The European fast food landscape is being affected by many of the same trends as the North American segment, but important differences in projected growth, chain penetration, size of the economy, and nation-specific consumer preferences call for tailor-made strategies for each market.

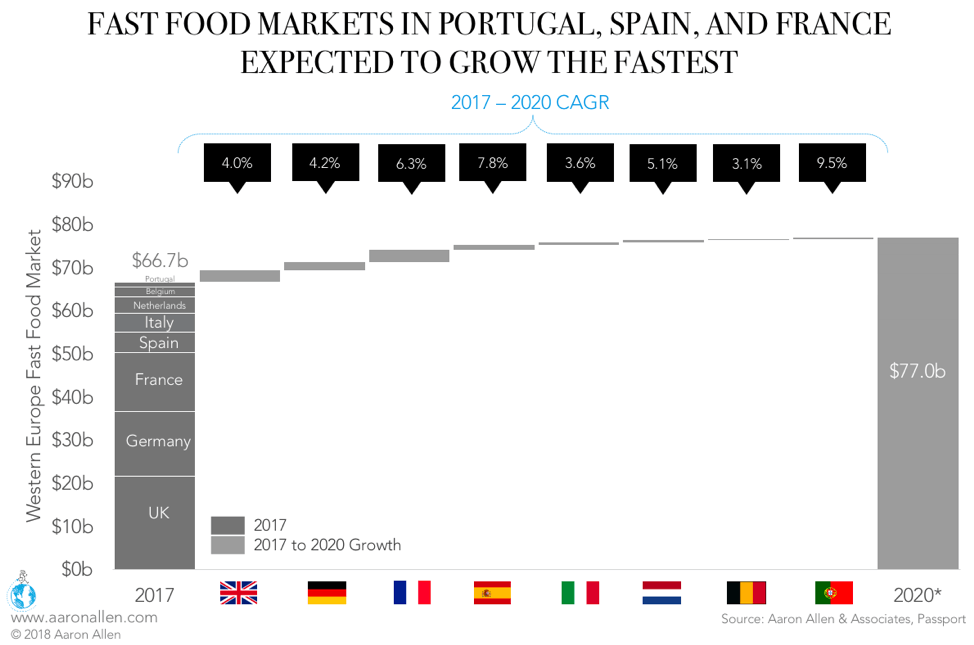

Consumers across Europe cite feeling too time constrained to prepare food at home or to sit down for a meal at a full-service restaurant — a global trend that benefits the quick-service and fast casual segments. We estimate that fast food in eight selected Western European nations (Belgium, France, Germany, Italy, the Netherlands, Portugal, Spain, and the UK) will grow by $10.3b in the next three years.

This is massive growth, but it only represents one-tenth of this market’s potential.

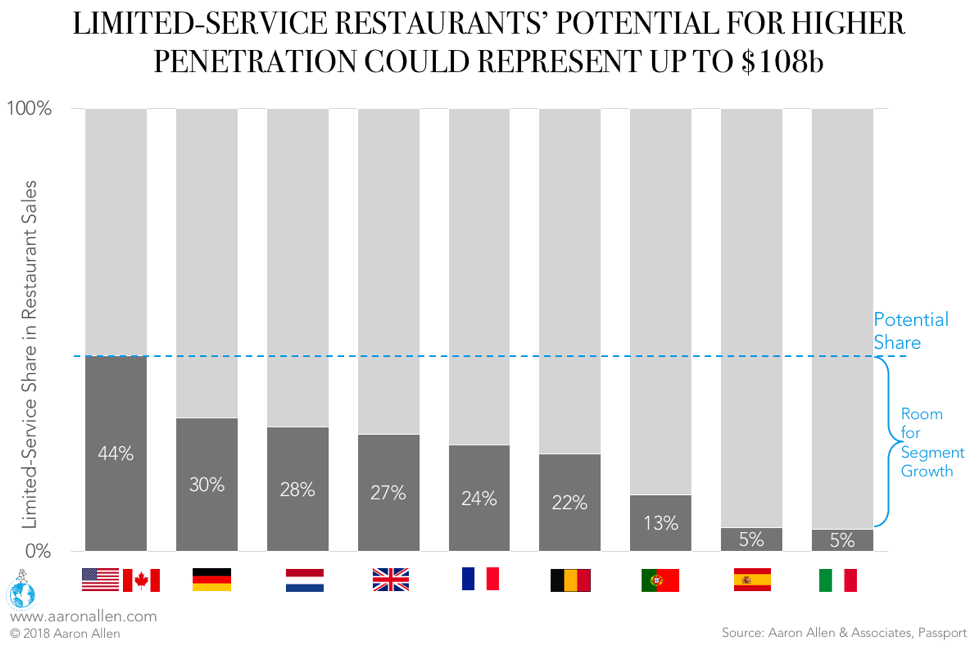

In North America, fast food makes up almost half (44%) of restaurant sales. All eight of the European countries we studied give much less of their food spend to this segment.

The potential here is staggering, especially when looking at places like Spain and Portugal, which have relatively small fast-food segments (5% and 13% shares, respectively) but a clear appetite for quick and easy dining options.

Because most quick-service brands are chain operations, we expect major brand penetration to increase in parallel. Indeed, in seven of the eight countries analyzed, chains are growing faster than independent operations, but half of these nations still have significantly lower rates of penetration than what we find in the US, where chains control 75% of the fast-food market.

Only France, Spain, and Portugal are approaching US levels. Interestingly, despite this high penetration, Spain and Portugal had the highest growth in chains of the eight nations (3.4% and 2.8%, respectively). Only chains in Germany and Belgium had negative growth over the period studied.

Based on our analysis, here are three guidelines for expanding a fast-food operation in the Western European market.

Expand in Spain But Tailor Operations for Italy

Spain and Italy have the smallest fast food markets, accounting for just 5% of restaurant sales. Despite this similarity, the two nations call for very different strategies.

Spain has a smaller economy than Italy, but its fast-food market is 7% larger, revealing a strong preference among Spanish diners for quick-service options. Further, in the next three years, Spain is projected to have higher real GDP and per-capita GDP growth (2.3% and 6.5% respectively in Spain versus 1.2% and 5.1% in Italy). Increases in disposable income tend to go to the Food Away From Home category, which means the Spanish restaurant market is likely to grow over the next three years.

Despite higher chain penetration in Spain (73%, against Italy’s 48%), this indicates that it represents a better testing ground for new fast-food options than the richer and larger Italy. Put simply: Spanish diners are more open to new quick-service concepts than Italians.

Italy has had a 1.4% CAGR among chains since 2012, showing that the market is expanding, if slowly. With more than half the market still controlled by independent restaurants, chain operators do have room to grow in Italy. But, considering the relatively low GDP-per-capita projections and the ongoing governmental crisis, fast-food companies should take a more careful and strategic approach to expanding in Italy.

Portugal & The Netherlands Are Good Bets

Of the countries analyzed, Portugal is projected to have the second highest GDP-per-capita growth (6.2%) between 2017 and 2020, just behind Spain. It’s also expected that its fast-food market will grow more than any other country’s: at an impressive 9.5% CAGR over the same period.

Of the three nations with the highest projected growth rates (Portugal, Spain, and France), Portugal has the lowest percentage of chained restaurants (68%). There’s plenty of room to expand in this less-crowded market.

The Netherlands also looks like a safe bet. Even though it’s a smaller market, it has robust fundamentals: best-in-the-region GDP growth forecasts (2.6%) paired with the highest GDP per capita, medium chain penetration (52%), and room for LSRs to grow their share in foodservice. (It currently accounts for 22%.) Not to mention that the fast-food market is expected to grow at a 5.1% CAGR.

Be Cautious in the UK & Germany

The two largest economies in Western Europe — the UK and Germany — also represent the most difficult challenge for fast-food operators. They have the lowest growth rates projected for limited-service restaurants (4.0% for the UK and 4.2% for Germany).

While there is still room for the segment itself to grow, and for chains’ presence within that segment to expand, chain operators should carefully consider how they will enter or expand in these markets.

Diners in both the UK and Germany are becoming more health conscious. In Germany, a move away from red meat has sparked growth in chicken concepts. Any restaurant looking to expand in these markets should carefully examine how consumer behavior is changing and how the current options meet — or fail to meet — these evolving preferences.

Location matters quite a bit in these markets as well. We don’t just mean paying attention to which cities or neighborhoods are already well penetrated by fast food — though that’s of course essential. We also mean thinking about the kinds of venues that could attract guests. Food halls, where a variety of concepts can open small outposts and which tend to be higher-end than the average QSR, would be excellent options in these markets.

Developers have already started working on what will be the largest food hall in the UK, with 50 eateries and bars under the same roof, and Harrods has recently begun renovations on its food halls, which have been in operation since 1902. Continental Europe’s largest department store — the Kaufhaus des Westerns (or KaDeWe to locals) — has given two of its floors over to a massive food hall.

Food halls have a longer history in Europe than they do in North America, but they have more traditionally mixed restaurant offerings with specialty boutiques. As the food hall balance shifts toward restaurants, higher-end quick service operators can gain a foothold in difficult markets by capitalizing on one of these ventures.

Thanks to the global drive for convenience, chained quick- and limited-services restaurants have an unprecedented opportunity to grow all over the world. Before committing to an expansion plan, they should study the nuances of each potential markets, seeking expert guidance on the competitive landscape, consumer profiles, and macroeconomic forces.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan, and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion in annual sales, span all six inhabited continents and 100+ countries, with locations totaling tens of thousands.