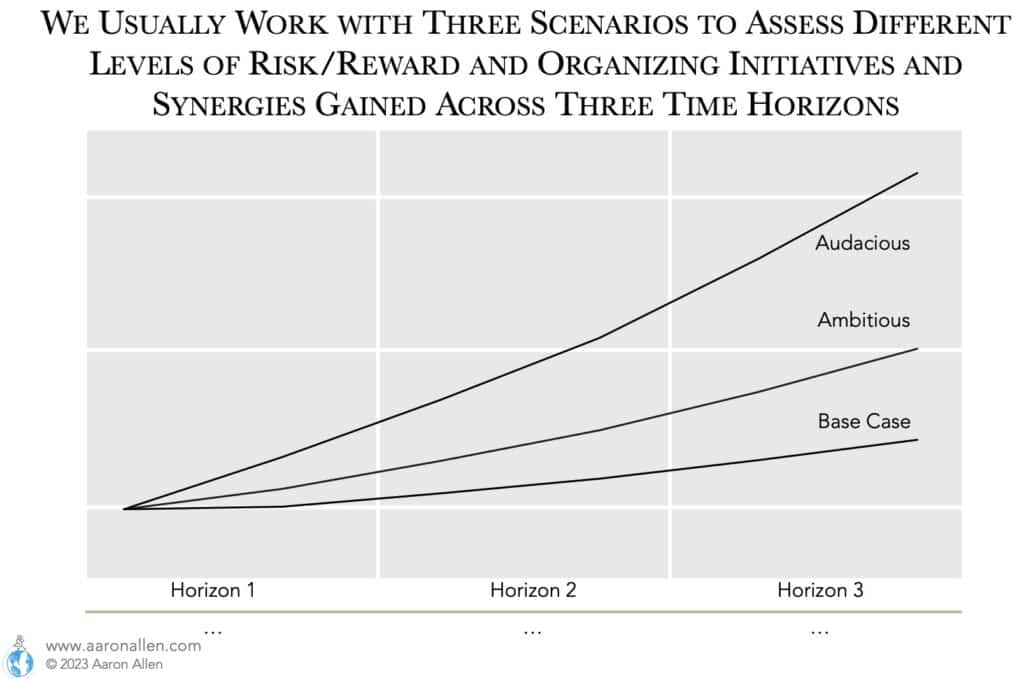

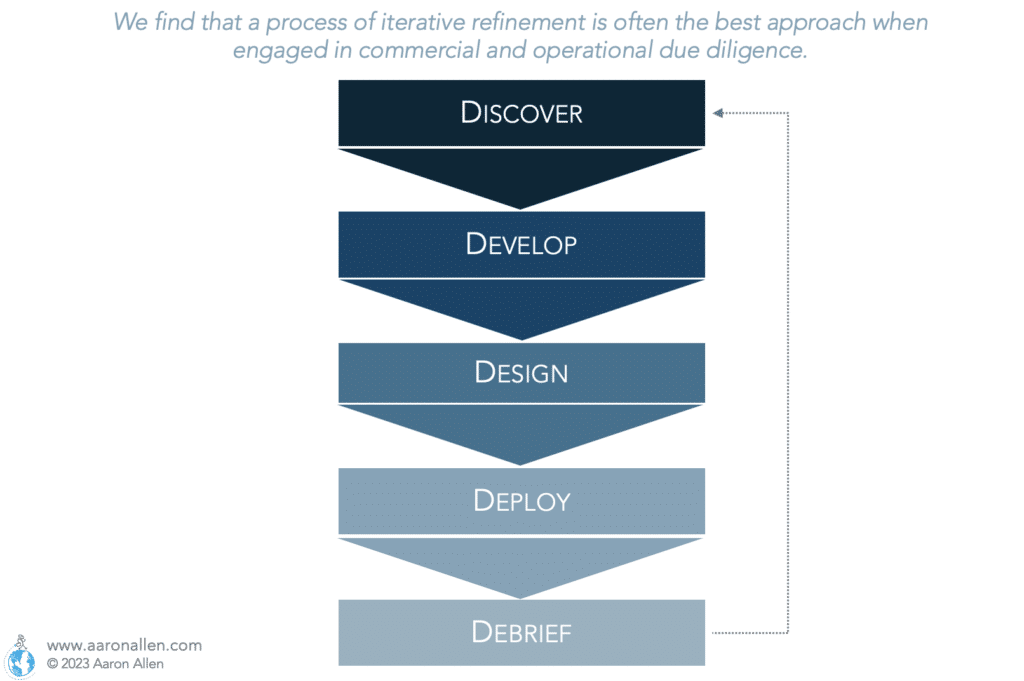

There is an art to executing successful M&A and the biggest advantage is in being thoroughly prepared to demonstrate exactly why a given deal makes strategic and financial sense — or why it doesn’t. Expert due diligence can challenge the investment thesis and the assumptions on which it is built.

In essence, it’s a pressure test of where the investment target is strong, and where it is weak (in terms of financial, legal, commercial, operational, and technological standards) and, further determining how it could grow down the line.

Without Exception,Due Diligence Reveals New Perspectives and Insights into the Target

1 – Mitigate the Risk of Buying a Restaurant

Commercial and operational restaurant due diligence help identify and evaluate potential risks associated with foodservice investments, enabling private equity firms, family offices, and other restaurant investors to make informed decisions and mitigate risks effectively.

2 – Use Restaurant Due Diligence to Validate Assumptions

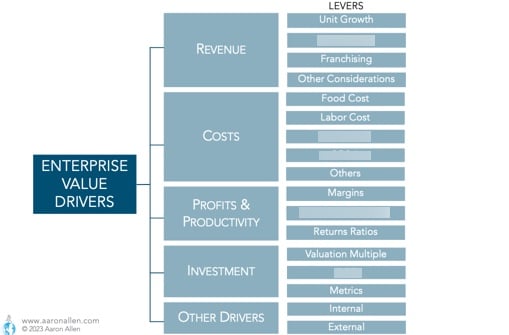

Thorough due diligence validates key assumptions and projections related to market potential, customer demand, competitive landscape, operational efficiency, and valuations, providing a solid foundation for investment strategies.

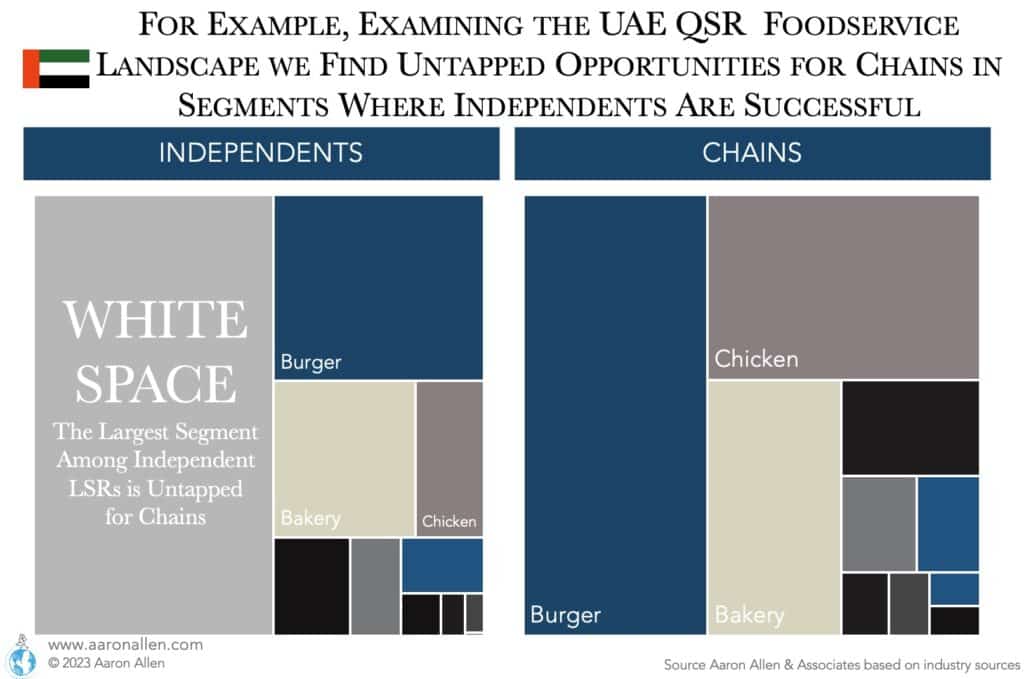

3 – Due Diligence Can Help Uncover Growth Opportunities

A specialized consulting firm can uncover untapped growth opportunities within the target market, helping investors identify areas for expansion, diversification, and innovation.

Getting Deals Done

4 – Enhance Decision Making with Market Intelligence

By conducting comprehensive due diligence, investors gain access to reliable market intelligence and expert insights, enabling them to make data-driven decisions with confidence.

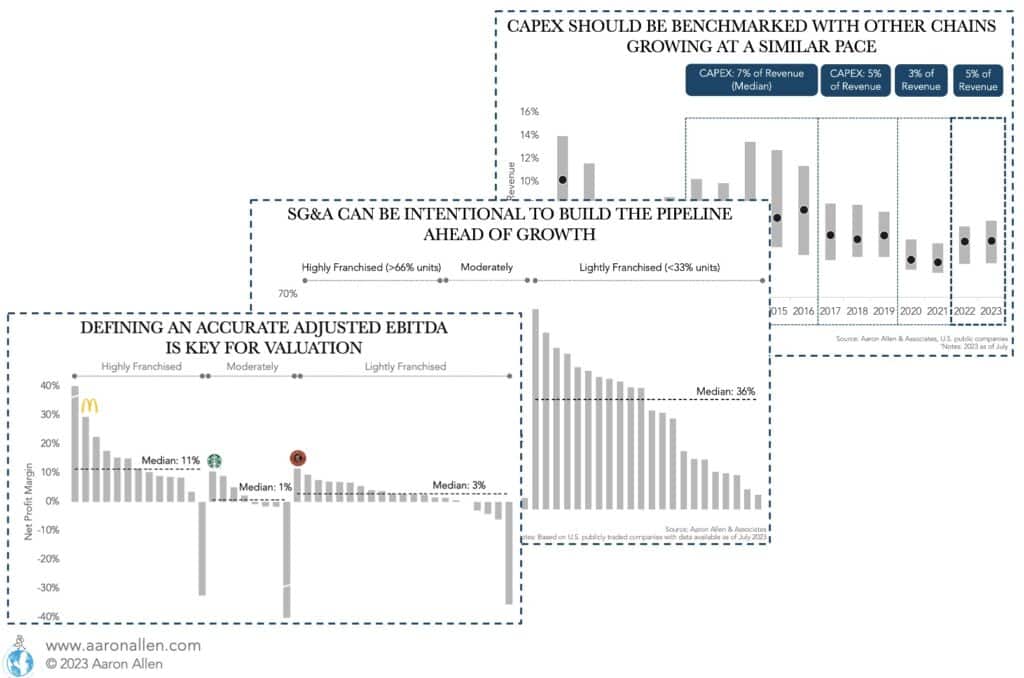

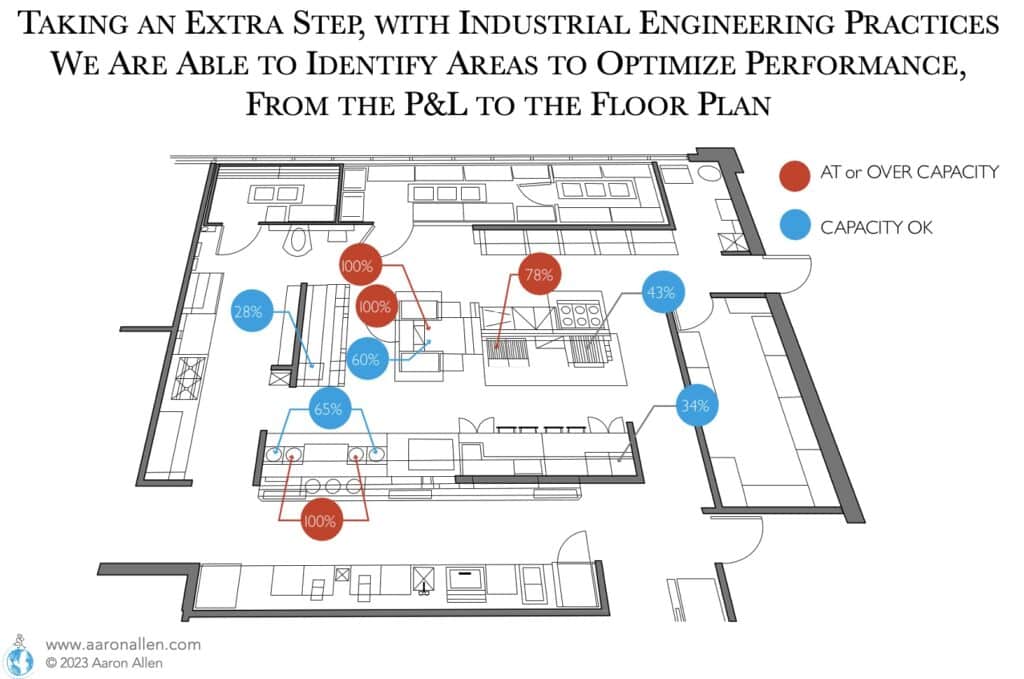

5 – Optimize Restaurant Operations

Operational due diligence helps identify opportunities for cost optimization, process improvement, and enhanced operational efficiency, leading to increased profitability and scalability.

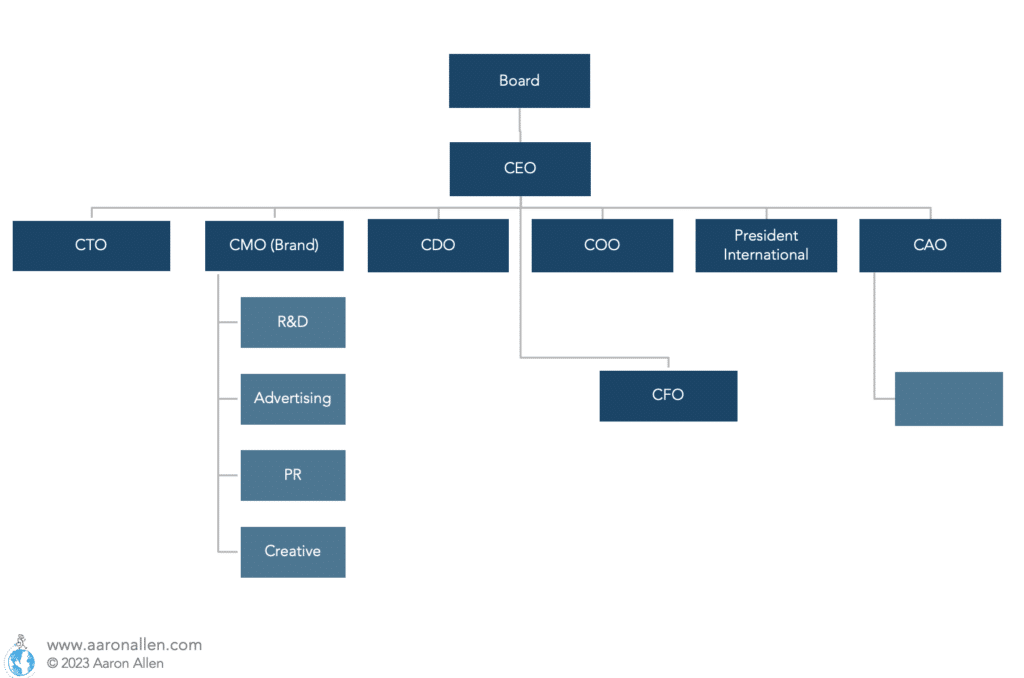

6 – Evaluate the Management Team

Specialized consulting firms can assess the capabilities and effectiveness of the target company’s management team, ensuring they have the necessary expertise to drive success and deliver on strategic objectives.

7 – Commercial and Operational Due Diligence Can Help Validate a Restaurant Chain’s Financial Performance

Thorough financial due diligence validates the accuracy and reliability of financial statements, ensuring investors have a clear understanding of the target company’s financial health and performance.

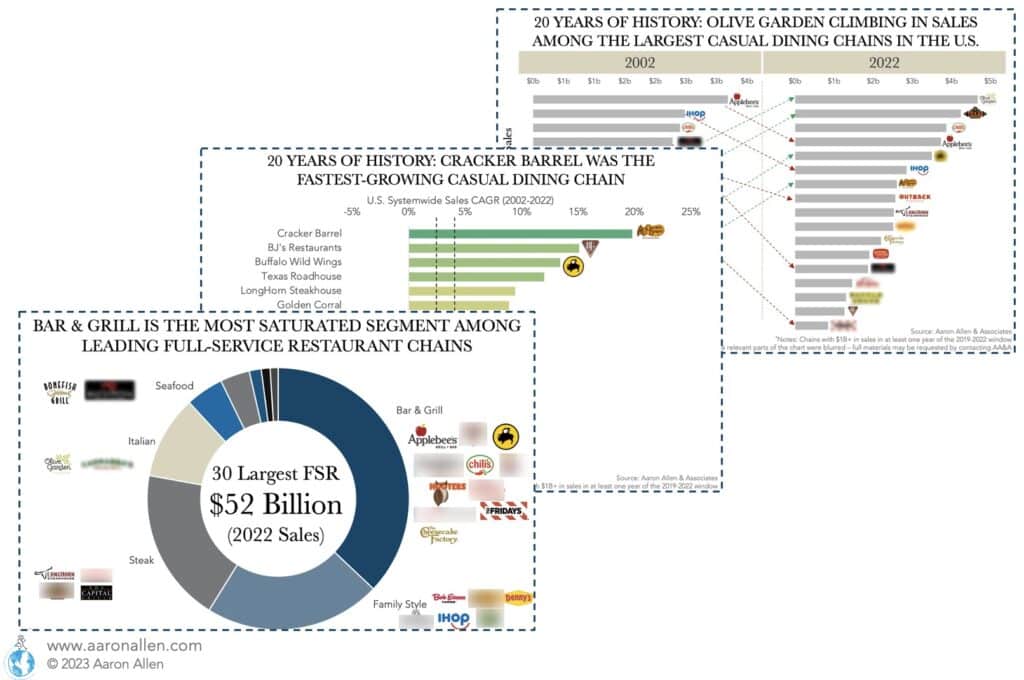

8 – Assess the Competitive Landscape with Restaurant Research

A consulting firm can analyze the competitive landscape, providing insights into market positioning, competitive advantages, and potential threats, enabling investors to develop effective market entry or expansion strategies.

9 – Identify Potential Synergies

Commercial due diligence helps identify potential synergies between the target company and existing portfolio companies, facilitating post-acquisition integration and maximizing value creation.

10 – Expertise and Industry Knowledge to Uncover What You Didn’t Know You Didn’t Know

Hiring a specialized consulting firm brings in-depth industry knowledge, experience, and expertise, enabling private equity firms, family offices, and restaurant investors to benefit from the insights and recommendations of seasoned professionals who understand the unique dynamics of the restaurant and foodservice sector.

Make Smart Investments with Better Buy-Side Intelligence

Supporting the Entire Deal Process

- Country Market and Industry Landscape

- Valuation Benchmarks

- Target Identification (List & Priority)

- Deal Sourcing

- Operational Due Diligence for Restaurant Chains, Contract Foodservice, Foodservice Technology, Foodservice Equipment, and Suppliers

- Commercial Due Diligence

- Assemble Due Diligence Team

- Manage Diligence at a Country Level

- Concierge Service, Deal Management

- 100-Day Plan/ Value Creation Strategies

- Post-Acquisition Integration

- Management Team Assessments

- Portfolio Rationalization

- Growth and Expansion

- Performance Optimization

- On-Going Support/ Operating Partner

- Identifying Potential Buyers

- Maximizing Value at Exit

- Negotiations

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims, specializing in brand strategy, turnarounds, commercial due diligence and value enhancement for leading hospitality companies and private equity firms.

Our clients span six continents and 100+ countries, collectively posting more than $300b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.