Did you know that the average restaurant has a profit margin of just 7%? That means for every $100 in sales, the restaurant only earns around $7 in profit. As a restaurant CEO or CFO, it’s important to understand what affects your profit margin and how you can improve it. In this guide, we’ll explore the factors that influence restaurant profit margins and offer tips on how to increase profitability. We’ll also look at profitability by geography, category, and franchising level. So whether you’re looking to boost your restaurant’s bottom line or just want to better understand how it works, read on for insight into restaurant profit margins!

How Do You Calculate a Restaurant’s Profit Margin Percentage?

How profitable are the most successful restaurant operations? The answer to that question will change based on the margins used to measure the organization’s performance. Here, we examine four metrics that investors and managers use to gauge a foodservice operation’s profitability: gross margin, operating margin, and profit margin.

How to Calculate Gross Margins for Foodservice

Gross margin reflects what percentage of revenue a restaurant operation keeps after paying for the costs of the products or services it sells. The higher ratio, the better, indicating a lower cost of goods sold (COGS), which includes any expenditure directly necessary for producing the items on a restaurant’s menu.

The ratio is calculated using the following expression:

The average restaurant profit measured by the Gross Margin is 45% (considering publicly traded restaurants in the U.S.)

How to Calculate a Restaurant Operating Profitability

Operating profit margin indicates what percentage of revenue remains after all operating costs have been deducted, including COGS, selling, general, and administrative (SG&A) expenses, and others. That is, operating profit includes more costs than gross profit, because it takes into account line items like marketing, managerial salaries, and other expenses not directly related to production.

How to Calculate a Restaurant EBITDA

The restaurant industry can be mighty unforgiving because of thin margins and high operating expenses. EBITDA (earnings before interest, taxes, depreciation and amortization) plays a crucial role, as it is designed to help owners and operators place a firm value on their restaurant company’s earning power by focusing on cash flow.

EBITDA is characterized as net cash income, or net operating income. To calculate EBITDA, restaurant owners must subtract their fixed costs from their gross profit. (EBITDA does not reflect noncash expenses such as depreciation and interest payments.) Operating profit, on the other hand, is calculated by subtracting the costs of goods sold, plus expenses, from total sales. Many operators and owners view restaurant EBITDA as a useful way of evaluating the actual earnings power of their operation, and to compare their businesses to others carrying different debt levels or depreciation values.

EBITDA is a very useful metric to measure corporate profitability and is a good tool for comparing companies, especially within the same industry as it excludes financial effects and capital expenditures.

It is calculated as follows:

![]()

Careful though! EBITDA essentially neutralizes the cost of debt and adds back income taxes to the net income. Therefore, companies tend to highlight their EBITDA when performance is still very impressive. In fact, a company with a negative net income may have a positive EBITDA.

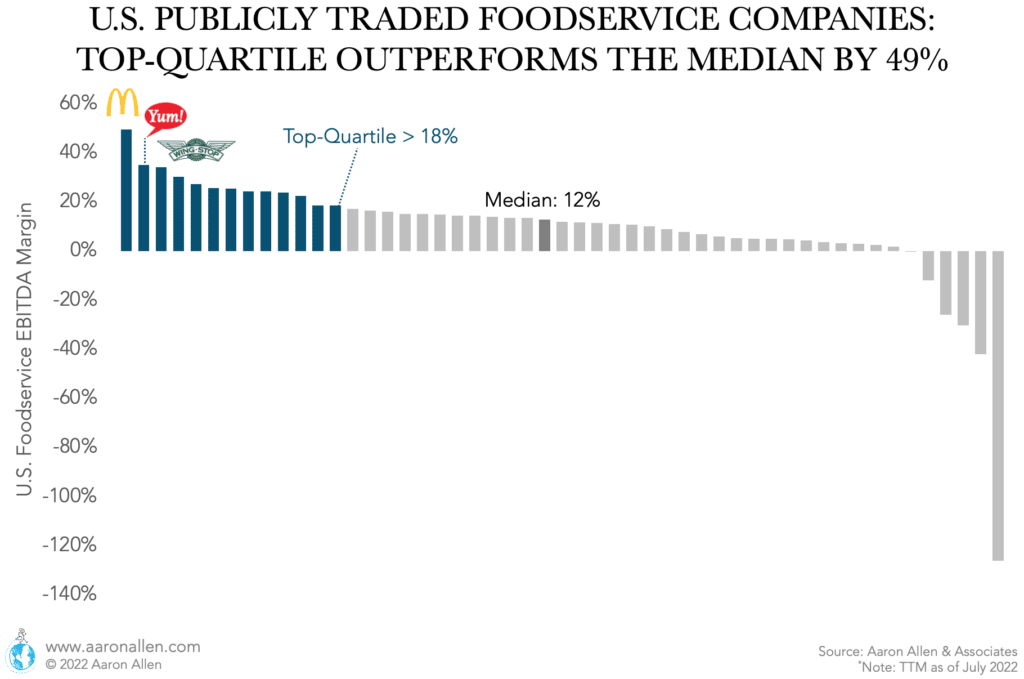

The typical restaurant profitability is 12% (EBITDA margin for publicly traded foodservice companies in the U.S.). The top-quartile (the best performers) is passing the 18% profitability margin. And while many of those are highly-franchised companies, most of the best performers are those able to harness headwinds and turn challenges into opportunities. On the other hand, the bottom-quartile (the worst performers) has a profitability (measured by the EBITDA margin) of only 5%.

How to Calculate the Net Profit Margin for a Restaurant

The net profit margin ratio includes every expense an organization pays out before calculating the percentage of each revenue dollar it gets to keep. It also considers other sources of revenue besides sales, like interest income.

While gross and operating margins are entirely under the company’s control, net profit considers line items including taxes, depreciation, debt payments, and extraordinary items.

Since EBITDA excludes the effect of depreciation and taxes on earnings, it should be complemented by an evaluation of the overall bottom line. By subtracting Depreciation & Amortization, Interest expense and Non-Operating/Unusual expenses (if any), and Taxes, from the EBITDA margin we obtain the Net Income.

It is calculated as follows:

These equations give management teams and potential investors different ways of slicing through the operation’s performance to help discover where costs may be excessive relative to performance.

The average restaurant profitability measured is 7% measured by the Net Profit Margin (based on U.S. publicly traded foodservice companies).

What Affects a Restaurant Profit Margin?

Some of the factors affecting the profitability level of a restaurant are the geography, the type of ownership (if it’s a franchisor, or if most of the locations are corporately owned, or if it’s a franchisee), the size (is it a big chain with hundreds of units or is it a small one with a couple dozens or an independent restaurant with one or two stores?), and the category (is it a quick-service restaurant chain or fast casual or casual dining?).

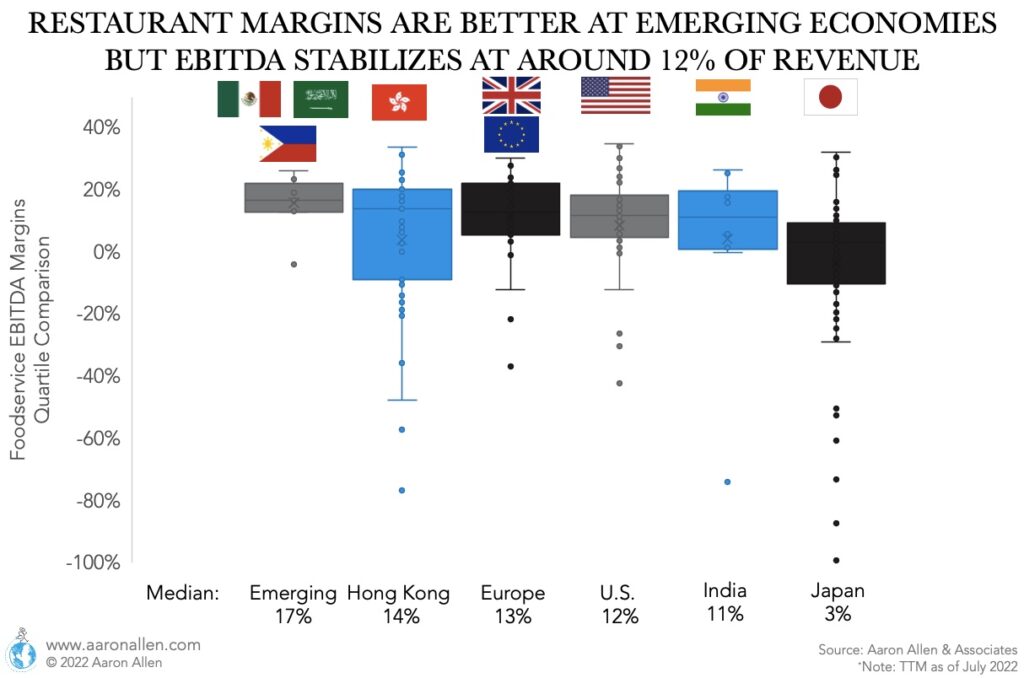

- Restaurant profit margins (measured by EBITDA as a percentage of sales) tend to stabilize around 12% independently of the geography — with a few exceptions.

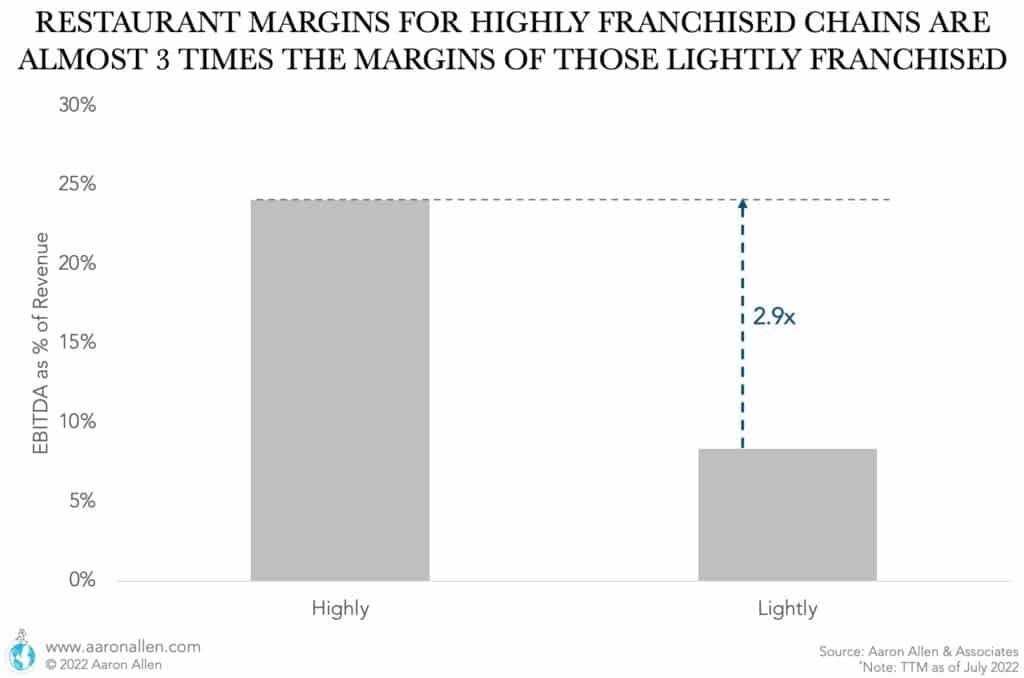

- Restaurant profitability is higher for franchised systems. Foodservice companies with highly franchised systems almost triple the profitability of those with lightly franchised systems (or not franchising at all).

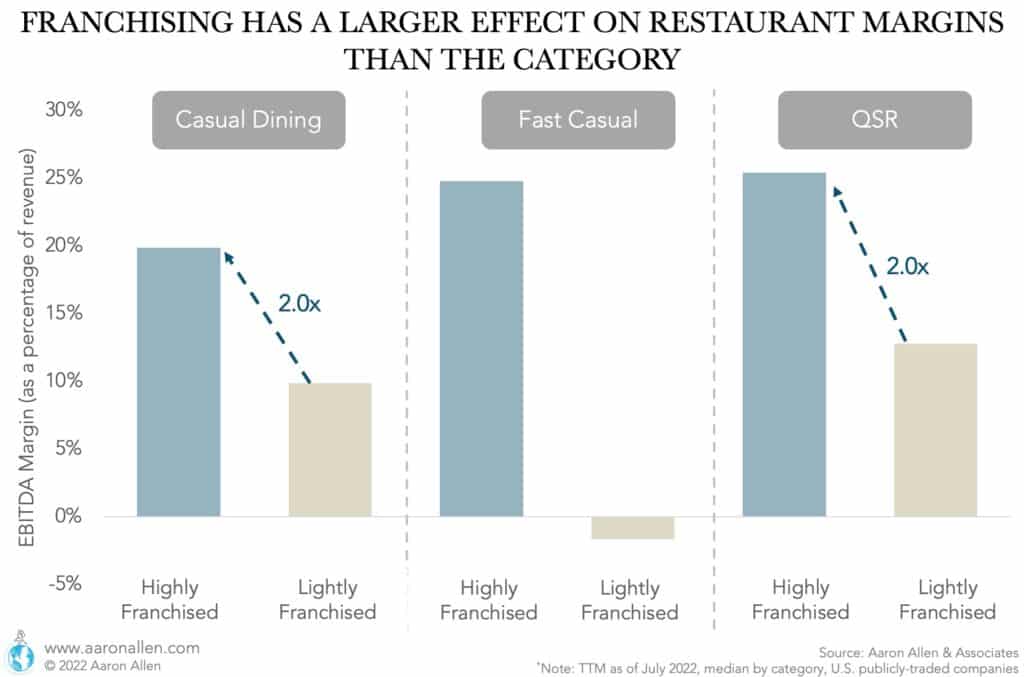

- Highly franchised QSR systems tend to be the most profitable, followed by highly franchised fast casual, and highly franchised casual dining.

The Average Restaurant Profit Margin is Higher in Some Emerging Markets

The median restaurant profit margin is 12% in the U.S., 13% in Europe including the UK (measured by the EBITDA margins of public foodservice companies). In some markets it can be significantly lower, like Japan, with an EBITDA margin of only 3%. In emerging markets like India, the median is not very different from mature markets (close to 12%). In emerging markets like the KSA, Mexico and the Philippines, the median restaurant EBITDA margin reaches 17%.

*Includes the Kingdom of Saudi Arabia, Mexico, and the Philippines.

Restaurant Profitability Is Almost 3x for Franchisors

Because of the nature of the model, franchisors have higher profitability than franchisees. Restaurant franchisors grant rights, territory rights, and share systems with franchisees and in exchange they receive a percentage of the franchisee sales (and other fees such as marketing fees).

Restaurant chains with highly franchised systems (we consider companies with more than two-thirds of their systems franchised) have a profitability of close to 25% whereas those with lightly franchised systems (less than a third of the system franchised, or even 100% corporate ownerships) have margins close to 8% of revenue. These stats are based on U.S. publicly traded companies.

What are the Most Profitable Restaurants?

Highly franchised QSR systems have the highest profitability margins in the restaurant industry (based on publicly traded U.S. companies). Highly franchised Fast Casual comes next, and highly franchised Casual Dining after. All the lightly franchised categories (QSR, Fast Casual, and Casual Dining) come after.

In particular, McDonald’s is the most profitable restaurant (considering U.S. public companies) with close to 50% EBITDA margins as of mid-2022, followed by Restaurant Brands International (parent of Burger King, Tim Horton’s, Popeye’s and Firehouse Subs) with a profit margin of 35%.

How Has Restaurant Profitability Changed Over Time?

The median EBITDA margin for restaurants remained stable between 2017 and 2021. In 2017, U.S. public restaurants had a median profitability of 14% and this number reached 15% in 2021.

The companies that increased profitability the most were Rave Restaurant Group (going from negative 7% to positive 22% and Yum! China from 17% to 34% EBITDA margin. However, close to two-thirds of the companies were worse off in 2021 than in 2017, with profitability dropping between a few points to between 15 and 17 percentage points.

Strategies to Improve Your Restaurant Profit Margin

When margins shrink, executive teams can be tempted to slash costs to the bone, but such decisions are self-defeating. Here are a few techniques to improve margins:

1 – Do a Brand Audit

A comprehensive brand audit can identify areas of opportunity for organizations across all functional areas, rather than simply focusing on ways to decrease expenses. This can result in strategies proven to boost revenue and streamline operations, both of which produce long-term and sustainable growth, regardless of market conditions.

2 – Simplify Your Menu

Concepts with focused menus perform better than those that offer a lot of options that complicate the back-of-house and require additional labor. Price optimization should be part of any menu engineering project. After studying items profitability and how the guests are making their decisions, management will be in a good position to define promoting certain items or removing some.

3 – Be Intentional About the Menu Layout

Menu engineering is part science (we like to take the facts from the transactional data) and part art. The menu layout (for written menus, for digital menus, drive-thru menus) will emphasize the most profitable items. Menu Engineering can increase profits by 20%.

4 – Train Your Stuff Properly

It may be counter-intuitive to assign extra dollars to training when you’re trying to improve profits but when employees are excited, it spills over to customers.

5 – Don’t “Just” Do Marketing, Think of PR Too

PR is often an overlooked element of marketing. While word of mouth is always good, positive public awareness is better built by a PR campaign leveraging media relationships, generating implied endorsements, and creating a story around the restaurant to generate brand recognition and buzz.

6 – Streamline the Front and Back-of-House

When your restaurant is running smoothly, everyone benefits. You can speed up table turnover and serve more customers per service by equipping FOH and BOH staff with tools that will help them work smarter, you can push specials that the kitchen is able to produce effectively, and you can incorporate technology like self-ordering and self-pay that will allow time-conscious guests to move quickly through the lines.

7 – Monitor the Right KPIs

If you can’t measure it, you can’t manage it. Are you able to track the most important KPIs in real time? Do you know your restaurant and kitchen capacity? Can you tell in real time if you are gonna be under- or over-staffed in the next hours? Knowing what your team can do and what’s happening with customers as well as what are the high-level metrics can help you solve problems sooner rather than waiting to the end of month to see where your margins are.

8 – Use Technology to Schedule Labor

The key to having a properly staffed restaurant is streamlining your staff’s schedules. It may seem like an easy task, but it’s not unusual for things to slip through the cracks when it comes down to managing employees. Several tools allow to schedule staff smartly, even allowing them to exchange shifts without a manager intervening.

9 – Make Sure Your Marketing Is Generating a Strong Presence Online

Remember to list your business in Google, update hours, addresses, menus, and other relevant information, make it easy to order online, partner with reservation platforms. It’s important to also actively manage and frequently update the restaurant social media presence (if people can only see old posts they will wonder if you are still open), including TikTok, Instagram, Facebook, and Twitter (at the least).

10 – Be Effective with the Use of Ingredients

Managing inventory and forecasting demand are great tools to reduce food waste. With food being around a third of a restaurant’s expenses, this can’t go under-scored.

11 – Grow the Top Line

We always say that top-line growth can cure any bottom-line ailments. Bringing guests back more often (guest experience, loyalty, menu innovation), bringing new guests (marketing and advertising, promotional activity), trying to improve the average check size (for example add-ons, sizes, shareables), and improving sales channels (delivery and off-premise) and product lines (are you catering to vegetarians? Should you offer merchandizing?) all need adequate attention.

Related Resources for Restaurant Profitability

- How to build the top-line

- What to do when sales are down

- How to use promotions to grow sales

- How to leverage technology to improve restaurant margins

- How to reduce food costs

- How to optimize labor costs

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion in sales, span all six inhabited continents and 100+ countries, with locations totaling tens of thousands.