An analysis of the top 100 independent restaurants in the US reveals a few trends: steakhouses, for one, are among the highest-grossing chains. American-focused concepts are tops, too, generating as much as sales as seafood, French, and Spanish independents combined.

But a look at how that list has changed since it was first published by Restaurant Business back in 2014 is revealing, also. A number of once big-names are no longer among the top 100 independents. In their place, a new crop of players have emerged.

The Top 100 Independent Restaurants in the US in 2017

This year’s Top 100 Independent Restaurants’ aggregate food and beverage revenues added up to some $1.8 billion in 2016 — a number not too far off from the 2015 list. The number of customers at the restaurants on the list has been increasing, leading to higher cumulative sales. However, overall average spending per table has remained more or less the same for the past three years

Among the highest-grossing independent restaurants, the top 30 account for $731.2 million in sales. The largest category among these is steakhouses, which comprise 26% of sales and 30% of the establishments.

The top restaurant specializes in Asian cuisine, while Steakhouses, Seafood, American and Italian cuisine represent the top 10 restaurants. Together, American concepts and Steakhouses account for 51% of 2016 sales of the Top 100 Independents. The sales of all the restaurants in the American segment are equivalent to those of Seafood, French, and Spanish cuisines. American and Steakhouse segments, however, don’t have the highest average AUV: $17.1m (American) and $17.6 (steakhouses) which is lower than Asian, Italian, and Seafood AUVs.

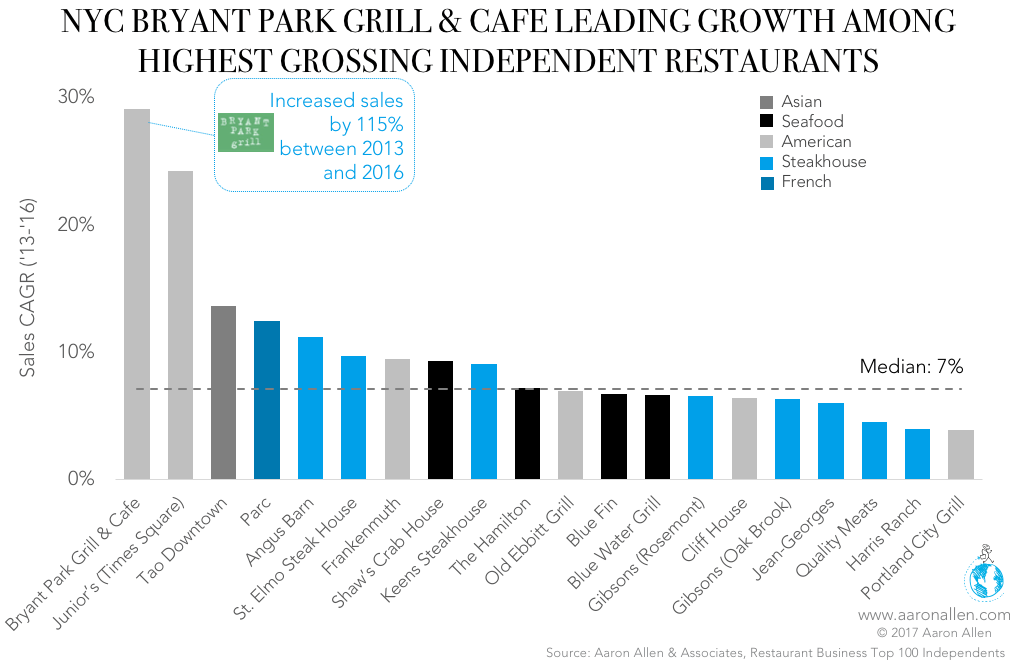

Sixty-three percent of the top 100 highest-grossing independent restaurants were also included in the rank back in 2014. Among these, NYC Bryant Park Grill & Café (owned by parent company Ark Restaurants) has the highest average annual growth (29% CAGR, more than doubling sales in three years), driven by a 63% total increase in meals served and keeping the number of seats constant. On the other hand, 40% of these top growers are steakhouses (in comparison, a quarter of the restaurants in the rank belong to this segment).

Trends Among the Top 100 Independent Restaurants in the US

One trend that we continue to see crop up on the list, again and again, is location. That New York City, Las Vegas, Chicago, and Washington D.C. have consistently held the top four spots in terms of cumulative restaurant sales. While New York leads in terms of sales contribution, Miami Beach and Las Vegas have significantly higher average check amounts.

When we look at number of meals, the story is quite different. Washington D.C. is the only city which is high in terms of both sales and number of meals served. Meanwhile, a greater number of people are eating out in smaller cities — in states like Michigan, Illinois, California, Colorado, and Tennessee.

We’ve also noted that a majority of the 2017 restaurants have cut year after year, appearing on the list since it was first published in 2014. Tao Asian Bistro, Joe’s Stone Crab, Old Ebbiott Grill, Carmine’s and Tao Downtown have consistently maintained their place in the top 10 rankings.

Sales for the top 100 highest-grossing independent restaurants in the US are growing roughly at the same pace as the restaurant market (their CAGR was 6.1% for ‘13-’16, while sales for Food Away From Home had an 6.2% CAGR). However, growth is decelerating due to softening average check and traffic growth.

There is no apparent trend in terms of average check size of the top 10 restaurants. We did, however, note a sharp spike for half of the restaurants listed between 2015 and 2016, and we also noted that Tao Downtown witnessed a 26% jump in average check amount between 2015 and 2017.

The New Players & Those That Didn’t Make the Cut

Among the top 100 independent restaurants are five establishments that are less than 18 months old. In total, 12 new restaurants made the list in 2017. Newbies included: Aria Cafe, the largest 24-hour cafe in Las Vegas, which served 767,000 meals last year alone; Orlando restaurant The Boathouse, which boasts more than $15 million in annual sales; and San Francisco’s Franciscan Crab, a Fisherman’s Wharf mainstay since 1957.

Sixty-three of the restaurants that were on the inaugural list (published in 2014) are still in the rank in 2017. But a number of independent restaurants have fallen off. Greek Islands, number 99 on the 2017 rank, fell off the list for a few years after 2014 but last year made more than $12 million in annual sales.

Among the lessons to draw from this year’s list is that “flat” is the new “up,” in many cases. With rents and labor costs rising, it’s never easy to be up in the restaurant industry. For those on the list, the key was to find avenues to control and reduce costs without adversely impacting the quality of the product or service.

About Aaron Allen & Associates

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion, span all 6 inhabited continents and 100+ countries, with locations totaling tens of thousands.

Other Relevant Content

Restaurant Debt Ratios

September 21, 2017 No Comments Read More »

2017 Restaurant Mergers and Acquisitions: An Update

September 21, 2017 No Comments Read More »

A Roundup of Restaurant Inventory Management Software

September 18, 2017 No Comments Read More »

U.S. Steakhouse Restaurant Sales: A Bright Spot In the Industry

September 12, 2017 No Comments Read More »