Restaurant trends are moving faster than many chains can even comprehend. Important dynamics are emerging to shape up consumer behaviors and the competitive landscape across geographies globally — from Canada to the Middle East, India and beyond — and across categories of the industry, from burgers to pizza to steakhouses and casual dining; from QSR in Europe to coffee in the UAE (and so much more).

Back in 2015, we published 10 Major Trends Reshaping the Restaurant Industry. Many of the forces covered in this piece are still very relevant today— from “fresh” being the most bankable word in foodservice to the Freakonomics of Netflix.

Leaders of established and emerging restaurant chains are thinking: What is shaping up in terms of consumer trends, food trends, restaurant technology, evolving dining behavior and consumption patterns, categories, segments, competitive dynamics, and macroeconomic conditions that may be relevant to our forecasts and future strategy?

Here are some of the answers.

Globally, the quick-service restaurant (QSR) industry — or commonly referred to as “fast food” by consumers — claims 25% of restaurant sales. Given this prominence, QSRs have a strong influence on food service trends.

Even though quick service is traditionally related to foods like burgers, subs, and pizza, they are largely influenced by food trends which result in menu updates and are being leveraged by some players better than others. For instance, in the U.S., the chicken segment is outgrowing the burger and sandwich categories among the top QSR players.

Other interesting stats related to fast food trends:

Many casual dining restaurant chains are still misreading the trends and business dynamics impacting their performance; often hoping promotional tactics can hurl them out of trouble. As a result, many of the category leaders are struggling.

One of the foodservice trends that has received the most coverage is casual-dining stagnation: the cumulative growth in same-store-sales equals 0% (considering U.S. chains with $1b in sales or more). That is, a typical restaurant in this segment would have a similar average unit volume as it had ten years ago, evidence of a sharp deterioration in margins.

Fast-Casual Trends

Fast-casual restaurants resulted from the confluence of two consumer trends: the desire for convenience and better quality (oftentimes fresh) ingredients. This service model has consolidated as a growing segment in the last twenty years in the U.S. and will penetrate emerging markets at an accelerated pace.

Delivery is only one of the forces shifting billions of dollars in the foodservice industry from traditional players to new channels and formats.

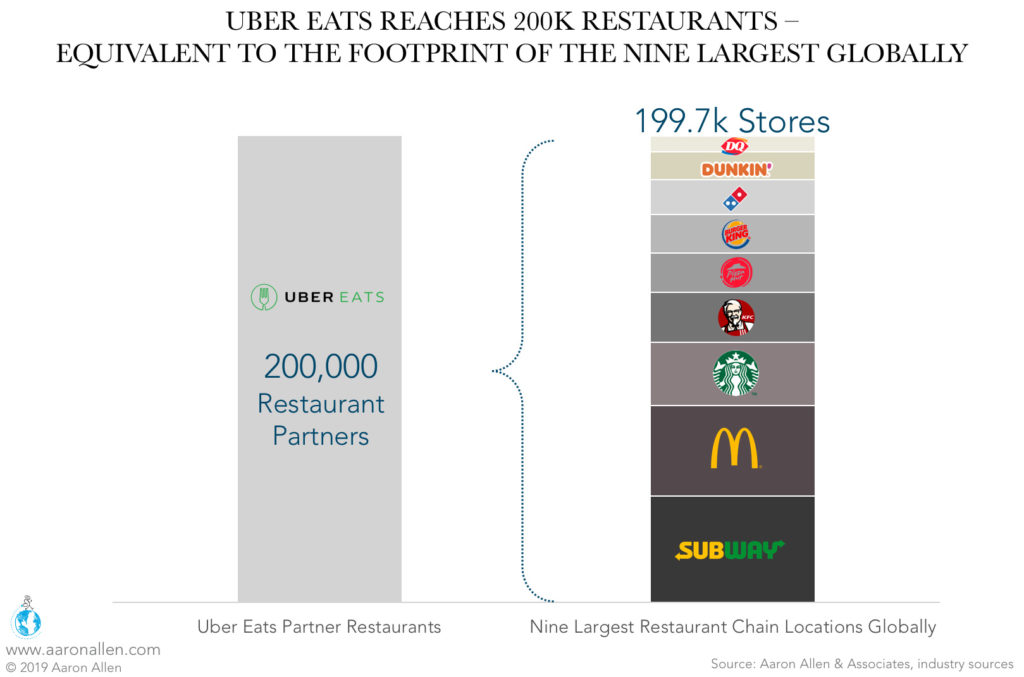

To illustrate the strength of this foodservice trend: Uber Eats, one of the leading food delivery players globally is now delivering food from 200,000 locations worldwide. This is staggeringly equivalent to the global footprint of the nine largest restaurant chains (in terms of number of outlets), combined.

Across the globe, Hotel F&B is being reshaped by powerful forces — Airbnb, food delivery, and technology among them. While some savvy companies are responding to these (and other) trends, many hotel food and beverage programs continue to lag behind.

With $140b in global foodservice spend taking place at lodging establishments, the trends in the foodservice industry have an increasingly strong impact on hotels’ revenue (particularly for operators who avoid many of the common mistakes in hotel F&B).

These are some of the hotel food and beverage trends in the hospitality industry globally:

Restaurants naturally are continuously looking to include new food trends on their menus, and even entire concepts can be born from emerging and evolving food trends.

Great campaigns (leveraging social media and digital marketing as tools) with the influence of the consumer space can turnaround sagging sales in the short-term and buy time and build momentum toward long-term initiatives, running on parallel paths. But if consumers become excited about new product offerings and the customer experience is negatively influenced through run-down locations or poor service, there can be a negative effect in the longer-term.

Even if promotions work for a quarter, it can devalue a brand if not executed effectively across all functional areas of an organization. There is a balance to be reached between operations being able to keep up, and responsiveness to changing food and consumer trends.

A leading food trend reflecting the consumer desire for fresh and healthful meals.

Plant-based meat and other meat alternatives have been making headlines for a while now. This food trend (also aligned with consumer trends for a healthier lifestyle) has received a lot of attention from foodservice investors and CEOs.

Coffee and snacking is a consolidated segment now, with coffee consumption reaching more than 2.2 billion cups daily in the world.

Restaurant business models that put the guest/customer and employee first by anticipating and responding to emerging consumer trends reshape and create markets that dethrone incumbent and dismissive brand leaders.

These are some of the trends changing the relationship between consumers and restaurants:

Via drive-thru, self-order kiosks, or other enablers is becoming increasingly important in today’s restaurant industry landscape. In the last 20 years, in the U.S. sales in limited-service restaurants and retail stores and vending have grown faster than average, resulting in increased market shares for these segments (+8.3%, +11.2%). These changes reflect the consumer demand for convenience, which is feeding into LSRs’ and retail stores’ sales.

With less time at their disposal, consumers are relying more on delivery and consumption at home. Globally, close to one-third of foodservice occasions take place off-premise (convenience stores and “on-the-go” snacks also contribute to this). This doesn’t mean the end.This doesn’t mean the end of full-service restaurants, but more and more consumers will dine-out only if it’s worth it as a differentiated experience.

More than 80% of Millennials expect companies to publicly commit to doing good. Large restaurant chains are taking steps to be part of this trend that emphasizes corporate social responsibility: Starbucks plans to create 10k eco-friendly stores globally, and is tracking and quantifying its environmental footprint; British delivery aggregator Just Eat is investing in R&D for alternatives to single-use plastics; and McDonald’s.

Not only do the number of channels available for marketing grow every year, as social media platforms pop up overnight and then disappear just as quickly (still miss you, Vine!), but new technologies, like narrowcasting, smartphone apps, and self-ordering kiosks, all demand their own approach. These are only three of the trendsthat need to be considered during marketing modernization:

AI and Machine Learning: in 2019 McDonald’s acquired Apprente, an early-stage leader in conversational technology that employs proprietary neuroscience-based artificial intelligence tech to create systems that understand and reproduce human interaction. The technology is expected to boost drive-thru order accuracy and speed, and may eventually be of use for kiosks and mobile ordering.

And even though habits might change and trends might shift, the global restaurant industry remains a force.

There is an abundance of cheap capital sloshing around the global economy that’s looking to the restaurant industry eager to invest in the next Yelp, Chipotle, or UberEats; when a company comes along that is potentially disruptive to the global restaurant industry, investors line up to fund the future.

This means emerging brands and new competitive threats can come seemingly out of nowhere and attack incumbent brands faster than they can react. Effective restaurant due diligence can identify areas that may have artificially enhanced EBITDA and, by extension, valuation. It also provides an unbiased opinion to the deal.

We’ve been covering trends affecting the restaurant industry for some time now. Many of the ones we called-in almost a decade ago, like the rise of fast-casual, the share-of-stomach war of groceries vs restaurants, and the need for a new unit economic model are more valid today than ever. These are some of the articles we’ve written for how different trends have been affecting the restaurant industry in the last ten years.

Aaron Allen & Associates works alongside leaders of global foodservice and hospitality companies on strategic issues related to growing and optimizing performance and value. Specializations of the firm include multinational expansion, system-wide sales building, brand and portfolio strategy, modernized marketing, industry trends, technology, and advanced analytics. Aaron has personally led more than 2,000 client engagements spanning six continents and 100+ countries for companies collectively posting annual revenues exceeding $200 billion.

We are focused exclusively on the global foodservice and hospitality industry. You can think of us as a research company, think tank, innovation lab, management consultancy, or strategy firm. Our clients count on us to deliver on our promises of meaningful value, actionable insights, and tangible results.

Founded and led by third-generation restaurateur, Aaron Allen, our team is comprised of experts with backgrounds in operations, marketing, finance, and business functions essential in a multi-unit operating environment.

We bring practical, relevant experience ranging from the dish room to the boardroom and apply a holistic, integrated approach to strategic issues related to growth and expansion, performance optimization, and enterprise value enhancement.

Working primarily with multi-brand, multinational organizations, our firm has helped clients on 6 continents, in 100 countries, collectively posting more than $300b in revenue, across 2,000+ engagements.

We help executive teams bridge the gap between what’s happening inside and outside the business so they can find, size, and seize the greatest opportunities for their organizations.