The United Arab Emirates (UAE), a federation of seven states, combines a rich history with thriving metropolitan areas — making it one of the Middle East’s most important economic centers. The owners, operators, and investors in UAE restaurant chains have reaped the rewards of its shifting demographics and its thriving economy has historically been linked to oil production and high oil prices.

Though traditionally conservative, the UAE is one of the most liberal countries in the Gulf with Western tastes (like fast food) increasingly blending with Middle Eastern customs. A slew of international foodservice companies have opened outposts in the UAE and, while restaurants have faced some challenges in recent years, the region still offers untapped potential (with its own unique set of challenges, of course).

Below, we offer our own UAE food industry analysis, taking a look at the region’s economy and social demographics, and examine what its continued evolution means for UAE restaurant chains.

UAE Foodservice or Consumption Drivers

As foodservice sales respond largely to factors such as the strength of the economy and population growth, the following drivers are especially important to note:

Food Spend

Per capita food spend in the UAE is among the highest in the world, at $3,159 in 2015, 32% higher than in the US (excluding alcohol), and about the same as the average person’s spend in Kuwait and Qatar combined. As spend in Food Away From Home (i.e. at restaurants) moves in line with the economy and population, a portion of the high value spend on food by Emiratis is explained by their high net worth — and by the fact that visiting malls and dining out are the primary sources of entertainment for many in the region.

GDP

As of 2017, GDP per capita is estimated to be $40,162 — 22nd in the International Monetary Fund’s rank and close to that of countries like New Zealand and Belgium. GDP grew at an average of 4% between 2010 and 2016, and even though growth has slowed down since oil prices slumped back in 2014 (and then again at the end of 2016), growth is expected to accelerate considerably next year (going back to 4.4%, according to IMF estimates). The average growth for the next five years is expected to be close to 3.5%, more than twice 2017’s rate, and almost 80% higher than the forecasted growth for the US. This should re-energize the restaurant industry after two years of weak sales, though other factors (such as market saturation) will also play a role.

Population

The UAE population is small, at only 10.1m people. Growth, however, is relatively strong: in 2017, the population is expected to grow 2.9% over the previous year, leading to a healthy expansion of the consumer base. The US population, in comparison, is growing at roughly a quarter of that rate. The distribution of restaurants and people, however, is not even, with a heavy concentration of foodservice establishments in Dubai causing a high saturation rate in that market. Dubai has close to 260 people per restaurant (compared to 320 people per restaurant in the US).

Economic Forecasts

In April, the IMF announced it had cut its forecast for Arabian Gulf oil producers’ economic growth this year, as their output cut deal is expected to wipe out any gains from higher oil prices in terms of government revenue. Still, analysts remain optimistic about the region’s efforts to diversify. Spending cuts and an increase in oil prices are helping GCC states lower some of the world’s highest budget deficits, and the International Monetary Fund has hailed the region’s progress in attempting to transform economies that have relied on hydrocarbons for more than five decades.

Non-oil growth is projected to rise to 3.3% by the end of 2017, reflecting more gradual fiscal consolidation, stronger global trade, and higher Expo 2020 investment. Oil GDP is projected to decline by 2.9%, a reflection of OPEC cuts in oil production. As a result, overall growth will ease to about 1.3% in 2017, before recovering to above 3% over the medium-term. Average inflation is projected to rise to 2.2% in 2017 (though restaurant prices are unlikely to follow suit).

Still Much Potential For UAE Restaurant Chains

Despite economic challenges brought on by sagging oil prices, many UAE restaurant operators continue to thrive. Consumer foodservice is an industry close to $15 billion — and one with an attractive long-term outlook. Several factors besides economic and population growth will be driving its performance over the next few years.

Though it’s a crowded market, there’s still a lot of room for growth among UAE restaurant chains (and those looking to expand into new markets). In the UAE, the share of spend on food away from home (i.e. restaurants) is lower than that of other developed countries. The US, for instance, is near to a 50%-50% split between restaurants and groceries. The breakdown in the UAE, meanwhile, is 46.7% restaurants, 53.3% groceries — but that split is set to weigh heavier for restaurants, and at an accelerated pace, over time.

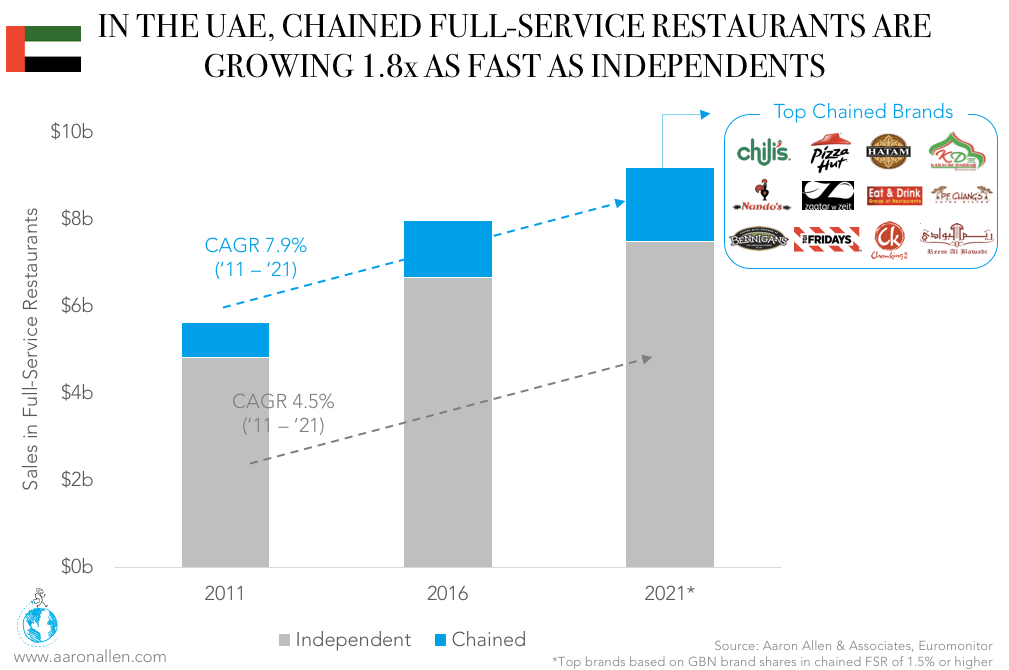

There’s also potential for the growth of certain cuisines and segments. Chained foodservice, for instance, is under-developed: While in the US and Canada the share of chained foodservice has remained stable over the last few years (at around 54% of the restaurant industry), in countries like the UAE and KSA, the market potential for the expansion of chains ranges from $4.3 billion to $5.1 billion annually, were it to reach a similar share. Though independents have dominated historically, chains tend to grow faster and cannibalize the mom-and-pops over time.

To further illustrate that point, consider full-service restaurants. In the United Arab Emirates, they continue to be fragmented in terms of cuisines, formats, and price point, with a diversity of casual and fine dininig options. Chained full-service restaurant sales are growing 1.8 times as fast as independents. The share of chains is set to grow to 19% in 2021 (from 16% in 2016). While segments like pizza are dominated by chains, others — such as Asian food — will begin to see an influx in chained operators.

Tourism

Tourism is booming, leading to a thriving retail sector and competitive restaurant industry. Globally, Dubai ranks fourth in terms of the number of international overnight visitors and first in terms of spend in the food and beverage sector.

And while Dubai gets the lion’s share of attention from Western media, Abu Dhabi’s tourism has grown twice as much: the number of visitors to Abu Dhabi increased 15% (versus Dubai’s 7.5%) in 2016, according to a MasterCard report. It also touts more opportunity for operators looking to expand into the Middle East. While Dubai tourists spent $31.3 billion in 2016, rourism spend was $2.65 in Abu Dhabi, affording the region much room for growth.

Restaurant operators’ top line is significantly impacted by tourism (both in terms of number of tourists and their composition). This is especially the case for international brands, most of which enter the market in partnership with local and regional conglomerates, who develop the franchises. Tourism made up 12.1% of GDP in 2016, and that share is expected to grow over the next ten years.

Technology and Venture Capital Are Shaping the Region

According to Huawei’s Global Connectivity Index (GCI) 2017, the UAE is already tops in terms of digital connectivity. The majority (75%) of Emiratis using delivery or take-away services at least once a week and two of the most well-funded tech startups (Reserveout and LUNCH:ON) are food companies, proving that investors are intrigued by the potential of foodservice in the region.

The appetite for investment doesn’t appear to be slowing down anytime soon, either. The Middle East’s Venture Capital industry is forecast to be worth $5 billion by 2019 (an enormous jump from $200 million in 2016). Investment could prove beneficial for chains in the region, as it certainly has in the US and around the globe.

Recent Headlines

- In October, the UAE instituted a hefty tax on sugary drinks and cigarettes: 50% on soda and 100% on energy drinks and tobacco products. The goals of the policy are two-fold: to generate revenue for the UAE government (as global oil prices remain low), and to improve public health, as the UAE has one of the worst diabetes rates in the world.

- A study commissioned by Google has found that modern mapping services (like Google maps) have the potential to unleash consumer benefits worth over AED2 billion ($550 million) per year in the UAE. According to the study, mapping services enable people to travel faster, and reduce travel time by 16% on average in the UAE.

- The digital economy is impacting the region in significant ways, with a report by McKinsey revealing that “at least 80% of urban consumers in the UAE now prefer to do a portion of their banking through digital channels.” The digitization of the banking sector is likely to impact other areas, as well — like retail and, certainly, restaurants.

- UAE earnings have been under scrutiny lately, with the markets recently proving a disappointment to many. NBAD Securities CEO Mohammed Yasin weighed in during a recent interview with Bloomberg

The Future of UAE Foodservice

The continued growth of UAE restaurant chains is a positive sign for the industry at large, but it does mean increased competition. As The National recently reported, the influx of international chain has also made it difficult for homegrown, mom-and-pop restaurants to compete. One independent restaurant owner told the publication that, when his business first opened, “there was no social media, word of mouth was the best way to spread among customers, no pictures, posts, reviews.” In the years since, he’s devoted time to ensuring his restaurant stands out by re-branding, soliciting customer feedback, and integrating technology when applicable.

With 138 hotel projects currently underway in the UAE (and a slew of new restaurants cropping up along with them), the competition is likely to grow even fiercer. Already, Dubai sees a rate of four new restaurant openings per day, and has one restaurant for every 260 people (versus 320 people per restaurant in the US).

Some smaller restaurants might not be able to compete in such a dynamic environment, but there’s still opportunity for homegrown concepts — particularly those that can pair Middle Eastern service and hospitality with an expert knowledge of the industry and all its best practices.

About Aaron Allen & Associates

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $200 billion, span all 6 inhabited continents and 100+ countries, with locations totaling tens of thousands.