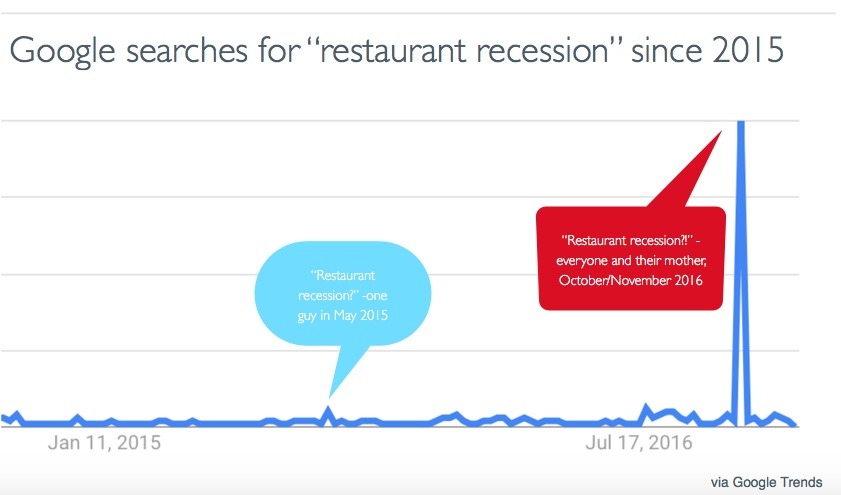

There’s been a lot of chatter around a so-called “restaurant recession” recently. The phrase really took off in July 2016, when analyst Paul Westra warned that the U.S. was on the brink of a “restaurant recession,” offering a bearish report on the industry and downgrading 11 restaurant stocks. A number of other analysts, along with the media and industry execs, took the buzzy phrase and ran with it. “The restaurant recession has arrived,” declared MarketWatch. Meanwhile, Nasdaq offered advice on how to beat it, while Google searches for the phrase “restaurant recession” reached their peak in late October/early November.

With so many restaurant chains struggling (no fewer than eight restaurant companies declared bankruptcy in 2016), it’s an easy excuse: “Of course it’s not our dated concept/menu/design! Haven’t you heard there’s a restaurant recession?”

But can we really blame all these shuttered restaurants and negative same-store sales on a restaurant recession? Things like economic uncertainty, rebounding from recession, and price sensitivity may be factors. But the real issue is that consumer demographics and consumption patterns are changing. And for casual dining restaurants, that should be even more worrisome than a recession.

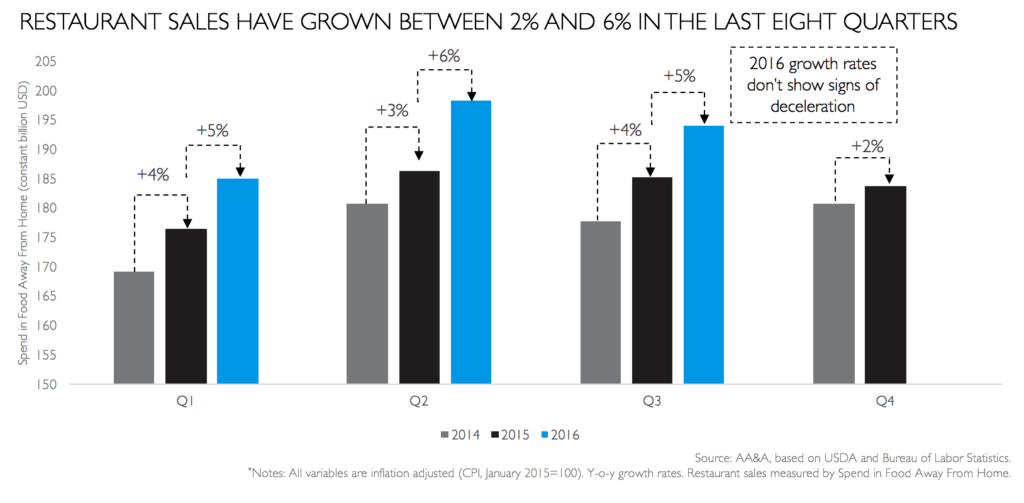

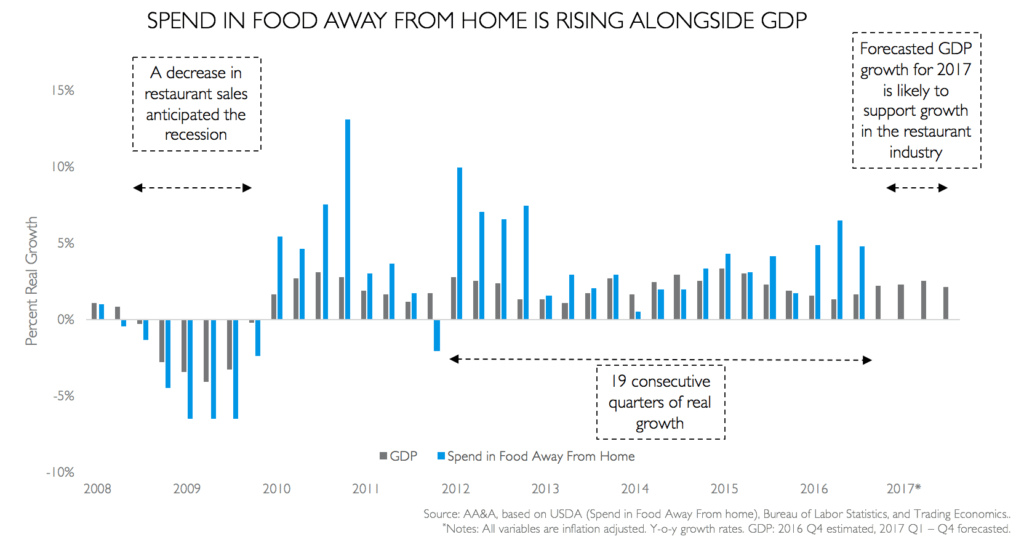

RESTAURANT SPEND IS AT AN ALL-TIME HIGH

A recession is defined as two consecutive quarters of negative growth. Yet spending on food away from home continues to climb, quarter after quarter. In 2016, for the first time in recorded history, Americans spent more at bars and restaurantsthan they did at grocery scores.

The number of restaurants is growing, too — and restaurant employment is also up. This is an especially interesting data point to note when it comes to a recession. Among the most notable attributes of an economy in recession is a high unemployment rate. Just look at 2009 when, in the midst of the Great Recession, restaurant employment was down by as much as 2.2. percent. Now, though, restaurant employment and spend in food away from home are growing — up 2.2%, year-over-year, in November 2016.

The average family size in the U.S. has shrunk. There are now more singles and solo diners than ever before and increasingly, they’re choosing convenience over stale, sit-down, restaurants.

Naturally, millennials are helping to spur the trend away from CDRs. Not only do they spend a higher percentage of their discretionary income on food than any other demographic in history, their tastes are slanted toward fast-casual and limited-service concepts.

But it isn’t just millennials who are shifting their habits. We’re in an era where the newest version of the iPhone all but renders the older versions obsolete. So it’s no surprise that, when something new pops up (be it meal kits, food trucks, or Sweetgreen), consumers make the switch.

CONSUMER BEHAVIOR IS SHIFTING

Meal kits offer one example of this pattern. In fact, one study foundthat meal kit subscribers are essentially offsetting their meals at casual restaurants. Prior to joining a service like Blue Apron or HelloFresh, meal kit subscribers spend some 37.2% of their total food spend at CDRs. After joining a meal kit, though, that number drops to 34.2%.

Three percentage points might not seem like a lot, until you look at sales at underperforming chains. At Taco Cabana, same-store-sales decreased 3.8% year-over-year by August 2016. Sales at Pollo Tropical, Brio, and Applebee’s were down, too: 1.4, 6.4, and 6.2%, respectively. Just because sales at casual dining restaurants are down doesn’t mean there’s a restaurant recession. It’s more of an evolution of consumer dining behavior and purchasing patterns, coupled with the failure of certain segments and stale concepts.

CONVENIENCE IS EATING CASUAL DINING

We’ve been calling this trend for years: Overall, casual dining chains are not doing well. CEOs often pin those negative numbers on consumers “trading down,” opting for fast-casual over casual, sit-down dining. Too many casual dining executives look at the success of fast-casual restaurants like Panera and Chipotle (before it’s recent failings, at least) and ask, “How can we make our food cheaper or faster?” What they fail to recognize is that consumers don’t want cheap. They want value (which doesn’t mean “cheap”) and convenience.

Growth in the U.S. market can only come through cannibalization. For one segment to grow, another segment has to take a hit — and we’ve never seen that more clearly than now. In 2015, food trucks are estimated to have brought in some $1.2 billion in revenue. Meal kits have grown into a $1.5 billion behemoth (a number that’s likely to double over the next few years). And then there’s delivery, the $210 billion elephant in the room.

In the midst of a so-called “restaurant recession,” a slew of fast casual brands (Five Guys, BurgerFi, Blaze Pizza) are offering double- and triple-digit percentage growth levels. Meanwhile, yesterday’s chain CDRs continue bearing the brunt of it. It’s easy for the underperformers to point to a soft economy or a recession or a shrinking middle class. Consumers, however, are actually spending more. The problem, they’re spending it elsewhere — on a food truck, a meal kit, the Whole Foods salad bar, or even a convenience store snack. And like an amoeba in a petri dish, these new concepts and formats continue multiplying.

SO WHAT DOES THIS MEAN FOR CASUAL DINING CHAINS?

The CEOs of casual dining chains probably aren’t sleeping too soundly these days. But unless they’ve got an economist on staff (most restaurant chains don’t), the trajectory and speed of these trends aren’t as readily apparent. A restaurant chain can become a vacuum.

The short version is this: Restaurants aren’t the victims of a recession. Instead, they’ve failed to innovate. Sure, they tout “innovation” in talking points whenever they can, but they’ve been slow to define what it might actually mean for them. They’re also falling prey to overexpansion and new rivals. New places to eat — fast-casual restaurants, food trucks, home delivery, meal kits — are cropping up at such a fast pace, it’s hard to keep up. In other words? We’re not eating less – we’re eating elsewhere.

* * *

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 68 countries for clients ranging from startups to multinational companies posting in excess of $37 billion. Collectively, his clients around the globe generate over $100 billion annually and span six continents and more than 100 countries.