Hospitality is one of the largest industries in Europe. In fact, a recent study conducted by HOTREC (the trade association for hotels, restaurants and cafés in Europe) found that the industry can be a key driver for job creation in Europe, even in times of crisis. And the region’s certainly seen a lot of uncertainty lately, thanks to policy changes and decisions related to BREXIT and the recent French election. Over the ten years since the start of the millennium, reports the study, the number of jobs overall in the EU economy grew by just 7.1%. The hospitality sector, meanwhile, created 29% more jobs in comparison to the year 2000. The numbers speak for themselves, illustrating the strength and opportunities associated with the European restaurant and foodservice landscape.

We analyzed the largest European restaurant and foodservice operators in Europe to determine the greatest strengths and opportunities of the region. Here’s the bulleted version of what we found, which we expand on below.

Key Takeaways:

• Europe, similar to many other markets, sees high market concentration among the top-selling companies.

• US concepts (QSR chains in particular) are taking a good bite of share from homegrown concepts.

• Americans are still the bigger spenders, but some countries (like the UK and Germany) are catching up in terms of ATV.

• The demand for QSR in Europe is still not as predominant as it is in the US, and less traditional segments (like contract foodservice at businesses and universities) see more traffic in Europe than in the US.

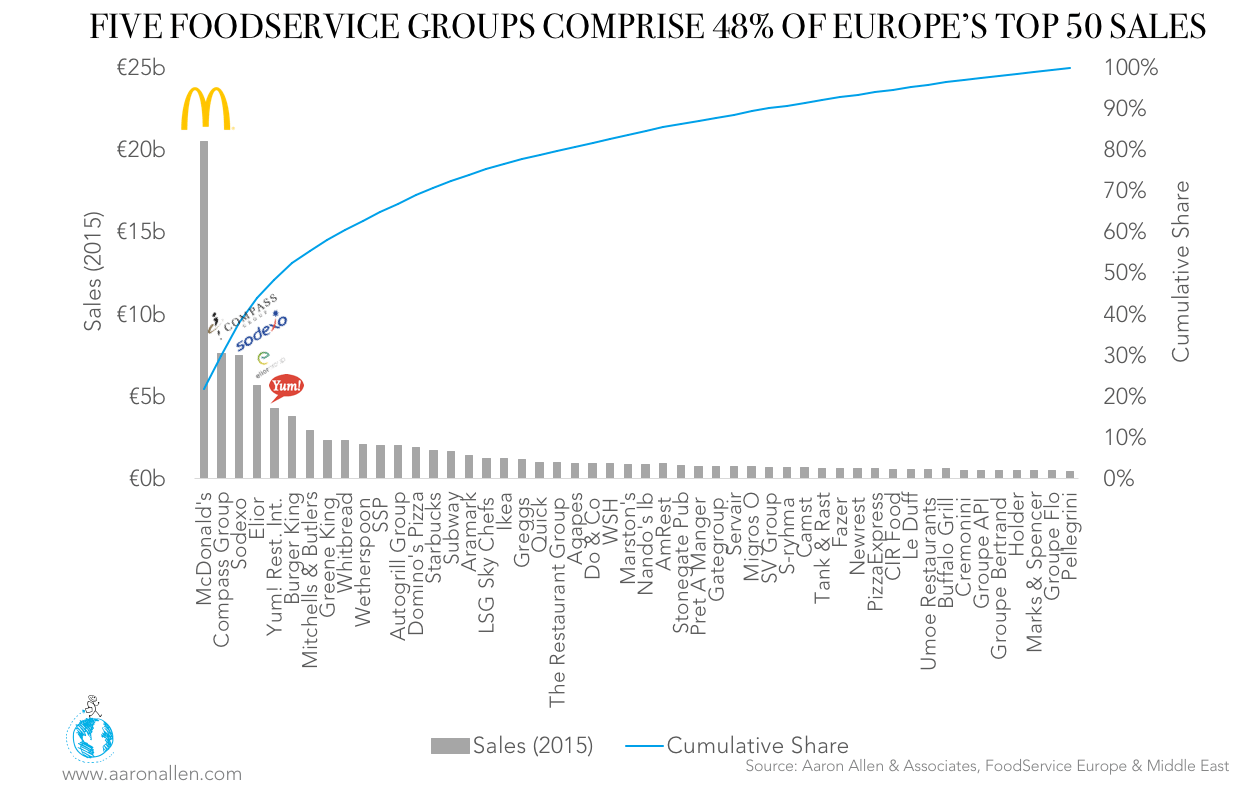

THE FIVE LARGEST EUROPEAN FOODSERVICE BRANDS ACCOUNT FOR NEARLY HALF OF THE TOP 50 SELLERS

The five largest foodservice groups in Europe — McDonald’s, Compass Group, Sodexo, Elior, and Yum! Restaurants International — account for nearly half the sales of the region’s top 50 foodservice companies. McDonald’s and Yum! are in the QSR segment, but the other three focus on the contract segment.

McDonald’s alone, the largest company of the bunch, has more than double the sales of the second-largest group (with 2.7 times the sales of Compass Group in 2015). Its first European outpost opened in the Netherlands in 1971 and today, the company has more than 8,000 restaurants in 39 different European countries (79% of its European outposts are franchised).

In addition to maintenance and cleaning services, Compass Group offers contract catering at sporting events, military bases, schools, hospitals, and businesses — boasting a client base that spans some 15,000 locations in the UK and Ireland.

A Paris-based multinational vendor of multiple outsource services, Sodexo offers a wide range of food services around the globe, including take-away; patient and visitor dining; student dining; vending machines; and staff restaurants. The company serves more than 450,000 meals a day in India alone. Founded in 1966 in Marseilles, it today touts itself as the 19th-largest employer worldwide with revenues of $22.5 billion.

Elior Group is one of the most notable global players in the contracted food and support services industry, offering catering services to businesses in the education, healthcare, travel, and leisure sectors. A leader in its main markets (Europe, North America, and Latin America), Elior operates in 15 countries and recently entered the Indian market. It’s currently number three in concessions catering worldwide, and number four in contract catering worldwide.

Yum!, the parent company of KFC, Pizza Hut and Taco Bell restaurants, made a 2016 announcement to significantly expand the European footprint of Pizza Hut through master franchise agreement with AmRest Holdings. The deal will see the pizza chain grow its presence throughout Eastern and Central Europe, with more than 300 new restaurants to be developed, owned, and operated by AmRest (ranked 27th of the European Top 50) over the next four years.

The high market concentration of the Top 50 can also be seen when looking at the most prominent F&B franchises (i.e. those with the most units). In fact, the top three European franchises have about the same number of locations as the next 55 chains, combined.

US CONCEPTS ARE RESONATING WITH EUROPEAN CUSTOMERS

Thirty-seven percent of sales from Europe’s top 50 foodservice and restaurant brands come from the US, an indication that US concepts are proving successful in Europe. Perhaps even more telling is that most of those concepts are Quick-Service brands. The UK has been one of the most significant contributors to Domino’s international success, for instance. The influence of Master Franchise partners in the region has helped the company’s UK market deliver impressive same-store sales numbers. Still, analysts believe Continental Europe is under-penetrated, with the potential for some 2,500 stores.

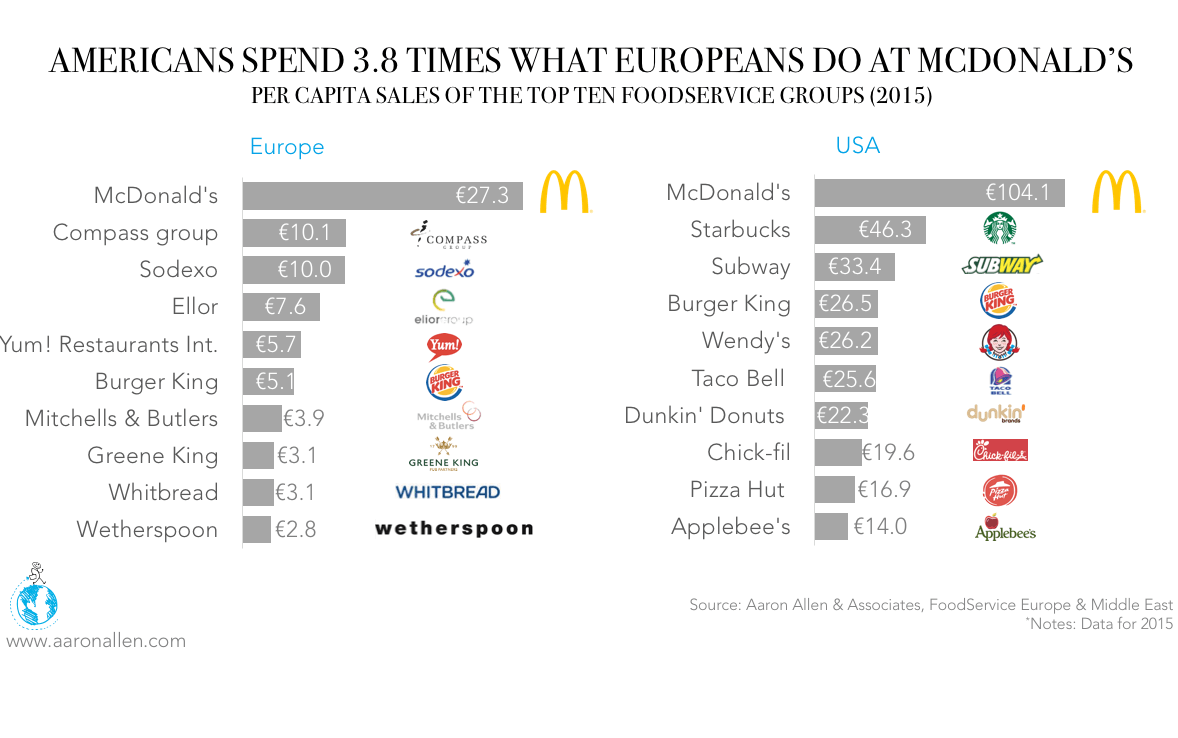

McDonald’s is at the top of the foodservice groups both in the US and in Europe. On a per-capita basis, however, Americans spend 3.8 times what Europeans do at McDonald’s (though, to be fair, the European spend on Food Away From Home tends to be lower than the American spend). While QSR and Casual Dining brands predominate the top ten in the US, there are also Contract Catering companies and Pubs in the European top ten.

Of course, local concepts are showing success, as well. Roughly half the sales in the Top 50 (48%, to be exact) are from brands based in the UK or France. Such companies include pub brand Mitchell & Butlers, currently in the midst of a fundamental overhaul that will see the expansion of the Miller & Carter steakhouse brand and a reduction in the number of mid-market Harvester restaurants.

Another pub chain, Greene King, saw like-for-like sales edge up 1.5% between April 2016 and April 2017. The company’s future looks even brighter — currently in the midst of a rebranding, Greene King saw sales at 63 upgraded stores rise by an average 30%.

HOW EUROPE’S RESTAURANT INDUSTRY COMPARES TO THE US

2015 sales of Food Away From Home (in the UK, Italy, Spain, France, and Germany) range between €34.2 billion (in Spain) to €72.2 billion (in Germany). By comparison, the US saw sales of about €454.6 billion that year — 1.57 times that of the UK, Germany, France, Italy, and Spain combined.

Among those countries (the UK, Italy, Spain, France, and Germany), the largest average spend per capita on Food Away From Home is made by people in the UK, who spent €1,127 in 2015. That’s roughly 53% higher than the average annual spend of a Spanish diner, but still below the US average of €1,409. Not only do Americans spend more on food, American restaurants tend to serve larger portion sizes. American diners also spend less time at the dinner or lunch table as Europeans, who engage in longer, more drawn-out meals (hence the continual popularity of quick-service and fast-casual eateries in the US).

Germany and France see similar restaurant spend per capita (within a 3% difference), even though Germany has a 13% higher GDP per capita. In other words, the French have a higher propensity to dine out than Germans do.

Despite the many differences in cuisine, portion size, and dining habits among countries, the average dining check in the UK and Germany (around €6.5) is similar to that of the US, which is only 4% higher, at €6.7. This value rapidly decelerates across countries however, with Italians spending approximately 60% what British or German diners do. French and Spanish diners fall somewhere in the middle of the spectrum, with average checks of €4.8 and €5.5.

While 71% of US dining traffic goes to Quick-Service chains, less than 50% goes toward QSRs in European countries. The second most trafficked dining segment is different for both regions of the world, too. In the US, it’s Full-Service Restaurants/Hotels, but in three of the five European countries examined here, it’s Workplace/Education (i.e. cafeterias in schools and businesses). In other words, there’s a lot of demand for contract foodservice and catering in Europe.

QUICK-SERVICE RESTAURANTS ARE LEADING OTHER SEGMENTS

QSR leads every other restaurant segment in Europe in terms of total sales, growth, average sales-per-company, and number of companies in the Top 50. A full 36% of Europe’s Top 50 foodservice brand sales in 2015 came via American QSR brands.

When examining share of sales by segment, it’s notable that QSR has a share of 25% or higher in the UK, Italy, Spain, France, and Germany.

WHAT THE FUTURE HOLDS

In recent years, hospitality has been one of the fastest-growing sectors in Europe in terms of employment. And despite some uncertainties, there are still plenty of positives: the tourism industry, obviously an important component of hospitality, continues to thrive. According to HOTREC, Europe is the largest tourism destination in the world with a market share of around 50%, representing some 475 million international arrivals.

The growing importance of Europe for business travelers and the region’s resilient economy are expected to help foodservice company revenues in the coming years. New homegrown concepts will emerge, new segments will take off, and opportunities will shift to the value end of the spectrum as dynamics shift. Overall, though, the foodservice industry is expected to grow steadily, at a compound annual growth rate of 2.1%.

* * *

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion, span all 6 inhabited continents and 100+ countries, with locations totaling tens of thousands.