Americans love hamburgers. With nearly 50,000 burger joints in the United States, there’s one location for every 6,300 citizens who – on average – consume 46 burgers each year; collectively gobbling down 14 billion hamburgers annually. Of all sandwiches sold in the U.S., 60 percent are hamburgers, and 71 percent of all beef American’s consume comes in the form of a patty pressed between two buns.

But is love enough to sustain the wildly optimistic better burger growth projections? Given that 86 percent of the establishments selling these in-demand menu items are chains – brands with aggressive plans for expansion – we’re able to deduce a few clues pointing to the impending better burger bubble burst.

ABOUT SHAKE SHACK (AND HOW IT’S GROSSLY OVER VALUED)

We all know Shake Shack had a huge IPO earlier this year. But what are they really worth, with their 41 domestic and 29 international locations? The company has expansion plans to open at least 10 domestic locations per year (thus far, Shake Shack has not offered any detailed international expansion plans).

If all goes to plan, in five years, the brand will have doubled its U.S. footprint, bringing the Shake Shack’s total global location count to 120 units (more, if Shake Shack does expand more aggressively abroad). Ultimately, company representatives announced, America’s in-vogue burger brand is working toward the goal of a 450-location domestic footprint.

So, if the Shake Shack team performs to perfection, expanding at the projected rate and maintaining an average unit volume (AUV) of about $3.8 million (difficult to achieve in non-metro markets), at best – by the brand’s own calculations – they will generate revenues somewhere in the $450 million to $500 million range by 2020. But they are already trading at a multiple (on revenues) between three to six times that projected best-case scenario.

Where else would you pay now three to six times what something will be worth five years later? With its $1.82 billion market capitalization, the company’s current value is a whopping 96 times EBTIDA.

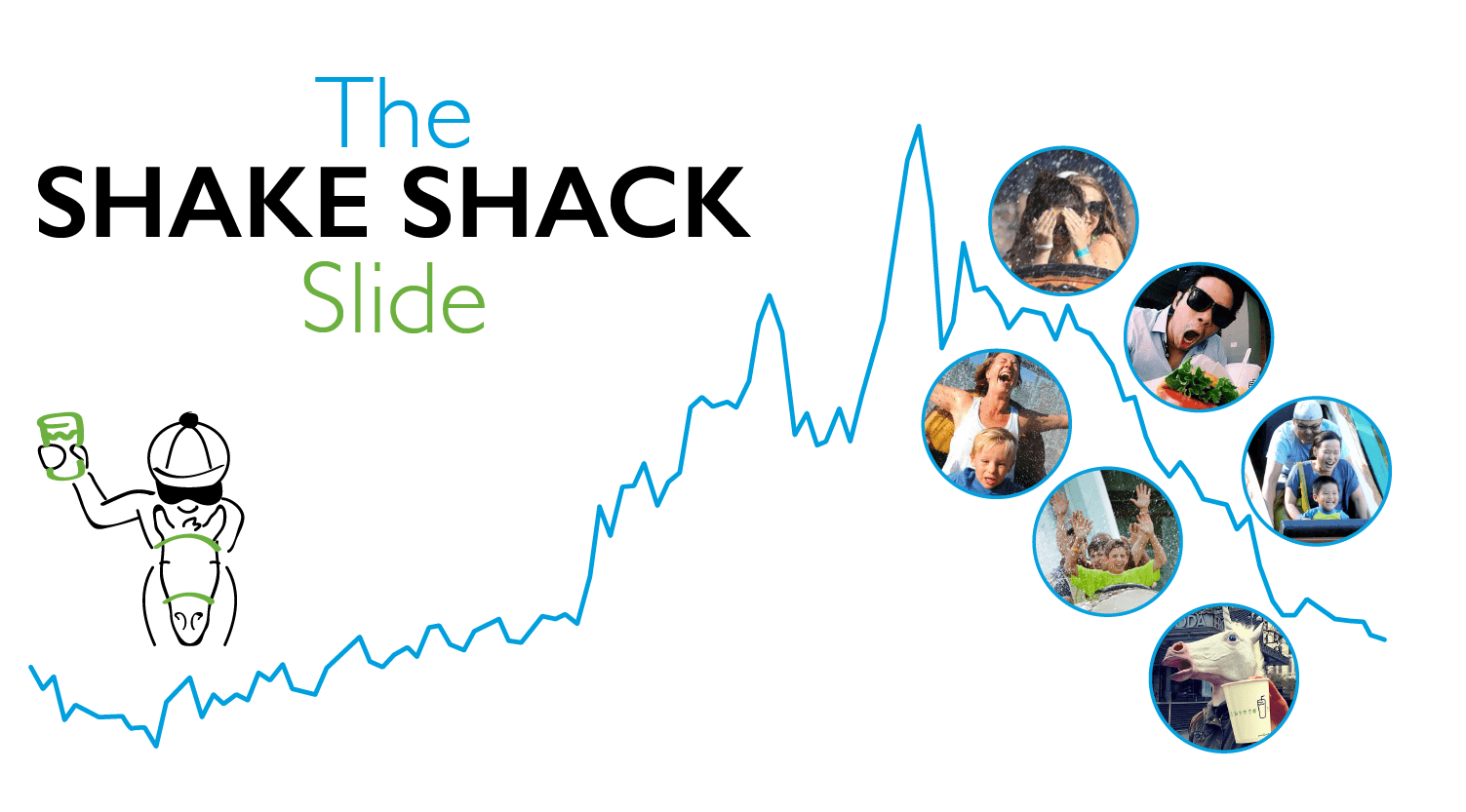

SLIDE BEFORE THE LOCKOUT EVEN EXPIRES

If you’ve ever waited impatiently at the back of a long line for a Shack burger, nervous they may run out of food before you get a chance to order, you can just imagine how much more anxiety those affected by the 180-day lockout period to sell their stock must feel. They’ve seen their shares go from a value of under $20 to almost $100; at one point holding their claim to a $3 billion fortune that they’ve witnessed falling sharply to half that value.

Already, 40 percent of Shake Shack’s shares are sold short, and on average, stocks fall around 10 percent once the lockouts are lifted. As the lockout period end approaches, despite what will definitely be urgings from the higher-ups to not sell, the market will be flooded with shares. By all accounts, Shake Shack is already over-valued by as much as 50 to 70 percent; and come July 29th – when the lockout lifts – we’re likely to see the stock finally price correct and a hard reality to set in.

UNIT LEVEL EXPANSION

More than 50 other national hamburger chains are planning to open what will be, collectively, thousands of new locations. Here are some of the big players and other growth highlights. This is in addition to the 450 locations Shake Shack dreams of.

- Burger Fi: Having grown 175 percent from 2013 to 2015 (33 to 68 locations), the chain is planning 10 new units just in the Charlotte market alone.

- Burger Fuel: This New Zealand chain, currently at 55 units, but with new investment from Subway founders, plans to hit 1,000 locations in less than seven years with aggressive expansion plans in the U.S.

- Bareburger: This brand grew from a startup in 2009 to 20 locations today (just six years).

- Wayback Burgers: A brand with 76 locations currently operational and an additional 200 contracted.

- Mooyah Burger: Having opened 16 new locations in 2013 and an additional 40 in 2014, at 60-plus units today, Mooyah Burger plans to be at 100-plus locations by the end of 2015.

- Smashburger: Currently operating 315 locations (having opened 65 units in 2014 alone), Smashburger plans to go public around November of this year (and they must be biting their nails off watching The Habit Burger and Shake Shack both beat them to the punch).

- Oh, and don’t forget Marky-Mark (and his restaurant reality show funky-bunch)! Mark Wahlberg and his brothers are getting in the better burger game, too, with Wahlburgers (the restaurant and reality show). While they have just two locations up and running, their website shows five states with “coming soon” banners (or, another way of looking at it – yet another better burger chain with plans to more than triple in size in the nearly-immediate future).

VALUATION COMPARISONS

In the full 2014 fiscal year, Shake Shack posted $155.8 million in revenues from 41 U.S. locations, and another 29 stores internationally. The market capitalization of Shake Shack is currently valued at $1.82 billion. That means that every single Shake Shack location is valued at an incredible $44 million. Of the other major industry players we looked at, the next highest is the recently-public Fogo de Chao (FOGO) coming in at a value of $17.6 million per location.

Even though Fogo de Chao does nearly twice the revenue-per unit, at double the EBITDA of Shake Shack (which means Fogo de Chao does almost as much in profit as McDonald’s does in AUV), it has a market capitalization of just $625 million (or about a third of Shake Shack) with only 11 fewer locations. So if they’re doing twice the revenue at twice the profit, why do they deserve only one-third of the market capitalization? We know Fogo de Chao isn’t a direct competitor like those we discussed before, but it’s the principle of the matter here.

Shake Shack’s valuation hit nearly $3 billion at its peak. The total U.S. hamburger industry does $73 billion per year. That works out to about four percent of the entire U.S. hamburger business for a chain that has global sales representing 0.00016 percent of the U.S. industry and a unit market share of 0.00065 percent. Put another way, based on an average unit volume of all hamburger restaurants in America of $1.46 million ($73 billion, split between 50,000 locations), Shake Shack’s value of $3 billion would make its 41 U.S. locations worth the equivalent of 2,054 other hamburger joints.

BURGER MARKET SATURATION

The market is already more saturated than the oil most of them use for their fries.

The better-burger market simply has too many players on the field chasing after the same ball. McDonald’s always has been, and always will be, associated with the hamburger – and even they are taking steps to hitch up to the better burger bandwagon. Adding 1.2 ounces of meat and some grill marks to each patty is like putting a racing stripe on an outdated car model and touting it as a new innovation, but hey, they’re trying.

PER CAPITA BURGER CONSUMPTION & MIX

On a percentage basis, hamburger consumption per capita actually lags behind population growth. America is already in the top two global percentile in per capita beef consumption – and 71 percent of all of the beef we consume is in the form of a hamburger. So, how likely is it that per capita hamburger consumption is going to increase if it already represents such a high percentage of the American diet?

Another factor besides the overall downward trend in beef consumption per capita in the U.S. seen in recent years, we should consider the shift in the demographic composition of the population. As Venessa Wong points out, “nothing tops ethnicity as a predictor of a diner’s taste in fast food.” While Hispanics – the fastest-growing ethnic demographic in America – consume more beef per capita than Whites and non-Hispanics, they prefer their ground beef served up in other ways than between two halves of a burger bun.

INDUSTRY VS. SEGMENT GROWTH

In 2013 the better burger segment was at around $3 billion in revenue and was forecasted to grow to $5 billion within five years. That’s around $400 million per year averaged through to 2018. Now let’s divide that out by what the typical hamburger joint does in average unit volume (according to our estimates, that’s an AUV of $1.46 million).

It works out to 1,369 new locations in total from 2013 to 2018 opening, or about 273 per year (assuming all others already open do not have revenue growth). If we take a higher average unit volume of what many of the better burger joints are doing (in the $2.7 million average unit volume range – more than the average McDonald’s, which is at about $2.4 million), the unit count growth would drop to 740 over the next three years (or, on average, just 148 new units per year). If we’re on track from 2013, it would mean that between now and 2018 somewhere between 370 to 682 new units will open.

But overall, the entire burger market grew less than two percent during a time when the entire restaurant industry grew by as much as double that percentage. So where is all of this growth going to come from? It’s not actually growth. Just ask McDonald’s. The company has closed — or has plans to close — hundreds of units in the U.S. this year alone. The “growth” in this segment is through cannibalization, not growth in per capita consumption.

EVERYBODY’S DOING IT

Could you imagine being Smashburger right now? They have more locations than Shake Shack and Habit Burger (plus these two brands’ next 12 months of expansion plans) combined and were called “America’s most promising company” by Forbes back in 2011 – before Shake Shack even stepped foot outside of New York. But Smashburger lost by a nose (literally just a few months) in the race to the gone-public finish line to both Shake Shack and The Habit Burger (who’s President and CEO — former COO of The Cheesecake Factory, which consistently posts the highest AUV in the industry — Russ Bendel has more “outside New York” experience than the whole Shake Shack upper management team combined).

The Smashburger IPO will be significantly lower than Shake Shack or Habit Burger, not because they have worse unit fundamentals or don’t have as good of a product (some might argue better), but because they were beaten to the punch. What’s the lesson here? Timing is everything, and invest in PR.

THE BETTER BURGER BUBBLE BURST

The hamburger isn’t going away. Neither is Shake Shack, or McDonald’s, The Habit Burger, or Smashburger anytime soon. We’re not hating on Shake Shack and congratulate Danny Meyer. He has the industry savvy and made more off of his burger joint in just a few months than he did in all of his years of experience in running fine dining restaurants combined. He’s respected and he deserves a big payday. I suspect even he would admit though that the stock is currently still overvalued.

SOME PREDICTIONS

- Shake Shack stock value will continue to fall.

- Smashburger won’t do nearly as well in their IPO as The Habit Burger and Shake Shack did when they go public later this year.

- McDonald’s will continue giving up market share and closing locations. They’re also likely to soon become the target of an activist investor as the stock value starts to fall like their same store sales have been in recent periods (two of the biggest activist investors out there are already separately turning around Wendy’s and Burger King – and kicking butt at it; they’re up double digits while MCD’s falls further as a consequence of their many McStakes).

- We’re not predicting American’s are going to make a huge reduction in per capita hamburger consumption anytime soon. But, just like when you crave a hamburger and start to feel satisfied after the first few bites, investor appetites are starting to become satiated with the better burger segment and there will be a period of contraction soon due to the oversaturation of burger concepts and promotions.

I want to reiterate that I’m not pessimistic about the Shake Shack brand; and certainly not down on Danny Meyer (he’s an industry hero and we predicted this would be a very hot IPO 5 months before they went public).

The caution about their stock value isn’t a criticism of their product or consumer appeal. Union Square Hospitality and Danny Meyer are already doing the right thing – taking some of this enhanced fame and fortune and investing it into concepts with greater upside (like their recent investment in Tender Greens). However, that’s not going to help your Shake Shack stock value anytime soon.