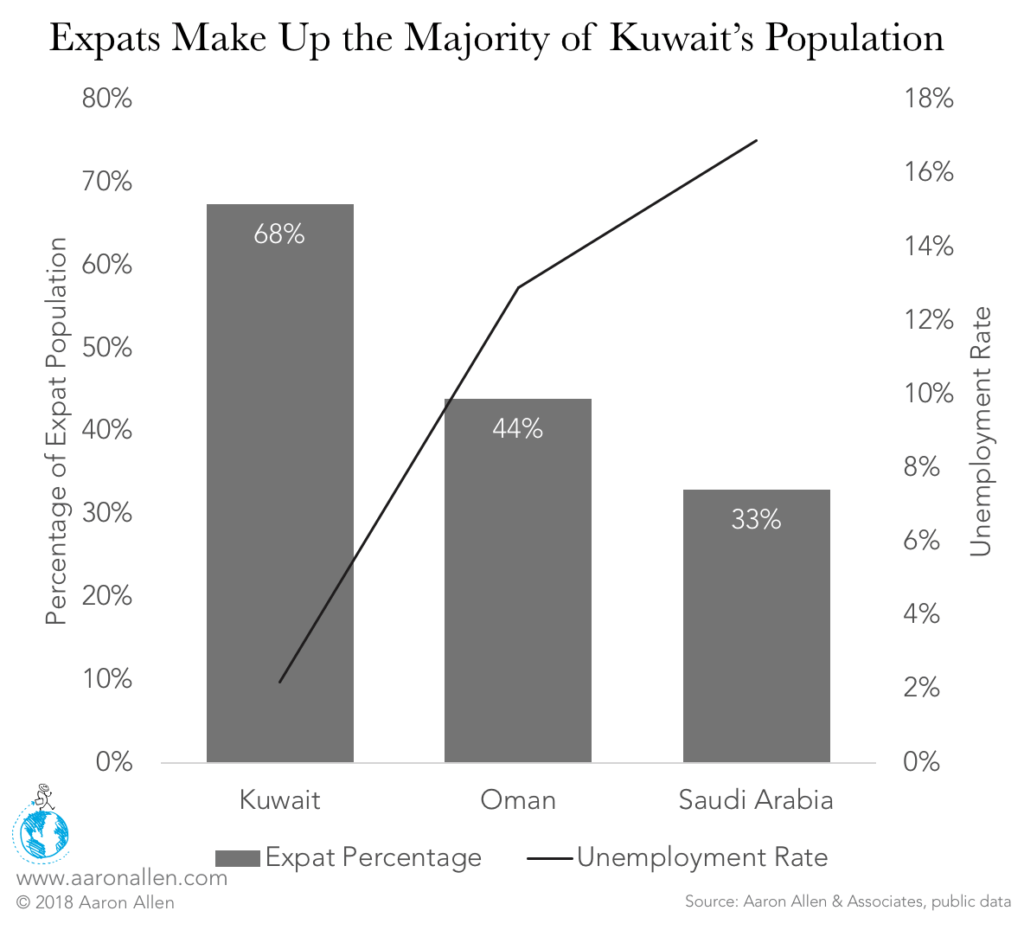

As several GCC nations continue to work to nationalize their workforces and address unemployment, the governments of Saudi Arabia, Oman, and Kuwait are implementing several initiatives to make it less attractive for companies to hire expats.

While reducing the number of expats should decrease unemployment among citizens, it will also raise labor costs. In the KSA, average wages in the private sector have increased every year since 2009. Between 2015 and 2017 the average annual increase was 4.6%. These increases are more expensive for Saudi nationals, whose minimum wage is SR5,300 ($1,412) compared to SR2,500 ($666) for expat workers. Oman has no minimum wage for expat workers, but nationals must earn at least OMR 325 ($844) a month.

While reducing the number of expats should decrease unemployment among citizens, it will also raise labor costs. In the KSA, average wages in the private sector have increased every year since 2009. Between 2015 and 2017 the average annual increase was 4.6%. These increases are more expensive for Saudi nationals, whose minimum wage is SR5,300 ($1,412) compared to SR2,500 ($666) for expat workers. Oman has no minimum wage for expat workers, but nationals must earn at least OMR 325 ($844) a month.

As a result of these changes, an estimated 730,000 non-Saudis have left the KSA’s workforce, which not only cuts into restaurants’ labor pool but also affects their revenue. For expats, average spend on food away from home is $500 per capita, so 730,000 fewer expat workers could translate into as much as $365m in annual lost revenue for restaurants. In Kuwait, which is calling for the exit of one million expats, the foodservice industry can expect an even larger impact on revenue.

Rent is Coming Down, at Least for Now

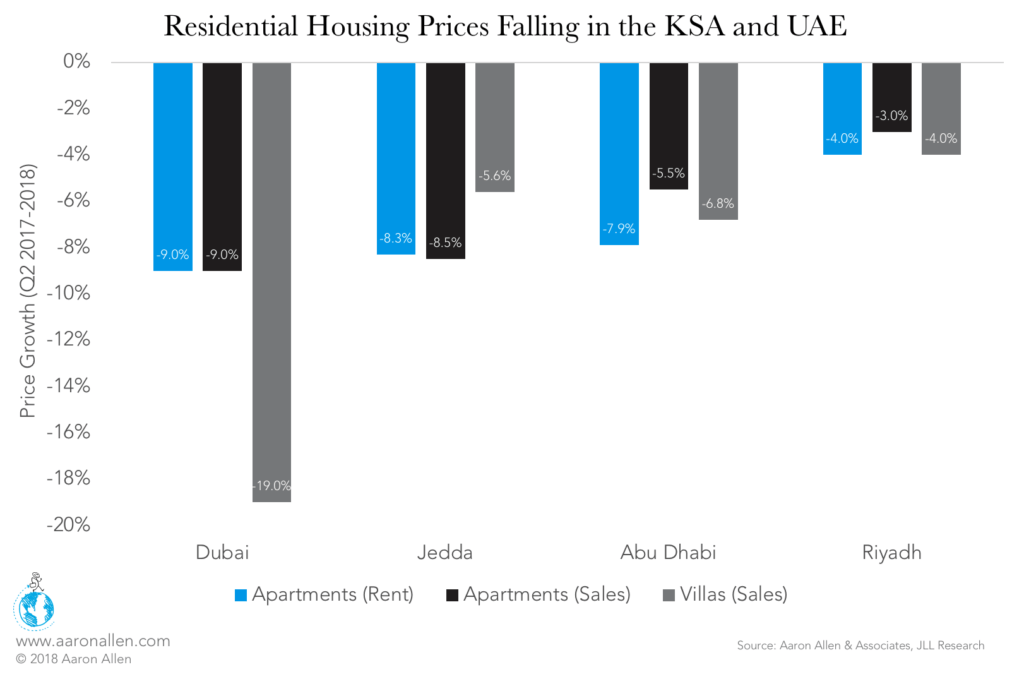

Restaurants will benefit from falling housing costs: as both rent and sale prices drop, consumers will have more to spend on dining out.

Restaurants will benefit from falling housing costs: as both rent and sale prices drop, consumers will have more to spend on dining out.

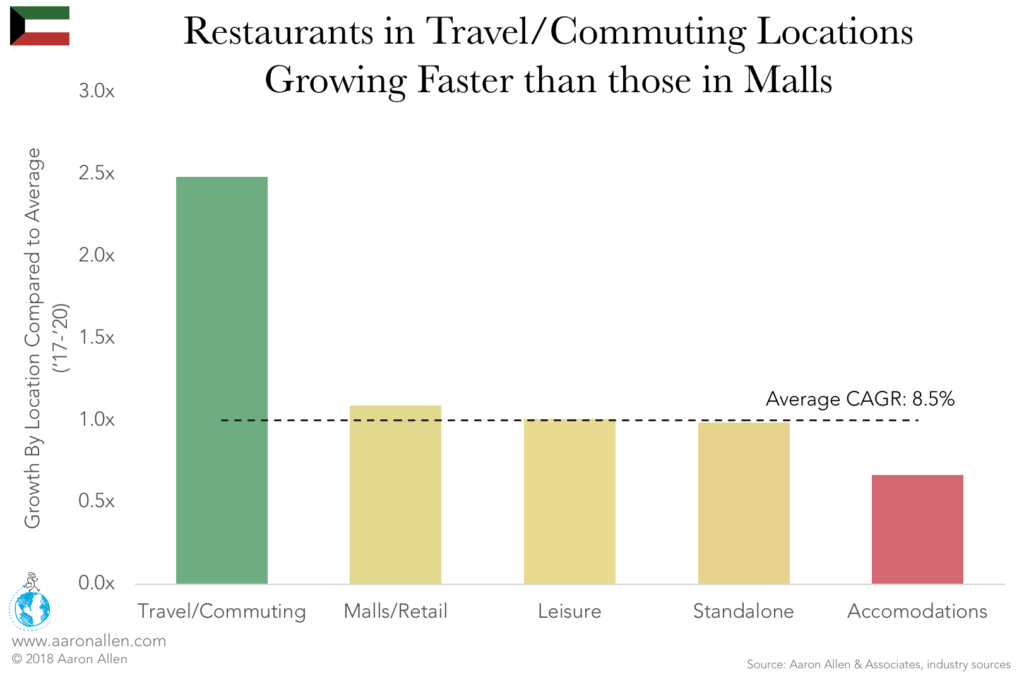

Commercial occupancy costs have also come down, but not because of increased supply or reduced demand. Rather, restaurants, retailers, and other mall tenants have pushed back against the exorbitant prices.

Two developing trends will impact rent prices in malls over the next decade. On the one hand, convenience is becoming a stronger driver of consumer behavior than the mall experience, so we expect to see these locations become less popular among foodservice operators. (See “Think Outside the Mall,” below.) But, as Gen Z becomes a stronger force in the market, the demand for mall space may once again go up. Despite being digital natives, these young people are reviving brick-and-mortar retail: though they rely on their smartphones to connect with influencers and to research products, many are as hesitant as baby boomers to buy something without seeing it in person.

Potential Paths to Increased Revenue

In developed markets, growth in foodservice typically mirrors increases in GDP, population, inflation, and disposable income. In emerging markets like the GCC, many more factors can play a role in the size of the pie — and who gets the biggest slice.

Consumer Spend Per Capita on the Rise

Growth in GDP per capita is expected to accelerate in 2018, which means more money in more people’s pockets — some of which is destined for restaurants.

Growth in GDP per capita is expected to accelerate in 2018, which means more money in more people’s pockets — some of which is destined for restaurants.

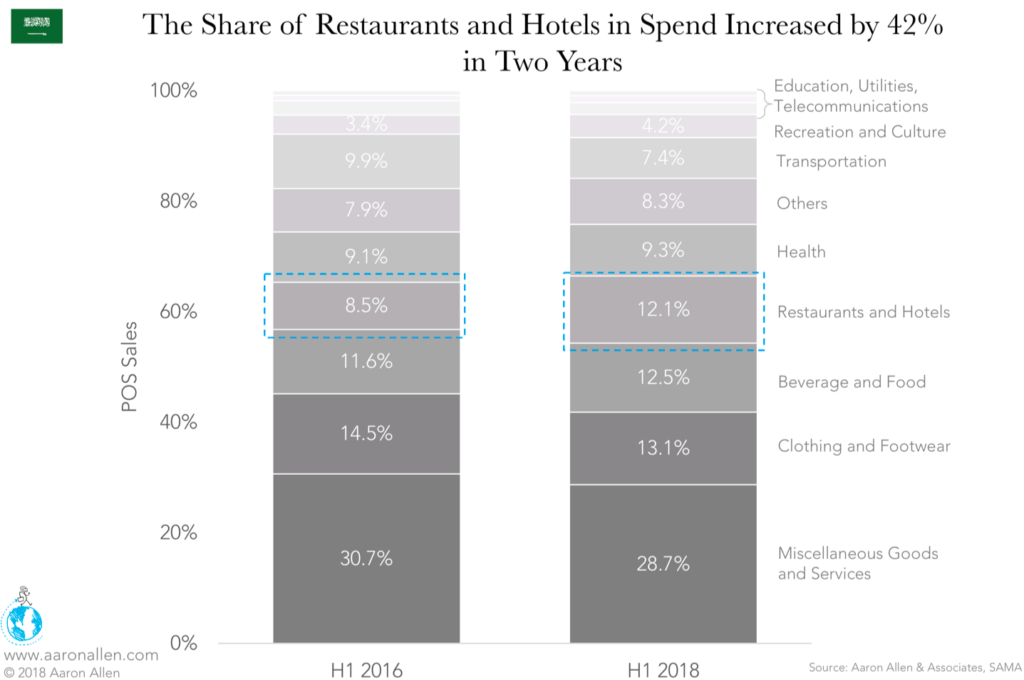

Based on credit-card transactions, restaurants in the KSA are claiming both a greater share and a greater amount of consumer spending. In H1-2018, restaurants and hotels received 12.1% of consumer discretionary spending, a 42% increase in share when compared to the same period in 2016.

Chains Gaining Strength, Cannibalizing Less Sophisticated Independents

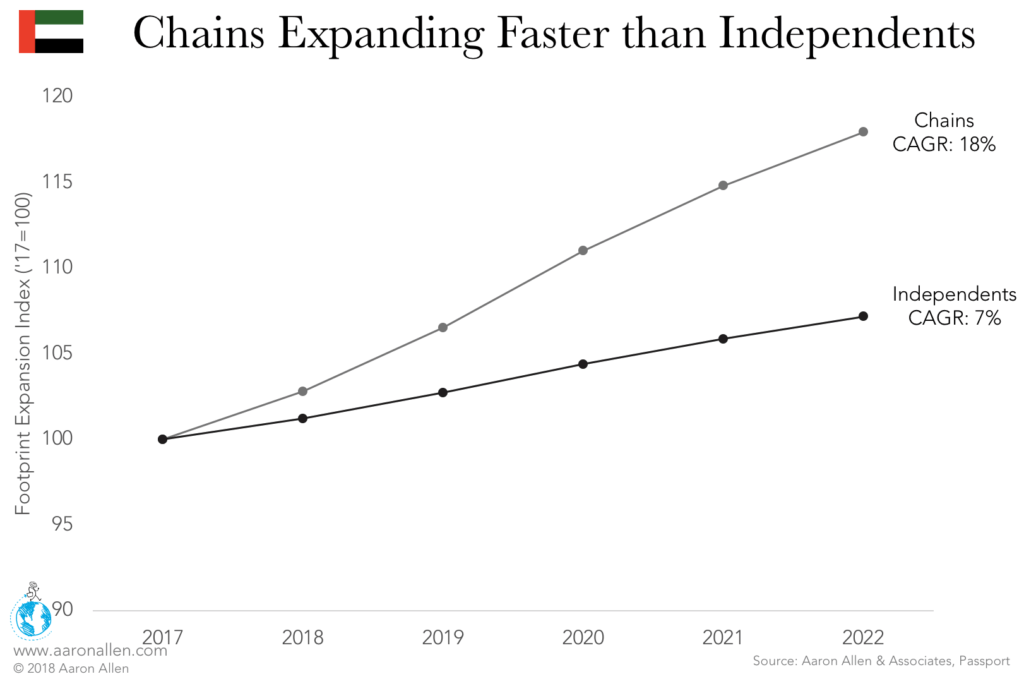

In both the UAE and KSA, independents account for about 80% of restaurants. However, chains are expanding much faster, growing their footprints 2.3x as fast as independents. Of the 5,500 new units projected to open by 2020, chains will claim 40% of the growth, taking about 900 potential new units away from independent operators. Chains are slowly but surely shifting the weight of the industry in their direction.

During this period of growth, the players that make the smartest investments in technology, complete strategic acquisitions, and build systems that satisfy shifting competitive and consumer trends won’t just steal market share from independents, they will also cannibalize competing chains that can’t keep up.

During this period of growth, the players that make the smartest investments in technology, complete strategic acquisitions, and build systems that satisfy shifting competitive and consumer trends won’t just steal market share from independents, they will also cannibalize competing chains that can’t keep up.

These chains’ market share is already significant — the biggest ten account for around 10% of foodservice sales — but developed economies have even higher rates of consolidations. In North America, the top ten brands account for 21% of the market.

Focus Essential to Successful Large Portfolios

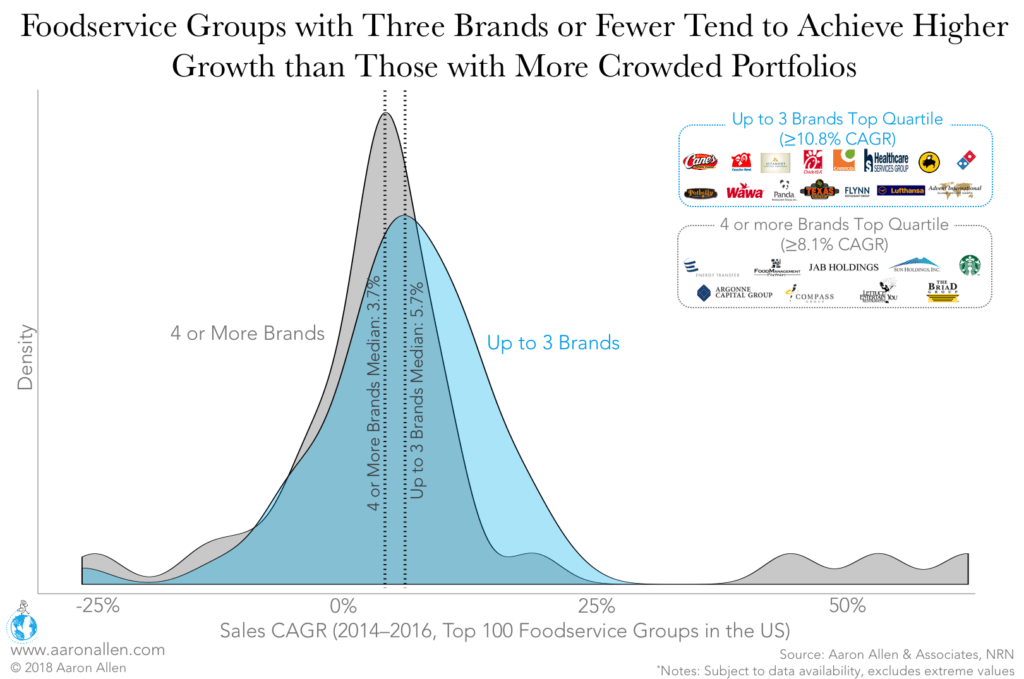

Though acquisitions are proven growth drivers, an under-performing brand can become a costly drag on a portfolio. Among publicly traded restaurant companies in the U.S., more focused conglomerates had higher CAGRs than groups with more concepts.

Of course, some large portfolios — such as JAB Holdings, which owns eight foodservice brands — perform very well. JAB has remained focused on one segment within the foodservice industry (coffee), giving them an advantage over portfolios with stakes across categories. Its subsidiary, Keurig Green Mountain, just purchased Dr. Pepper Snapple Group, which will create a merged beverage company with a combined $11b in annual revenue.

Of course, some large portfolios — such as JAB Holdings, which owns eight foodservice brands — perform very well. JAB has remained focused on one segment within the foodservice industry (coffee), giving them an advantage over portfolios with stakes across categories. Its subsidiary, Keurig Green Mountain, just purchased Dr. Pepper Snapple Group, which will create a merged beverage company with a combined $11b in annual revenue.

In MENA, two of the largest foodservice operators have 20 or more brands in their portfolio, and at least five have more than ten concepts. As the restaurant industry in the region consolidates, it likely won’t be the group with the most brands that wins. The winner will be the group with the best acquisition strategy.

How to Thrive in the New Normal

Both macroeconomic factors and industry-specific forces are conspiring to radically reconfigure the foodservice landscape in GCC nations. Trying to maintain steady margins with ill-advised, short-sighted, and reactionary measures will give operators a nasty surprise.

Some executives will take a different path, and their organizations will benefit from modernized systems, innovative technologies, and a distinctive sense of place that differentiates them from other brands. These initiatives will help them leapfrog competitors who are slashing wages, portions, and quality to artificially prop up their profits in the short term. The most successful operations will blend brilliant business acumen with exceptional service, offering guests cleanliness, speed of service, convenience, value, appeal, relevance, shared values, and a differentiated — yet consistent — experience.

This work begins with the organizational structure of each operation. Already, foodservice operations are recognizing the changed circumstances in the region and adapting how they do business to keep up.

Invest Inside the Business First

If some recent headlines from the region offer any lessons, the need for stronger corporate governance is surely among the key takeaways. A stronger system of visibility and accountability might have saved the fund, a realization that underlines the need for even (and perhaps especially) the most prestigious organizations to undergo regular audits.

Organizations in the region are often plagued by ineffective communication. This diagnosis may sound less worrisome, at least in the immediate, than shrinking margins and slumping revenues, but it affects every aspect of the operation. Here are its hallmarks:

Alone at the Top

Many organizations reward leaders who take credit for their subordinates’ contributions. Those who manage to claw their way to the top of the ladder and pull it up behind them get the spoils, rather than earning reward and recognition for helping others climb.

This culture has a profoundly negative impact on morale among the crew and middle management. They are left standing in the dark waiting for the ladder; they’ve been told it’s coming, even though it hasn’t been authorized — and likely won’t be. This has also produced a culture in which employees may be afraid of violating the hierarchical structure, so they don’t alert senior management to ongoing problems or developing crises.

Start-Stop Management

The turbulent market in the GCC incentivized executive teams to pounce on every opportunity, in fear that a competitor could get there first. This has created a management style that sometimes feels as if it is switching rapidly from task to task, rather than focusing on a long-term, strategic goal. Conducting business this way challenges staff at every level, as they struggle to keep track of the day’s ever-changing priorities rather than working to enact overarching objectives.

Unfulfilled Promises

Under-qualified managers reassure their superiors that everything’s under control by presenting qualitative (and at times self-serving) explanations for recovery. These anecdotal and alpha-male answers often try to claim all the glory for victories and shift all the blame for setbacks, behavior that has been taught, reinforced, and rewarded by the organizational culture. Leaders often trust that these employees are telling the truth and don’t dig deeper to understand the numbers behind the numbers.

Best Isn't Good Enough

Even in companies that set goals and link compensation to strategic success — a rarity in the region — KPIs are often unbalanced and ill-advised. This can cause even greater longer-term harm. Right now, unprepared lieutenants are scrambling teams on tactical, short-term initiatives that often further frustrate or mask the underlying conditions that produced the organization’s struggles in the first place. Instead of a shared, company-wide vision of the future, do-your-best objectives are in place, which are as good as no objectives at all.

Many of these habits stem from the frontier-market conditions that have prevailed in the GCC for decades. But, as these countries’ economies mature, the most successful organizations will be those that take a more strategic approach, informed by robust corporate intelligence that cascades throughout the operation, enrolling stakeholders and shareholders alike. Here are five concrete recommendations for reimagining how business is done.

If knowledge is power, buying more of it is the smartest move. Market research helps executive teams understand the factors and forces driving the foodservice industry so that they can anticipate the moves and countermoves of their competitors — both the ones they know about and the ones that may not be on the radar.

Meanwhile, installing dashboards that provide the right reports and the right KPIs at the right time will move knowledge beyond the qualitative and anecdotal to the quantitative and data-driven, giving executives a clear-eyed and objective perspective on their operations. These diagnostic tools provide transparency and accountability, allowing leaders to evaluate the whole organization in real-time.

The fast-moving GCC market has encouraged quick decision making and short-term goal setting. As markets continue to mature and stabilize, the organizations that look further into the future will have greater success. Strategic planning programs that find, define, and deploy the initiatives that will have the biggest impact on the organization can help executives envision two, ten — even 25 years — into the future.

It’s essential, however, that these plans be tailormade. Just because someone walks into the boardroom with a shoebox full of another company’s training manuals and strategic initiatives doesn’t mean they have the capabilities to adapt them, much less recreate them in a fit-for-purpose way that aligns with the brand’s unique value proposition and moves it toward its goals. Instead, leaders end up with a counterfeit strategy that’s a mimic of someone else’s masterfully conceived plans, as ill-fitting as a stranger’s bespoke wardrobe.

Having a long-term strategy informed by a complete understanding of operations, competition, and market conditions doesn’t count for much unless it can be effectively communicated both within the organization and out to guests and the media. Developing robust corporate communications departments will set successful businesses in the GCC apart from competitors and quickly become mandatory as Western standards of journalism begin to prevail in the region.

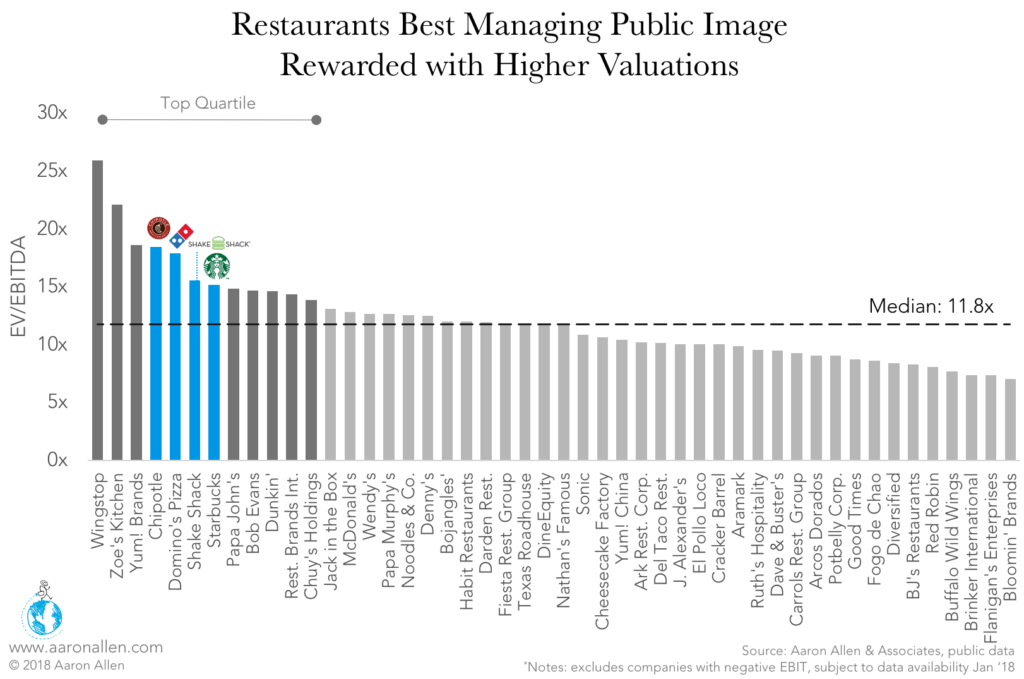

Modernizing marketing to keep pace with the number of new channels for communicating with guests and media is one of the more urgent tasks facing operators in the GCC. Marketing is invaluable not just for reaching new and existing guests but also for building valuations: the organizations with well-managed public images reap EV/EBITDA multiples 15x and above.

Modernizing marketing to keep pace with the number of new channels for communicating with guests and media is one of the more urgent tasks facing operators in the GCC. Marketing is invaluable not just for reaching new and existing guests but also for building valuations: the organizations with well-managed public images reap EV/EBITDA multiples 15x and above.

Even without hiring a team to handle social and earned media, however, these companies will benefit from simply reallocating their budgets. The global average for yearly marketing spend in restaurants is 3% of revenue (though some leading chains in the region devote up twice that), and organizations that cut their marketing budgets significantly — or entirely — during the downturn will have to catch up to compete. No matter where their annual spend on marketing currently sits, most operations will benefit from making capitalized expenditures in order to modernize their capabilities.

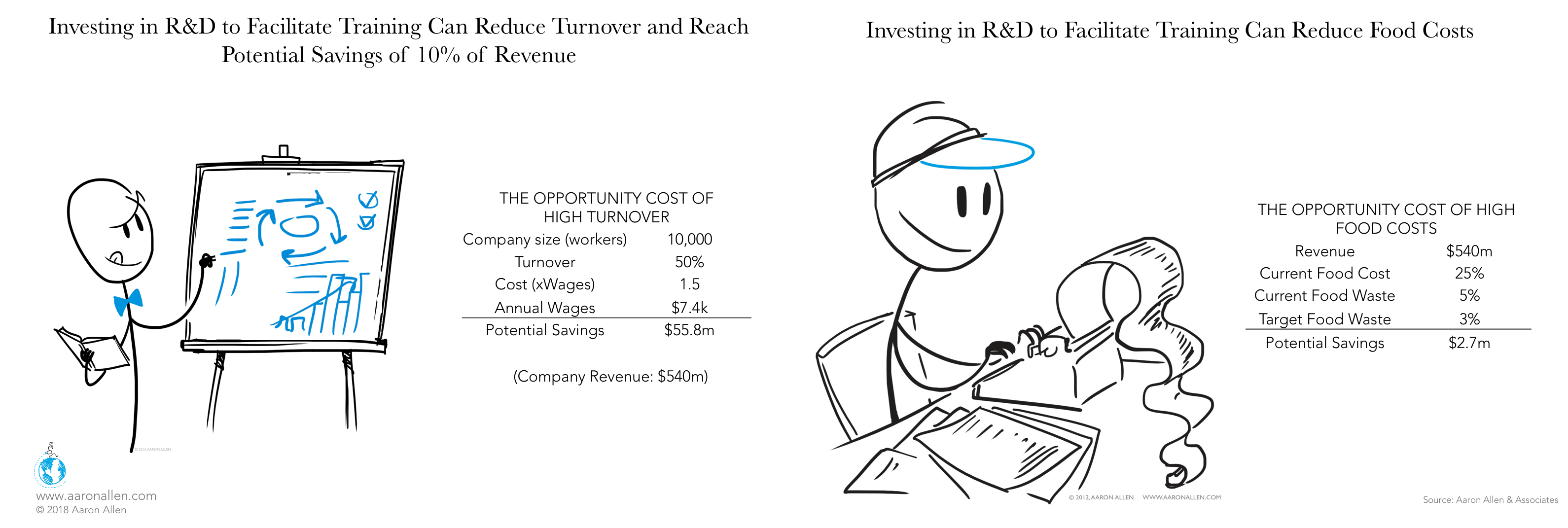

Many regional foodservice operations see training crew-level employees as an unnecessary investment, but the organizations that choose to forgo the expense are most likely paying for it other ways: untrained (or poorly trained) cooks and servers impact the P&L statement in lots of ways, from food that has to be thrown away because it was prepared incorrectly to guests who will never return thanks to bad service.

Proper training can reduce food costs by 0.5% of revenue. This figure may seem insignificant until you imagine it across a $1b system. In that instance, a training program focusing just on preventing food waste could save the operation $5m annually. Restaurants that don’t invest in training also tend to have higher rates of turnover. Since the cost of replacing an employee is about 1.5x their wages, a 50% turnover rate would drain about 10% of the revenue from an operation. Most training programs cost only half that.

The lack of training speaks to a commonplace perception in the region: working in foodservice is a dead-end career. The U.S. restaurant industry once faced a similar challenge, until the National Restaurant Association (NRA) developed a vocational program that effectively linked the practical skills needed to work in foodservice operations with career development opportunities. The organizations in the GCC that create equivalent programs will not only benefit from more efficient labor models but will also play an important role in easing national unemployment rates, furthering the industry as a whole, and improving the perception of service.

The best, surest way to cut costs is to increase sales. And the surest way to increase sales is to invest in the existing operation. Most foodservice systems are aware that their operations have inefficiencies, a few drags on the operation, but these agitations and pain points haven’t become prominent enough to be prioritized as necessities. Instead, they remain chores that the company hopes to get around to someday. But taking care of these nagging issues can quickly increase same-store sales.

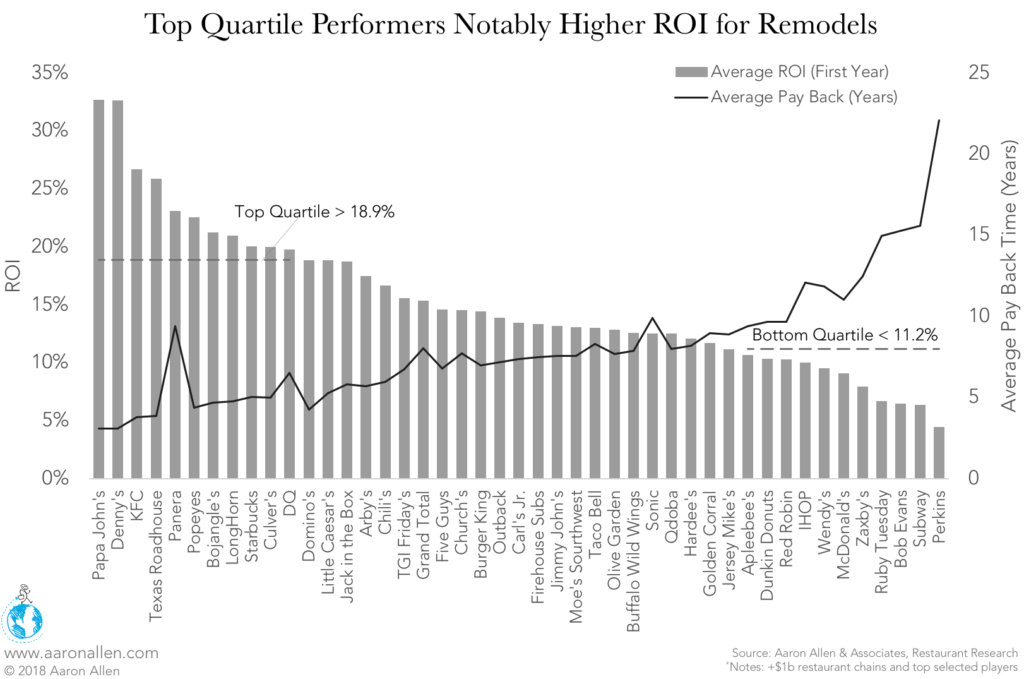

Performing basic repairs and maintenance, improving cleanliness standards, and conducting QA/QC audits can lead to fast same-store sales gains. Remodels, if done correctly, can create average sales lifts of between 3% and 10%, depending on the category. In the U.S., these initiatives get an average 15% ROI, with top performers reaching 18.9% and higher. Leveraging organizational design, industrial engineering, and branding into the creation of store of the future prototypes will allow operations to bake greater efficiency and consumer relevance into each location.

Performing basic repairs and maintenance, improving cleanliness standards, and conducting QA/QC audits can lead to fast same-store sales gains. Remodels, if done correctly, can create average sales lifts of between 3% and 10%, depending on the category. In the U.S., these initiatives get an average 15% ROI, with top performers reaching 18.9% and higher. Leveraging organizational design, industrial engineering, and branding into the creation of store of the future prototypes will allow operations to bake greater efficiency and consumer relevance into each location.

Considering the economic downturn that operations in the GCC face, it may be hard to convince boards and other C-Suite staff to commit to new investments. After all, they’ve been watching revenues and margins fall for three years, so caution is justified. But this penny pinching is part of what’s squeezing margins, as operations try to make more efficient that which shouldn’t be done at all rather than making the investments into people, process, plant and physical environment, and professional services that will create a more secure future for the organization.

Build, Buy, and Invest for the Future

Perhaps the most decisive factor in the development of foodservice operations in the GCC is that the majority of them are franchised. While this has allowed master franchisees to build large systems throughout the region with sales in the ten figures, it has also stunted the development of key aspects of these organizations, resulting in a strong physical infrastructure without the intellectual property that makes these imported brands so appealing to guests. Indeed, one of the most pressing dilemmas in the GCC is the push and pull between mega-franchisees and their Western parent companies. In many cases, neither side is willing to make investments to improve the system, instead expecting the other party to take the lead.

The development of technology has become a casualty in this conflict. For example, with some of the highest smartphone usage rates in the world, GCC guests would embrace mobile ordering apps, giving the restaurants that offer that convenience more market share than those that rely on foot traffic alone. While franchisees are correct that their parent companies should create the basic infrastructure for such products, GCC-based organizations would do a better job than Western teams when making regionally aware adaptations.

Rather than treating the franchise relationship as one in which royalties flow up and intellectual property flows down, master franchisees will benefit from understanding these as true partnerships. If not, they will continue to suffer from areas of underdevelopment, including:

R&D may conjure visions of scientists in lab coats, but it refers to the broader creation of intellectual property, which would include everything from recipes and menu boards to technology and training programs. In other words, research and development investments cover the development of the skills and capabilities necessary for a chain’s operation. Because master franchisees rely on parent companies for this IP, many feel uncomfortable — or even incapable of — creating their own.

Western brands dominate the GCC landscape. In the UAE, none of the top ten chains are local: most come from the U.S. and the U.K.

The KSA has more homegrown concepts in its top ten (Herfy, Kudu, Al Baik, and Cone Zone), but its number one slot still belongs to McDonald’s.

84% of the value of the S&P 500 comes from intangible assets, like intellectual property and goodwill. Franchise-only operations do not have the opportunity to grow value through intangibles; in fact, much of the work they put into creating memorable dining-out experiences disproportionately benefits the franchisor. Resistance to developing proprietary tech is likewise tamping down valuations.

Executive teams are beginning to change their perspective on business as usual. Here are five areas of opportunity for breaking out of the mega-franchise development and building lasting foodservice systems designed to thrive in the new normal.

Early movers will have the opportunity to acquire full regional rights or a territory buy-out of best-fit future brands. In contrast to the acquisition and franchise strategies that have prevailed in the GCC previously, these purchases should be based on a proper mandate, rather than the desire to accumulate short-term wins. The goal is not to have the biggest portfolio, but rather to build a portfolio that attracts the largest and most loyal audience.

Other areas of the industry, specifically catering and contract foodservice, offer opportunities for consolidation. In Western markets, one or two large brands control the majority of the share of foodservice operations in airports, hospitals, and schools. The organization that begins consolidating these services in the GCC — particularly in airports, many of which are expanding to accommodate the increasing number of tourists — could combine them into a large system with sustainable growth potential.

Arguably, franchise brands are easier to manage because systems and standards are already in place. But they often turn out to be more expensive, between paying out franchise fees and missing out on the benefits of enhanced valuation. Moreover, an emerging consumer trend, among both domestic guests and tourists, is the desire to experience an authentic sense of place. (Al Baik’s cult-like popularity attests to this development.)

There is an area of opportunity for homegrown concepts and flavors to flourish, and potentially be exported globally, which would open up new lines of revenue for GCC operators. For example, 20% of Domino’s 2017 revenue came from royalties. International franchisees pay an average of 3% of sales in royalties, so, with more than 9k international stores, the pizza chain earns an average fee of $22.3k per location every year.

Technology will soon become an essential component of the restaurant industry, and the underlying infrastructure is one of the most significant areas of opportunity for both regional operators and technology companies. Over the next three to five years, hundreds of billions of dollars will shift within the $2.7t global foodservice industry, as guests seeking convenience, accuracy, and speed will buy more from companies or through channels that provide those services.

From mobile ordering and self-service kiosks to predictive analytics and automated kitchens, the restaurants that install these innovations first will likely win a disproportionate amount of market share and reap stunning valuations in the process. Tech companies that create and license these products can expect a boom, as operations unequipped to develop technology in-house will turn to them for help.

While there has been a recent downward trend in occupancy costs, there is still a need for operators to look beyond what will once again be very high retail rent costs. Though the prestige of new shopping centers has been an important factor in real-estate decisions, guests’ desire for convenience will soon matter just as much as securing a location in a newly opened or highly trafficked mall.

Delivery-only locations, pop-up kitchens, food halls, and other non-traditional formats are something to be considered. Different location types will not only optimize occupancy costs, they will also create new dining experiences, offering another way for brands to stand out.

While there has been a recent downward trend in occupancy costs, there is still a need for operators to look beyond what will once again be very high retail rent costs. Though the prestige of new shopping centers has been an important factor in real-estate decisions, guests’ desire for convenience will soon matter just as much as securing a location in a newly opened or highly trafficked mall.

Delivery-only locations, pop-up kitchens, food halls, and other non-traditional formats are something to be considered. Different location types will not only optimize occupancy costs, they will also create new dining experiences, offering another way for brands to stand out.Over the next 5+ years, food sustainability will play a major role in national economic diversification programs. These efforts aim to make GCC countries less reliant on imported foods, even moving them toward exporting agricultural products.

Though governments are leading these efforts, food sustainability initiatives provide new opportunities for foodservice operations, both regionally and internationally, to invest in vertical farms, aquaculture, and other ways of creating a sustainable agriculture sector in the GCC. The impact of these developments could fundamentally transform these nations’ economies and improve the health of residents.

GCC Poised to Make Major Impact on Global Economy

Though the transition to a more developed market will challenge many operators — likely causing some to leave the foodservice sector entirely — it offers incredible opportunities for those willing and able to take a forward-looking approach.

Margins are shrinking, and growth is harder to capture. But the markets are also stabilizing, and, where the GCC once imported technology and intellectual property from the West, it is now poised to make its own, remarkable contributions to the global economy.

But foodservice operations clinging to the way things used to be won’t win in this period of massive disruption. It’s time to invest and innovate, to build foodservice systems that can thrive in the new normal and compete with operations from all over the world.

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to identify, size, and seize opportunities to drive growth, optimize performance, and maximize enterprise value. Our due diligence services help chained restaurant operations and private equity firms plan, evaluate, and close strategic acquisitions.

Collectively, our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Our strong specialization in the Middle East is complemented by engagements in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.