Selling to restaurants is hard. Restaurant industry suppliers have to really understand the market landscape, the need, and the mind of the buyer. In the industry, these are times of rapid change. But times of dramatic change can also create opportunities for tremendous upside (if you know where to look and have the wherewithal to build and execute a bold and decisive strategy).

Whether you are a food supplier, a beverage supplier, a utensils and supplies provider, a restaurant equipment supplier, a services company, or a foodservice technology company, this article will help you understand what restaurant chains and independents are looking for — and how to cater to their needs well enough so that it’s worth it for them to switch their old vendor.

The Opportunity for the Foodservice Supply Chain: Address the Main Challenges Operators are Facing

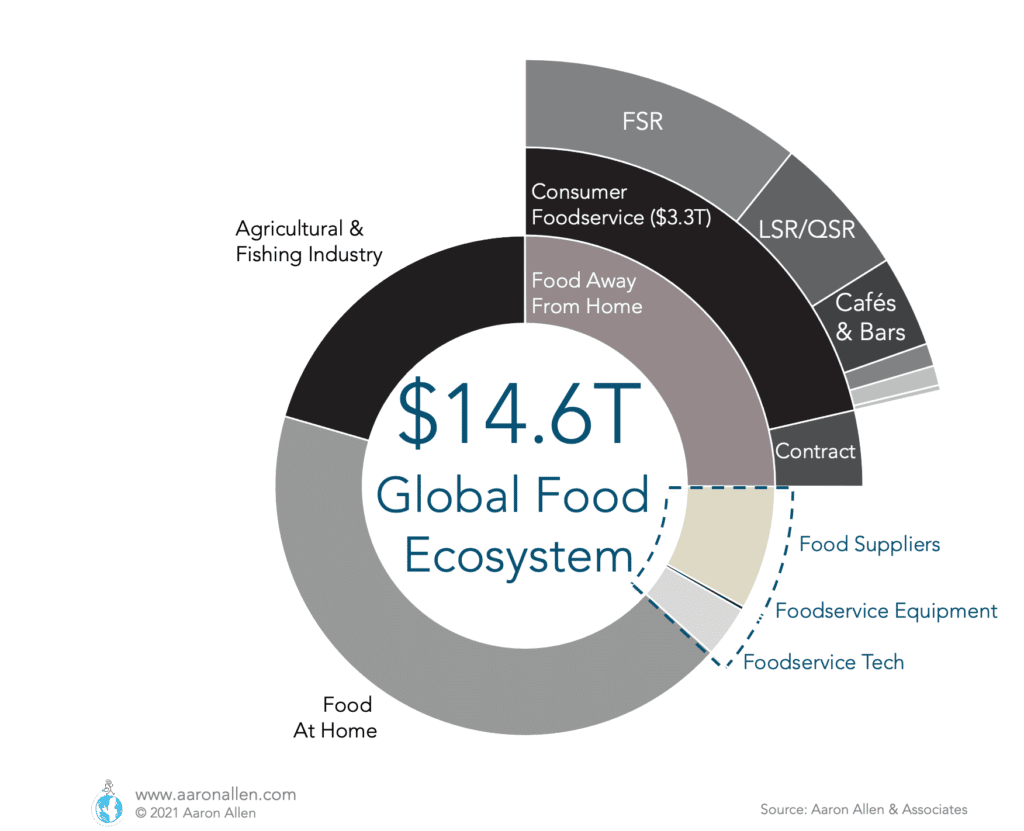

While many only think “restaurants” when thinking “foodservice,” we look at the entire global food ecosystem of $14.6T.

It’s one of those areas that the average restaurant customer may not normally think about: how food gets to the dining room. From “farm to fork” or “farm to table” has been a discussion for a while (we’ve started using the slightly less-sexy phrasing of from “seed to sewer” to really capture the full production to disposal process).

There are a whole host of challenges involved along the way. And just like many operators, the foodservice distribution model hasn’t been disrupted, pretty much since it started. By our estimates:

- The global foodservice supply chain represents close to $1 trillion.

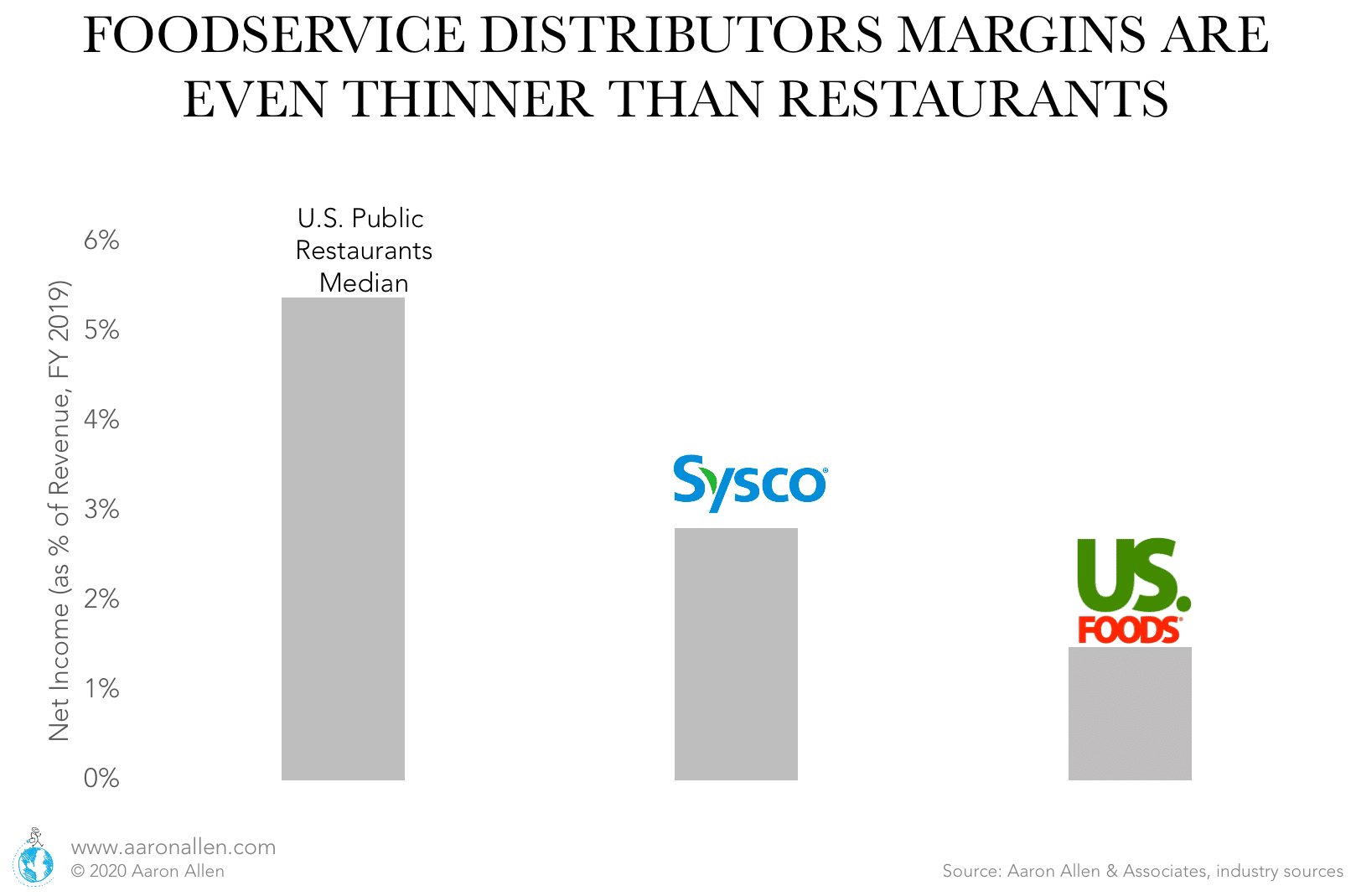

- Margins for suppliers and distributors are often even thinner than restaurants: Sysco and U.S. Foods have net income of lower than 3% of revenue, while the median for U.S. publicly traded restaurants is higher than 5%.

Here are some of the biggest areas that we see as concerning (and areas of opportunity) within the foodservice supply chain:

Suppliers Need to Be Reliable and Prioritize Foodservice Safety Needs

Food Safety |

|

|---|---|

Sanitation |

|

Traceability |

|

- Evaluating products through the mindset of a buyer

- Providing actionable feedback for potential enhancements

- Facilitating top-to-top introductions for enterprise accounts

- Generating global exposure for products and services

- Identifying capital providers and strategic partnerships

The Suppliers With the Best Understanding of Restaurant Logistics Are the Ones to Succeed

Purchasing |

|

|---|---|

Receiving |

|

Storage |

|

Inventory Management |

|

Distribution |

|

Fleet Management |

|

Last-Mile Delivery |

|

Efficiency Is In the Mind of the Restaurant Buyer

Make/Buy Decisions |

|

|---|---|

SKU/PLU Counts

|

|

Comparability

|

|

ERP Systems |

|

Agricultural Production |

|

Yields |

|

Global Trends Affecting the Foodservice Supply Chain

Driver Shortages |

|

|---|---|

Commodity Price Fluctuations |

|

Natural Disasters |

|

Invested in the Status Quo |

|

The Opportunity for Foodservice Equipment Suppliers: Everything Is Getting Smarter

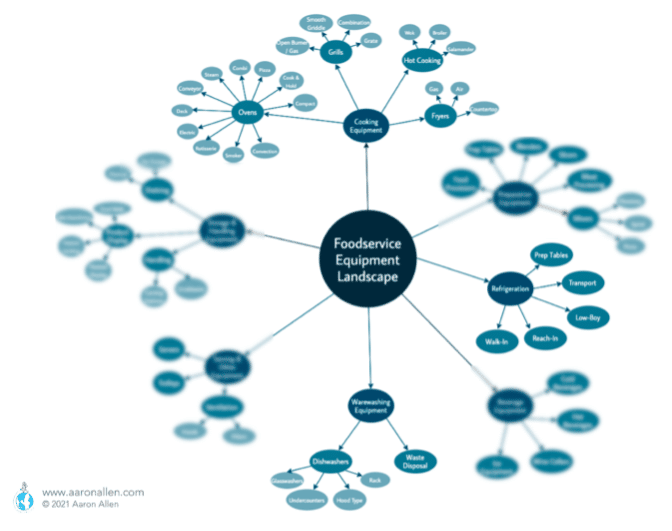

As Henry Ford famously said, if he’d given people what they wanted it would have been faster horses. This is a fitting sentiment when we think of the global consumer Foodservice Equipment landscape.

When we hear talk about technology, there’s rarely a focus on the Foodservice Equipment industry. For the players in this industry, growth has come primarily from acquisitions and incremental growth achieved through the expansion of key accounts. Technology has not been widely adopted primarily because incumbents have done little to innovate and bring to market compelling reasons to switch.

Those operators that are driving innovation are doing so within their own brands (and this is happening just among the very largest in the world). Little to no innovation is driven by operators in the middle market and below.

In short, the global foodservice equipment category is ripe for disruption and it is up to the supply side to demonstrate the virtues of the product and attract demand.

Foodservice Equipment Statistics

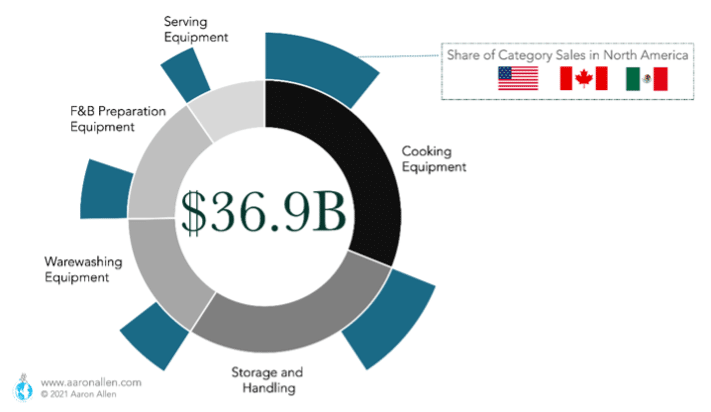

- The foodservice equipment industry represents close to $37 billion in annual sales.

- The top five players account for close to a third market share: Hoshizaki Electric, ITW, Middleby, Ali Group, and Welbilt.

- North America is the largest market but not the fastest-growing region.

- Go-to-Market strategies attractive for QSR chains are requisite for success.

At this point, large foodservice equipment companies can become platforms for bolt-ons. There is an opportunity to take something dumb and mature, something smart and yum, and put them together. In this line, with AACP we’re looking into some interesting investment opportunities that totally alter the foodservice equipment landscape.

How to Sell to Restaurants

Suppliers trying to sell to restaurants often find that doors get shut before even being able to introduce themselves. The restaurant management is trying to navigate one of the most demanding businesses on earth and responding to multiple demands. There are ways though to cut through the clutter, to communicate the value of the product and help improve food quality, optimize processes, and innovate the back-of-house.

Here are some of the questions we help restaurant suppliers answer.

- Where is the industry headed, and how does the supplier’s product fit into that future?

- How do operators evaluate and decide on investments and supplier partnerships? How is this different in chains and independents?

- How do we evolve our offering to stay relevant to the operators of tomorrow?

- What motivates the buyer decision-making process in chain operations?

Thinking through some of these is a good exercise for suppliers as a first step towards communicating effectively.

How We Help Foodservice Industry Suppliers

Selling to restaurants can be challenging. The industry is becoming more fragmented. Massive disruption is impacting nearly every aspect of foodservice. And operators are often (understandably) overwhelmed by the number of products and services available and being sold to them each day. For restaurant suppliers to be able to sell to restaurants, they not only have to have an appealing product but they also have to get to the right people at the right time with the right message. It’s not easy to unlock the share of the global food ecosystem but it can be done.

We work with OEMs, supplier, manufacturers, brokers, distributors, technologists, and other product and service providers seeking to better understand and serve the dynamic needs of the global foodservice industry.

State of the Industry Analysis | Enterprise and Key Account Strategy | Total Addressable Market | Go-to-Market Strategy | Segmentation Analysis | Brand Strategy | Product Strategy | Channel Strategy | M&A Strategy | Cross-Border Expansion | Distribution and Logistics Strategy | Financial Forecasts | Due Diligence | Business Plans | Investor Presentations | Board-Level Business Case Development | Thought Leadership & Exposure | Joint Ventures and Partnerships | Capital Introductions | and more

Frequently Asked Questions about Foodservice Industry Suppliers

What companies supply food to restaurants?

Some of the largest food suppliers in the U.S. are Sysco, US Foods, McLane Foodservice, and Gordon Foodservice.

What companies supply equipment to restaurants?

Some of the leading players in foodservice equipment are: Hoshizaki Electric, ITW, Middleby, Ali Group, Welbilt, Electrolux, Fujimak, Cambro Manucaturing, Dover, and Duke Manufacturing.

What are the main categories of products in the foodservice equipment industry?

Cooking Equipment and Storage and Handling (including refrigerators and freezers) are the largest categories based on sales. Other large categories are Warewashing Equipment, F&B Preparation Equipment, and Serving Equipment.

Who are the main buyers of foodservice equipment?

Full-Service Restaurants and Hotels tend to have the highest spend on restaurant equipment. However, the opportunity in limited service (QSR and fast-casual) is attractive for equipment companies because of the predominance of chains (franchisees that have to follow the standards of franchisors) and general standardization.

About Aaron Allen & Associates

Aaron Allen & Associates works with leaders of global foodservice and hospitality companies on strategic issues related to growing and optimizing performance and value. Specializations of the firm include multinational expansion, system-wide sales building, brand and portfolio strategy, modernized marketing, industry trends, technology, and advanced analytics. Aaron has personally led more than 2,000 client engagements spanning six continents and 100+ countries for companies collectively posting annual revenues exceeding $300 billion.