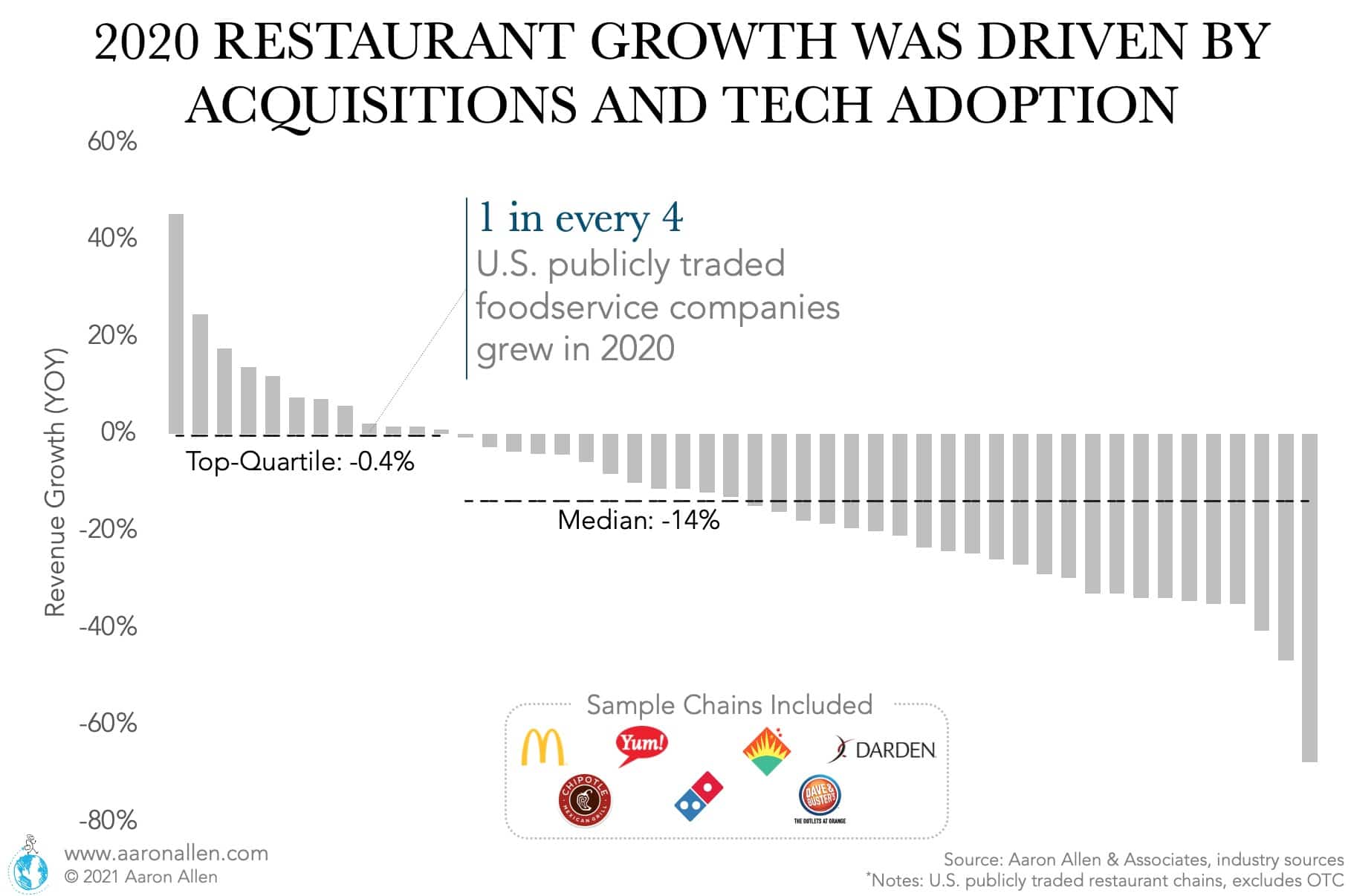

Restaurant technology and operations were not greatly impacted by the Second and Third Industrial Revolutions (when consumer and electronics products led growth). The sector is now in a prime position to make modernization efforts and — in doing so — becomes a target for investment.

The foodservice technology industry currently represents close to $500 million in revenue. However, this figure does not include cutting-edge new technologies that can be applied to the restaurant space.

We estimate technologies that could be applied to restaurants have a global TAM of $3 trillion (counting categories as diverse as POS Restaurant Management Systems to Automation & Robotics to 5G and ERP Systems, across industries).

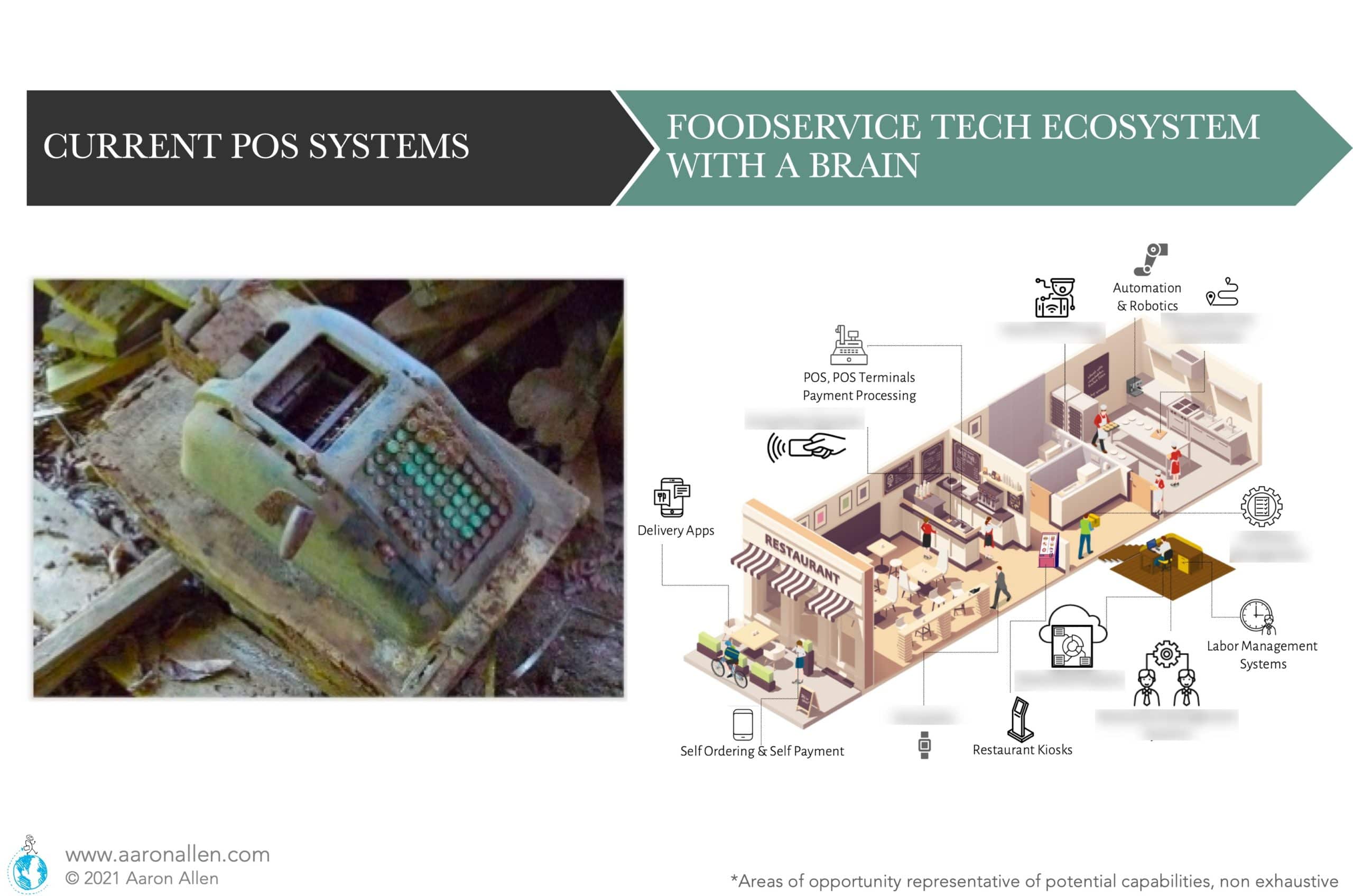

Restaurants have been historically slow to adopt technologies (we’re looking at you, state-of-the-art-2002 legacy point of sale systems), but increasing cost pressures across all major line items are going to force operators to make upgrades or be left behind by both their competition and their consumers.

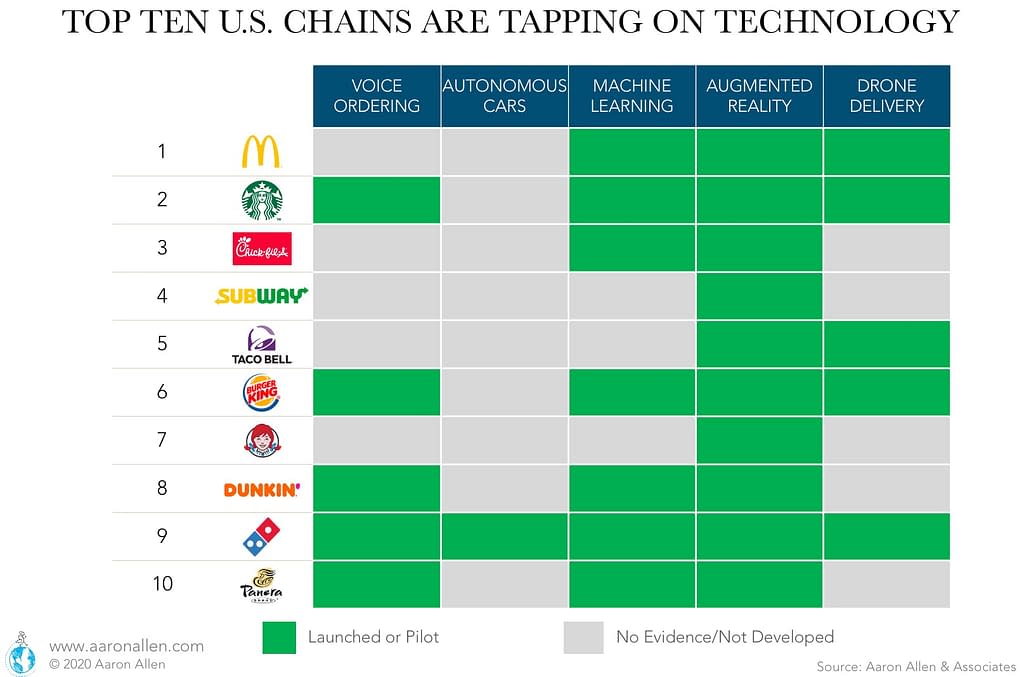

We’ve all seen the headlines about robots, digital ordering kiosks, and drones. But few restaurant operators are actually doing anything about it or taking the time to educate themselves about advances that will completely change the way they do business.

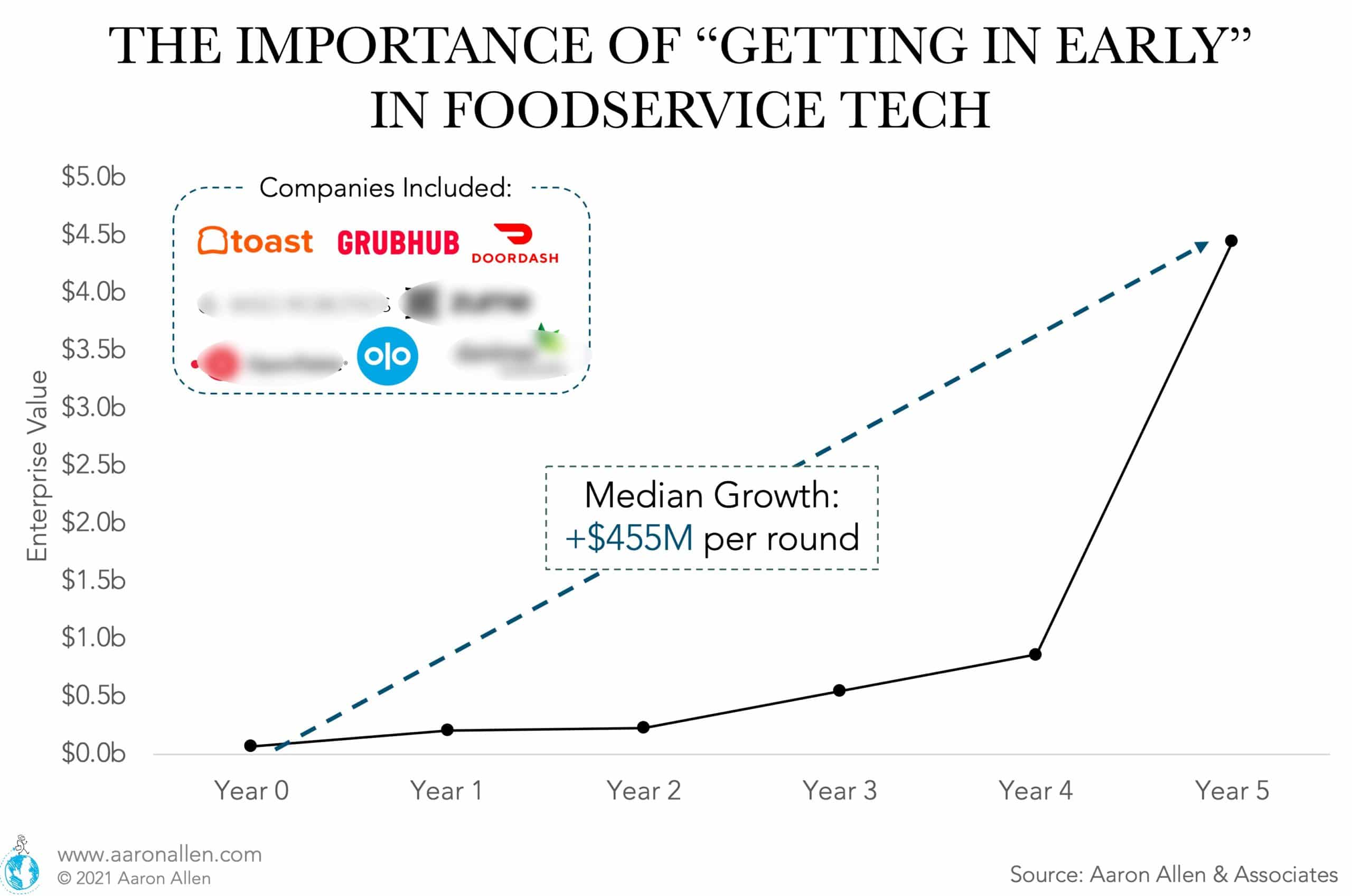

In many ways, the food and hospitality industries are playing catch up to recent technological advancements. The next five years will be a turning point for the industry — which means making investments today.

Technology in restaurants presents a tremendous opportunity for investors, technologists, and future-looking operators focusing on bold bets to transform adversity into advantage. These are some of the drivers fostering changes to technology in restaurants.

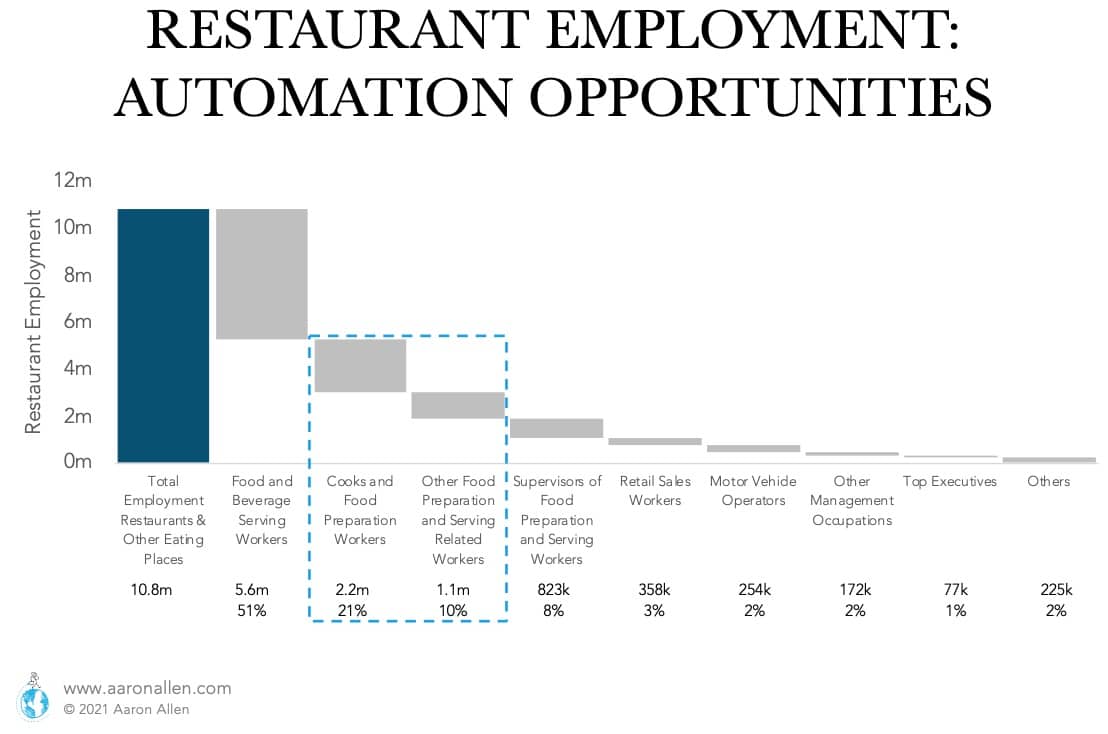

Higher labor costs is, arguably, a good thing for foodservice in the longer term. The result will be not only greater emphasis on training, engineering more efficient unit economic models, labor models, and productivity improvements — these efforts will also be benefited by a wide variety of exciting new tools that have not yet been adapted to or adopted by the industry.

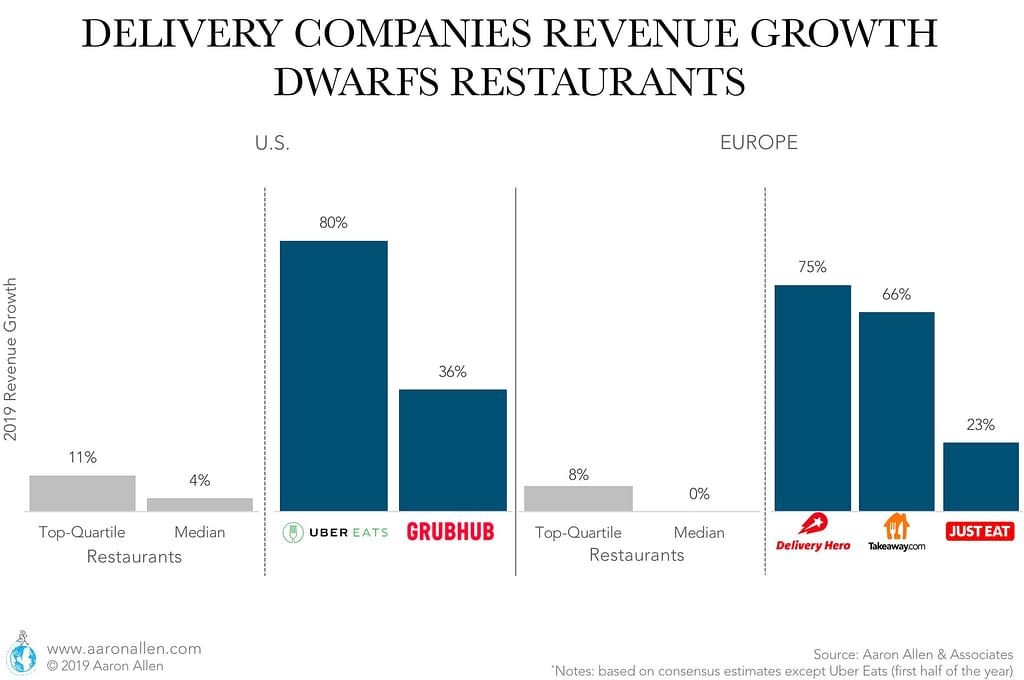

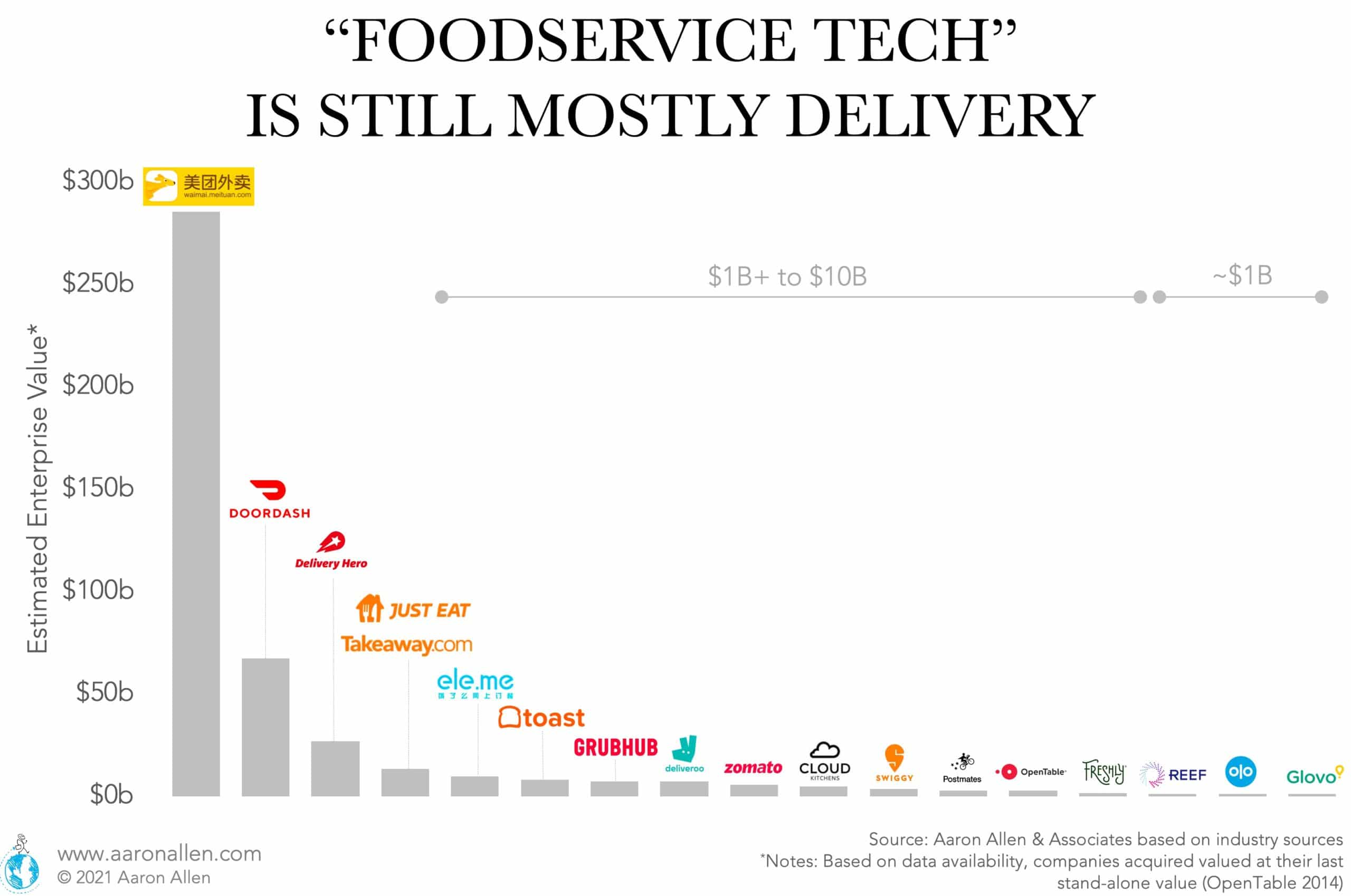

Unlike in restaurants — where, in the U.S. and other mature markets, the industry has reached a point of saturation such that any one company’s growth is coming at the expense of another — the delivery sector has not been a zero-sum growth game over the last few years. In the United States and Europe, delivery companies are reaching growth rates that are ten times the growth of the restaurant industry.

The entire segment is accelerating, and many restaurant operators are still battling with both the ups and downs of delivery. On the one hand, there’s the low-hanging fruit of incremental sales (particularly for the casual dining sector, which has net neutral on same-store sales growth over the last decade). On the other, there are the added operational logistics that many operators feel underprepared or ill-equipped for.

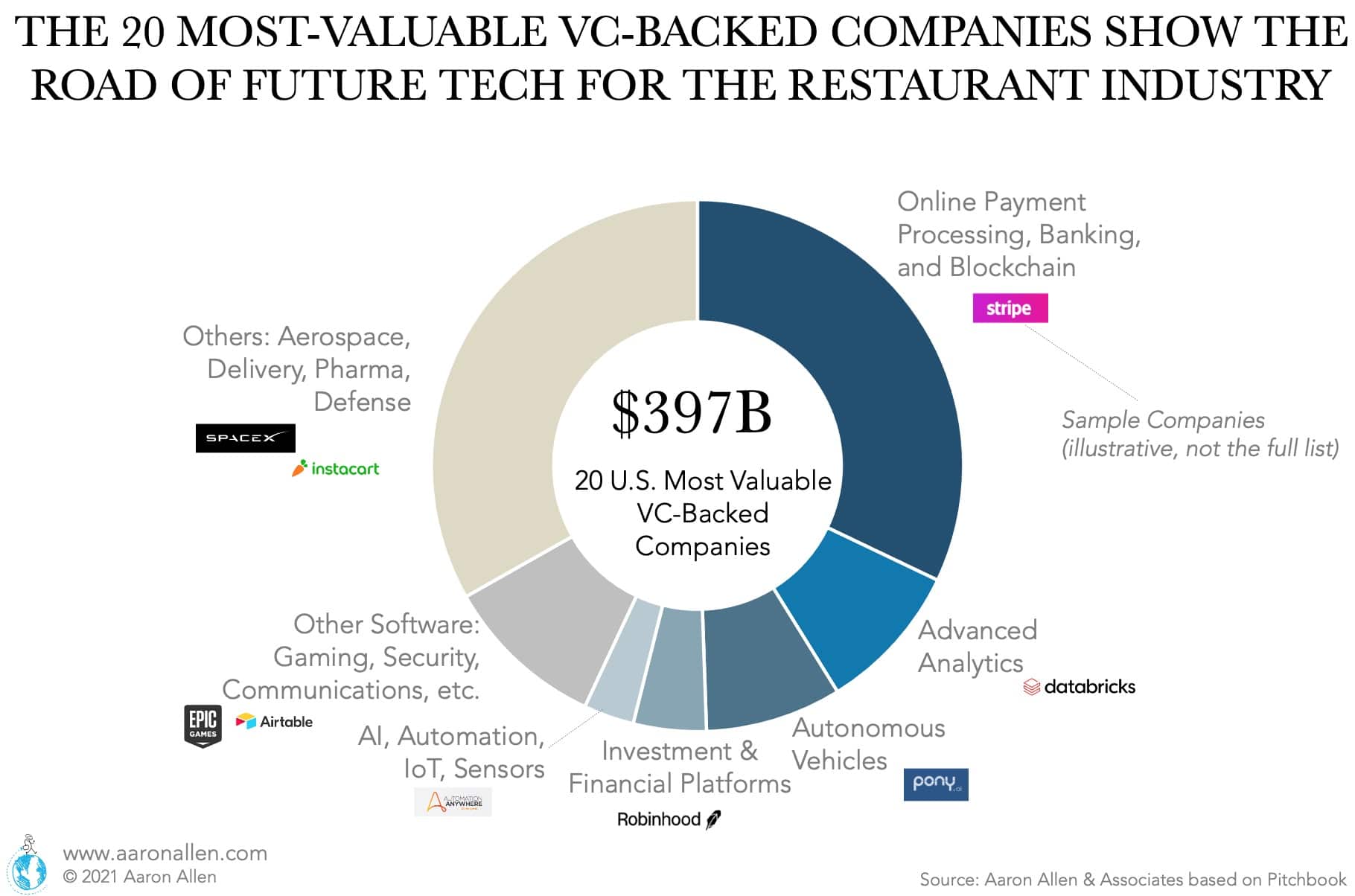

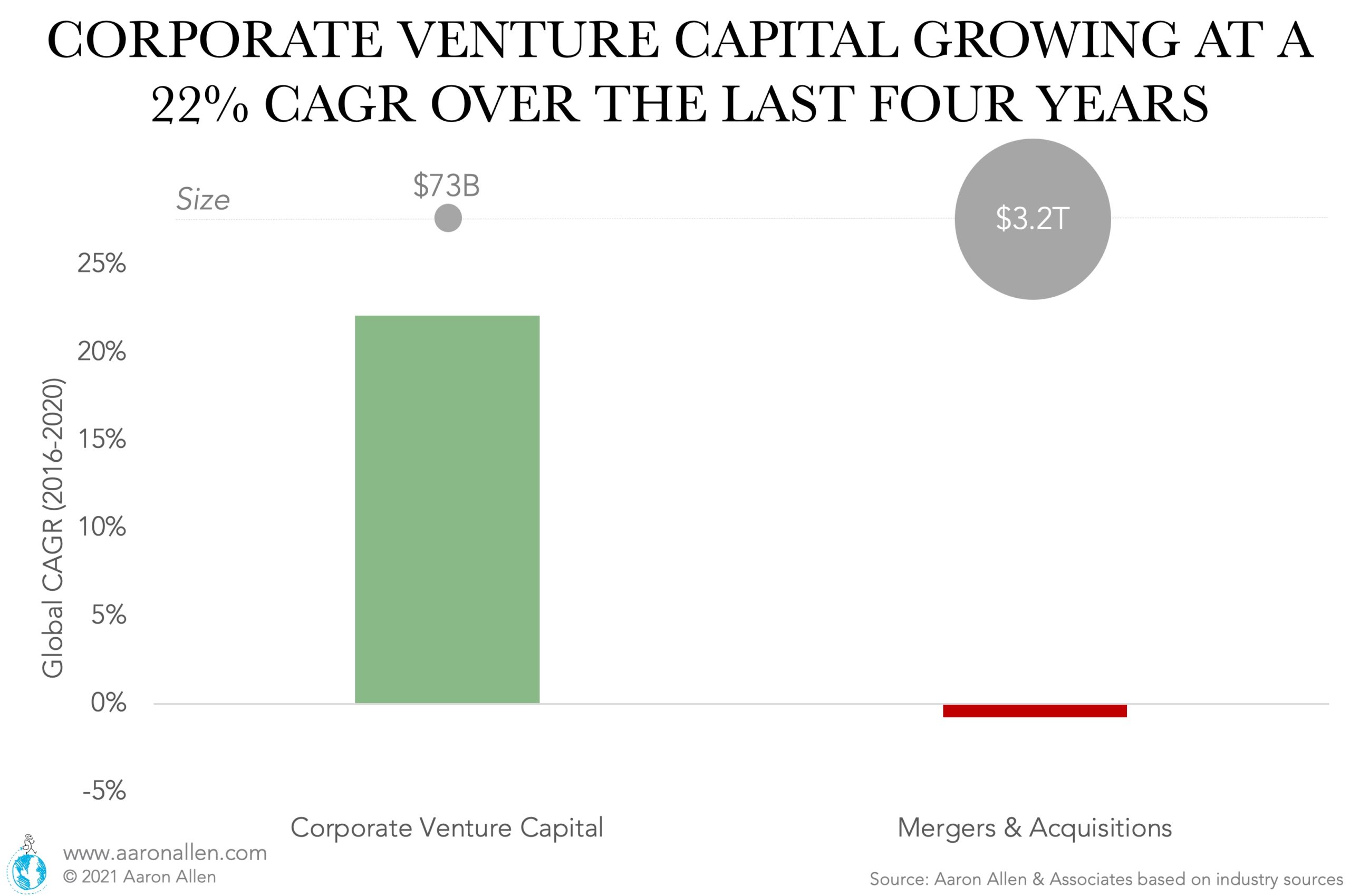

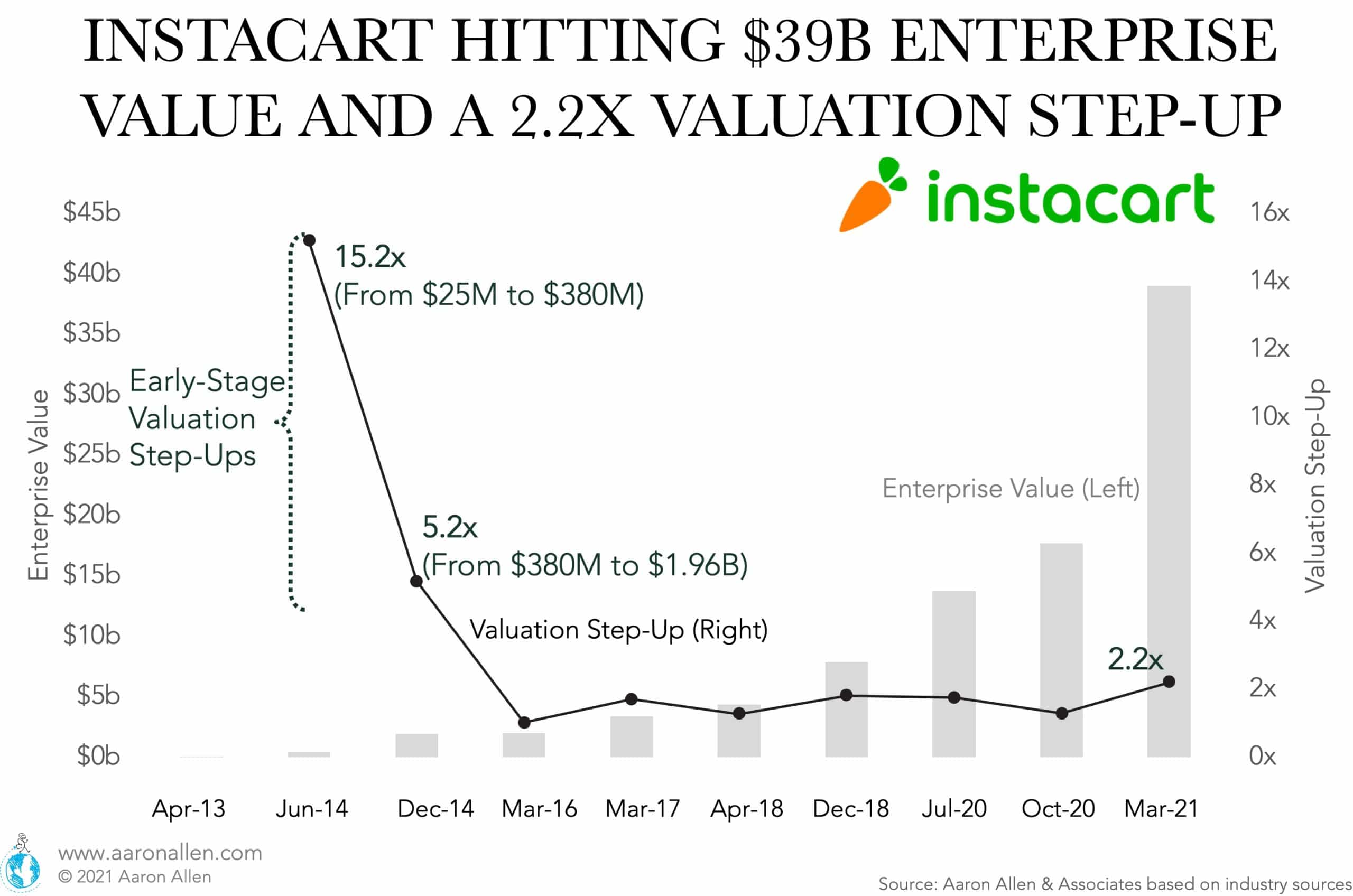

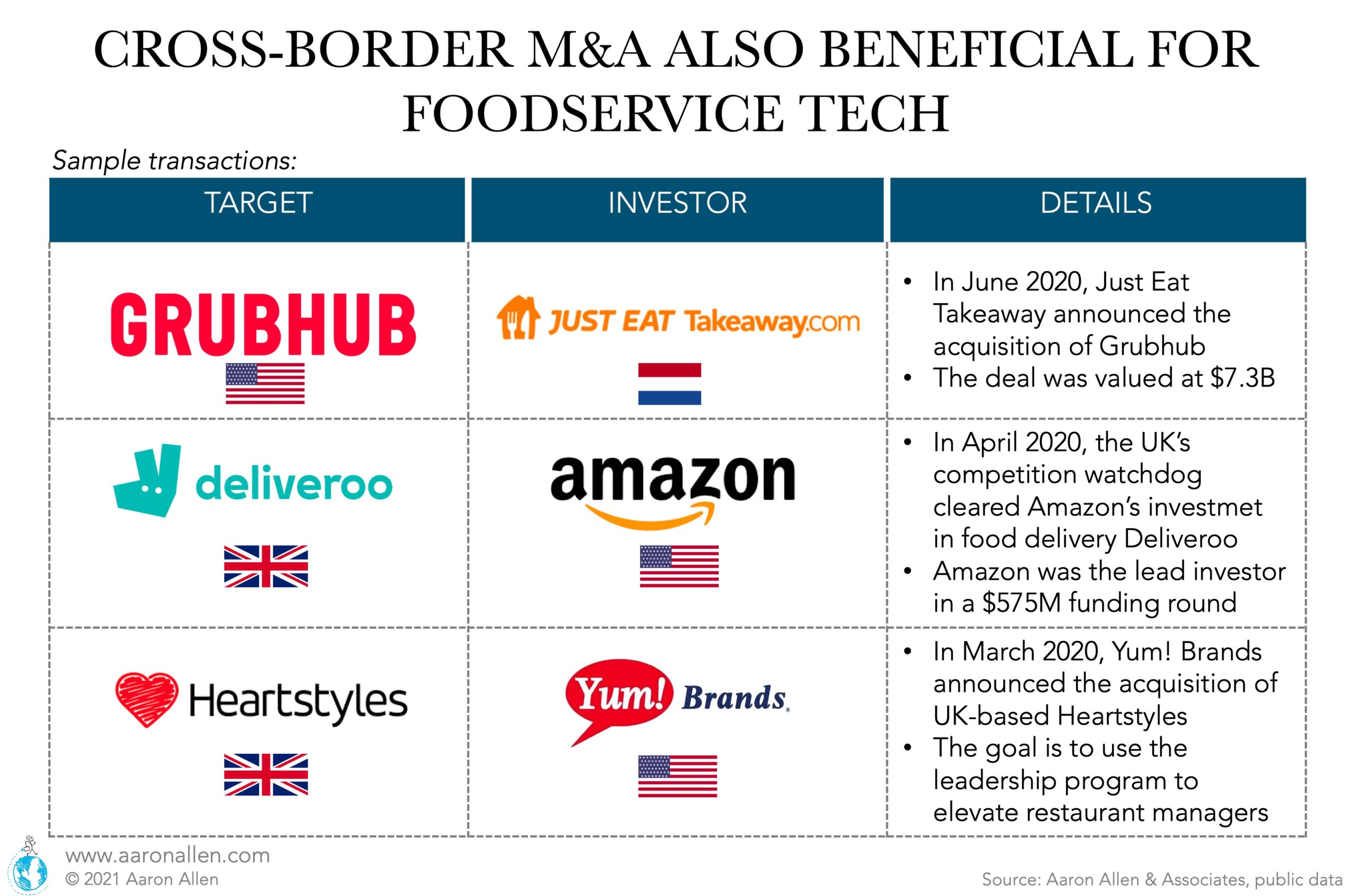

VCs are backing foodservice technology and seeing a variety of returns. Companies also invest in tech via CVC. The right CVC investment can unlock new layers of growth, open channel expansion opportunities, or drive improved systemwide efficiencies through new technologies. Several foodservice companies have pursued CVC programs because of this, including Starbucks, Chipotle, and Yum Brands.

New restaurant technology offers operators novel tools to drive the top- and bottom-line. New ways to carry out training, to engineer more efficient unit economic models, labor models, and productivity improvements will benefit from a wide variety of exciting new tools that have hardly been adapted to or adopted by the industry.

A POS system is vital for all restaurants. It includes software (often sold as SaaS) and hardware that allows to record transactions, process payment (credit cards or cash), often sends the order to the kitchen, prints a receipt, and more. Most modern POS blend restaurant management software, ordering, and payment.

Kiosks are self-ordering devices that allow guests to customize their order and free staff from having to take the order. Most of these systems are integrated with the kitchen and offer contactless payment. They are more successful at upselling than a human cashier would be and are also correlated with loyalty.

A kitchen display system allows the kitchen to keep track of orders via digital screens. It automates timing (when does the kitchen have to start preparing dishes) and helps the back of house organize and prioritize orders without printing order tickets.

Online reservation software allows customers to book a table via their phones or computer, without the need of calling the restaurant. Many of them have automated payment options, guest communications, and integrated channel management.

Enables saving labor time and avoids mistakes by automating what would be manual inventory management. Inventory Management Systems help keep track of stock, optimizing the amounts on inventory to avoid food waste. Many inventory software are integrated with the POS.

While QR codes had existed for years, they took off during the COVID pandemic. Guests scan QR codes on their phones and (via a link) are able to access menus, contactless payment, and other features.

Touchless or contactless payment enables guests to pay on their own, without interaction with another human and even avoid people touching surfaces. They involve the use of credit or debit cards (no cash) and include mobile payments, EMV payments, or QR code payments.

Online ordering allows guests to order food via a website, and mobile order enables to do so via phone apps. It can help grow revenue via off-premise consumption (delivery and takeaway). One alternative is to use third-party delivery platforms that allow ordering in advance (even if the guest is picking up the order); these usually charge a fee. Another option is to develop the restaurant app to order directly.

Artificial Intelligence (AI) refers to computer systems’ ability to interact with the environment in a way that would normally require human intelligence. Understanding speech, playing games, autonomous vehicles, and language translation are some examples.

In the restaurant industry, artificial intelligence is being employed in very diverse applications, from quality control to upselling, intelligent menu boards, license plate recognition, and loyalty programs.

Though voice-ordering it’s not a new restaurant technology trend, it hasn’t been fully leveraged yet. With voice ordering, customers can place an order via Alexa, Google Home, or Siri in just a few seconds and all via voice commands. The use of voice assistants (including those in smartphones) is projected to triple in five years.

For example, Advanced Analytics is applied in delivery software: UK delivery leader Deliveroo employs real-time analytics to identify bottlenecks and optimize food preparation time, as well as reduce food waste by means of purchasing ingredients based on predictive analytics. Upside: faster speed of service, multiply by 2x the number of meals produced by restaurants.

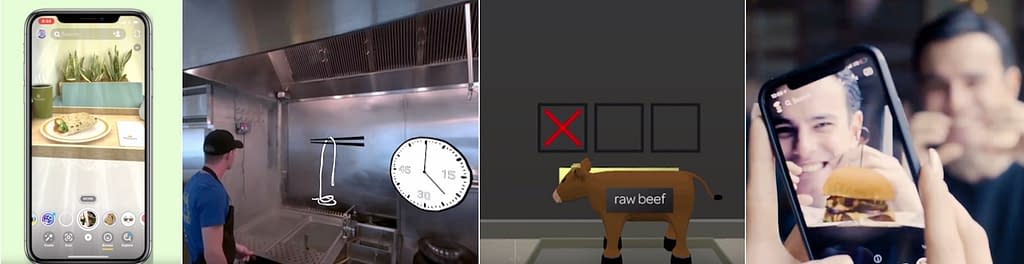

Augmented Reality (AR) consists of laying a computer-generated image over the user’s view or environment, resulting in a composite. Additional senses can be also leveraged, besides eyesight, including auditory, olfactory, or haptic features.

Virtual Reality (VR) also uses an interactive computer-generated image but doesn’t incorporate the user view. Sensory stimuli for sound are often employed as well.

The restaurant of the future will likely leverage this technology. A recent survey showed that 46% of restaurant owners expect facial recognition and 3-D will be used in most restaurants by the end of 2025 — for things like portion control, measuring guest sentiment, and checking food quality. Over 53% believe technology will increase restaurant flow; 53% think it will benefit design optimization, 51% see it aiding staff training, and 50% feel it will provide better entertainment for guests.

Geofencing uses GPS technology to create a virtual fence that allows software to respond when a device (often cell phones) accesses or moves around a location. It can be used to track how a guest moves in an establishment, track delivery orders, and increase traffic (by prompting users who are passing by).

Machine Learning is the application of artificial intelligence that develops programs that allow computers to access data and learn automatically. The objective is to identify patterns in large datasets. Predicting customers preferences, virtual assistants, supply chain opportunities, improving the online ordering experience, and social media insights are some of the applications.

A delivery drone is an aerial vehicle often used to distribute packages and seen as a key solution to “last mile delivery” problems. While the technology is not mainstream commercially (and needs further regulation), it has the potential to be revolutionary for eCommerce.

Autonomous or driverless vehicles drive themselves without human intervention, by means of their ability to detect the environment they are in. With the driver representing an estimated 22% of the average food delivery order cost, autonomous vehicles have the potential to reduce costs significantly. Similar cost reductions could be achieved on the supply and purchasing side.

Some examples of automation in foodservice are the following. In 2018 Pizza Hut unveiled a prototype for an automated kitchen operating on a Toyota truck. The concept, a “pizza factory on wheels” has a robotic arm, an oven, and a station to assemble boxes. Upside: Speed of service (pizzas take less than 7 minutes to be ready), labor cost reduction.

As of mid-2019, Quick Service McDonald’s was testing robot cooks that fry chicken and fish, toss fries, and serve beverages. The advanced kitchen equipment automates repetitive tasks. Upside: labor cost reduction, performance optimization.

A handful of companies have developed robots that cook or serve tables: Penny, Flippy, and Elf are a few examples of restaurant robots. The last one (Elf) takes orders and talks to diners. Upside: reduce labor costs, free waiters to take on other tasks.

Who have been the leaders in restaurant modernization? What has worked (or failed) in the past? While innovation — by definition — does not come from a case study, it can still be helpful to study past performance to inform future strategies.

With more than 70% of its U.S. transactions coming at the drive-thru, it’s not surprising that much of McDonald’s technological innovations have focused on this important sales channel. McDonald’s purchased Dynamic Yield in 2019 for $300 million, with the goal of using its personalization and decision logic capabilities to improve the customer experience and efficiency of its drive-thru lanes.

The company also acquired Apprente in 2019 to automate the voice ordering process, with the Apprente team also becoming the founding members of McD Tech Labs to further expand McDonald’s technology infrastructure and digital capabilities.

Starbucks was one of the early restaurant industry leaders with respect to mobile ordering and payments (including an early partnership with Stripe). Following an initial test in 2014 Starbucks expanded its mobile order and pay platform nationwide in 2015 and to other countries like China and the United Kingdom in subsequent years. In many ways, the introduction of Starbucks mobile order was an acknowledgment that some consumers had evolved past the “third-place experience” on which Starbucks built its brand and were looking for more convenience.

More recently, Starbucks has been using technology to better consumers’ different need states within its global store base, including digital-order focused Pickup stores and a partnership with Brightloom to make cloud-based solutions available for its license partners globally.

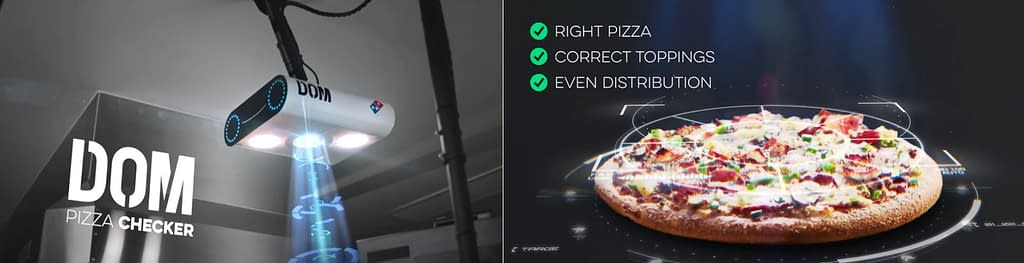

Domino’s has become one the restaurant chains most synonymous with technology in the past decade and closest to the “restaurant of the future”. In 2015, Domino’s Pizza USA President Russell Weiner famously declared that “[Domino’s is] more than a pizza company, we’re a technology company.”

Since 2010, the company began turning to technology to streamline the delivery process, seeing a nearly 17% year-on-year growth in revenues as a result. Over five years (2011-2016), Domino’s unveiled ordering via Twitter, Slackbot, Facebook, Amazon Echo, and Apple Watch — and the chain’s delivery market share increased 24% (and its stock prices soared 880%) in the same time period. Between 2010-2017 Domino’s stock performance was 3x the return of Amazon, Apple, and Google.

Domino’s was one of the pioneers with its digital ordering app (one of the first that allowed customers to “build and order their own pizza”, but has since become a leader in restaurant technologies through innovations like order tracking, delivery through autonomous vehicle or electric bikes, and delivery capabilities at non-traditional “hot spots” like parks and schools.

Struggling to reduce friction for to-go customers, Panera launched its “Panera 2.0” platform in 2011 to better integrate its digital ordering, payment, and operations technologies. Beyond increasing convenience — no small goal in the era of the time-constrained consumer — these innovations are improving customer satisfaction, increasing order size, and making operations more efficient.

In 2017, the company was acquired by JAB Holdings for $7.7B after it hit $1B in digital revenue, 6.67x the $150M technology investment the company made in 2014 with the launch of Panera 2.0.

Eventually, the technology expanded to include order-ahead kiosk and delivery capabilities, resulting in one of the most comprehensive and dynamic technology stacks in the restaurant industry, even when measured by today’s standards.

Russian-based Dodo Pizza has prided itself on being one of the fastest-growing restaurant chains in the world for the past several years. However, none of this growth would’ve been possible with its proprietary “Dodo IS” cloud-based ERP system, which provides the data for its mobile app, website, and contact center while also offering tools for kitchen workflow, delivery, and sales analytics.

Backed by a team of over 100 software engineers, Dodo will likely remain one of the leaders when it comes to applying tech to foodservice, including Internet of things, voice ordering, AI, and robotics.

In what once was a liability for the company, Jollibee’s tech stack has been a major factor behind the company’s growth from a regional powerhouse to global player with more than 5,800 locations across 34 countries Jollibee’s earlier technology focused on more traditional restaurant ERP functional areas like restaurant waste and productivity, back-end services, and procurement system.

In more recent years, however, Jollibee has become a global leader with respect to cloud kitchens and a hub-spoke delivery model (using in-house and third-party delivery services).

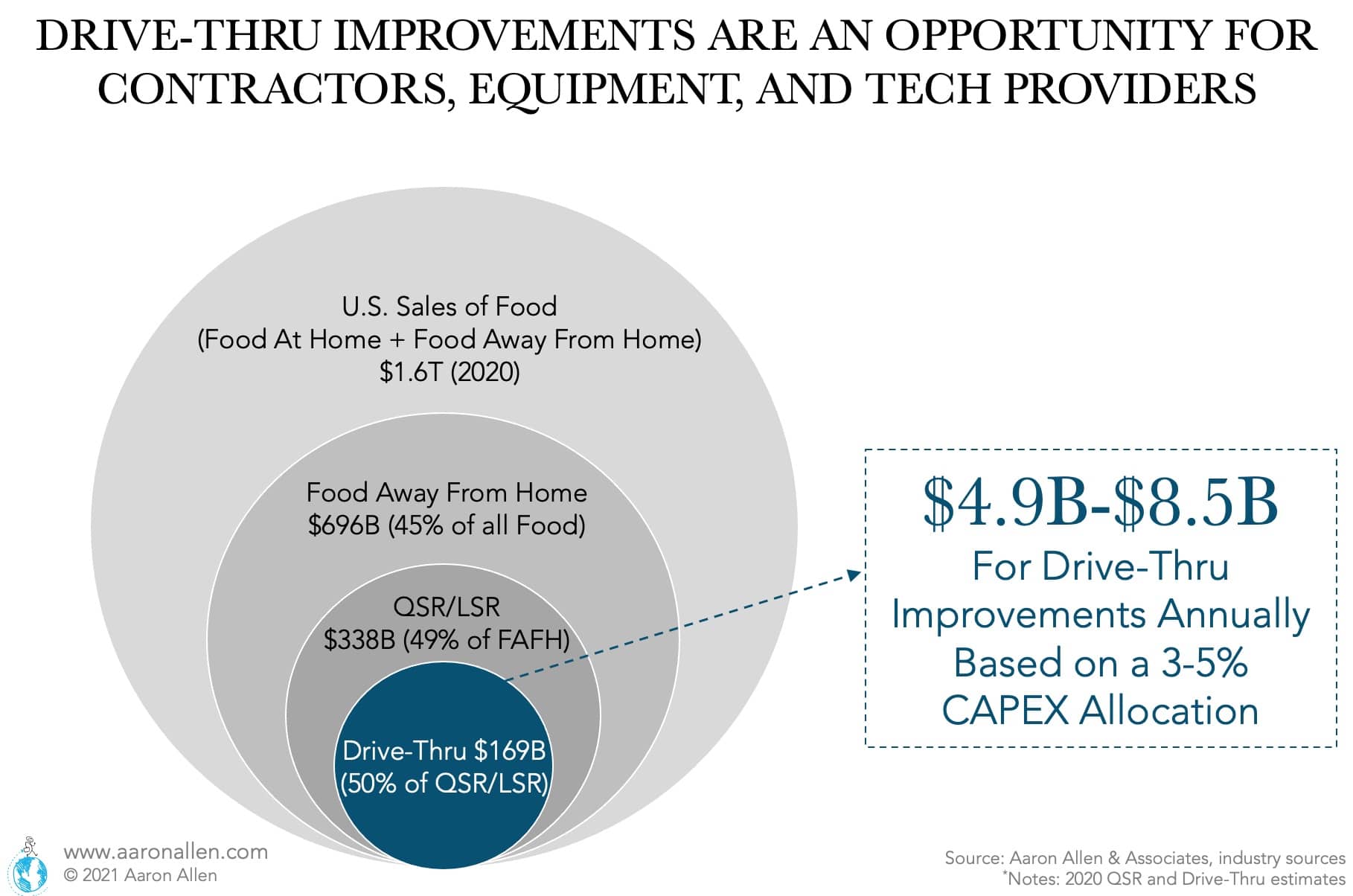

While restaurant delivery services grabbed many of the headlines during COVID-19, new drive-thru innovations like technology-enabled menu boards, AI-backed voice ordering, and separate drive-thru lanes dedicated for mobile orders and third-party aggregators may end up being one of the pandemic’s lasting legacies for restaurant technologies. With the QSR and fast-casual categories likely to hang on to some of the market share the past year, drive-thru technologies that help to maximize unit-level productivity are likely to gain more attention (and investment) in the years to come.

The following doesn’t intend to be a comprehensive list, but rather to present some examples of types of companies competing in each category.

What most immediately think of when considering restaurant tech is the point of sale system, or POS. Companies catering in this category include Clover, Qu, Revel Systems, Oracle Micros, SpotOn, Toast, Lavu, Shift4, TouchBistro, Square, Lightspeed, NorthStar, Upserve, NCR, Salido, SpotOn, Shopkeep, OrderSnapp, Brink POS, and Maitre’D.

Focused on the back of the house, leading inventory systems include Fourth, Bevspot, Restaurant365, Provi, Simple, SevenFifty, PlateIQ, Altametrics, MarketMan, XtraChef, FoodMaven, Sourcery, Lavu, BlueCart, BirchStreet, Compeat, Orca, SimpleOrder, Orderly, and CostBrain.

Helping to streamline accounting practices, companies include Sage, Wave, Procurify, NetSuite, FranConnect, Restaurant365, Plate IQ, FreshBooks, Deskera, Xero, Get Linked, Free Agent, QuickBooks, Crunch, and KashFlow.

Helping coordinate back-of-house functions, leading KDS companies include SR, Advantech, Bermatech, and FreshKDS.

Operating as both a B2B and B2C function, reservations systems for restaurants include Yelp, OpenTable, Waitlist Me, Resy, Tablelist, tripleseat, tock, Gather, TableUp, and Hostme.

Addressing one of the main pain points in the foodservice industry, labor management systems include Proliant, Poached, Harri, When I Work, Shiftboard, Swipeclock, Culinary Agents, Jolt, Snag, Sling, 7 Shifts, Schedule101, Push, Worksmith, Planday, Pared, Fourth, HotShedules, Stratex, Instawork, Shiftgig, Dolce, Humanity, Homebase, Bizimply, ScheduleFly, and Deputy.

Expanding beyond in-restaurant sales, catering software includes Foodify, Platterz, Foodsby, CaterCow, Foodee, Fooda, Forkable, Stadium, ZeroCater, Peach, Ritual, EZ Cater, Chewse, FoodtoEat, Monkey Media, Better Cater, and Spoonfed.

Another B2B and B2C bridge, sometimes referred to as “third-party aggregators, online food delivery companies include Doordash, Postmates, UberEats, Grubhub, Caviar, Deliveroo, Just Eat/Takeaway, Delivery Hero, Glovo, Waitr, OrderUp, Slice, MealPal, EatStreet, ChowNow, CardFree, MenuDrive, Bringg, Olo, Onfleet, Zuul, Relay, Ordermark, Flipdish, SpeedETab, and Seamless.

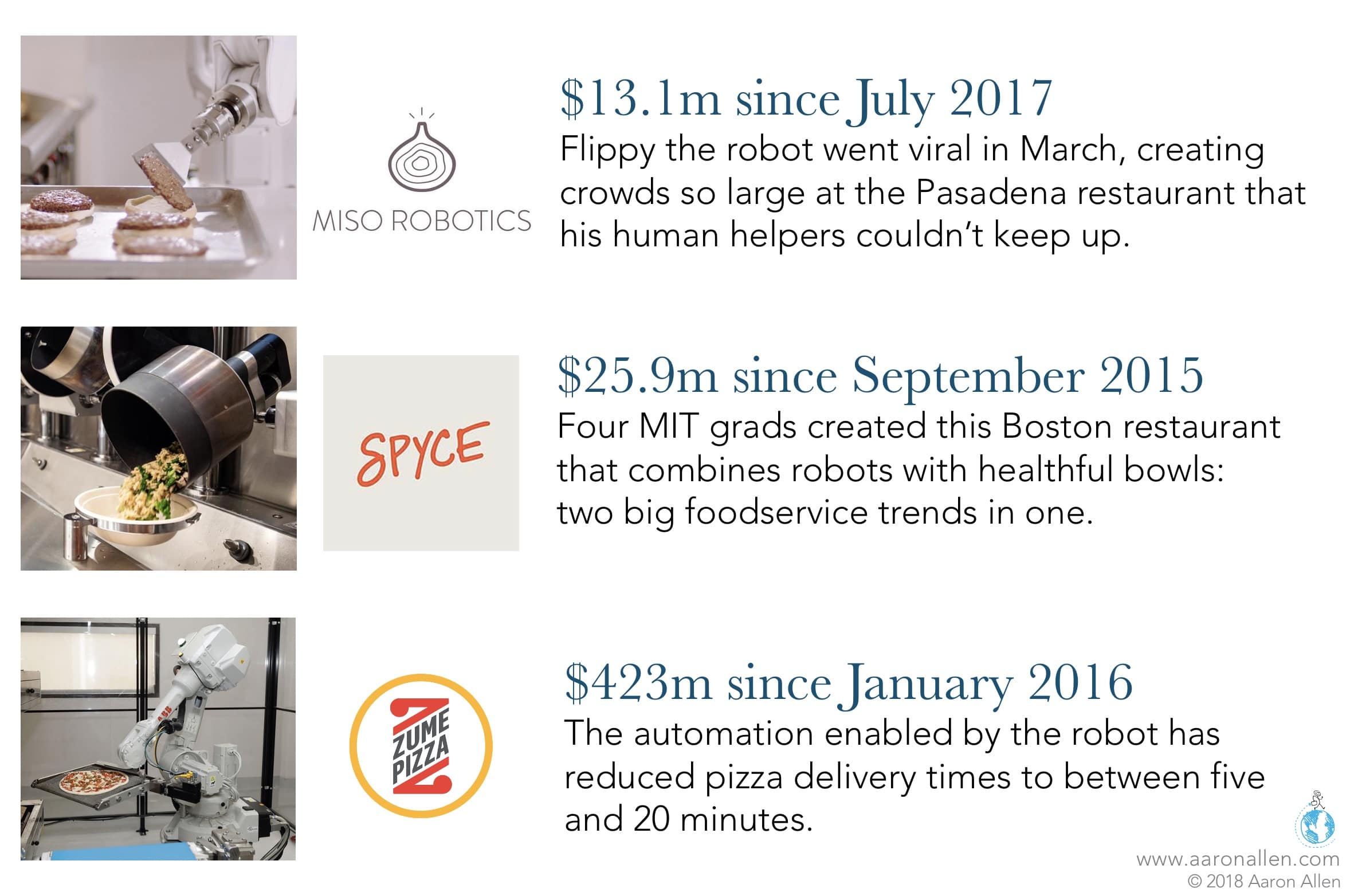

A relatively new but increasingly significant category in robotics includes companies such as Picnic, Chowbotics, Mashgin, Miso Robotics, Dishcraft robotics, Autec, Bear Robotics, Starship, Nuro, and Creator.

Sometimes overlapping with the POS system, but serving a dedicated function, ordering and payment software companies include Brightloom, Onedine, Ziosk, Presto, SpeedETab, Tray, TableSafe, Rooam, Zivelo, Bite, Advanced Kiosks, Alveni, Acrelec, Tapin2, and Olea.

Another emerging category in foodservice tech, leading ghost kitchen companies include CloudKitchens, Kitchen United, Reef Technology, Kitopi, Zuul, and Rebel Foods.

While not all dedicated to restaurants specifically, leading marketing technologies for the industry include Groupon, Bentobox, Punchh, Fishbowl, AppFront, Main Street Hub, Seated, Sevenrooms, OpenMenu, Thanx, PayTronix, SinglePlatform, Venga, Yext, Wisely, Mobivity, Hooked, Bridg, Incentivio, PosIQ, Fishbowl, Fivestars, Valutec, Google AdWords, and Mailchimp.

The costs of dismissing new restaurant technologies are often underestimated, and businesses can never make it too easy for people to buy from them. Here we include some examples and definitions to help make sense of the latest restaurant technology trends.

From outside-the business insights to shape corporate strategy, to inside-the-business analytics to improve efficiency and efficacy of effort and resource allocation, applying advanced restaurant analytics can be leveraged to improve top and bottom line.

Artificial intelligence refers to computer systems’ ability to interact with the environment in a way that would normally require human intelligence. Understanding speech, playing games (AlphaGo), autonomous vehicles, language translation are some examples. In the restaurant industry, artificial intelligence is being employed in very diverse applications, from quality control to upselling, intelligent menu boards, license plate recognition, and loyalty programs.

Augmented reality consists of laying a computer-generated image over the user’s view or environment, resulting in a composite. Additional senses can be also leveraged, besides eyesight, including auditory, olfactory, or haptic features.

Automated kitchens can prepare meals with little to no intervention of humans (usually using robotic arms). Automated kitchens are attracting a lot of investment, from Miso Robotics, creator of Flippy, to Spyce, where robots cooks the entire meal (though they still employ humans to help customers figure out the system). For many restaurant businesses the pace of adoption is slow, so consumers shouldn’t expect that their next meal will come from a robot. Upside: labor cost reduction, performance optimization.

Autonomous vehicles drive themselves without human intervention, by means of their ability to detect the environment they are in. With the driver representing an estimated 22% of the average food delivery order cost, autonomous vehicles have the potential to reduce costs significantly. Similar cost reductions could be achieved on the supply and purchasing side.

Payment flexibility has always been important to restaurant guests, but who among us hasn’t been met with a “We can only split the bill for parties of 8 or more” when visiting a restaurant? With apps like Venmo (which allows users to easily send money to others with just the touch of a button) growing in popularity, it makes sense that restaurants would offer easier ways for guest to go Dutch. There are several apps aiming to allow restaurants to deliver a more customized payment experience, including Divvy, Billr, and Plates.

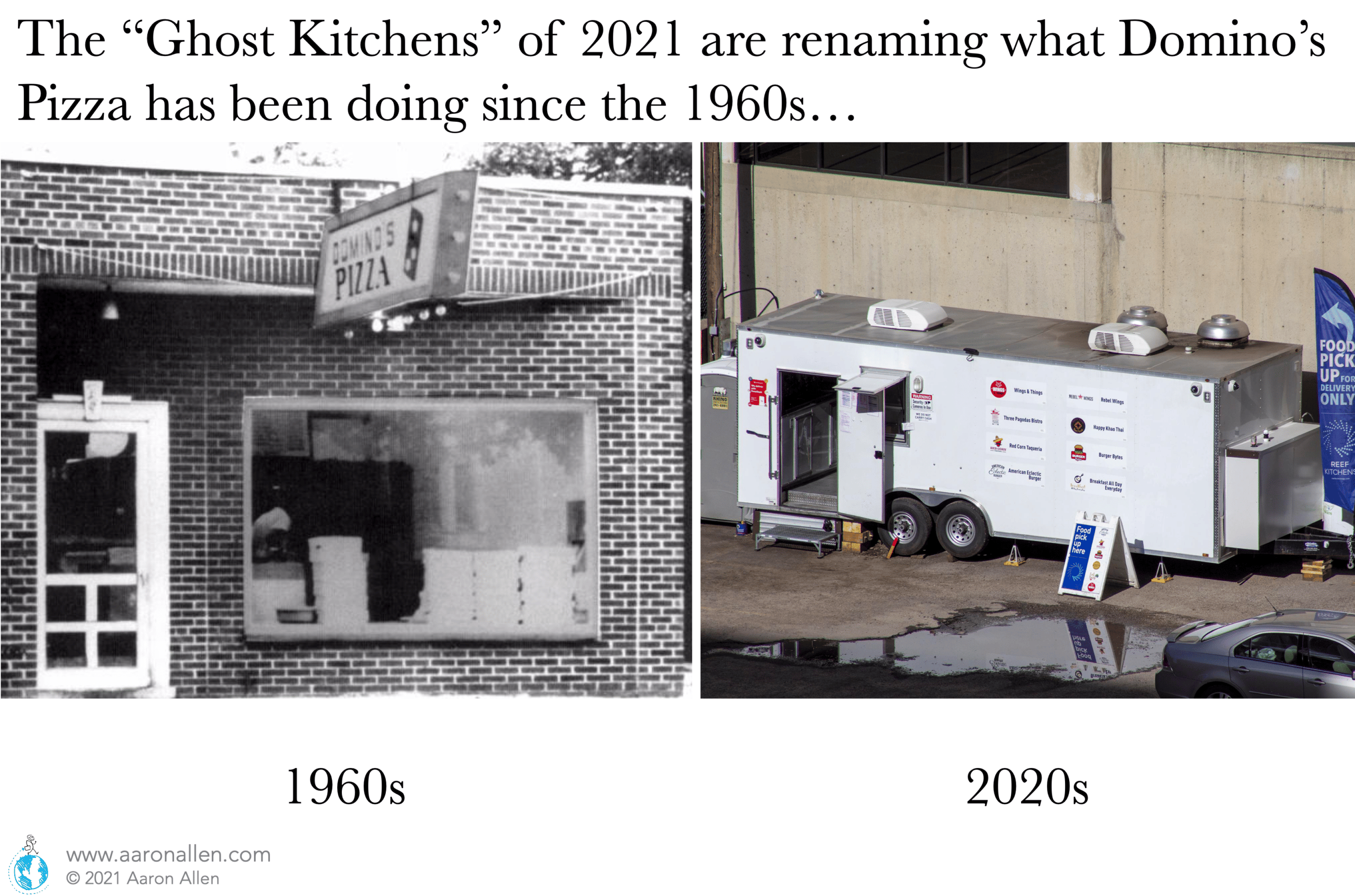

What we’ve said in the past to be the biggest buzzword of the restaurant industry for a time: these are delivery/takeaway-only restaurants that don’t have any sitting space. For most, guests order via third-party platforms. Though this has basically been Domino’s model for decades, ghost kitchens’ popularity grew significantly after the COVID-19 pandemic. This also made room for the creation of brands that work exclusively as ghost kitchens. The industry of dark kitchens was estimated to be $40 billion in 2019, and some estimates indicate that it could grow to be a quarter of the global foodservice industry by 2030.

Contactless transactions take place when two devices are close to each other, but don’t need to touch to process the transaction. In restaurants, it is widely used for payment, though the term has been introduced to food delivery (“contactless delivery”) as well.

This field refers to the ability of computers to understand images, video, and live streaming. It can help automate tasks that the human eye regularly does. There are very few applications to the restaurant industry so far.

Buying or selling services or products over the internet. Food delivery services would enter this category.

This is a technology that allows identifying faces from images or video. The restaurant of the future will likely leverage this technology. A recent survey showed that 46% of restaurant owners expect facial recognition and 3-D will be used in most restaurants by the end of 2025 — for things like portion control, measuring guest sentiment, and checking food quality. Over 53% believe technology will increase restaurant flow; 53% think it will benefit design optimization, 51% see it aiding staff training, and 50% feel it will provide better entertainment for guests.

A delivery drone is an aerial vehicle often used to distribute packages and seen as a key solution to “last mile delivery” problems. While the technology is not mainstream commercially (and needs further regulation), it has the potential to be revolutionary for eCommerce.

Geofencing uses GPS technology to create a virtual fence that allows software to respond when a device (often cell phones) accesses or moves around a location.

Geolocation consists of determining the location (geographical coordinates) of a device often to help locate human users. The process usually employs GPS, IP addresses, radiofrequency, or MAC addresses.

IoT is a blanket term that refers to a series of objects equipped with sensors and software to “talk to each other”. The objects connect to other objects and devices and are able to exchange data via the internet.

The most “modern” appliance in the restaurant industry has a green screen on it. There is an opportunity to combine smart features into “dumb” equipment to make them smarter. Many suppliers are realizing it’s time to invest into R&D, product, and channel development. It’s a question of who can prepare fast enough.

These systems allow inventory control by centralizing and controlling the flow of goods (mostly food ingredients), reducing food waste (by comparing theoretical food costs with actual ones and evaluating the variances), and facilitating kitchen operations.

Usually presented in digital screens, systems that connect to the point of sale (POS) in commercial kitchens, ultimately streamlining communication between front- and back-of-house, monitoring preparation times, and reducing order preparation mistakes.

Machine Learning (ML) is the application of artificial intelligence that develops programs that allow computers to access data and learn automatically. The objective is to identify patterns in large datasets. Predicting customers’ preferences, virtual assistants, supply chain opportunities, improving the online ordering experience, and social media insights are some of the applications.

When payment takes place with a mobile device rather than cash, check, or credit card. Examples are ApplePay and Samsung Pay.

Mobile Order-and-Pay technologies keep growing. Starbucks and Domino’s have pioneered mobile order and pay. Already in 2017, Digital payments made up nearly a third of Starbucks’ sales. The coffee giant opened the app’s mobile order-and-pay capabilities to non-Rewards members in 2018 and saw the share of digital ordering almost double: mobile order and pay represented 13% of company-operated transactions in the U.S. in 2018, as opposed to 9% in 2017.

When customers can purchase using the internet, visiting the restaurant website, or using an app, selecting food items, arranging for pickup or delivery, and making the payment. Loyalty programs have leveraged online ordering to make purchases easier and faster and increase frequency as well as average check size.

The convenience restaurant technologies offer has had profound effects on consumer behavior. For one, with online and mobile ordering guests are less concerned about being judged for their order when they place it digitally. Pizza chains such as Domino’s, Pizza Hut, and Papa John’s reported that spending on the average order is 18% higher online than via the phone.

Almost half of consumers also cite improved experience with digital order. They save time and skip long lines by picking up their already prepared and paid-for food. The ability to browse the menu at their own pace is another benefit of digital ordering, as is improved order accuracy.

From the business’s perspective, these technologies provide insights into consumers’ ordering habits and preferences, allowing for more tailored product offerings.

Restaurant POS systems are computerized programs that allow recording transactions and payments (credit and debit, cash, even paying via phone or online). Nowadays, POS software is capable of integrating sales data, customer information, inventory tracking, payroll, cash flows, and consumer sentiment all in one.

Consists of the use of machines to perform (usually repetitive tasks) done by humans. We’ve been writing about automation and robotics in the restaurant industry for a while now. Robots can do the dangerous, boring, monotonous jobs that people don’t want to do.

Self-ordering capabilities are becoming mandatory for QSR and fast-casual operations. In 2020, it was reported that the global self-service kiosk market was close to $27 billion.

Manufacturers continue to upgrade and polish their products while POS system providers have been working on units that incorporate mobile ordering, kitchen display systems, and back-office IT management systems.

Research shows that kiosks can produce check increases of up to a third, with some reaching even higher growth. Self-service orders tend to have higher margins than counter orders because kiosks are so cost-effective, allowing a higher volume of orders without increasing the number of front-of-house employees, building higher sales per labor hour.

VR uses an interactive computer-generated image to show a 3D setting in which the viewer can feel immersed.

Customers can place an order via Alexa, Google Home, or Siri in just a few seconds and all via voice commands. The use of voice assistants (including those in smartphones) is projected to triple in five years.

In today’s day and age, there can be a tendency to be dismissive of the forces actively reshaping the industry — things that once sounded like science fiction (neuromarketing, machine learning, automation, and so on) are becoming more and more part of the conversation, and part of the actuality of disrupting many chained restaurants in the era of the Fourth Industrial Revolution.

While most foodservice executives recognize the need for innovation to keep pace with evolving consumer demands and behavior, many resist creating these new ideas on their own: they’d rather someone else take the risk than stake their capital. Not only does this leave them with pale imitations of strategy tailormade for a competitor, but it also means they miss out on the incredible valuations that come from being a leader in the field. The moment to act is now.

We work at the intersection of capital, concepts, and management teams for foodservice operators, technology providers, and investors.

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims, specializing in brand strategy, turnarounds, commercial due diligence, and value enhancement for leading hospitality companies and private equity firms.

Our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.

We are focused exclusively on the global foodservice and hospitality industry. You can think of us as a research company, think tank, innovation lab, management consultancy, or strategy firm. Our clients count on us to deliver on our promises of meaningful value, actionable insights, and tangible results.

Founded and led by third-generation restaurateur, Aaron Allen, our team is comprised of experts with backgrounds in operations, marketing, finance, and business functions essential in a multi-unit operating environment.

We bring practical, relevant experience ranging from the dish room to the boardroom and apply a holistic, integrated approach to strategic issues related to growth and expansion, performance optimization, and enterprise value enhancement.

Working primarily with multi-brand, multinational organizations, our firm has helped clients on 6 continents, in 100 countries, collectively posting more than $300b in revenue, across 2,000+ engagements.

We help executive teams bridge the gap between what’s happening inside and outside the business so they can find, size, and seize the greatest opportunities for their organizations.