In September 2017, Restaurant Business released its list of the top 25 Fastest-Growing Fast Casual restaurant chains. The list was full of notable names, from sweetgreen to Blaze Pizza, and unveiled plenty of trends. The fast-casual segment’s growth hasn’t been as strong as in years past (more on that below), but it is still growing, with new players cropping up all the time (and that continued growth continues to spell trouble for other segments blaming a restaurant recession for their dipping sales). Here, we delve further into the list of the fastest-growing fast-casual restaurant companies, examining how the chains benchmark against one another and which segments appear to be coming out on top.

Pizza Continues to Dominate

Of the 25 fastest growing fast-casual restaurants, five are pizza concepts (MOD Pizza, Pie Five Pizza, Blaze, &pizza, 1000 Degrees Neapolitan — we have included Modern Market in the category “Healthy”, though they also sell Pizza), accounting for 39% of all sales. And though fast-casual pizza is still a fairly young concept, it’s a segment that’s been slowly eating into the delivery pie. Blaze Pizza, named the fastest-growing restaurant chain in the country by Business Insider this year, boasts more than 200 locations in the United States – as well as a slew of big-name investors. One of them, NBA star LeBron James, sank $1 million into the concept — a slam dunk, as it turns out (his original investment has reportedly turned into $35 million and growing).  The fast-casual pizza segment continues to shine despite the fact that the fast-casual sector has seen a slight decline in growth. According to Restaurant Business, the fast-casual industry grew by 8.1% in 2016. Of that, pizza comprises some 37% of all fast-casuals. And the segment continues to see new players. The folks behind Shake Shack, for instance, recently launched Martina (a fine dining-fast casual pizza fusion concept) in New York City. Also, a popular concept among the fastest-growing fast-casual restaurants is healthy options. Of the top 25, seven have a heavy focus on healthy or nutritious items, accounting for a quarter of sales. Together, concepts representing pizza or healthy foods represent 64% of the sales of the top 25 fastest growing fast casuals, and 12 out of the 25 brands.

The fast-casual pizza segment continues to shine despite the fact that the fast-casual sector has seen a slight decline in growth. According to Restaurant Business, the fast-casual industry grew by 8.1% in 2016. Of that, pizza comprises some 37% of all fast-casuals. And the segment continues to see new players. The folks behind Shake Shack, for instance, recently launched Martina (a fine dining-fast casual pizza fusion concept) in New York City. Also, a popular concept among the fastest-growing fast-casual restaurants is healthy options. Of the top 25, seven have a heavy focus on healthy or nutritious items, accounting for a quarter of sales. Together, concepts representing pizza or healthy foods represent 64% of the sales of the top 25 fastest growing fast casuals, and 12 out of the 25 brands.

How the Fastest Growing Fast Casual Restaurant Chains Compare

Sales for the 25 fastest growing fast-casual restaurant chains grew a median of 70% in 2016 — close to nine times the growth rate in spend in Food Away From Home (all measured in nominal value). The fastest-growing among the 25, in terms of sales, are Halal Guys (+740%, more than ten times the median of those ranked), a Mediterranean/Middle Eastern concept that began as a food cart in New York. All the pizza concepts in this rank saw sales increases close to the median growth of the group or higher. Those to grow the most (in sales) were MOD Pizza (second in the rank) and Pie Five Pizza Co. (fourth in the rank).

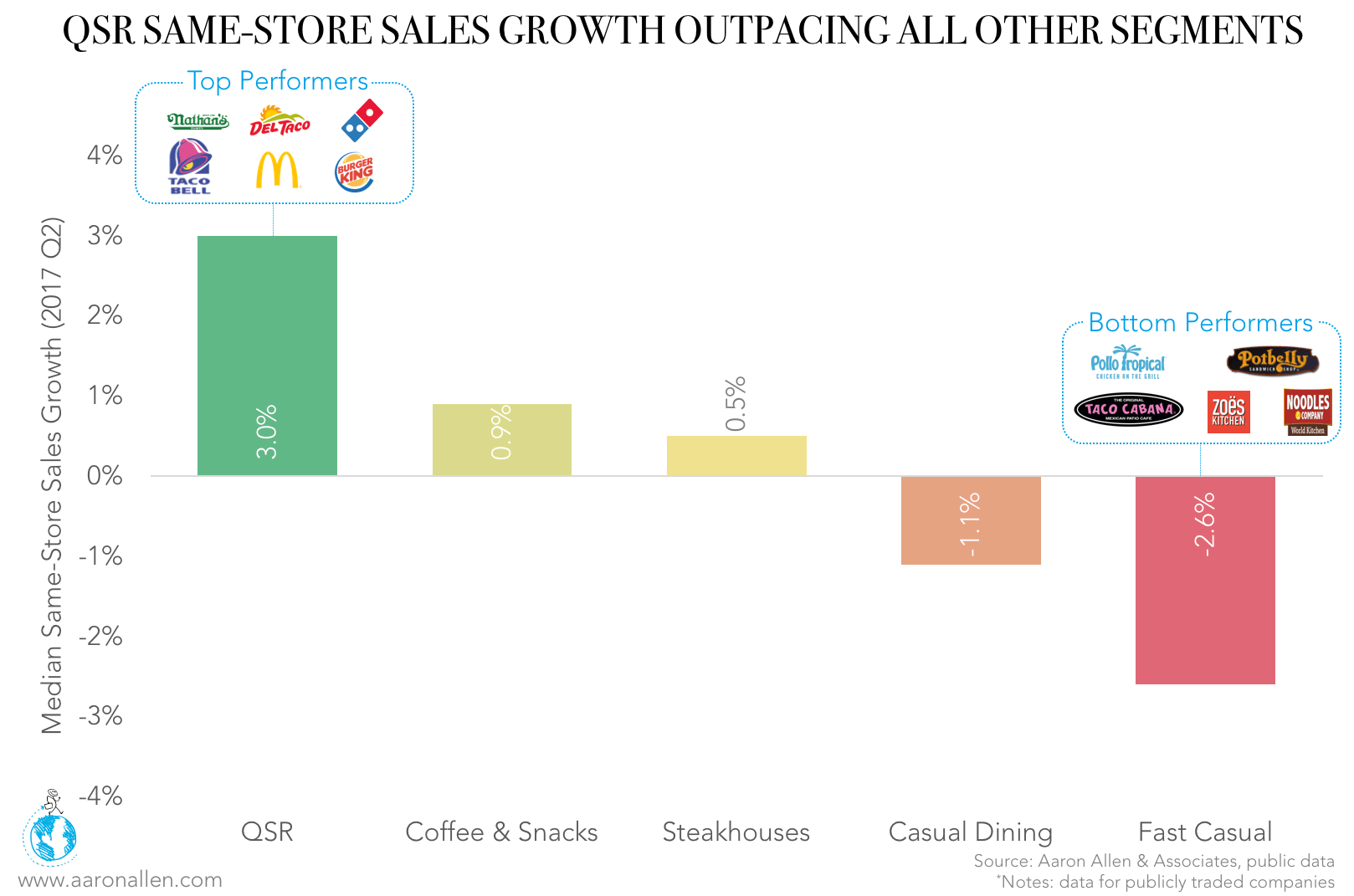

Though sales growth is highly related to expansion (99.3% correlation), the rank by unit growth changes slightly. For instance, while Halal Guys was the fast-casual to grow the most in both sales and units, MOD Pizza saw higher growth in sales (130% and second in the rank) than in units (103%, which puts it fourth in a rank by expansion rate). It’s worth pointing out that not all fast-casual restaurants are doing quite as well as those on the list. In the case of publicly traded companies, same-store sales deteriorated in the second quarter of the year (median decrease of 2.6%). Some of the worst performers were FC chains such as Pollo Tropical, Potbelly, Taco Cabana, Zoes Kitchen, and Noodles.

How Fast Casuals are Being Funded

There’s no shortage of Venture Capital funding in the restaurant space. While the funding of several remains undisclosed, others have received heaps of dough (pardon the pun). CAVA, a Mediterranean concept with US systemwide sales of $26.8 million, has over $154 million from five rounds of funding. Total funding for the aforementioned Blaze Pizza remains undisclosed, though the chain did receive an infusion of capital from Private Equity firm Brentwood Associates in July 2017. Build-your-own-salad chain sweetgreen has received more than $128 million. In June, B.Good raised $3,434,366 in one funding round. Here’s a look at how they all compare, funding-wise:

So, what does this mean for the industry? The biggest pizza chains (Domino’s, Pizza Hut, etc.) have certainly taken note of the fast-casuals mentioned above, all of which are serving crispy pies with gourmet toppings in mere minutes — and offering it at an attractive price point. Those who haven’t taken note of the rise of chains like these (including many casual dining operators) could risk losing share to the fresher, more convenient, and more tech-friendly options. Of course, it also means that with so many players in pizza and health-conscious fast-casual dining, there won’t be room for many more (we might see the smaller chains, for instance, get acquired or merge with other companies).

About Aaron Allen & Associates

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $200 billion, span all 6 inhabited continents and 100+ countries, with locations totaling tens of thousands.