We receive thousands of inquiries each year from every corner of the foodservice industry and from all around the globe. There are some common patterns in what we’re being asked. Some of most frequent questions include:

- What regions and categories are driving growth?

- What segments are expanding and collapsing? Who is gaining and losing market share?

- Should we expand more domestically?

- Should we develop new formats prior to expansion?

- What is the total addressable market for our particular category or cuisine?

- Should we create or acquire a new concept? If so, should that be in the same cuisine or segment we are currently operating or rather based on where future growth is forecasted to come from?

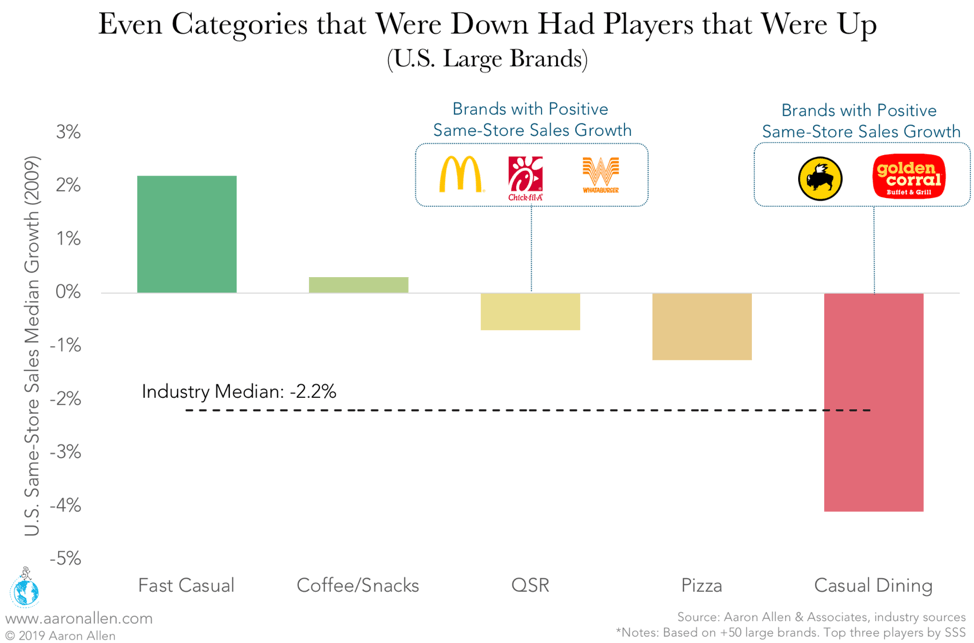

There’s almost nowhere in the world that is experiencing contraction in terms of overall restaurant industry growth. As true as that is, it’s also true that there’s almost nowhere in the world where someone isn’t losing market share at someone else’s expense.

Global growth is coming in pockets and patches. And some of the patterns that we see are that there are headwinds and tailwinds in terms of the macroeconomic conditions and operating environment. Success favors brave leaders making bold but carefully calculated bets, often using a combination of intuition and empirical evidence.

Knowing Where to Play and When

Identifying growth opportunities in terms of categories, cuisines, and geographies, and what that may mean for plans related to growth and expansion, performance improvement, and enterprise value enhancement is critical.

Our team tracks movements of the $3.1 trillion global restaurant industry across categories, cuisines, ownership types, phases of the business lifecycle, and both the macroeconomic conditions of geographies as well as granular internal analysis across functional areas of the business.

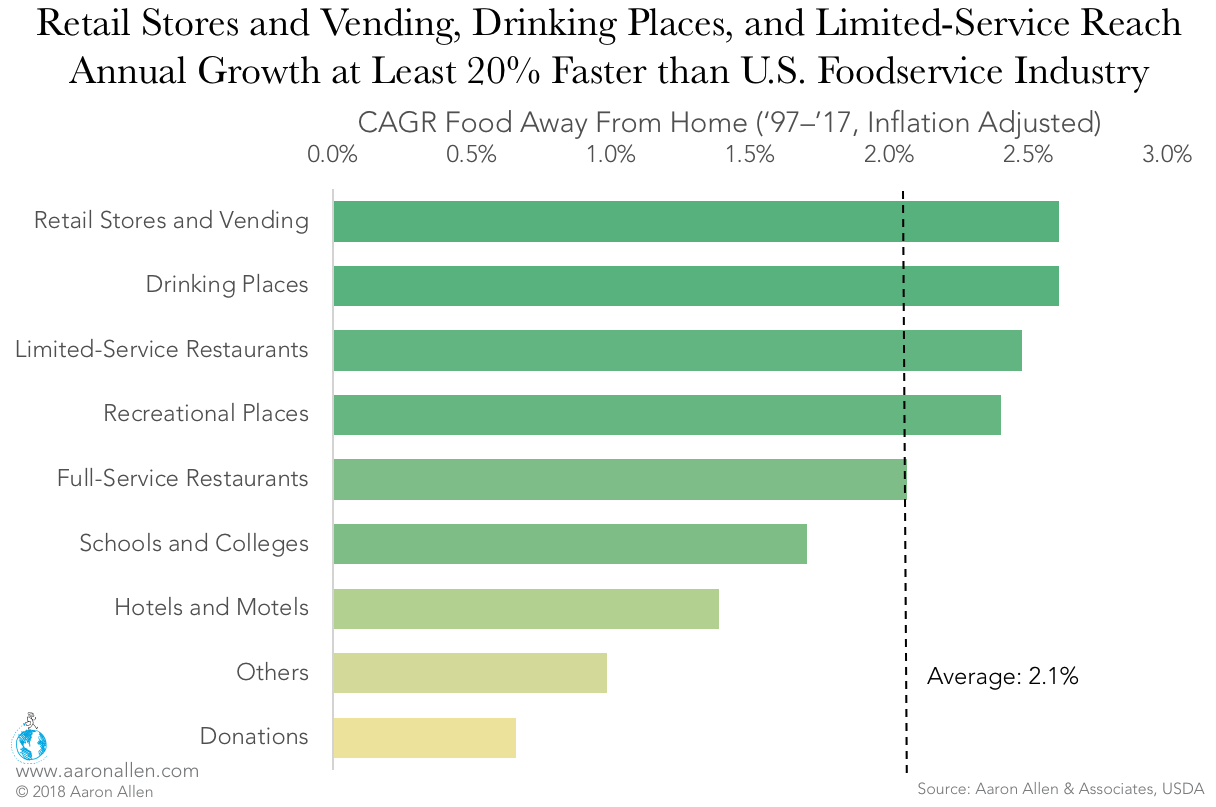

The restaurant industry offers consistent growth. For many decades, it would be an anomaly that foodservice didn’t have growth, and there have been only a couple dips over a 40–50-year history. In the U.S., the industry has grown at a 2.1% CAGR over the last 20 years (accounting for inflation).

Some segments, including retail stores and vending, drinking places, and limited-service restaurants, are growing at least 20% faster than average each year. Meanwhile, other segments including schools and colleges as well as hotels and motels, are struggling to keep up. Quantifying the opportunity in a specific category allows for targeted expansion strategies and lower risk.

Related insights on specific markets and segments include:

- Quick Service is Doing Great in Europe

- Margins Continue to Shrink in the Middle East

- How the Canadian Restaurant Industry is Changing

- Fastest-Growing Fast-Casual Chains

- Casual Dining Chains Entering Dangerous Waters

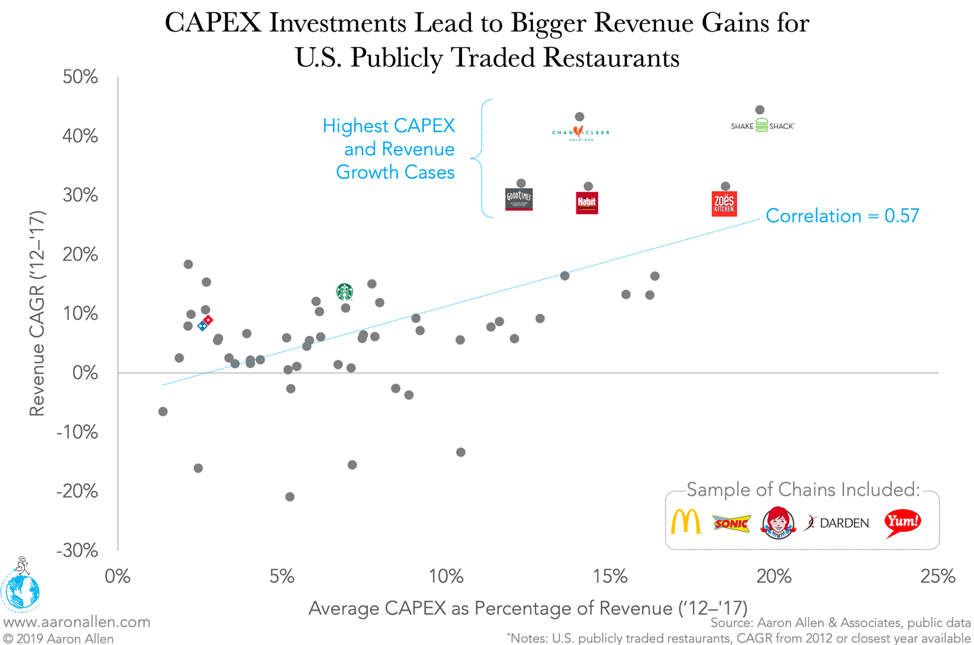

CAPEX Investments an Indicator of Future Performance

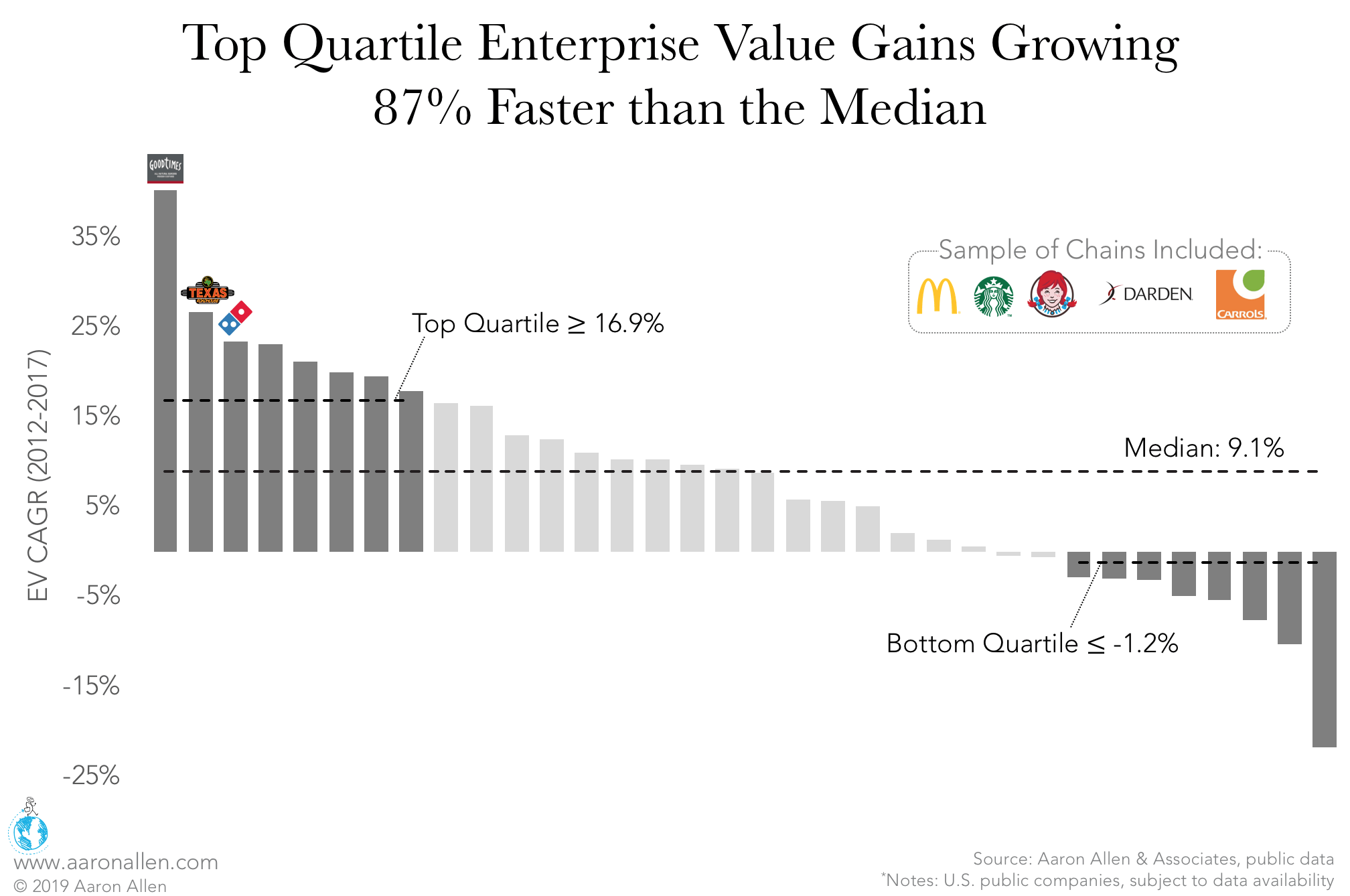

There’s a clear correlation: those who invest more in CAPEX are outperforming the market and their competitors. Winners are investing while others sit on the sidelines waiting for clear skies and a well-worn path to follow.

There are similar proof points related to investments in R&D and corporate intelligence — areas that are often considered “soft” or “intangible” that are paying significant returns. In fact, top-quartile publicly traded restaurant companies in the U.S. grew 87% faster than the median in terms of enterprise value.

Data Without Insight Is Useless

We’re believers that you should always trust your gut, but that those gut decisions should also be informed by data — rather than whim.

Those who are growing the fastest are developing industry best practices. And their growth isn’t just because of lucky period-over-period gains. It’s born out of big brains and big plans armed with deep data, all set in motion years earlier.

Growth is always there. You just have to know where to look and who to ask.

The most successful organizations are those consistently asking themselves: how do we leapfrog the competition of today and outsmart the competition of tomorrow?

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help identify, size, and seize opportunities to drive growth, optimize performance, and enhance enterprise value. Our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business lifecycle.