The restaurant industry has been undergoing some pretty major changes lately. Restaurant delivery growth has skyrocketed in recent years. Automation is transforming the industry, one human-replacing-robot at a time, too. And the bulk of the companies paving the way for those trends are still just startups. Today, “startup” seems an almost euphemistic word for companies that are bringing in millions and, in some cases, valued at more than $1 billion.

Some modern startups are geared to the consumer — a slew want to corner the market on grocery delivery and the increasingly-crowded meal kit space is still popular, too. But others are aimed at the back of house (staffing, ordering, cooking, etc.). Perhaps less headline-generating than UberEats, but still incredibly well-funded.

Here’s a look at some of the ways startups will begin to change the restaurant landscape.

THE AMOUNT OF FUNDING SHOULD SERVE AS A SIGNAL FOR OPERATORS

While those in some segments of the industry (cough, cough, CDRs) continue to blame their poor sales on a restaurant recession, it seems that there’s no shortage of funding for foodservice startups.

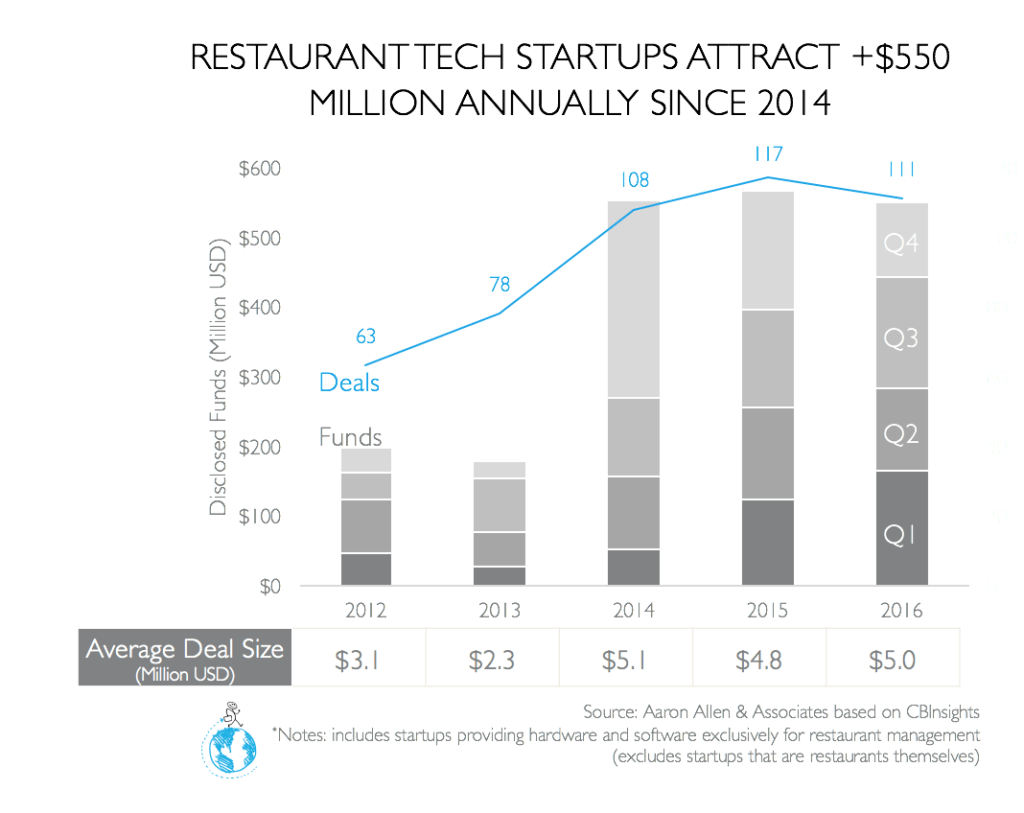

There’s certainly more money flowing into delivery startups than into the Casual Dining Restaurant coffers, for instance. Funding to restaurant tech startups has been stable at high levels since 2014, though it did decrease slightly in 2016. In 2016, there was a 3% drop in funding and a 5% drop in the number of deals. The average deal size, however, increased by 2%.

The largest deal in 2016 was for FiveStars, a startup that provides restaurants with consumer loyalty programs. The second largest deal was for Olo, which supplies restaurants with delivery and online ordering platforms.

A slew of other big-name startups have burst on to the scene in recent years. Blue Apron, arguably the biggest player in the meal kit space, became a $2 billion company in just three years, and is now reportedly flirting with an IPO. FreshDirect, an online grocer delivering to the New York area, has at least $297 million in disclosed funding. Ele.me, a food delivery site, has raised at least $2.3 billion ($1.25 billion of which came from e-commerce giant Alibaba).

It’s happened fast, but not overnight. Grubhub’s delivery service launched in 2014, yet many restaurants still don’t offer delivery (despite how quickly that and other services like it have grown).

While chains like Outback, Applebee’s, and Olive Garden are still struggling to stay relevant, they’re losing tables to faster, fresher, and more convenient fare (and, yes, meal kits, grocery and restaurant delivery).

STARTUP FUNDING MIRRORS CONSUMER TRENDS

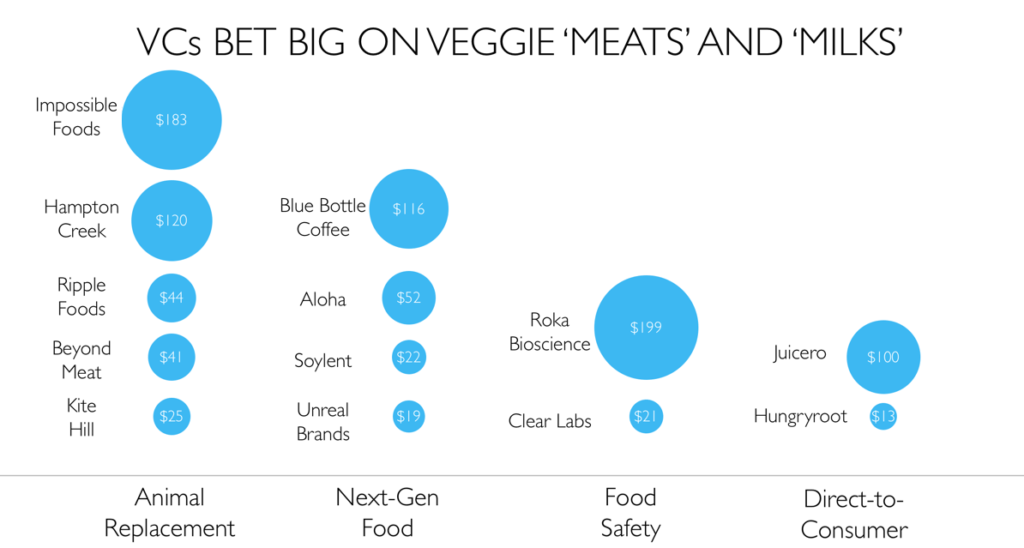

With “healthy” and “fresh” continuing to be two of the most bankable words in the industry, it’s unsurprising that Venture Capital firms (VCs) and investors are funding health-minded startups at a rapid clip.

Faux meats and dairy products have scored big in their recent funding rounds. As if the sheer scale of funding wasn’t compelling enough, it seems that even those who champion real meat are getting in on the veggie game.

Tyson Foods, the largest meat processor in the U.S. and the parent company of Jimmy Dean and Hillshire Farms, has invested an undisclosed amount for a 5% stake in Beyond Meat — part of an effort to take the plant-based “meat” (which bleeds beet juice and allegedly tastes like the real thing) mainstream. Tyson also launched a $150 million VC fund dedicated to startups aiming to revolutionize the food industry.

Lab-grown meat is making waves with VCs, too. Memphis Meats, which grows meat from stem cells in a laboratory, set a $1.5 million target for a recent funding round. The company was eventually forced to increase the round to $2.75 million, due to overwhelming demand from investors.

Investors are interested in insects, too. Exo, a startup specializing in protein bars made from cricket flour, raised $4 million in the first-ever Series A for an insect protein startup. Many cultures have been eating insects for centuries but Exo (and a slew of investors into startups like it) are betting that the practice will go mainstream, as consumers look for more sustainable forms of protein than beef. Meal-replacement startup Soylent snagged $20 million in Series A funding, with the bulk of the money coming from VC firm Andreessen Horowitz.

Other health-minded startups making headlines in recent years include Juicero, which raised $70 million in Series B funding for its flagship product: a $699 countertop device that, similar to a Nespresso or Keurig, cold presses juice out of “packs” of pre-packaged fruit.

NOT ALL STARTUPS ARE AIMED AT CONSUMER-FACING TECHNOLOGY. A LOT OF MONEY IS GOING TOWARD STARTUPS AIMED AT OPERATORS, TOO

Not all startups are attempting to put crickets on the dinner table or be the next Uber of groceries. In fact, some of the most well-funded aim to make life easier on operators.

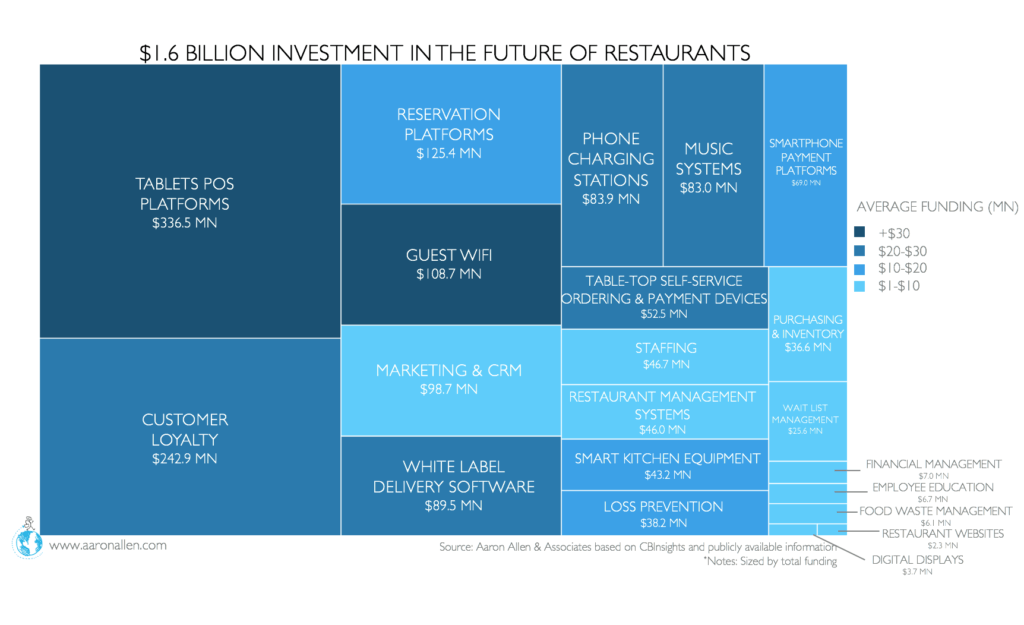

Tablets, customer loyalty, and delivery software are perhaps the sexiest trends, but millions are also flowing into restaurant management systems, smart kitchen equipment, inventory systems, and staffing startups, too. And it isn’t just in Silicon Valley — while 64% of these companies are headquartered in the U.S., 5.5% are in the UK, and 4.4% each are in Singapore, Israel and China. In other words, restaurant tech is a global phenomenon, so operators in every part of the globe would be wise to take note.

THE KEY FOR OPERATORS WILL BE KEEPING A CLOSE EYE ON TRENDS

Ultimately, for operators, these startups will become the competition. Rather than simply competing with traditional restaurants, now chains are competing with new ways of dining altogether: food trucks, meal kits, and delivery apps included. The casual dining industry is already bearing the brunt of this shift (though some are still blaming their troubles on a restaurant recession).

Those willing to face this new world will either need to get out ahead of trends or leapfrog them entirely. For restaurant CEOs, this is a scary thought, but it’s not without its advantages. Tyson Foods, for one, has taken a strategy to support sustainable growth and innovation — rather than waiting for lab-grown meat to one day kill off the real thing (or, at least, steal some of its share), the company is getting out ahead of the trend. In the future, Tyson might be blamed for being “part of the problem,” but it will be part of the solution, too.

A lot is happening in the world of restaurant startups (albeit, a lot of it under the radar). Getting in on these trends early could pay a lot of dividends down the road. With so much money flowing in to foodservice-related startups, operators will soon allow operators to control and optimize nearly every functional area of their operation.

* * *

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 68 countries. Collectively, his clients around the globe generate over $100 billion annually and span six continents and more than 100 countries.