Volatility, variance, disruption, and downright white-knuckle rides await us all in 2019, at least on some level. Whether your company will be up, down, or skidding sideways depends on a variety of variables that we will touch on briefly here.

Let us first enjoy (or cringe our way through) a hearty word salad: digital, delivery, disruption, automation, autonomous vehicles, aggregators, artificial intelligence, big data, blockchain, robotics, Internet of Things, self-ordering, machine learning, rapidly evolving consumer trends and dining behaviors, tightening liquidity and increased cost of capital, aggressive activist investors, labor pools drained to labor puddles, and Convenience Engineering™ helping transform the guest experience and unit economic models of foodservice.

There is a lot happening all at once. We cover many of the evolving trends most relevant to the industry as a whole, though here we present the most prevalent restaurant trends of 2019.

Change Comes from Many Directions and in Many Forms

That speeding-up effect is what some are calling the Fourth Industrial Revolution. If it feels like sensory overload, you’re probably pretty plugged in to what’s happening. If it seems like some science fiction stuff others are dreaming up to distract operations dinosaurs from their “back to basics” plans, then we might all have a better sense for who is positioned to lead companies and categories forward (and who may be “retired” from the prestigious positions they are currently pressured to either deliver from or be dislodged from).

It is equal parts thrilling and terrifying. The global foodservice industry is going to have to start responding and performing with the agility and technological savvy of a Silicon Valley startup if it is to maintain its relevance and share of stomach.

Pause. We know that last paragraph turned off half of our audience. But, please, be patient long enough to be convinced of just how impatient you should probably be.

When we hear the argument that the restaurant industry can’t or shouldn’t be compared to the technology industry, we … well, we breathe into a brown paper bag for a bit and then respond with equal parts exacerbation and encouragement.

While the biggest change the restaurant industry incurred from the Third Industrial Revolution was the Point of Sale System, the one we’re living in now is going to impact every functional area of foodservice and will change what we eat, where we eat, how we order our food, how we pay for it, and more.

Here are some of the trends we expect to see (or continue) for foodservice in 2019 — and beyond.

Global Growth to Remain Steady but Key Geographies Slowing Down

Global GDP growth in the next five years is projected to reach similar levels to the last five (averaging 3.6% annual growth). There are, however, large differences between regions. Emerging and developing Asia (including China and India), Sub-Saharan Africa, the Middle East, and North Africa are set to grow the fastest, while growth in the Euro area is projected to be the slowest.

Since the firestorm of the global financial crisis in 2009, the U.S. has recorded one of the longest streaks of economic expansion in its history. It makes sense: who wouldn’t want to recover from that terrible period (or “turbulent time” as it was so often referred to) and have prosperity continue to compound?

While a slowdown from ~3% to ~2% growth in the U.S. may not seem like much on the surface, it actually translates to a “loss” of more than $70 billion for the economy in 2019 alone.

The global economic climate is like a party where we’re all grateful for the invite and enjoyed it while it lasted. But the parallel to this is that one would not want to arrive too early or leave too late.

Implications for Restaurants:

- Fewer new store openings in many geographies, and a slower pace for those openings

- Some regions jump-starting to newest categories, rather than growing more traditional segments (including casual dining)

- Flat to negative same-store sales for many categories in developed markets

Higher Cost of Capital Impacting CAPEX Allocations

Liquidity is tightening as the U.S. Federal Reserve is paying down the balance sheet and pulling $50 billion out of the market each month (since October 2018) while also raising interest rates. These moves, which in turn put a downward pressure on the prices of stocks and bonds, are resulting in a level of uncertainty that may lead to a market slowdown — some fear (pundits pontificate daily) a full-on recession is coming, with many guessing the quarter like a game show contestant.

Even though higher interest rates could be negative for M&A (leveraged buyouts, for example, would become more expensive), there are many factors that will continue to foster private equity activity in the foodservice space. Tax incentives (cuts in the U.S. and other regions, including China) and the fact that the more types of investors (sovereign wealth funds, family offices, etc.) have become active participants in the sector are both helping to broaden the market.

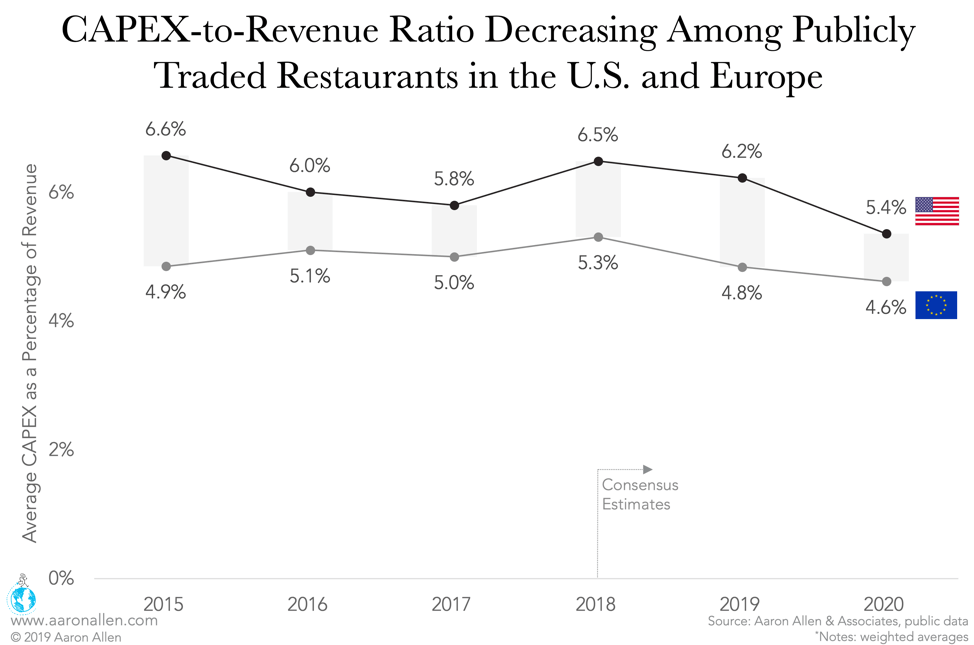

The increases in the cost of capital, in addition to more stock buybacks and other factors, have led to expected decreases in CAPEX as a share of revenue for publicly traded restaurants in the U.S. and Europe over the next two years. While this is partially due to some companies moving to more asset-light models, it also indicates that some organizations aren’t making the kind of forward-looking investments that would help to expand margins, improve efficiencies, and grow footprints.

Implications for Restaurants:

- Equity financing may become more attractive than debt (though interest rates are still relatively low), and capital allocations will be under tougher scrutiny for investments including new locations, remodels, capitalized technology improvements, etc.

- Economists and executives will be kept busy reworking variables — and those who don’t do the math ahead of time will feel it more (eventually) in the balance sheet with regard to enterprise value, cash flows, liquidity, and so on

- Debt ratios in the restaurant industry reached a median of 65% (for publicly traded companies in the U.S.) and interest payments are at about 16% of operating cash flow — this will naturally increase as rates are on the rise

Increased Labor Costs Threaten Margins, But Could Help Save Casual Dining

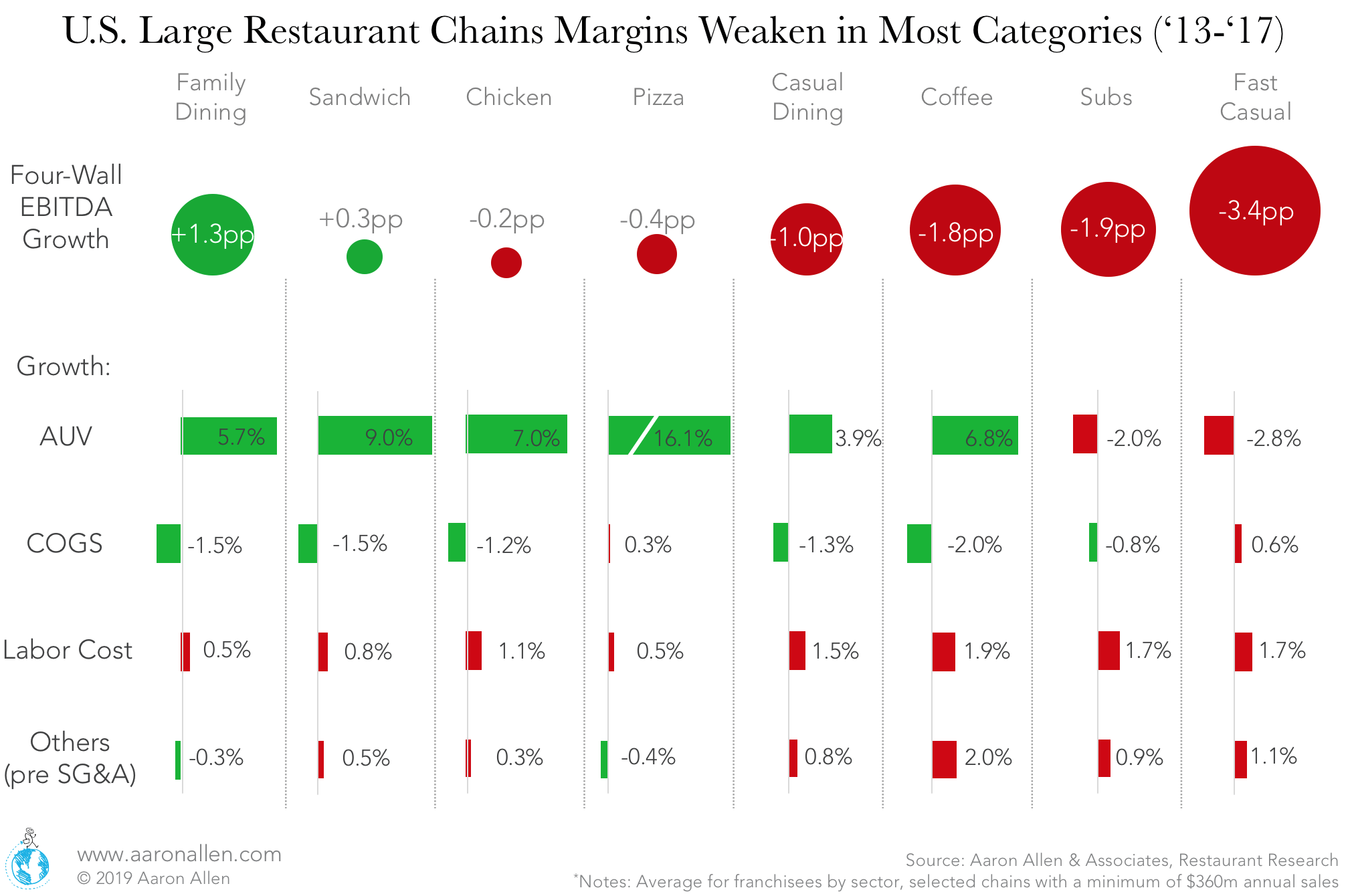

Minimum wage increases, overtime rulings, immigration reform, nationalization programs, urbanization, record-low unemployment levels (a 38-year low in the U.S.), and more are converging to increase labor costs across nearly every line-item driver. Decades of delay in improving the living wage for restaurant workers in the U.S. and globally (or productivity via modernization and industrial engineering techniques other sectors have been applying to improve efficiency) will soon catch up with foodservice categories and unit economic models that are the most margin-sensitive.

Darden CEO Gene Lee has said that “the biggest challenge in the industry is going to be a war for talent. Brands that can hire, train, and retain frontline employees to bring their brands to life are going to win.” As they’ve done before, Darden saw the writing on the wall. The company has outperformed the casual dining sector on the whole in the last decade.

And while there’s been a lot of lip service relative to casual dining and service levels, in particular, there hasn’t been a dramatic improvement with regard to training to address the issues this category is facing. In fact, there’s been quite a bit of pulling back relative to these initiatives, as they’re seen as more of a cost than an investment which can provide returns through enhanced labor efficiency, improved employee retention, reduced breakage, stronger service levels, reduced customer attrition, and so on.

The rising cost of labor can actually (arguably) be a good thing for the industry overall and economies in the longer term. The result will be not only greater emphasis on engineering more efficient unit economic models, labor models, and productivity improvements — these efforts will also be benefited by a wide variety of exciting new tools that have not yet been adapted to or adopted by the foodservice industry. This presents a tremendous opportunity for investors, technologists, and future-looking operators focusing on bold bets to transform adversity into advantage.

Implications for Restaurants:

- Companies who make investments in productivity improvements will leapfrog their competition

- Improved compensation can help offset turnover (which costs the U.S. restaurant industry an estimated $95b annually)

- Technological advancements benefitting limited-service more, initially, to offset labor costs, followed by full-service operators making investments in modernizing training and enhancing relevance

People and Purpose Become More Valuable (Again)

Sometimes a parrot can repeat a phrase it has heard many times with an astonishing resemblance to how it heard it said before. It sounds so human that one can’t help but wonder if it understands the phrase and is repeating it with the same meaning and conviction. “Purpose-driven” has become an example of this in the industry, as it’s now a buzzword for many organizations that have seen plenty others reap the benefits from successfully executing the strategy.

While a monkey-see, monkey-do approach will work up to a point, authenticity is crucial — disingenuous attempts can backfire. There are plenty of attempts to mimic companies who are truly purpose-driven (hard to believe how many times we’ve heard “we’ll be food with more integrity!” after Chipotle’s success) which are often uttered as a precursor for an executive position soon to be turned over.

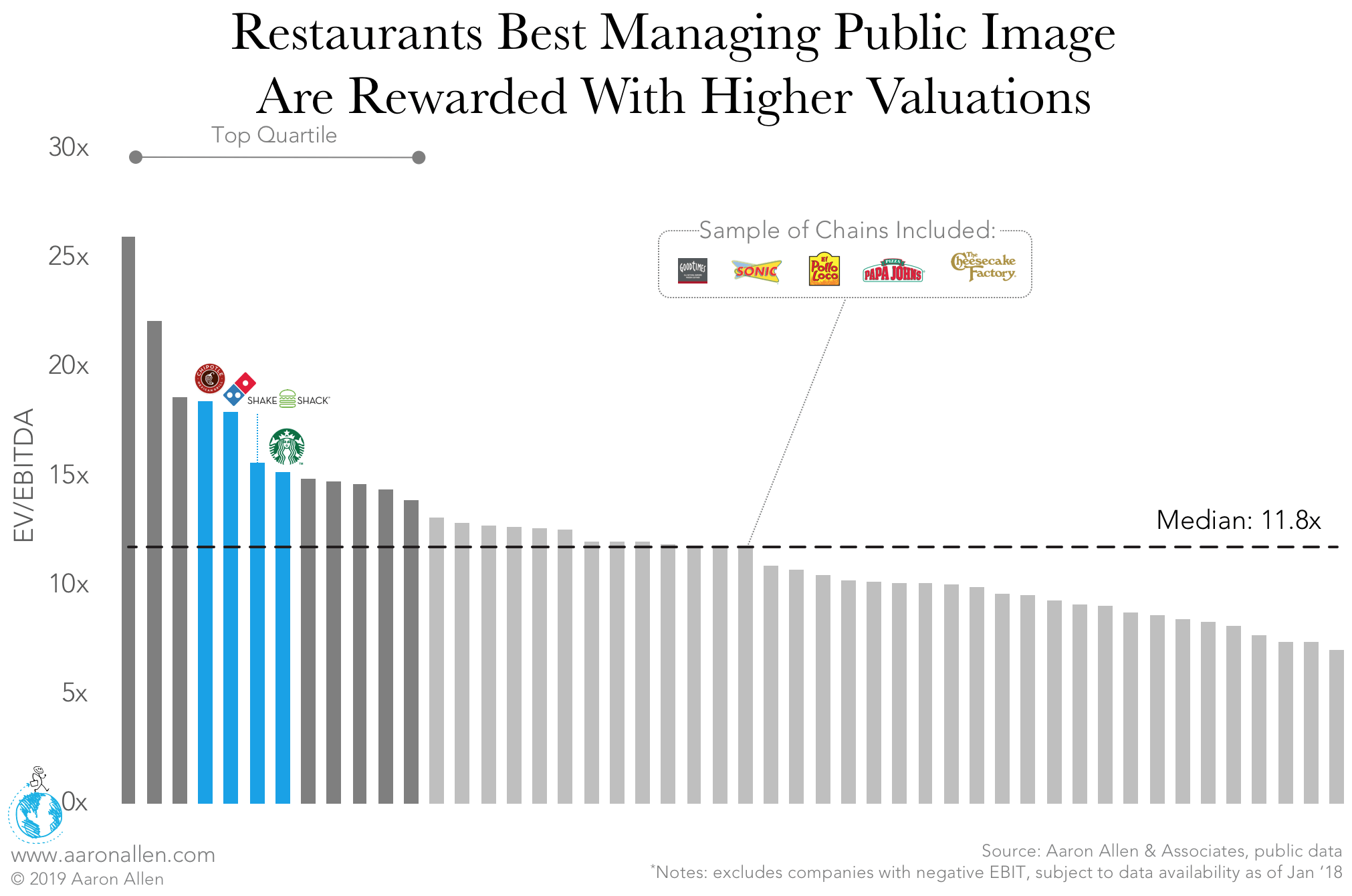

There are lots of ways for a company to show it is purpose-driven, and it’s not just around charitable contributions. Doing good for those you serve — employees, shareholders, communities, and the industry as a whole — can lead to positive impacts across the spectrum: attracting a like-minded workforce, customers willing to pay a premium (leading to higher margins, which will naturally reflect in the valuation of the business), and other benefits such as better real estate opportunities, stronger partnerships, and the multiplier effect of earned media.

There are lots of ways for a company to show it is purpose-driven, and it’s not just around charitable contributions. Doing good for those you serve — employees, shareholders, communities, and the industry as a whole — can lead to positive impacts across the spectrum: attracting a like-minded workforce, customers willing to pay a premium (leading to higher margins, which will naturally reflect in the valuation of the business), and other benefits such as better real estate opportunities, stronger partnerships, and the multiplier effect of earned media.

Implications for Restaurants:

- More companies across sectors thinking about what their purpose is (not just focusing on profits), and how they can effectuate it

- Enhanced enterprise value continues to expand for purpose-driven organizations

The Amazon Deathstar Appears Above the American Foodservice Industry

The first invasion wave of an e-commerce tech giant aiming its master-blaster ray at the restaurant industry will likely happen in the American market with Amazon converging several weapons it has built or acquired into something that’s more deadly than anyone component (Amazon Go, Amazon Restaurants, Amazon Basics, Amazon Fresh, Prime Now, one-click ordering, voice ordering, Whole Foods) is, independently.

The combined potential of this is so significant it deserves its own series. It should also be noted that in the same way that generations of technologies have been leapfrogged in emerging markets (e.g., moving from desktop internet right to mobile internet), the impact of services similar to Amazon (like Alibaba in China, noon(.com) in the Middle East, and so on), and how much more quickly they can be adopted and disruptive to the economy as a whole.

Many restaurants don’t consider grocery stores as competitors. Least of all are they thinking of e-commerce. But what would happen if (when?) Amazon decides to start a prepared food subscription program? It could be the best of both worlds for the consumer, and the deathstar for restaurants.

Implications for Restaurants:

- Restaurants are the mom-and-pop bookstores of the mid-2000s and need to innovate to dodge the same dreadful fate being hurled at them (like a wrench rotating its way to their forehead, they see it coming but apparently prefer to watch it coming until they feel it, rather than just duck)

- Amazon Go, which launched in December 2016, is projected to generate $4.5 billion in sales by 2021 (and is already taking a not insignificant share of wallet)

- For as much as we forecasted where delivery would be today (years ago), the next three years will further accelerate the widening performance gap between those who are looking to and investing in the future and those clinging stubbornly to the past

Delivery Aggregators Get Aggregated

More money has been raised in the last three years for restaurant and food delivery aggregators than in the previous 18 years of restaurant IPOs, combined. But what we will expect to see in 2019 (and the years ahead) is consolidation among these companies. This has already started, with GrubHub’s acquisition (and subsequent shut down) of Eat24 — a classic hike and spike strategy.

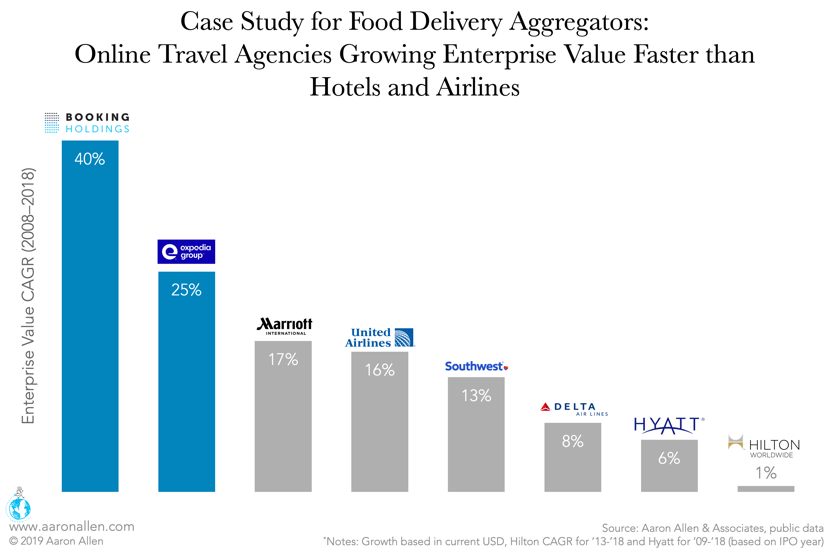

Online travel agencies were as disruptive for the accommodations and air travel industries as food delivery aggregators are becoming to restaurants. In the last ten years, Booking and Expedia grew their enterprise values by 40% and 25% annually, respectively. In 2008, they represented about 11% of the enterprise value of four of the largest publicly traded hotel and airlines companies (Marriott International, United Airlines, Southwest, and Delta Air Lines — Hyatt and Hilton were not public at the time); that share has increased to 70%.

For operators, margins are going to continue to be an issue when it comes to delivery: the biggest battle between restaurateurs and aggregators is the amount being paid to the delivery companies — so much so that some of the larger operators will move to creating in-house delivery services, if they haven’t already started. (Many have called to ask us how — and delivery companies have asked for our help, too — but easy gains often feed the hubris that precedes humility.)

Implications for Restaurants:

- Aggregators aggregating: the history of travel and hotel aggregators will serve as a benchmark for some of what will happen with restaurant delivery today

- There will be an evolution of the business model (both on the side of the delivery platforms and the companies using them) which will happen on an accelerated timeframe

- Even more Amazon/Whole Foods implications here, and the possibilities from other combinations are nearly endless (think about a potential combination between self-driving cars and navigation services, and the ability to deliver fresh ingredients or fully prepared meals with nothing more than the push of a button, or via voice ordering, or the convenience of a sweet-yet-sophisticated robot that anticipates your desires and acts without even articulating them explicitly)

Alternative Proteins Claim Capital

It will be a few years yet before alternative proteins gain so much ground that it scares the establishment, but smart money is already making bets (including incumbents putting corporate venture capital to work by investing early in — and shaping the future of — companies that could one day grow into rivals). The plant protein market is expected to grow 6.6% annually, reaching nearly $19 billion by 2026. Some companies investing in this sector include Tyson (with a stake in Beyond Meat), General Mills (Beyond Meat, Urban Remedy, Farmhouse Culture), PepsiCo (Health Warrior, Bare Foods), Nestle (Wildscape), and restaurant chains including White Castle, FatBurger, and Umami Burger partnering with Impossible Foods. Beyond Meat filed for the first IPO in its category, expected to take place in 2019 for $100 million.

We’ll still eat a lot more chicken than crickets in 2019, so don’t take this forecast as a silly and commercially unviable suggestion that the average operator try jumping on a bandwagon that’s still being built and lab-tested; nor a prediction that Q3’s hottest menu promotion will be what scientists in lab coats are working on today.

But with that said, there is a movement toward greater sustainability. There has to be. Agricultural production simply can’t keep up with population growth. Between water shortages, arable land decreases, species depletion and extinction, climate change and volatility (whether you believe in the politically-charged reasons or not, the impact to crops and food supply, when there is a drought or massive storms is clear), there will be more attention toward ecologically conscious proteins.

Implications for Restaurants:

- Lab-grown meats, insect-based proteins, 3D-printed foods, vertical farms, urban and pirate gardens, and more will begin to be included in conversations for the future of the industry (in the next few years, they will become competitors for share of stomach)

- What may seem or sound like military-only applications now will move toward commercial markets (it’s easy to forget that the French government incentivized inventors to develop a cheap and effective way of preserving large amounts of food to help feed Napoleon’s Army and this led to the invention of jarring and canning)

Interested in learning more about how we help leadership of emerging and established restaurant chains and foodservice technology companies identify areas of opportunity and discover new approaches to anticipate and take action in today's day and age?

Urbanization Births Format Innovations

Globally, ~55% of the population lived in cities in 2018, and that is expected to reach 68% by 2050 (accounting for an additional 2.5 billion city residents by that time). In the U.S., the population in large cities has grown three times faster than the rest of the country over the last seven years. People moving back to the cities is leading to costs increasing faster than low-wage foodservice workers can afford right at a time when operators need them most.

Urbanization will support frontier markets becoming relevant globally, and companies will find it to be increasingly complex when assessing whether and how to expand into these markets. Developing markets will also become more relevant over the next decade, as they’ll account for ~60% of the population and nearly two-thirds of global GDP.

Just as restaurants (casual-dining chains, in particular) followed the population migration over the last few decades to the suburbs, where lower rents afforded larger footprints, the projected changes in the population distribution will lead to new formats. Delivery-only concepts that don’t require prime real estate will become increasingly popular, and new profit centers will be born to accommodate the changes.

Implications for Restaurants:

- Large restaurant brands will look toward fast-growing markets and develop customized entry strategies and will need to keep in mind brand translation and regional competition

- As new formats meet new times, dark kitchen concepts will increase in prevalence; their enhanced scalability will help to reach levels of growth that were previously deemed impossible for restaurants

- In many geographies (China and the U.S., in particular), large cities are reaching a saturation point, prompting a shift of focus to mid-sized cities

The Smart Get Smarter

It’s not just about analytics, KPIs, graduate degrees, continuing education, those “smart carts” at the airport, and city bikes in traffic-congested municipalities. It’s also not just about technology that seems so far off as to be impractical in disciplined corporate planning environments.

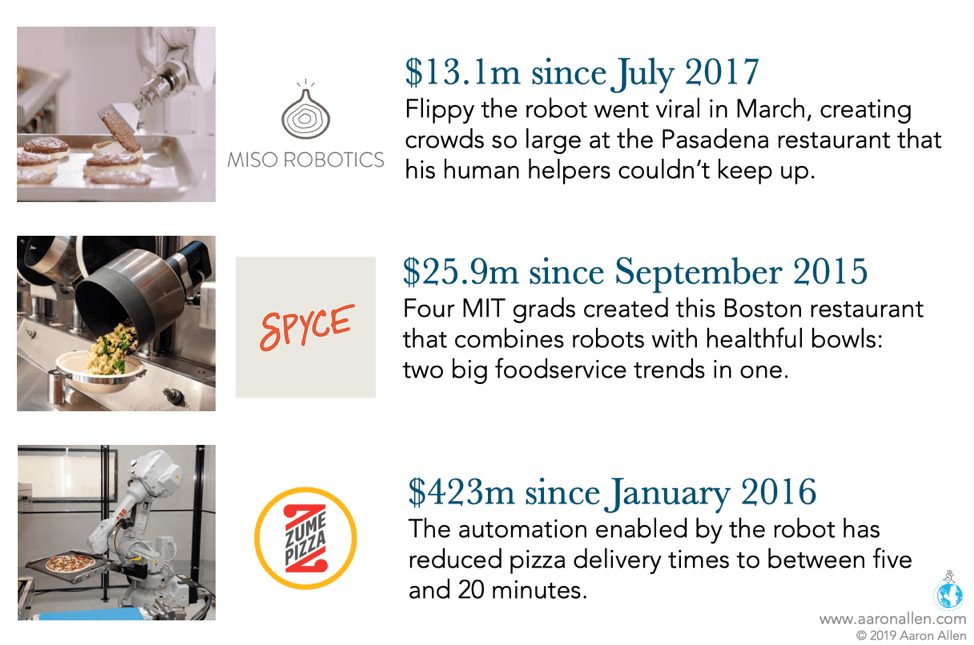

Artificial intelligence, machine learning, sensors on everything, the Internet of Things, biometrics, synchronized robotics, automation — the list goes on — will help to make the companies who are investing in these technologies even smarter. We’re now to the point where we can trace a single strawberry from farm to fork.

Implications for Restaurants:

- Artificial intelligence leading labor schedules and optimization

- Pricing and supply chain algorithms (factoring in geography, brand, supplier, etc.) helping to reduce distribution costs

- Driver shortages to be solved with autonomous vehicles (this may not necessarily be in 2019, but it’s not too far out)

Blockchain and Payment Tech

With the ability to enable faster access to funds, reduced liability and risk from data breaches, and increased throughput by eliminating payment bottlenecks, blockchain and other payment technologies will have a significant impact on the restaurant industry.

While restaurants have been historically slow to adopt technologies, the fact that the consumer has become increasingly used to — now to the point of expecting — these conveniences will ensure that the adoption rates are faster than before. Self-order and self-payment will be increasingly incorporated into restaurants, which will also help organizations with regard to CRM (really just a fancy way of saying “we know who our customers are, and we try to keep in touch”).

Implications for Restaurants:

- Blockchain being implemented allowing for faster and more secure payment processing for both the consumer and the company

- Potential savings when switching from traditional credit card processing to blockchain payment options

- Disruption of legacy point of sale companies

Ones to Watch

While it was a quiet year for Chipotle (which has been flying relatively under the radar, while posting its best year since 2013, after former Taco Bell CEO Brian Niccol took the helm) and Amazon (with headline mentions focused mainly on the search for its new headquarters), expect to hear much more from them in the year ahead.

Some other companies (and individuals) on the watch list for this year include: McDonald’s (CEO Steve Easterbrook has been pressured with slowing pace and franchisee discord), Ron Shaich (both with ActIII Holdings and his work to shake up corporate America’s focus on short-term results), Tender Greens and sweetgreen (a classic East Coast v. West Coast battle in the same category with sweetgreen — the first restaurant unicorn now valued at more than $1 billion — winning the last round), CDRs as a whole, and massive franchisees and emerging market regional powerhouses that are expanding beyond their home turf through the acquisition of foreign chains.

Implications for Restaurants:

- Master franchisees will become as powerful as their franchisors (and they’ll work on colonizing new markets as they outgrow previously self-imposed geographical boundaries of expansion)

- The first restaurant or foodservice tech unicorn IPO in 2019

Volatility is the New Normal

CEOs of today are not passengers in cushy chauffeured coaches or entitled to Jacuzzis and jets. They share more in common with the adventurous sea captains of yesterday than the aristocracy. They recognize that they are responsible to and for a great many. They have not made it to the top so much as they have been entrusted with the fates of the many they serve (shareholders and stakeholders; companies and communities; a profession and trade; the lives and legacies of themselves and all else who place their trust in them).

Modern CEOs left firm ground long ago, and now captain boats that must navigate not just choppy seas and a surging or receding tide, but also romance temperamental financiers, harness the finicky winds in predictable ways, inspire and communicate with a sometimes distrusting crew, and chart dangerous new waters in pursuit of fertile ground to plant flags and grow crops; and return all the fruits of this labor and risk safely, to deliver both handsome profits and healthy sailors (as flawlessly and with the flair of a master magician’s best trick).

It’s nearly as overwhelming as the human spirit is resilient and resourceful. All throughout time — across geographies, cultures, and dispositions — humankind has endured and overcome difficult situations and circumstances. Today is no different, except — with acknowledgment to the exception that has always been true — the challenges of today are new and more, well, challenging. They require more ingenuity, passion, commitment, and those wonderfully human characteristics of the human spirit. Faithful, optimistic, undaunted, and determined to make improvements for themselves and others in the service of a greater good.

Today, that requires factoring in the calculus of global markets and competition, outsmarting the machines we built to outsmart us, digging even deeper for both the motivation and inspiration to contribute (to wider society, closer constituencies, and even the global tribe) in a way that is memorable and meaningful.

So, As To What You Should Expect For Restaurant Trends 2019?

More of the same. More intensified.

Some will put in valiant efforts and advance us all forward in ways we could not have previously imagined. And, sure, others will freeload, frustrate, and seek enrichment in unfair (even despicable) ways. There will be good days and bad days; awful people and awesome people. Some days we will feel the lightbulb go off, and some days it would seem someone intentionally shot the lights out.

But, for certain, you can count on 2019 moving faster than 2018. For life to be both more complex and simplified. For work to be more challenging and rewarding. For some service experiences that make you want to pull your hair out and some that make you want to hug someone and express just how much you appreciate them, their effort, and what impact they had on you and your life.

And, you can also bet that those companies that invest more in their people, systems, products, corporate purpose, the best advisors, and thoughtfully-constructed plans, will outperform those that didn’t. More to the point, for the hospitality industry (and by extension foodservice, travel, retail, and service businesses) that put the crew first (put themselves wholeheartedly in the service of being in the service of others) will not only grow faster and farther, they will help bring us all to a better place; lavished with the prizes because of the higher calling of the endeavor and not just the elusively fat profits a faux contributor falsely presumes.

What Does It All Mean?

The spectrum of challenges and opportunities of the foodservice industry of the future cannot be seen with only a microscopic nor macroscopic lens; it requires both, plus a telescope and an operator with the ability to quickly change the direction and focus of view without getting vertigo. It can be helpful to use the buddy system and use your judgment on what to target and when to pull the trigger while having a spotter to help analyze the conditions and hone your aim.

There’s a natural tendency to think like lab rats — going about life as normal and oblivious to what the scientists are working on until confronted with something that disrupts a comfortable routine. We’re living as part of a generation that will witness more modern marvels than any other in history. The majority of our population has always lived in an era where both TV and radio existed, so it’s easy to forget that it took decades between those inventions, which were both quantum leaps in technology.

Over the last ten years, there have been mostly incremental changes made with regard to our day-to-day lives. The same will not be said ten years from now.

Some Things to Keep in Mind Heading Into 2019

No matter what kind of steel-hearted robot we serve or build, human traits — gratitude, generosity, graciousness — will continue to be appreciated and in vogue.

We are equally responsible for helping contribute to a better way forward as anyone above or below us; anyone who came before us to inspire; or anyone who follows in our footprints and example.

Service is above us, not beneath us. Contributing to a greater good may be the greatest thing about our species.

And our industry was born from and designed specifically for this purpose: to serve, enable, nourish, encourage, and enrich others selflessly.

About Aaron Allen & Associates

Aaron Allen & Associates works with leaders of global foodservice and hospitality companies on strategic issues related to growing and optimizing performance and value. Specializations of the firm include multinational expansion, system-wide sales building, brand and portfolio strategy, modernized marketing, industry trends, technology, and advanced analytics. Aaron has personally led more than 2,000 client engagements spanning six continents and 100+ countries for companies collectively posting annual revenues exceeding $200 billion.