After a sharp decline in oil prices produced several years of macroeconomic slowdown, the UAE is projected to continue to have modest economic growth in 2018 but recover to 3% growth next year. Despite the sluggish economy, the UAE food and beverage industry has experienced consistent growth over the past five years, and restaurants in the UAE are uniquely positioned to capitalize on development projects across the country.

In addition to a steady uptick in global oil prices over the past year, positive economic projections are driven largely by Dubai’s preparation to host the World’s Expo in 2020. Additionally, Abu Dhabi’s Vision 2030 diversification plans are spurring massive construction and sustainability projects.

The addition of several new malls, hotels, airport and neighborhood expansions as well as theme parks and sports stadiums all offer local restaurant operators the opportunity to enter new markets or explore franchise opportunities.

But competition remains fierce. Restaurateurs looking to expand in this market should take steps to develop their brands with strong product differentiation and invest in technologies that keep costs low and attract new customers.

How Oil Prices and Politics Have Impacted the UAE Economy

Despite ongoing attempts to diversify its economy, the UAE has historically remained vulnerable to fluctuations in oil prices.

Beginning with the global financial crisis in 2008, demand for oil dropped as international credit remained tight for investors and as large oil importers, like the US, sought to move away from Middle Eastern resources by investing in domestic production and renewable alternatives.

To offset declining oil prices and spur outside investment, the UAE tapped into its sovereign wealth fund to continue development projects. The decision to increase spending in the midst of declining oil revenues was further prioritized in 2011 in response to concerns that the Arab Spring protest wave could spread to GCC countries like the UAE, just as it had in Bahrain.

Oil prices took another major hit in 2014, this time due to oversupply. New oil sources contributed to the glut, but Emirati and Saudi geopolitical considerations likely also played a role.

After the 2015 Joint Comprehensive Plan of Action (JCPOA) eased international sanctions on Iranian oil, the UAE and Saudi Arabia continued rapid production. As production increased, the price of oil fell to a low of $27 per barrel in February 2016.

In late November 2016, the UAE and Saudi Arabia reached an agreement with OPEC to cut oil production and stabilize oil prices, likely spurred by the election of Donald Trump, who recently fulfilled his campaign promise to tear up the Iran nuclear deal.

As the UAE pushes toward greater economic diversification, oil will remain an important tool for financing major national projects. As prices begin to rebound so too should government revenue, which suffered a 38.5% loss from late 2013 (~$583b) to late 2016 ($358.5b).

Why the UAE Food and Beverage Industry Continues to Grow

Buoyed by continued government expenditures on domestic construction and development projects, the food and beverage industry in the UAE has remained above the fray of fluctuating oil prices and geopolitical developments. Over the past five years, the UAE food and beverage market has grown 22% from $10.8b in 2013 to a projected size of $13.2b in 2018.

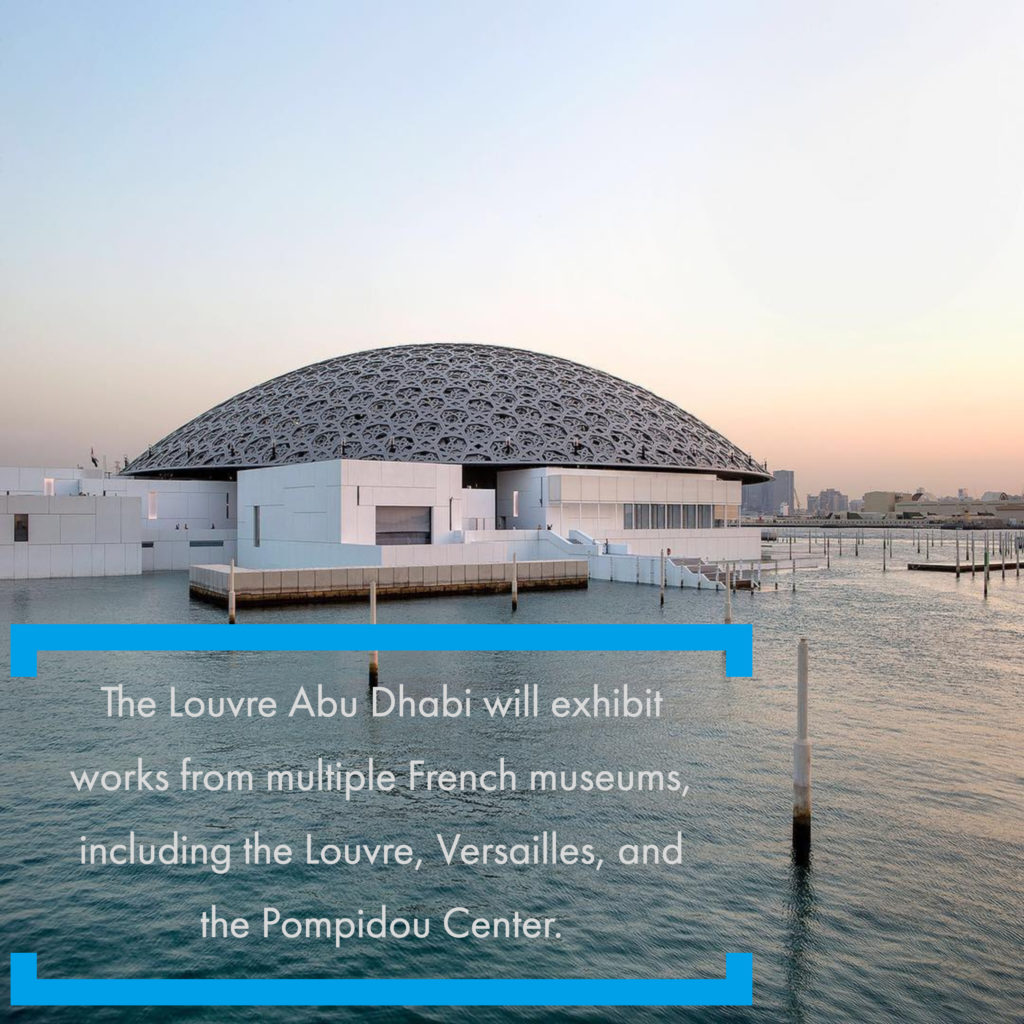

The upcoming 2020 Expo in Dubai and Abu Dhabi’s Vision 2030 diversification plans are fostering ongoing investment. In anticipation of the six-month World Expo, Dubai has embarked on numerous construction projects, including new malls, hotels, a record-breaking tower, airport and neighborhood expansion projects, theme parks, sports tourism, and other attractions. Abu Dhabi is also looking to bolster its standing as the UAE’s cultural capital with the recently opened Louvre Abu Dhabi, a new airport terminal, and ongoing real estate and neighborhood expansion projects.

Capitalizing on events like the World Expo to launch lasting economic development is not without precedent. For example, Chicago leveraged the World’s Fair in 1893 to rebuild following the Great Fire of 1891 that destroyed much of the city. Each venue set to open across the UAE provides a unique opportunity for restaurateurs to expand or make inroads in the market.

However, the future of the UAE hospitality industry is not based solely on the old adage that “if you build it, they will come.” Other factors, like population growth and greater GDP per capita, will likely drive demand for restaurants.

Within the UAE and the broader GCC, high temperatures coupled with a more traditionally conservative society have made indoor, family-friendly destinations like malls a popular destination. Higher projected population growth over the coming years and increased GDP per capita will increase foot traffic to such locations, and 87% of Abu Dhabi mall shoppers stop by a restaurant or café while shopping.

How to Thrive in the UAE Restaurant Industry

While continued domestic investments are likely to cushion the UAE restaurant industry from any major shifts in oil prices or the geopolitical landscape, the market will nevertheless remain challenging for operators in the near term.

In 2017, restaurants across the country continued to report flat or declining sales. These figures are largely driven by an oversupply of restaurants.

To withstand this oversaturation, restaurant operators should focus their efforts on building a strong brand and identifying their unique position and story that distinguishes them from the competition. Strategic advertisements, both physical and digital, can help attract new customers.

Restaurants in Levantine, Indian, or Italian (including pizza) cuisines are positioned to remain top performers, as local tastes continue to incline toward these segments.

Further, while 90% of the UAE’s food demand is satisfied through imports, the country is working toward sustainability by investing in new farms. Restaurant operators should consider sourcing their food locally, which could not only help cut costs but also attract customers looking to support (literally) homegrown industries.

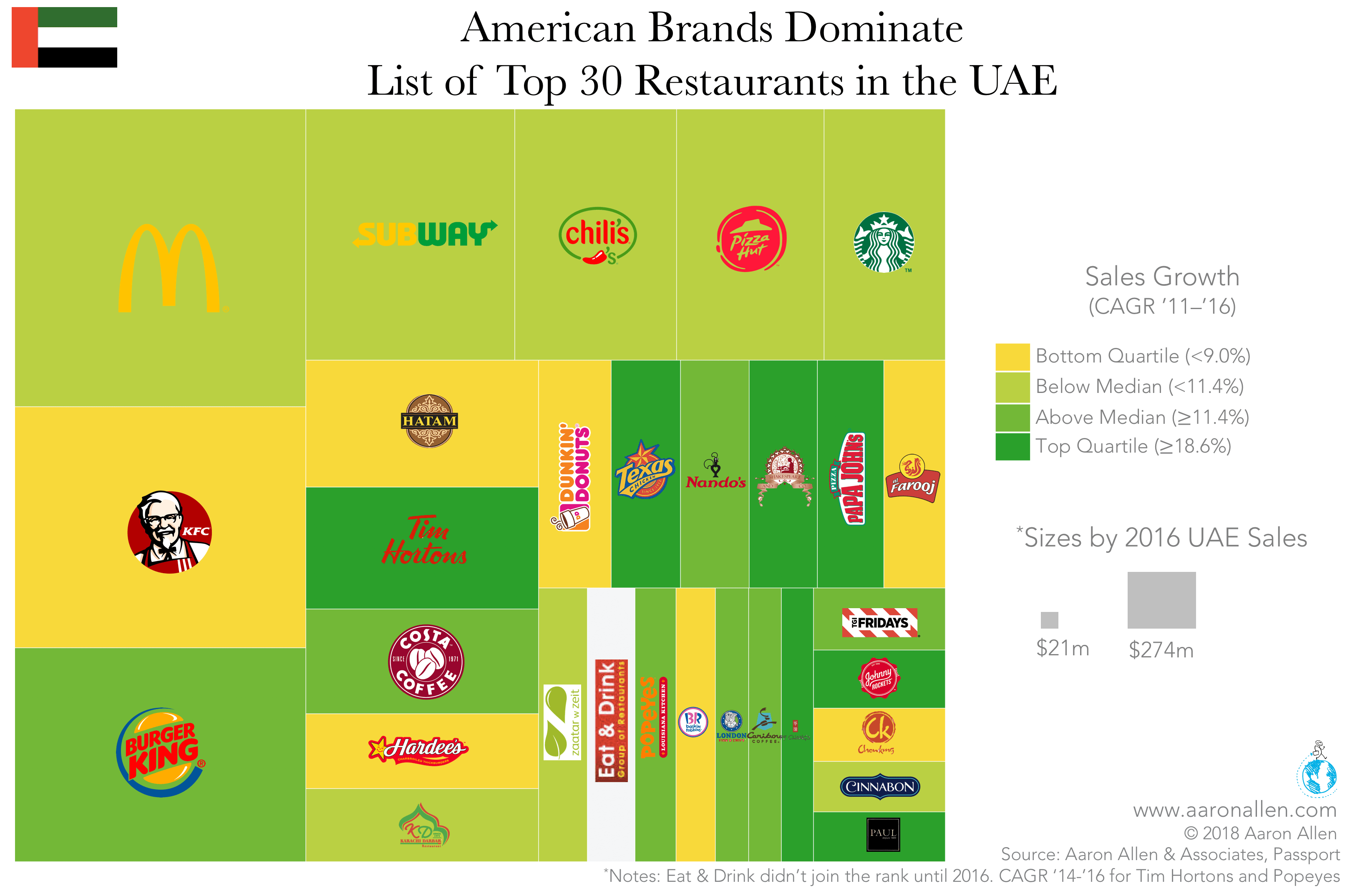

This is also true for local and regional brands. Currently, US brands claim 18 of the top 30 restaurant chains in the UAE.

Three UAE-based chains appear in the top 20 of this list: Hatam, a casual-dining outlet that offers Persian food, Al Farooj Fresh, which specializes in chicken, and Karachi Darbur, a full-service restaurant offering Pakistani, Indian, and Chinese cuisine. As the UAE continues to focus on food independence and economic diversification, we can expect more room for local chains to flourish.

Many observers worried that the new 5% value-added tax (VAT), instituted on January 1, 2018, would push sales down as price-sensitive consumers sought quality products at a lower price point. The new tax did lead to the fastest input-cost inflation since 2011, but January registered the strongest employment growth in over two years in Dubai.

To address flat or declining sales, restaurant operators should focus on leveraging technology and innovative concepts to optimize their operations and reduce costs. Mobile delivery apps can cut in-house services, and shared kitchen spaces can provide delivery-only offerings in untapped markets. Given the hot climate and congested traffic conditions in places like Dubai, restaurants leveraging innovative delivery options are poised to perform well.

Challenges aside, operators can still find success in the dynamic and competitive UAE restaurant market. Ultimately, restaurants with quality products that are willing to adopt innovative solutions will be the ones who succeed in the growing UAE restaurant industry.