Disruption from Coronavirus has been especially significant for the restaurant industry. The economic slowdown, public markets in distress, supply chains interrupted, tourism coming to a halt, consumers staying at home (which — for many — translates to a lower disposable income), and huge uncertainty can have long-lived effects for many restaurant businesses. A global economic downturn is impacting businesses across the world, though there is a case to be made for why recessions are ultimately good for the restaurant industry.

This reveals the importance of having contingency and crisis plans in place (and, frankly, how common it is for chains to under-invest in the planning process). Ignoring macro risks is riskier than ever. Great corporate planning is about more than financial forecasts — and the more thorough it is, the less a CEO has to keep him or her awake at night.

GLOBAL IMPACT:

- Between 3.1b–5.4b people in the world are projected to get the coronavirus (between 40%–70% of the population) within a year, according to a Harvard University epidemiologist

- With a mortality rate of 3.4% (according to the World Health Organization), between 105m–184m people could die from the virus

- This death rate is unprecedented since World War II, where some 75m people died — this means that coronavirus could be anywhere from 40%–145% more lethal

- By comparison, foodborne illness affects 770m globally every year (and half of foodborne illnesses are estimated to be associated with restaurants), though it kills approximately 500k people

- The average American knows 600 people, which means that — on average — 20 people you know may die

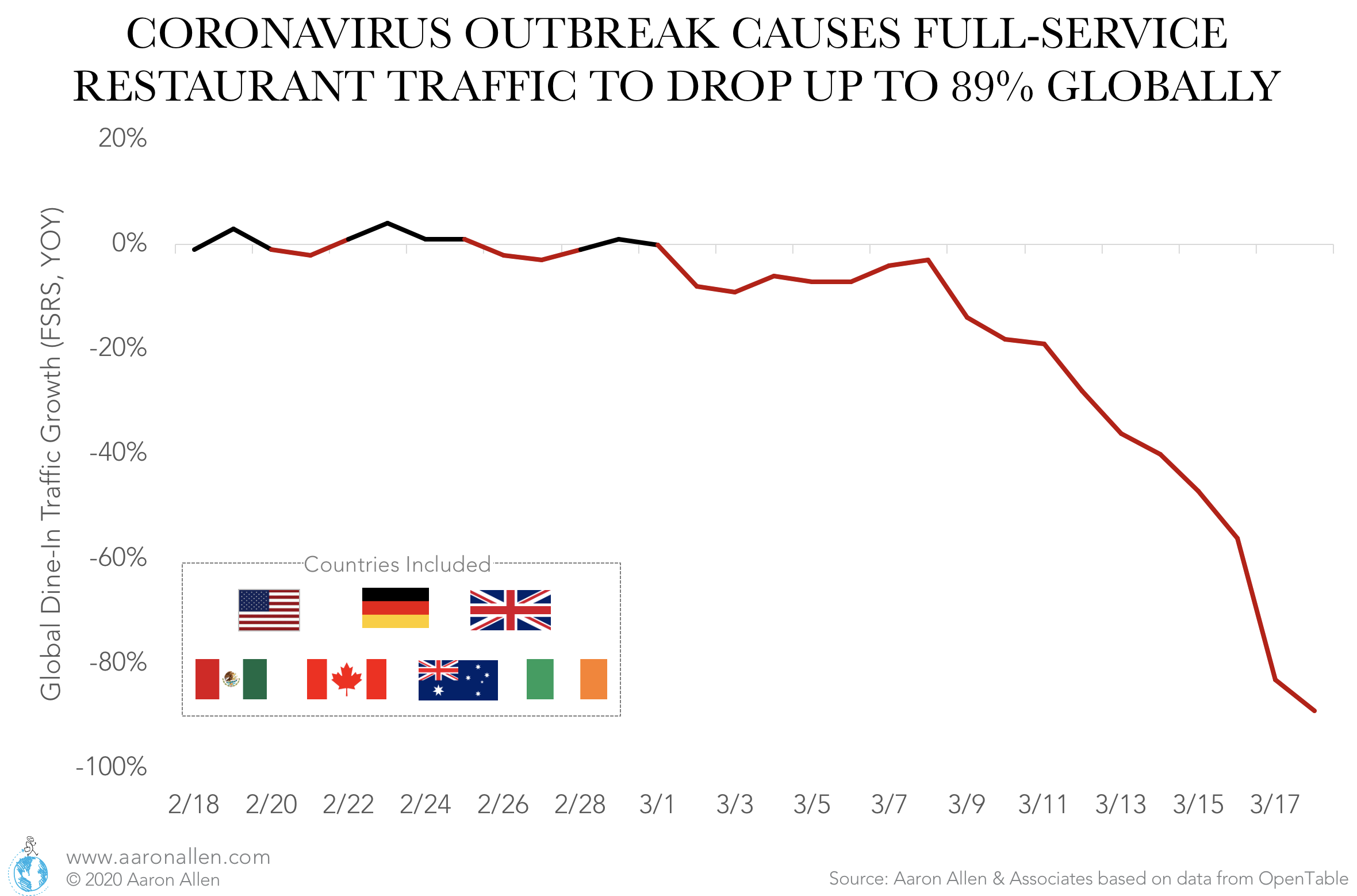

- Some estimates put global dine-in traffic for full-service restaurants down 89% year-over-year as of March 18th (comparisons are daily)

ECONOMIC IMPACT:

- 49% of Americans live paycheck-to-paycheck (FNBO) and one-third of the population is a $400 expense away from financial hardship (and having to either borrow or not be able to cover an unexpected cost)

- The average foodservice worker, making $10/hour, could lose up to $400 of income — assuming they miss 5 days of work with sickness

- At the start of the 2008 financial crisis (September–November ’08), the S&P500 restaurant stock index lost $26b in market cap; between February 19–28, 2020 (when the worst of the coronavirus fears impacted the market) the loss was $42b

- Global stock markets lost $6t in less than a week after the effects of coronavirus began to ripple throughout industries

U.S. RESTAURANT IMPACT OF CORONAVIRUS:

- There are more than 15.3m restaurant industry employees in the U.S. alone, servicing roughly one million foodservice establishments (source: National Restaurant Association)

- Labor costs represent an average of 30% of standard unit-level revenue for most restaurants; any reduction in revenues has a dramatic impact on the P&L at a unit-level

- More than 170m Americans visit some type of eatery every day (source: TTRA)

- Social distancing recommendations which have been issued by both federal and local governments around the world reduce demand drivers for restaurants (including movie theaters, concert venues, etc.) further impact the industry

- Naturally, many Americans will be planning to stay home and restrict dining out, so we can expect to see plenty of empty restaurants, but delivery drivers are not the salvation — rather, they’re the pollen bees of the virus, as they fly from delivery to delivery, potentially spreading sickness among families contained in their homes

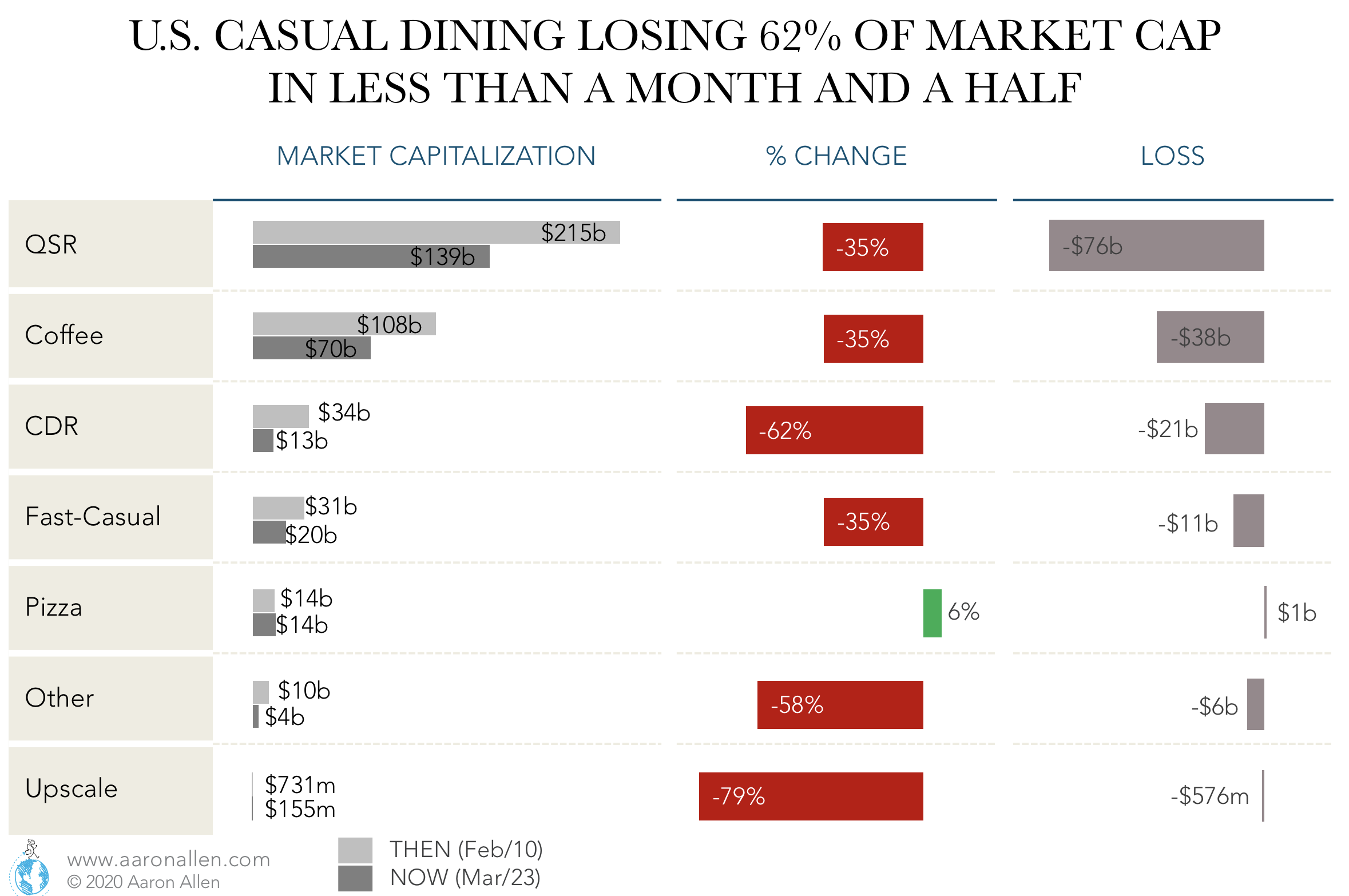

- Publicly traded restaurants in the U.S. lost $152b in market capitalization in 42 days (from February 10 to March 23); that’s equivalent to: 2.9 times the current total market cap of airlines, or 2.2 times the market cap of hotels, motels, and cruise lines, or 2.5 times the market cap of the clothing industry

RESTAURANT INDUSTRY CORONAVIRUS TIMELINE

It’s amazing how fast this crisis is moving and how transformative and long-lasting the consequences will be, globally. Here we present a timeline for the Coronavirus crisis from the viewpoint of the restaurant industry to understand what policies are in place and what the top players are doing. We’ll be updating as developments continue to unfold.

December 2019 – February 2020

March 2020

April 2020

May 2020

June 2020

July 2020

ADDITIONAL INSIGHTS ON THE CORONAVIRUS IMPACT ON THE RESTAURANT INDUSTRY

About Aaron Allen & Associates:

Aaron Allen & Associates works with leaders of global foodservice and hospitality companies on strategic issues. Specializations of the firm include multinational expansion, system-wide sales building, brand and portfolio strategy, modernized marketing, industry trends, technology, and advanced analytics. If you’re a foodservice operator or investor seeking to drive growth, optimize performance, maximize value, or create a modernized portfolio in the face of increasing competitive dynamics and an accelerated pace of change, we can help.