It’s a fascinating time for restaurant innovation around the world. The $3.1 trillion global restaurant industry is relatively predictable in terms of growth (it mirrors that of population and inflation), but what was already one of the most complex businesses in the world is becoming even more so following the arrival of the Fourth Industrial Revolution.

With it has come new consumer demands for innovation and convenience, new technologies for managing operations and connecting with guests, and a fast pace of disruption that has helped upstart companies and segments leapfrog established organizations. While the previous two Industrial Revolutions didn’t have much of an impact on restaurants, the one we’re living through now certainly will.

These are some of the questions, and associated answers, that are indicative of how much the foodservice industry is going to change over the next five years.

1. Why are restaurant chains starting to attract more venture capital funding?

The predictability of growth in foodservice makes it a pretty good bet for investors. Within the sector, everyone is looking for up-and-coming brands and trying to spot what could be the “next Chipotle.”

Brands that are a fit with evolving consumer dining behaviors and interests (the fast-casual format, a focus on fresh and healthful, etc.), put an active effort toward corporate social responsibility (which resonates with millennials — the generation that spends more as a percentage of their income on restaurants than any other demographic), and are incorporating tech-enabled enhancements into their business models.

Concepts that fit this bill, especially those backed by strong management teams, have the potential to be home-run investments.

2. What is it about fast-casual that makes a restaurant more scalable or gives it more potential for growth?

The majority of the global foodservice industry, and the U.S., in particular, is made up of quick-service restaurants (QSRs), what consumers typically refer to as “fast food.”In the U.S., half of the food we consume is on food away from home (restaurants, bars, cafeterias, etc.). Of that, half is spent at chains. Of those chain sales, more than half (60%) is made up by the top 100 chains. And of those top 100 chains, half of the sales are accounted for by just 10 companies (all of which are quick service restaurants).

Within the chained operations, full-service casual dining restaurants (CDRs) have become less relevant in recent years, as they’ve done less to move both their consumer and investment proposition.

Between the QSRs and CDRs lies an interesting hybrid in fast casual restaurants that have a more compelling unit-economic model and combine the replicability and ease to scale of QSRs with a more relevant appeal to the consumer — and, by extension, investors. The largest costs at any restaurant are food, labor, and occupancy. All three of those have been engineered at a higher efficiency in the fast-casual model.

3. How does incorporating technology improve the ability to scale and become more efficient?

Ultimately, there are a lot of things converging. Businesses can never make it too easy for consumers to buy from them. Restaurant technology has and will continue to make day-to-day interactions more frictionless, and we’ll never want to go back to a less-convenient model.

It’s not just the consumers who can benefit from restaurant innovation relative to technology. Restaurant owners and operators can gain efficiencies as well in terms of managing restaurants with real-time visibility into how the business is performing, helping with everything from sales growth to cost optimization.

A restaurant is like a manufacturing plant, but the industry hasn’t changed in terms of tech-enabled efficiency nearly as much as manufacturing has over the past 100 years. Technology is becoming disruptive to the industry in many ways — particularly to those who have been slow to adopt it. This has created room for the up-and-coming chains who have engineered these updates into their business models from their inception.

4. What are some of the main challenges of running a restaurant in today’s day and age?

There are plenty, but one of the biggest is that margins are being pressured from multiple fronts. In recent history, commodity costs have been favorable (and oil prices, which are responsible for about one-fifth of the price of food, have been low), but they are slowly creeping up. Labor costs have increased quite substantially, which has been a long time coming (minimum wage increases, overtime rulings, etc.) and will continue to eat away at margins.

These factors, compounded with the nuances of what was already a dynamic business, are adding to the effort and intensity in a turbulent financial time for those in the restaurant business.

5. What are some of the emerging restaurant innovation trends that will continue to grow for the next five years?

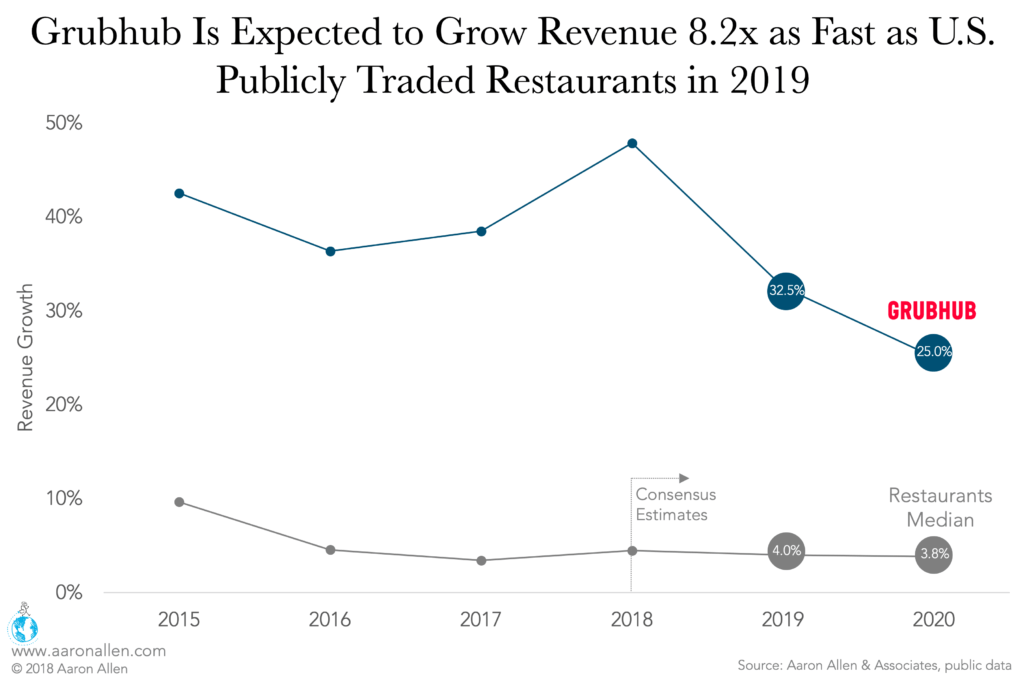

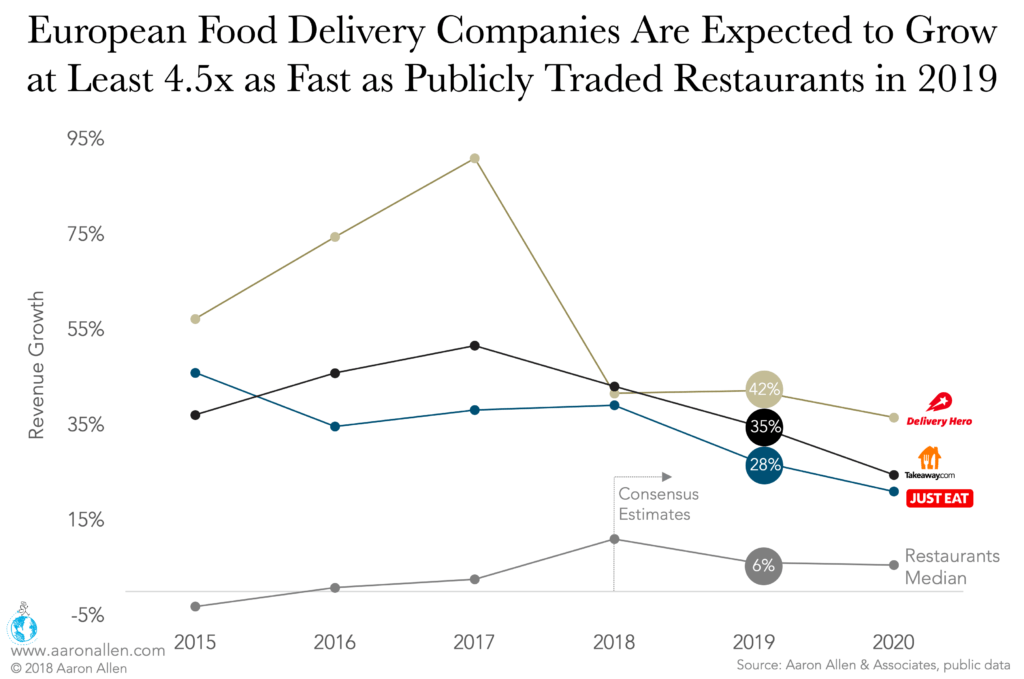

Delivery will continue to get a lot of attention from restaurateurs and investors alike (as it should — it’s one of the most significant forces to shape the industry in the last decade). Globally, food delivery represents close to 6% of restaurant sales, and it’s a trend that’s not slowing down. In fact, there’s been more money raised in the last two years for food delivery companies than the last 17 years of restaurant IPOs combined.

The food delivery market is set to reach $200+ billion (moving to ~10% of total foodservice). While that swing may not sound like a lot, in a $3+ trillion industry the impact will be very significant. Entire categories will be affected, and there are some inefficient dinosaur companies who will be most vulnerable. g

Other disruptive technologies including restaurant robotics, automation, big data, machine learning, 3D printing, autonomous vehicles, and so on, may seem like they’re ideas out of Science Fiction and have been met by much skepticism by many leaders in the industry, even though they will be making very real impacts on global foodservice. One of our favorite quotes to reference is from the former CEO of Blockbuster who, four years before the company went bankrupt, said that “neither RedBox nor Netflix [were] even on [their] radar screen.”

If you're a foodservice operator or investor interested in restaurant innovation, seeking to drive growth, optimize performance, maximize value, or create a modernized portfolio in the face of increasing competitive dynamics and an accelerated pace of change, we can help.

6. How will the layout of restaurants — and specifically kitchens — change to accommodate these trends?

Dark kitchens and delivery-only concepts are going to become increasingly popular. This is, in part, driven by the shift of population and the global urbanization trend (people are moving into cities at a faster rate now than in the last decade or so). The population shift makes it pretty predictable to see where restaurants will be opening, especially as the majority of a restaurant’s customers originate from within a 10-minute drive time.

Restaurant designs, from size to format to profit centers, will be updated to accommodate these changes for a desired dining experience. Each of the functional areas of the business will be impacted. What will these changes mean for HR — how restaurants will recruit, train, retain, and so on? What will it mean for marketing? Design and construction? Location strategy? Menu development and supply chain? And what else are restaurant CEOs thinking about?

7. Will voice ordering have a big impact on restaurants?

It absolutely can and should. Domino’s (which is the leading case study for investments in technology and their impact on valuation) has successfully integrated its “Easy Order” technology with the Amazon Echo so it can be as easy as saying “Alexa, order Domino’s” and dinner will arrive at your doorstep.

But there’s a divergence in restaurant brands’ abilities to execute these programs. In an effort to say “look how cool and relevant we are” some chain restaurants have piloted voice order with Alexa, but the end result was just a clunky two-minute process that arguably detracted from the experience rather than improving it.

Restaurant groups who are making innovations most successfully aren’t doing it just for the novelty of it or to get publicity. Rather, they’re thinking about applying core tenets of the hospitality industry and developing and implementing a program will improve the guest experience and meaningfully move the needle for their business.

8. How is the personalization trend crossing over into restaurants? Is this something that more consumers will demand?

While we may all think we always want more options, studies have confirmed that societies with the most choice are actually the unhappiest. With that said, in the service industry, there’s a happy medium between providing the guest with options and making them feel overwhelmed.

Everybody wants to feel in control, and self-order options are an excellent way to enable that for customers. Mobile ordering menus and kiosks are also a great way for operators to capitalize on richer merchandizing techniques (menu engineering, pricing psychology, etc.) which can be limited on a printed menu.

9. Will the trend of “lifestyle brands” also impact restaurants? What will they need to do to keep up?

There’s been a movement from marketing for demographics to now putting a greater focus on psychographics. People buy brands that reflect how they see themselves. Rather than a person’s age, gender, or socioeconomic background, focusing on a shared set of beliefs resonates more with the consumer and allows for more accuracy and efficacy with regard to marketing strategy.

The age-old example of Coke versus Pepsi is one of the most popular marketing and branding case studies. Coke has the best positioning as “the original.” Pepsi marketed itself as the alternative, the “choice of a new generation.” This points to the benefits of psychographic marketing. Everybody wants to feel younger — so Pepsi’s positioning helped to gain the market outside of its 18–24-year-old target demographic.

The faster pace of innovation will come to play here, as well. Neuromarketing, behavioral economics, and sensory branding will converge so products and brands appeal to us in ways that we might not even consciously recognize. Take the Starbucks Pumpkin Spice Latte as an example. It taps into the brain with smells — the sense that’s most closely linked to memories and triggering emotional responses — that connect us with the holidays (a time of year we’re typically less budget-conscious). This has helped Starbucks sell more than 400 million PSLs since 2003.

Today’s standard restaurants are operating, for the most part, as state-of-the-art 1992. How will they compete in a world where the Internet of Things means everything is traceable and you can monitor your strawberry all the way from the field to the salad bowl?

While the Fourth Industrial Revolution may sound like a techy buzzword, it’s far more than that. How slowly the restaurant industry has moved historically is an indicator of how many systems may now or soon be in trouble, without really knowing how much trouble they’re in.

About Aaron Allen & Associates

Aaron Allen & Associates is a global strategy firm focused exclusively in the restaurant and hospitality industry. We help both foodservice technology companies and leadership of emerging and established restaurant chains identify areas of opportunity and discover new approaches to anticipate and take action in the age of a rapid pace of change and disruption. If you’re interested in learning more about how we can help your business drive growth, optimize performance, and maximize value, contact us here.