Although a restaurant company might sell assets or raise money with outside financing, the bulk of its cash should come from its operating cash flow: the money collected from food and beverage sales minus the funds spent on operating costs. A restaurant cash flow statement is an important tool for investors, as well as for operators looking to see how their company sizes up to the competition. Below, we’ll look at how a restaurant cash flow statement is laid out, what to look for, and how the cash flows of public restaurant companies compare.

Free Cash Flow vs. Operating Cash Flow

Operating cash flow, free cash flow and earnings are all important metrics in the evaluation of a restaurant chain being considered for investment. While the sale of a restaurant company has the effect of boosting earnings, it can affect cash flow if the company isn’t paid for that sale. On the other hand, a restaurant company that is profitable on a cash-flow basis could still have meager earnings, due to the industry being somewhat capital-intensive. Here’s the breakdown: Operating Cash Flow (OCF) is, essentially, a measure of the cash equivalent of a company’s net income. Operating cash flow indicates whether a company is able to generate sufficient positive cash flow to maintain and grow its operations, or it requires additional, external financing for expansion. Public companies calculate operating cash flow by adjusting net income to cash basis using changes in non-cash accounts, such as depreciation, accounts receivable and changes in inventory. Free Cash Flow (FCF) is a measure of a company’s financial performance, calculated as operating cash flow minus capital expenditures. FCF represents the cash that a company is able to generate after spending the money required to maintain or expand its asset base. The calculation used to determine free cash flow is net income plus amortization and depreciation minus change in working capital minus capital expenditures.

Reading a Restaurant Cash Flow Statement

There are three financial statements the balance sheet, the income statement, and the cash flow statement. A restaurant cash flow statement is used to determine whether a particular company is healthy — does it have the available cash to function? The cash flow statement is broken into three categories: Cash Flows From Operating Activities; Cash Flows From Investing Activities; and Cash Flows From Financing Activities. Two of the most important pieces of the cash flow statement, when determining a company’s health, are Net Income and Financing Cash:

- Net Income: While income is technically meant to be a number of how much a company makes, it’s not always illustrative of the big picture. Instead of relying solely on that number, investors would be wise to look at the line in the statement that denotes cash flow. If a company’s cash flow is a smaller number than net income (or a negative number), that should be a red flag, as it shows the company is losing money.

- Financing Cash: This shows whether the company has borrowed money, or raised money by selling stock. This allows an investor to see whether a company actually has the cash flow to pay its dividends, or if it’s borrowing the funds to pay the dividends.

The Cash Flow of Public Restaurants

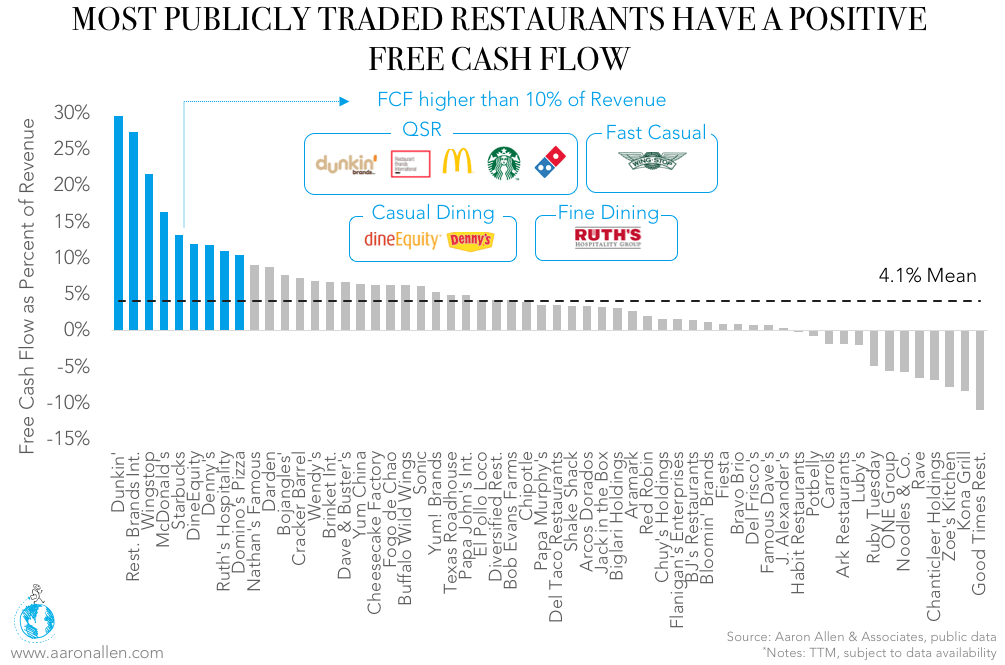

The majority (78%) of publicly traded restaurants have a positive Free Cash Flow (FCF), calculated as operating cash flow minus capital expenditures. Among those with more than 10% of revenues in FCF are five QSR companies, many of which have made large investments in improving convenience.  The Fast-Casual Wingstop (which also has a high gross margin), Casual Dining companies DineEquity and Denny’s, and Fine Dining chain Ruth’s Hospitality Group (which has a low CAPEX compared to other steakhouses) are also among the top. Forty-five percent of public restaurants with positive Net Incomes have Free Cash Flows larger than their Net Income. Leading this group is Red Robin, which touts an FCF that is 322% the size of its Net Income. The burger chain was even able to turn a negative FCF last year into a positive one (over twelve trailing months).

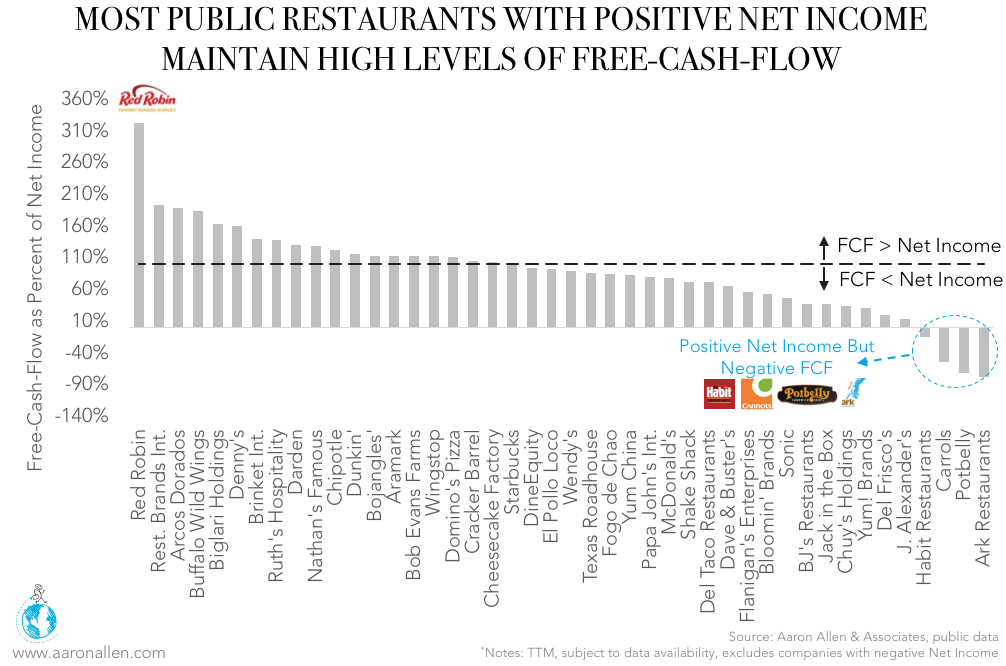

The Fast-Casual Wingstop (which also has a high gross margin), Casual Dining companies DineEquity and Denny’s, and Fine Dining chain Ruth’s Hospitality Group (which has a low CAPEX compared to other steakhouses) are also among the top. Forty-five percent of public restaurants with positive Net Incomes have Free Cash Flows larger than their Net Income. Leading this group is Red Robin, which touts an FCF that is 322% the size of its Net Income. The burger chain was even able to turn a negative FCF last year into a positive one (over twelve trailing months).  Sixty-four percent of those with a positive Net Income are able to convert three-quarters or more of that revenue into FCF. On the other hand, many companies have an FCF lower than their Net Income. In the extreme case, Habit Restaurants, Carrols Restaurant Group, Potbelly Corp, and Ark Restaurants have negative FCF in spite of positive Net Income.

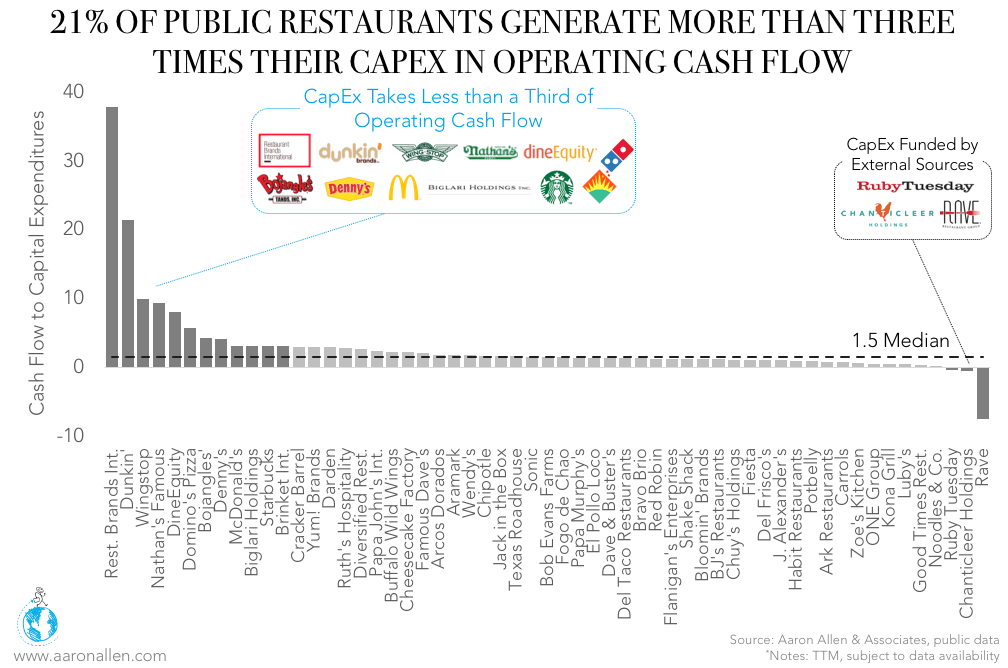

Sixty-four percent of those with a positive Net Income are able to convert three-quarters or more of that revenue into FCF. On the other hand, many companies have an FCF lower than their Net Income. In the extreme case, Habit Restaurants, Carrols Restaurant Group, Potbelly Corp, and Ark Restaurants have negative FCF in spite of positive Net Income.  For every dollar invested in Capital Expenditures (CAPEX), publicly traded restaurants get 1.5 times as much Net Operating Cash Flow back, as a median. Twenty-one percent of the above companies are generating Operating Cash Flows of more than three times their CAPEX. This group includes McDonald’s and Starbucks, who together add up $3.3 billion invested in CAPEX.

For every dollar invested in Capital Expenditures (CAPEX), publicly traded restaurants get 1.5 times as much Net Operating Cash Flow back, as a median. Twenty-one percent of the above companies are generating Operating Cash Flows of more than three times their CAPEX. This group includes McDonald’s and Starbucks, who together add up $3.3 billion invested in CAPEX.

About Aaron Allen & Associates

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion, span all 6 inhabited continents and 100+ countries, with locations totaling tens of thousands.

Other Relevant Content

Restaurant Debt Ratios

September 21, 2017 No Comments Read More »

2017 Restaurant Mergers and Acquisitions: An Update

September 21, 2017 No Comments Read More »

A Roundup of Restaurant Inventory Management Software

September 18, 2017 No Comments Read More »

U.S. Steakhouse Restaurant Sales: A Bright Spot In the Industry

September 12, 2017 No Comments Read More »