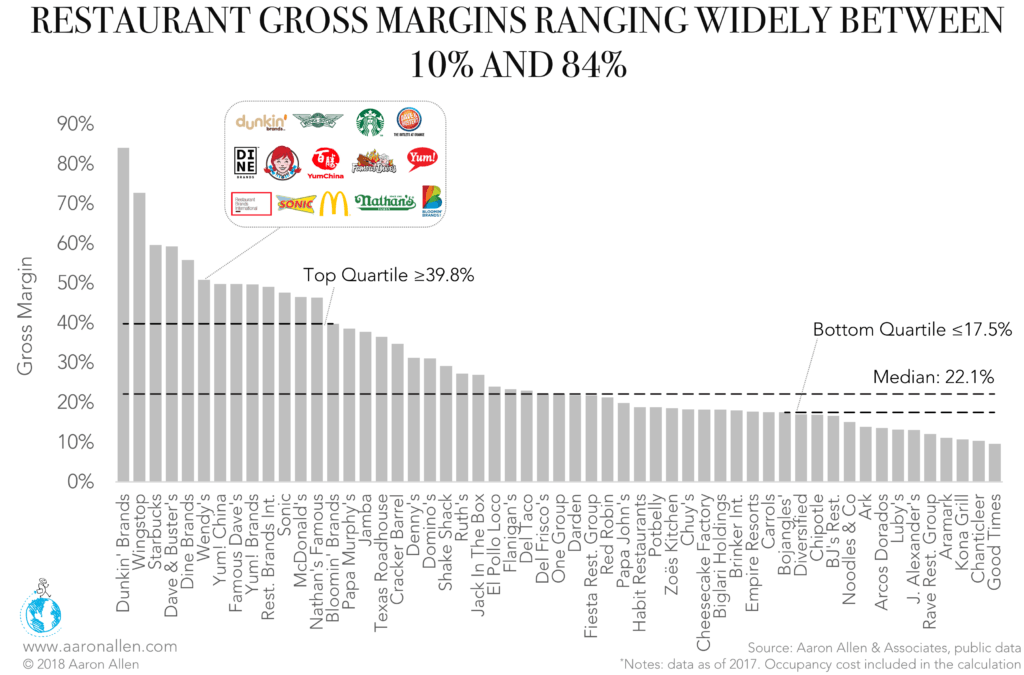

Gross margins consider the relationship between how much money a restaurant makes and how much money it took to generate that revenue in direct costs. High ratios indicate a lower cost of goods sold (COGS); a low gross margin indicates that the organization isn’t benefiting from high markups on its products.

Among top publicly traded players in the U.S. foodservice industry, operations with simplified menus and lean labor strategies have higher gross margins.

High Labor Costs Cut Into Gross Margin

Top-quartile U.S. foodservice chains generate a gross profit margin at least 1.8x the industry median (22.1%), earning at least $0.40 in gross profit for every dollar of revenue.

Dunkin’ Brands leads the pack, but its $0.84 in gross profit on each $1 in revenue is a little misleading. The coffee-and-donut chain is 100% franchised, meaning the parent company doesn’t cover any labor or food costs, which greatly reduces its COGS.

On the other end of the spectrum sits Good Times Restaurants. With a gross margin of only 9.6%, the QSR chain’s revenues barely cover the costs of goods sold. This low margin indicates that it will likely struggle to cover its operating and non-operating expenses, producing negative operating and net profit margins.

The low gross margin owes to high food and packaging costs. In 2017, beef and bacon prices surged at the same time that the company introduced improvements to its core menu, inflating the COGS line item. Further, because Good Times operates only in Colorado, where the labor market is pushing wages up, payroll costs have cut into profits.

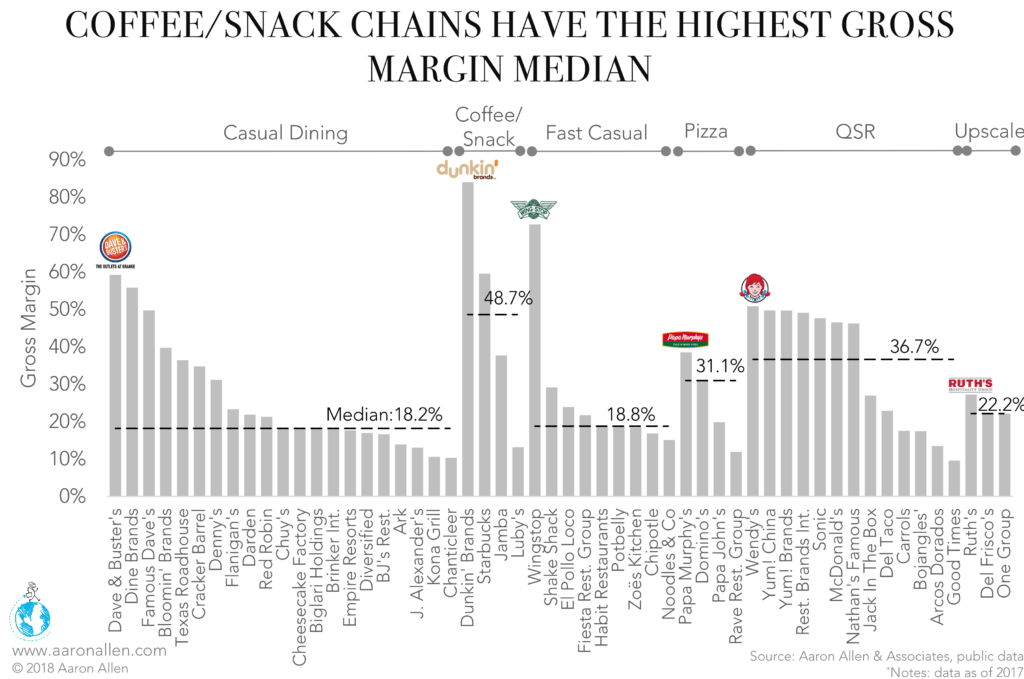

Lean Labor Helped Coffee/Breakfast Companies’ Gross Margins

While increases in the price of bacon and beef hurt Good Times, the 8% decline in coffee prices over the same period handed companies in the coffee/breakfast segment COGS savings. Segment leaders Starbucks and Dunkin’ coupled this bonus with a lean labor strategy, which works to optimally staff each location based on expected traffic.

These companies have further expanded their reach by focusing on digital and off-premise sales, offering virtually infinite opportunities for growth.

High gross margins imply a robust restaurant operation, but this ratio is just one piece of the puzzle when assessing an organization’s financial health. Reviewing both operating and profit margin, which take more than COGS into account, provides a more comprehensive understanding into how well a company is running.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion in sales, span all six inhabited continents and 100+ countries, with locations totaling tens of thousands.