Restaurant bankruptcies have always been a topic of conversation in the industry. Very seldom can there be discussions about foodservice operators without the topic of the failure rate of restaurants coming up. That said, foodservice is actually a very resilient business.

There is no question — regardless of geography — we will all continue to eat; the how and where will change so dramatically that hundreds of billions of dollars in global consumer foodservice spending will shift from incumbent brands to innovators and more convenient and profitable models.

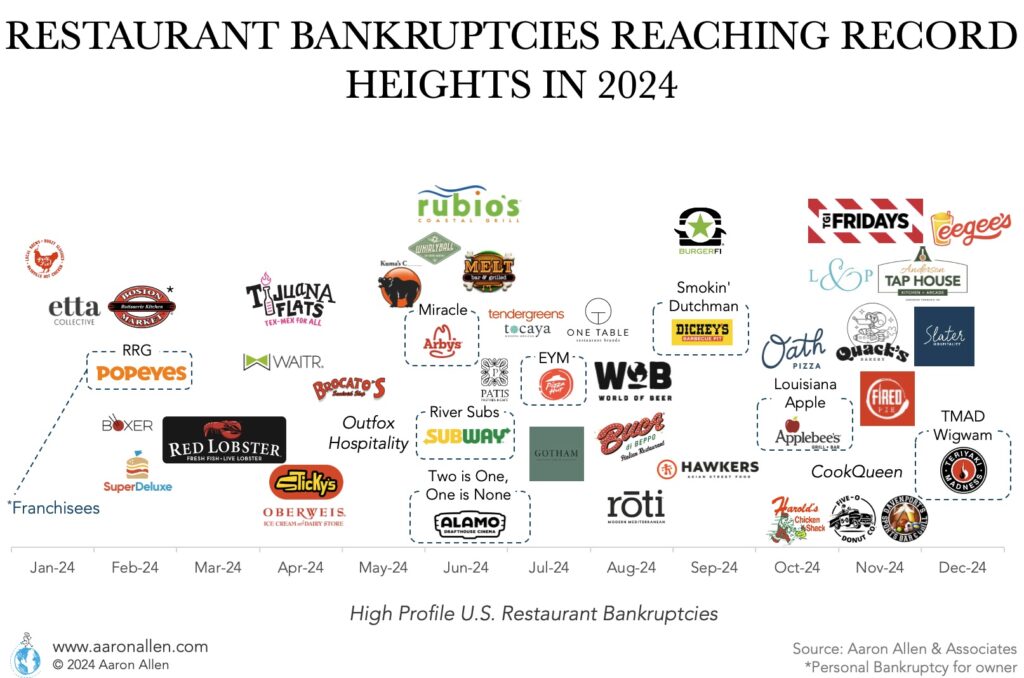

Here we keep track of the most notable bankruptcies in the restaurant industry.

The following restaurant chains have gone bankrupt or are in a bankruptcy process between 2020 and 2024. Many still cite the pandemic as the reason for their demise and will have to liquidate their assets or be subject to massive reorganizations (though others — especially in the casual dining segment — were in trouble before Covid-19 hit).

Increases in labor costs, higher interest rates, negative same-store sales, years of negative EBITDA, flawed real estate strategies, high food prices, customers cutting down on dining out, and COVID lingering government support withdrawal are some of the factors chains and franchisees were unable to surpass and leading to a soaring number of restaurant bankruptcies in 2024.

We are seeing this play out in many geographies. Despite the pain and pressures of challenging conditions, it seems like in some organizations it hurts less to remain indecisive — holding one’s breath waiting for the situation to improve itself – than it does to bite the bullet on bolstering the team, capabilities, competencies, and critical thinking that’s needed to confront the issues head-on. It somehow hurts less to lose millions slowly over many months than to plunk down a few hundred thousand to get the shot in the arm that’s so desperately needed. Our advice? Waiting may hurt less, but it costs a lot more in the long run.

After decades of struggles and a failed attempt at a merger, TGI Friday’s filed for Chapter 11 in November 2024, indicating $37 million in debt and less than $6 million in assets. At the time of the filing the company had 161 restaurants in the U.S., about a quarter of them corporate-owned and three-quarters franchised. The company also had 316 restaurants operated by franchisees outside the U.S.

Smokin’ Dutchman Holdings, a franchisee of Dickey’s Barbecue Restaurants, filed for Chapter 11 bankruptcy in Michigan. The company operates four restaurants and cited its parent company’s excessive demands as a major cause of its financial issues. Smokin’ Dutchman has around $2.1 million in debt and was seeking court approval to use its own assets to maintain operations. It opened its first Dickey’s in 2018 and generated approximately $3.3 million in revenue in 2023.

BurgerFi International Inc., based in Florida, declared bankruptcy facing debts of up to $500 million. The company warned of potential bankruptcy weeks before filing and cited struggles with declining sales and a failed acquisition of Anthony’s Coal Fired Pizza. Internal changes, including a new CEO, aimed to revitalize the brand but did not yield desired results. BurgerFi’s sales dropped 7.5% from 2022 to 2023, with a decrease in unit count.

Hawkers Asian Street Food, a 15-unit chain based in Florida, filed for Chapter 11 to maintain control amid issues with a lender seeking to take over. The company was founded in 2011 and offers a menu of Asian street foods.

Original Harold’s Chicken of Nevada, which has two locations in Nevada, filed for Chapter 11 with $40,000 in debt owed. The company did not list any assets or give a specific reason for filing but indicated that it could not distribute funds to creditors after administrative expenses.

Louisiana Apple, an Applebee’s franchisee with 14 locations, filed for Chapter 11 following claims of significant debt by City National Bank of Florida. Legal actions ensued over missed payments and a breach of franchise agreements, prompting bankruptcy to possibly reverse asset transfers and address financial obligations.

Oath Pizza declared Chapter 7 bankruptcy and will liquidate assets after closing its locations. Founded in 2015, the chain had previously attracted attention for its pizza offerings and sustainability efforts, but faced financial difficulties leading to the closure of all corporate locations.

The restaurant reported under $97 thousand in assets and over $530 thousand in debt. After opening successfully in August 2022, sales dropped by 35%. Anderson Tap House took loans to cover losses but continued to struggle, leading to its bankruptcy filing, which indicates funds will be available for unsecured creditors.

Quack’s Bakery in Austin, Texas, filed for Chapter 11. Known for its custom cakes and baked goods, the bakery has been operational for over 40 years. With under $97 thousand in assets and over $875 thousand in debt, Quack’s Bakery aims to keep its business afloat while restructuring.

TMAD Wigwam, a franchisee of Teriyaki Madness in Henderson, Nevada, filed for Chapter 11 in November, 2024. Assets and debts were estimated between $500 thousand and $1 million, with plans to restructure and provide funds for unsecured creditors.

Slater Hospitality, based in Atlanta, filed for Chapter 11 in 2024. Its concepts include several restaurants and entertainment spaces. Founded in 2002, Slater Hospitality reported assets between $0 and $50 thousand and liabilities between $1 million and $10 million. The company plans to restructure while ensuring business continuity and providing distributions to unsecured creditors.

CookQueen LLC, operating various food concepts in Long Beach, California, filed for Chapter 11 in November 2024. The company has assets and liabilities both ranging between $1 million and $10 million. The filing included disputes about unpaid rent for cloud kitchen contracts, and the case was dismissed for failure to file proper documentation.

Several franchisees went bankrupt in 2024, including RRG with 17 Popeyes Louisiana Kitchen restaurants.

In February 2024, Jay Pandya filed for personal bankruptcy after an initial filing two months earlier that was dismissed by a judge.

The chain with more than 500 restaurants filed for Chapter 11 and was later sold to creditors, with Fortress Credit Corp. emerging as the new owner. Red Lobster was the highest-profile restaurant bankruptcy of the year. “Endless shrimp”, weak same-store sales, closures, and debt were among the problems contributing to the chain’s financial troubles.

Restaurant Delivery company ASAP shut down operations and entered an asset sale in April 2024. The company was called Waitr before and founded in 2013 and was acquired in 2018 by Tilman Fertitta’s SPAC, Landcadia Holdings, for $308 million.

The company closed 40 restaurants in 2024 (ending with 91 units as of the bankruptcy date) and cited an over-bloated menu and slow execution among the causes for the bankruptcy. The company was sold to Flatheads, LLC. Assets were in the $1 million – $10 million range and liabilities in the $10 million – $50 million range.

The New York-based chain cited the COVID-19 pandemic and high costs of delivery as the main reasons for the bankruptcy. Assets were in the $500 thousand – $1 million range and the liabilities were in the $1 million – $10 million range.

The fast-casual chain closed almost 50 restaurants (86 remaining) in California and filed for Chapter 11 in June. Weak restaurant traffic due to macroeconomic conditions and work-from-home, rising costs (including the increases to the minimum wage in California) were quoted as the reasons for the financial trouble.

The company had 48-stores in Texas. The bankruptcy was triggered by a wrongful death lawsuit.

The company is based in Louisiana and operates 25 Arby’s in five states. Commodities prices and labor costs affecting the cash flow were cited as the main reasons for the filing.

The bowls and salad chain parent company, One Table Restaurant Brands, filed for Chapter 11 bankruptcy protection. The company manages 40 restaurants (including brand Tocaya) and declared liabilities in the $10 million – $50 million range and assets under $50k.

The Texas-based company filed for Chapter 11 in July 2024, after being sued by Pizza Hut for unpaid royalties.

The company blamed high interest rates, cost inflation, and consumer habits (with a decline of the craft beer trend) for the bankruptcy. Underperforming locations would end leases and the company would be restructured.

The company has 40 restaurants and is owned by Plante Hollywood since 2008. Risings costs and labor difficulties were the main issues mentioned in the filing.

The fast-casual chain’s footprint shrank to half in 2021-2024. The effects of the pandemic, with about half of the locations being in downtown areas, were still being felt. 19 restaurants are left at the time of the filing.

Jognesh Pandya, Boston Market’s owner personally filed for bankruptcy protection in December 2023.

With about 300 restaurants, the company has more than $300k of debt in unpaid taxes and several locations have also closed due to evictions for unpaid rent. Food distributor US Foods is also claiming the company owes it more than $10 million.

Filed for Chapter 11 in November 2023. The company has 73 restaurants and estimated assets and liabilities in the $1 billion to $10 billion range. The group states that the parent company mandates expensive remodels that have poor ROI.

The Burger King operators filed for bankruptcy at the end of 2023. Meridian had 96 restaurants in its portfolio in Virginia, Ohio, Illinois, and Pennsylvania when it filed for bankruptcy. The Burger King franchisor openly opposed the reorganization.

The franchisee operated 145 Hardee’s in its most successful period. Declining sales caused problems for the company to serve its debt and pay rent.

The population migration and work-from-home trends had negative effects on the foot traffic for this fast-casual chain with a location strategy concentrated in downtown areas. It was acquired by Corbak Acquisition for $12 million.

After the founder’s death, the QSR franchisee operating 19 restaurants filed for Chapter 11 in March 2023.

Went Bankrupt in March 2023. This franchisee had eight restaurants and filed for bankruptcy after a rape lawsuit.

Toms King Sold for $33 Million. The company went bankrupt in January and sold most of its restaurants (90 stores) in an auction by March 2023.

Filed for Chapter 11 in November 2023. The Burger King franchisee operated more than 170 restaurants and made more than $220 million in sales in 2022.

Went Bankrupt in September 2022. The Midwestern pizza chain parent company Dynamic Restaurant Holdings filed for Bankruptcy in Q3. However, the company has franchised restaurants that will remain open.

Filed for Chapter 11 at the End of 2022. This is the second time the restaurant casual dining chain files for bankruptcy. Bertucci’s had 47 stores at the time of the filing, $98 million in annual sales, and an operating loss of $14 million.

The company filed for bankruptcy for seven locations, excluding five in New York City. The cause was the repercussions of the pandemic.

One of the chains that filed for bankruptcy before the COVID-19 crisis (in January 2020). In declaring bankruptcy, the quick-service restaurant chain indicated debts of between $50–$100 million. Insolvency will affect around 30 unsecured creditors and restructuring is taking place.

A chain of pubs that filed for bankruptcy protection in January 2020. Three letters of intent were submitted for the acquisition and the company lenders also submitted a stalking horse bid to bankruptcy court for an undisclosed valuation.

The parent to the Village Inn and Bakers Square Brands arranged for debtor-in-possession financing for $20 million. Therefore, the company is continuing operations, is able to restructure and may access debt consolidation, and eventually pay off its debts.

The company was on the border of being insolvent and filed for bankruptcy protection in Federal court in February 2020. SD Holdings franchises 73 Sonic-Drive-In restaurants, 14 MOD Pizza stores, and 3 Fuzzy’s Taco Shop locations. Filing for bankruptcy was part of a strategy to sell its locations. Liquidation of assets wouldn’t be enough to pay a secured debt of more than $22 million.

NPC International declared Chapter 11. We indicated that the Pizza Hut and Wendy’s franchisee was considering bankruptcy earlier in 2020. The company had missed interest payments had seen its debt downgraded. The company was able to avoid bankruptcy late in 2019 but had defaulted on debt financial covenants. As of June 2020, NPC declared bankruptcy citing “challenges magnified by COVID-19” and is expected to go through a re-organization process.

Cosi had to file for bankruptcy for the second time since 2016. The principal of the company’s majority shareholder passed away in 2018 and funding was interrupted. From there, the fast-casual chain was unable to find debt relief, leading to bankruptcy.

The parent to Logan’s, Rock Bottom Restaurant & Brewery, and Old Chicago was another restaurant chain to file for bankruptcy. Proceedings started with an auction of assets with a stalking horse bid made by a company lender (Fortress Credit).

The fast-casual chain founded in Germany and with 6 units in the U.S. faced insolvency due to the coronavirus lockdowns and started proceedings in Germany. A consortium of bidders — including the Van der Valk family (one of the major hospitality dynasties in the Netherlands and an initial Vapiano franchise partner), Henry McGovern (Founder and former Chief Emotional Officer of AmRest), and Sinclair Beecham (Founder of Pret a Manger) — are expected to complete a transaction in June 2020 to help re-start the brand.

The parent of Brio Tuscan Grille and Bravo Cucina Italiana filed for Chapter 11 Bankruptcy in April 2020.

When declaring bankruptcy, the QSR deli chain explicitly mentioned the coronavirus crisis as the cause for its bankruptcy in the filing (despite having received a loan from the Paycheck Protection Program).

Parent of Souplantation and Sweet Tomatoes Garden Fresh Restaurants was another of the chains that have gone bankrupt due to the coronavirus crisis. The 97 salad bar restaurants are buffet-style and would struggle to see guests back even after restrictions are lifted. Chapter 7 bankruptcy protection was attained in May.

SRH filed for bankruptcy in May 2020 and also cited the coronavirus crisis as the reason. The company’s brands, Bamboo Sushi and QuickFish, were acquired by the investment firm Sortis Holdings.

A franchisee for IHOP operating restaurants in four states also filed for Chapter 11 in May. The franchise agreements with Dine Brands Global had been terminated in April.

LPQ filed for bankruptcy and is looking for an acquisition for $3 million to Aurify Brands for 35 of its restaurants.

The HopCat Brewery and Pub parent filed for Chapter 11 in early June, also citing the pandemic as the reason. BarFly’s assets were sold in October 2020: HopCat, Stella’s and Grand Rapids Brewing company were sold out of bankruptcy for $17.5 million to Congruent Investment Partners and Main Street Capital.

Parent of Chuck E Cheese’s and Peter Piper Pizza — filed for Chapter 11 bankruptcy in June 2020. The family eatertainment segment has been among the hardest hit by the coronavirus pandemic. The company was highly leveraged, listing $1 billion in debt. The owner of CEC, Apollo Management, plans to restructure the company.

Twisted Root declared bankruptcy on three corporate stores. The fast-casual “better burger” chain is keeping six corporate stores running for off-premise sales. Assets and liabilities were indicated in the $500k–$1 million range.

The parent company of Fig & Olive (a 10-unit, upscale Mediterranean concept operating in five markets including New York and Washington, D.C.) filed for Chapter 11 bankruptcy protection as all locations were closed and 700 employees laid off as a result of the pandemic.

One of the U.S.’s top foodservice distributors filed for bankruptcy (Chapter 11) in June 2020. The foodservice distributor supplied QSR chains (including Burger King, Tim Hortons, Wendy’s, Applebees, IHOP, and Chilli’s) and also handled logistics for Darden.

CPK filed for Chapter 11 bankruptcy as of July 30, 2020, due to the Coronavirus crisis. The company is expected to go through restructuring with a $30 million bridge loan and to transform long-term debt into equity. Locations will be closed (the company had 200 locations in the U.S. and sales for $635 million in 2019). In November 2020, the pizza chain restructured, converting $220 million in debt to equity.

Matchbox filed for bankruptcy (Chapter 11) in early August, citing the pandemic as the cause. The casual dining chain went through restructuring and was acquired in November by Thompson Hospitality.

Garbanzo filed for Chapter 11 bankruptcy due to reduced sales amid the global pandemic. The fast-casual franchise was already struggling before the shutdowns, having lost $2.2 million as of 2019.

Blue Star filed for Chapter 11 bankruptcy protection at the end of August. The company indicated the lockdowns due to COVID-19 as the cause for a production halt and a loss of its retail-driven revenue.

Stephen Starr’s Upland restaurant in Miami (owned by S. Lot Partners, LLC) filed for Chapter 11 bankruptcy in early September. The company indicated the Coronavirus pandemic as the reason. The location had assets for up to $50k and liabilities in the range of $100k-$500k.

The Luby’s board approved a plan to liquidate Luby’s Cafeteria, Fuddruckers, and its Culinary Contract Services business failing to find a buyer (a process that had started before the pandemic). The sales of assets is estimated to generate between $92 million and $123 million.

The parent to Maison Kayser, Cosmoledo LLC, declared Chapter 11 in early September. All Maison Kayser locations had been closed since March due to the pandemic. Aurify Brands was the bidder for the assets.

Toojya’s was acquired out of bankruptcy by PE firm Monroe Capital Management. The company is now debt-free thanks to the restructuring process. TooJay’s now has 21 locations after 9 closings due to the pandemic.

American Blue Ribbon Holdings emerged from debt reorganization after filing for Chapter 11 back in January. Two companies were created: VIBSQ Holdings LLC (Village Inn restaurants and Bakers Square restaurants) and Legendary Baking Holdings LLC (Legendary Baking).

Casual dining Sizzler USA declared bankruptcy in September, blaming the COVID-19 pandemic. Assets and liabilities are in the range of $1-10 million. The company had been losing sales before the pandemic (sales declined close to 4% in 2019).

This was one recent restaurant bankruptcy that was not related to the pandemic. It was acquired out of bankruptcy by Schmitt Industries.

The 6-unit Chinese crepes chain declared bankruptcy and closed down in August 2020.

The waffle sandwich fast-casual had L Catterton as a former investor (they exited) and assets were sold to TCGM Holding Company.

In October 2020, the largest Golden Corral franchisee filed for chapter 11 and it’s seeking to reorganize after COVID.

The casual dining brand closed more than 40% of its locations during the pandemic. In October 2020 it filed for Chapter 11 protection with more than $40 million in senior debt and $19 million in other liabilities, including rent, utilities, and vendors.

The 25-unit Applebee’s franchisee filed for Chapter 11 because of the pandemic. The company was employing 600 people.

The fast-casual chain declared bankruptcy with more than $80 million in debt.

The chain of dine-in movie theaters filed for Chapter 11 in October 2020. The company had 33 locations, more than $100 million in secured debt, and more than 900 employees.

New York’s Maison Kayser locations were sold to Aurify Brands out of bankruptcy. Some of the units are planned to be converted to Le Pain Quotidien restaurants. The acquisition closed in November 2020

In December 2020, the fast-casual chain filed for Chapter 11 protection because of pandemic-related closures that brought revenue down by 67%.

The eatertainment concept declared bankruptcy with only two locations left open. The company has a $20 million debt to CrowdOut. The total amount of debt is between $20 and $50 million and in the same range as the value of assets, according to the filing.

The pizza chain declared bankruptcy in December 2020. It negotiated to be sold to D&B Investors, its primary lender. Cici’s has more than 300 restaurants (corporate and franchised) and cited food delivery as one of the main reasons for dwindling sales.

The Jack in the Box franchisee (with 70 restaurants) filed for Chapter 11 early in 2021 with liabilities between $10-$50 million and assets of only $1-$10 million.

The parent to Old Country Buffet and Furr’s declared Chapter 11 in April 2021. Most of the restaurants were closed.

The parent to casual dining brands Daily Grill and the Public School declared bankruptcy in June 2021, closing several restaurants.

Advice for Operators in Precarious Situations

We’d recommend looking for buyers and strategic alternatives before it gets worse. The liquidity crisis will soon turn into a solvency crisis. We’d give it about 60 days. That’s when travel restrictions will lift, runway and cash burn will run out for many struggling businesses, and restaurant M&A will resume to a white-hot level. There is more private capital sitting on the sidelines than the government has put into rescue plans.

It’s hard to get deals done without the ability to meet face-to-face. The timing of going back from pause-to-play will coincide smoothly with the solvency crisis. In some ways, you could look at this situation and point to vultures circling in the sky with smiles while the prey enters their death-throws; but — depending on perspective — what happens next could also be characterized as looking up into the sky and seeing a caped superhero coming in to rescue a struggling enterprise.

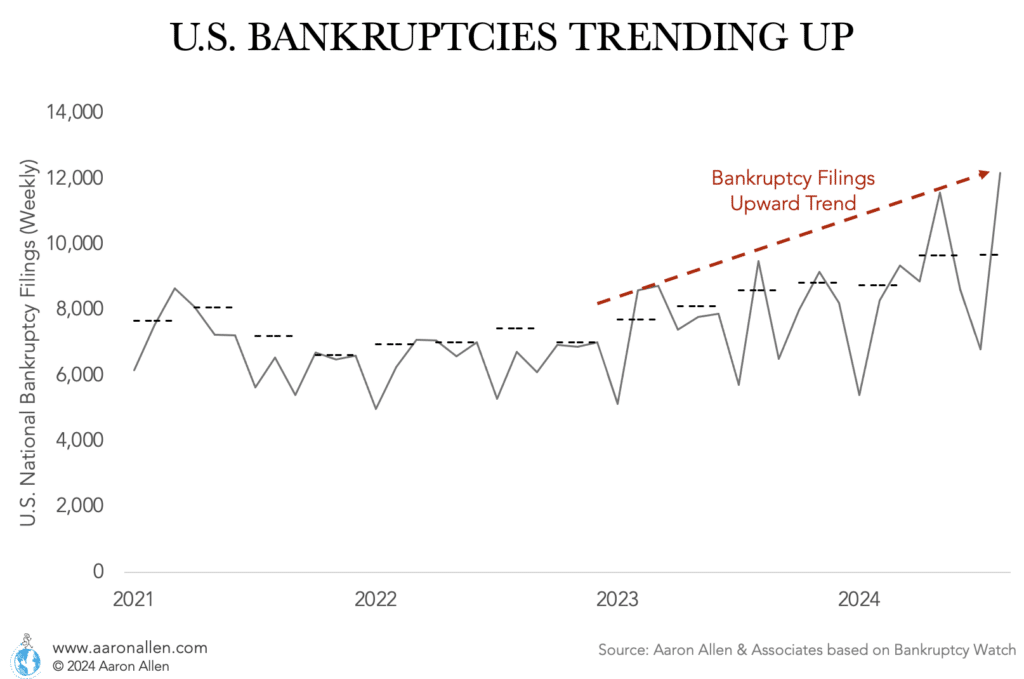

The number of struggling businesses filing for bankruptcy has been showing an increasing trend since the end of 2022. 2024 has so far shown the worst average numbers of the last few years.

And though many companies are able to restructure and continue operating, in many industries (in the restaurant industry in particular) in most cases the businesses aren’t able to bring the shine back.

It’s an imperative to develop new business models and plans ahead of sitting down with creditors. In many cases, effective turnaround plans can gain traction and confidence, but they require credibility and objectivity to convince other shareholders and stakeholders to come along. It’s essential to win not just their consent, but their renewed trust and enthusiasm for a new and inspired vision.

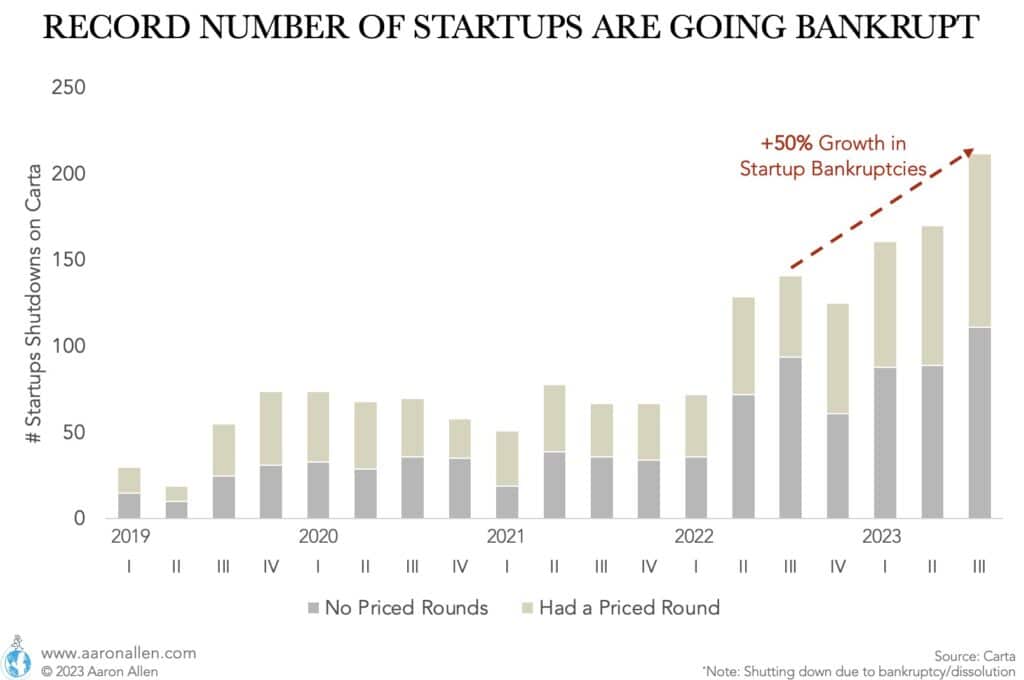

Relevant for foodservice technology companies, startups funding dried up and they are going bankrupt.

Reports are indicating that startups are seeing record levels of bankruptcies, with a 50% increase in Q3 of 2023 compared to 2022.

When you look at 2024 it’s not all doom and gloom but it’s very different from what we had in the last two years.

What should have happened during the pandemic didn’t happen because of the amount of stimulus (with governments pumping cash into the economy). As a result, bankruptcies were delayed — but here they come.

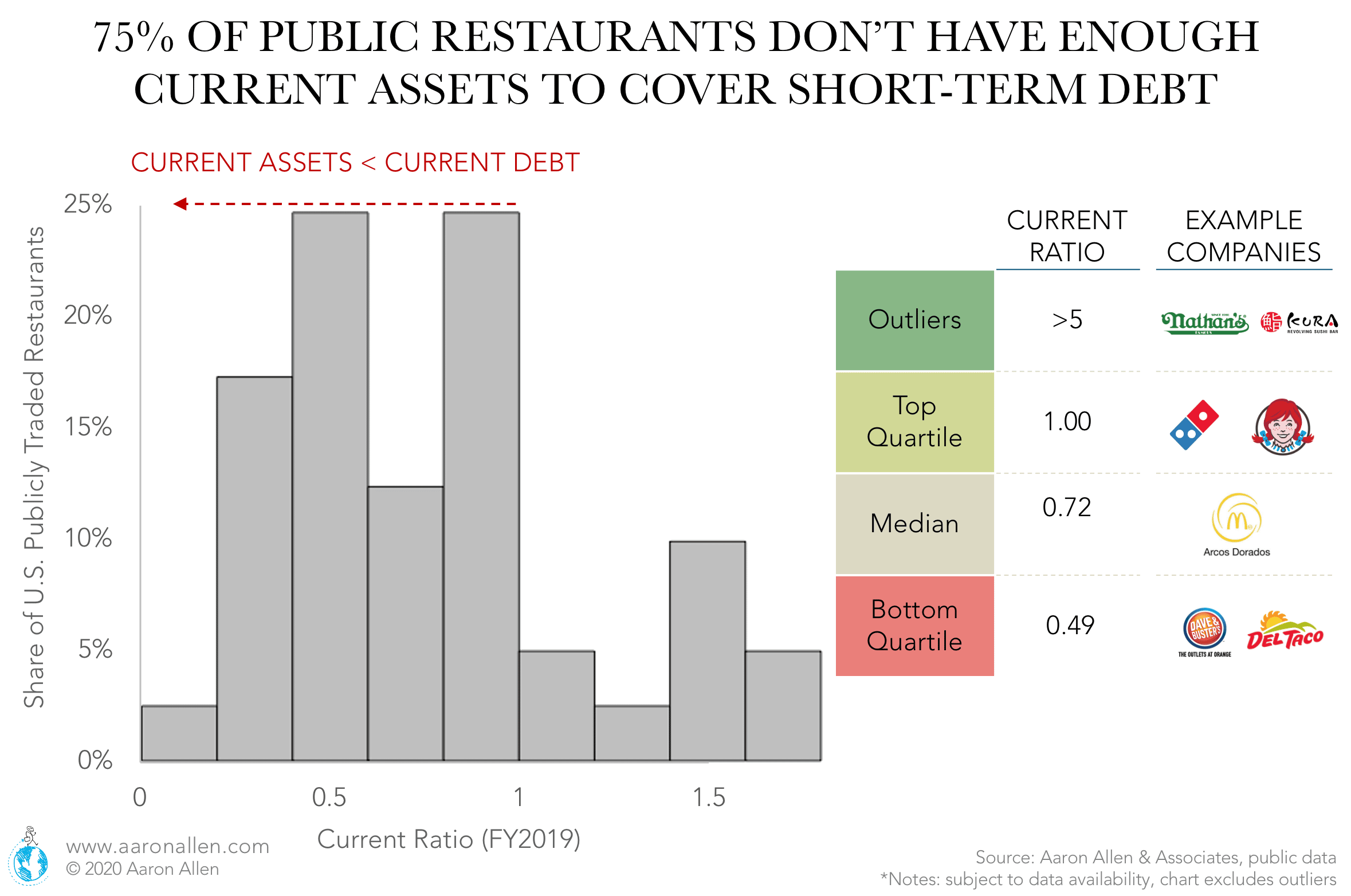

In early 2020 we conducted a study of public restaurant companies in the U.S. to assess their risk of bankruptcy in the wake of the economic uncertainty brought on by the coronavirus pandemic. This analysis is based on a calculation called the Altman-Z” Score (a variation of the Altman-Z Score which is commonly used to calculate the credit strength of manufacturing companies), based on key financial metrics including: Current Assets, Current Liabilities, Total Liabilities, EBIT, Total Assets, Retained Earnings, and Book Value of Equity.

Generally speaking, an Altman-Z” Score greater than 2.6 is deemed “safe”, between 1.1–2.6 is in the “gray area,” and lower than 1.1 is viewed in the ”distress zone.” These calculations were completed in May 2020 using Q1 2020 data for U.S. publicly traded restaurant companies, or the last available data (depending on companies’ fiscal year in the analysis set).

A total of 46 companies are included in the analysis ranging service styles (QSR, fast-casual, casual dining, etc.) and both franchisee and franchisor business models. These companies total an estimated $148b in annual U.S. system-wide sales and account for 100k locations across the country. The analysis also includes Arcos Dorados and Yum! China which operate exclusively in Latin America and China, respectively. For the purposes of classification, companies considered “highly franchised” have greater than 66% franchised units system-wide, “moderately franchised” between 33–66%, and “lightly franchised” below 33%.

Some highlights of our analysis include:

We’d like to not that these are not predictions nor forecasts, but rather calculations based on working capital, retained earnings, EBIT, market value, sales, and assets. Many restaurant companies operating with different models (highly franchised systems versus wholly corporate-owned systems, for instance) have naturally varied financial metrics that impact the calculations and financial performance.

This period will usher in a fresh wave of consolidation through mergers and acquisitions. In many cases, recessionary M&A involves distressed and dislocated assets that can be purchased for pennies on the dollar. However, it’s not always predatory or unwelcome. In our view, this period of change will just be accelerating the transformation that was already underway and being profitably harnessed by industry leaders.

Those that are most optimistic often tend to be either those that are under-informed and bubbly optimists by nature — or, they are those that have done their homework and developed a silver-lining investment thesis. Foodservice is a multi-trillion dollar global industry that has remained as consistent as inflation and population growth for decades and spend has been irreversibly redirected in a single quarter — displacing and shifting hundreds of billions of dollars in global consumer discretionary spending. While it will be fatal for some and fortune-building for others.

We found that more than six every ten restaurant chains are in the “distress zone” when using this calculation (highly leveraged, low earnings, or a combination of both). While this is not a direct indicator of bankruptcy risk — and there are significant differences in operating models for these companies (franchisors versus more corporate-owned locations, etc.) — there are some fascinating findings.

Even with the injection of liquidity, it is not enough to cover what the losses are — with the industry down tens of billions per month right now it’s going to be very hard to get back, even once restaurants are at full capacity.

Restaurant bankruptcies are multiplying in 2020 and several chains filed for chapter 11 or debt protection across all segments: from quick-service restaurants Krystal Burger (declared bankruptcy back in January), to fast-casual chains Vapiano, Cosi and Le Pain Quotidien to buffet Garden Fresh Restaurant.

It’s usually the case that smaller companies are more vulnerable to economic shocks than large companies. Among U.S. public restaurants, the risk of bankruptcy increases by more than a third when comparing small-, micro-, and nano-caps to large caps. While 50% of large caps are in the distress zone according to Altman’s Z’’-score, the share of companies in the red zone increases to 69% for public restaurants with less than $2b in market cap.

The retooling that was already in motion is accelerating and the industry will look very different a few years from now.

Companies with negative working capital are most likely to face liquidity issues because they lack sufficient current assets to cover current debt. In the U.S., publicly traded restaurants have a total of $1.5b in working capital (46 companies). However, 65% of chains have negative working capital (accounting for a deficit of $6.1b).

The restaurant industry received 9% of the first Paycheck Protection Program (PPP) loan batch ($31b) and it’s not nearly enough to cover what the losses are. Greater consolidation will happen than in any of the recessions before.

There are many proof-points to demonstrate the differences in approach of top-quartile and bottom-quartile performers. When we look at Operating Margins, the differences are staggering. In moderately and lightly franchised publicly traded restaurants in the U.S., the top-quartile Operating Margin is 9x the margin for the bottom-quartile. For highly franchised restaurants, the top-quartile makes twice the profit margin of the bottom-quartile.

The top performers are also putting more toward R&D and building proprietary systems that are reinforcing the moat around their business and locking out their competition. This is a great time to make operations faster, leaner, and more agile to optimize margins and achieve top-quartile performance.

The Working Capital to Total Assets ratio reveals the percentage of remaining liquid assets, once Total Current Liabilities are paid out, compared to the company’s Total Assets. As a rule of thumb, ratios lower than 15% are generally considered unsatisfactory, and negative values are considered critical. 93% of U.S. publicly restaurants are in these zones. For many restaurant chains, investors will have to step in to solve the liquidity crisis ahead of other critical initiatives focused on innovation and re-inventing the economic model.

The higher the Current Ratio (Current Assets to Current Liabilities), the more able a company is to pay short-term debt. In the restaurant industry, the current ratio reached a median of 0.72 (FY 2019 for publicly traded companies in the U.S.) and for three-quarters of the industry, the current assets are not enough to cover all short-term debt. Some foodservice companies in the bottom quartile had current ratios lower than 0.50 (current assets covering less than half of current debt).

While liquidity pumping into the economy is buying time, many restaurants won’t be able to sustain their existing debt levels. This scenario will likely lead to plenty of distressed restaurant assets in the near future, which will spur activity as the global pause on M&A lifts as travel restrictions are loosened.

A sobering stat: the restaurant industry has been the sector with the most bankruptcies in the last three months, with 12% of U.S. bankruptcies (more than 300) coming from this industry alone.

More consolidation will happen than in any previous recession. We think 10-15% of restaurants in America will close permanently by the end of the year (with that potentially increasing to 20% if another wave of the virus hits and without further government assistance). The bulk of that will be Casual Dining, full-service restaurants and independents.

In the U.S., 4.4 million restaurant jobs have been lost (comparing 2019 with the average employment for April–June 2020), and though there are no official figures for closings, we estimate between 198,000–231,000 restaurants will close in 2020. This will be the first year the number of establishments doesn’t climb in at least 20 years (even during the 2008/2009 recession the number of restaurants continued to grow).

Highlights of this analysis were featured in Bloomberg News.

We are a global strategy firm focused exclusively on the foodservice and hospitality industry helping middle-market companies and investors with both buy- and sell-side M&A advisory services. Our clients include restaurant chains, foodservice technology providers, and alternative foodservice formats. We also specialize in multi-national, multi-brand portfolios, and cross-border transactions.

Our restaurant and foodservice industry M&A advisory services include:

Going beyond the three financial statement models to identify and unlock trapped potential and value-accretive opportunities by building a perspective from the most granular-level data to the big picture of a global market place, we apply a data-driven, analytical process combined with deep and specialized foodservice industry experience and expertise.

We are focused exclusively on the global foodservice and hospitality industry. You can think of us as a research company, think tank, innovation lab, management consultancy, or strategy firm. Our clients count on us to deliver on our promises of meaningful value, actionable insights, and tangible results.

Founded and led by third-generation restaurateur, Aaron Allen, our team is comprised of experts with backgrounds in operations, marketing, finance, and business functions essential in a multi-unit operating environment.

We bring practical, relevant experience ranging from the dish room to the boardroom and apply a holistic, integrated approach to strategic issues related to growth and expansion, performance optimization, and enterprise value enhancement.

Working primarily with multi-brand, multinational organizations, our firm has helped clients on 6 continents, in 100 countries, collectively posting more than $300b in revenue, across 2,000+ engagements.

We help executive teams bridge the gap between what’s happening inside and outside the business so they can find, size, and seize the greatest opportunities for their organizations.