Restaurant Investment is altering the industry landscape. For restaurant investors and restaurant businesses in general, this is a good time to modernize your restaurant and consumer foodservice industry investment thesis (and there is a lot more afoot than delivery, ghost and cloud kitchens, 70 million Americans changing diets, food halls, alternative formats, alternative proteins, the increase in vegetarian and vegan consumers, urbanization, AI, etc.).

Whether the long-term goal is to become the #1 foodservice company in a region, be the most successful restaurant IPO in history, or build brand equity globally, restaurant investment is a key element of the business plan to:

The smart money is scanning the horizon not just for what is but what’s next and has undaunted determination to disrupt what’s now.

The following articles and research cover how restaurant CEOs are making investment decisions from acquisitions to CAPEX allocations to IPOs and taking on private equity partners.

The restaurant M&A fever is catching across geographies, cuisines, categories, and ownership types — and burning white-hot from foodservice tech startups and corporate venture capital initiatives to budding emerging brands and even the consolidation of mature and distressed brands around the world. All types of investors with different investment strategies (private equity funds, institutional investors, family offices, high-net-worth individuals and larger foodservice operations) from inside and outside the industry are looking for chains to invest in, grow and expand into new geographies.

Restaurant finance can help inform a myriad of decisions. From restaurant performance measurement and management analysis to strategic planning and due diligence and feasibility studies, modeling the profit and loss statements and benchmarking and analyzing performance gaps hand in hand with operational key-performance indicators is the place to start.

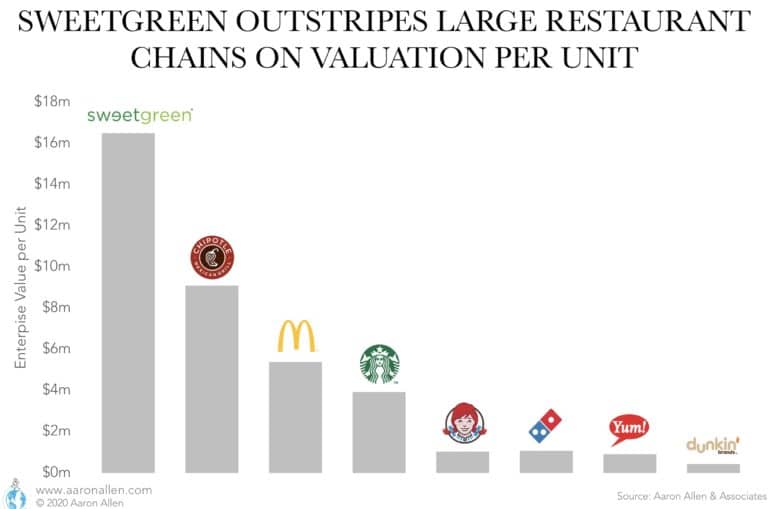

As Private Equity activity continues to flourish in the foodservice sector, restaurant valuation multiples have followed suit — rising even when deal volumes drop. Premiums for high-quality targets are on the rise, with valuations reaching their highest multiple (11.1x) since 2007. Investment opportunities are strongly tied to valuations. We present what are the valuation trends impacting restaurants.

The CAPEX-to-revenue ratio of publicly traded restaurants in the U.S. decreased in 2017 (for the first time since 2008) by 29%, and has remained at low levels since then. While the majority of businesses are decreasing CAPEX investments and debating over where they should be allocating funds — whether to infrastructure improvements or buybacks or dividends — market share winners are gaining traction with investments in guest experience enhancements, technology, infrastructure, and other competitive moat- building strategies.

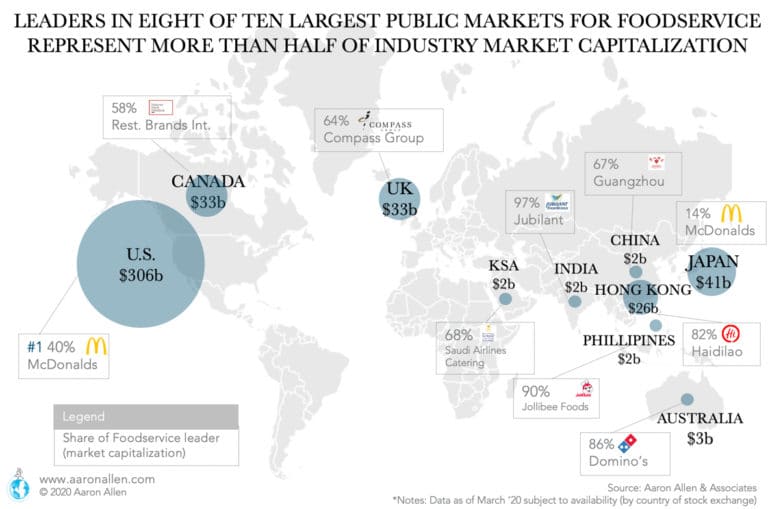

Some of the most prominent foodservice companies in the world also have a dominant presence on global stock markets. We explored those foodservice public companies in the largest ten stock exchanges in the world and present restaurant stocks insights for long-term shareholders and stakeholders.

Who are the players growing the fastest? Disrupters. Among them, the rise of alternative formats that traditional industry tracking sources are failing to keep up with (in other words, consumption is increasing, just not in traditional formats and channels).

Through our extensive experience conducting restaurant commercial due diligence engagements, we’ve found that the same findings continue to crop up again and again.

In the restaurant industry more companies are going private than making initial public offerings. The pains of going public these days can be avoided while still gaining funding as there are trillions in private equity capital ready to be invested globally (and billions earmarked for foodservice).

How could you grow your business with a $50m private equity investment? Would you expand into new markets, roll out the prototypes you’ve been dreaming of, or deploy new technology to make it even easier for diners to get your food? Here we offer a brief overview of PE funds operations, focusing on each stage of the deal.

Signing a deal with a private equity firm can, naturally, have profound effects on the organization operationally in addition to the impact on value creation strategies and resources. The process has its risks, and teams can often disagree on how to reach goals. Here’s a guide to help restaurant executives prepare for taking on a private equity investment and some special considerations for middle market restaurant companies.

With the new normal in the GCC being received as unsettling to operators in the region, we foresee consolidation being a major theme across the restaurant industry — and that the biggest winner will be the group with the best acquisition strategy.

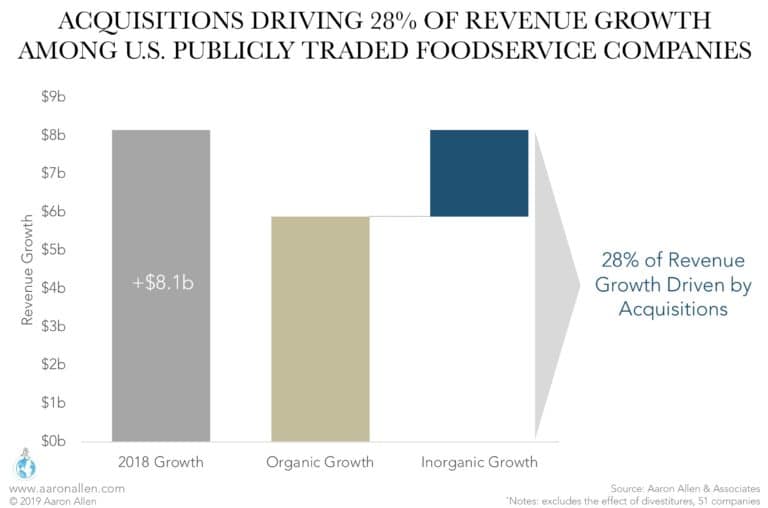

Between 2004 and 2016, the deal flow (number of restaurant acquisitions and mergers) in the US increased by 86% and deals have become increasingly more strategic (rather than financial). We rounded up the restaurant M&A activity of the past two decades including some well-known exits and significant rates of return.

Private Equity investors have found a niche in the restaurant industry, and assets under management are increasingly cropping up in Asia, the Middle East, and South America. These are some of the largest private equity firms that have been the most active in the restaurant industry.

Food tech is making its mark on the restaurant industry in a major way. In fact, we’re witnessing such a seismic change that the full ramifications of how tech will impact restaurants still remains to be seen.

On the sell-side, with valuations at a ten-year high (U.S. restaurants EV/Sales averaged 1.5x in 2019 though the effects of the coronavirus will be negative), it could be a good time to evaluate an exit.

On the buy-side, it may be worth paying a premium for the right platform (in high-growth geographies and segments) and incremental add-ons. A creative and modernized investment thesis, due diligence, and custom market landscape insights are requisite for an acquisition and expansion strategy that leapfrogs the competition.

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims, specializing in brand strategy, turnarounds, commercial due diligence and value enhancement for leading hospitality companies and private equity firms.

Our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.

We are focused exclusively on the global foodservice and hospitality industry. You can think of us as a research company, think tank, innovation lab, management consultancy, or strategy firm. Our clients count on us to deliver on our promises of meaningful value, actionable insights, and tangible results.

Founded and led by third-generation restaurateur, Aaron Allen, our team is comprised of experts with backgrounds in operations, marketing, finance, and business functions essential in a multi-unit operating environment.

We bring practical, relevant experience ranging from the dish room to the boardroom and apply a holistic, integrated approach to strategic issues related to growth and expansion, performance optimization, and enterprise value enhancement.

Working primarily with multi-brand, multinational organizations, our firm has helped clients on 6 continents, in 100 countries, collectively posting more than $300b in revenue, across 2,000+ engagements.

We help executive teams bridge the gap between what’s happening inside and outside the business so they can find, size, and seize the greatest opportunities for their organizations.