A slew of headlines have plagued the GCC in recent months — many related to poor economic conditions brought on by political issues and sagging oil prices. GCC restaurant stocks have been impacted but, despite the recent problems, the region (and the hospitality sector in particular) continues to experience growth, making it a burgeoning location for both homegrown concepts and international foodservice and hospitality chains looking to expand to the Middle East. Case in point: the most prominent public hospitality companies, which have grown by leaps in bounds since their founding and continue to grow even despite economic conditions.

Below, we round up the most prominent public foodservice companies and examine how GCC restaurant stocks and hospitality stocks have been affected by the current economic climate.

PUBLIC HOSPITALITY COMPANIES IN THE KSA

The following are the public hospitality or foodservice companies in the Kingdom of Saudi Arabia, ranked from largest to smallest market cap.

Fawaz Abdulaziz AlHokair

Fawaz Abdulaziz Alhokair Co. engages in the retail and wholesale business of fashion, clothing, furniture, electronics, and accessories. It represents several brands covering fashion as well as cosmetics, entertainment, and food and beverage. The company was founded by Fawaz bin Abdulaziz Al-Hokair, Salman bin Abdulaziz Al-Hokair, and Abdul Majeed Al-Hokair on March 18, 1990, and is headquartered in Riyadh, Saudi Arabia.

Al Tayyar

As one of the leading tourism and travel-services providers in Saudi, Al Tayyar Travel Group boasts more than 3,000 employees and serves customers in over 430 branches in Saudi Arabia and abroad. The company has invested in branches across KSA, the GCC, Egypt, Sudan, Lebanon, Malaysia, the United Kingdom, Canada, and other popular tourist destinations.

Saudi Airlines Catering Co.

Saudi Airlines Catering was established in 1981 and, in the 35 years since, has witnessed a rapid expansion in operations, which now spans local and international markets. Since its founding, the business has diversified and now operates across the key sectors of in-flight, retail, and catering and facilities.

Herfy Food Services Co.

Founded in Riyadh in 1981, Herfy has grown to become one of the largest fast-food companies in the Middle East, even surpassing international chains in terms of presence. It has a total of more than 210 restaurants and 4,000 employees throughout Saudi Arabia. In addition to operating its own restaurants, Herfy produces and sells bakery and pastry products and provides companies and others with cooked meals.

Dur Hospitality

Dur Hospitality was established in 1976 and specializes in operating a wide portfolio of hotels and residential compounds across the kingdom of Saudi Arabia. Formerly known as the “Saudi Hotels & Resorts Company – SHARACO”, Dur Hospitality was one of the first companies in the KSA to introduce five-star hospitality services. Today, the company touts 20 properties and more than 1,600 employees. Hotel properties include Makarem Riyadh Hotel, Holiday Inn Tabuk, and Makarem Umm Alqura Hotel.

AL Hokair Group

Al Hokair Group was founded in 1975 to invest in the sectors of entertainment and hospitality under the leadership of Sheikh Abdulmohsin Alhokair. Over the five decades since, the group’s projects have expanded to include 79 entertainment centers and 34 hotels spread across Saudi Arabia and the United Arab Emirates. The company’s hospitality partners include Marriott, Intercontinental Hotel Group (IHG), and Hilton Hotels.

Tourism Enterprise

Market Cap:

The primary focus of Tourism Enterprise Co., established in the 1990s, is the ownership and management of the Palm Beach Resort. In addition to developing and managing resorts, the company also engages in the renting of hunting and marine equipment, and leasing of housing units and chalets. It is headquartered in Dammam, Saudi Arabia.

PUBLIC HOSPITALITY COMPANIES IN THE UAE

The following are the public hospitality or foodservice companies in the United Arab Emirates, ranked from largest to smallest market cap.

Emaar Malls

Founded in 2014 and headquartered in Dubai, Emaar Malls has become synonymous with luxury, having developed and operated some of the most well-known retail centers and shopping malls (including “Super Regional Malls” — ie. those in excess of 800 thousand square feet) in the region. The company also operates in the “Specialty Retail” segment, i.e. shopping centers mainly offering specialty stores for fine and casual dining, commercial offices, or retail outlets of manufacturers. The company’s real estate arm (the publicly-traded Emaar Properties) has developed some of the most large-scale projects in the region, including Burj Khalifa, the tallest building in the world.

ALDAR Properties

ALDAR owns nine hotels in Abu Dhabi, including seven luxury properties in the Yas Island complex, adjacent to the Formula 1 race track. Projects include the Yas Crowne Plaza (a 4-star hotel operated by IHG); Yas Viceroy; and Yas Rotana. The company was founded in 2005 and is today one of the leading real estate developers in Abu Dhabi and the wider Middle East region.

DXB Entertainments (P.J.S.C.)

The Dubai-based leisure and entertainment company DXB brings together a diverse portfolio of world-class brands in the areas of theme parks, family entertainment, retail and hospitality. The company is the owner of Dubai Parks and Resorts, the Middle East’s largest integrated theme park destination, and also manages five Dubai-based, family entertainment centers in addition to a chain of cinemas, all owned by Meraas. DXB Entertainments is traded on the Dubai Financial Market (“DFM”) under the trading symbol DXBE and boasts a market cap of AED 6.2 billion ($1.6 billion) as of July 2017.

Abu Dhabi National Hotels

Abu Dhabi National Hotels was founded nearly four decades ago as a hotel owner and asset manager. In the years since, the company has evolved into a hospitality group encompassing hotels, restaurants, destination management services, catering, and transportation. Under its Hotels Division, ADNH owns some of the most reputable and recognizable hotels in the Emirate, including The Ritz-Carlton Abu Dhabi and Park Hyatt Abu Dhabi Hotel and Villas. The group’s restaurants division is represented by the collection of innovative food and beverage concepts under the umbrella of the “Venetian Village,” wherein franchises of international restaurant brands operate within the grounds of The Ritz-Carlton Abu Dhabi, Grand Canal.

National Corporation for Tourism & Hotels

The National Corporation for Tourism & Hotels (NCT&H) was formed in 1996 as a way to develop both tourism and commerce in the United Arab Emirates, specifically in Abu Dhabi. It focuses on four areas: hotel acquisition and management, hospitality service, transport, and catering. Danat Hotels & Resorts is the company’s upscale hotel division, offering a diverse portfolio of four- and five-star hotels in the UAE (including Danat Jebel Dhanna Resort, Danat Al Ain Resort, and Al Raha Beach Hotel).

Foodco Holding

Foodco Holding was established in 2006 under the banner of Abu Dhabi National Foodstuff Company, as a standalone subsidiary. The company is supported by a team of approximately 500 employees, with operations covering the food sector, retail, packaging, catering, restaurant franchising, and other areas. The company boasts a diverse portfolio of products covering a wide range of fast-moving consumer goods, including rice, sugar, edible oils, pasta, canned foods, frozen vegetable, and more.

Marka PJSC

Marka is the UAE’s first publicly traded retail operator focusing exclusively on the fashion, hospitality, and sports segments. Founded in 2014 and listed on the Dubai Financial Market (DFM: MARKA), the company’s hospitality brands include Taste of Italy, Harper’s Bazaar Cafe, and Vitolo.

PUBLIC HOSPITALITY COMPANIES IN KUWAIT

The following is the sole public foodservice company in Kuwait.

Kuwait Food Co./Americana Group

Kuwait Food Co. (also known as Americana) specializes in both the operation of restaurants as well as the manufacturing of food products. It operates in restaurants, retail, food industries, and inter-company transactions. The company was founded in 1963 and is headquartered in Kuwait City. Americana is one of the largest restaurant groups and franchise operators in the region, with more than 1,200 restaurants across 14 countries. The group’s portfolio includes many of the top global brands in the industry: KFC, Pizza Hut, Hardee’s, TGI Friday’s, Costa Coffee and Krispy Kreme, and most recently Signor Sassi in addition to its own homegrown casual dining and fine dining concepts.

HOW PUBLIC GCC RESTAURANT STOCKS & HOSPITALITY STOCKS COMPARE

Kuwait Food Co. (Americana) has a market cap of $2.7b, making it the seventh-largest in that stock exchange, with a share of 3% of the Kuwait stock exchange market cap. Three percent might not sound like much at first glance but that’s a GCC restaurant stock with more bang than one of the biggest in the US (by comparison, Starbucks, the largest foodservice company listed on the NASDAQ, has approximately 1.2% of the market cap on that exchange).

In the UAE, Emaar Malls and Aldar Properties make it to the top 20 in terms of market cap. Though these are not foodservice companies, their performance can give some insights into the market pulse for the overall hospitality industry. All the hospitality companies considered in the UAE comprise 7% of the market capitalization (Dubai Stock Exchange and Abu Dhabi Securities Exchange). Meanwhile, in the KSA, none of the foodservice/hospitality stocks considered make it to the top 20 companies in terms of market cap, as the top 20 is dominated, instead, by financial institutions. Herfy is the only strictly-foodservice company to be found on this stock exchange and boasts a market cap of $920 million (0.2% of the total market cap).

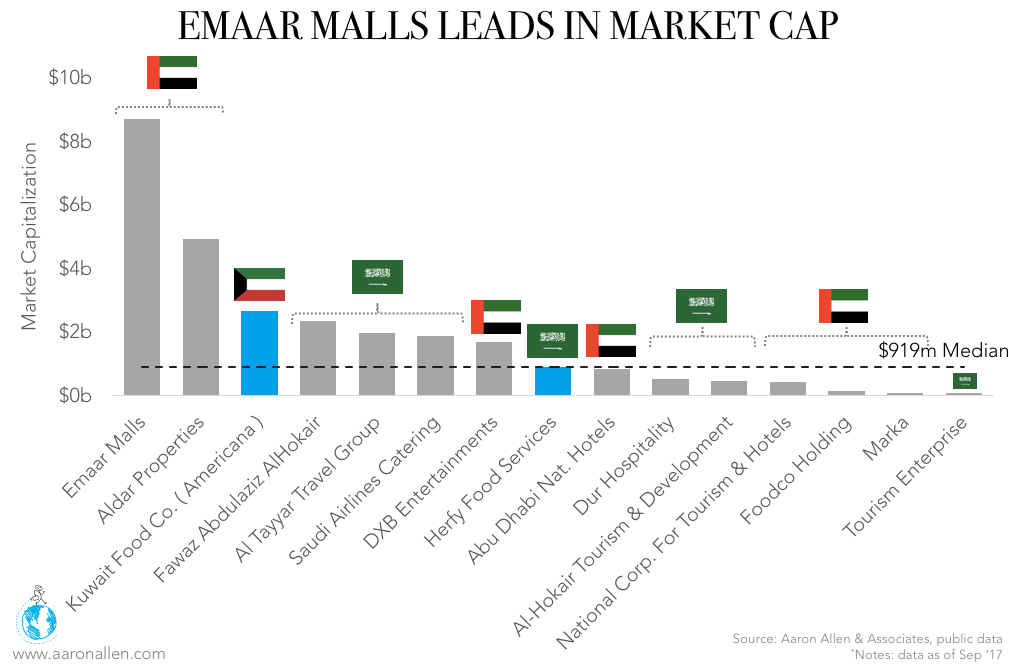

Among foodservice and hospitality public companies in the overall GCC, Emaar Malls (UAE) leads in market capitalization ($8.7b). In comparison, the two foodservice companies of this group — Kuwait Food Co. and Herfy — have a combined market cap of $3.6b (together comprising just 41% that of the market cap of Emaar Malls).

PAIN POINTS & SUCCESS IN THE GCC HOSPITALITY INDUSTRY

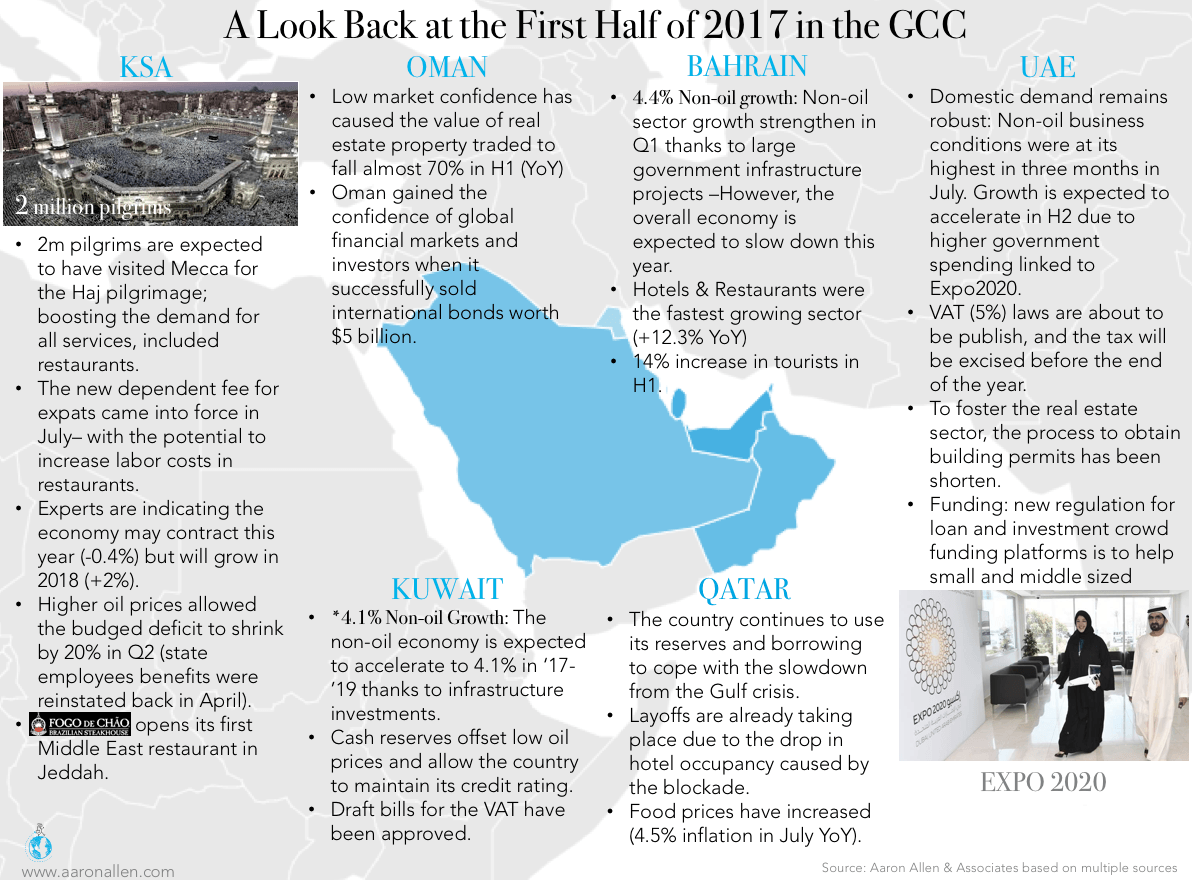

There have been a host of recent policies and business decisions that will affect operators and restaurant companies (public and private) in the region. Here’s a look back at how the first half of 2017 has stacked up in the various regions of the GCC:

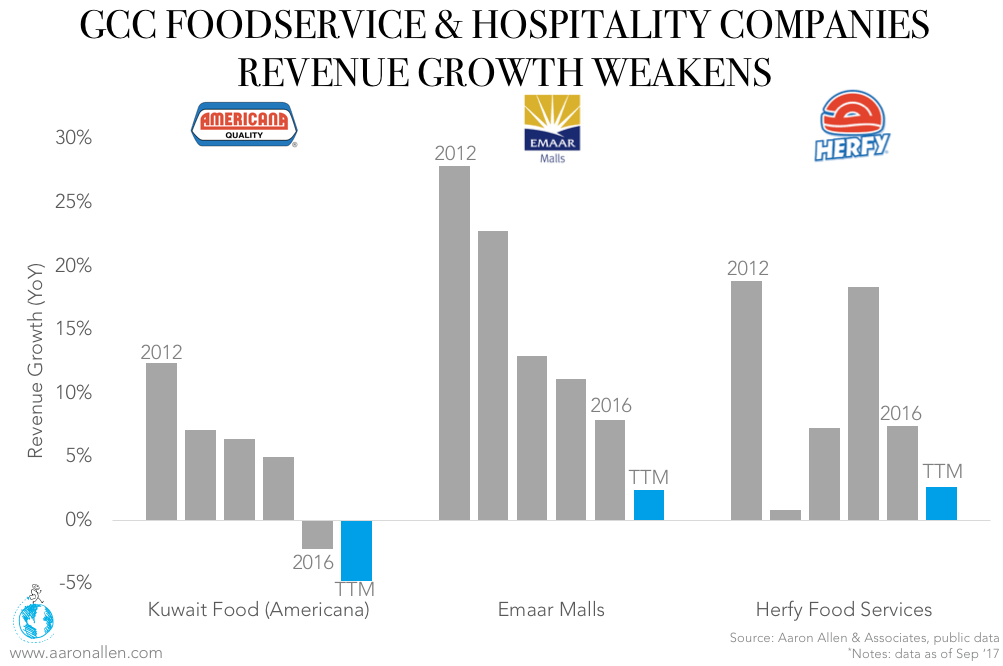

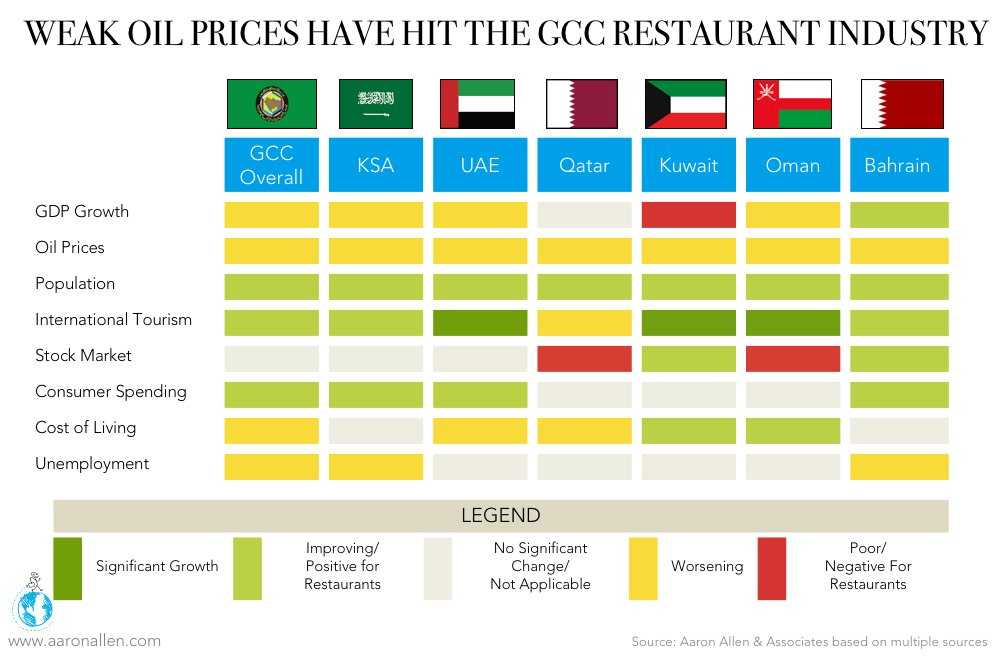

Oil prices have impacted even the most notable companies in the GCC, with revenue growth weakening nearly across the board. This “new normal” has been setting in since 2015, when the region began turning to familiar issues that many thought would go away in the wake of the Arab Spring. In 2017, the GCC continues to endure economic pain due to falling oil prices as well as threats of regional terrorism (Qatar has been accused of sponsoring terrorism and has thus been isolated from its Gulf allies as a result).

Oil prices tumbled more than 45% in 2014 (the steepest yearly drop since the 2008 financial crisis) and have since had an unavoidable impact on the Middle East’s foodservice and retail sectors. Kuwait Food Co. (Americana) revenue has decreased close to 5% (over a trailing twelve-month period), while Emaar Malls and Herfy revenue growth decelerated to less than half of their 2016 figures.

As a result, GCC restaurant stocks haven’t been spared, with weak performance witnessed over the past year. The median growth in stock prices in the KSA, UAE, and Kuwait (all industries) was 7.4%. By comparison, the S&P500 has grown 16%, as of September 2017. All but one of the foodservice and hospitality stocks considered above have underperformed the median. Only FoodCo Holding saw a stock price increase above the median (26.1% growth over the last 52 weeks).

As growth in the restaurant industry hinges, to a large extent, on macroeconomic performance, weak oil prices and oil production cuts (which have been extended until Q1 2018) have translated to weaker growth for restaurants. In the context of this “new normal,” however, non-oil growth remains healthy, bolstered by tourism and population growth. The largest risks are in Qatar — where the full repercussions of the June blockade are yet to be seen — and in Kuwait, which is the most dependent on oil.

While foodservice and hospitality are two of many sectors feeling the pinch, analysts remain optimistic about the Middle East’s efforts to diversify. Spending cuts and an increase in oil prices are helping GCC states lower some of the world’s highest budget deficits, and the International Monetary Fund has hailed the region’s progress in attempting to transform economies that have relied on hydrocarbons for more than five decades. GCC restaurant stocks should benefit, as a result, and foodservice and hospitality companies will likely see spend, sales, and traffic increase as the regional economies adjust and move forward.

* * *

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition and have worked with a slew of the leading foodservice companies throughout the Middle East. Collectively, our clients post more than $200 billion, span all 6 inhabited continents and 100+ countries, with locations totaling tens of thousands.