In 2015, estimates pegged the value of restaurant mergers and restaurant acquisitions (M&A) in the US at roughly $120.8 billion, jumping 58% from the previous record the prior year. In 2016, the value of those deals was down some 23%, but the number of deals was up, with restaurant deals comprising 1.1% of all (13,142) M&A deals.

Between 2004 and 2016, the number of restaurant acquisitions and mergers in the US increased by 86%. And in recent years, deals have gravitated more towards strategic (rather than financial) deals: the share of strategic deals increased 16% over the same time period, in fact.

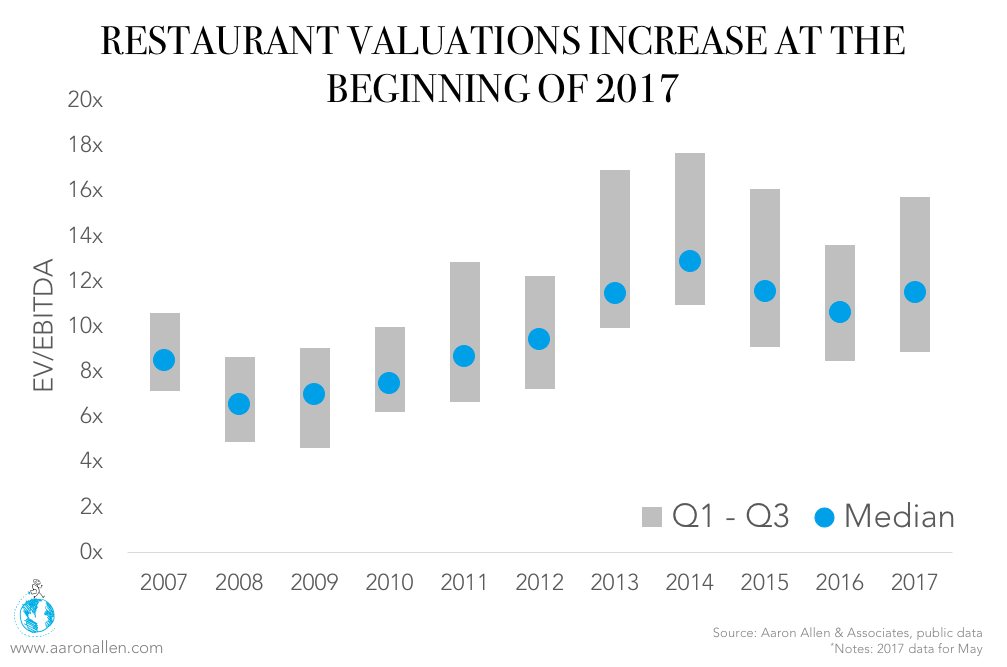

Restaurant valuations are seeing a surge, as well. Despite fluctuating between 2008 and 2015, the median valuation for publicly-held restaurants increased 8% from 2016 (from data collected at the end of May) and is now nearing 2015 levels.

So what does this mean for the future of restaurant acquisitions? For one thing, they’ll continue growing in number and in value. And the strategic factor suggests that a level of understanding (one supported by a specialist with knowledge of the external and internal factors affecting restaurants today and tomorrow) will be much-needed. Below, we round up some of the most notable restaurant acquisitions in recent history, including the largest (in terms of value) from the past two decades, along with a handful of smaller deals that were large for their geography.

THE LARGEST RESTAURANT ACQUISITIONS OF THE PAST 20 YEARS

Restaurant Company: Tim Hortons

Buyer: Burger King

Seller: Company

Price: $11.4 billion

In 2014, Burger King struck a deal to buy the Canadian doughnut and coffee chain Tim Hortons for approximately $11.4 billion, making for what became “one of the biggest fast-food operations in the world.” The two companies essentially formed a new, global company — one with operations based in Canada.

Restaurant Company: Panera

Buyer: JAB Holdings

Seller: Company

Price: $7.5 billion

While rumors swirled that that Panera might be acquired by one of its peers in the restaurant industry (like Domino’s, Restaurant Brands International, or Starbucks), the bakery and cafe chain eventually found a new parent in JAB, the German-based conglomerate that’s also acquired Krispy Kreme, Keurig, and Peet’s Coffee & Tea.

Restaurant Company: Burger King Holdings

Buyer: 3G Capital Partners

Seller: Company

Price: $3.87 billion

Just eight years after being sold off by Diageo, Burger King found itself in the midst of another restaurant acquisition. In 2010, the fast-food giant agreed to sell itself to 3G Capital, an investment firm with roots in Brazil, in a deal valued at $4 billion, including the assumption of debt. At the time, the deal marked the largest leveraged buyout of a fast-food chain ever.

Restaurant Company: OSI Restaurant Partners (now doing business as Bloomin’ Brands)

Buyer: Bain Capital, Catterton Management, Kangaroo Acquisition

Seller: Company

Price: $3.34 billion

It was November 2006 when OSI Restaurant Partners (then parent company of Outback Steakhouse, Carrabba’s Italian Grill, and Bonefish Grill) was sold in a $3.3 billion deal. The casual-dining company said it would be acquired by Bain Capital and Catterton Partners in what was at the time one of the largest restaurant acquisitions ever. The company now does business as Bloomin’ Brands.

Restaurant Company: Wendy’s

Buyer: Triarc Cos., Trian Fund Management (Arby’s)

Seller: Company

Price: $2.46 billion

In April 2008, Triarc, the parent company and franchisor of the Arby’s Restaurant Group, and Wendy’s International completed their merger transaction. The combined company — Wendy’s/Arby’s Group, Inc. — would be, according to then-CEO Roland Smith, better positioned to “deliver long-term value to stockholders through enhanced operational efficiencies, improved product offerings, shared services and strong human capital.”

Restaurant Company: Dunkin’ Brands

Buyer: Carlyle Group, THL Partners, Bain Capital

Seller: Pernod Ricard SA

Price: $2.4 billion

In December 2005, Dunkin’ Donuts announced that a consortium of global private equity firms (consisting of Bain Capital Partners LLC, The Carlyle Group and Thomas H. Lee Partners LP) completed the acquisition of Dunkin’ Brands Inc. from Pernod Ricard SA for $2.4 billion in cash. At the time, the PE firms said the deal would provide the resources needed to support the company’s growth plan, making Dunkin’ Brands “ideally situated to execute its strategy across the Dunkin’ Donuts, Togo’s and Baskin-Robbins brands and geographies.”

Restaurant Company: Kuwait Food Company (Americana)

Buyer: Emaar Properties

Seller: Al Khair National

Price: $2.36 billion

In June 2016, A UAE-based investor group led by Emaar Properties chairman Mohamed Alabbar announced it had agreed to buy Kuwait Food Company shares from its majority stockholder for $2.36 billion. the deal allowed the investor group to acquire a 26% stake in Kuwait’s Americana, the company that operates KFC and Pizza Hut restaurants in the Middle East and North Africa.

Restaurant Company: Burger King

Buyer: Burger King Holdings, TPG Capital, Bain Capital, Goldman Sachs

Seller: Diageo

Price: $2.3 billion

Diageo, the world’s largest liquor company, sold its restaurant chain, Burger King, to a private equity consortium for more than $2.2 billion in 2002. At the time, the London-based Diageo was looking to transform itself into a company focused on liquor sales. Diageo once owned brands including Pillsbury and Häagen-Dazs, as well as Johnnie Walker, Guinness, Smirnoff, Baileys, Cuervo, Tanqueray, and Captain Morgan.

Restaurant Company: McDonald’s China

Buyer: CITIC, Carlyle Group

Seller: Company

Price: $2.1 billion

In January 2017, McDonald’s sold most of China, Hong Kong business to state-backed conglomerate CITIC Ltd and Carlyle Group LP for up to $2.1 billion. The 20-year deal capped months of negotiations between the fast-food chain and private equity firms including Carlyle and TPG Capital Management LP.

Restaurant Company: Red Lobster

Buyer: Golden Gate Capital

Seller: Darden Restaurants Inc.

Price: $2.1 billion

Darden sold Red Lobster to Golden Gate Capital for $2.1 billion in July 2014. In the years since the restaurant acquisition, the seafood chain has turned to overseas expansion in search of a comeback. The chain has opened more than 20 international locations since it was acquired in 2014, bringing the number of Red Lobster’s overseas restaurants to at least 51 (excluding Canada).

Restaurant Company: Applebee’s

Buyer: IHOP

Seller: Company

Price: $2.05 billion

In one of the most reported restaurant acquisitions in recent memory, IHOP made a $1.9 billion bid for the struggling bar-and-grill chain Applebee’s in 2007. Both brands have struggled to regain their footing (along with dozens of others in the Casual Dining space) in the years since, though. In August 2017, it was reported that some 100 Applebee’s locations and roughly 20 IHOPs would shutter their doors. An earnings report released the same week showed that sales fell by more than 6% at Applebee’s and nearly 3% at IHOP in the previous quarter.

Restaurant Company: Popeye’s

Buyer: Restaurant Brands International Inc.

Seller: Company

Price: $1.8 billion

Restaurant Brands International made headlines in 2017 when it announced it would acquire Popeyes Louisiana Kitchen for $1.8 billion in cash. The company is expected to use its international reach to bring Popeyes’ to new geographies around the globe. Restaurant Brands was formed in 2014, through an $11 billion merger between Burger King and Canadian chain Tim Hortons).

Restaurant Company: Bob Evans Farms

Buyer: Post Holding

Seller: Company

Price: $1.5 billion

In September 2017, shares of Bob Evans Farms’ soared following the announcement that Post Holding Inc. (maker of Honey Bunches of Oats and Grape-Nuts cereals), would buy the company for roughly $1.5 billion. After activist investor Thomas Sandell began pushing for change, Bob Evans announced it would split the company in 2017, when it sold its 522 Bob Evans restaurants to private-equity firm Golden Gate Capital in a $565 million deal. The chain was then taken private as Bob Evans Restaurants.

Restaurant Company: Rare Hospitality (LongHorn and Capital Grille)

Buyer: Darden

Seller: Company

Price: $1.4 billion

Darden Restaurants, the operator of the Olive Garden and Red Lobster restaurant chains, agreed to buy Rare Hospitality International Inc. for about $1.4 billion in 2007. The Atlanta-based Rare owned, operated, and franchised 287 LongHorn Steakhouse restaurants and 28 Capital Grille restaurants at the time.

Restaurant Company: Krispy Kreme Doughnuts

Buyer: JAB Holdings

Seller: Company

Price: $1.35 billion

In 2016, German conglomerate JAB Holdings acquired Krispy Kreme Doughnuts Inc. for a cool $1.35 billion. The deal marked the latest feather in the cap for JAB which, that same year, had also acquired Caribou Coffee, Einstein Noah Restaurant Group, Peet’s Coffee & Tea, and Stumptown Roasters.

Restaurant Company: Starbucks

Buyer: Starbucks

Seller: Uni-President Enterprises, President Chain Store Corporation

Price: $1.3 billion

In June 2017, Starbucks announced the largest single acquisition in its history, a roughly $1.3 billion deal that would allow it to acquire the remaining 50% share of its East China business from joint venture partners Uni-President Enterprises and President Chain Store Corporation. The deal paves the way for Starbucks to own 100% of the approximately 1,300 locations in the Shanghai and Jiangsu and Zhejiang Provinces.

Restaurant Company: Chuck E. Cheese’s

Buyer: Apollo Global Management LLC

Seller: CEC Entertainment Inc.

Price: $1.3 billion

In 2014, Apollo announced it would buy out Chuck E. Cheese’s parent CEC Entertainment, which operated 577 of the kid-friendly restaurants, for $1.3 billion, including the assumption of debt. In recent months, Apollo has been rumored to be considering a sale of the chain. In May, Bloomberg reported that the company was in talks with investment firm Ares Management LP over a sale that could value Chuck E. Cheese’s at roughly $2 billion.

Restaurant Company: Domino’s

Buyer: Bain Capital

Seller: Company

Price: $1.1 billion

In 1998, Bain Capital (then led by Mitt Romney) made a splash in signing a more-than $1 billion deal for Domino’s Pizza. Unlike many other acquisitions, Domino’s was not in need of rescue or turnaround at the time. Instead, the company’s founder (Thomas Monaghan) was looking to cash out all but a small stake and use the proceeds to start a Catholic university. Bain reaped a 500% return on its investment over the next 12 years.

Restaurant Company: PF Chang’s

Buyer: Centerbridge Partners

Seller: Company

Price: $1.1 billion

It was 2012 when PF Chang’s China Bistro sold for $1.1 billion to Centerbridge Partners. At the time, the Asian concept was struggling to shore up sales and foot traffic, and hoped the deal would provide it with greater flexibility to focus on a “long-term strategic plan of elevating the guest experience, enhancing the value proposition, growing traffic and improving the performance of the company’s brands.”

Restaurant Company: CKE Restaurants

Buyer: Apollo Global Management

Seller: Company

Price: $1 billion

In 2010, once-rumored Labor Secretary Andrew Puzder sold CKE to Leon Black’s private equity firm Apollo Global Management, in a deal that allowed Puzder to remain CEO. Apollo invested $436 million in the buyout and collected $996 million when exiting in November 2013, three and a half years later, according to reports from the time. In 2013, Roark Capital inked a deal to acquire CKE from Apollo. That deal reportedly valued CKE at between $1.65 billion to $1.75 billion.

Restaurant Company: Peet’s Coffee & Tea

Buyer: Joh. A. Benckiser, BDT Capital

Seller: Company

Price: roughly $1 billion

In 2012, Peet’s Coffee & Tea was acquired for $974 million by JAB Holding. In 2015, it was announced that Peet’s would acquire a majority stake in the Chicago-based Intelligentsia Coffee & Tea. JAB has since gone on to acquire a number of large coffee and bakery chains, including Caribou Coffee and Panera.

Restaurant Company: Portillo’s

Buyer: Berkshire Partners

Seller: Portillo Restaurant Group

Price: Undisclosed (reportedly nearly $1 billion)

In 2014, Chicago-based Berkshire Partners announced its acquisition of Portillo’s for nearly $1 billion. The hot dog chain operates 38 locations in four states, though the acquisition was meant to increase the number of units and expand to new markets.

Restaurant Company: Cheddar’s Scratch Kitchen

Buyer: Darden

Seller: Company

Price: $780 million

In March 2017, Darden Restaurants agreed to buy Cheddar’s Scratch Kitchen for $780 million from a group of stockholders, including private equity firms L Catterton and Oak Investment Partners. Cheddar’s currently has 165 locations, including 140 owned and 25 franchised, in 28 states, though Darden has noted the chain has “significant growth opportunities in new and existing markets” and average annual restaurant volumes of $4.4 million.

Restaurant Company: Einstein Bros. Bagels

Buyer: JAB Holding Company

Seller: Einstein Noah Restaurant Group

Price: $374 million

JAB announced it would purchase the parent company of Einstein Bros. Bagels for $374 million in 2014. The bagel purveyors stock soared 50% upon the news. No stranger to restaurant acquisitions, in the years since JAB has continued to add to its cadre of coffee and breakfast chains, leading some to deem it the company “taking over breakfast in America.”

OTHER NOTABLE RESTAURANT ACQUISITIONS

Restaurant Company: Aramark Corp.

Buyer: Consortium including Thomas Lee Partners, Warburg Pincus, and The Goldman Sachs Group

Seller: Company

Price: $6.09 billion

Also not technically a restaurant acquisition but a big one for foodservice nonetheless. In 2006, food services company Aramark, which provides food to institutions including companies, colleges and universities, sports stadiums, and hospitals, announced it would be acquired by a group led by the company’s chief executive and a group of investment funds, for $6.3 billion. Aramark valued the deal, including debt, at $8.3 billion.

Restaurant Company: OpenTable

Buyer: Priceline

Seller: Company

Price: $2.6 billion

While it’s not technically a restaurant acquisition, the purchase of OpenTable certainly had ramifications for the industry. In 2014, travel reservations giant the Priceline Group announced it had acquired online restaurant reservations site OpenTable for $2.6 billion. At the time, OpenTable was generating less than $200 million in annual revenue, and many have argued Priceline overpaid for the platform. In the third quarter of 2017, Priceline announced it had taken a $941 million non-cash impairment charge against OpenTable’s goodwill and would be slowing down the pace of OpenTable’s growth. A number of competing reservation sites have cropped up since the acquisition, including Resy, Reserve, and Yelp’s platform.

Restaurant Company: Sodexo Inc.

Buyer: Sodexo Alliance

Seller: Company

Price: $1.85 billion

In 1998, Sodexho merged with Marriott Management Services, at the time one of the largest food services companies in North America, to become one of the largest food services providers in America. In 2001, Sodexho Alliance acquired the outstanding shares of Sodexho Marriott (the Marriott name has since been dropped and the North American unit is now known as Sodexo Inc., a wholly-owned subsidiary of Sodexho Alliance). At the time, Sodexho Inc. was one of the three largest corporations in North America offering outsourced support services (including food, laundry, and housekeeping) to businesses and public institutions.

Restaurant Company: Dave & Buster’s

Buyer: Oak Hill Capital Partners

Seller: Wellspring Capital

Price: $570 million

In 2010, entertainment chain Dave & Buster’s sold to Oak Hill Capital Partners in a $570 million deal. At the time, partners at the firm said they saw the restaurant chain as a very strong candidate for a successful initial public offering. The chain eventually went public in 2014.

Restaurant Company: Checker’s

Buyer: Oak Hill Capital Partners

Seller: Sentinel Capital Partners

Price: $525 million

In March 2017, private equity firm Oak Hill Capital Partners again made headlines when it announced plans to buy the Tampa-based Checker’s fast-food chain from its equity ownership for roughly $525 million.

Restaurant Company: Long John Silver’s, A&W All American Food Restaurants

Buyer: Tricon Global Restaurants, Inc. (Yum)

Seller: Yorkshire Global Restaurants

Price: $320 million

In 2002, Tricon Global Restaurants signed an agreement to acquire Long John Silver’s and A&W All American Food Restaurants, then owned by Yorkshire Global Restaurants, for $320 million in cash. Tricon underwent a name change that same year and now goes by a more-familiar moniker: Yum!

Restaurant Company: Kahala Brands

Buyer: MTY

Seller: Company

Price: $300 million

Canadian company MTY Food Group Inc. acquired Kahala Brands, the Arizona-based operator of a cadre of brands including Pinkberry, Blimp, and Cold Stone Creamery, for $300 million.

Restaurant Company: Levy

Buyer: Compass Group

Seller: Company

Price: $250 million

Under a deal closed in April 2006, Larry Levy, one of the biggest names in Chicago’s restaurant scene, sold his restaurant and catering business to British foodservice firm Compass. Compass acquired a 49% stake in Levy (parent company of restaurants including Spiaggia and Bistro 110) in 2000. In 2006, Compass acquired the remaining 51% of Levy Restaurants for $250 million.

Restaurant Company: La Tagliatella

Buyer: AmRest Holdings

Seller: Company

Price: $233 million

In 2011, AmRest Holdings announced the closing of its acquisition of Restauravia Grupo Empresarial S.L., which put the company in ownership of 76.3% of Restauravia shares with the remaining 23.7% comprised of rolled over equity from Restauravia’s management. The Spanish-based Restauravia was the owner of La Tagliatelle (which, at the time, comprised 105 Italian casual dining restaurants) and 30 KFC units. At the time of the acquisition, AmRest announced plans to extend its reach in KFC (the company already operated a number of KFC units in Europe) and double the number of La Tagliatella restaurants within five years.

Restaurant Company: Tam’s Yunnan Rice Noodle

Buyer: Toridoll Holdings Corp.

Seller: Jointed-Heart Catering Holdings Limited

Price: $127+ million

Japanese restaurant group Toridoll, the country’s largest operator of noodle shops and eateries, announced it would take control of the Hong Kong company operating Tam’s Yunnan Rice Noodles outlets, in a takeover valued at 15 billion yen (or roughly $127 million).

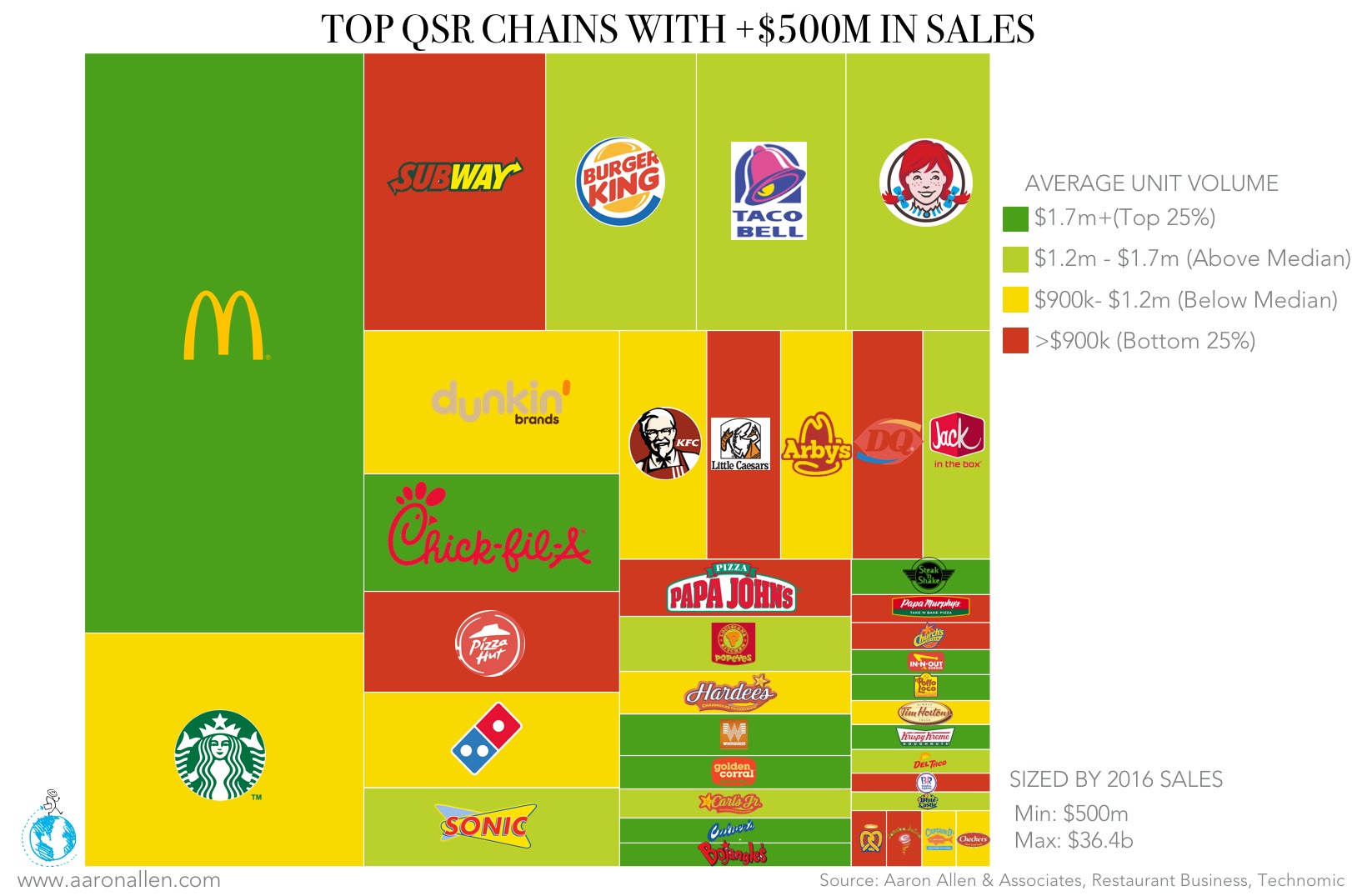

As we’ve seen historically, future restaurant acquisitions will hinge largely on trends: the popularity of QSR and burger concepts will likely lead to future mergers or acquisitions, for instance. In 2016, 38 QSR chains made more than half-a-billion dollars in sales. Family casual chains, as well as burger (Whataburger, McDonald’s, In-N-Out, Culver’s, Steak & Shake) and some chicken concepts (Chick-fil-A, El Pollo Loco, Bojangles) are among the top earners, each bringing in an average of more than $1.7m in sales per unit.

Urbanization and the rise of e-commerce will give rise to the acquisition of chains that have historically been featured in malls, while cannibalization will force some concepts to merge or be acquired by their competitors. Restaurant acquisitions will also allow for expansion throughout the globe for many chains — as such, the importance of thorough due diligence and planning (with the help of an industry specialist) will grow.

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains, and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 68 countries for clients ranging from startups to multinational companies posting in excess of $37 billion. Collectively, his clients around the globe generate over $200 billion annually and span six continents and more than 100 countries.