Restaurant Transformation Lessons from 300 Physicists Who Failed and 3 Industry Leaders Who Won Big

Executives championing change and technology in restaurants can learn a lot from the failure of a physicist and the loss of two billion dollars. At the time, the largest scientific investment in the history of the world was supposed to go to Waxahachie, Texas, just outside of Dallas, but the project evaporated. The decision came down to one question, or rather, one scientist’s inability to effectively answer one question, and that failed communication meant that one of the most important discoveries in the history of science took place in Switzerland instead of the United States.

When the scientists lost the project, they said they were victims of “the revenge of the C-students.” But the lawmakers said the scientists were too arrogant: they’re brilliant people, but they’re not salesmen. The scientists couldn‘t get the politicians to hear what they were saying, and the lawmakers couldn’t get the scientists to say what they needed to hear before approving another billion-dollar investment.

Those working to effectuate significant change within their organizations will eventually face difficult questions. What answers will satisfy the doubters while achieving the aims of the greater good for the company, employees, customers, and ultimately, the investors and skeptics, too?

The foodservice organizations that have most successfully harnessed technology share a few attributes. Most importantly, they started their transformations while facing significant threats. The technological answers they found focused around improving the guest experience rather than enacting change for its own sake. As a result, they increased market share, restored or reinforced relevance, and built incredible value for their organizations. Their secret was not to champion technology in restaurants, but to champion change.

Technology in Restaurants: A Breakdown Before Breakthrough

It’s easy to point to what the most innovative foodservice organizations have done and highlight their exciting ideas and applications. But if you trace these initiatives back, they came into being because the company needed to revive the business. The genesis of the best tech advances in the industry were turnaround efforts. These companies had breakdowns before they had breakthroughs.

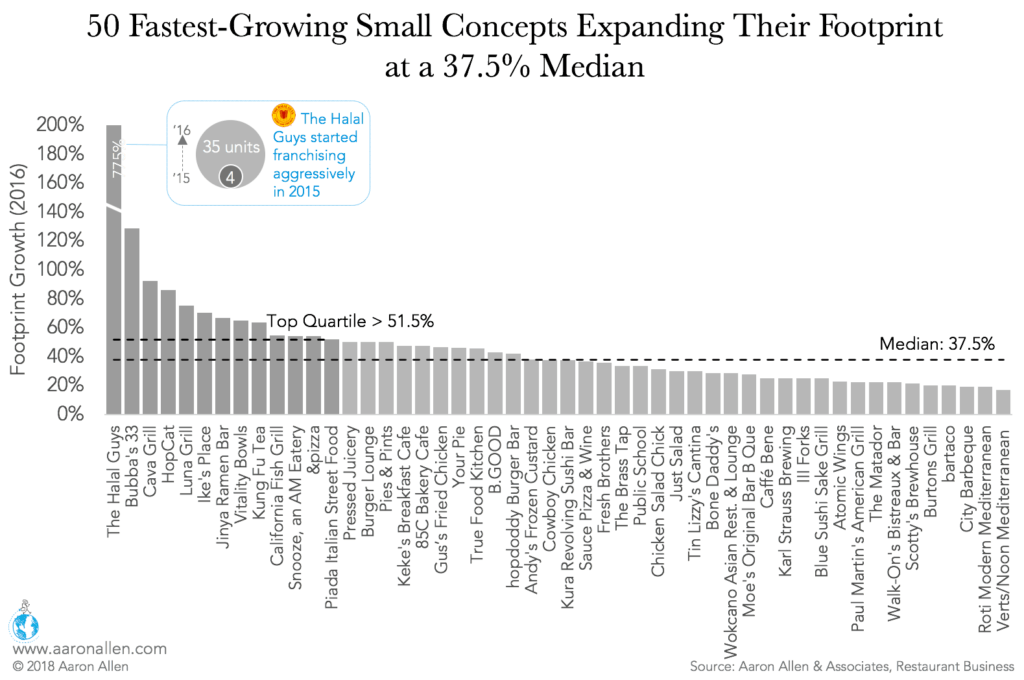

The U.S. food industry has become incredibly competitive. Of the $3.5t global restaurant industry, $800b is spent there. More than 30% of all industry revenue is earned in the U.S., which has less than 5% of the world’s population. Share only comes at someone else’s expense. And the pressure isn’t just coming from the big guys: it’s also the up-and-coming chains.

These fast-expanding brands are increasing their footprints at a 37.5% CAGR. The industry as a whole grows by 3%, on average, annually. If the largest chains are claiming billions, and the newcomers are taking 30%–40% growth, it’s squeezing those in the middle.

The challenges and opportunities facing the foodservice industry are fairly universal across categories, geographies, and the size of the business. One of the constant refrains is, “Are we relevant?” This question has plagued casual dining over the past ten years. Since 2007, it’s had zero growth.

Many food service companies are turning to technology to restore and maintain their relevance. Others are doing so to create more efficient, and employee-friendly, labor models. Just as mobile order-and-pay apps make restaurants more convenient than ever for guests, so do scheduling apps for their crews, enabling them to swap shifts on their phones (much improved from the old days of driving to the restaurant to put in a shift change request on a corkboard). Some organizations were pushed to make these changes after losing market share while others did more than they had to before they were forced to, but all did so in hopes of meeting and exceeding consumer and employee expectations.

Domino’s Won Over Its Critics by Focusing on Convenience

Domino’s has reinvented itself as a tech company that sells pizza, but it wasn’t too long ago that it was really struggling. It lost its position as the largest pizza company in the world and had to figure out how to win that title back.

To champion change inside an organization, the harshest critics have to be convinced. For Domino’s, that was the customer. In other operations, it’s internal stakeholders. Technological change requires alignment all the way from the crew to the CEO. And even then, the CEO has to answer to the board or public markets, or try to recover from waning public perception.

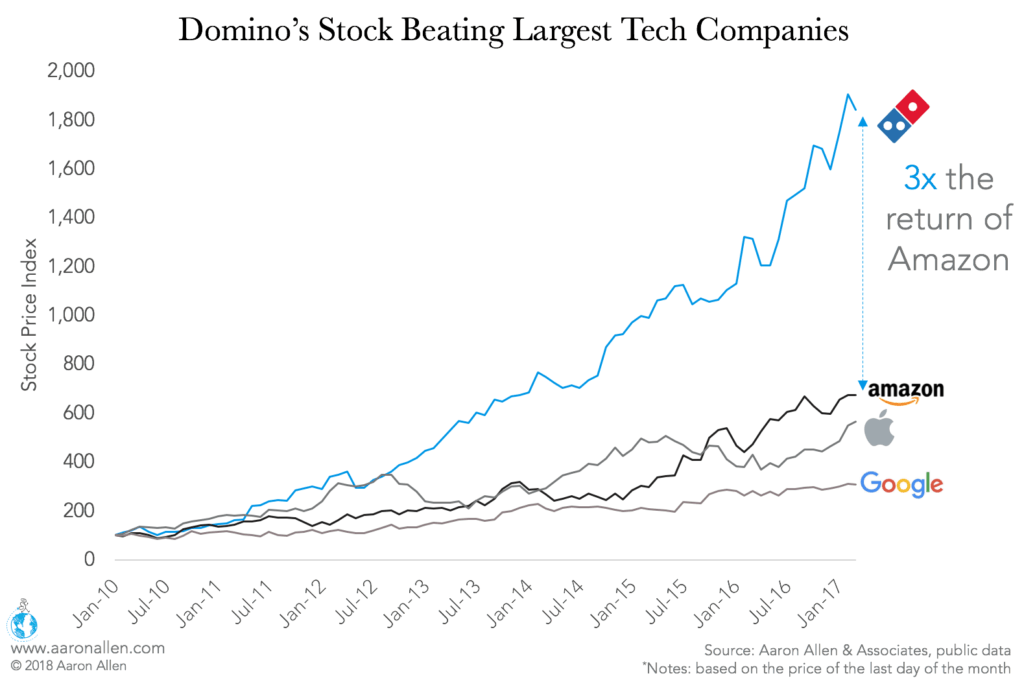

Of course, Domino’s numbers speak for themselves. The customer videos above were shot in 2009, and Domino’s stock price has increased tenfold since then.

And not only that, but the pizza chain eventually came to far outperform Google, Apple, even Amazon, whose CEO just became the richest man in the world. These incredible returns come from Domino’s commitment to making its delivery service as fast and convenient as possible. To put the prescience of this decision into perspective, 10% of all foodservice revenue globally (~$270b) is expected to go through delivery in the next ten years.

Domino’s even went so far as to build its own car. An organization that was suffering partnered with Ford to develop a vehicle specifically for delivery. In a lot of ways, that thinking may seem counterintuitive, but it’s part of what worked. First, it relates to Domino’s core competency as the leader in pizza delivery. Second, it speaks to how the brands and companies that survive over decades must constantly reinvent themselves. It’s probably not a coincidence that Domino’s sought out Ford as a partner: they’re both historic Detroit-area brands that joined forces to find rejuvenation.

Domino’s “Anyware” program has been very successful, and arguably the best case study for technology in restaurants. Consumers can say, “Hey, Alexa, order pizza,” and their favorite Domino’s pizza will show up at their door. They can push a button, and their order processes. That level of convenience, which strips out all of the unnecessary friction points inside the ordering process, can move tremendous amounts of revenue and market share very quickly, as Domino’s has.

But before Domino’s could launch these programs, its leaders had to win support from top to bottom. In 2012, Patrick Doyle sent Kelly Garcia, SVP of eCommerce Development and Emerging Technologies, and Dennis Maloney, Chief Digital Officer, click to read more, to the board with their plan to transform the company. They won the board’s support and secured the necessary budget. But next they had to win over everyone else, so the company set about changing the culture. It began using the tech transformation as a recruiting tool, so that they could surface the most excited and committed applicants. Now, the chain has very low turnover because its staff is bought into what the company has done — and what it has the potential to do next.

Panera Thought Beyond the Quarter and Saved Guests Ten Years of Waiting by Implementing Technology in Restaurants

The Panera 2.0 program was an investment of only $40m. Of course, $40m is a lot of money, but on a $5b company, it’s a very small percentage. Panera eventually became one of the top-performing foodservice stocks in history, but CEO Ron Shaich became more and more frustrated by investors’ short-term thinking, so much so that it contributed to his decision to leave the company.

Much of this frustration came from the fact that he couldn’t get buy-in for what he really believed the company should be doing in terms of technology. But the investments did pay off: JAB acquired Panera in 2018 for $7.5b, a 20% premium on share prices at the time of the sale. Technological transformation doesn’t take place overnight, and leaders need to develop strong commitment from all levels of the organization to see these initiatives through to success.

McDonald’s Is Investing in Technology in Restaurants and Building a Moat Competitors Will Struggle to Cross for Years to Come

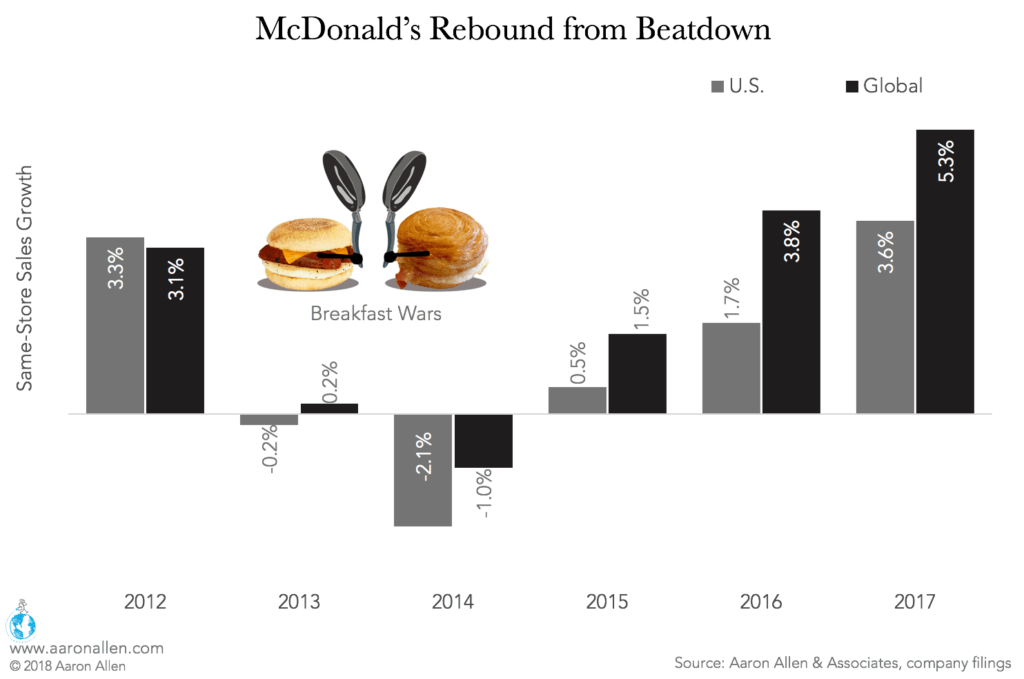

McDonald’s, like all long-lived organizations, has ebbed and flowed through the years. As a result of the breakfast wars, they experienced a major drop in same-store sales starting in 2013.

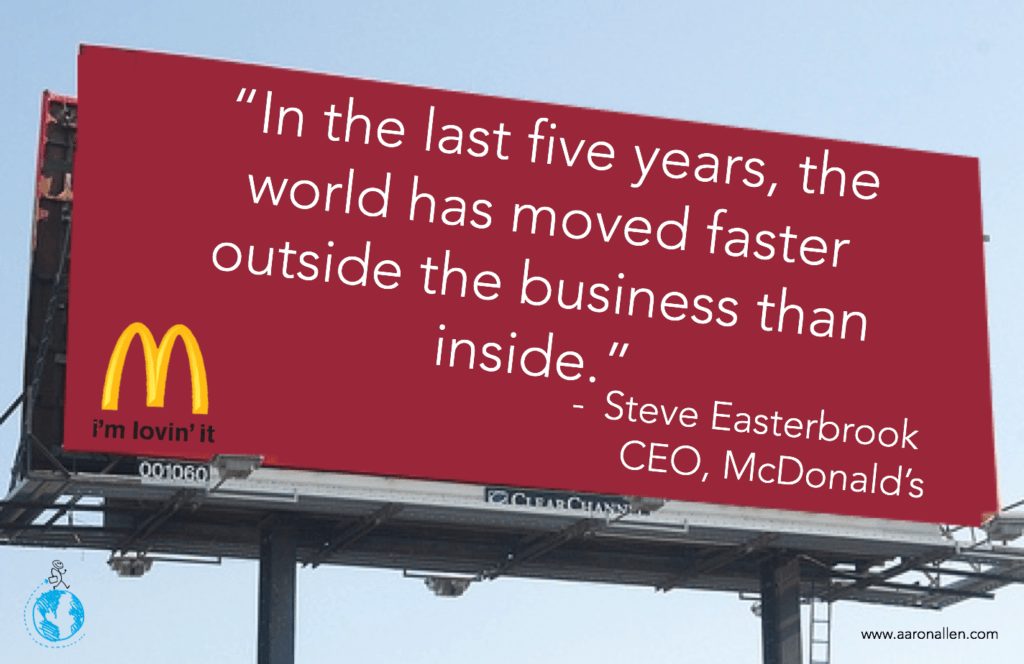

In 2015, Steve Easterbrook took over as CEO to a tremendous amount of public criticism. The initial turnaround initiative was packaged in a complicated, 14-point plan that would be almost impossible to execute within such a large organization. But the executive team simplified those ideas, and they’ve been investing heavily in technology.

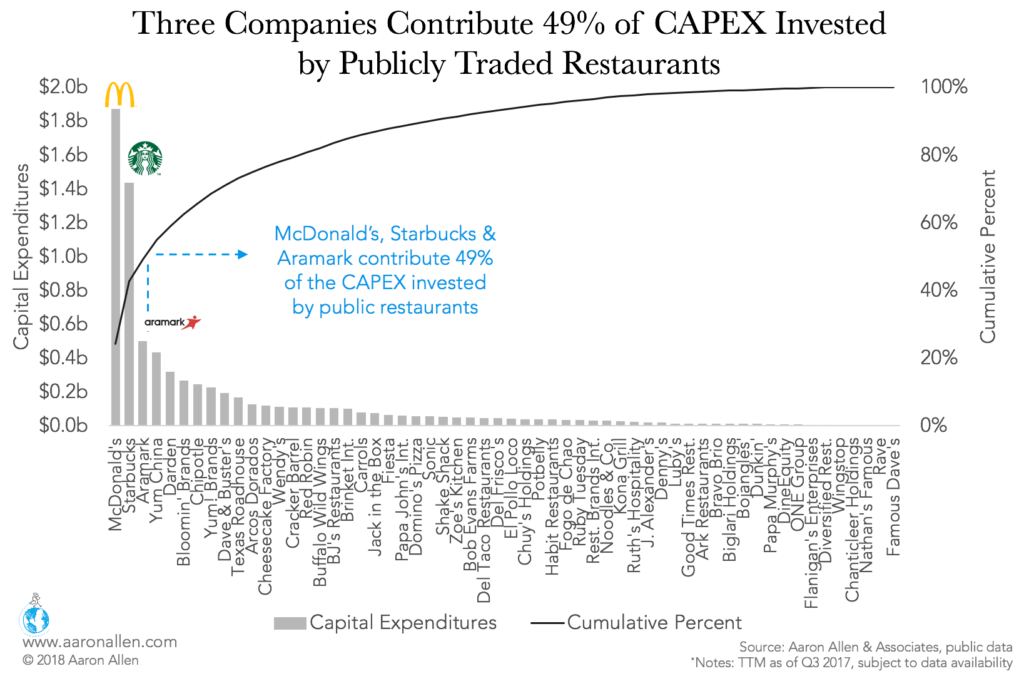

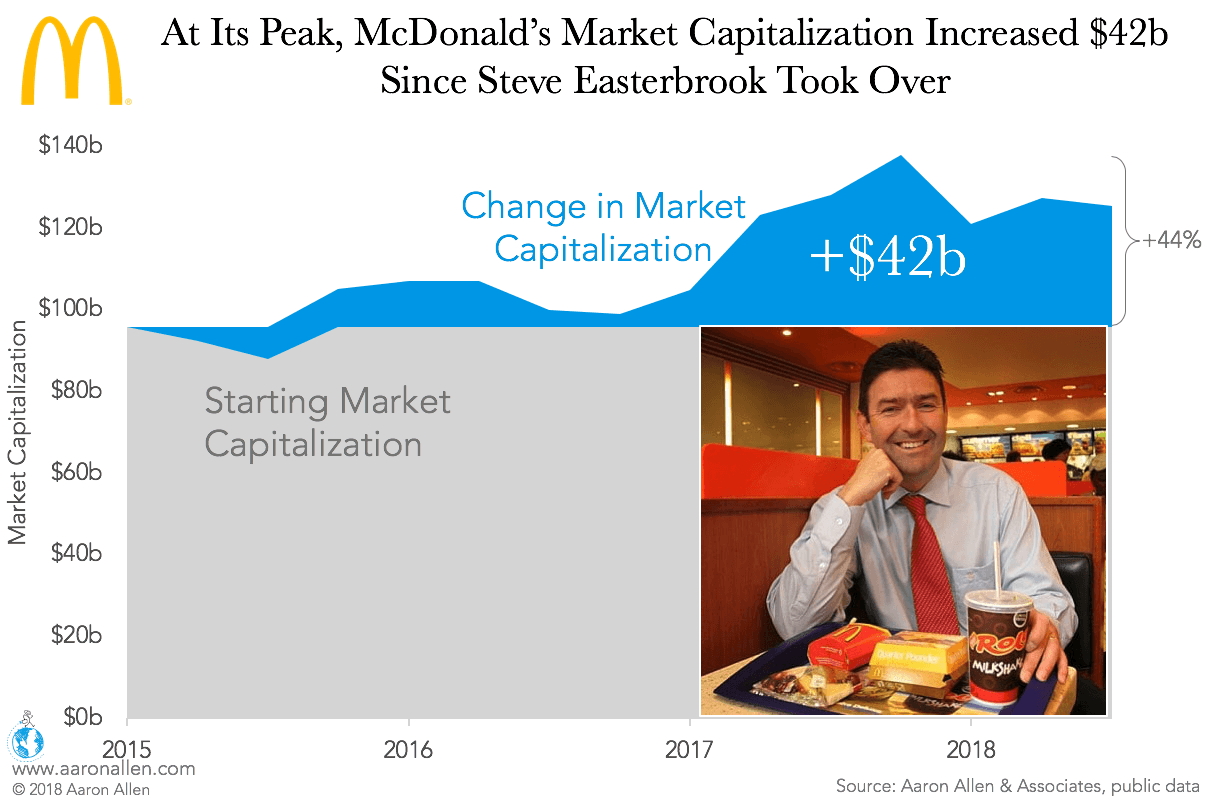

The rebound has been remarkable. Easterbrook acknowledged that things had changed more outside the business than inside the business in the last five years. And that’s when he realized that McDonald’s had to move faster. It’s done so, investing hundreds of millions of dollars per quarter in the Experience of the Future initiative. This CAPEX spending is so large, it will make it almost impossible for the rest of the industry to catch up. The market has rewarded this transformation, adding (at its peak) $42b in market capitalization.

Many leaders in the industry may question whether foodservice has to move as fast as technology. But both industries share the same consumer (and discretionary dollars), whose expectations have been set by organizations like Apple, which unveils a new phone each year, obsoleting the last one. Now restaurants are facing their own challenges of heightened consumer expectations, and the largest players are able to invest hundreds of billions of dollars per quarter in technological advancement — more than most restaurant companies will probably ever see in total sales, let alone CAPEX budgets.

In the U.S., almost half of public company CAPEX comes from just a few companies. Billions upon billions of dollars are being invested in technology, and the organizations that fall a few steps behind now will find themselves at the back of the pack within a few years.

Starbucks Customer-Centric Tech Outpacing the Competition

Starbucks became the second-largest foodservice company in the world by adding 2,500 units each year. Operations in the lower portion of the 100 largest chains still haven’t reached that number, and Starbucks is adding it every year. But former CEO Howard Schultz was rejected 217 times when he initially tried to get funding for expansion.

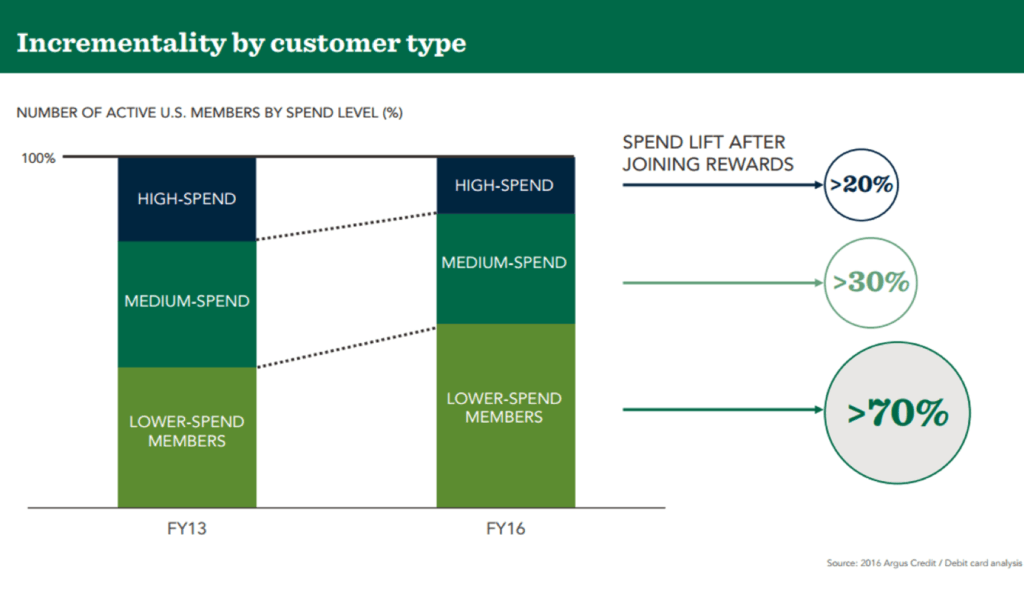

One reason for Starbucks’ incredible success is that very tenacity. As customers move to the loyalty program, the coffee chain is seeing all guests — high-spend, medium-spend, and lower-spend customers — add 20%, 30%, and 70% to their orders. In an industry that grows 3% a year, Starbucks is increasing its footprint annually and growing check averages by incredible percentages. Those figures are meaningful not just for Starbucks but for everyone in the industry.

Starbucks’ tech initiatives aren’t specifically aimed at driving sales. The company is leveraging technology to better serve customers. Its mobile order capability lets guests skip the line, and it has recently installed menu boards that allow customers to communicate via sign language. Meanwhile, sticky tape and squawk boxes, tech that’s state-of-the-art 1979, is still in use by companies whose CEOs are scratching their heads and wondering where their sales and customers rode off to.

There’s a big divergence between the two models, and it’s beginning to add up.

Newer, Faster, More Efficient Threats Are Coming

Though it grabbed headlines at the time, the conversation around the Amazon–Whole Foods merger has quieted down. But it will pick back up again soon. Add Prime services to one-touch and voice ordering, food subscriptions services, and delivery drones, and it’s not long until the sky looks like this.

Within a few years, Amazon will be able to combine its distribution and shipping centers with closer touchpoints and a larger network. Its cashier-free convenience stores are opening in major cities, and it’s testing autonomous delivery vehicles for groceries. Much of the talk around Amazon focuses on this automation, which seems to alter the perception of what’s really happening. It’s not that robots are taking over; it’s that convenience and new ways of driving efficiency are changing these organizations from the inside out.

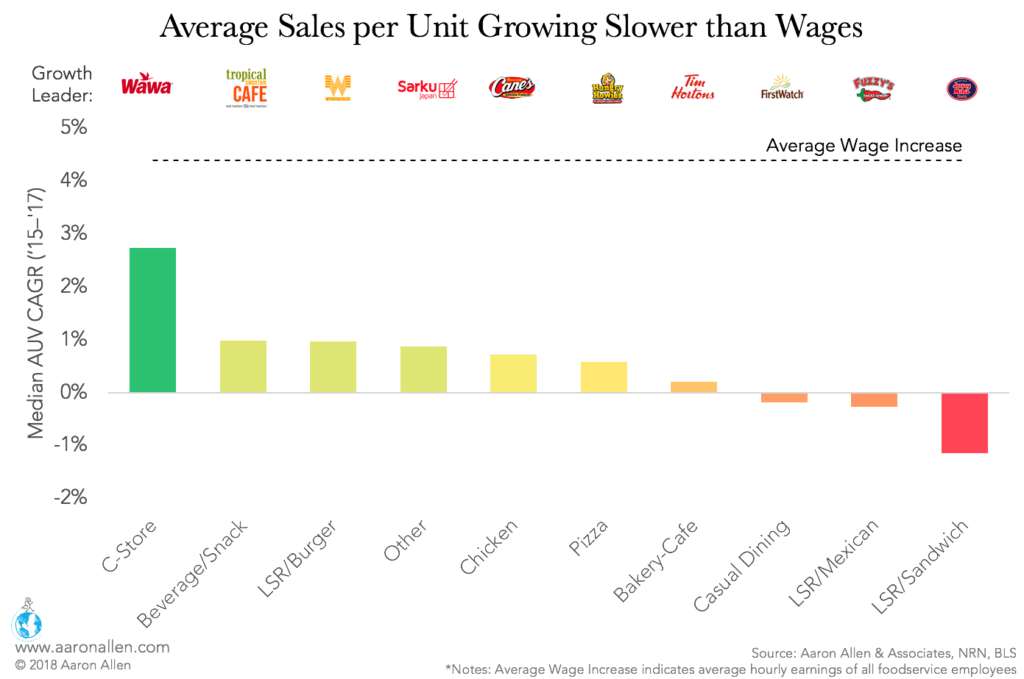

In consumers’ push for convenience and efficiency, grocery stores will likely have a massive impact on restaurants for the first time in decades. They are 261% more efficient on sales per employee than foodservice operations. Across categories, average sales per unit is growing more slowly than wages, and gains in productivity do not match labor cost increases.

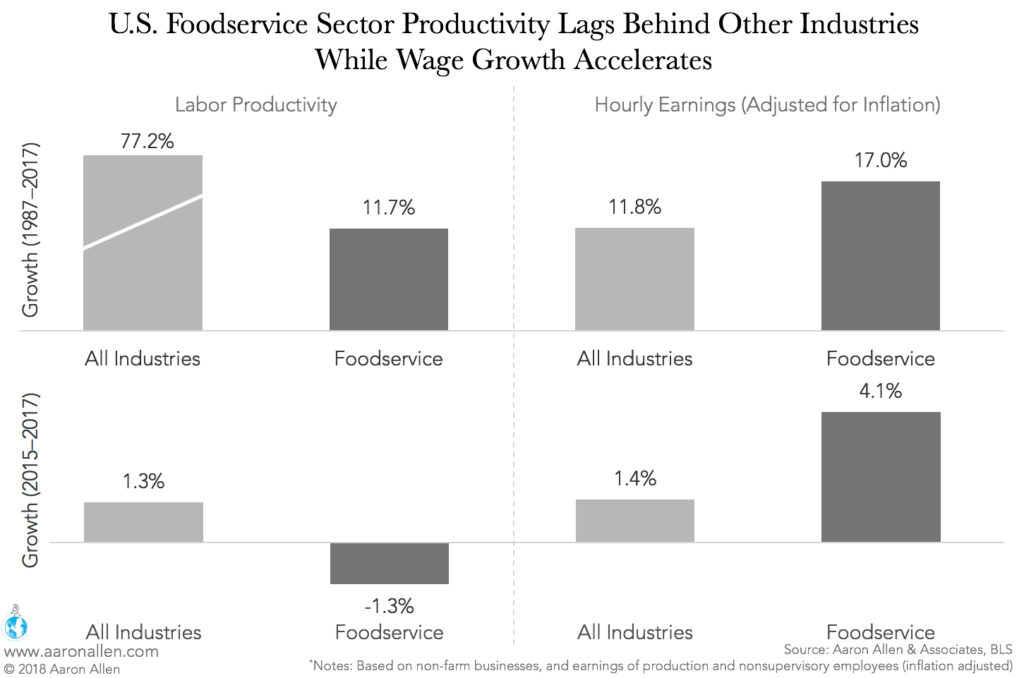

While productivity across industries increased a staggering 77.2% between 1987 and 2017, labor productivity in foodservice has grown just 11.7%. Meanwhile labor cost increases in restaurants are outpacing the rest of the economy. Hourly wages have gone up, on average, 11.8%; in foodservice, they’ve increased 17%. As labor costs have gone up, food-away-from-home prices have increased, resulting in a significant gap between prices at restaurants and grocery stores.

These developments are reversing a 50-year trend. Since the middle of the last century, the restaurant business has reliably taken one point of share of wallet away every year from grocery stores. The industry got so used to this that grocery stores stopped showing up in SWOT conversations, but in 2017, grocery stores took a point back.

Champion Change by Putting Colleagues and Guests First

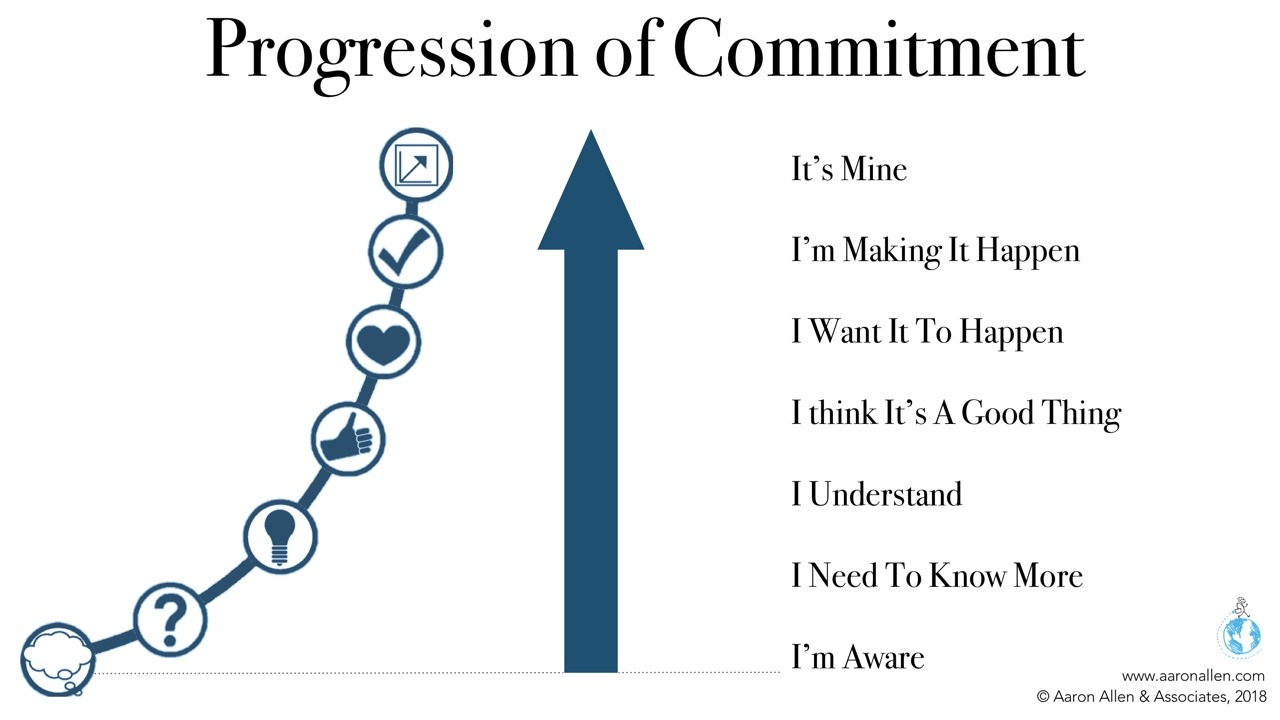

When it comes time to champion change, leaders must help stakeholders and shareholders alike move through the progression of commitment until the whole organization experiences a genuine sense of ownership over the transformation.

Even the most experienced captains rely on pilots with technical expertise to help them through the Panama Canal; even skippers of small vessels know it’s wise to navigate unfamiliar waters with the latest maps. Many leaders turn to experienced and objective advisors to augment resources and capabilities throughout the course of a transformation drive, which often follows this path:

- Identify the problem. Asking and answering the right — sometimes difficult — questions about what’s truly impacting performance is a critical, but often overlooked, first step in a successful change initiative. Change for the sake of change often produces more effort than result. Transformation benefits companies when it is in service of a specific goal.

- Assess feasibility. Finding the right size for the initiative and balancing it against other competing business priorities across the system ensures that the results maximize value and return. Informed by diagnostic work, including dynamic what-if scenario models, these questions are easier to answer than “will we find God,” but no less essential to success.

- Prioritize and plan. What’s the gap between where the organization is and where it wants to be? A comprehensive rollout plan lays out a clear path to the finish line for all shareholders and highlights the essential role they will play bringing it to life, enrolling them in the necessary work.

- Design and develop. Moving from the big idea to its practical implementation means considering its operational impacts across functional areas of the business. Rushing through this stage can create unforeseen challenges throughout the system, delaying deployment and damaging buy-in.

- Champion change. A successful rollout requires broad support, and leaders who align incentives can move more quickly and confidently than those who still have to convince others of the benefits of the program. Highlighting how the new technology in restaurants or procedures will impact employees’ day-to-day activities, how it reflects the core values of the organization, and most importantly, how it will benefit them — as well as the guests and community — creates real, committed enthusiasm.

- Monitor, manage, and maintain. If you can’t measure it, you can’t manage it. Establishing KPIs, installing dashboards, and institutionalizing best practices turn anecdote and opinion into data-driven insights about the pilot program’s performance.

- Reiterate and refine. The most successful companies are those that have radically reinvented themselves at least once and look forward to doing so again. They take a methodical approach to enacting a transformation in order to surface more opportunities to improve performance. This recursive process helps refine the technical aspects of the initiative, but it also means guest and employee experience can direct the recalibrations, making the final product a truly shared venture.

Expert guidance helps overcome possible limitations and setbacks by reducing corporate inertia or cognitive bias and challenging potentially flawed assumptions to ensure a program reaches its fullest potential. The most seasoned executives are often those who are best positioned to recognize when there are dangers that justify enlisting the help of others.

The best transformations aren’t only in the pursuit of change. They’re in the pursuit of delivering exceptional guest and employee engagement, competitive differentiation, and increased productivity and efficiency. These are worthy pursuits and may help surface initiatives that deserve and demand a champion.

This article is adapted from a speech Aaron Allen gave in September 2018.

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims. We help organizations navigate initiatives to modernize marketing, integrate technology, and keep pace with consumer trends.

Our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.