There is plenty of capital sloshing around out there, and no matter if you are a restaurant chain, a foodservice contractor, a supplier, or a restaurant technology company, getting your fair share will require a significant commitment of resources (time, focus, preparation, investment).

It’s a common misconception among those that have bootstrapped or raised capital primarily from known providers (friends and family) to think all that’s needed is a business that’s humming and a figure in mind and then investors just wire millions of dollars within a few weeks of meeting. That’s not at all how it works in the real world though.

- Invest in a company who’s business plan is written on a cocktail napkin (with bad handwriting)?

- Hire a key member of management who doesn’t have a professional resume or bio?

- Make one of the biggest purchases of your life based on loose paperwork and verbal promises?

It Takes Money to Raise Money

Qualified middle-market investors will require a lot more than a one-page business plan downloaded from the internet and filled-in in a couple of hours. And it will cost far more in lost opportunity to skimp on hiring professionals to help you prepare.

Quality advisors will more than pay for themselves with:

- Shorter Time to Close: Raising capital or looking for investors to exit the business is time-consuming. Since the M&A process can take anywhere from 6–12 months, attempting to do so while running the business day-to-day is most likely to negatively impact performance. These efforts can also be a distraction for a prolonged period with do-it-yourself approaches. In the end, an advisor will save you time, likely earn you a higher valuation, and spare you headaches.

- Higher Valuation: The better you look on paper, the higher value you’ll reap. If your brand has a strong pipeline of franchisees, it will earn a better multiple. Quick-service restaurant (QSR) chains — on the whole — receive higher valuations than casual dining. The same goes for purpose-drive brands. A specialized industry M&A advisor will be able to assess what’s a fair offer and sell the rationale to investors, paying for themselves many times over throughout the process.

- Higher Certainty to Close: M&A advisors know what investors want (and sometimes more importantly, what they don’t want), and how to best position the sell-side to avoid mistakes that would get the opportunity spiked at the teaser round, and watch out for potential missteps that would leave the buy-side with the wrong impression. This will reduce the chance of having a dead or broken deal process.

- Improved Positioning, Improved Results: Like writing your own resume or trying to act as your own agent when negotiating, the more professional somebody can make you look — the more likely you are to succeed (and your reward will be all the higher). Having professionally crafted collaterals enables the process to run smoothly on your side by already anticipating investors’ requests. On the contrary, if materials are underwhelming and the process is sloppy and full of first-time seller mistakes, the buyer may back off, thinking (rightly or wrongly) the company may not have the right infrastructure and systems in place.

- Enhanced Buy-Side Competition: When an M&A advisor runs a process (after developing all the collaterals), they will reach out to highly qualified buyers and maintain a competitive process to boost valuation and improve certainty to close. Competition amongst capital providers is a significant advantage to the seller. The advisor also knows who to reach, so it’s not a waste of time. Depending on the size of the company, some would be fit for venture capital, others for private equity, and some would better match the mandate of some family offices.

- Minimized Headaches: An M&A advisor can provide objectivity and act as a representative in negotiations, so you don’t have to drag through long conversations in which many details can alter the benefits of the deal. How the deal is closed, how the payment is made, what happens to the teams afterward, how involved (if at all) the owner will be in the future, and many other complexities are hard to manage and risky to attempt if you don’t have any M&A experience. As a seller, you also don’t want to stand alone in front of professional due diligence teams that are tasked with trying to poke holes into the deal if the information presented is not accurate and presented with a perspective that brings the right light into the business.

Selling a company in the foodservice industry?

Whether a restaurant chain, a supplier, or a technology company, an M&A Advisor will significantly contribute to getting a fair valuation — and reduce risk — rewarding what has been built and the pipeline of potential.

What Does an M&A Advisor Do?

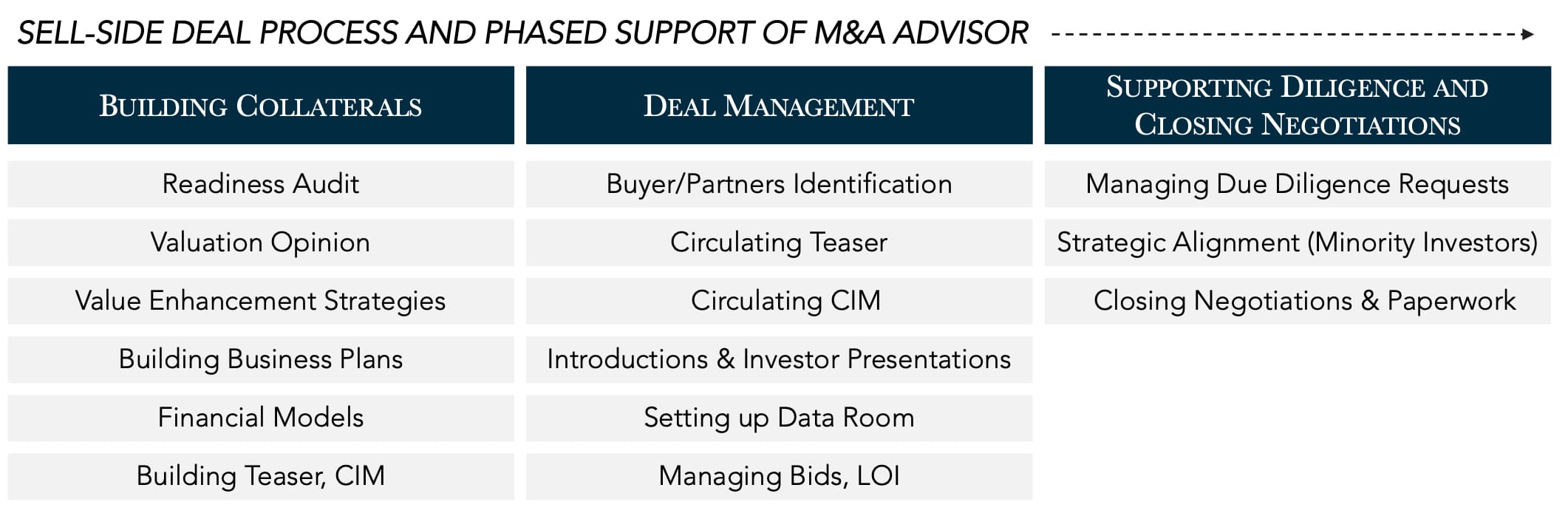

An M&A advisor will work as an intermediary facilitating an investment or acquisition process. The advisor can provide expertise across the stages of the M&A process for the buy-side or sell-side. When a company is considering the sale of a minority or majority stake, they can hire a sell-side advisor.

Supporting the sell-side process ranges from assessing the business and developing collaterals to negotiations and the selling of the business. In this type of engagement, the sell-side typically pays an engagement and success fee to best align incentives on outcomes.

When preparing for a private equity investment, sell-side advisors can support with:

- Pre-Deal: Through conducting a readiness audit, the sell-side advisor may pressure test the business for flaws and weaknesses that would arise during diligence. This way the seller can overcome problems ahead of time and make improvements to be better positioned ahead of moving into a transaction process.

- Building Collaterals: Professional marketing materials range from only preparing a CIM (Confidential Investment Memorandum) to potentially building comprehensive business plans, value enhancement strategies, and financial models that investors will want to see to assess the value of the business more fully.

- Deal Management Concierge Services: The M&A advisor has a network of industry investors to reach out for buyer identification. They will approach third parties and assess their qualifications and intentions to acquire or invest in the business. From there they will run a competitive process, circulating materials and collecting bids (which may involve several rounds of negotiations).

- Supporting Diligence Requests and Closing Negotiations: Once one or two potential buyers have submitted letters of intent (LOIs), the advisor will support due diligence requests from the buy-side (so that it interferes as little as possible with the normal business operations), ensure strategic alignment with the plan (in the case of minority investors), and close the transaction.

Effectively selling a business doesn’t happen overnight. Here are some key considerations and things you will need to have and that an advisor can help accelerate and create:

- Teaser

- CIM

- Business Plan

- Investor Presentation

- Valuation

- Due Diligence

- Financial Forecasts

- Quality of Earnings (QofE)

- Professional Bios for Management

- Data Room

- 36 Months of (Audited) Historical Financial Records

- Fixed Assets Register

- Employment Records

We support with both sell-side mandates and middle-market buy-side advisory for restaurant and foodservice industry investments.

How Much Do M&A Advisors Charge?

There’s usually a range of fees and they can also differ in their structure. For example:

Investment Banks: Usually more than a couple hundred thousand dollars to get started, and success fees are in the millions to tens of millions. There’s often a minimum potential success fee (industry standard of $1m) to take on a project.

M&A Advisory: Usually have a more adequate price for lower and middle market. An initial fee of $100-$200k+ is usually applicable to take the company to an “investable” point, building out marketing materials and, oftentimes, financial models. On-going retainers throughout the transaction process are standard, with success fees typically ranging between 5–10% of enterprise value (depending on the size of the transaction).

Business Brokers: Typically assist with selling or buying small companies (for example an independent restaurant or a small franchisee with a couple of locations). They help secure a price, fill in paperwork, and they’re paid through a commission (usually more than 5%) of the enterprise value. They don’t typically help build business models or marketing materials.

Sell-Side Fees Explained

Since there are several factors impacting fee structures, it’s helpful to assess possibilities prior to making a decision on future steps. For instance, an advisor that only charges a success fee may seem like a good deal on the surface, but most likely they will not look past the first offer (and you may leave significant money on the table in the end). In some cases, a monthly fee may sound too high, but the advisor is willing to detract it from the success fee when the transaction closes, the additional investment would ultimately be in the best interest of the business.

An overview on some of the typical sell-side advisor compensation buckets is available below.

Initial investment/commitment fees are usually non-refundable and covers the costs of preparing materials like the CIM and teaser as well as marketing the company. This also gets the process started with contacting investors and getting the seller’s name out (posting the company on investment sites, sending e-mail blasts to select contacts, etc.).

These fees do not typically cover an extensive review of financials or validation of EBITDA calculations or a deeper dive into the business performance.

Advisors often charge a monthly retainer until the business is sold. This usually implies a higher level of involvement and engagement of the advisor in preparing the company for a sale (beyond the teaser and CIM). It may also include valuation analysis and vetting buyers as well as managing the data room and diligence process while managing requests from the buy-side.

Earned when the transaction is closed, this fee may range between 5–10%+ of the enterprise value attained (the bigger the deal, the smaller this percentage tends to be).

One way to calculate success fees is setting a base enterprise value with an assigned percentage. As the company value increases, the percentage does too (the advisor has an incentive to get a higher deal value). Another way is to use a Lehman-type of formula, where there is a high percentage to start (for example the first $20m at 5%) and then subsequent deal value increments are subject to a smaller fee (the first $20m at 5%, the next $10m-$15m gets a 3% fee, and so on).

Additional advisors and expenses may include financial & accounting audits and diligence, technology audits (in some cases), setting up/managing a secure data room, photography expenses, collecting and archiving historical records, developing collaterals, and travel costs (among other ad-hoc expenses) are not typically included in upfront and retainer fees. These may be added to the investment needed, depending on your specific situation.

The Sell-Side M&A Process: Steps for Success

Getting a restaurant transaction-ready will help an executive team spot red and yellow flags, find good strategic fits, and make the most informed decisions about your company’s future. Here are some key steps in the process.

Before diving head-first into an M&A process, it’s helpful to first evaluate your options. Are you looking to take some chips off the table and stay active in the business? Bring on a strategic partner to support further growth and expansion? Sell a majority and transition out of the business over time? There are often many potential “right ways” forward — and thinking through the pros and cons of each (and what’s most important to you) is a good way to get started.

Most businesses don’t even file taxes without consulting multiple internal stakeholders and recruiting some external help. Private equity deals will likely have a more significant impact on a company’s long-term success than any one year of tax returns, so a similarly rigorous approach is needed before embarking on a capital-raising venture.

Some key members of the sell-side deal team include:

- Internal stakeholders

- Attorneys to vet letters of intent and bids

- A sell-side advisor with experience in restaurant investments to guide the company through each step of the process, help them understand the private equity marketplace, and provide unbiased opinions about the organization’s financial, operational, and commercial position

- An investment banker could complement or be an alternative to the sell-side advisor

Just as much as defining the best-case scenario is important, it’s helpful to know what will make you walk away from a deal (early in the process so you can have this as a guidepost to continue coming back to). Some topics here may include figuring out the lowest acceptable enterprise value (or investment level), how key players fit into the future, and any other non-negotiables.

Private equity firms spend a lot of time looking for and studying potential investments, often before even contacting the target organization. Foodservice businesses looking to raise capital should do the same.

When evaluating potential investors, the executive team should consider:

- The investor’s experience in foodservice

- The size and outcome of previous investments and acquisitions

- Current portfolio

- Regional expertise

- Strategic orientation

Particularly on the strategy, a sell-side advisor can help operators spot red and yellow flags, ensuring that the restaurant chain’s concerns are addressed before it’s too late.

To ensure a fair transaction for all parties, a restaurant should determine a target value (or at least a range) in advance — not handing this power solely o the buy-side deal team to control this part of the conversation. In many cases, PE firms have valuation mandates that may never match the sell-side aspirations.

Financial advisors on sell-side restaurant deals can help calculate value effectively and assess if the timing is right so that sellers neither leave too much on the table nor scare off potential investors (and be a helpful third-party negotiator in this process).

Investment firms often conduct multiple rounds of due diligence, digging into the target company’s financial history and future, the industry and market landscape, and its operational strengths and weaknesses. Restaurants seeking private equity financing should do the same before considering any offers.

External advisors can help pressure test the P&L and bring a clear view of an organization’s finances and operations, not to mention key industry and market indicators, so that the executive team can identify — and correct —obstacles to the transaction before potential investors discover them on their own.

Once you’ve identified areas of opportunity (and worked to mitigate risks), it’s time to start shopping for offers. You’ll usually work up a “teaser” — a short document that describes why the business makes a sound and compelling investment.

Interested investors will then ask for a Confidential Information Memorandum, which will include more information about the company — moving forward to access to a data room for further diligence.

There will likely be a fair bit of back-and-forth between parties (with the diligence and negotiation period extending for 30–60–90+ days). Advanced preparations (and the right advisors) can help to speed this process along.

Tips To Help You Pick the Right M&A Advisor

Finding the right partner to help you sell your business can be a nuanced process. Just like any relationship — personal or professional — trust is usually key for a successful partnership. Here are some things to look for in an M&A advisor:

- Network: It’s important to understand the depth of connections (know-who) the advisor has (are these real connections or are they reaching out to random e-mails they found on the internet?). The advisor shouldn’t just contact as many potential investors as possible without vetting them (many of them won’t be qualified to buy your business and your data could fall at the hands of the competition).

- Industry Expertise: Will the advisor be able to make a fair and accurate recommendation on valuation? Will they be able to understand and market the growth plans? Industry acumen is a significant part of what the advisor can bring to the process.