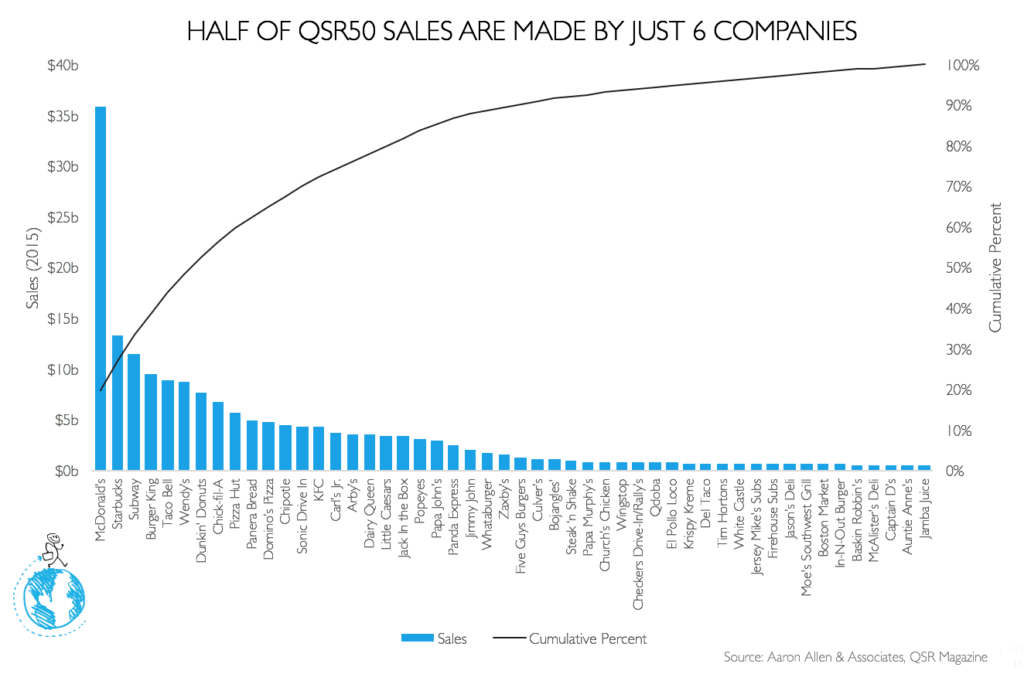

Quick-Service Restaurants (QSRs), where customers generally order at a cash register and pay before they eat, have taken a large share of headlines — and stomach real estate — over the past 13 years. But despite the talk of all the new players entering the scene, nearly half the sales of the 50 top-selling QSR brands come via just six chains: McDonald’s, Starbucks, Subway, Burger King, Taco Bell, and Wendy’s.

Two of those chains — McDonald’s and Starbucks — make a combined $50 billion annually (roughly equal to the combined sales of the bottom 36 companies on the list). But just because we continue to see the same crop of big names on the list time and again doesn’t mean changes aren’t afoot. In fact, the list of the most popular QSR chains (published annually byQSR Magazine) have seen some notable changes in recent years – and the major players have some new competitors to worry about.

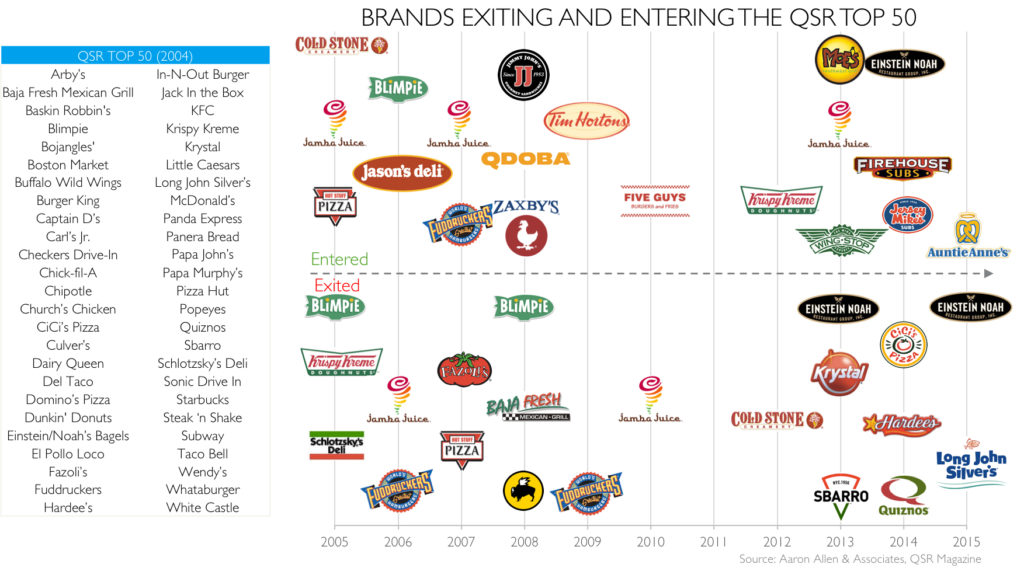

Of the top 50 QSR chains from 2004, 36 companies have remained on the list over the last ten years — including the usual suspects (McDonald’s, Starbucks, Chipotle, Panera, Sonic, KFC, Burger King, etc.) Other brands have been less stable, with their exits — and sometimes re-entrances — displayed below as well.

Those chains that have seen the highest growth in Average Unit Volume (AUV) have a couple things in common:

1. Simple menus: As menu complexity increases, the growth in average unit volume generally seems to decrease.

2. An emphasis on tech and digital ordering: Those chains at the top of the list get top marks for speed and efficiency in drive-thru service (which isn’t at all surprising considering the new crop of high-tech startups with which restaurant chains are now competing).

Below, some of notable evolutions to the top 50 QSR list in recent years, utilizing the most recently published data:

SOME CATEGORIES ARE LOSING SHARE TO COFFEE AND SNACKING

Among the top 50 QSR chains, the Burger and Pizza categories (both of which have seen cannibalization due to oversaturation) lost share to the Coffee & Snacks, Sandwich, and Mexican categories. The Coffee & Snacks category increased its share by 68%, Mexican by 34% and Sandwich by 19%. Meanwhile, Pizza decreased its share by 21% and Burger by 16%.

This trend has manifested itself throughout the industry, with Casual Dining Restaurants (CDRs) taking a hit, in part, because of new forms of dining like coffee, snacking, food trucks, meal kits, and a litany of other new competitors.

Those competitors are certainly taking note. At Starbucks, an expansion into tea and food is expected to drive further ticket growth. Food sales have already contributed 2 points to U.S. same-store sales, and could send the company’s stock up as much as $16 per share.

THOSE WHO HAVE SEEN THE MOST GROWTH HAVE ALSO UNDERGONE MUCH EXPANSION

The chains that exhibited the most overall sales growth (Chipotle, Panda Express) also saw the most unit growth. Naturally, the reverse was true too. Over at KFC, the Colonel wound up with nearly a quarter fewer locations between 2004 and 2015.

It’s important to note, however, that the industry doesn’t yet have the categorizations or proper equipment to accurately monitor and measure the changing segments. While Chipotle is a competitor of QSR chains, it’s actually considered “limited-service” by some standards, which have not been able to keep up with the dynamic shifts in the industry in the last few decades.

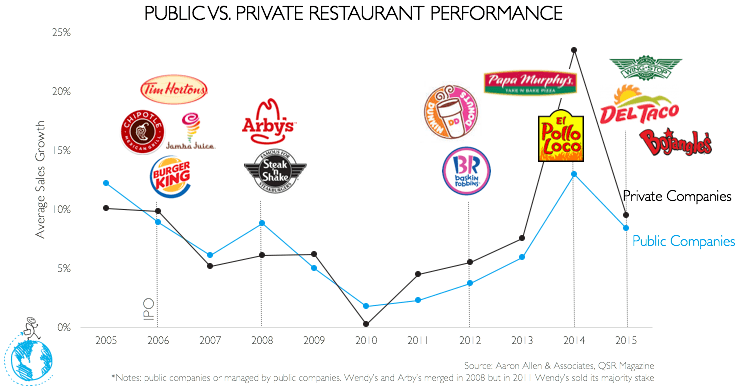

PUBLIC QSRs DON’T SEEM TO BE OUTPERFORMING PRIVATE ONES

Though the list of publicly held restaurants has grown over time, public companies in the QSR50 do not seem to consistently outperform private ones (measured by sales), or vice versa.

One pretty astounding example of that is the performance of the privately-owned Chick-fil-A, whose restaurants average around three times as many sales as KFC, a subsidiary of the publicly-owned Yum! Brands. In fact, Chick-fil-A generates more annual revenue than dozens of other chains that have more than twice as many locations (including KFC and Arby’s). Much of that growth, as outlined above, can be attributed to a simple menu and a reliance on tech. Chick-fil-A’s One app (which allows guests to order and pay for food via smart phone) was so popular it hit number one in the Apple store within three days of launching.

In the below chart, we considered public companies as well as companies bought by public groups (for instance, Tim Hortons and Burger King are owned by Restaurant Brands International, and Baskin Robbins and Dunkin’ Donuts belong to Dunkin Brands International).

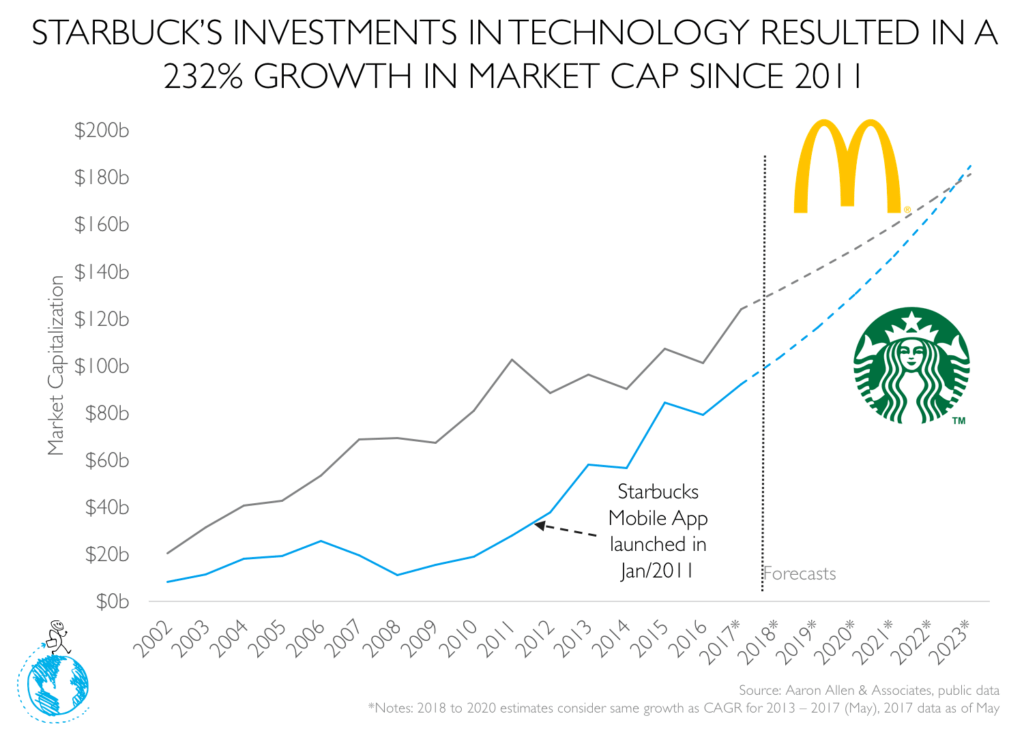

THE QSRs WHO’VE PERFORMED THE BEST HAVE OVERWHELMINGLY TURNED TO TECH

Operators in the modern restaurant landscape have a lot to contend with, including the increased expectations of tech-savvy guests and a new slew of competitors. While much has been written about the fast-casual and quick-service chains turning to tech to help cut labor costs and boost profit margins, fewer are noting how restaurant tech can allow guests more autonomy and convenience through services like kiosk and mobile orders. In short, technology is giving way to convenience — those who offer both are quickly stealing share from those who haven’t innovated beyond the drive-thru.

The chains that have made engineered convenience into the dining process have certainly reaped the benefits. Panera’s investment in tech, for instance, fueled sales and foot traffic, and had a tremendous impact on the guest experience, shaving years off of customer wait time. The project cost a hefty $40 million but, since its launch in 2014, that investment has paid off in at least one, very big, way. In April, the company announced it had entered into a definitive merger agreement with JAB Holdings, in a transaction valued at approximately $7.5 billion.

At Starbucks, the use of tech (via the mobile order and pay app) has proved so popular that the company is now redesigning its stores to keep pace with mobile order pick-ups. In fact, the company’s many investments into technology helped result in a 232% growth in market cap since 2011. By comparison, McDonald’s market cap grew only 21% over the same time period.

At least for the foreseeable future, the biggest players in QSR will remain the biggest players; McDonald’s isn’t going away anytime soon. But they and others like them will have to make some changes to ensure they stay at the top of the QSR totem pole — namely, further investments into ensuring convenience.

Be on the lookout for more analysis on the QSR 50 when the list is updated later this year.

* * *

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 68 countries. Collectively, his clients around the globe generate over $100 billion annually and span six continents and more than 100 countries.