No matter the economic climate, there are always opportunities for investors in the restaurant industry. While consumer habits evolve and trends may shift, this also creates opportunities for tremendous upside especially if you know where to look and have the wherewithal to build and execute on a bold and decisive strategy.

With so much capital flowing into foodservice from private equity firms, venture capitalists, and other investors, restaurant due diligence is as important as ever. Rigorous due diligence helps buyers, sellers, and other investors understand the full picture of an investment – its risks, forecasts, and factors impacting its performance — before a restaurant investment is completed.

There is an art to executing successful M&A and the biggest advantage is in being thoroughly prepared to demonstrate to a potential partner exactly why a given deal makes strategic and financial sense. Thorough due diligence can challenge the investment thesis and the assumptions on which it is built. In essence, it’s a pressure test of where the investment target is strong, and where it’s weak (in terms of financial, legal, commercial, operational, and technological standards) and, further determining how it could grow down the line.

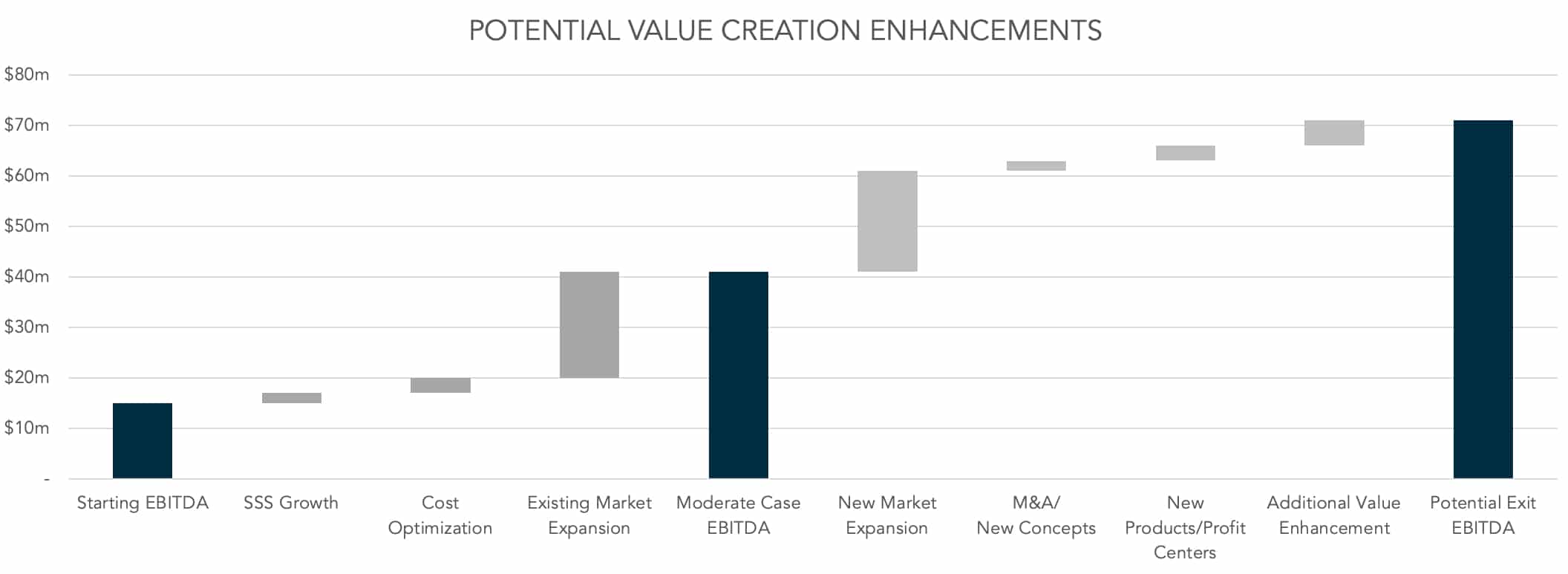

Potential Value Enhancements

Those with specialized expertise in the industry will offer a different perspective, exploring unique angles that others may or not find without that knowledge (for example: how its enterprise value can be increased through improving products, facilities, enhancing profit margins, etc.). They also might note some common due diligence findings that others wouldn’t be as familiar with. And will help make sure the investor is paying a fair valuation for the restaurant chain.

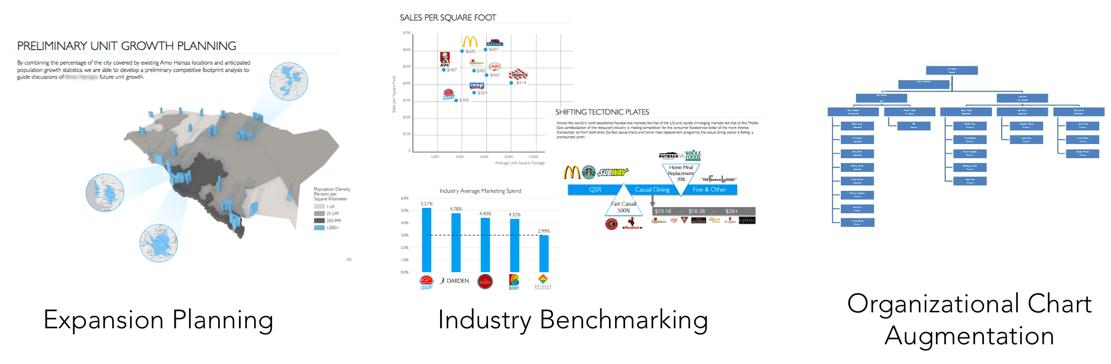

Evaluating a single-unit restaurant across all its functional areas (from menu to store design to marketing strategy) can be a complicated process, but the level of complexity multiplies as the number of locations increases and geographical spread widens. Our restaurant due diligence work has focused on middle-market institutional investors and chains with units spanning multiple continents and, in most cases, several different brands spanning categories, cuisines, countries, and operating models. The questions that need to be worked through for these multi-unit, multi-region, multi-concept companies are complicated and require a considerable amount of calculus.

What Is Restaurant Due Diligence?

There are several types of due diligence, including commercial, operational, financial, legal, and technology, which are generally conducted prior to an acquisition. Each type concentrates on different audit criteria, but with a similar goal: to determine if an investment is worthwhile and identify facets of a business that can be addressed to ultimately increase the company’s enterprise value. There are unique considerations for each industry – below, we will focus on the foodservice sector.

Due diligence serves to help an investor understand the impact, risks, and forecasts of a particular industry and provide a clear and comprehensive view of a target company through the holistic lens of value creation.

Growing a target company is not always as easy as “just add water” – though it can appear so prior to proper due diligence. If your firm is looking to make an investment into a foodservice company (or you’re a chain restaurant operator looking to take on private equity funding), here’s some of what you should understand about the exercise, though every target will have its own unique set of circumstances that would benefit from professional advice.

Pre-Deal Due Diligence Creates Post-Deal Value

Restaurant Investment: Buy-Side and Sell-Side

Foodservice companies have an increasing pool of funding alternatives when developing expansion strategies. Restaurant investment has proved particularly intriguing to private equity firms throughout the globe — our firm has been approached by between $6 billion and $7 billion in capital from institutional investors earmarked for the global F&B space (particularly in the GCC, European, and U.S. markets).

The challenge now is for would-be buyers and would-be sellers to connect.

Buy-Side | Institutional investors, private equity firms, venture capitalists, family offices, and other types of investors with assets under management and determining what acquisitions and investments to make to obtain a certain return (IRR) given a level of risk. In the foodservice space, investors are often looking for chains to grow and expand. Depending on the mandate, distressed assets and consolidation can also be pursued. The steady growth of the restaurant industry combined with the remarkable valuations assigned to the most innovative players makes foodservice an attractive space for investors. |

|---|---|

Sell-Side | Companies looking to raise debt, equity, or sell the business. Many foodservice operations are turning to mergers and acquisitions to fuel topline growth, enter new markets and segments, and integrate necessary new technologies. |

Distressed Restaurant Deals and Due Diligence

In the case of distressed companies, creditors often turn into buyers. Due diligence in those cases can be enhanced due to better access to information. If the buyer of the distressed company is not a creditor, it’s always important to remember that for highly leveraged companies, creditors can become high-profile stakeholders with levers to impose conditions on the deal.

Besides the usual due diligence questions, other issues to consider would be:

- What is the situation in terms of liquidity? How much capital will need to go in to cover current liabilities in excess of accounts receivables?

- What short and long-term obligations can be re-negotiated to get better terms?

- What is the value of the assets? What is the key IP (intellectual property) of the business and what is its value?

- What are plans for the turnaround are key for developing DCF (Discounted Cash Flow) models and to determine valuation? (In some cases, since historical performance may be irrelevant to determine future sales, expert input on what’s realistic is key to avoid biased projections.)

Sell-Side Advisory

Types of Restaurant Due Diligence

To prepare for a potential transaction, investors should evaluate several different functional areas of the foodservice company. Below, we examine the types of due diligence that investors typically evaluate and questions that often come up during the process.

Restaurant Commercial Due Diligence

Restaurant chain buyers conduct commercial due diligence to uncover the actual commercial viability of the business and identify the potential for growth and returns. It consists of situating the business within the market, competitive set, and consumer landscape.

Commercial due diligence helps determine whether a restaurant chain business plan stands up to the realities of the market, what external forces and factors could help or hinder the target, and what’s the risk to profitability based on a chain’s locations, leases, and competitors. Those questions can include – but are certainly not be limited to — the following:

- What political considerations (regulations, policies, taxes, labor laws) should be taken into account?

- How are macroeconomic factors impacting the restaurant company? How might they in the future?

- How have societal shifts (remote workers, changing family sizes, more solo diners, etc.) impacted the business? What other emerging consumer trends and dining behaviors will become more important (and less) over the holding period?

- How can value be unlocked through expansion into new markets, or created throughout post-acquisition, or via bolt-on acquisitions?

- Can the current operational structure support future expansion? Will some holes (to supply chain, organizational chart, etc.) need to be filled – and if so, at what cost in terms of CAPEX and expansion delays?

- How will technological advancements impact the target going forward? Could value be added to by increasing the use of technology (in terms of mobile ordering, ERP, back-office systems, automation process improvements)?

- How does the target plan to expand? Is it familiar with the costs in uncharted/foreign expansion markets? Will it be able to hire the same types of employees and have access to the same ingredients, contractors, supply chain, product, and operational standards that have been utilized at other locations?

- What else could go better or worse? What other factors could impact investment assumptions or risks?

Restaurant Operational Due Diligence

Operational due diligence for restaurant chains consists of reviewing the target’s operational performance through the lens of culinary systems, food and labor cost analysis, potential guest experience improvements, and capacity and throughput analysis to help uncover risks and get a more accurate value of the potential return on the investment. Some of the operational questions investors in the foodservice industry are looking to get answered include:

- How do the target company KPIs compare with industry benchmarks and other comparable concepts?

- How do service standards, traffic, sales, and marketing efforts compare to competitors?

- Are the restaurant’s food and labor costs in line with industry standards? If it’s going to expand, will it be able to maintain those costs as a percentage of sales?

- What potential changes would enhance the guest experience and drive revenue?

- How well-institutionalized are company culture, operational systems, and best practices currently? How replicable are these systems moving forward, and are they sturdy enough to support the expansion aspired to in the investment thesis over the holding period?

- How have facilities been maintained (what are R&M schedules, condition of fixed assets, etc.)? What might need to go into post-acquisition plans in order to bring locations up to par?

- Could (and should) the chain’s design be improved upon? Can unit-level CAPEX be better optimized?

- How are food safety risks being mitigated? How is inventory tracked and recorded? Are the proper systems in place for inventory and supply chain management? Is there a high yield of ingredients? What sort of post-acquisition improvements should be made (including centralized production or food preparation)?

- In a Pareto analysis, which are top and bottom contributing locations? Why are these locations better- or worse-performing? How may these patterns, anomalies and outliers factor into more granular modeling of investment thesis assumptions with regard to revenue and cost drivers?

- What changes have been made to capital expenses and operating costs (food, labor, utilities) recently? Are these changes sustainable? How will this impact P&L cost structures?

- How are yield, throughput, bottlenecks, and other operational shortcomings impacting performance? What will be required to fix those and what would ROIC be over the course of the holding period?

Financial Due Diligence for Restaurant M&A

For restaurant M&A, the process of financial due diligence consists of reviewing, analyzing, and validating the past financial performance and health of the target company, to determine a view for the future and ensure there are no missing pieces. Documents to review typically include the trailing three years of balance sheets, income statements, cash flow statements, individual location P&Ls, tax returns, loans and debt, and others. The restaurant financial due diligence process will raise the following questions:

- Have the financials been audited? If not, when was the last external audit of the target?

- What is the company’s current liquidity, debt, credit and financing structure? How will this look moving forward?

- Is there any considerable debt on the business? Can the target afford to take on additional debt?

- What are the major components of operating expenses—including labor, food costs, rent, supplies, promotions—and how has this trended over time?

- Are there changes that could be made regarding lease agreements?

- How have forecasted budgets compared to actual performance?

- Are there any unusual trends or fluctuations in operations that would result in non-recurring expenses or income?

- What are the target’s projections for performance over the next several years?

- Could the capital expenditures for the last several years be further improved upon?

- Does seasonality impact working capital needs?

- Have the owners of the target company attempted to sell it before? If so, what happened?

Legal Due Diligence for Restaurants

In the process of a restaurant acquisition, the goal of the legal due diligence process is to surface any potential legal problems or controversies that may arise from the transaction. The legal team will collect and review all the target’s legal structures and documents to assess the investment risk from this point of view. Some of the questions that will be answered during Restaurant Legal Due Diligence include:

- Does the target have full rights and ownership of the operation? Are there any exclusivity agreements in place?

- What are the company’s contract administration systems? Are there contractual obligations in place that could present a risk or impairment?

- Is the chain subject to any legal liabilities or liens? Are there any related-party issues?

- Are there any franchise or license agreement issues?

- What is the company’s legal organization structure (i.e., which subsidiary entities are owned by which parent companies, where is each incorporated, and what does the ownership of each one look like)? Are there any hidden majority or minority investors buried in the organizational structure of the company?

- What sorts of trademark and intellectual property issues might affect the company?

- Are some groups of employees within the company represented by unions? If so, is the union contract up-to-date and inclusive of scheduled wage rate changes, work rule limitations, guaranteed benefits, and other issues that may alter the costs of the business or be subject to litigation?

- Are there pending discrimination claims against the company? Is there a history of such claims in the past?

- Are there any disadvantageous contractual terms the target is subject to?

- Does the target suffer from an inordinately high proportion of injuries or workers’ compensation claims?

- What other legal liabilities or vulnerabilities exist, and what protections from breach of contract and misrepresentations should be factored into the term sheet negotiations (including callbacks, carve-outs, errors and omissions coverage, etc.)?

Foodservice Technology Due Diligence

The M&A fever has also been burning white-hot for foodservice tech. When the target of the acquisition is a foodservice technology company, the enterprise value is primarily driven by software, processes, and intellectual property. The goal of performing technology due diligence is to ensure that the capabilities are there and uncover any risks or weaknesses the technology may present. Some of the questions that will arise are:

- Will the technology of the target incorporate seamlessly with our systems?

- What is the technology stack in use?

- What capabilities do we need for a successful tech integration?

- Should the development team be kept intact? What are the roles and risks of the transition?

- Are the code, architecture, and systems within expected parameters? Will any of these need to be overhauled? How is data security and protection dealt with?

- Are there any licenses used, how critical are they, and what would be the cost of renewal?

- Are operational continuity and disaster recovery plans in place?

- What it’s the roadmap for the technology in the future?

Restaurant Investor Due Diligence

Are you considering taking on an investor or raising capital for expansion? Institutional investors, venture capitalists, and private equity funds, can often step-in to back new concepts or help established chains grow. The sell-side should also perform some type of “investor due diligence”, especially if they intend to remain involved in the business after the sale or if looking for a minority investment.

Some of the key points to investigate are:

- Do they share the company mission and agree on the brand identity?

- What’s the investor’s record? How many (and how much) similar investments do they have and how successful have those businesses been since they were involved?

- What are the funds available? Can they deploy more funds if needed in the future? When was the last time they put capital to work?

- How well does the restaurant chain integrate with other businesses in the investor’s portfolio and how could that be an advantage?

- Is this investor able to influence the media, supply chain, other investors to benefit your business?

- What’s their proposal for growth and expansion? Do they share the same vision?

- What is the time horizon of the investment?

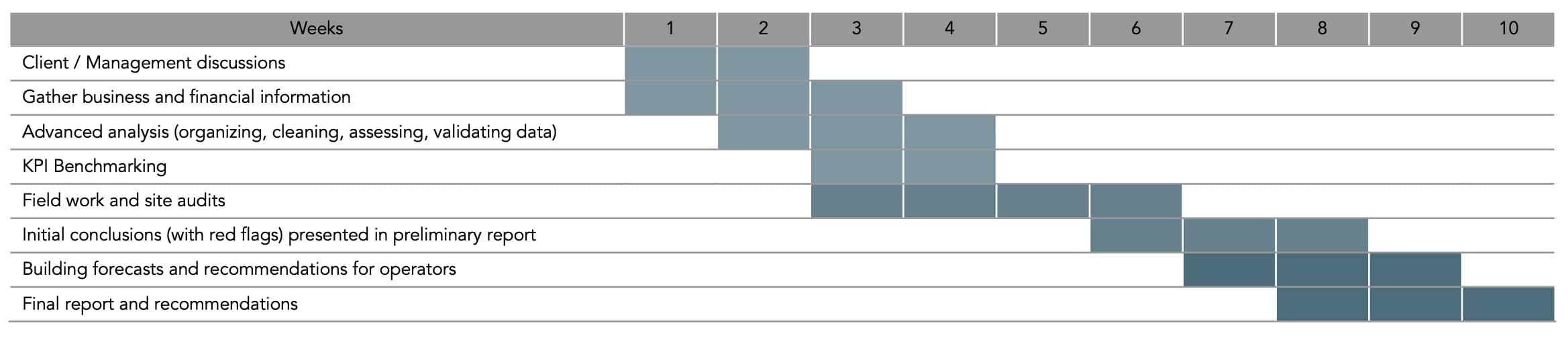

Restaurant Due Diligence Timing and Procedures

As specialists in the restaurant and hospitality industries, we understand how quickly the landscape is being reshaped and the pressures investors have to make the right bet in a very constrained amount of time (we’ve previously covered how the investment process may look for operators).

In our practice, the commercial and operational due diligence is guided by formulating answers and actionable recommendations around key questions. Areas identified as value-creation opportunities are categorized into both quick-hit and longer-term initiatives. We review conditions inside and outside the business and apply (proprietary) proven frameworks and methodologies to gap analysis and opportunity identification while providing market and industry landscape insights and additional background.

With a comprehensive understanding of the foodservice landscape, we highlight the factors impacting every functional area of the business, in the historical-, current-, and future-state. We obtain deep insights into the target’s past performance, identifying areas for performance optimization, and providing feedback on the feasibility of financial forecasts based on what’s possible from the operational point of view. Actionable recommendations on a go-forward basis range from quick-hits and low-hanging fruit to longer-term opportunities for optimization and top-line growth.

Here are some particularities and a starter timeline for restaurant commercial and operational due diligence.

Sell-Side: Is It a Good Time to Sell? And How to Prepare For an Investment.

Are you considering taking on an investor or raising capital for expansion? Do you wonder if it makes sense to refinance debt? Have you been curious about what kind of valuation your company could command today (and how you might improve it)? Are you (or someone you know) stuck in ‘The Founders Trap’ (wanting to let go of the day-to-day, but not giving the proper authority and support to the person that can and should)?

We see this a lot (across geographies and many different businesses, but especially family- and founder-led businesses). Sometimes, the collective of senior shareholders and stakeholders know that a change needs to be made, but they’re not sure if that means selling the business, better succession planning, or just improved communication and shared commitment to a common vision.

If you and your senior team find that you are often (collectively and/or individually) wondering if you should buy, sell, hold, grow, create, or divest, you will probably want to diligence yourself before someone else does. Even if you are sure you want to keep and improve the business, sometimes it makes sense to have it put through the paces of a commercial and operational due diligence that a private equity firm would insist on if/when looking at how to unlock and create improved performance and profitability. Without exception, the process reveals new perspective and insight that can contribute to improved business strength and performance.

And, if it turns out you are considering taking on private equity investment, here are a few tips to help you prepare.

Sell-Side Due Diligence Checklist for Restaurants

Before making an investment, funds and private investors want to know as much as possible about the business opportunity. This due diligence checklist will help the deal team start the internal research project, which will give them — and potential investors — a comprehensive overview of the enterprise. A sell-side advisor, with assistance from legal counsel, accountants, and bankers, can help assemble these components, identify areas that need further research and documentation, and tailor the process for the specific restaurant.

- Company name

- Company domicile

- Year established

- Legal structure

- Articles of Incorporation

- Restructuring documents (if any)

- Subsidiaries & equity interests (if any)

- All financial information should include the previous three years of records

- Back Office & Accounting systems used

- Point of Sale (POS) system(s) used

- Annual and quarterly financial information

- Financial projections for the next three year

- Unit-Level Profit & Loss Statements

- System-Wide Profit & Loss Statements

- CAPEX Budgets

- Opening Schedules

- Training manuals

- Recipes

- Proprietary products

- Proprietary technology

- Quality assurance processes

- Organizational chart

- Executive and Deal Team bios

- Employee count

- Standard employment contract

- Historical staffing records

- Personnel policies

- Job descriptions

- Orientation & onboarding materials

- Industry segments

- Size of business

- Strategy

- Menu & Products (including current & past menus as well as the dates of menu & price changes)

- Theoretical Food Cost Worksheets

- Recipes & plating documentation

- Location-level Information, including square footage, number of tables and seats, as-built documents, date opened, and date of last remodel

- Suppliers

- Marketing analysis

- Brand positioning

- Branding materials (logos, style guides, social media profiles, web collaterals)

- Promotional Materials

- Marketing Budget Allocation & Calendar

- Historical marketing campaigns

- Historical press releases

- Client base & customer satisfaction data

- Regulatory information

- All contracts, including supplier contracts, leases, and license agreements

- Income tax returns for prior 6 years

- Government audit reports (if any)

The Most Common Restaurant Commercial and Operational Due Diligence Findings (and the Risks of Not Working with an Expert)

Through our extensive experience conducting restaurant commercial due diligence engagements in the past, we’ve found that the same findings continue to crop up again and again, no matter how different the restaurant companies themselves might be. Below is a roundup of the most common findings we see, and what investors and financial due diligence may overlook.

Missing these issues in the pre-deal phase can cost buy-side deal teams millions after the close, especially since they have to invest more to discover the cause of their dropping sales and shrinking margins. With industry-specific due diligence, they know exactly what they’re getting into.

EBITDA Is Often Overstated, Buyers May Negotiate Better Valuations

Naturally, it’s in the seller’s best interest for EBITDA to be high: the higher the EBITDA, the higher the total valuation, the more cash for the seller. But while the EBITDA of a restaurant chain might be financially accurate, it won’t necessarily be operationally sustainable.

So, if EBITDA has jumped significantly in the lead-up to a sale, don’t necessarily expect that level of profitability to continue throughout the entire holding period. An industry expert can validate the sustainability of handsome efficiency gains in the 18 months prior to a term sheet being signed. Budget allocations that would likely be the first line items a business might cut to increase EBITDA in the short-term include:

- Marketing

- Training (both development and implementation)

- Man-Hours (cutting back on staffing, or leaving certain positions vacant)

- Repairs & Maintenance

- Sudden Reductions in Food Costs/COGS

- Below-Market Compensation (companies might underpay employees with the promise that wages will rise once a new owner steps in)

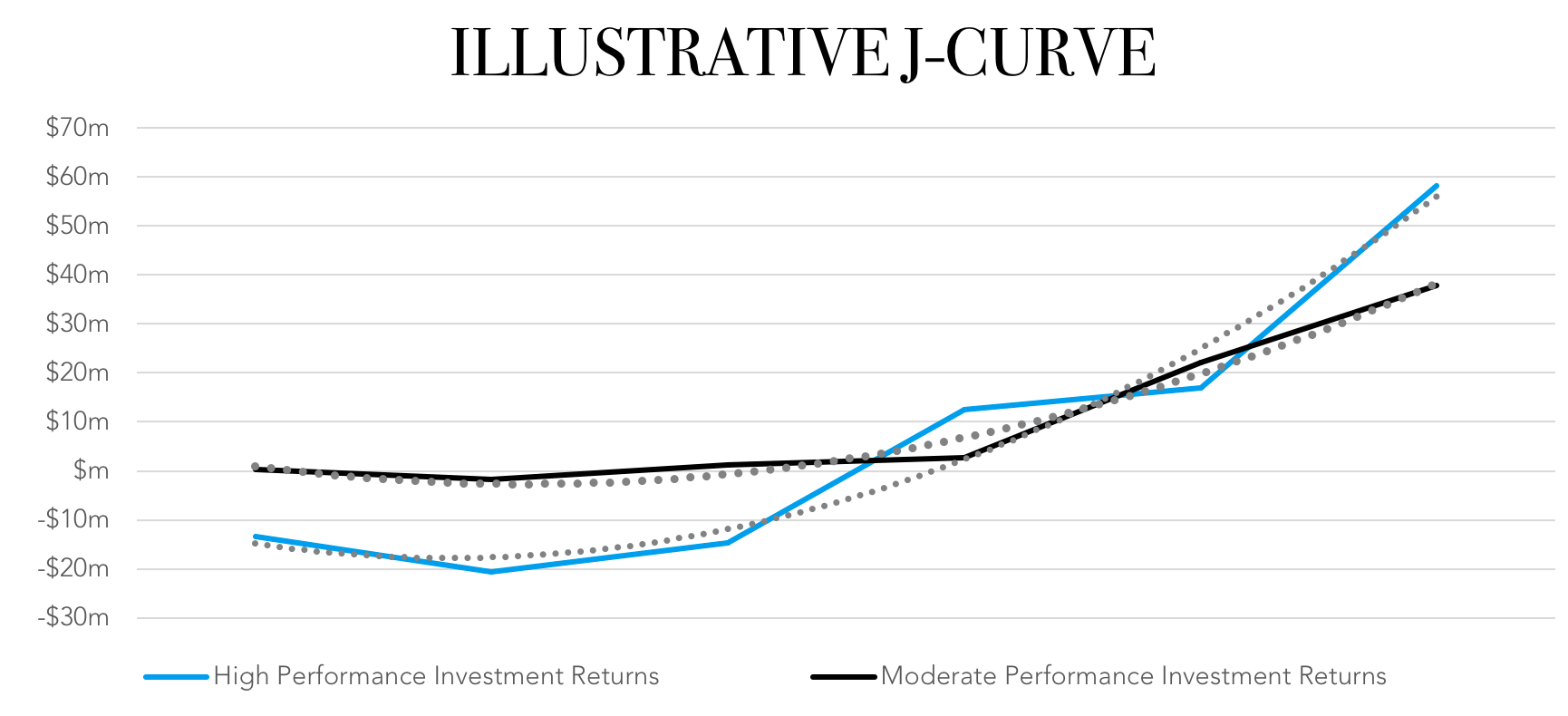

Unfilled key positions and a lack of marketing or training materials might result in a temporarily higher operational performance (and, by extension, a higher valuation), but once those positions are filled or the marketing or training ramps up, EBITDA will decrease, resulting in an unexpectedly steeper J-curve.

Another important piece of the EBITDA puzzle is shared overhead, which is often difficult to quantify — particularly in the case of a multi-brand system selling off a brand or business unit. An investor looking to buy a company that shares office space, staff, and a marketing budget — among other shared resources — with five other companies will need to account for whether those allocations have been fully isolated and replacement costs forecast and extrapolated.

CAPEX Requirements Are Often Underestimated

Not all companies being sold are positioned for immediate growth, and the thought of making additional investments throughout the course of the holding period can sometimes be overlooked when seeing the potential of the target company. Often, there is a mistake of budgeting too little CAPEX during the due diligence process, rather than laying a proper foundation in the early stages of an investment which can then help expedite growth and enhance the value on an accelerated basis.

It is often the case that additional investments and enhancements to infrastructure are requisite to enable improved performance. Even sophisticated restaurant operators can sometimes lack the systems and visibility into true costs. While new unit opening costs, for instance, may be accurate in aggregate, less visibility into the detailed cost structure can lead to faulty assumptions in the financial modeling (particularly in aggressive case scenarios). This cost includes more than just the building materials and direct labor. Executive planning time, meetings with real estate agents, soft costs of development and engineering, and more all add up — but may not be included in the CAPEX budgets for previously built locations (though they were incurred, and absorbed elsewhere in the budget).

While not all investments are treated as a “turnaround”, there are plenty of opportunities to transform a business – including making fundamental operational changes or adding new products or profit centers. Below are some areas that require CAPEX investment, but can increase a company’s value over a holding period:

- New Prototypes Backed by Industrial Engineering: One of our key recommendations for investors come the post-acquisition phase is to create a plan and develop a prototype for a new unit before expansion. Focus on the existing business in the first year, taking the time to conduct industrial engineering studies to fully quantify and incorporate performance enhancements, to improve staffing models, eliminate operational bottlenecks, etc. It would be better to open six new locations that are operating at their highest and best potential in the second year, rather than two locations in the first year that are sub-par and perpetuate an inefficient design. Not all chains pay attention to industrial engineering, but it’s an investment that pays off, especially as a chain is preparing for rapid expansion.

- Infrastructure & Technology: Technology requirements to support growth are often underestimated. The infrastructure supporting a 10-unit chain will be different than that supporting 20 units, or those managing a multi-brand portfolio or expanding into new markets that are less understood or have less historical performance to benchmark against. Similarly, investments into ERP systems, executive dashboards, and back-office systems help investors gain real-time insight into a business. Some of this will be identified in the due diligence phase (to the extent necessary to make assumptions), but granular-level plans will be needed as part of post-acquisition initiatives.

- Institutionalization of the Business: While common among well-established companies, materials including comprehensive training, technical specifications/documentation, and integrated inventory systems are not always standard in middle-market companies. The development and implementation of these systems and tools increases consistency, availability, and accuracy of data.

- New Profit Centers & Centralized Enhancements: Many operators underestimate the cost of developing new profit centers. Adding delivery capabilities, for instance, might boost revenues, but requires considerable investment (delivery vehicles, packaging, technology and software, training, updated marketing collaterals, etc.). Unlocking value within new profit centers can potentially yield a return that will more than offset those costs, but a thorough understanding of CAPEX and OPEX impact should be performed by industry specialists in the due diligence phase.

An Overly Rosy Picture of OPEX Gains

A comprehensive restaurant commercial due diligence engagement requires knowledge of emerging consumer dining behaviors and trends, benchmarks against competitors, comparisons to key restaurant industry ratios, and much more. Restaurant investors often factor huge efficiency gains into their models without realizing how unrealistic those projections might be. A restaurant chain’s historical EBITDA will be a much more accurate representation of company performance than the EBITDA immediately prior to sale.

The same systems and the same people won’t yield larger efficiency gains overnight. It takes time to find, install, and assimilate management, and investors all too often underestimate the intensity of the post-acquisition transition period. On the lookout for low-hanging fruit, private equity firms might look to what they can do right now to boost company performance.

We recommend that those in the quest for short-term gains not lose sight of longer-term initiatives, which will likely yield even higher returns. Rather than immediately remodeling a store, for instance, adding a fresh coat of paint or cleaning up a group of stores can still lead to short-term gains, while planning the mid- and long-range initiatives on a concurrent path.

Due Diligence Involving Restaurant Industry Experts Increases Potential Returns

A comprehensive restaurant due diligence effort requires knowledge of emerging consumer dining behaviors and trends, industry benchmarks and key restaurant industry ratios. Just as a restaurant chain wouldn’t use its in-house counsel to navigate a Private Equity or M&A transaction (opting instead for someone well-versed in finance), an experienced and specialized advisor can enable investors to make better-informed and more sure-footed decisions concerning the investment’s potential and the company’s vision. In fact, a 2016 Harvard study found that “private equity deals led by partners with prior operational experience, particularly in the restaurant industry, show greater improvement in inspection results than those led by partners with financial or banking resumes.”

In other words, specialized partners already experienced in working with institutional investors on due diligence will be able to better understand the dynamics of the industry and a company’s performance within it. Due diligence is about much more than simple market analysis. A true expert will have deep industry experience across categories, cuisines, ownership types, and geographies, bringing well-demonstrated abilities in terms of understanding both the internal and external factors impacting a restaurant business. Ultimately, such a full, transparent view will help better inform and provide validity to not only the investment thesis, but also the financial returns.

- Specialists can bring important insights generalists may miss in terms of global trends and factors impacting the business (both internal and external)

- They can better communicate with the industry target — speaking the lingo, knowing how back-office and point-of-sale systems work, and offering an understanding of the terrain and outlook, serving as an almost translator between investor and target

- The combination of local know-how and global understanding specific to the industry is increasingly valuable

The commercial due diligence process should assess everything from transaction-level granularity (including a trailing 36-month analysis), industry-specific KPIs and benchmarks, company culture, and corporate governance. The rigor of fully assessing a business from top to bottom (how it has performed historically, its current state, and where additional value could be unlocked or could be created) requires more than just face-value analysis when connecting granular data and modeling to the greater investment assumptions. Determining how to gain efficiencies in terms of cost optimization, revenue-building potential, entering new markets or adding new products is especially powerful when done it in a way that’s relevant for the specific company within its operating market.

Frequently Asked Questions

Glossary of Terms

Acquisition: The process by which one business buys a second (generally smaller) company which is then absorbed into the parent organization or run as a subsidiary. The company acquired is often referred to as the “target.”

Buy-side Deal Team: The team of investors, advisors, lawyers, and accountants that represents the group making the investment.

Debt Financing: Financing that occurs when a firm raises money for working capital or capital expenditures by selling bonds, bills or notes to individuals and/or institutional investors.

Equity Financing: The process of raising capital through the sale of shares in an enterprise (i.e. The sale of an ownership interest in a company in order to raise funds for the business’ expansion).

Institutional Investor: A large organization (i.e., bank, pension fund, mutual fund, labor union, or insurance company) that makes substantial investments on the stock exchange. They invest in private equity and venture capital because of its consistent ability to deliver superior long-term returns and outperform other asset classes. Because they’re considered to be more knowledgeable than the average investor, institutional investors are subject to fewer of the Securities and Exchange Commission’s protective regulations.

Merger: The process by which two organizations join forces to become a new business, usually with a new name.

Private Equity: Individuals and firms that invest into private firms or perform buyouts of public firms with plans to take those firms private. A private equity investment will generally be made by a private equity firm, a venture capital firm, or an angel investor.

Sell-Side Deal Team: This team represents the target restaurant throughout the investment process. It typically includes key internal players, an investment banker, lawyer, accountant, and a sell-side advisor with both foodservice and investment experience.

Additional terms are available in our Investment Glossary

Our private equity and due diligence services focus on mitigating risk and maximizing value. We are available to support from sourcing through exit, and we can make targeted interventions at any stage of the investment life cycle.

Our experience in this landscape has also made us the go-to source for both buyers and sellers looking to make deals. We’ve been approached by $6-$7b on the buy side and a number of promising concepts looking for capital to expand. Get in touch if you think we can help your organization.