The restaurant industry can be mighty unforgiving, thanks to thin margins and high operating expenses. EBITDA (earnings before interest, taxes, depreciation and amortization) plays a crucial role, as it is designed to help owners and operators place a firm value on their restaurant company’s earning power by focusing on cash flow. Below, we examine how restaurant EBITDA differs from operating profit, and take a look at the EBITDA of publicly traded restaurant companies in the US and a few other markets (including the UK and the GCC).

Restaurant EBITDA vs. Restaurant Operating Profit

EBITDA is characterized as net cash income, or net operating income. To calculate EBITDA, restaurant owners must subtract their fixed costs from their gross profit. (EBITDA does not reflect noncash expenses such as depreciation and interest payments.) Operating profit, on the other hand, is calculated by subtracting the costs of goods sold, plus expenses, from total sales. Many operators and owners view restaurant EBITDA as a useful way of evaluating the actual earnings power of their operation, and to compare their businesses to others carrying different debt levels or depreciation values.

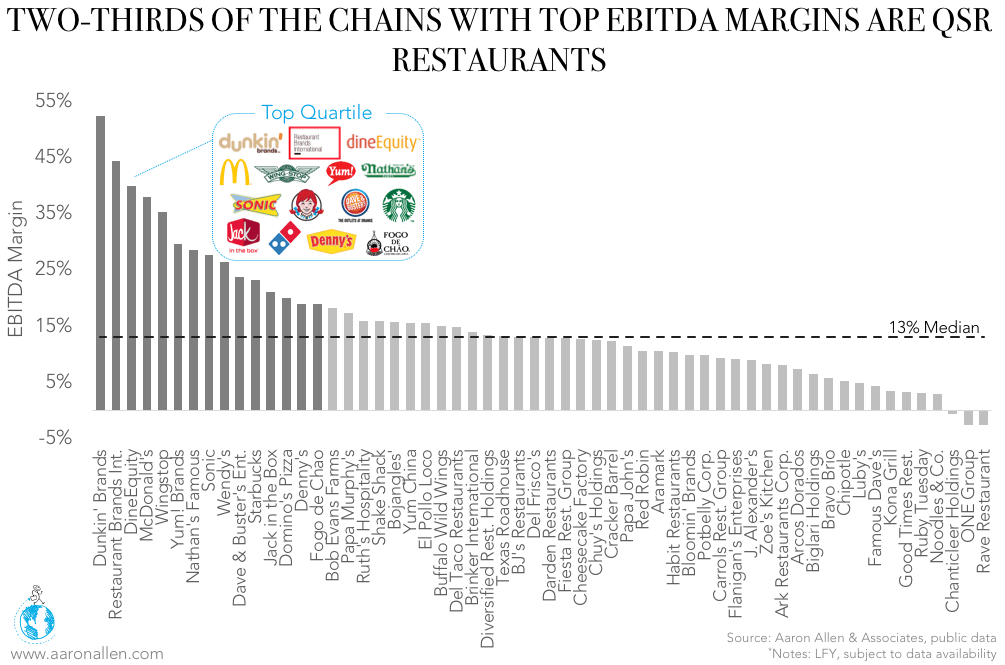

The EBITDA of Publicly-Traded Companies

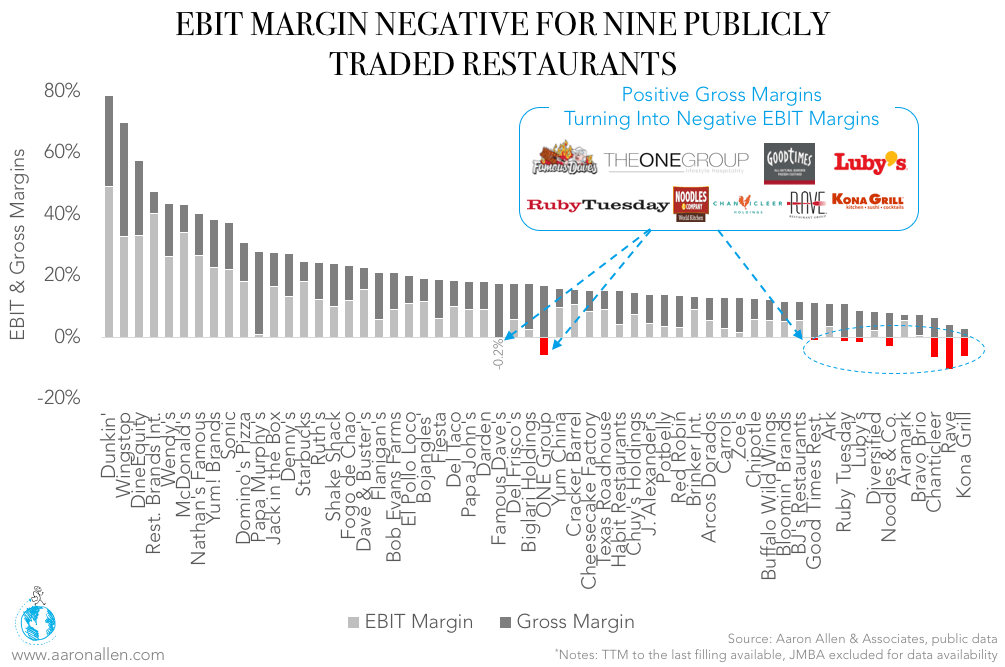

Publicly traded restaurants in the US have a median EBITDA margin (EBITDA-to-Revenue) of 13%. Two thirds of the companies in the top quartile (those with margins higher than 18.7%) are QSR concepts. The highest margin corresponds to Dunkin’, which quadruples the median.  For some publicly traded restaurants, gross margins are more than offset by Selling, General & Administrative Expenses and Depreciation & Amortization. As a consequence, EBIT margins are negative. Notably, The ONE Group, parent to steakhouse STK, has a gross margin of 16.7% (close to the median of publicly traded restaurants), which reduces to a negative 5.9% EBIT Margin given high SG&A Expenses.

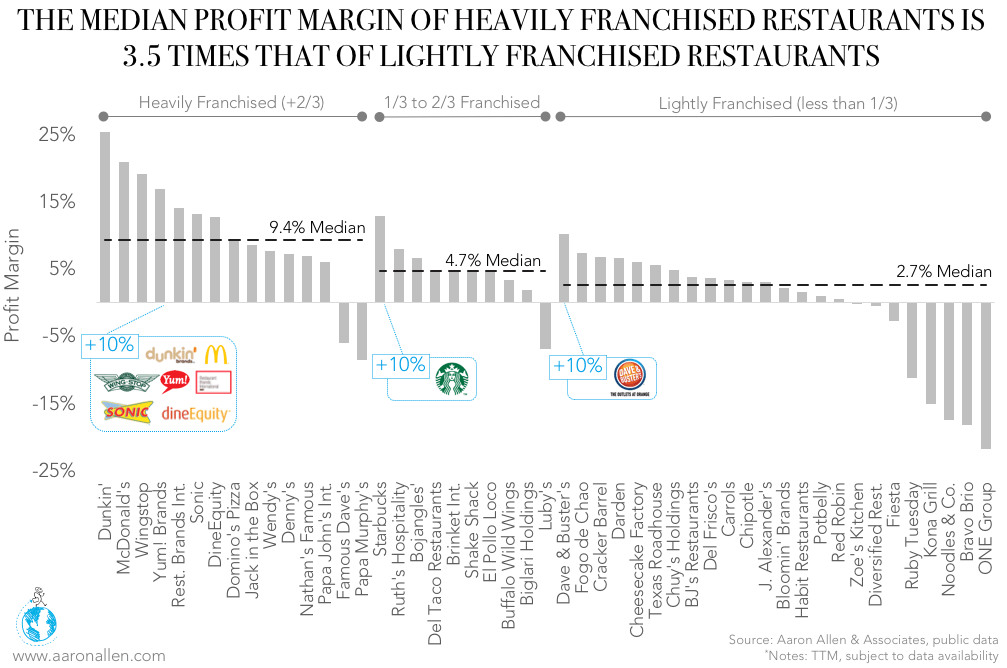

For some publicly traded restaurants, gross margins are more than offset by Selling, General & Administrative Expenses and Depreciation & Amortization. As a consequence, EBIT margins are negative. Notably, The ONE Group, parent to steakhouse STK, has a gross margin of 16.7% (close to the median of publicly traded restaurants), which reduces to a negative 5.9% EBIT Margin given high SG&A Expenses.  Since EBITDA excludes the effect of depreciation and taxes on earnings, it should be complemented by an evaluation of the overall bottom line. By subtracting Depreciation & Amortization, Interest expense and Non-Operating/Unusual expenses (if any), and Taxes, the EBITDA margin for publicly-traded restaurants is reduced from a median 12.9% to a profit margin (Net Income-to-Revenue) of 4.8%. As a median, the Profit Margin for publicly traded restaurants is 4.8%. However, there’s large variability depending on the concept and how heavily franchised the company is. For every dollar in sales, highly franchised restaurants keep a median of 9.4 cents in earnings — that’s 3.5 times the margin for restaurants with less than a third of their business franchised.

Since EBITDA excludes the effect of depreciation and taxes on earnings, it should be complemented by an evaluation of the overall bottom line. By subtracting Depreciation & Amortization, Interest expense and Non-Operating/Unusual expenses (if any), and Taxes, the EBITDA margin for publicly-traded restaurants is reduced from a median 12.9% to a profit margin (Net Income-to-Revenue) of 4.8%. As a median, the Profit Margin for publicly traded restaurants is 4.8%. However, there’s large variability depending on the concept and how heavily franchised the company is. For every dollar in sales, highly franchised restaurants keep a median of 9.4 cents in earnings — that’s 3.5 times the margin for restaurants with less than a third of their business franchised.  An international comparison of median EBITDA margins reveals margins of between 12.9% (among US companies) and 18.8% (in the GCC) for publicly traded restaurants. The median hides a wide variation in each geography, however.

An international comparison of median EBITDA margins reveals margins of between 12.9% (among US companies) and 18.8% (in the GCC) for publicly traded restaurants. The median hides a wide variation in each geography, however.

In the US, margins range between -2.7% (Rave Restaurant Group) and 52.3% (Dunkin’), while in the UK, some margins are as low as -27.5% (DP Poland) and go up to 46.2% (Ei Group). There are only two publicly traded restaurant companis in the GCC, both with EBITDA margins higher than 10%.

The Case Against Leaning Too Heavily on EBITDA

Most restaurant companies tout EBITDA as a measure of operating performance, though some critics caution against that. Because the restaurant business is so capital intensive, and assets like equipment and improvements carry so little value after their installation, capital expenditures must be taken into account when discussing EBITDA as a valuation measure.  Berkshire Hathaway chairman Warren Buffett, for one, is no a fan of companies touting EBITDA as a measure of operating results:

Berkshire Hathaway chairman Warren Buffett, for one, is no a fan of companies touting EBITDA as a measure of operating results:

There are more frauds talking about EBITDA. That term has never appeared in the annual reports of companies like Wal-Mart, General Electric, or Microsoft. The fraudsters are trying to con you or they’re trying to con themselves. Interest and taxes are real expenses. Depreciation is the worst kind of expense: You buy an asset first and then pay a deduction, and you don’t get the tax benefit until you start making money. Trumpeting EBITDA is a particularly pernicious practice. Doing so implies that depreciation is not truly an expense, given that it is a “non-cash” charge. That’s nonsense. In truth, depreciation is a particularly unattractive expense because the cash outlay it represents is paid up front, before the asset acquired has delivered any benefits to the business.

About Aaron Allen & Associates

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion, span all 6 inhabited continents and 100+ countries, with locations totaling tens of thousands.

Other Relevant Content

Restaurant Debt Ratios

September 21, 2017 No Comments Read More »

2017 Restaurant Mergers and Acquisitions: An Update

September 21, 2017 No Comments Read More »

A Roundup of Restaurant Inventory Management Software

September 18, 2017 No Comments Read More »

U.S. Steakhouse Restaurant Sales: A Bright Spot In the Industry

September 12, 2017 No Comments Read More »