The better burger craze has been one of the more remarkable fast food trends of the past decade. Now, the burger segment has turned into a David-Goliath matchup, with Shake Shack dominating Average Unit Volume (AUV) and McDonald’s dominating total sales size.

Unlike in the story, however, Goliath seems most likely to win: sales at McDonald’s and Burger King bounced back last year while Shake Shack, Habit, and Steak ‘n Shake experienced declines. At least in fast food, size matters.

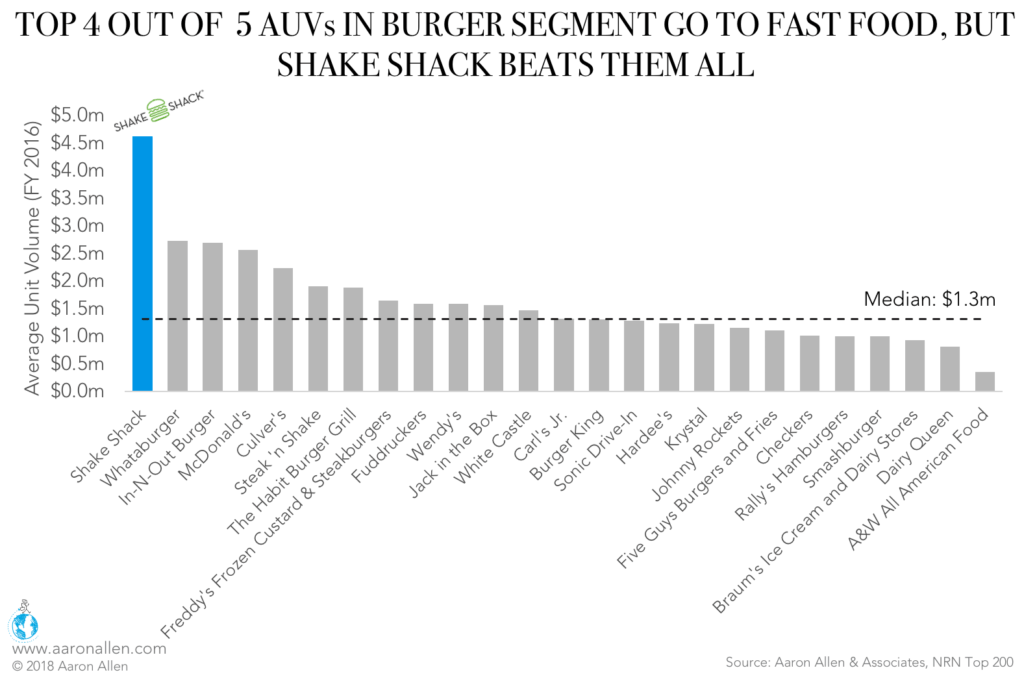

In 2016, Shake Shack’s AUV reached $4.6m, 3.5x the median of other limited-service leaders. A higher-quality product — and a strong consumer fan base — allows the chain to charge more per burger than big chains while still maintaining steady traffic.

Quick-service mainstays fill out the rest of the top five: Whataburger ($2.73m), In-N-Out Burger ($2.69m), McDonald’s ($2.56m), and Culver’s ($2.24m). Margins favor this group, as well: McDonald’s FY 2016 net income was 20.0% compared to Shake Shack’s 6.2%, and these figures did not change significantly in 2017.

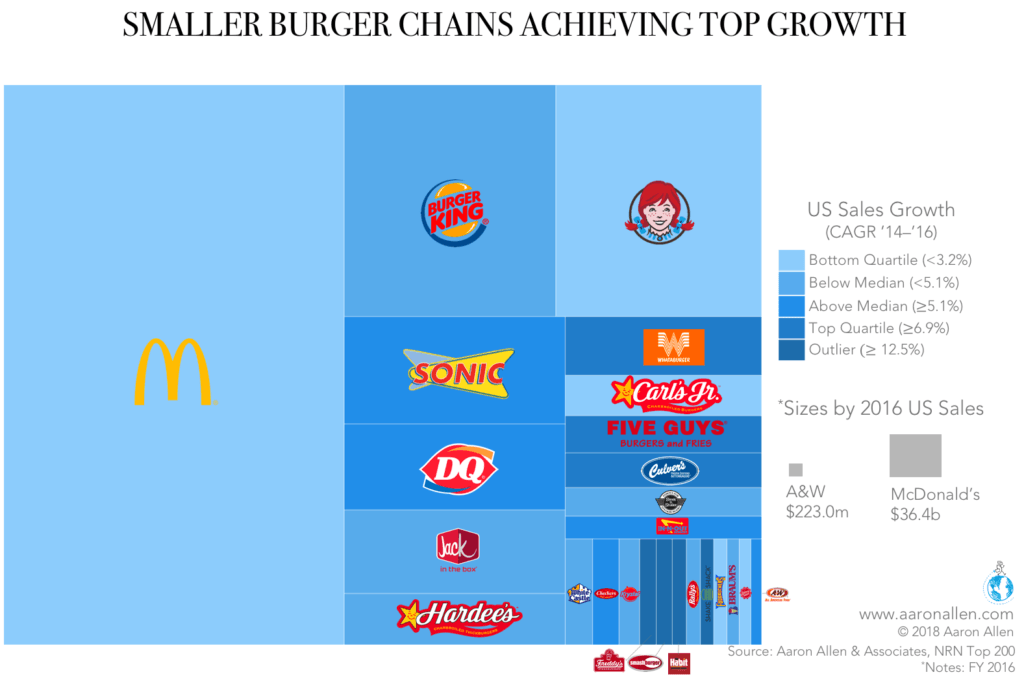

Smaller chains are growing much more quickly than market leaders. Shake Shack reached a 51.7% CAGR between 2014 and 2016, and other small players — Freddy’s Frozen Custard & Steakburgers, Smashburger, and The Habit Burger Grill (each with less than $350m in total sales in the U.S.) — grew at rates higher than 14% CAGR.

This picture is worth a thousand words: it shows very clearly how much larger an operation like McDonald’s is when compared to other burger chains. With 36,899 locations worldwide, it towers above not only Shake Shack (with 168) but also Burger King (with 15,738). Even though they’re often mentioned in the same breath or as equal comparisons, McDonald’s has more locations on the island of Hong Kong than Shake Shack has total.

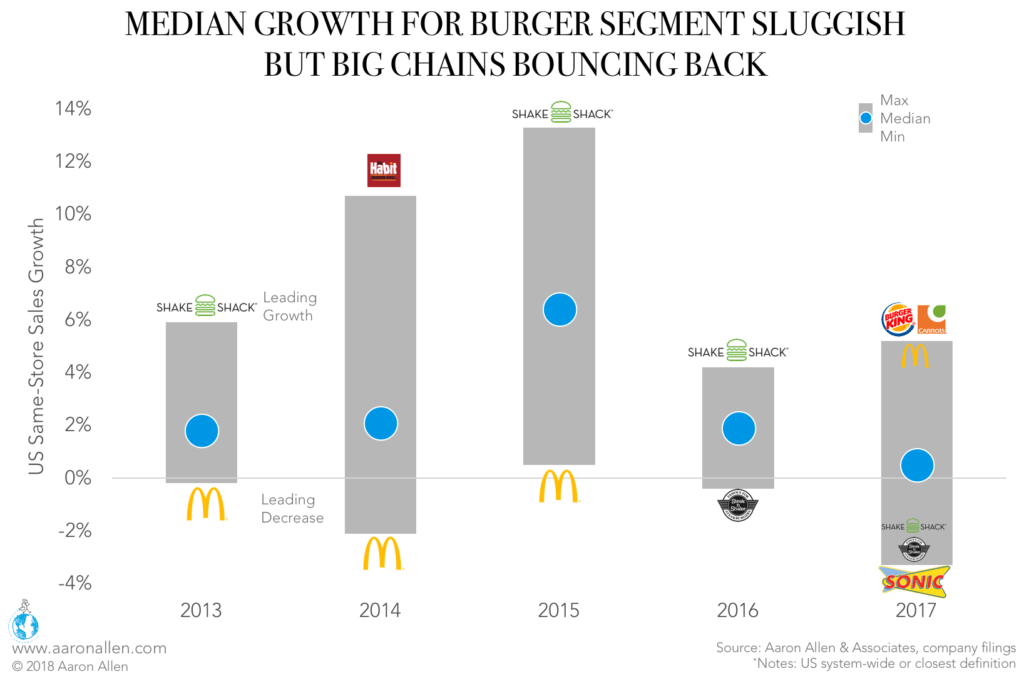

Not only are these Goliaths much bigger than Shake Shack and Habit, but their sales are also bouncing back after a few difficult years.

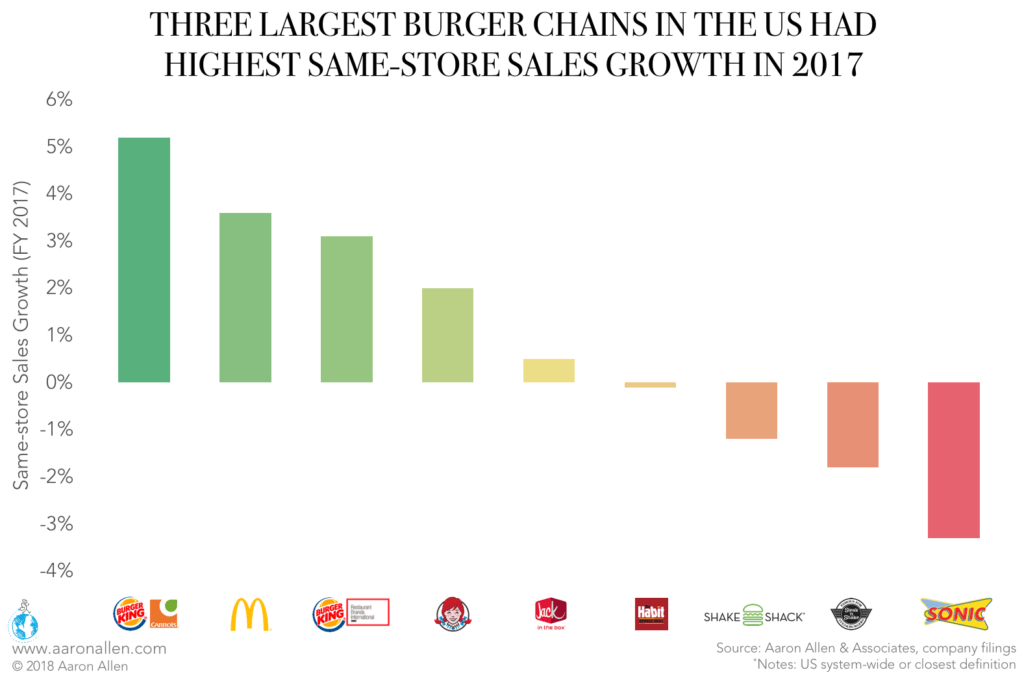

McDonald’s, Burger King, and Wendy’s had some of the highest same-store sales growth in 2017. Carrols, the largest Burger King franchisee in the U.S., had 5.2% growth, and McDonald’s achieved a 3.6% growth. Restaurant Brands International Burger King units grew by 3.1% (though this figure includes international growth as well), and Wendy’s North America did so by 2.0%.

Growth among these giants deeply affects smaller chains: we estimate that a 3.6% same-store sales growth at McDonald’s equals the sales of 986 burger restaurants (considering the median AUV of the top 25 chains in the country). That means McDonald‘s sales growth last year is the same as In-N-Out Burger‘s and Shake Shack‘s sales combined. As a consequence, McDonald’s managed to grow U.S. sales despite having net closings for 119 restaurants.

This growth has reconfigured the fast-food burger landscape. Shake Shack, which led growth during 2015 and 2016, moved to the negatives last year, while McDonald’s claimed the second-leading spot in 2017, after negative growth or the lowest growth between 2013 and 2015.

This turnaround was handled by Steve Easterbrook, who took over as CEO in March 2015 and has focused on convenience engineering, heavily investing in tech. These innovations — from self-ordering kiosks to curbside pick-up — make getting McDonald‘s easier than ever for time-starved diners.

This data shows that convenience is continuing to drive consumer behavior. From this perspective, Shake Shack has fallen behind: it has just started testing in-Shack kiosks and third-party delivery. People may want a better burger, but they want a fast and convenient burger even more.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion in sales, span all six inhabited continents and 100+ countries, with locations totaling tens of thousands.