As countries around the Middle East expand their identities and economies beyond oil production, the world has taken note. This has been seen through a regional construction boom, increased tourism and an uptick in Western-style consumerism — and private equity has found a home in the region’s restaurant industry, as a result.

Activity in the food and beverage (F&B) industry focuses on the tier one and two Gulf Cooperation Council cities. Throughout the region dining out is often one of few options for entertainment, and a growing population has the disposable income to indulge.

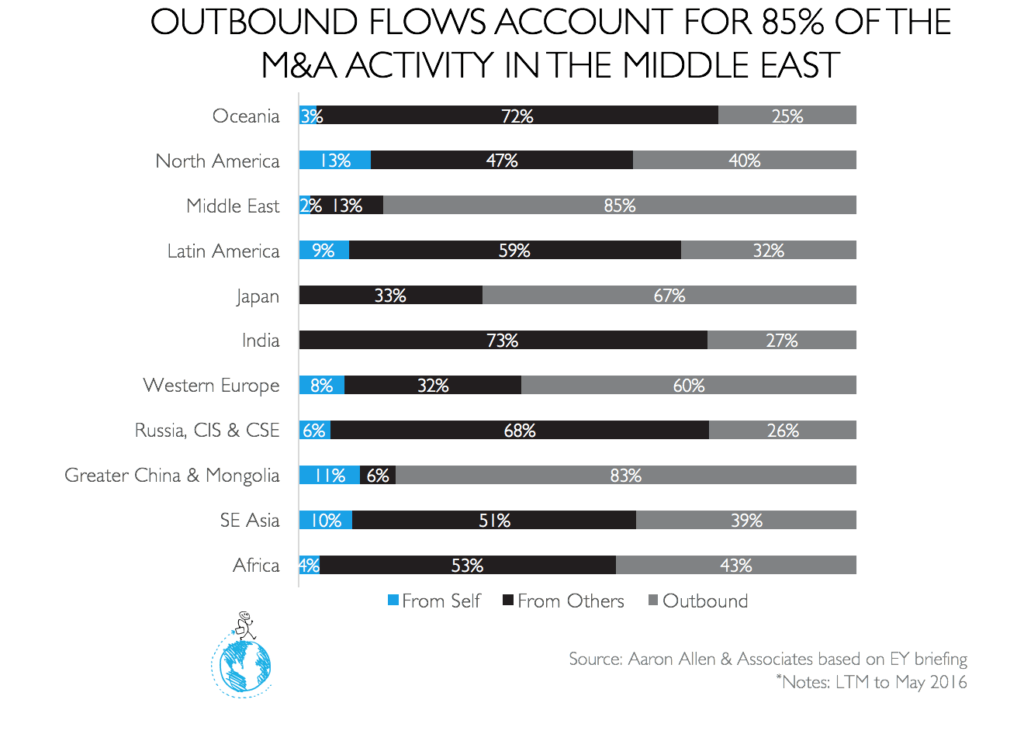

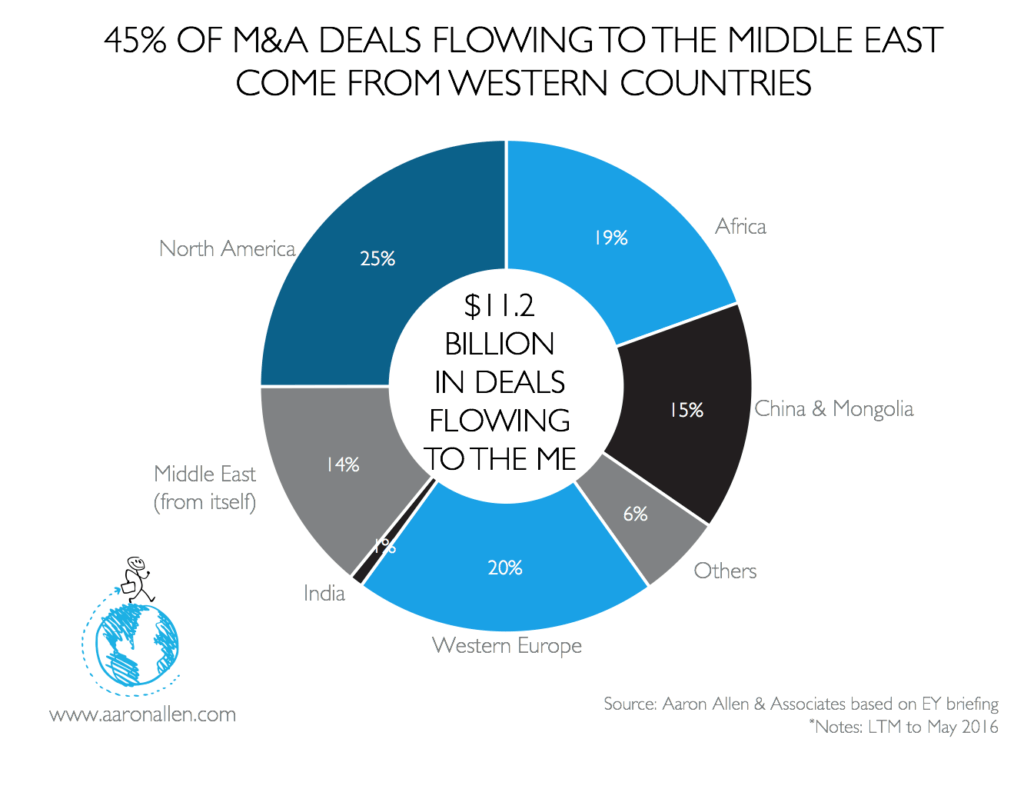

It’s not all smooth sailing, however. Due to low oil prices and market fluctuations, regional M&A transactions activity slowed in 2016. However, F&B is one of the few arenas, along with health care and education, where M&A activity maintained its momentum in the overall Middle East and North Africa (MENA).

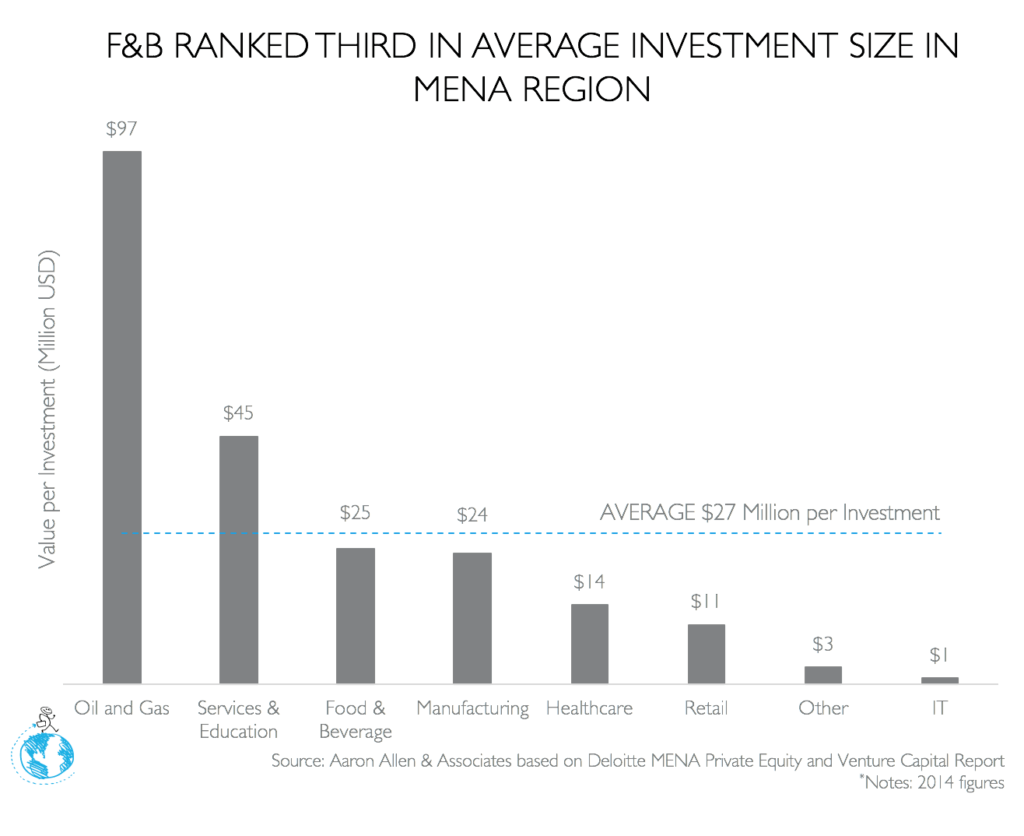

Private Equity (PE) activity, however, has remained much more dynamic. Worldwide PE activity in F&B has held steady since 2011. A few years ago, more than 50% of investment was concentrated in the U.S. and about 25% in Europe. But by 2015, those figures had shifted to 40% U.S., 44% Europe. This represents a growing trend in expanding investment activity. However, investments led by banks in MENA have been slow to recover to pre-recession levels. Consequently, PE investment is poised for a comeback, especially in a few key industries in the MENA region and specifically within GCC countries. In 2014, F&B was ranked third in terms of value per investment among industries in MENA.

MAJOR PLAYERS & MAJOR GROWTH

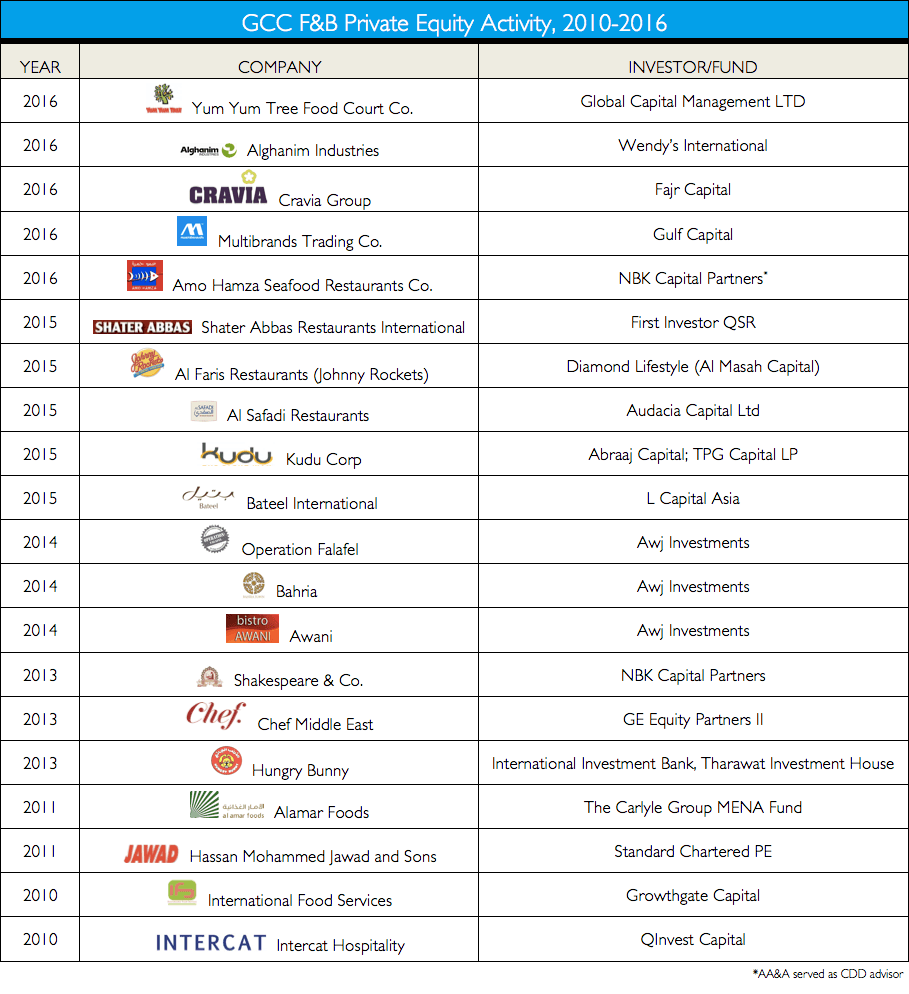

There were 15 PE deals in the region between 2010 and 2015. Of these, 10 deals were F&B group-involved, the bulk of which (six) were concentrated in the UAE. QSR brands were among the most popular investments, including Carlyle Group’s acquisition of a 42% stake in Saudi Arabia-based Alamar Foods, the region’s master franchise of Domino’s Pizza and Wendy’s; and Tharawat Investment House’s acquisition of a 49% stake in Hungry Bunny, a Saudi Arabian fast-food chain with outlets across the GCC.

Fajr Capital (a major player in Middle East private equity investment) acquired Cravia Group, which is based in the UAE, in May 2016. Cravia operates across the MENA region and includes some of the most recognizable F&B franchises around the world: brands such as Cinnabon, Seattle’s Best Coffee, Carvel ice cream, Five Guys and Zaatar w Zeit. Currently, Cravia has 85 restaurants and employs more than 1,500 people. Fajr Capital’s investment will allow for continued growth in the company’s established markets and movement into new markets in the MENA region.

Yum Yum Tree Food Court Co. (Yum Yum Tree) has grown from just six restaurants to nearly 180 units, primarily in the popular QSR segment. Today Yum Yum Tree operates across Bahrain, the UAE, Qatar and Saudi Arabia. The company operates more than 20 international and regional brands including Vanellis, Subway (in Bahrain only), Teryaki, Pad Thai and Al Mangal. Global Capital Management LTD (GCM), a division of Global Investment House, bought Yum Yum Tree in December 2016 through PE funds managed by the company. “This acquisition gives our clients unique access into a growing sector which is resilient to economic downturns,” CGM managing partner Sulaiman Al-Rubaie said in announcing the deal.

Gulf Capital is taking advantage of F&B’s potential in Saudi Arabia. Gulf Capital has bought a 100% stake in Multibrands Trading Co. (Multibrands). A strategic buy, Multibrands is a leader in the F&B industry with products serving KSA through franchised chains, hotels, cafes, bakeries, and restaurants. Gulf Capital has focused much of its investment in market segments with the most projected growth. These include, as mentioned above, F&B, health care and education, as well as power, water, and overall fast-moving consumer goods (FMCG).

Early in 2016, NBK Capital Partners (NBKCP) invested in Amo Hamza, a successful casual dining chain in KSA specializing in seafood (Aaron Allen & Associates performed the Commercial Due Diligence and Operational Due Diligence for this transaction). With six additional investments in the region (including Shakespeare & Company and Al Faysal Bakery), NBKCP is a significant and important player in the F&B sector in the GCC/MENA region.

The 2016 PE deals illustrate that there’s room for all players, including homegrown brands and established international brands eyeing expansion. Western fast food giant Wendy’s has already established a solid presence in the MENA region with 17 branches in the UAE. Moreover, the company has growth ambitions in the region, with a goal of 150 outlets in the next decade. To do this, Wendy’s partnered with Alghanim Industries (Alghanim) in February 2016. Based out of Kuwait, Alghanim is a large conglomerate with operations in manufacturing and engineering to consumer credit to advertising. Alghanim has spent the year revamping the brand’s stores, retraining employees, and updating recipes to improve overall business operations. The Alghanim and Wendy’s partnership is expected to branch out into Kuwait and KSA.

FUTURE PLANS

The theme for GCC private equity in 2017 is one of cautious optimism. As oil prices stabilize, private equity in the region is also expected to pick up. Early stage venture-capital style deals with technology start-ups will attract international and local interest, helping to increase M&A activity in the region. Many countries and cities in the region are aiming for economic diversification through development plans and national visions.

Dubai has implemented an ambitious Industrial Strategy 2030, with initiatives not only in F&B but in aerospace, maritime, pharmaceuticals & medical equipment, aluminum & fabricated metals, and machinery & equipment. Dubai’s recent investments in construction and tourism have caught the world’s attention. The destination can leverage its infrastructure and airports to serve the growing demand for food, specifically halal products. Additionally, Dubai is strategically located to facilitate distribution throughout the region.

KSA also has a vision for diversification with its National Transformation Plan, also to be implemented through 2030. Over the next four years the overall F&B market is projected to grow by 6.5% annually. Analysts at Gulf Capital, an alternative asset management company, consider KSA a growth opportunity as the country is underserved, from grocery outlets to foodservice locations.

Qatar’s National Development Strategy provides an integrated framework for policy formulation, as well as regulatory and institutional framework changes and implementable projects linked to overall national and sectoral outcomes.

FORECAST FOR MENA F&B

Many opportunities in the region remain. The Gross Domestic Product (GDP) in the greater MENA region is expected to reach USD 2 trillion by 2020. The largest markets are KSA (at USD 902 billion) and UAE (USD 502 billion). As economies in the region diversify and household income levels rise, the F&B industry stands to benefit, especially in casual dining and fast food, where PE activity has been focused.

A major event likely to positively impact economic prospects in Saudi Arabia is the planned IPO for ARAMCO, considered the world’s highest valued company. It’s expected to yield a significant economic windfall for KSA, translating to improved consumer optimism and spending.

Evolving demographics are another factor fueling F&B growth in the region. GCC countries are comprised of younger populations and working expats, which translates to a direct rise in demand for food that is both better quality and more conveniently procured. Fine dining, QSR and fast casual establishments are well-positioned to serve these groups. In addition, tourists to the region are driving growth for the F&B industry. Between now and 2024, The World Travel & Tourism Council estimates travel to the region would grow at an annual rate of 7.8%. Tourists tend to land in tier one and tier two cities, increasing demand in already expanding markets. In 1980, urban dwellers represented about 69% of MENA’s population. By 2014, this number had risen to 85% and is estimated to reach 90% by 2050.

Regional governments are aware of and responding to the growth in the F&B industry. The need for faster transportation of food, better infrastructure, and the human resources needed to drive profit are all issues — and, likewise, opportunities for investors. And it certainly doesn’t look like investment will slow in the coming years. Based on investment activity between 2010 and 2015, major partnerships between international brands looking for new markets, national companies looking for new ventures, and investors looking to manage new operations, the MENA region will continue to be a hotbed of M&A activity.

* * *

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Collectively, our clients around the globe generate over $100 billion annually and span six continents and more than 100 countries. For more on how we can help you achieve your most inspired ambitions, let’s start a conversation.