Looking at the 50 fastest-growing small concepts always provides new insights into consumer preferences and the overall industry landscape. At the same time, it can help investors recognize what’s hot and understand which expansion rates are feasible.

Two things jump out of this list. First, one of the major trends we predicted would affect foodservice for 2018: a desire for healthful (but not necessarily “healthy”) food, is driving sales. Second, bars and grills are doing great business.

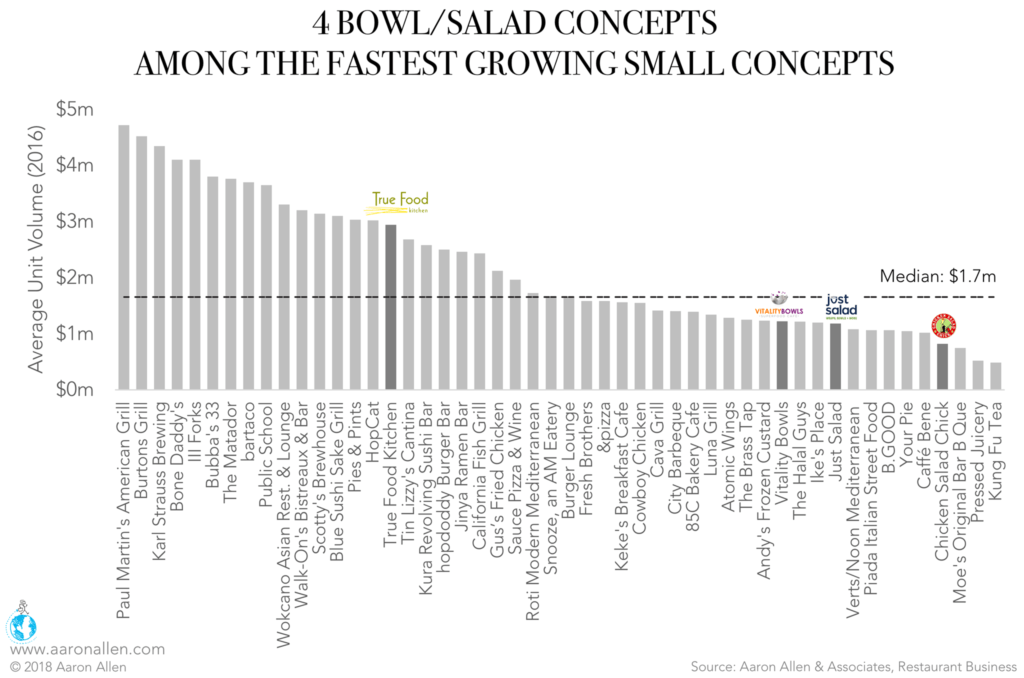

Four healthful brands appeared among the 50 fastest-growing small concepts: True Food Kitchen, Vitality Bowls, Just Salad, and Chicken Salad Chick. Average sales per unit range between $820k (for Chicken Salad Chick) and $2.9m (for True Food Kitchen, which has the smallest footprint of the four).

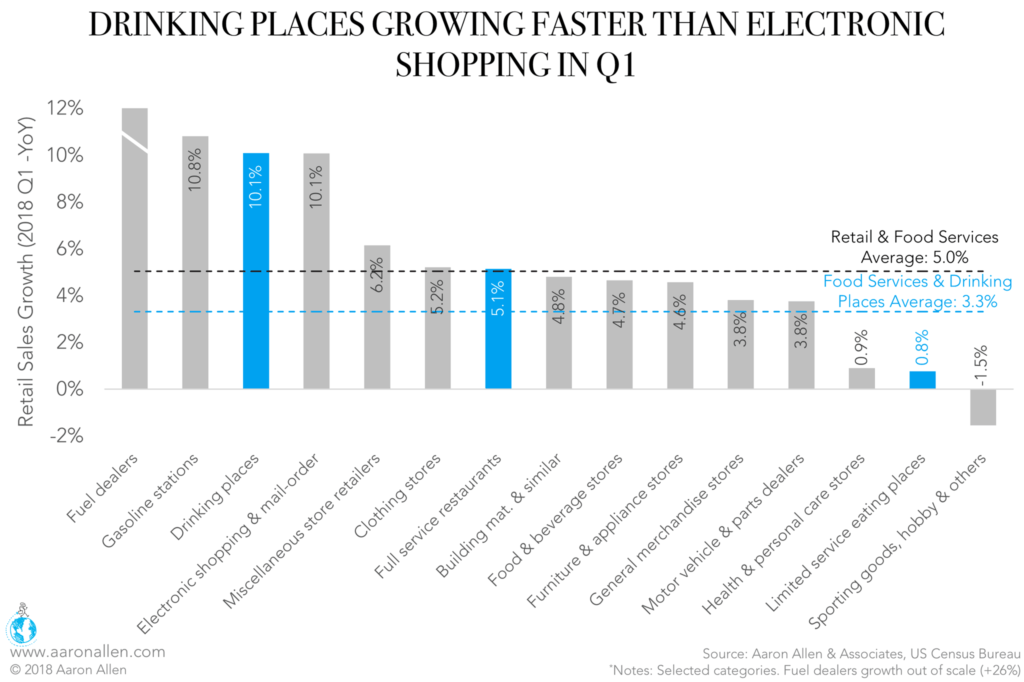

But the segment is dominated by bars and grills, which aligns with sales figures for Q1 2018. Overall, retail and foodservice sales grew by an average 5.0% percent.

Fuel and gasoline dealers were the big winners, given recent oil price increases, but drinking places (bars, beer gardens, nightclubs, and so on) came third, beating out electronic shopping & mail-order, a major growth segment over the past few years.

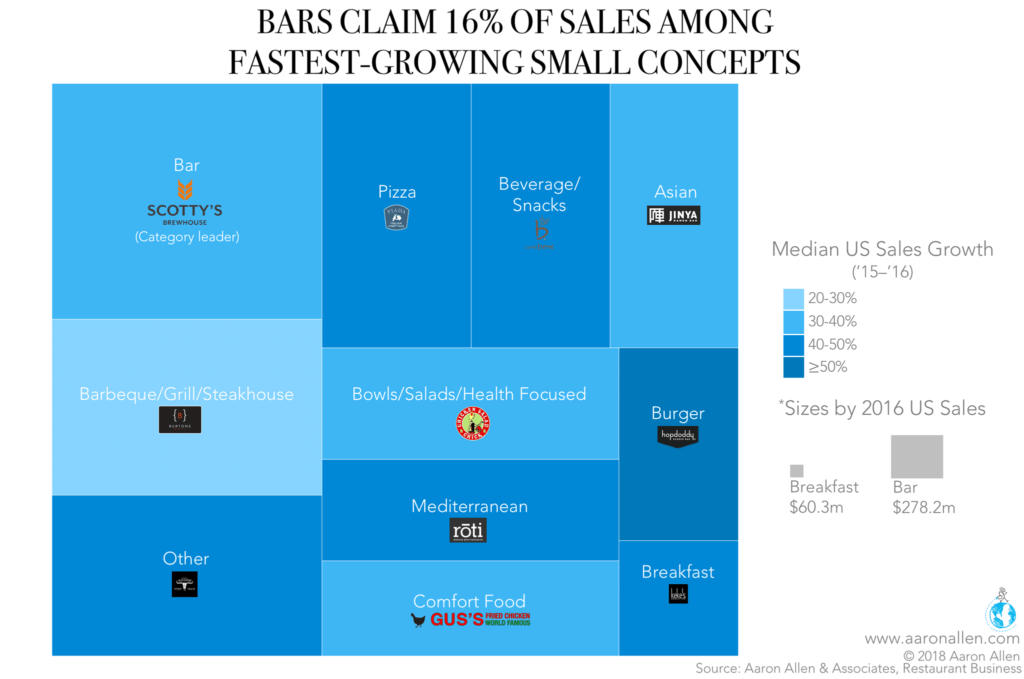

Among the 50 fastest-growing small concepts, bars claimed the largest percentage of sales, amounting to $278.2m.

Though plenty of bars appear in this fast-growth short list, they weren’t the fastest-growing segment. Burger concepts took that prize, with a median growth of 55.2%. Hopdoddy Burger Bar led with $36.3m in sales and 17 locations.

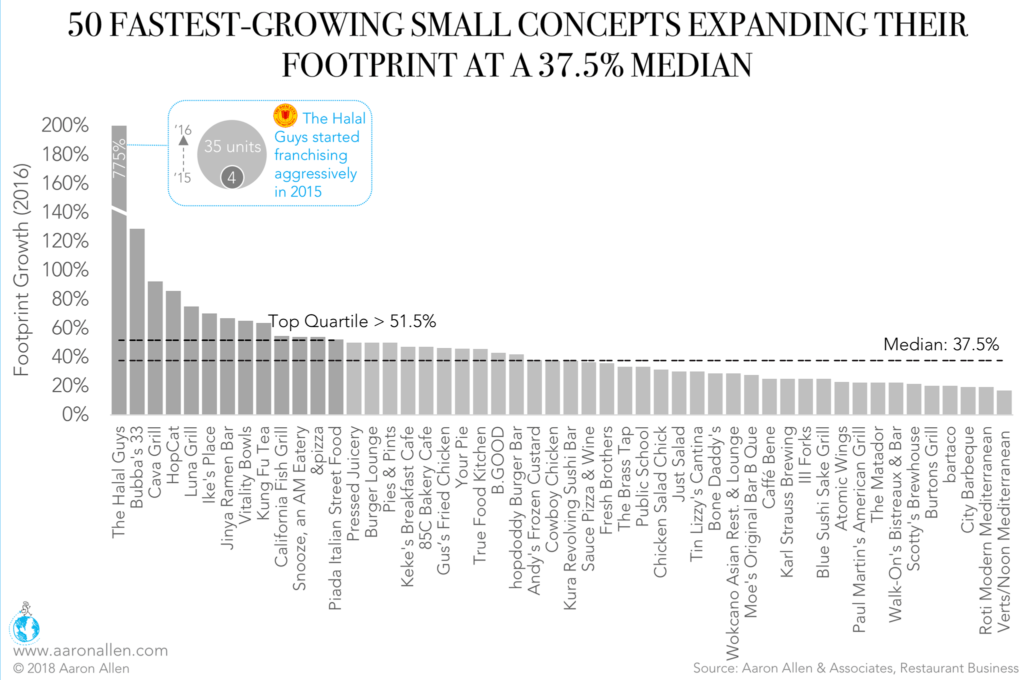

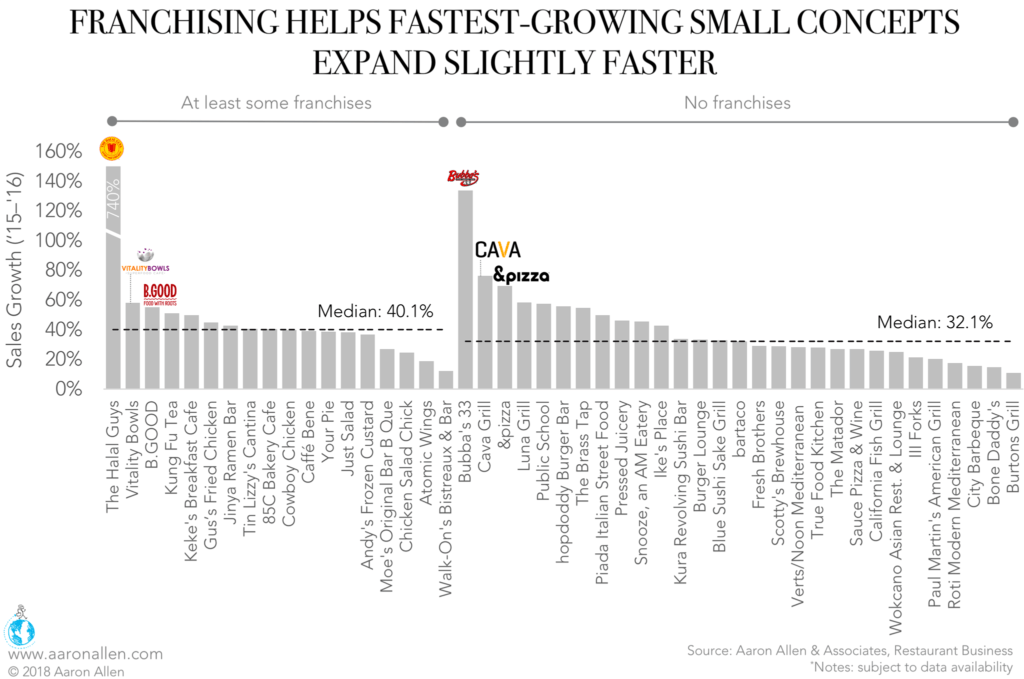

When it comes to physical expansion, there’s no competition. Middle Eastern Concept Halal Guys dominated with an astonishing 775% growth rate — from 4 stores in 2015 to 35 in 2016. The median growth rate in the rank was 37.5% in 2016, fast enough to double footprints in less than three years.

The majority of the 50 fastest-growing small concepts don’t franchise. Those that do, however, are growing slightly faster than their competitors: the median growth among franchisors is eight percentage points above non-franchising chains.

Franchising also correlates with lower volatility: 61% of the restaurants in the franchising group are within 10 percentage points of the median, but this number decreases to 41% for those that maintain only company-owned locations.

Based on market median valuation ratios, we estimate all 50 restaurant companies belong to the lower middle-market segment (companies with enterprise values between $25m and $100m), with sales ranging from $25.2m to $49.7m in 2016. Fast-growing chains like these are often considered exciting investment opportunities because of their physical expansion and sales growth.

However, not all emerging companies are built the same. A high-speed approach may leave flaws in the planning process, resulting in gaps in the supply chain, inconsistencies in branding, or underdeveloped training programs that leave some locations underserved. Firms interested in investing in the lower middle-market should consult with a buy-side advisor who can identify which chains have a solid foundation, surface any stumbling blocks, and help strategize solutions before it’s too expensive to go back.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion, span all 6 inhabited continents and 100+ countries, with locations totaling tens of thousands.