Restaurant venture capital is starting to take on a new meaning. While it may refer to the early financing of a restaurant (or chain), more recent trends and activity have evolved to the term being primarily focused on foodservice technology investments.

We are currently in the bronze age of restaurant technology, and the golden age is about to come. To participate in big valuation wins, investors have to get in early. In many cases, the revenue and EV acceleration will be like going from 0–60 mph in less than 2.4 seconds (many won’t believe this could happen and will therefore miss the opportunity).

Some key takeaways:

- Venture capital broke new records during the pandemic (across industries)

- U.S. VC deal value grew almost five times in the last ten years to more than $150 billion

- There are plenty of opportunities for VC investors in foodservice tech, and the upside can be realized quickly

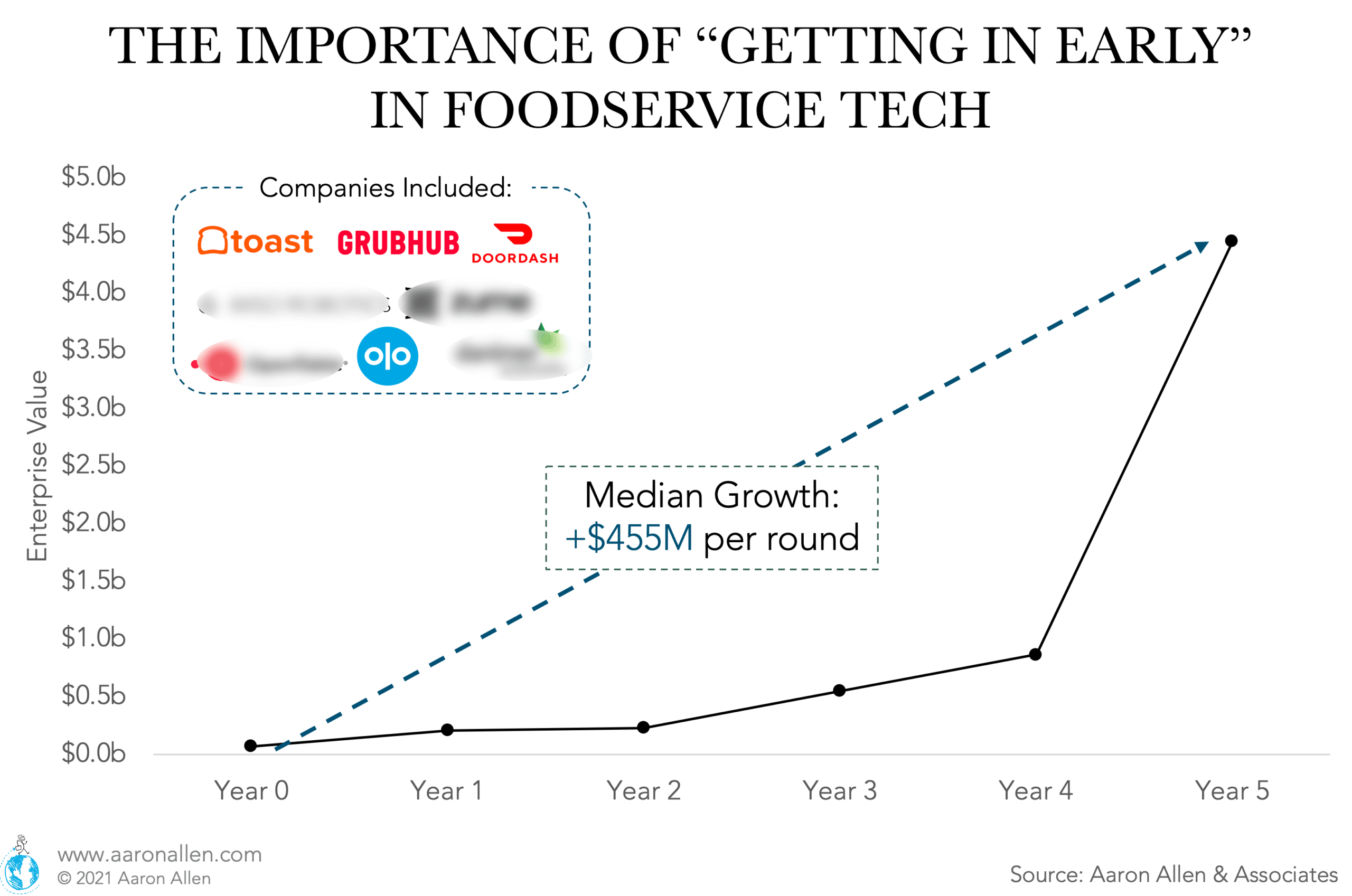

- A sample of foodservice tech companies indicates an average enterprise value growth of $455 million per funding round

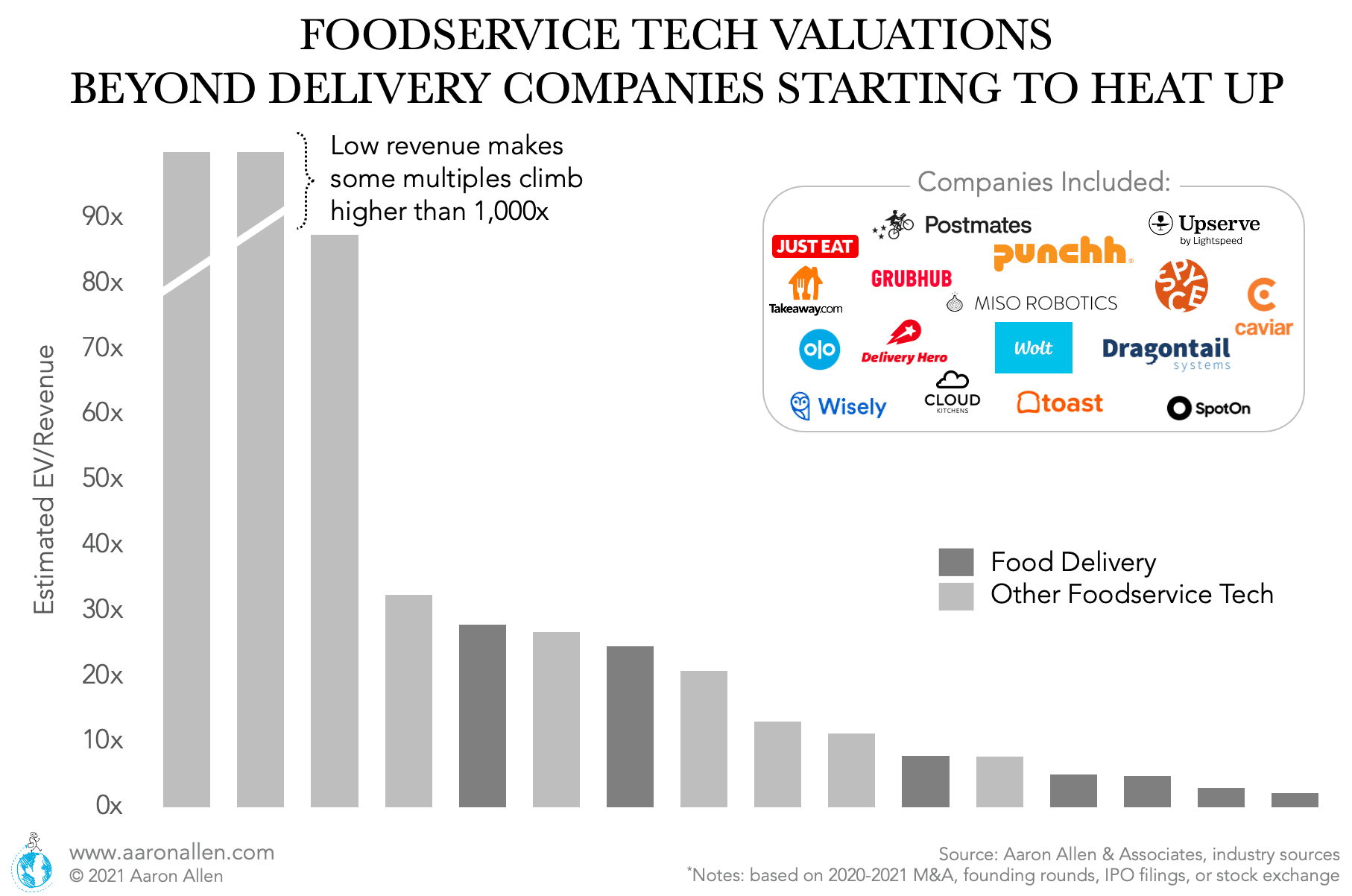

- The highest Enterprise Value to Revenue ratio we recorded was not for food delivery companies but for other types of foodservice tech (considering a sample of recent transactions)

While private equity capital is pouring into the usual choices and boosting valuation for restaurants and more traditional foodservice tech, there’s a lot of new market development within foodservice tech that benefits from VC funding.

Venture Capital Not Taking a Break During the Pandemic

The M&A activity halt at the onset of the pandemic resulted in many VCs reallocating attention and resources to ventures already in their portfolios — rather than sourcing new deals. This resulted in record numbers for both fundraising and deal value. VC activity in the U.S. reached $156B in 2020 (across all sectors), and there’s a similar amount in dry powder expected to be deployed in 2021.

VCs are backing foodservice technology and seeing a wide range of returns. Decisions regarding where to invest today should not be based on what others wanted yesterday or can prove today, it’s much more about predicting what will happen in the tomorrows ahead. It’s also about having the right team in place that can make that vision a reality and is able to bridge the gap between tech developers and restaurant operators.

How Are Valuations Responding to Increased Venture Capital Activity?

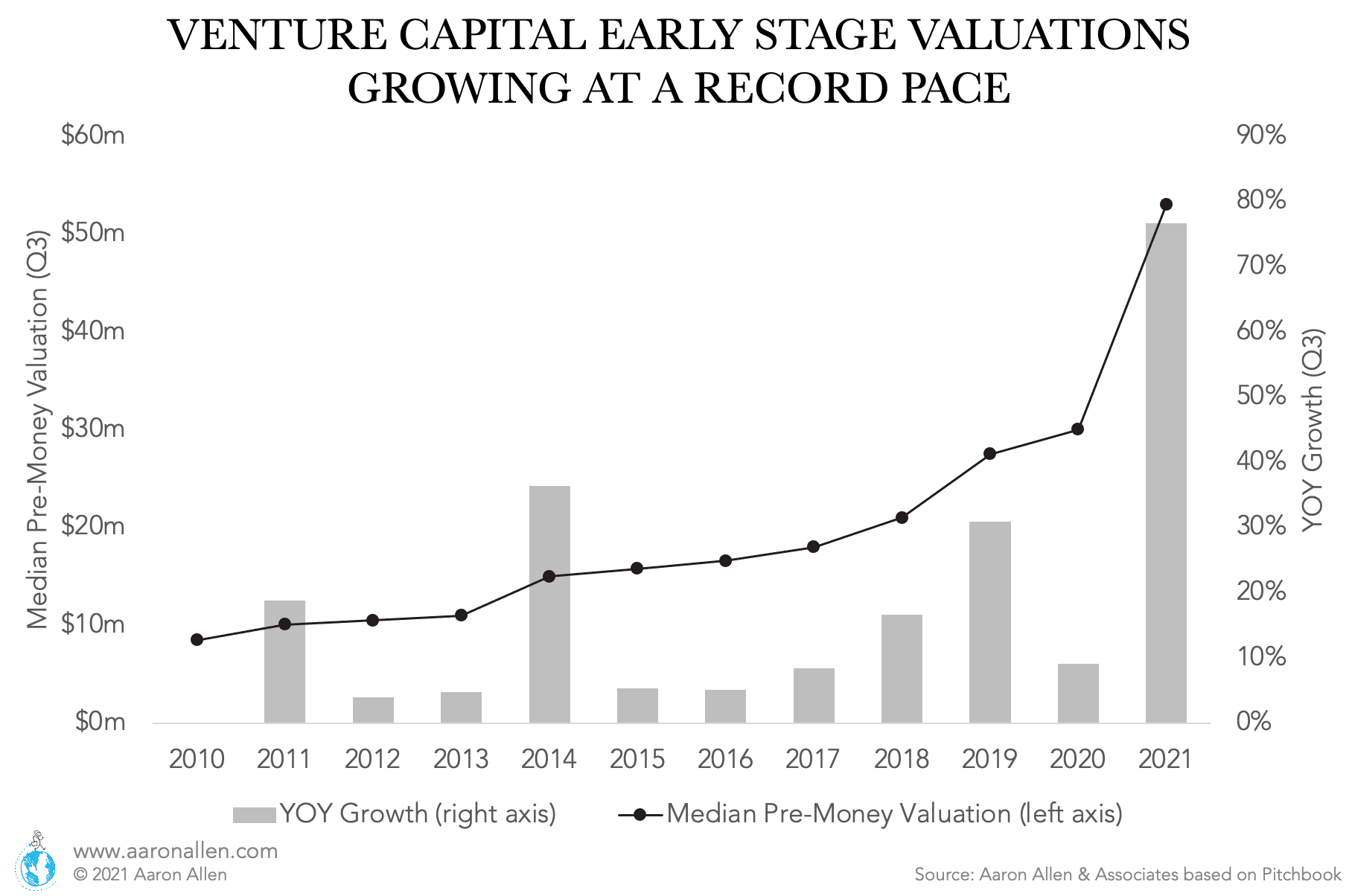

Across industries, valuations of VC-backed startups are growing at a record pace. In the third quarter of 2021, the YOY median pre-money valuation growth reached 77% (a level not seen in at least ten years).

Investors are moving to earlier-stage companies and boosting valuations.

Who Are the Most Valuable VC-Backed Companies?

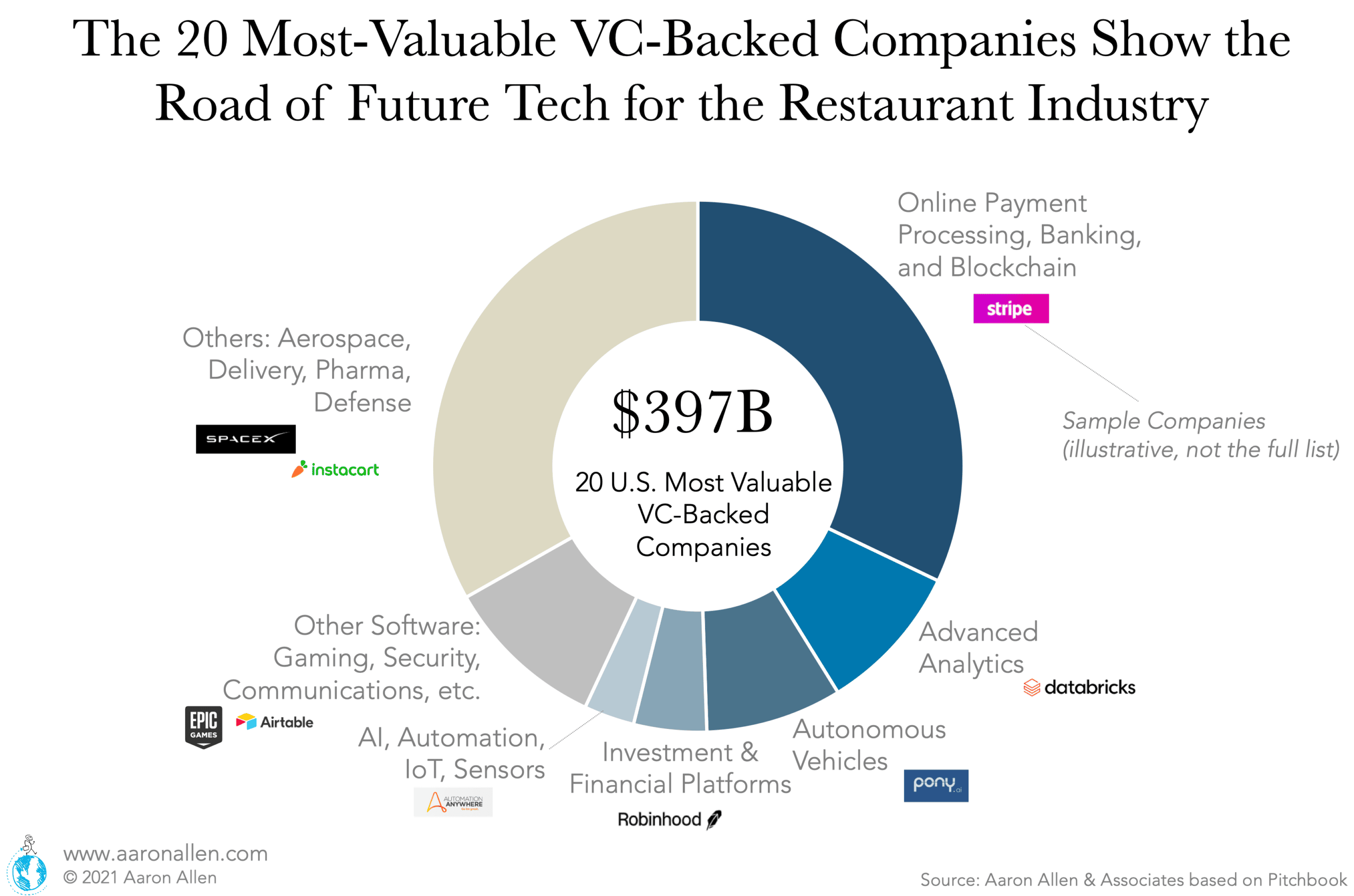

The 20 most valuable VC-backed companies in the U.S. are worth close to $400 billion. Their distribution across segments can be taken as a proxy (and inspiration) for what technologies are going to have an impact in the foodservice industry over the next few years.

While Online Payment Processing and Blockchain companies take the largest share (representing close to a third of the value), Advanced Analytics, Autonomous Vehicles, AI, Automation, IoT, and Sensors account for 20% of the value of the top 20.

Corporate Venture Capital Is Also in the Race

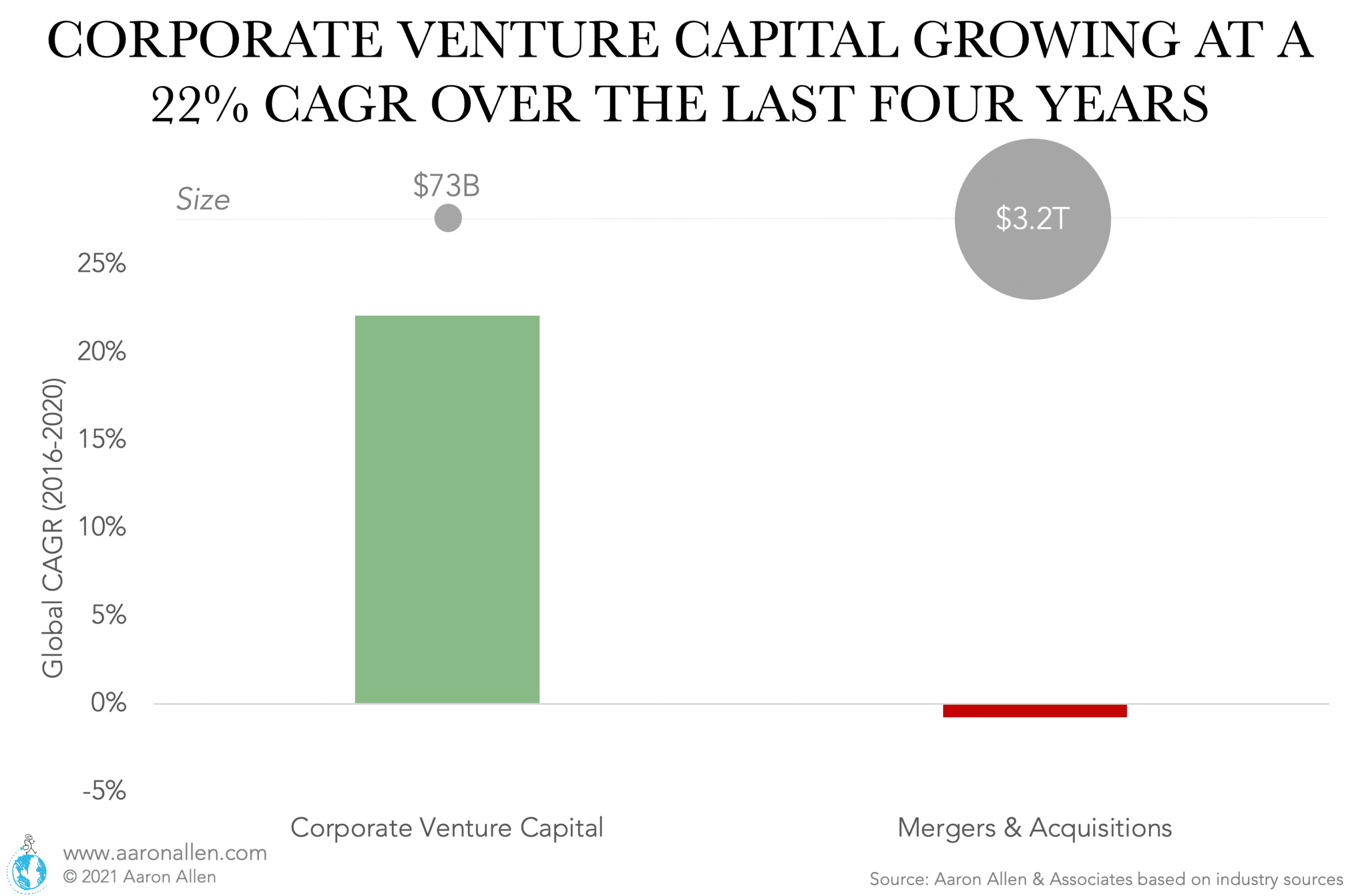

As venture capital has increased in popularity over the past several years, corporations have also gotten in on the game. Global CVC activity has grown at a 22% CAGR over the last four years — in comparison, M&A has been relatively stable at around $3.2 trillion.

While M&A enables companies to access new markets or new products and typically involves companies with a certain trajectory, CVC has more to do with R&D and long-term opportunities with attractive potential.

There are many merits to building a corporate venture capital group, and it’s not just generating future financial returns. The right CVC investment can unlock new layers of growth, open channel expansion opportunities, or drive improved systemwide efficiencies through new technologies.

Venture Capital in Foodservice Technology

The opportunities in foodservice technology for Venture Capital investments are plenty. Some of these have the potential to grow in valuation at an outstanding pace while solving some of the industry’s most pervasive problems and even helping from a point of view of sustainability.

Those who are ahead are motivated by a combination of both profits and purpose.

Investing in Early-Stage Foodservice Tech

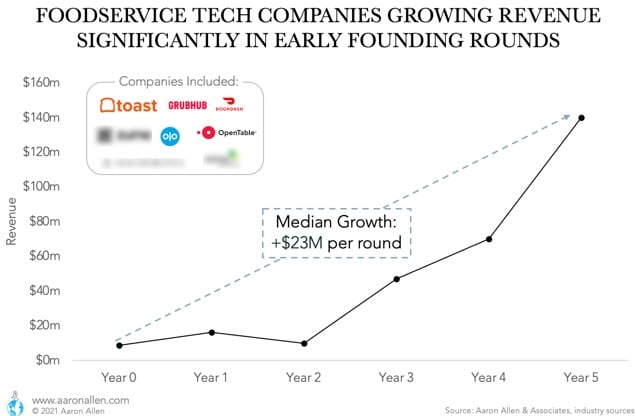

We reviewed a sample of foodservice tech companies (including categories like delivery, POS, robotics, SaaS, and more) and calculated that on average, enterprise value grows $455 million per funding round (from Seed Round and Series A onwards). Investors getting in early can see huge valuation growth.

This enterprise value growth is backed by revenue (or an Annual Recurring Rate) growth of about $23 million per round. In many cases, what these companies require to jump to the next level are industry expertise to attune the global go-to-market strategy, product iteration, and market/industry positioning.

Recent Restaurant and Foodservice Tech Valuations and Growth

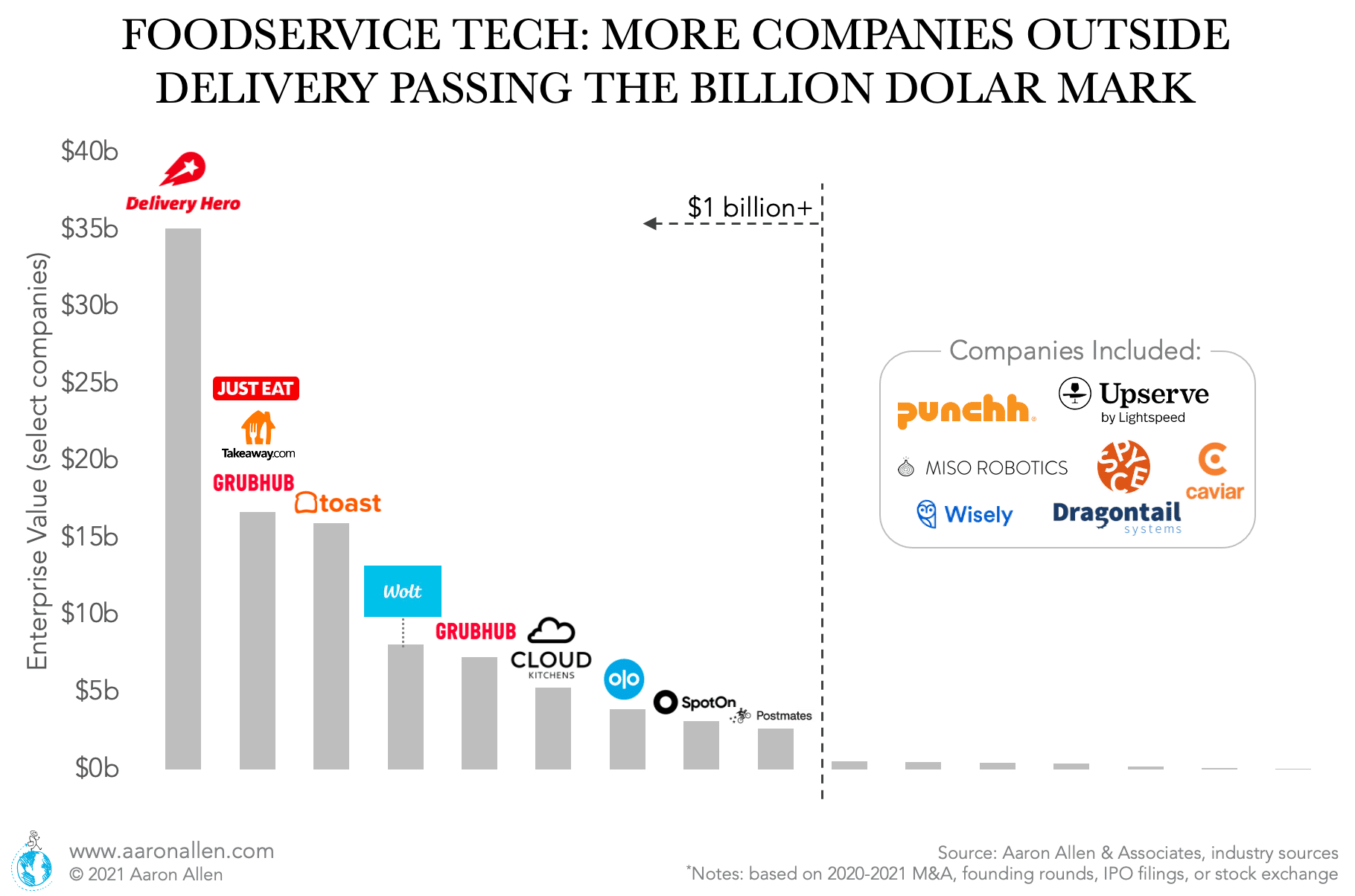

When looking at the value of foodservice tech, it’s mostly delivery or POS companies. But as emerging categories start to come out of pilots and into a go-to-market phase, the landscape is starting to change.

We compiled the enterprise value of some of the most recent foodservice tech companies that have been through acquisitions, fundraising, are close to an IPO, or are publicly traded. Though the billion-dollar mark had mostly been for food delivery companies so far, we’re seeing more and more other foodservice tech passing this valuation.

Some of the capabilities of AI, automation, robotics, advanced analytics, and other technologies are closing in on the point when massive adoption starts. The best opportunities for investors are only on the radar of a handful of qualified industry experts right now.

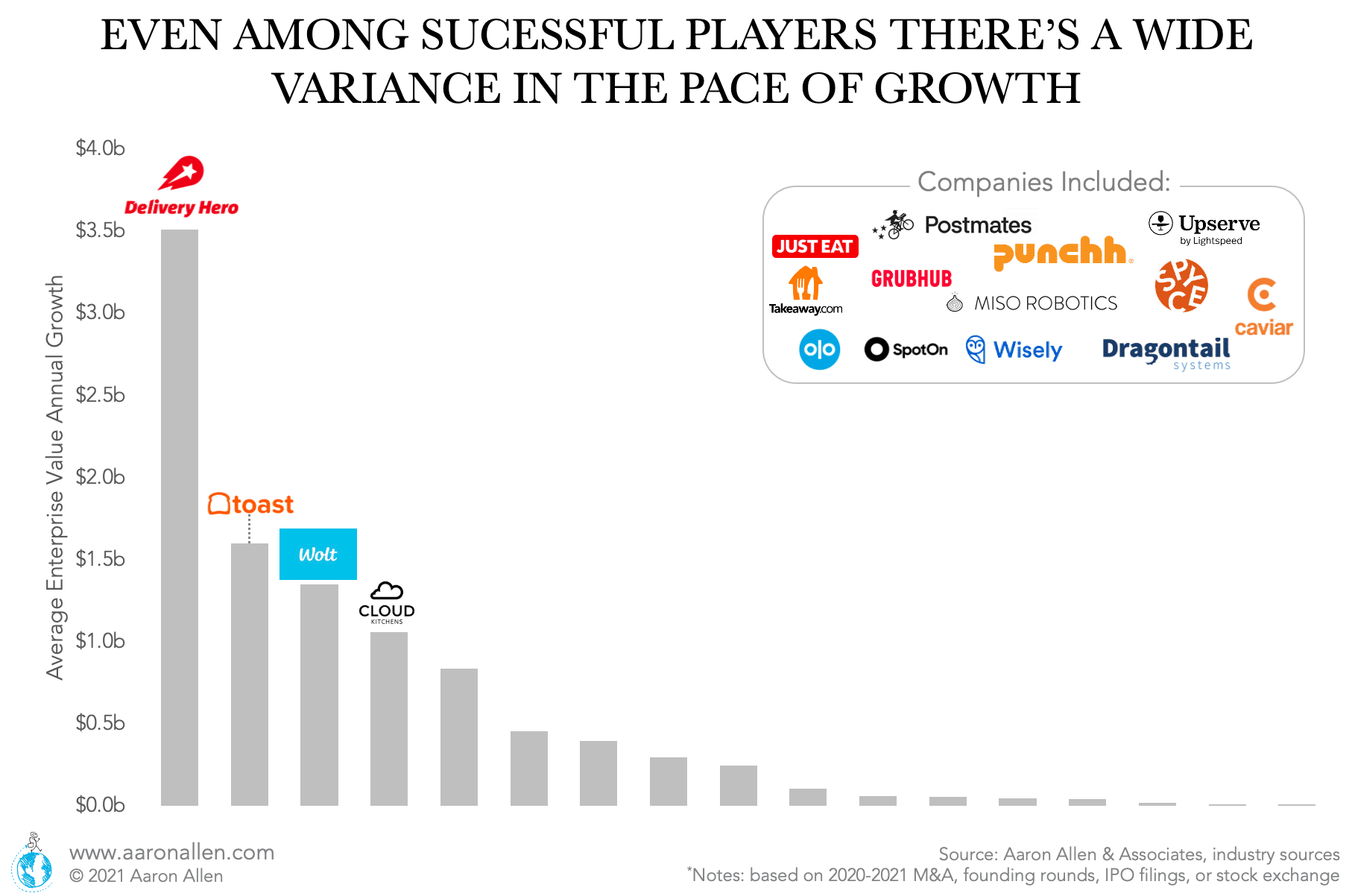

Growing more than $1 billion in EV per year: delivery companies Delivery Hero and Wolt, Cloud Kitchens, and Toast (with a $20b+ IPO). Several other foodservice tech companies have been in a range from $8 million per year to $800+.

Some tech companies will jump to very high valuations, the key is to identify which ones have the flexibility to adapt to what restaurant operations need and want.

The highest Enterprise Value to Revenue ratio we recorded was not for food delivery companies but for other types of foodservice tech (climbing to outsized valuations because of their low revenue). This may not surprise a tech investor, but it’s not common for food (even foodservice tech) investors, who are not seizing many opportunities that seem “too good to be true”. There are many applications of foodservice tech that restaurant chains are ready to implement but investors are unwilling to finance. There’s a lot of “you go first” mentality — and seasoned groups that come with industry expertise will be able to separate the wheat from the chaff.

Restaurant Technology Case Studies Showing a Path for VC

Industry expertise is necessary to find the gems with the best shot at becoming the most valuable foodservice tech in the world. As with most start-ups, the following case studies started with a friends-and-family round, followed by venture capital funding. We are pointing out a few of the factors that helped these companies grow to become some of the most successful in their industries.

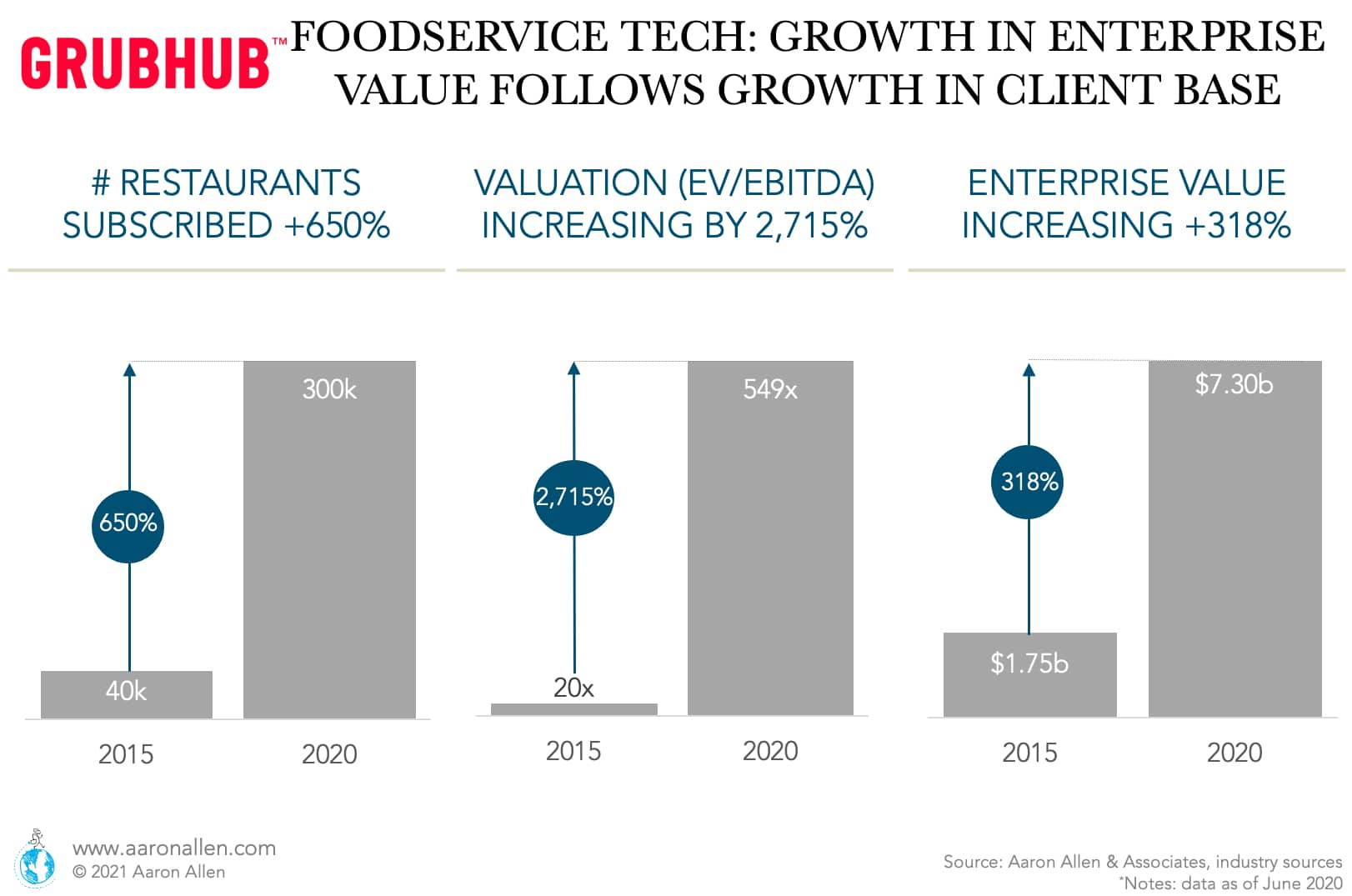

Grubhub Shows Enterprise Growth Gaining Traction with Number of Subscribers

Food delivery aggregators constitute a case study for all foodservice tech companies in terms of a correlation between market penetration and valuation. Delivery was a land grab, and Grubhub understood this very well.

Grubhub’s client base grew by 650% from 2015-2019, and a 318% growth in enterprise value followed. In practical terms, for every restaurant subscribed the company got $24,000 in EV when they were acquired by Just Eat/Takeaway in June 2020.

There are many early-stage foodservice tech companies that could be a solid deal, with a strong team, product, and company/category with incredible market potential. They often need the help of industry experts to get more exposure and traction (from product iterations to positioning to locking key accounts).

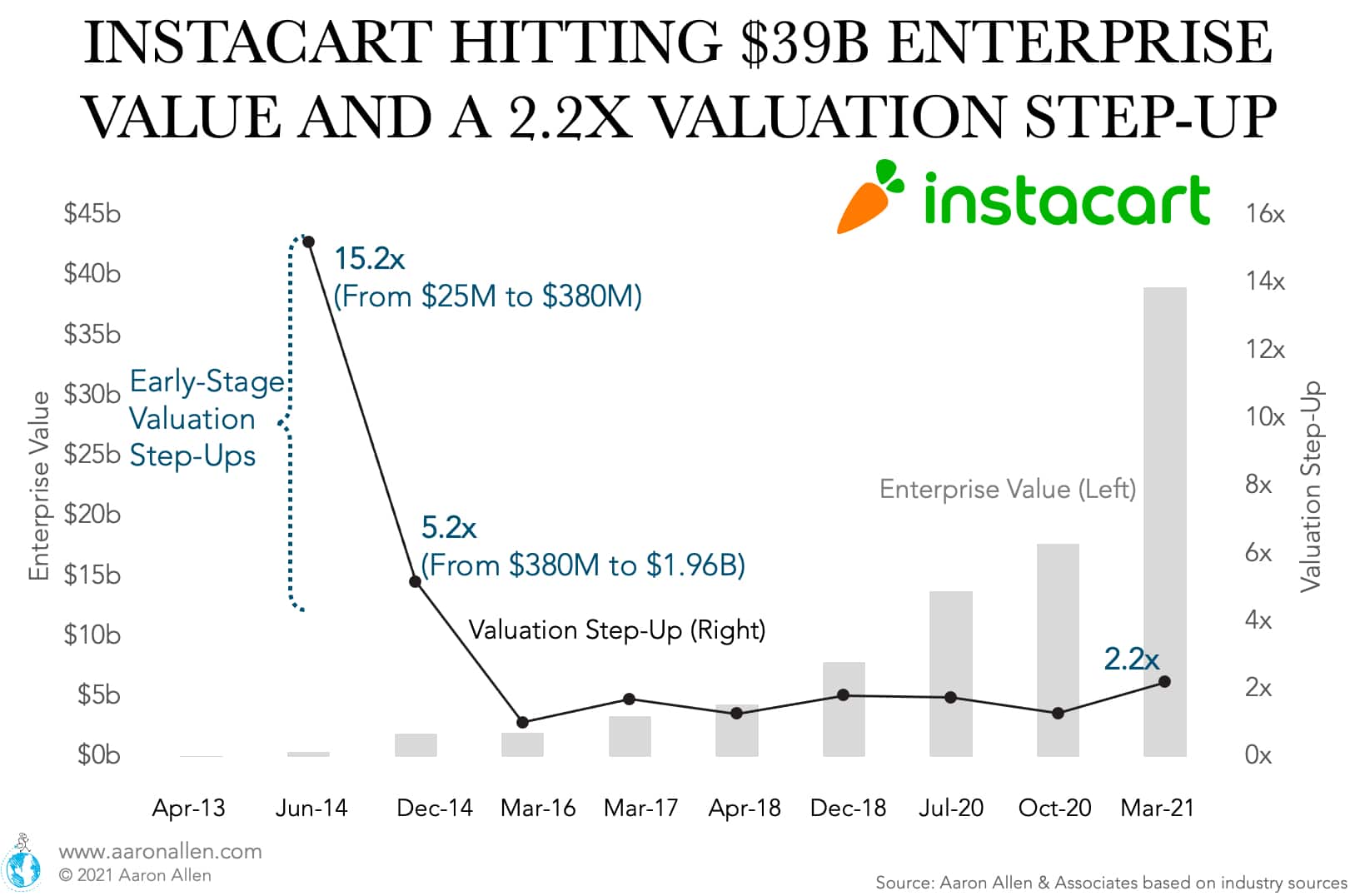

Instacart Shows the Valuation Step Ups Foodservice Tech May Also Reach

Instacart is not a foodservice technology company, but it’s an interesting adjacent case study. The company’s enterprise value has grown at an average of 249% between rounds (meaning the value multiplied by 1,560 times in 8 years). During the March 2021 funding round, the EV doubled (more than impressive when considering this is in the billions of dollars).

However, the valuation step-ups of the initial funding rounds also show how investors can benefit at the early stages. The valuation step-up in early 2014 was 15.2x (from $25M to $380M) and 5.2x in late 2014 (from $380M to $1.96B). Valuation step-ups stabilized at around 1.5x after that (until the 2.2x jump in the last round of March 2021).

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims, specializing in brand strategy, turnarounds, commercial due diligence and value enhancement for leading hospitality companies and private equity firms.

Our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle. If you are seeking expert advice for a foodservice business or investment, you can get in touch with us here.