With over 2,000 engagements across 100+ countries, Aaron Allen & Associates has helped some of the world’s most recognized restaurant chains, investors, suppliers, and tech companies achieve remarkable growth. We’re sharing five restaurant case studies that showcase how we’ve driven enterprise value and transformed challenges into opportunities.

These examples offer insights into how strategic actions can lead to significant, measurable results….

Our client list, as may be expected, includes many esteemed brands throughout the world. Moreover, our experience means that we have a deep knowledge of the players, market dynamics, trends, and both the micro and macro factors shaping the industry around the globe. We are restricted by confidentiality agreements and the boundaries of our own ethical sensibilities from disclosing our clients past and present, and therefore do not provide full client lists out of an abundance of caution for discretion. Below is a brief sampling of some of the initiatives and results we have helped our clients implement and achieve.

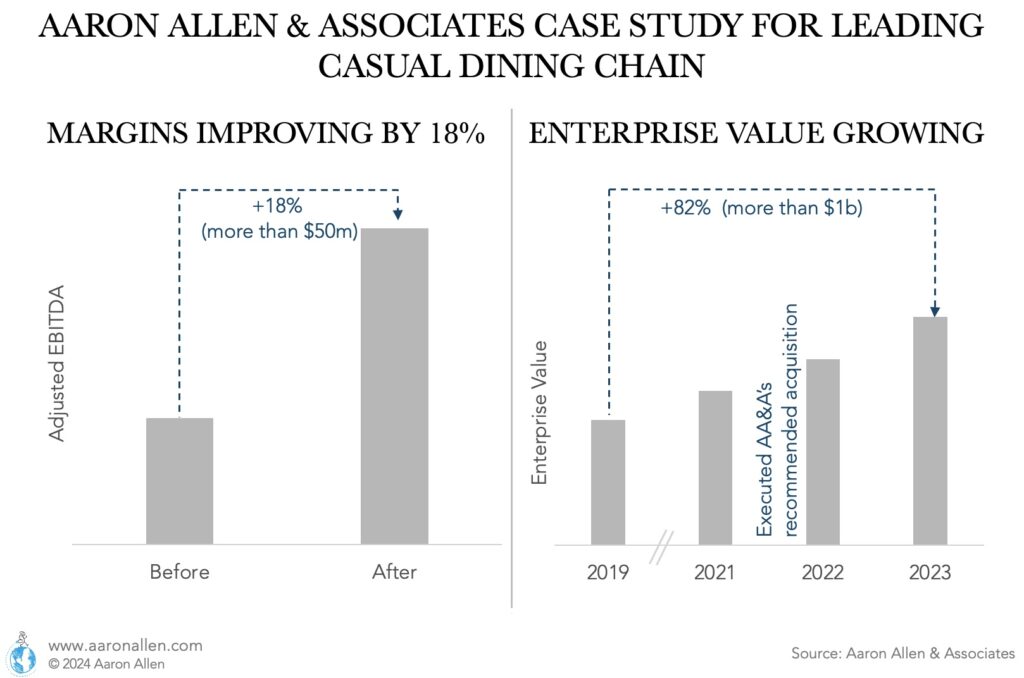

Restaurant Case Study #1: Casual Dining Chain Leveraging the Menu as a Catalyst for a Turnaround

Focused on reinvigorating a casual dining national brand through strategic marketing, operational improvements, and executive leadership guidance during critical transition periods.

BACKGROUND AND CHALLENGE

COMPANY STATS:

- Enterprise Value: ~$2b

- Sales: >$1b

- # Units: 100-150 range

Problems identified by AA&A:

- Slow service speeds and long customer wait times

- Highest volume profit centers bleeding the most traffic

- Understaffed in peak periods

- High employee turnover

- Inefficient equipment plans and layouts

- Menu misaligned

ACTION AND APPROACH

Granted special access to extensive data, AA&A utilized advanced data science techniques to identify and address operational bottlenecks and market opportunities.

- Process flows

- Menu ideation

- Signature items

- Capacity assessment

- Productivity benchmarking

- Guest experience assessment

- Price and performance correlation

- Menu merchandizing recommendations

RESULTS AND IMPACT

- Recommendations for changes in kitchen equipment leading to faster service and improving returned guests statistics

- Recommendations on ”can’t do at home” items, extensions on customization ability, signature items

- A streamlined menu helped improve margins, with Adjusted EBITDA going from 23% pre-engagement to over 27%

Take Action Today

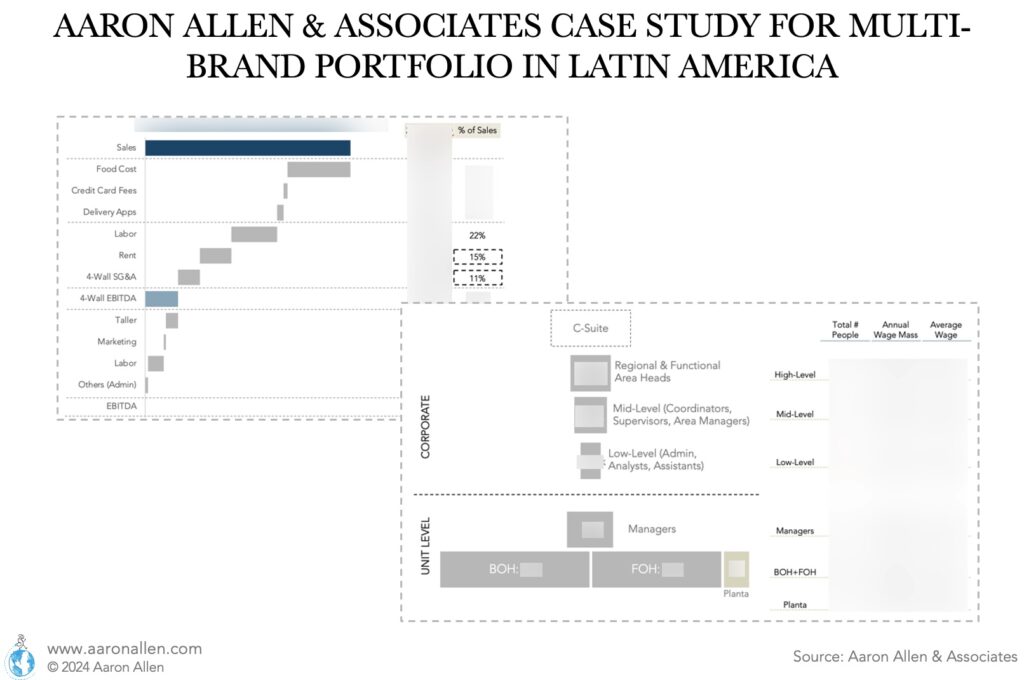

Restaurant Case Study #2: Multi-Brand Portfolio Strategic Mid- and Long-Term Business Plan Advisory

The client was a multi-brand, multi-product platform in Latin America.

COMPANY STATS

- The group had 10-15 brands in LATAM and was backed by one of the most important family offices in the region

- Annual revenue in the $40m-$50m range, ~10% EBITDA

ACTION AND APPROACH

Scope of work:

- 5-year plans and priorities

- Roadmap and critical path

- Budget and CAPEX parameters

- Shared services and infrastructure

- Broad-brush organizational design

- Post-pandemic growth milestones

- Identifying target growth markets

- Brand strengths and opportunities

- Franchising vs. corporate expansion

- Business model recommendations

- Timelines for expansion

RESULTS AND IMPACT

Some of the strategic advice given by AA&A that the company followed:

- M&A: Divest — AA&A recommended divesting brands to focus on the high achievers. The company exited one of the brands identified as a low-margin brand

- 5-year plans are starting to be applied, with remodels happening selectively as well as SG&A, food cost, and labor cost optimization

- Labor cost optimization opportunity in one of the countries

- Opportunity to Optimize corporate SG&A with the divestiture of low-performing brand and units

Restaurant Case Study #3: Commercial Due Diligence and Investment Thesis Validation for Foodservice Tech Company

We supported a middle-market investment group in North America with more than $200m in assets under management investing across more than 20 industries. The company was doing diligence for an investment in a restaurant technology company in the U.S.

TARGET COMPANY STATS

- Leading company in its category (top two by sales)

- Had raised a cumulative of close to $100m in funding at the time of the project

IN PURVIEW

Support with custom research to evaluate the market, positioning, and risk of a target company in the foodservice technology space. Insights into the foodservice industry landscape included:

- State of the Industry

- Total Addressable Market

- Competitive Landscape (past, present and future)

- Timelines for Growth, Partnerships

- Consumer Decision Process, Penetration and Retention

- Adoption Rates

- Risk and Relevance for the Technology

- Disruption and Mitigation Strategies

- Forward-Looking Support with Investment Thesis

ADVISE AND IMPACT

- The diligence work from AA&A advised in favor of the investment, with a few yellow flags for competitive threats

- Three years later, the target company had its IPO and raised more than $100m in cash, giving an opportunity to exit the investment and make a return in a short time

Start a Transformation

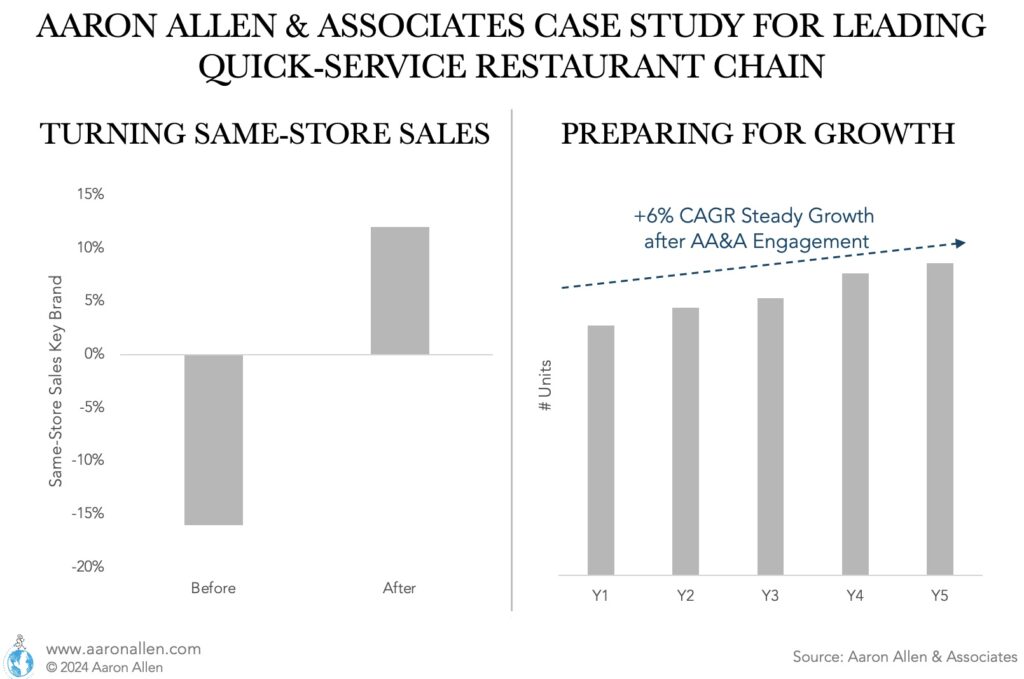

Restaurant Case Study #4: QSR Operations Audit and Sales Turnaround for Multi-Brand F&B Group

Illustrated comprehensive value creation through operational and financial analysis, leading to an IPO and substantial revenue growth. The focus was to streamline operations, ignite growth, and pave the way for a substantial IPO.

COMPANY STATS

- ~20 brands across 15-25 countries and 2,000+ outlets

- Large operator in Food Away From Home and QSR

across MENA - Master franchisee and proprietary brands

ACTION AND APPROACH

- On-site field work, visiting every major market for each brand (1k+ photo observations)

- P&L gap analysis

- Systems gap analysis, accuracy, SOPs assessment

- Location performance cross-section assessment

- Labor analysis

- Purchasing analysis, supplier analysis

- Menu analysis, comps

- Tech stack gap analysis

- Employee survey, morale assessment

RESULTS AND IMPACT

This project demonstrates AA&A’s capability to facilitate large-scale strategic overhauls and highlights our expertise in steering companies towards successful public offerings

- Sales Turnaround: Strategic initiatives, particularly in technology and operational efficiencies, led to a +12% boost in same-store sales for the leading brand

- Investment into New Categories: strategic advice to acquire brand rights for high-growth-forecast categories led to the expansion in coffee

- Service Standards: suggestions to improve service, speed, order accuracy, and cleanliness led the company to obtain accolades from the franchisor and improvements in operations compliance scores of 60%

- Productivity improvements: the year after the engagement employee productivity increased by close to 10%

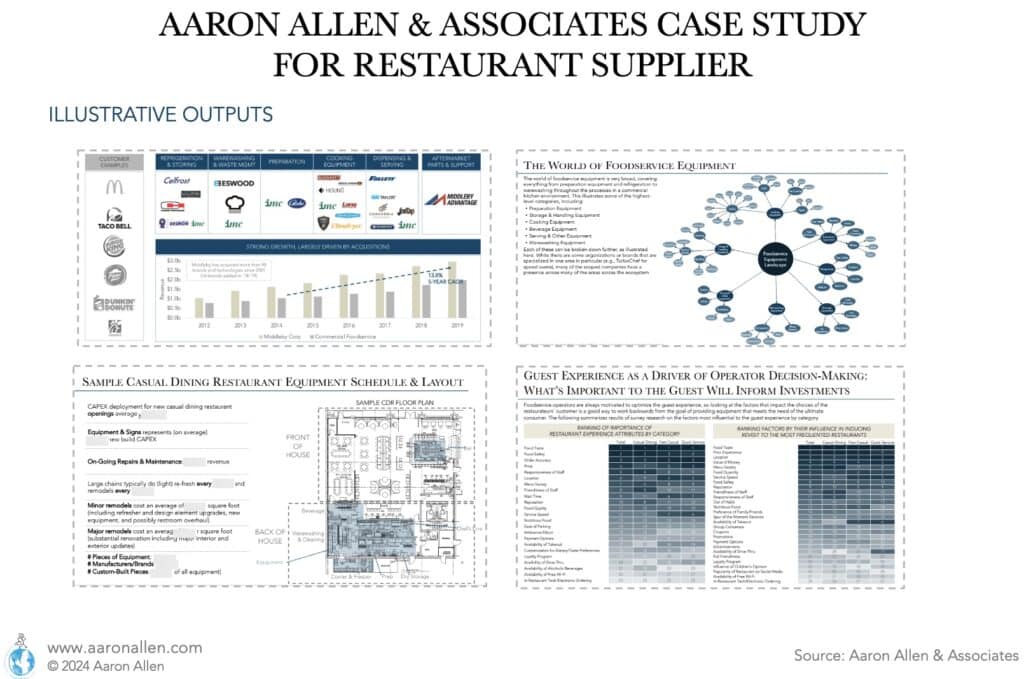

Restaurant Case Study #5: Comprehensive Understanding of the Foodservice Equipment Landscape

An Original Equipment Manufacturer (“OEM”) had questions relative to commercial foodservice equipment purchases, technology/innovation, and restaurant decision-making. The company was looking to get a comprehensive understanding of the foodservice equipment (FSE) landscape to decide whether or not to get into the foodservice space at scale.

COMPANY STATS

- $20-$30 billion range in annual revenue

- More than $1 billion adjusted free-cash-flow

- 60k-80k employees range

ACTION AND APPROACH

Insights into the foodservice industry landscape, including:

- Competitive landscape

- Deep dives into competitors’ product portfolio

- Equipment acquisition cycles for restaurant chains

- Restaurant chain typical equipment allocations

- Equipment efficiencies in labor, maintenance, food cost, etc.

- Complexity and variations by type of restaurant segment

- Cost of switching/stickiness

- Restaurant decision-making process (mind of the buyer)

- Decision-making for franchisors vs. franchisees

- Operating model OEM-dealer/distributor

RESULTS AND IMPACT

Drawing on our firm’s industry experience, expertise, network, know-how, and know-who, we applied a holistic approach and combined anecdotal, qualitative, and quantitative insights to provide answers and tools:

- Audited the competitive landscape and areas of opportunity

- Surfaced white space and identified gaps existing in the offerings of domestic commercial foodservice

equipment providers - Introduced opportunities for disruption via innovation related to labor automation and alternative formats

- Recommended a dual focus on North America as the biggest segment but also a different market as the fastest-growing

- Inorganic approach to fast growth

About Aaron Allen & Associates

Aaron Allen & Associates is a global restaurant consultancy specializing in brand strategy, turnarounds, and value enhancement. We have worked with a wide range of clients including multibillion-dollar chains, hotels, manufacturers, associations and prestigious private equity firms.

We help clients imagine, articulate, and realize a compelling vision of the future, align and cascade resources, and engage and enroll shareholders and stakeholders alike to develop multi-year roadmaps that bridge the gap between current-state conditions and future-state ambitions. Learn More.