Acquisitions typically drive one-fourth of restaurant industry growth. And there’s plenty of capital to put behind foodservice companies. But there is an even bigger opportunity to invest beyond restaurant operators and into enterprises that are not even on the radar right now (like those looking to alternative formats and improved unit economic models, as well as transformative technologies) that will jump to very large valuations over the next few years.

Investors can obtain outsized returns in the foodservice industry (whether investing in large restaurant chains, foodservice technology providers, suppliers, or international powerhouses) while also fulfilling a purpose. As an investor, the key is finding the right partner to source opportunities that others don’t have access to — and to provide a team to support top-quartile value creation.

Here we outline ten reasons why smart money is investing with industry insiders.

1. Proprietary Deal Flow

Investment banks sell (to investors) what they have in inventory. On the other hand, industry specialists tend to have access to all kinds of proprietary deals that are not in the common inventory. It’s like the difference between going to a broker versus a car lot. The car lot is going to sell you what they have in the lot, whereas the broker can shop in any car lot to get the model you want at a competitive price.

2. Targets Want to Go With a Winner

Target companies recognize the strategic value add of industry experts and seek to find them to support their growth. When industry experts have a track record of value creation, they can accelerate development due to top-to-top relationships, translate between tech companies’ development teams and operators’ needs, and provide patient capital to support the company throughout its business lifecycle.

3. Deal-by-Deal Flexibility

A deal-by-deal model has several advantages over a Committed Capital Fund. Granted, a fund has commitments from investors — but these commitments also go the other way round (to LPs) with limitations on where to invest capital. If a target company doesn’t fit the specifications, it’s going to be overlooked — even if it has a better risk-return profile than companies that do meet the criteria. On the contrary, in a deal-by-deal model, promises are made one deal at a time, and LPs can be better matched with targets.

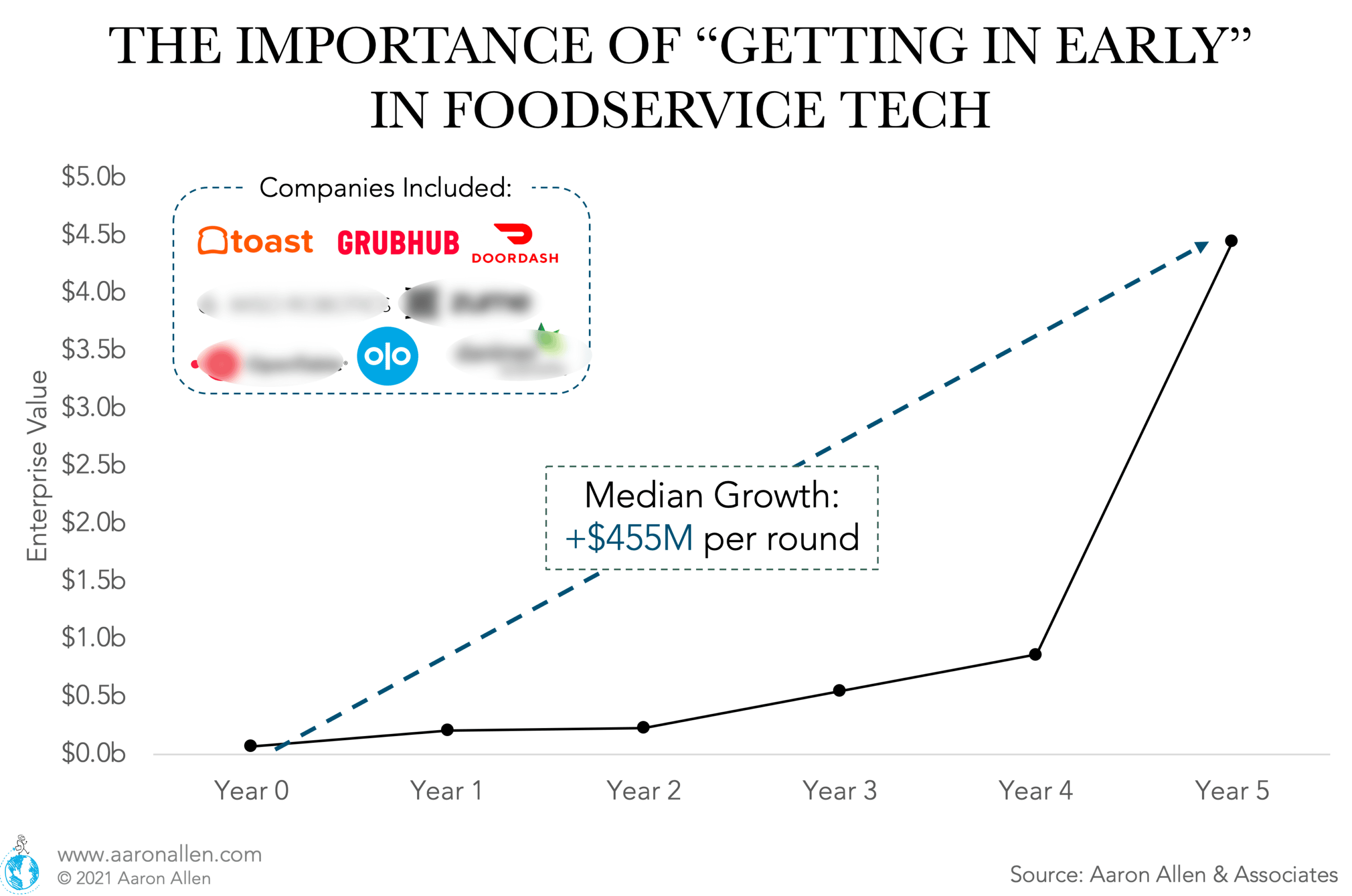

It can also be hard for CCFs to right-size the opportunity — specifications about how early in the game they can invest may leave them out of big valuation jumps (taking a small sample of foodservice tech companies we calculated that on average, enterprise value grows $455 million per funding round). Investors getting in early can see huge valuation growth.

4. Industry Team Over Deal Team

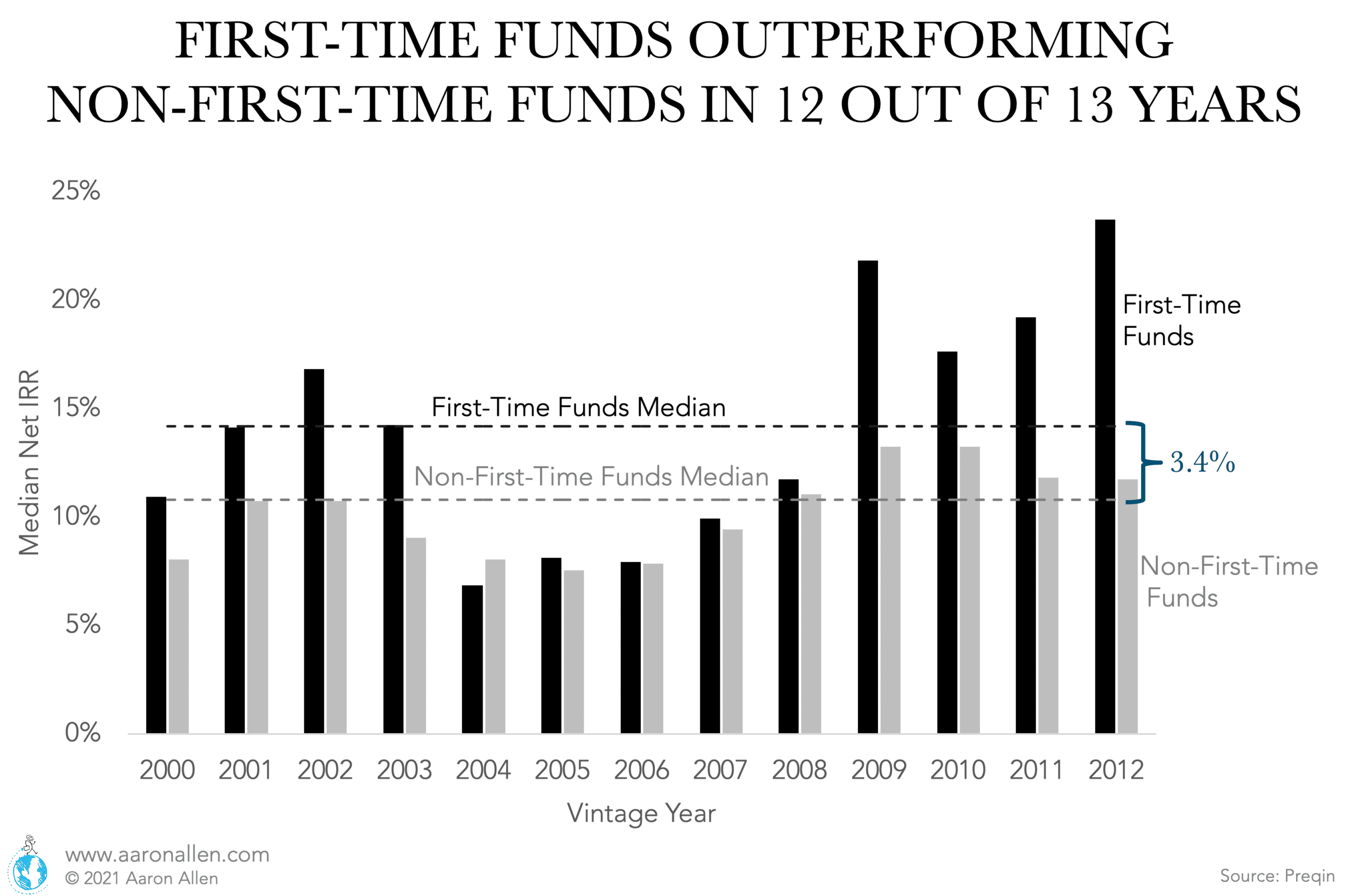

LPs are taking note of first-time funds outperforming experienced PE and VC firms and migrating their capital to those. The reason? Whereas the fund may not have a long history (in most cases, each team member has relevant deal experience), they are highly experienced in their industries.

In the lower middle-market, it’s not really relevant how many people are on the deal team. Financial structure experience can be brought into the team with a few key positions. Would you rather pay a team of bankers for financial engineering of a restaurant chain, or a team of industry experts who can develop a value creation plan for every segment, geography, and competitor?

5. Bringing a Unique Perspective

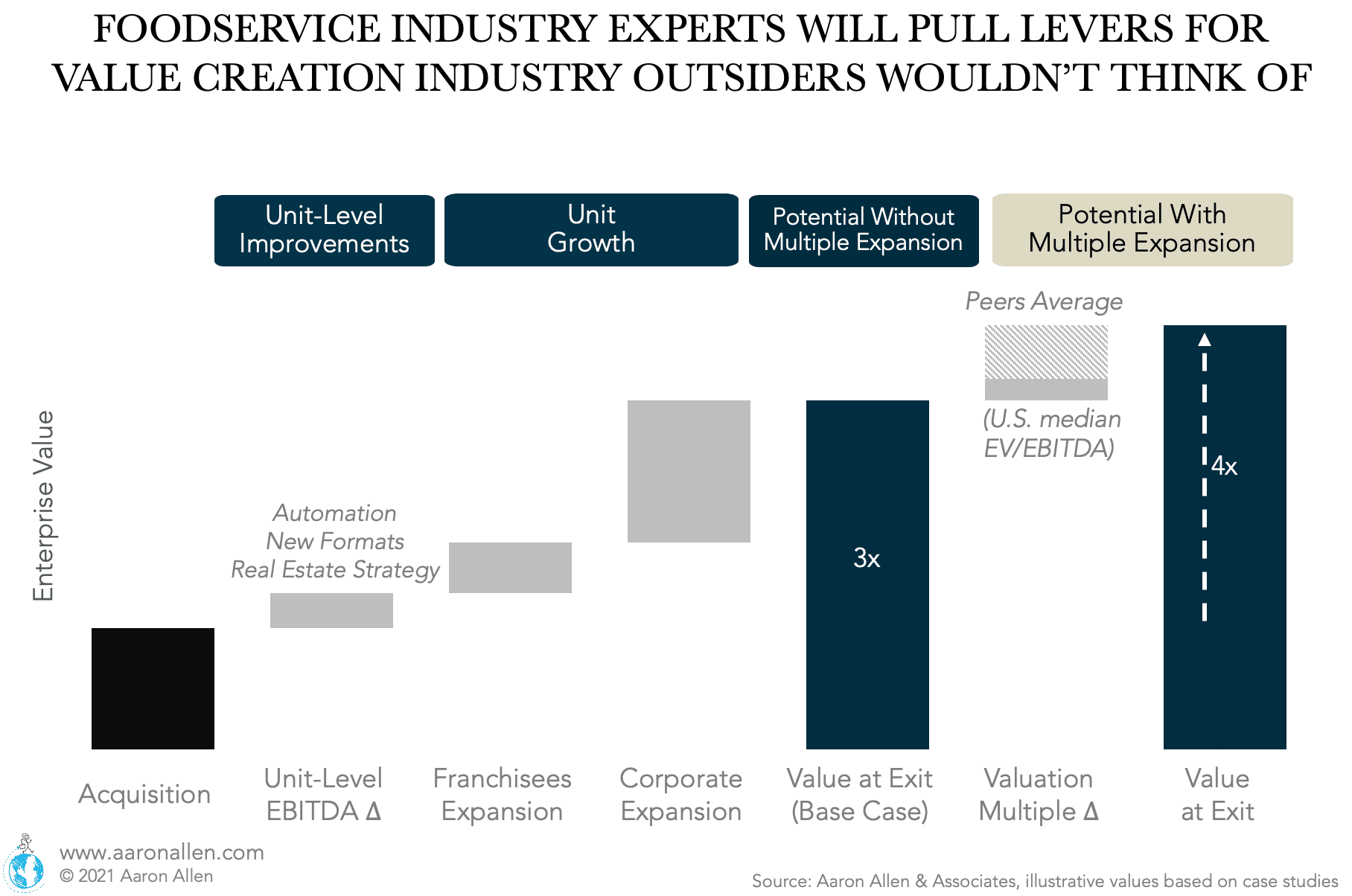

Even for investors that “see every deal”, they often put it through a traditional PE glass and may not pull the same value creation levers as industry experts.

Industry experts can see the diamond inside a lump of coal. The same way fixer-uppers can improve the value of a beat-up house, it’s often the case that industry experts can actually fix the foundation of a business (in a way that is not obvious even to the most seasoned investment bankers). There can be a consulting advantage when it comes to fast results on strategic value creation plans.

6. Getting Away from the Stale and Overused Private Equity Playbook

Anyone can strip out costs to increase EBITDA and ‘value’ — for some time. Companies trying to reach their A-game with technology or marketing modernization strategies don’t want to rely on PE firms applying “one size fits all” cost-cutting measures and tactics masquerading as corporate strategy. There’s a reason why not all pilots fly all types of planes, or land on all runaways and any conditions.

Instead, industry experts can build up the business from the inside out to build sustainable growth that is not just a short-lived sugar high.

7. Ripe vs. Rotten

If you had the chance to buy seafood at Kroger versus some off the back of a crab boat, what would you choose? Kroger is convenient, but you get three-day-old fish that’s been passed between trucks and handled along the way. The same happens with deals. Industry expertise is paramount to distinguish which companies are ripe for investment.

The highest ROIs are obtained when industry insiders work in the area of “what you didn’t know you didn’t know.” When shifting between categories, cuisines, geographies, and operating models, things aren’t always as they appear on the surface. A holistic and integrated approach is key to unlocking tremendous shared potential.

8. Now vs. Next

Industry insiders are going to know what’s next before it’s over popularized, the trends everybody is talking about now are 7 years old.

Starbucks would have never been born out of a focus group. Uber would have to be hit with every cynic’s stick before scaling continents. Delivery would be dismissed by casual dining CEOs in much the same way the former Blockbuster Video CEO dissed Netflix as “not even on their radar”.

It moves faster these days, but Henry Ford knew during an earlier industrial revolution: business models that put the guest/customer and employee first (engineering convenience and ‘a better way’) reshape and create markets that dethrone incumbents and dismissive brand leaders.

To be disruptive, you have to embrace experienced, yet unique, talent (both those inside the company and the external advisors and partners required to revolutionize a global industry).

9. Know-How and Know-Who

Foodservice experts know the ecosystem of the industry, which means advisors, strategic alliances and joint ventures. Know-who helps catapult adoption at a much faster rate than what industry outsiders can support.

It’s hard to conceptually think of how to do an investment in a space where you have no context. Years of experience globally with boots-on-the-ground across regions grant the know-how that allows industry experts to be like cats — instinctively landing on their feet.

10. (Speaking the) Language of the Land

There is a credence of credibility that comes from knowing your way around the kitchen and being able to talk with the wide range of constituents in the ecosystem. At Aaron Allen Capital Partners, we’re often the translator bridging the gap between inventors, investors, and operators.

If you are in a tourist spot wearing an expensive suit and get into a taxi, you’re going to pay “the tourist rate”. Someone who speaks the language of the land will help you pay local rate, not tourist. Risk mitigation requires industry insiders.

Ready to Invest in the Future of Foodservice™?

We’re seeing some of the most attractive foodservice industry investment opportunities that can be found in the world today. Our ambition to become the beacon for foodservice technology opportunities is coming true even faster than we could have imagined. It’s a beautiful thing when passion and profession come together on a meaningful endeavor intended to faithfully serve others.

About Aaron Allen Capital Partners

Aaron Allen Capital Partners is focused on making investments in purposeful companies with high-growth potential on a globally relevant and viable scale. Our aim is to help make the world better one bite at a time (investing across the spectrum of the global foodservice industry; from seed to sewer).

What types of investments can you expect to see from us? Impact investing, ESG, foodservice technology, robotics, automation, advanced analytics, artificial intelligence, SaaS, Internet of Things, blockchain, traceability, 5G, sustainability, food security, food safety, 3- D printing, geospatial tech, biometrics, modernized nutritional systems, and several other strategies too sensitive to share with regard to our industry investment thesis.

We’re so proud of the like-minded partners (portfolio companies and investors) that are lining up to participate in this movement to help Fund the Future of Foodservice™.