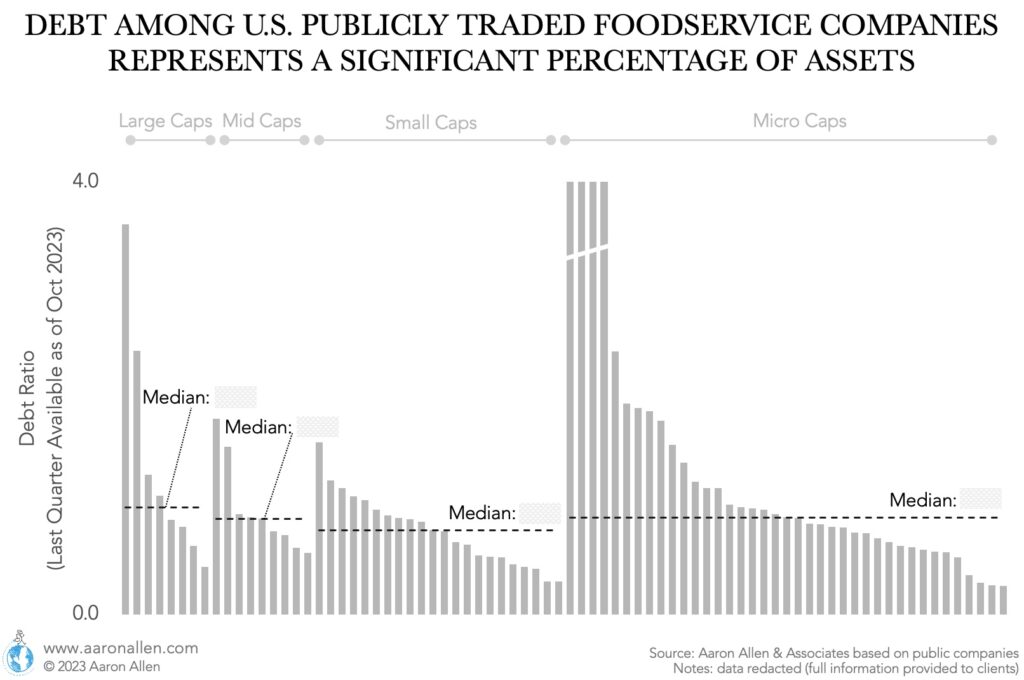

Restaurant debt represents an average 90% of assets. With these numbers, raising interest rates can be fatal for some — and fortune-building for others. This period will usher in a fresh wave of consolidation through mergers and acquisitions. In many cases, recessionary M&A involves distressed and dislocated assets that can be purchased for pennies on the dollar. However, it’s not always predatory or unwelcome. In our view, this period of change will just be accelerating the transformation that was already underway and being profitably harnessed by industry leaders.

Secondary markets allow investors or lenders to get liquidity and exit a position or an investment before the initially expected termination period. A new investor or lender will assess the value of the asset, negotiate, and offer a price to buy out the original investor. There are secondaries markets for debt as well as for private equity investments.

In this article we examine what’s happening in the markets for private debt secondaries, private equity secondaries, and how these trends affect restaurant chains in debt. Whether you are a lender, investor, operator, part of a management team, or in executive leadership, you can benefit from looking at debt through this lens.

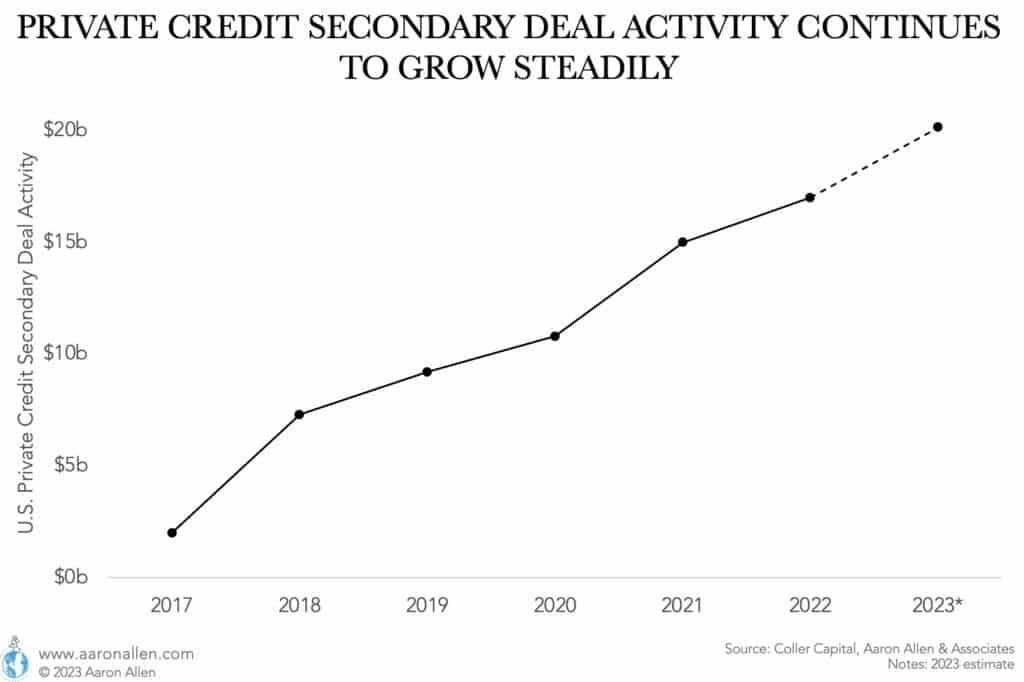

Private Debt Secondaries Are on The Rise

Private debt secondary markets activity has grown steadily over the last five years, and we expect 2023 to continue that trend. Private debt (bonds, loans, direct lending, mezzanine debt, or other credit strategies) can switch hands (likely at a discount) when the original lender is seeking liquidity and there is a buyer that can benefit from buying at a discount to the face value of the debt.

As higher interest rates cause a slowdown in loan repayments, some private debt funds are seeing limited capital inflow and have to exit some of their current positions.

The restaurant industry is no exception, and we are seeing more restaurant chains struggling with debt payments, covenants, and interest payments.

What Does It Mean for Restaurant Debt?

Get Ready for Debt Floor-Doors to Swing Open

When debt is sold on the secondary market, the original lender or creditor transfers the debt to another party. The buyer of the debt becomes the new creditor. The secondary market provides an avenue for the original lender to free up capital by selling the debt to another investor. The borrower’s obligations remain the same.

As interest rates increase and with a potential restaurant recession looming on the horizon, we are seeing more restaurant debt going through secondary markets. With most debt in a privileged position (paid before any equity gets a return) and more and more restaurant chains struggling to pay their debt, some of that debt is changing hands and creditors may end up taking over as the new owners of the business. In such cases, management may remain in place or it may be needed that a third party takes over to stabilize the business, preserve the assets, and facilitate a path toward recovery.

Restaurant Chains: How We Can Help

Restaurant chains in debt should consider their alternatives besides bankruptcy, get an objective assessment of what is the business worth, and package up materials to maximize the sale price.

Waiting can compromise cash flow and reduce the negotiating power on the sell-side. With many signs indicating a difficult 2024, valuations are likely at a peak point. But know, it takes money to raise money.

We can help you:

- Business valuation opinion

- Consider options besides bankruptcy

- Identify weaknesses and opportunities across the P&L to boost revenue and margins

- Professionally package up models and marketing materials before it’s too late (fire sales tend to be negative for the seller)

Tripped a Debt Covenant?

A debt covenant is a contractual agreement between a borrower and a lender that outlines certain conditions and restrictions on the borrower’s financial activities. It helps protect the lender’s interests by ensuring the borrower maintains specific financial ratios or meets certain operational requirements.

When a debt covenant is “tripped” or breached, it means that the borrower has violated one or more terms of the agreement. The consequences of tripping a covenant can vary but range from acceleration of debt to higher interest rates or even restructuring or declaring the loan in default and losing control of the company.

Before taking next steps (to take over or to give the borrower extra time to pay their debt), lenders can benefit from expedited commercial and operational due diligence to get a clear assessment of the business and enable a confident and sure-footed decision. Even if they know that the business is probably worth more than the discounted debt, there is value in learning what are the assets strengths and weaknesses, what is going to be involved in rehabilitating the business (“are we throwing good money after bad?”), and how long will a turnaround take.

Restaurant Lenders: How We Can Help

For those who are currently restaurant lenders or if you are in the market looking buy a debt position to takeover a restaurant chain, you will need a fast assessment of the asset: how much work is needed to stop the margins bleeding? Is there an angle for a unique selling proposition? Can the brand compete over the next few years? Can we make it attractive for the next seller a few years from now? There is a risk implied as well in the possibility that the current Management team doesn’t stay in place, and the new owner can benefit from an Operating Partner (and a plan for a turnaround) to navigate the day-to-day more effectively.

We can help you:

- Assess the business valuation

- High level (fast) commercial and operational due diligence

- Assess the current management team

- Operating Partner (hire somebody to run the business)

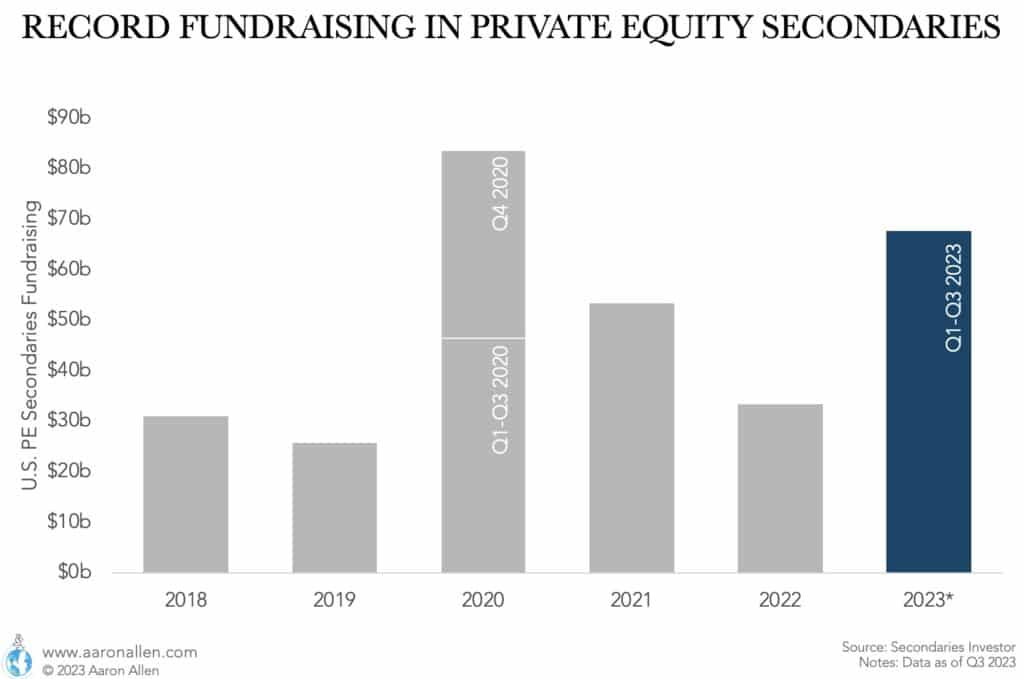

Private Equity Secondaries Funds Are Raising Record Capital

Secondaries funds raised record amounts of capital in 2023. Up to September, reports indicate that the total raised was close to $70 billion, surpassing all previous years for Jan-Sep and already surpassing the amount raised for the full year 2021 and 2022. Secondaries accounted for more than 10% of private equity fundraising, doubling the market share for the previous year.

With estimates indicating around $200 billion in dry powder, secondaries funds are actively seeking investment targets. We believe the increased activity in this market together with a slowdown in the capital raised for traditional PE vehicles is signaling a difficult 2024 to come. Investors are selling parts of their portfolios generating a new type of dealflow — and at significant discounts. For buyers, it can be a shortcut to increase exposure in certain industries (buying rather than building from scratch) and gain economies of scale.

Restaurant Investors: How We Can Help Private Equity, Family Offices, and HNWI

For those looking to invest in the restaurant industry via secondaries (debt or equity),

We can help you:

- Market landscape

- Business valuation opinion

- Commercial and operational due diligence

- Value creation plans

- Receiverships

- Operating Partner

Restaurant Debt KPIs and Benchmarks

Restaurant Debt Ratio

U.S. publicly traded restaurant companies are highly leveraged and the median debt-to-assets ratio shows no big difference between large, mid, small, and micro caps.

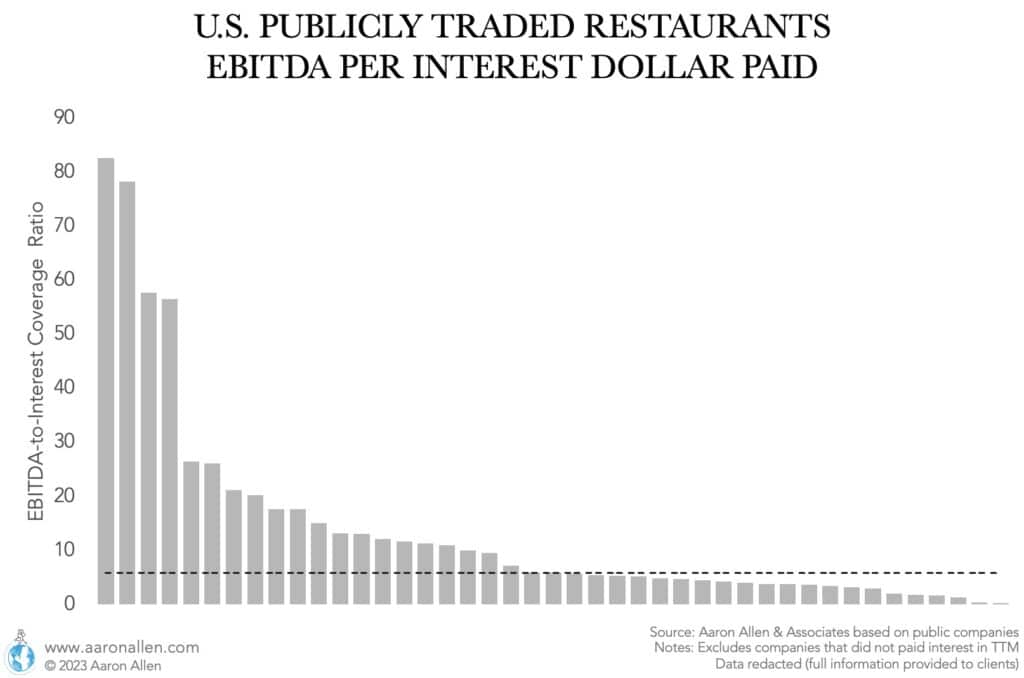

EBITDA-to-Interest Coverage Ratio

Financial metrics such as the EBITDA-to-Interest ratio help us anticipate what the situation could be for an industry in the face of rising interest rates and a potential economic slowdown. In general, an EBITDA coverage ratio of over 10 is considered good (10 dollars of EBITDA for every dollar paid in interest). In the U.S., more than a third of publicly traded foodservice companies have a ratio lower than 10.

We don’t want to see restaurant bankruptcies multiply, but it may be the time to build the top line and organize financing.

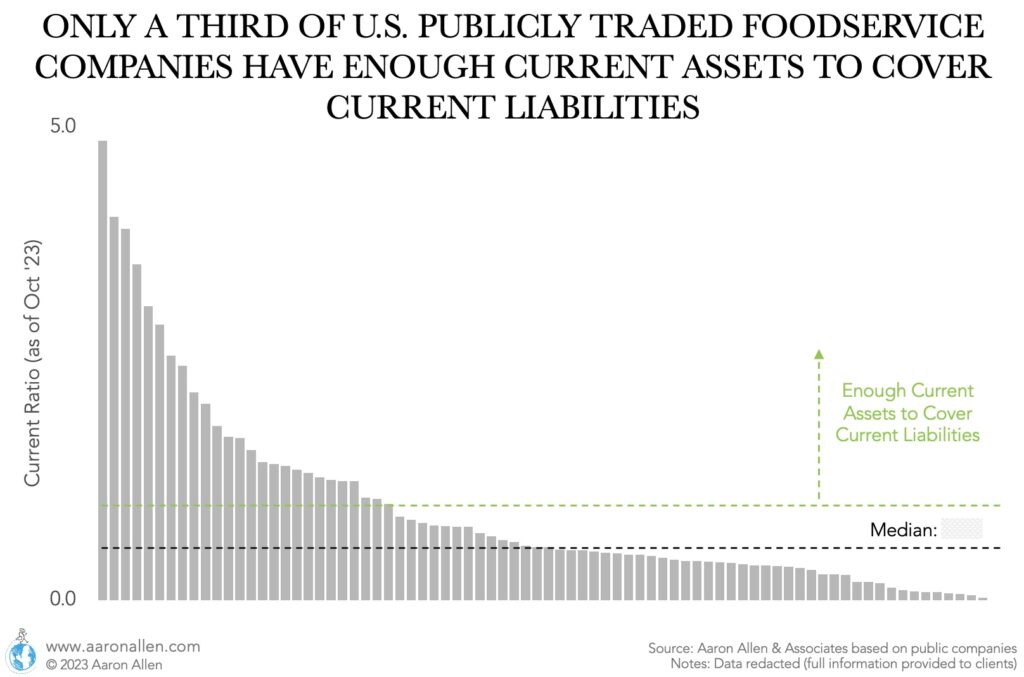

Restaurant Current Ratio

The current ratio (the total current assets of a company divided by its current liabilities) helps understand a company’s ability to pay short-term debt. In the U.S., only a third of the publicly traded foodservice companies has enough current assets to cover current liabilities. The restaurant industry tends to operate with a low current ratio, and it hasn’t changed much compared to pre-pandemic benchmarks.

However, it can be a vulnerability. If the economic situation deteriorates, for many restaurant chains investors will have to step in to solve the liquidity crisis.

The retooling that was already in motion is accelerating and the industry will look very different a few years from now.

Receiverships

For restaurant chains experiencing financial distress, we can act as a third party to manage the operations, stabilize the business, preserve the assets, and facilitate the path toward recovery. Our cross-functional expertise and hands-on experience will help pump new life into the brand, assess areas of growth, and make the necessary changes to make the asset attractive for the next buyer.

Operating Partner

Private Equity firms have often been successful at finding Operating Partners with industry-specific experience to enhance and execute the investment strategy and maximize ROI. We apply resources to help improve performance, profitability, and growth (and ultimately the return on investment). From strategic direction and support in value creation (ideation and execution), to an unparalleled foodservice network, we can tailor an operations team and run the daily operations to maximize the value throughout the holding period.

Expedited Commercial and Operational Due Diligence

We provide an objective assessment of the target business with a focus on surfacing any potential problems (and opportunities) in the P&L and growth plans, the competitive landscape, scalability, differentiation, COGS/purchasing analysis, and expansion-related concerns. Our specialized expertise enables a better informed, confident, and sure-footed investment decision.

Restaurant Management Support

We can help you look at the business like an activist investor would (without being one) to identify performance gaps and improvements to boost the top-line and improve the bottom line. We can elevate the capabilities of the existing management team, and provide valuation opinions and help professionally craft materials for a selling process.

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims, specializing in brand strategy, turnarounds, commercial due diligence and value enhancement for leading hospitality companies and private equity firms.

Our clients span six continents and 100+ countries, collectively posting more than $300b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.