Restaurant research is key for foodservice executives dealing with accelerating change, fierce competition, and hotly contested markets: the pressure on leaders in the restaurant industry is intense, and they need relevant, actionable insights to make sure-footed decisions.

Seismic shifts are rearranging segments, redefining guests’ expectations around the quality and speed of restaurant experiences, and revolutionizing how meals are ordered, prepared, and delivered.

While it’s easier than ever to get a birds-eye view of global markets (and anyone with an internet connection can do so), this perspective often remains at the level of headline and observation, providing little in the way of actionable intelligence. Meanwhile, the pace of change continues to accelerate, both within the hospitality industry and the world as a whole.

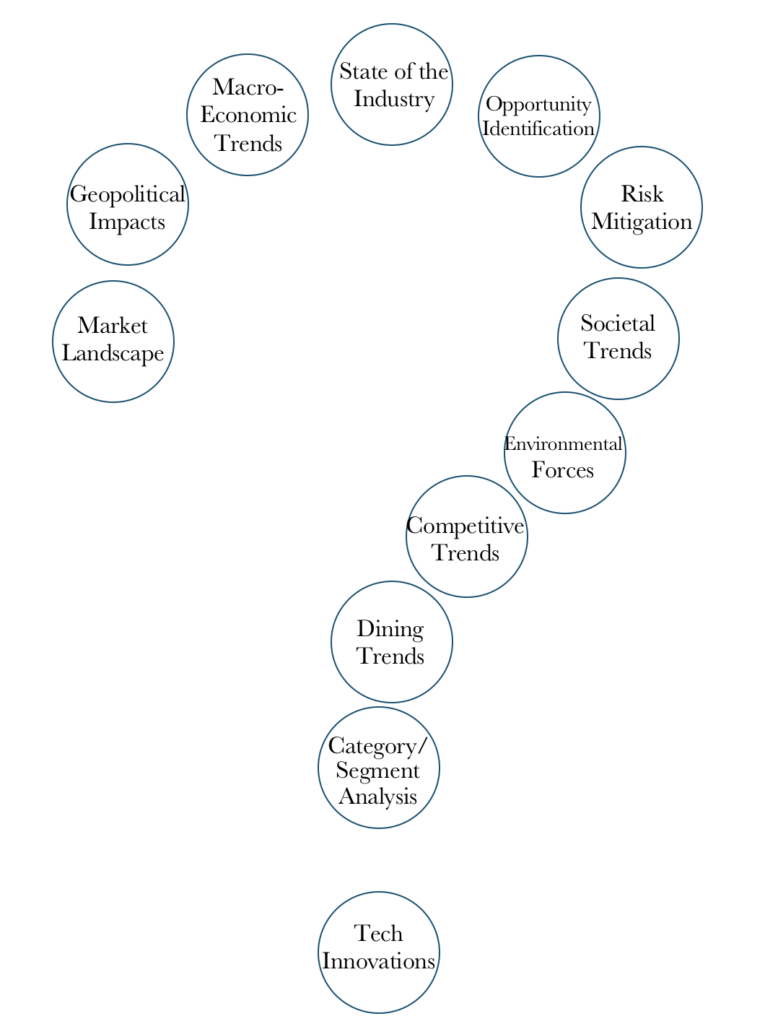

With our Restaurant Research services we help our clients understand emerging categories, evolving purchasing behavior, and the conditions — and competition — in existing and expanding markets. Backed by decades of experience across all functional areas of chained foodservice operations, our market research services (including restaurant market studies, consumer trends, competitive analysis, and more) help combat bias and inertia, surfacing the insights executive teams need to make informed decisions before launching new products, profit centers, and features, expanding into new formats, channels, and markets, or investing in new technologies, concepts, and brands.

Which global markets are growing fastest? How is this expected to change and evolve?

What regulations are targeting foodservice operators (business regulations, trade policies, etc.)?

Are conditions generally favorable or unfavorable for restaurants? What are the forecasts?

Is foodservice performing better or worse compared to other industries and segments?

What are the biggest areas of opportunity (for growth, expansion, optimization, etc.)?

What are the largest risks posing a threat to our organization, and how can we address them?

How will emerging and anticipated societal trends impact our business?

What proposed environmental policy changes could impact the costs of building and expansion?

Which companies and brands will pose the most substantial threats, now and in the future?

How will consumer dining behavior and consumption patterns be different in five years?

What categories, cuisines, and segments are growing? Shrinking? Why, and what is expected?

What are the predictions of and implications for existing and emerging technologies?

Through distinctive, data-driven insights informed by our unparalleled understanding of the dynamics driving the foodservice industry — and the ability to connect the dots in a way that is both holistic and actionable — we provide with restaurant research to help clients:

Our expertise extends across all the foodservice universe: from restaurant trends to fast food facts to the food delivery industry.

Restaurant sector analysis covering restaurant industry outlooks, growth by geography and category, and economic and political factors influencing foodservice.

Restaurant analytics and benchmarks relevant to improve performance including labor costs, food costs, and sales-building.

C-suites are awash in data like never before. P&L statements, social media engagement metrics, same-store sales numbers, channel analyses, year-over-year AUVs, financial forecasts, media buy reports, throughput analyses, and market updates flood inboxes, giving the illusion of complete knowledge and control. Restaurant Research insights and foresight can shape not only corporate strategy — they can also help make and shape markets and categories.

We deliver crisp, clear corporate intelligence relative to the forces and dynamics influencing industry performance, the competitive landscape, evolving consumer dining behaviors and consumption trends, and inform decision-making with dependable, yet hard-to-get, data and razor-sharp forecasts for where things are headed and how to harness both headwinds and tailwinds for improved performance.

Market research for restaurants refers to answering key industry questions about the consumer, evolving trends, demand, location, growth categories and geographies, and more. The answers to these questions help hone inthe restaurant strategy and reduce risk.

The menu (quality, variety, pricing), customer service (hospitality and including elements such as consistency and speed)andmarketing are key elements that determinethe success of a restaurant.

Increases in labor costs, higher interest rates, negative same-store sales, negative EBITDA, flawed real estate strategies, high food prices, customers cutting down on dining out, and evolving consumer trends are some of the factors affecting restaurant performance and leading to a soaring number of restaurant bankruptcies.

Pricing is both an artand a science. The science part should be rooted in achieving target theoretical food costs and profit margins. The art part of it though is how to make the science part more appetizing and appealing. That being said, beveragesare typically the most profitable items as well as some sides.

We are focused exclusively on the global foodservice and hospitality industry. You can think of us as a research company, think tank, innovation lab, management consultancy, or strategy firm. Our clients count on us to deliver on our promises of meaningful value, actionable insights, and tangible results.

Founded and led by third-generation restaurateur, Aaron Allen, our team is comprised of experts with backgrounds in operations, marketing, finance, and business functions essential in a multi-unit operating environment.

We bring practical, relevant experience ranging from the dish room to the boardroom and apply a holistic, integrated approach to strategic issues related to growth and expansion, performance optimization, and enterprise value enhancement.

Working primarily with multi-brand, multinational organizations, our firm has helped clients on 6 continents, in 100 countries, collectively posting more than $300b in revenue, across 2,000+ engagements.

We help executive teams bridge the gap between what’s happening inside and outside the business so they can find, size, and seize the greatest opportunities for their organizations.