It’s time to free the guest from the tyranny of too many choices.

Humans have a remarkable ability to over-complicate. And this has certainly been true in recent years for restaurant chains that lacked the discipline to prune and manicure their menu strategy.

Much like the sense of surprise and panic of looking at the bathroom scale late in the holiday season and feeling startled enough to get back into the gym and cut a few pounds, marketers — and those responsible for menu rollouts — are realizing they need to drop some weight.

Many clients have asked us for help with menu engineering, and we’ve noticed a few common stumbling blocks. Promotional items and limited-time offers get confused with product development, leading to lower-priced — and lower-impact — menus. Redesign efforts are often assigned to junior teams, who lack the experience and authority to take a holistic approach to menu development and make the necessary decisions. To combat these, we suggest:

- Aligning the menu with consumer trends to create innovative signature items

- Devoting research and development efforts to the culinary program, which will be repaid as the new menu creates improvements across functional areas

- Elevating redesign efforts to the C-Suite, so that menu engineering becomes part of the chain’s long-term strategic planning

Pricing Tactics Masquerading as Innovations

With all the noise and fervor around innovation, it is interesting to note that much of what is happening on menus has more to do with promotions and pricing strategy than it does with R&D, differentiated product development, and meaningful improvements in the areas of speed of service, order accuracy, guest convenience, and operational efficiency.

As chains struggle with shrinking sales, they often face pressure from shareholders to cut SG&A costs, which include culinary development. This sometimes means relying on large distributors for help with menu development, resulting in lots of brands suddenly offering very similar options — precisely what happened to some British pubs just after the 2008 crisis.

We need only look at the sad state of casual-dining chains to see the consequences of this mistake. Rather than find new approaches to menus that would delight guests and align with a brand’s unique promise, personality, and positioning, these chains drifted into the sea of same.

Their menus all started looking like copies of each other’s, and most began running variations on a 2-for-$20 deal. Not only did they fail to offer guests anything that differentiated them from the competition, but the price-slashing made them seem cheap.

Trying to compete with lower-priced QSRs and up-and-coming fast casuals was a strategic error. Innovating exciting signature items would have had the opposite effect, helping them stand out from other concepts both within and outside the category. The menu is a key part of the experience of dining out, and innovation can help refresh a stale brand.

We Eat with Our Eyes First, So Keep the Design Simple, Too

The menu is a chain’s most important piece of marketing collateral, and it should be its best salesperson. But just as menus can end up cluttered with limited-time offers that no one had the heart to kill, they can also end up looking like the design department threw every font, color combination, and Photoshop filter at the page just to see what would stick. Even if there are relatively few items on each page, visual confusion spreads to the guests, who aren’t sure how to navigate the menu.

Selecting the right font, colors, and layout can reinforce the brand story so that it flows through every customer touch point. Appropriate use of menu merchandising techniques — on both paper and digital menus — can lead guests’ eyes to signature and high-margin offerings, boosting sales of items that most differentiate the concept and add to the bottom line.

When these changes are done correctly, chains see quick and sustainable gains. When done incorrectly — or not done at all — they see dampened enthusiasm, lowered throughput, and slow drive-thru lanes.

Simplifying Menus Leads to Increased Same-Store Sales

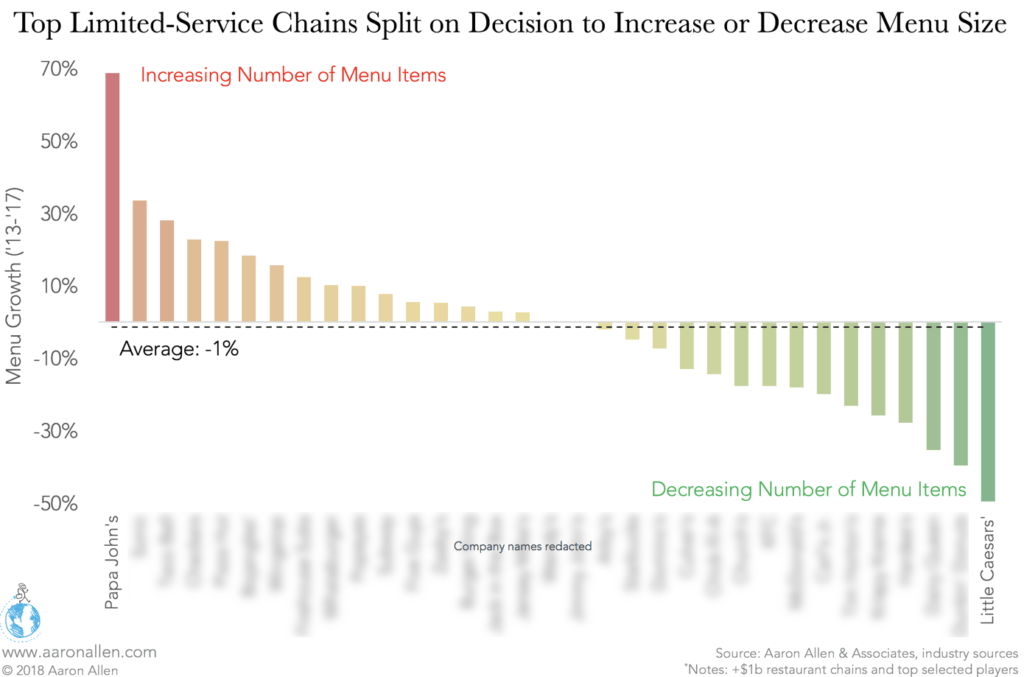

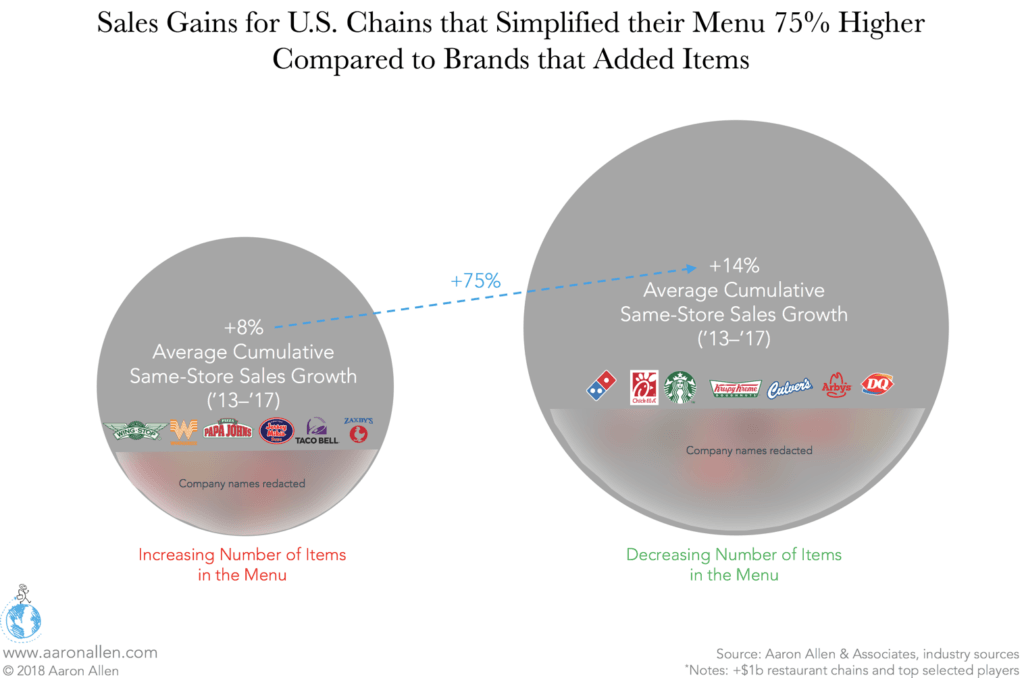

Between 2013 and 2017, limited-service restaurants in the U.S. couldn’t decide whether to decrease or increase the number of items on their menus.

Some large chains, such as Papa John’s, Sonic, and Taco Bell, increased menu items by at least 28%, resulting in menus up to 1.7x the average size. Meanwhile, Dairy Queen, Dunkin’, and Little Caesars saw the biggest menu reductions.

The chains that reduced the number of items on their menus claimed an average same-store sales growth of 3.3%, while their competitors saw an average 1.9% same-store sales growth per year. This 1.4 percentage point difference added up between 2013 and 2017, giving the concepts with simpler menus much stronger growth: 14% against 8%, a 75% difference.

Menu Complexity Affects Operational Efficiency (and Drive-Thru Performance Can Suffer)

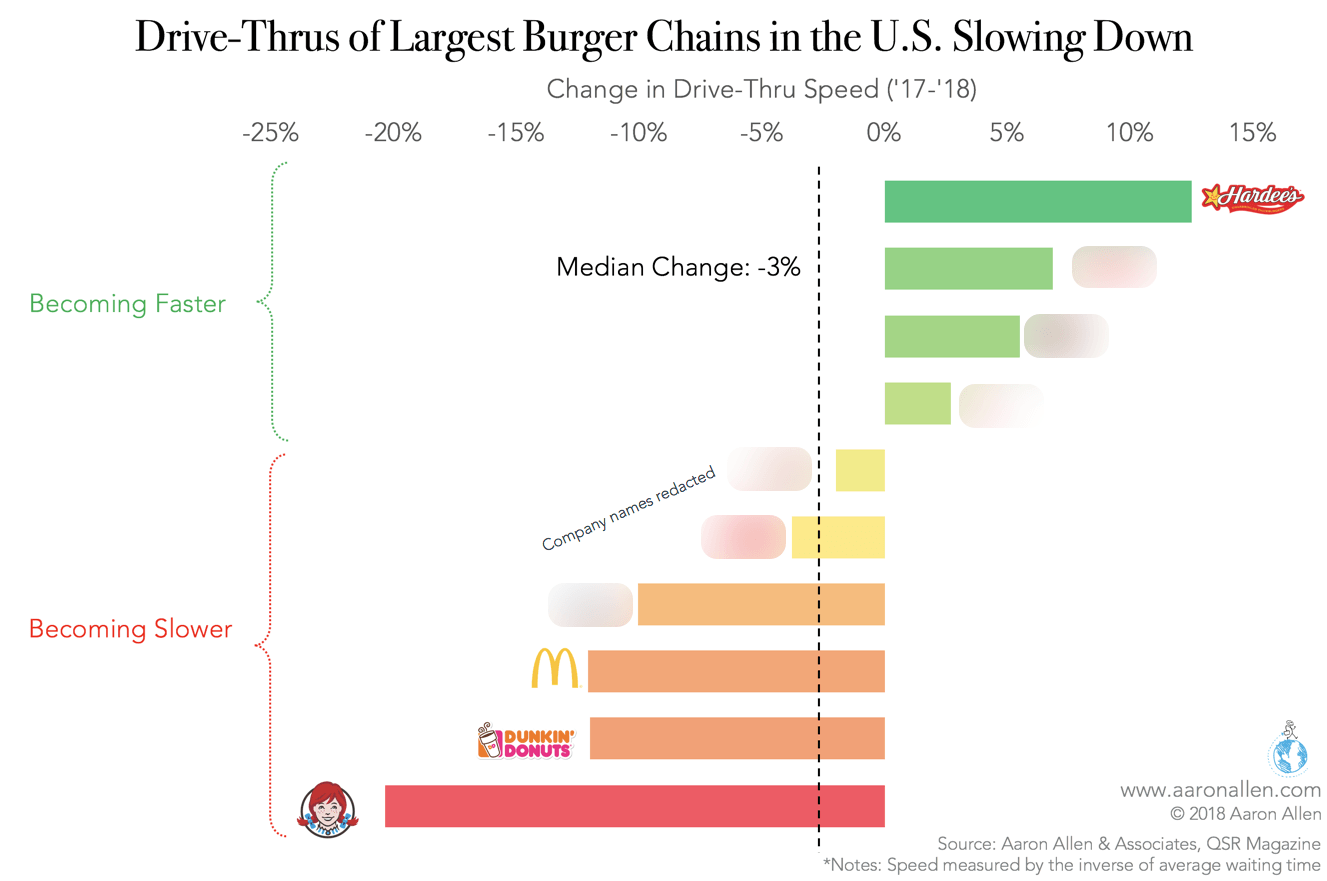

McDonald’s menu has grown massively over the years: it went from 30 items in 1980 to 108 choices in 2014. When Steve Easterbrook took over in 2015, the chain cut its menu by 33%, but it bounced back, growing to 87 menu items in 2017. The recent increase in complexity had a serious impact on drive-thru performance, with speed of service deteriorating by 13%.

With 60% of QSR revenue coming through the drive-thru, these slowdowns can significantly damage performance.

Starbucks Needs a Food Formula

Starbucks has also struggled to get its drive-thru performance right. The chain established an effective formula for ordering from its drink menu: size (venti), hot or iced, drink name (vanilla latte), and any additions or changes (no whip, quad shot). This system makes it easy for guests and baristas to navigate an incredibly complex set of offerings. In fact, it works so well, Starbucks has radically simplified its menu boards, showing only a handful of drinks, with pricing and nutritional information for the grande size only.

This method worked for Chipotle. Though their menu boards have fewer than 50 words on them, guests can build more than 65,000 possible options. In contrast, QSR menus have about 800 words but only 64 items.

Starbucks should follow Chipotle’s (and its own) example with its food program. Though there is a system (the breakfast sandwiches go meat, cheese, egg), the descriptive names of the ingredients — not just bacon but double-smoked bacon and reduced-fat turkey bacon — creates confusion for guests and baristas.

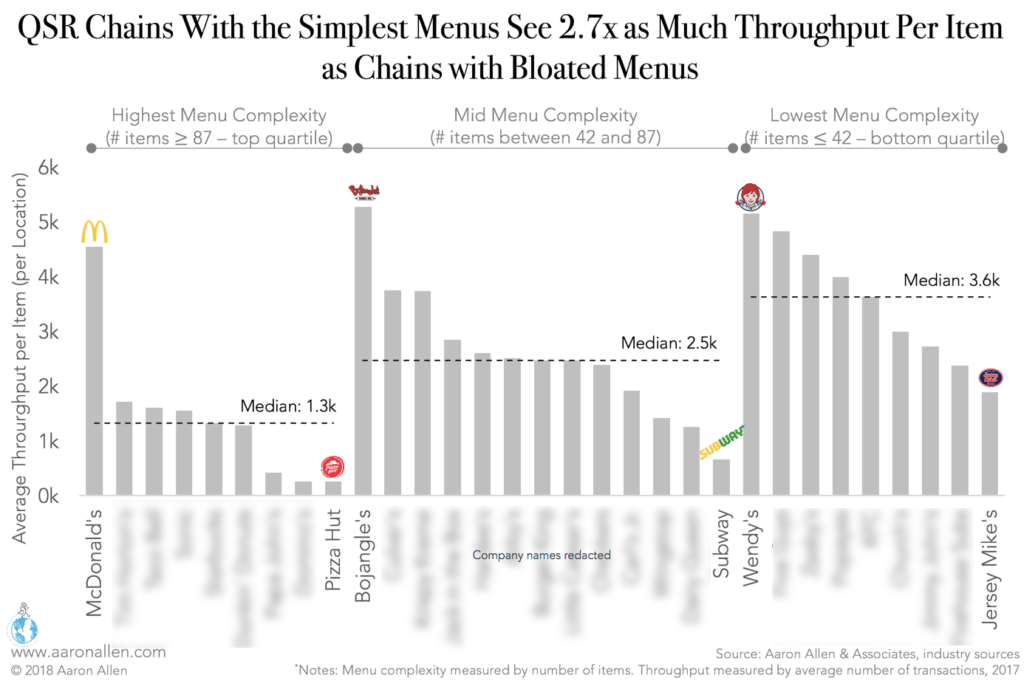

Throughput Almost Triples for Chains with Simple Menus

Changes to the menu cascade across the operation, impacting crew-level employees’ day-to-day activities. Altering the menu can constrict or improve throughput massively.

Though large menus don’t necessarily translate to fewer transactions per location, there’s a lower pay-off per item.

Among some of the top QSR players in the U.S., those with the simplest menus saw 2.7x as many transactions per item (considering the median of the group) as those with the most complex menus. This underlines the profound impact of menu strategy on what will surely be one of the biggest stories in foodservice in 2019: labor.

Labor Challenges Must Also be Met with Improved Menu Strategy

Restaurants have benefitted from favorable commodity costs in many geographies globally. Even still, restaurants had price inflation 3x that of grocery stores.

With labor costs increasing around the world in 2019 — and competitive pressures continuing to build — getting it right with the menu will be very important. Labor will not only become more expensive though; in some key markets the labor pool is really a labor puddle, making it especially difficult to fill positions that require skilled crews.

Improvements should happen through the lens of product development, day-part and profit center growth opportunities, pricing strategies, labor optimization strategies, enhancements to the guest experience and to operational systems to increase speed of service and order accuracy and reduce unit-level complexity.

Menu Strategy Must Be Holistic

One of the surest and quickest means to improving performance for a restaurant chain is through effective menu engineering strategies. It’s about more than tactical design, merchandizing techniques, promotional tactics and pricing strategies though. When done correctly, a holistic improvement is possible that also delivers benefits in terms of operational efficiency, brand and competitive differentiation, media interest that garners positive publicity, guest appeal that stimulates new trial and frequency, sustainable lifts to sales and profitability, and even reinvigorated morale and employee engagement at the unit level.

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims. We have helped evaluate and engineer menus for some of the world’s largest restaurant brands, as well as helped restaurant companies around the world drive revenues, increase profits, and enhance the guest experience through improved marketing, messaging, and menu engineering.

Our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.

The Founder’s Trap: Breaking Free & Securing Your Legacy

What if the biggest threat to your business’s future isn’t the competition — but you? There’s a story I think about often. My father, a

5 Case Studies to Help You Grow in the Restaurant Industry

With over 2,000 engagements across 100+ countries, Aaron Allen & Associates has helped some of the world’s most recognized restaurant chains, investors, suppliers, and tech

Restaurant Automation: The Ultimate Blueprint for Streamlining Operations and Maximizing Profits

Why Restaurant Automation is the Future of Foodservice Restaurant automation is more than a trend — it’s a fundamental shift in how foodservice businesses operate,

Restaurant Turnaround: A Comprehensive Guide to Revitalize and Grow

Navigating the High-Stakes World of Restaurant Turnarounds Restaurant turnarounds are critical in an industry where downturns can strike suddenly, turning once-thriving establishments into struggling operations.