The timing for both bold buyers and smart sellers seems so well-aligned at this moment that it is utterly understandable for the M&A fever to be catching across geographies, cuisines, categories, and ownership types — and burning white-hot from foodservice tech startups and corporate venture capital initiatives to budding emerging brands and even the consolidation of mature and distressed brands around the world. With the combination of $2.5 trillion in dry powder (across industries, globally), limited inventory to sell, and still historically low interest rates (to finance transactions), restaurant valuations have climbed to record heights. International valuations can reach even higher multiples.

International valuations can reach even higher multiples. Some examples of legacy chains making these types of acquisitions include:

Some examples of legacy chains making these types of acquisitions include:

There’s Plenty of Capital to Put Behind Foodservice Companies

The timing to take advantage of this sellers’ market is ideal for many companies with the right strategic plans and the right representation. Having the right team in your corner can save time, avoid distractions, help accentuate the best attributes of your business, expand your network and connections, and add a level of professionalism (serving as a spokesperson and advocate representing your interests), ultimately maximizing your value. Here are five reasons why now may be a good time to consider a sale:1. You Can Benefit from High Valuations

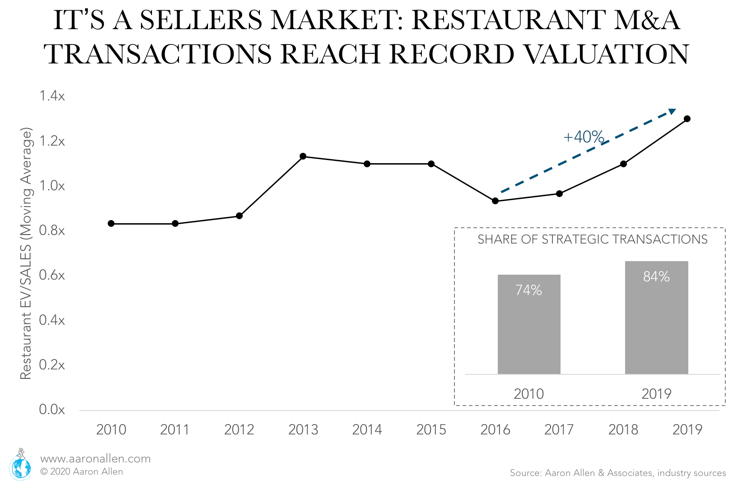

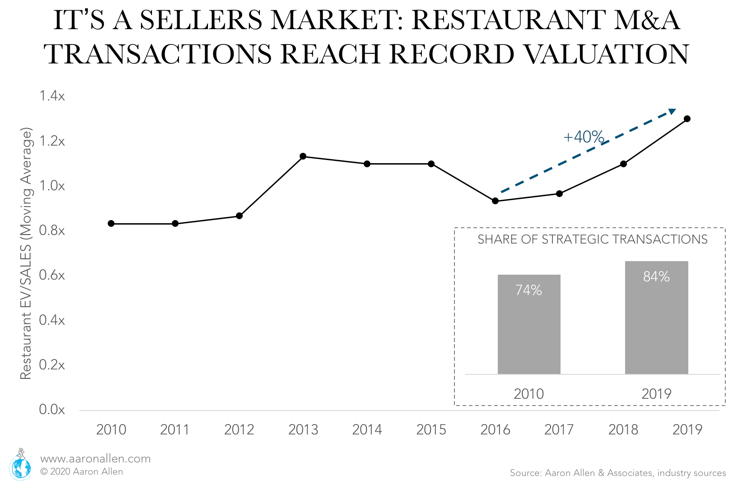

The average EV/Sales multiple reached 1.3x in the U.S. last year — 40% higher than three years ago. Strategic transactions are also doing their part in crowding-out financial deals (the share of strategic transactions has climbed by ten percentage points in the last ten years) and driving multiples up. International valuations can reach even higher multiples.

International valuations can reach even higher multiples.- In the Middle East, the median EV/Sales multiple for Consumer Cyclicals (which includes foodservice companies) reaches a median of 4.2x EV/Sales (3.8x as high as in the U.S.)

- Canadian Keg Royalties Income Fund and Boston Pizza Royalties Income Fund reach EV/Sales multiples of higher than 6x

- In India, Jubilant Foodworks — which owns the rights to operate Domino’s in India, Sri Lanka, Bangladesh, and Nepal, and Dunkin’ in India — reaches an EV/Sales multiple of 6.4x

2. Low Cost of Capital Makes it More Plentiful

Interest rates are still at historical lows, allowing for higher IRRs in leveraged buy-outs.- Reference interest rates (i.e. 1-year U.S. treasury bills) are well below their historical averages

- Restaurant companies finance 70% of assets with debt (as a median, among U.S. publicly traded companies and OTC stocks)

- The foodservice industry is paying below-median interest rates when compared to other industries (4.26% vs a median of 4.75% across industries for 2019)

3. Largest Amount of Dry Powder in History Means Investors are Thirsty for Deals and Finding them Hard to Come By

At the end of 2019, the amount of capital available for private equity fund managers to put to use (known as dry powder) surpassed the $2.5 trillion (yes, that’s trillion with a “T”) mark. This is the highest amount of investment capital available in history. And foodservice companies are increasingly becoming a target.4. Legacy Chains Need Growth Vehicles, and Are Willing to Pay for Them

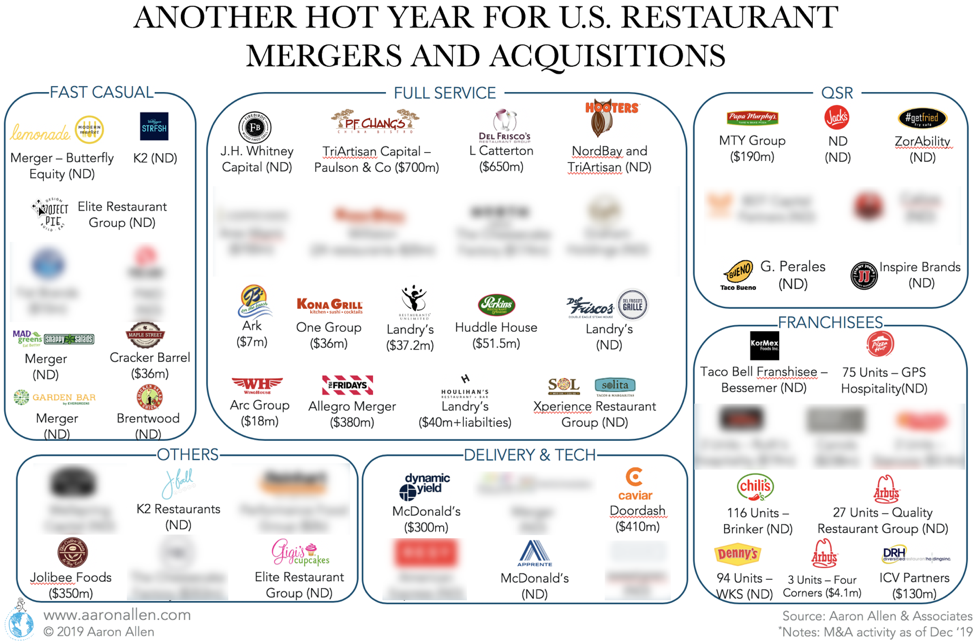

The size and scale of large chains was once considered part of their strategic advantage. Now, it can include investment risks derived from disruption — and its unapologetic cousins — howling at the castle gates and beating down the doors of incumbent kings and queens. Additionally, established chains are facing saturation and slow growth in their home markets. Acquisitions of “growth vehicles” (whether new and upcoming concepts in faster-growing segments or technology to foster existing or new revenue centers) can help to supercharge growth, in particular. Some examples of legacy chains making these types of acquisitions include:

Some examples of legacy chains making these types of acquisitions include:- McDonald’s tech acquisitions in 2019 (Dynamic Yield, Aprente, and investment in-app developer Plexure) are expected to foster growth of out-of-premises consumption as well as improve the customer experience

- The Cheesecake Factory acquired the incubator Fox Restaurants and casual-dining North Italia

- Inspire Brands acquisition of Jimmy John’s adding almost 20% in revenue