Alternative foodservice formats are increasing in popularity across the globe. More and more, we’re seeing companies that are looking to provide food via convenient and affordable formats that have attractive unit economics or are more relevant to emerging consumer trends — bringing food to customers where they live, work, eat, play, shop, and so on.

The amount and intensity of new formats popping up and the way consumers’ appetites are changing (nearly 70 million Americans have made significant changes to their diets) should be sufficient enough to spark a strategic conversation around the wider implications for foodservice. Both restaurant investments, whether via private equity or corporate venture capital, and long-term planning can and should be modernized to factor in non-traditional threats that may not have been showing up on the corporate radar and assessment of evolving consumer and competitive landscape.

Just like an amoeba in a Petri dish, many now-expanding categories that started out with just one instance are proliferating throughout the industry, taking meal or snacking occasions from traditional foodservice operators. While some of these will be flash-in-the-pan fads (and we’re not necessarily making any bets on, endorsing, or recommending the cases below), here are a few examples of alternative foodservice formats:

1. Delivery-Only Concepts and Dark Kitchens

Delivery is one of the most dynamic forces reshaping the restaurant industry. Delivery-only (sometimes referred to as “dark kitchens” where there is no customer-facing location) represents a growing share of consumer foodservice sales globally, and it’s significantly higher in more mature regions like Western Europe and North America.

- In the U.K. Deliveroo launched pop-up takeaway and delivery food kitchens in May 2017, where they set pods (effectively shipping containers outfitted with restaurant equipment) in low-rent real estate areas — like parking garages — to satisfy a demand for delivery in areas where occupancy costs can be very high

- These operating models are in alignment with the increased demand for delivery while reducing labor costs

- The format is also more flexible to switch concepts or menu offerings without additional remodel costs

2. Automats and Vending

The automat, which originated in the late 1800s and reached its heyday in the 1950s before falling out of popularity in the mid-70s, is having its own renaissance. The vending machine model has clear benefits for unit economics, both from the CAPEX investment point of view and labor and staffing cost optimization, and is in direct alignment with the increased consumption of snacks worldwide.

- In 2017, a Japanese ice cream robot debuted that can serve a fresh cone in less than a minute — and at a lower price point than traditional stores

- Similar vending machines were selling for $65k to $200k back in 2014 (whereas traditional frozen yogurt/ice cream shops start at $300k for buildout and equipment)

- San Francisco startup Eatsa also launched an updated and vegetarian take on the automat in 2015, where diners order and pay via an iPad and then pick up food from a cubby when their name pops up on an automated door

3. Mechanization and Robotic At-Home Kitchens

It’s not just restaurant kitchens that are being revolutionized. The first residential robotic kitchen already exists and can be operated with your phone to cook without human intervention.

- The robot’s hands replicate human movements and use the same technology employed by NASA

- The machine can produce more than 100 programmed recipes, and even has options for dietary restrictions (including plant-based and vegan diet substitutes) and calorie counts for consumers paying particular attention to their food choices and nutrition to eat healthier

- The initial cost to the public as of 2017 was between $75k–$92k, which was naturally met with some dismissiveness (though the same thinking was applied to $15k plasma TVs back in 1997)

4. Food Halls

Before the pandemic, food halls were expanding at a rate 16x as fast as restaurants in the U.S., and this is a growth pattern expected to gain momentum globally as well. Between 2015-2019, this segment of foodservice has more than doubled its footprint, and interest in the format — which alleviates some operational risks and costs for operators in the service industry — is not expected to slow down.

- There were some 180 food halls in the U.S. as of 2018, and between 2015 and 2020 projections indicated an increase of 4.3x (from around 70 to about 300)

- Typically, food halls are between 10,000–50,000 square feet in size and can feature as many as 20 different concepts

- Beyond the traditional food hall, mini versions (less than 10,000 square feet) are starting to crop up in offices and living spaces which can fit more than a half dozen vendors in the same amount of space of two and a half traditional McDonald’s

5. Food Trucks

Kogi Barbecue, a pioneer in the food truck space, gained notoriety because it was one of the first and most successful cases of restaurants using Twitter. It was a very fast turnaround from its inception in 2008 until food trucks were being listed as one of the most influential restaurant trends noted in industry trade publications. While its growth has ebbed and flowed over the years, the unit economic model remains attractive.

- In the U.S., food truck sales were reaching almost $1 billion by 2020 (an increase of 16% since 2015), and much of the growth in the category was making up for losses from stalls and kiosks in malls

- Traditional brick and mortar chains such as Taco Bell, Olive Garden, and Chick-fil-A have used food trucks to sell their products or test new items

- Startup hard costs (relative to buildout, equipment, etc.) for food trucks can be as low as one-third of a traditional location buildout, and operating expenses (with fewer permits, no property tax, lower maintenance costs, etc.) can reduce costs as much as 25% compared to standard restaurants

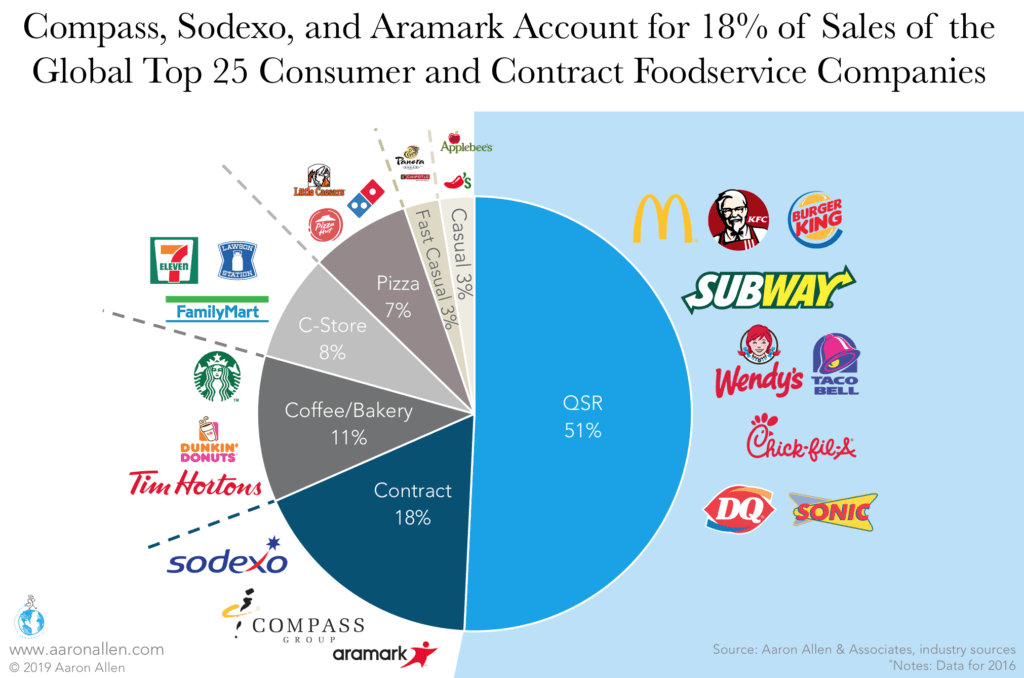

6. Contract Foodservice

Some of the largest foodservice companies in the world are those that many consumers wouldn’t recognize the brand names of. Compass, Aramark, and Sodexo are all leading contract foodservice operators which service airports, hospitals, stadiums, and arenas around the world.

- As of 2019, in the U.S., managed foodservice represented some $53.6b (about 7% of all food away from home)

- Contract companies represent 18% of sales among the largest 25 foodservice brands globally, including Aramark (U.S.-based), Compass Group (U.K.-based), and Sodexo (France-based)

- The global contract foodservice market had an estimated size of $260b before the pandemic, and the largest player (Compass) reached $23.2b in sales in 2018 — equivalent to about a third the global sales of the largest global consumer foodservice brand, McDonald’s

Restaurant Research Services

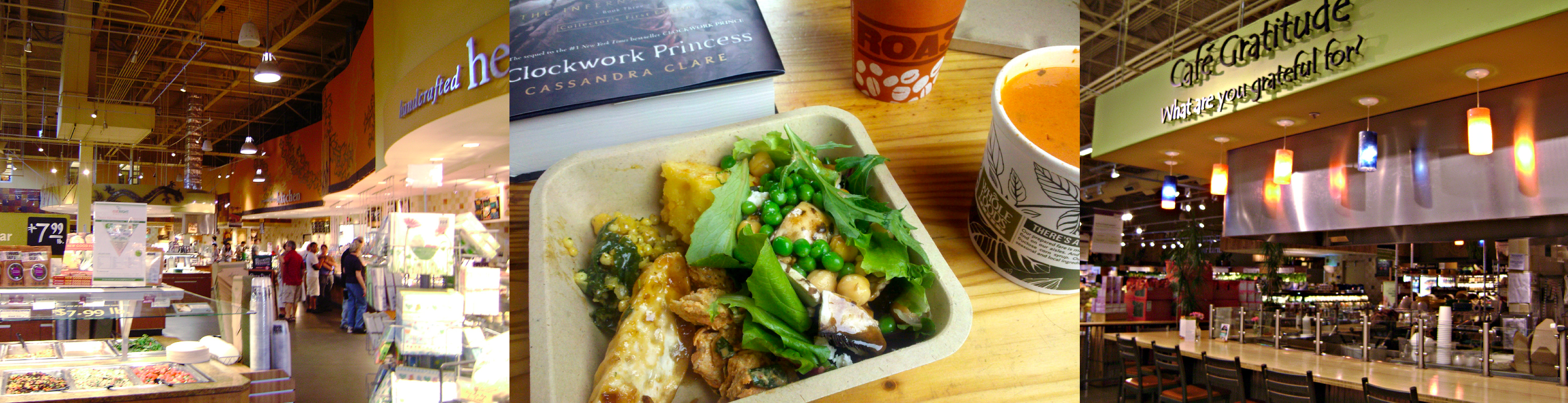

7. Groceraunts

For the last ~50 years, restaurants have been steadily stealing share from grocery stores (so much so that the industry has pretty much taken that consistent growth for granted). But grocery stores have started to fight back in recent years, some of them even adopting the “groceraunt” model, adding in more of a focus on prepared and ready-to-eat options (and alternatives to more processed foods).

- Price inflation has gone up three times as fast in restaurants as it has in grocery stores, largely attributable to wage increases and the requisite labor levels in a restaurant environment

- Sales per employee in grocery stores are 3.6x greater than in restaurants

- Groceraunts generated 2.4 billion new visits and more than $10 billion in 2016, and 58% of consumers say that a grab-and-go or prepackaged food option would be appealing in retail/grocery stores

8. Pop-up Restaurants

Another trend from the past that’s coming back into fashion are pop-ups — reminiscent of 1960s super clubs. Many chefs are opening pop-up restaurants to showcase a special menu or offer select, seasonal choices. Hotels are also taking advantage of the pop-up trend by using their seasonal spaces to make up for business being down in the colder months. They are looking to re-configure existing spaces to attract local clientele and become a draw (with outdoor living rooms, fire pits, heaters, etc.). Many hotels are adopting a rediscovery of seasonality to provide consumers with both consistency and a sense of surprise.

- Restaurant Day in Finland (a celebration of food culture and a highlight of pop-ups) takes place four times a year and has hosted 3,600 one-day restaurants that have served 180,000+ customers since its inception in 2011

- Pop-ups capitalize on the long-standing principle of scarcity in marketing by putting an upscale or fine-dining spin on the same concept of limited time offers available at QSRs

- Millennials, who spend more on dining out as a percentage of their income than any other demographic, are a perfect target for pop-ups — especially as they are also in alignment with the experiential focus that both they and Gen Z seek

9. Cashierless Convenience Stores

Even though the unit models for grocery stores or C-stores are very different than those for restaurants, these categories are competitors for share of stomach and wallet of the same consumer.

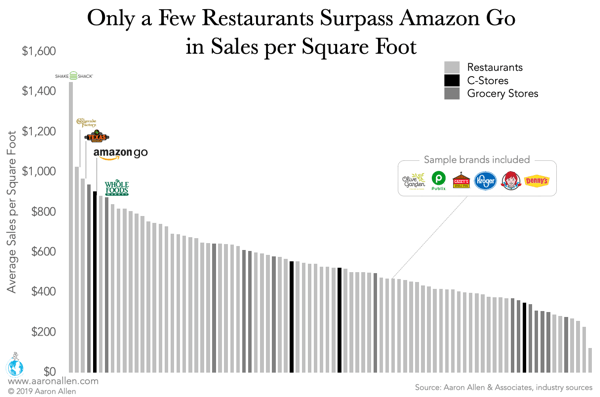

- Only a handful of restaurant chains surpass Amazon Go and Whole Foods in sales per square foot — one of the best indicators for productivity in the foodservice industry

- Amazon Go could reach as much as $4 billion in sales by 2021 (even though it only has nine stores operating as of early 2019), continuing to steal share from QSRs and snacking occasions

- Other C-stores are also trying to attract a larger share of consumers’ wallets — Casey’s General Store, for instance, is tapping into pizza delivery (it began the service in a few locations in 2011 and now offers online ordering)

10. Meal Kits and Home Meal Replacement

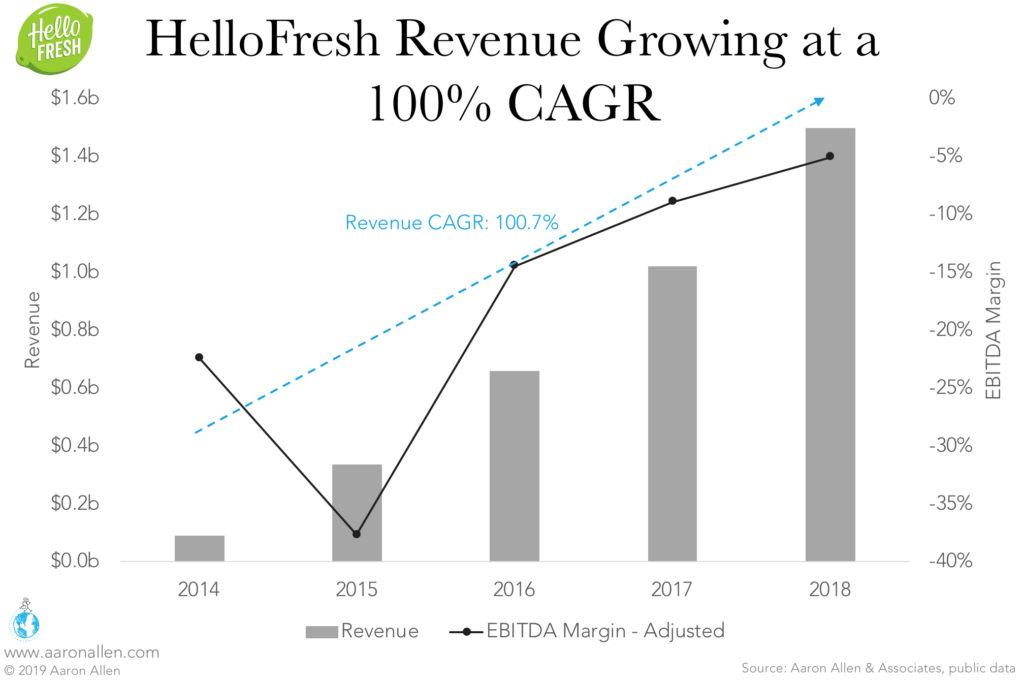

Though meal kits are estimated to represent less than 1% of restaurant sales, the category has been one more papercut on the industry. The model is in alignment with both the desire for healthful eating and more convenience, though it faces the challenge of competing with an ever-growing range of ready-to-eat options.

- Several grocery store chains are bringing meal kits to their aisles — Walmart is selling them from its Culinary and Innovation Center and Kroger bought Home Chef for $200m and is now selling meal kits in its stores in addition to the original subscription model

- Blue Apron, the only U.S.-based publicly traded meal kit company, hasn’t performed very well lately (both with regard to revenue and profitability), though it did significantly outpace the growth of both food at home and food away from home sales from 2015–2016

- HelloFresh, the largest meal-kit provider in the U.S. which headquartered in Berlin, has revenue exceeding $1b and close to 1.5m subscribers globally

Measuring the Impact of Alternative Foodservice Formats

There are many dedicated trade organizations tracking performance across categories (FSR, QSR, etc.) in foodservice, and reporting on trends impacting the industry — everything from an increase in the number of vegetarians to new food production methods to new beverage options.

But, while there are a national restaurant association and a grocery association both monitoring performance of their individual industries, implications of the but all of the implications of new formats like those outlined above are yet to be quantified by these governing bodies. After all, should meal kits be considered as grocery or restaurant spend, or a little bit of both?

Each of the individual alternative options may not seem significant, but — in combination — they are certainly impacting performance for the industry across the board.

Get the Latest Market Intelligence

Forward-Looking Companies Making Smart Bets Early

It’s long been a strategy for some of the world’s largest consumer packaged goods companies to buy up smaller companies (either potential competitors or strategic partners) before it becomes too expensive to do so. Coke’s acquisition of Vitamin Water and Conagra Foods (owner of Healthy Choice and Marie Callender’s) purchasing Birds Eye frozen vegetables are only two of plenty of similar examples.

Some in the foodservice space are beginning to adopt a similar approach via corporate venture capital. Chipotle, for instance, launched an accelerator in August 2018 to support food-focused ventures centered on innovation in agricultural technology or sustainability.

The long-term benefit is not from something flashy with a great PR engine behind it to attract media attention or a well-produced YouTube video for a product or concept that may or may not have viable commercial potential. Rather, it’s from looking at what changes in emerging consumer dining behaviors are driving these things and developing a modernized M&A strategy and investment thesis to support sustainable growth.

About Aaron Allen & Associates:

Aaron Allen & Associates works with leaders of global foodservice and hospitality companies on strategic issues. Specializations of the firm include multinational expansion, system-wide sales building, brand and portfolio strategy, modernized marketing, industry trends, technology, and advanced analytics. If you’re a foodservice operator or investor seeking to drive growth, optimize performance, maximize value, or create a modernized portfolio in the face of increasing competitive dynamics and an accelerated pace of change, we can help.