Food tech has made its mark on the restaurant industry in a major way. In fact, we’re witnessing such a seismic change that the full ramifications of how tech will impact restaurants still remains to be seen. What is for certain is that tech companies will continue to crop up, receive funding, and eventually make their way on to a public exchange. The past few years alone have seen a slew of big names enter the fray, from meal-kit behemoth Blue Apron to food delivery giant GrubHub.

Below, we round up the most recent food tech IPOs (from 2014–2017) and examine how they stack up.

RECENT FOOD TECH IPOs

Blue Apron

Meal kit startup Blue Apron (APRN) made history as the first such company to go public, after it filed for an IPO in June 2017. Its filing made headlines (and raised the eyebrows of investors) when it was revealed that the company had lost $54.8 million dollars in 2016, a 16% greater loss than the previous year, and that it had spent $144 million on marketing in 2016. Blue Apron shares began trading on the New York Stock Exchange on June 29, with shares initially trading at $10.

Delivery Hero

Shares of online food delivery company Delivery Hero soared as much as 8% on the first day of its stock market debut in June 2017. The Berlin-based company boasts a market capitalization of 4.7 billion euros ($5.3 billion) thanks to the successful debut on the Frankfurt stock exchange. At the time, the company said it would use the funds raised in its IPO to repay loans and to finance the growth and development of its business.

GrubHub

Shares of the online food ordering company Grubhub finished its debut day on the market with a 31% gain (the stock was up more than 50% at one point, but pulled back). The company priced its initial public offering of 7.4 million shares at $26 per share, raising nearly $200 million in the April 2014 deal.

First Data

First Data — a company specializing in mobile payment technology, customer loyalty programs, gift cards, and security programs — went public (and went big) in 2015. Its October 2015 IPO was the largest of 2015, raising $2.6 billion and giving the company a market cap of $14 billion.

Square

Square, the payment technology company founded by Twitter CEO Jack Dorsey, raised $243 million by pricing its initial public offering at $9 per share. The IPO proved to be a disappointment for the San Francisco payment platform, which had expected to price its 27 million shares between $11 and $13.

Quotient Technology (Coupons.com)

Though discounts website coupons.com had first planned to sell 10 million shares of its stock at a price ranging from $12 to $14, after meeting with potential institutional investors, it sold an additional 500,000 shares at a price of $16. It eventually brought in $168 million at that price, with an initial valuation approaching $1.2 billion, in its March 2014 debut. The company, founded in the 1990s, offers printable coupons for grocery stores, food, and other retail brands.

Everyday Health

Everyday Health Inc. (EVDY), a provider of digital health and welfare solutions, raised $100 million in its March 2014 IPO, offering 7.2 million shares at a price range of $13-$15 per share. The medical advice website utilizes celebrity diet and exercise experts(like Jillian Michaels and CNN’s Sanjay Gupta) and is home to a number of online properties, including 25 websites, 26 mobile applications, seven YouTube shows, 31 social media outlets, and a broadcast cooking show. The company was acquired in October 2016 by Ziff Davis, a digital media company in the technology, gaming and lifestyle categories, and is no longer public.

Just Eat

Just Eat’s 2014 debut was the biggest UK tech IPO in the seven years prior. At the time of the IPO on the London Stock Exchange, the market valued the company at £1.47 billion ($2.44 billion). Today, it hovers at some $4.1 billion.

THE BEST (AND WORST) FOOD TECH STOCK PERFORMERS

Most of these food-tech stocks have seen price increases since their IPO (all except Blue Apron). While Square doubled its stock prince (since its IPO and until the end of August 2017), Quotient Technology, Just Eat, and Grub Hub all saw stock price increases larger than 50%. On the other hand, Blue Apron which first began trading at the end of June 2017, accumulated a price drop close to 50% by the end of August 2017.

Blue Apron’s stock troubles have been blamed in large part on Amazon’s recent acquisition of Whole Foods. Less than two months after its initial public offering, the meal kit’s stock was hovering at around half its IPO price, leading some to call it a “catastrophe” and a “disaster” further impacted by multiple shareholder lawsuits claiming that company management misled investors.

In July, Blue Apron’s stock was deemed the worst-performing large IPO of 2017 by Renaissance Capital (a manager of IPO-focused ETFs). The company has faced questions over its high customer-acquisition costs as well as increasing competition from Amazon, which moved into the meal-kit space shortly after Blue Apron went public.

Those in the online food and delivery space have fared a little better, though it’s worth pointing out that the sector is becoming increasingly competitive – especially with the addition of large players like Amazon and Uber entering the space. Meanwhile, other, newer companies, continue to expand.

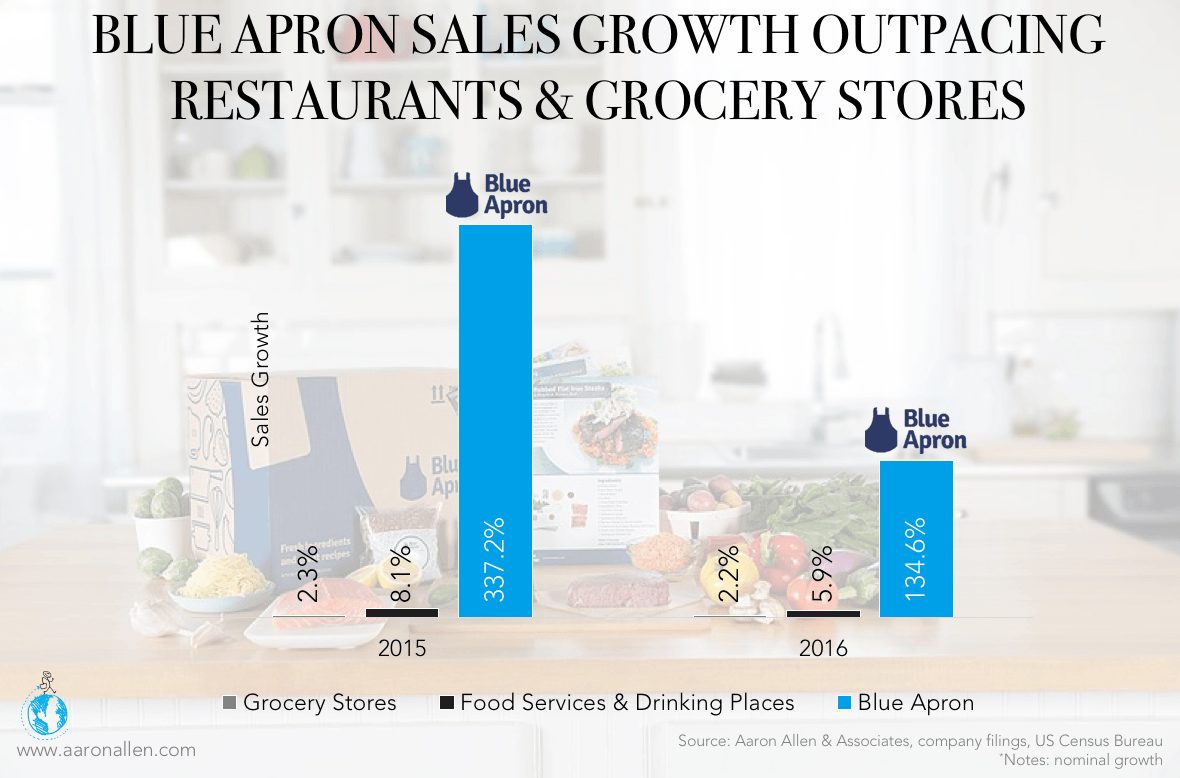

But even despite its struggles, the continued popularity of Blue Apron and meal kit companies like it is already affecting restaurants. Over the last two years, the increase in sales of Blue Apron has significantly outpaced the growth of restaurant sales in the US. Though meal kits are estimated to represent less than 1% of restaurant sales, outstanding growth such as the one experienced by Blue Apron is taking a toll on pockets of the industry.

THE FUTURE OF FOOD TECH IPOs & WHAT THEY MEAN FOR THE INDUSTRY

So far, 2017 has already seen two high-profile food tech IPOs: those of Blue Apron and Delivery Hero. Certainly not yet a frenzy in terms of companies going public, but the activity isn’t slowing down. There’s speculation that a number of food tech companies will hit the market in the coming months and years, including HelloFresh (which initially filed in 2015, but put its IPO on hold), Zomato, and Yext. There are also rumors that, if it can fix some of its internal issues with a new CEO at the helm, Uber will soon go public in a multi-billion-dollar (some speculate as much as $100 billion) IPO.

With so many companies cropping up — and eventually going public — the sheer scale of options for implementing tech in a restaurant is overwhelming. But those who continue lagging behind are widening the gap between their dated business models and industry leaders, like those who have unveiled high-tech point-of-sale systems, self-ordering kiosks, mobile ordering, and food delivery. Those who wait it out, to see how other chains handle innovation and how guests respond, will find themselves at a considerable disadvantage. Technology moves fast and the urgency for innovation is growing.

OTHER RELATED CONTENT

A History of Restaurant Initial Public Offerings, 2000-2017

Panera Saved Customers 10 Lifetimes Worth of Waiting

How Tech is Killing Off Independent Pizzerias

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 68 countries for clients ranging from startups to multinational companies posting in excess of $37 billion. Collectively, his clients around the globe generate over $200 billion annually and span six continents and more than 100 countries.