We’ve all heard of UberEats, Postmates, and Caviar. Chances are, you may have even used a mobile delivery service to order lunch. But the future of food delivery is more than a flash-in-the-pan. Delivery isn’t the new quinoa, or 2017’s answer to kale. It will fundamentally alter the foodservice business, and lead to a seismic shift in the restaurant industry. Not every restaurant around the globe needs to jump into offering delivery immediately — for many, there are more pressing matters at hand — but every restaurant will have to confront delivery sooner or later.

It seems that not a week goes by without a headline announcing store closures or bankruptcies of even the largest Casual Dining Restaurants (CDRs). In February, Bloomin’ Brands announced that 40 of its underperforming stores would close. That same month, the sales decline of Applebee’s ultimately forced CEO Julia Stewart to resign from parent company DineEquity.

While some have blamed the slow demise of CDRs on a restaurant recession, we believe it’s actually due to a slew of other factors. Among them, cannibalization, urbanization and changing consumer habits, which are making way for newer, more convenient dining options including meal kits, food trucks, and fast-casual restaurants. With more people moving into cities (and an increasing number of solo diners), restaurants are being forced to change their location strategy and their footprint. The fast-casual boom has changed the restaurant real estate game, and made it more difficult for CDRs, which typically have large, standalone locations not conducive to urban areas. On top of that, fast-casual chains have cornered the market on healthy (or at least seemingly healthy) meals — often at a fraction of the cost and time of dinner at a sit-down restaurant.

But it isn’t just fast-casual or urbanization that’s to blame for the troubles at CDRs. While CDRs have seen their revenues dwindle, meal kits have grown into a $1.5 billion-and-growing behemoth. Food trucks are estimated to have brought in $1.2 billion in revenue in 2015. Naturally, delivery (which presents an estimated $210 billion market opportunity) is digging into the share of restaurants, too.

Meanwhile, some still-struggling CDRs are desperately trying to claw their way out of the hole by offering discounts, copycat menu items, and turning to the same stale promotions that got them in trouble to begin with. While the Applebee’s and Ruby Tuesday’s of the world are dusting off their empty booths, delivery is stepping up to bat — offering far greater convenience for today’s time-starved, mobile consumer.

There’s a natural progression that often goes unchecked and the restaurant industry is very much evolving. So, when it comes down to survival of the fittest, what happens next? If fast-casual and other convenient options are eating CDRs, what will ultimately eat fast casual? For those chains that aren’t careful, delivery could be the biggest predator.

MONEY TALKS

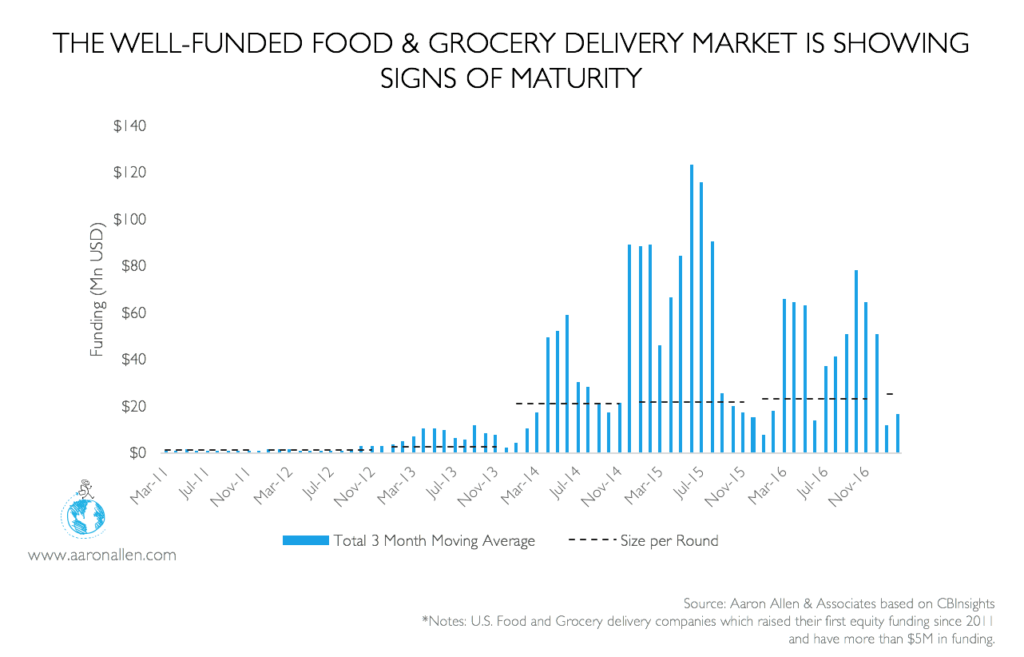

If you’re curious to know what will have the biggest impact on restaurants, just look at the money trail. Since 2012, meal delivery and grocery delivery startups have raised more than $8.4 billion in venture capital, cumulatively. To put it in perspective, that’s more than every restaurant IPO of the last 16 years, combined.

At least five of the online delivery platforms are each valued at more than $1 billion and, overall the food and grocery delivery startup market is showing signs of strength and maturity.

Consumer behavior is shifting. The move from brick-and-mortar to online has already massively impacted the retail sector — with chains like Sears, Wal-Mart, and JC Penney are losing market share to Amazon by the second. But those online shoppers? They’ve got to eat — and increasingly, they’re turning online to satiate that appetite, too.

One of the biggest shifts in food service has been in fast casual. Considering all the consumer and investment money poured into it, projections are that the fast casual sector will hit $100 billion in the U.S. (it currently sits at around $30 billion). But delivery makes fast casual look like a speed bump. According to a 2016 industry report from Morgan Stanley, the food delivery market still presents a $210 billion market opportunity. The food delivery market’s current worth amounts to just one-half the penetration of e-commerce and one-eighth that of online travel.

Consumer use of delivery services is certainly on the rise. In the U.S., weekly use of meal delivery services doubled in just five years (between 2010 and 2015). In India, food ordering is growing up to 20% per year. In the UK, it’s expected to triple by 2020. At the same time, less money is being spent on fast food meals — people are still eating, they’re just looking for even more convenient ways to do it.

One global survey found that online ordering is regarded as the most important technological offering a restaurant operator can have (53% of respondents), ahead of digital menus and loyalty programs. In spite of this demand, restaurant use of technology is in its infancy, with nearly half of operators describing their use of tech as “lagging.”

DELIVERY WILL EVENTUALLY BE AN ESSENTIAL. THAT DOESN’T MEAN EVERY CHAIN SHOULD OFFER IT RIGHT NOW.

There’s no doubt that every restaurant, worldwide, will have to confront and consider offering delivery. Whether they do or not hinges on a slew of variables including products, margins, packaging, profitability, segment. But to not consider delivery at all is like a restaurant thinking they don’t necessarily need a website. Of course, chains will have to determine whether it makes more sense to utilize a third party (like UberEats, Postmates, etc.) or offer delivery in-house. We’ve seen clients spending as much as 15% of their revenue on a third-party delivery service. Margins like that are simply unsustainable.

Those who jump headlong into offering delivery, without planning it out properly, are more likely to see a loss due to poor planning and improper implementation. Chains need to take into account how a delivery program would integrate with a CRM system; whether it would be rolled out regionally or system-wide; how they’ll get buy-in from franchisees.

And — even before all that — restaurants have to take into account whether they’re ready to offer delivery. Are there more pressing matters at hand? Are the restaurants clean? Are they in need of more hires? Do the restaurants have any sort of marketing plan in place? If so, what percentage is being spent on digital?

The hospitality business comes with a slew of variables, but the basics (cleanliness, good service, good food) should be covered before delivery is even considered. Ultimately, delivery is about engineering convenience. There are still ways to implement convenience (curbside pickup, for instance) without immediately turning to delivery.

DELIVERY MIGHT NOT CRUSH RESTAURANT CHAINS, BUT IT WILL COST THEM

Over time, innovation will mean more than simply clicking your way to a burger delivery. The tech and restaurant industries are already sowing seeds for further progress — like delivery via drone, autonomous vehicle, and even 3D printer. But for now, many are struggling to get on board with offering delivery at all.

CDRs — arguably the sector of the industry that’s struggling the most — are lagging behind, though some are working to integrate delivery. The Cheesecake Factory, for instance, offers delivery via DoorDash at nearly half of its 194 U.S. restaurants, with plans to expand to more locations this year. In February, the chain reported its 28th straight quarter of positive same-store sales — bucking the downward trend of many of its competitors.

One contributing factor as to why CDRs have suffered is the popularity of newer segments like fast casual. So, will delivery do to fast casual what fast casual did to CDR? Probably not — at least, not any time soon. In the short term, it’ll cost them and every other segment of the restaurant industry. But the smart chains (and the large ones, who can afford it), will work to stay ahead of the game, offering their own delivery service, so they can turn it into a profit center rather than relying on third parties like DoorDash and Postmates, which wind up costing them profits.

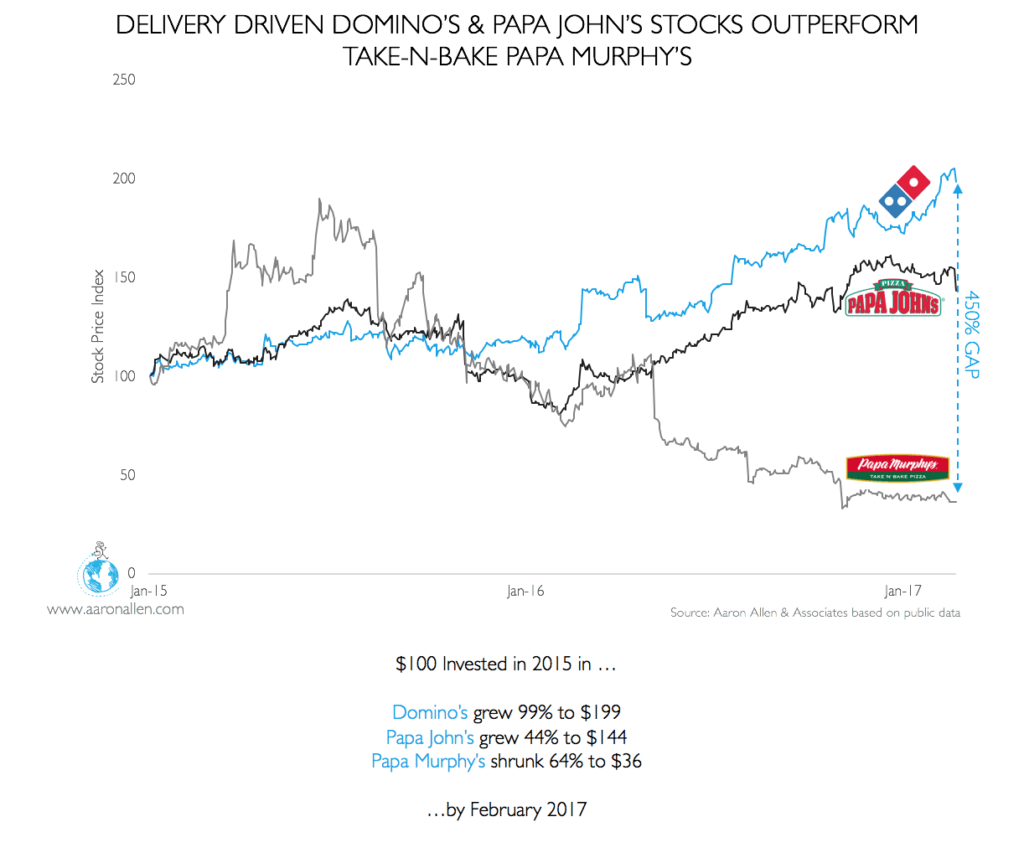

Tech has already started killing off independent pizzerias. But even some large pizza chains are feeling the pain of not offering delivery. Just look at the stock of take-n-bake pizza chain Papa Murphy’s, versus that of the delivery-heavy Domino’s and Papa John’s.

THIRD PARTY DELIVERY SERVICES CONTINUE CROPPING UP

Offering delivery is much easier for companies that already have a big digital footprint. The biggest challenge will be for those just beginning to expand their digital presence. The use of tech at Domino’s helped bring the chain back from the brink of bankruptcy — but it helps that the company knew what it was doing. It, and others like it, have been hiring those from the tech world (Chick-fil-A, for instance, brought aboard a Facebook alum before it unveiled its online ordering app).

Whether it’s someone within the company or outside of it, a translator — one that knows enough about tech and the restaurant industry to put the two together — is becoming paramount to any chain’s success. The secret sauce lies in melding the capabilities of Silicon Valley with an understanding of the industry.

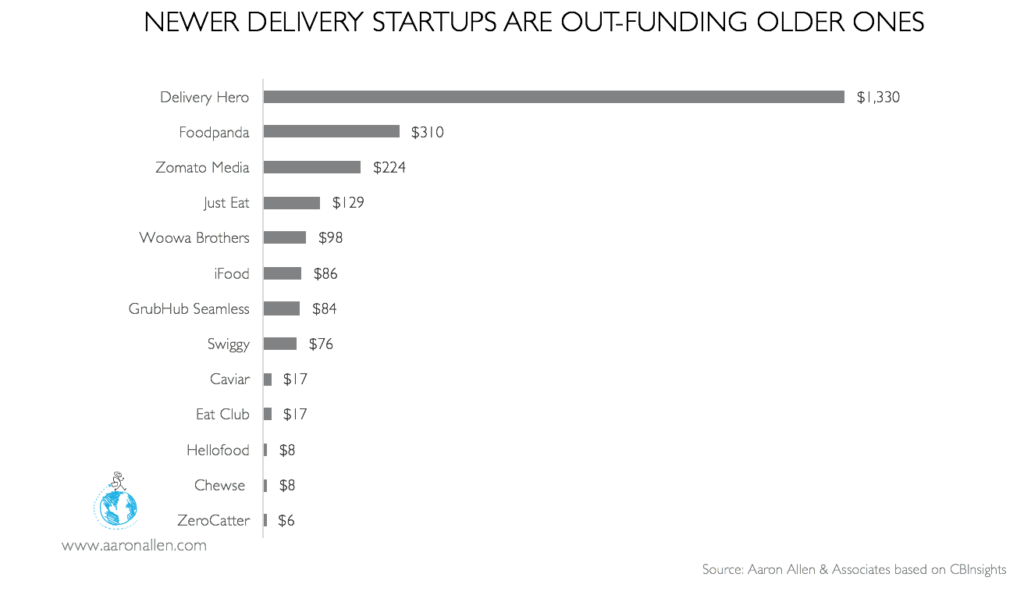

Those who don’t have the knowledge or wherewithal to start their own, in-house delivery service will have to rely on a third party — and there’s no shortage of those. In fact, the most recent players on the scene are on the receiving end of more funding than those who have been in the business for more than a decade. The five-year-old Delivery Hero (a Berlin-based food delivery service) has raised ten times the funding of the 15-year-old Just Eat.

Many of the modern delivery apps are so convenient, in fact, that it’s easy to order a meal by accident (I can attest, as I’ve actually done this before, using Caviar). But aside from convenience for customers, these incredibly popular services do all the work for restaurants (a big plus for those who aren’t interested in hiring drivers and create an online delivery portal). Of course, they do cost money, and eat into profits. Another struggle? Some food just doesn’t travel well, which can hurt the reputation of some restaurants in the long run.

In the next few years, we’ll likely see a new breed of delivery restaurants cropping up in response to this phenomenon — those that offer delivery only, with no option to eat in. David Chang (the brains behind the wildly popular Momofuku) unveiled his delivery-only venture, Ando, in New York in 2016. The restaurant has funding from big names like actor Aziz Ansari and angel investors like Dick Boyce, the former chairman of Burger King. And, because it’s delivery-only, Ando’s menu is comprised of only those foods that travel well.

WHEN DELIVERY DELIVERS

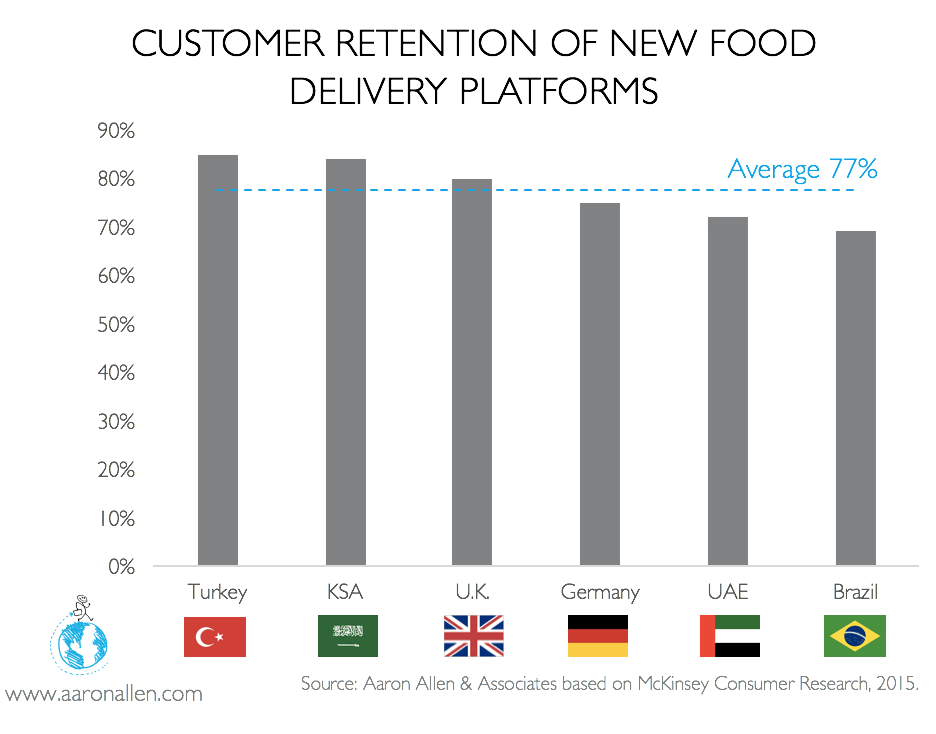

When done right, delivery helps restaurant operators cultivate customer loyalty, enhance profitability, and expand into new market segments. Overall, customer-facing technology is poised to deliver a distinguishing, competitive edge – for a price. Some chains, facing poor traffic numbers, are hoping delivery will help garner them new or lapsed customers. McDonald’s, for one, announced it would launch its own delivery service this year and will roll out mobile ordering in roughly two-thirds of its stores.

For many operators, strategic financing can be the key that will help them adopt delivery technology that can enhance their operations as well as the customer experience.

The real value of new technology lies in the value it brings to a business — for many restaurants, delivery opens up a new segment of customers: those who crave convenience as much as they do affordability. Technology can also facilitate human connection and increase efficiency though it comes at a cost and many view it as risky. The early adopters, however, have a strategic advantage: When you’re the first to do something, you get the benefit of publicity.

Domino’s, for one, has nearly perfected the guest experience when it comes to delivery. From the chain’s ordering via computer, Alexa, Twitter, Facebook, etc. to its order tracker (and even a custom-made van that ensures pizza is hot upon arrival), Domino’s offers a slew of ways to order a pie. Are they all necessary? Probably not but, even if one isn’t successful (who is actually going to order delivery via reindeer, really?) it will at least garner the chain lots of earned media.

THE INDUSTRY WILL LOOK A WHOLE LOT DIFFERENT, THANKS TO DELIVERY

We might not recognize the industry in a few years — but it wouldn’t be the first time. The era of speedy pizza delivery was ushered into the U.S. in the 1960s, by Domino’s. Today, some 83% of pizzerias offer delivery. At Domino’s, more than half of all deliveries now come via online.

Currently, nearly three-quarters of all deliveries are still made the old-fashioned way: via phone. With the proliferation of delivery apps, and customers’ increasing comfortability with technology, we can expect to see a dramatic shift in online versus phone orders. In 2015, around 1.02 billion phone orders were placed for delivery — down from 1.39 billion in 2010. During that same period, online orders more than doubled, jumping from approximately 403 million to nearly 904 million by 2015.

In short, we’ve come a long way. But changes are happening faster than ever before, thanks to technology. If funding and growth are any indication, delivery will be bigger than the dot com bubble and burst of the ‘90s. There’s no overstating it. The effect of delivery will be the most seismic to hit the industry in several decades.

* * *

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 68 countries for clients ranging from startups to multinational companies posting in excess of $37 billion. Collectively, his clients around the globe generate over $100 billion annually and span six continents and more than 100 countries.