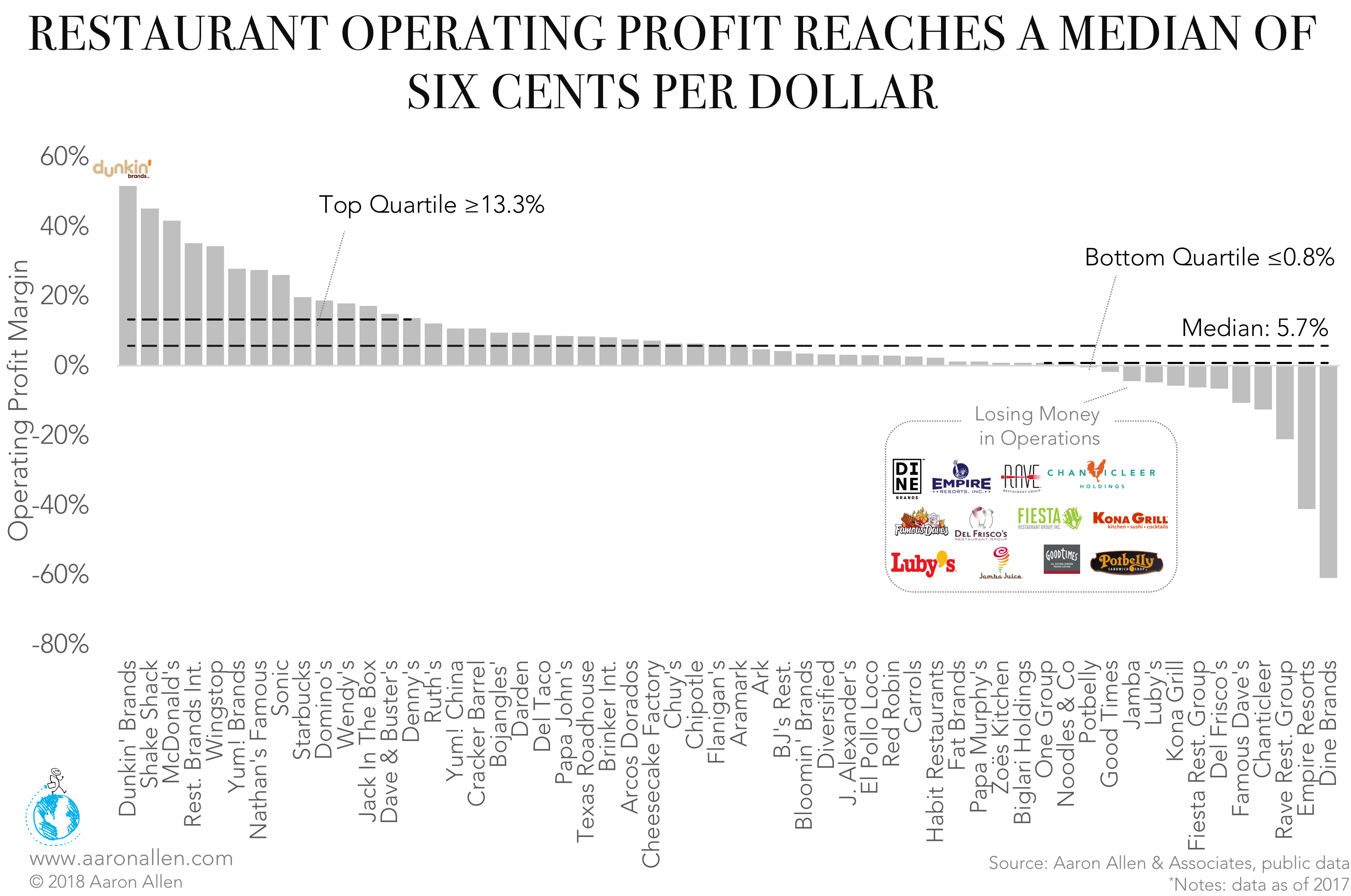

It’s no secret that the operating margin is thinner in foodservice than almost anywhere else, owing to the fierce competition in the industry. However, some chains have achieved impressive results.

Companies with a defined focus that differentiates them from other operations have better operating margins than those organizations that try to do too much. Franchising also helps strengthen operating margins, as it spreads costs out among non-company-owned units.

A Clear Focus Plus Low SG&A Costs Boost Operating Margins

Among publicly traded foodservice operations in the U.S., the top quartile has operating margins of at least 13.3%, 2.3x the industry median.

As it does in gross and net profit margins, Dunkin’ Brands leads the pack, making $0.52 in operating profit for every dollar of revenue — 9.0x the industry’s median of 5.7%.

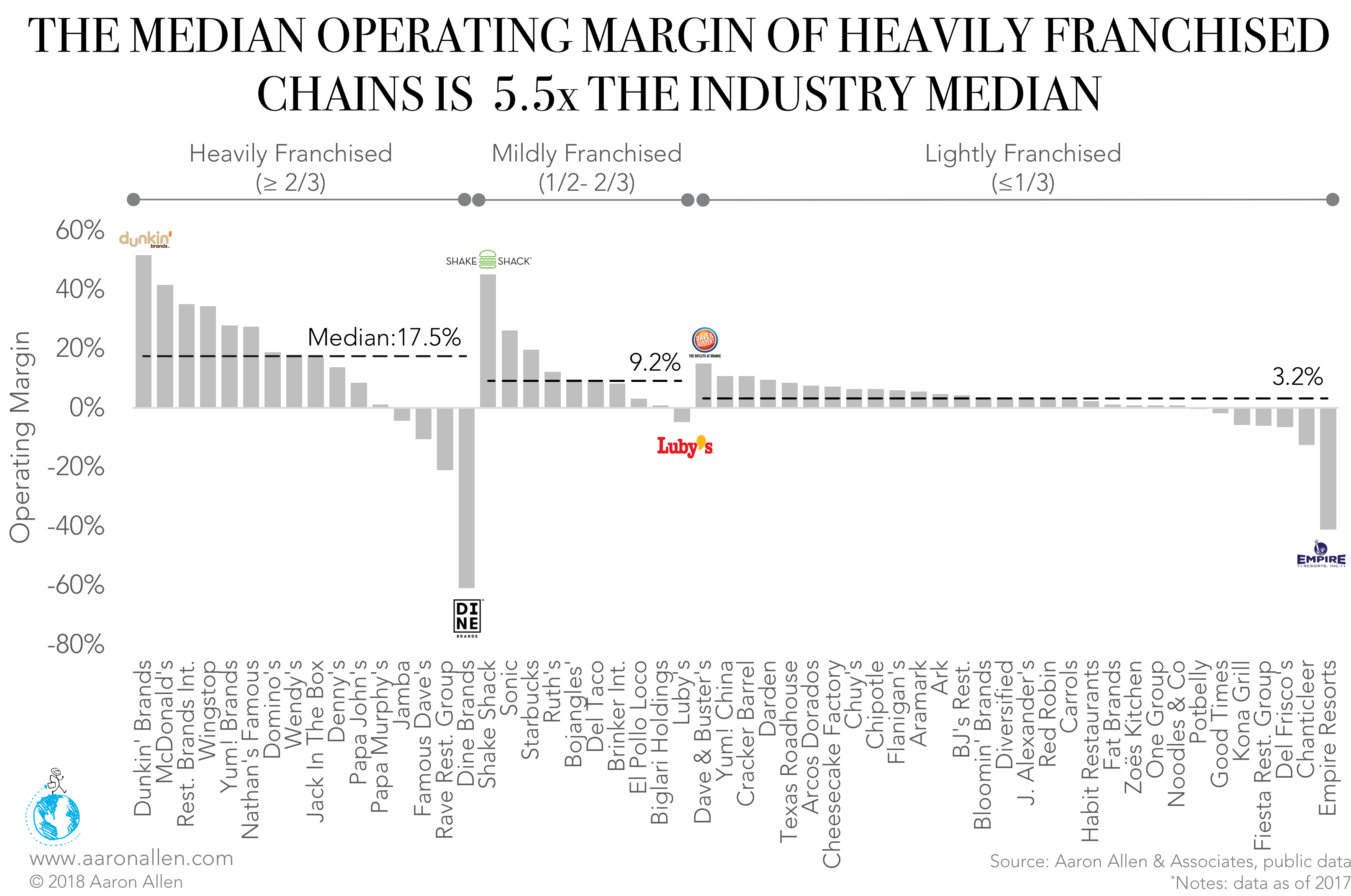

Franchising Likely to Improve Gross Margin

We can once again explain Dunkin’s high margins by pointing to its 100% franchise rate — the company doesn’t own a single location. Comparing the chain’s 84% gross margin to its 52% operating margin shows how much SG&A costs can impact profitability.

In fact, the lowest performer — Dine Brands, with a -60.9% margin — had large SG&A expenses, mostly from hefty non-recurring cash severance and equity compensation charges related to the separation of the previous CEO, Applebee’s stabilization initiatives, and the parent company’s rebranding strategy.

Operating margin growth parallels increased franchise rates. Chains with two-thirds or more franchised locations enjoy the highest operating margins in the foodservice industry, with a median of 17.5% — 5.5x the lightly franchised (less than one-third franchise operated) chains’ median of 3.2%.

Heavily franchised chains such as Dunkin’ Brands, Wingstop, and McDonald’s are shielded from food and labor inflation concerns at the corporate level as the majority of these costs are shouldered by franchisees. Other operating expenses, such as advertising and marketing campaigns, are often shared between the franchisors and their franchisees, offering substantial relief to parent companies.

As rivalry intensifies among restaurants, many operations are looking for ways to boost sales, reduce costs, and improve these margins. While some chains are betting on a more focused value proposition, others are relying heavily on their franchise model to achieve those goals.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $200 billion in sales, span all six inhabited continents and 100+ countries, with locations totaling tens of thousands