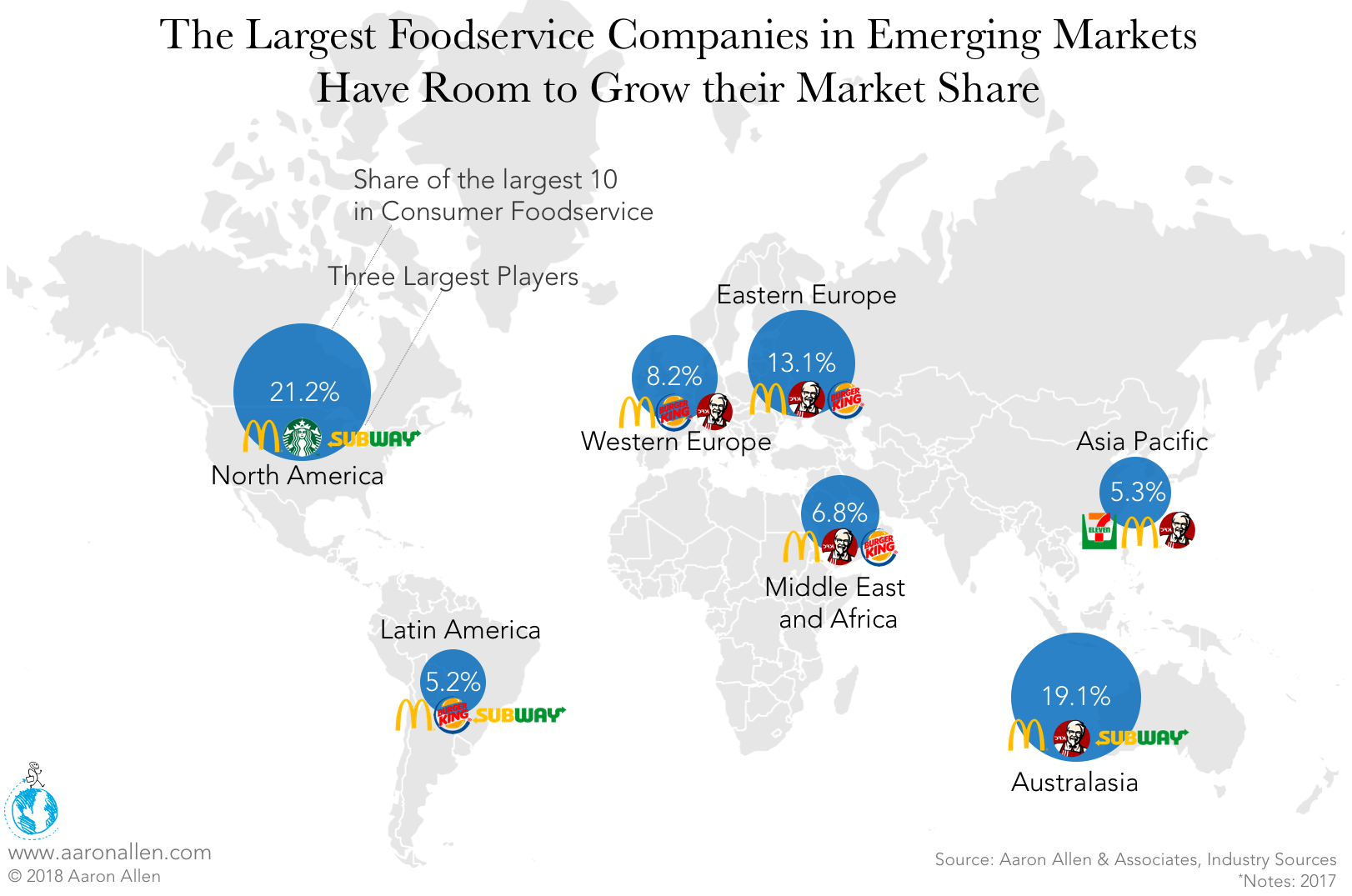

In North America, the largest 10 restaurant chains control more than one-fifth of the foodservice market, equivalent to $128.5b. Only Australasia comes close to North America. In Asia Pacific, the top 10 control just 5.3% of the market; in the Middle East and Africa, the share is slightly higher, at 6.8%.

These emerging markets offer plenty of opportunity for chains to expand and claim market share, whether they be U.S. or Canadian brands looking to create (or grow) an international footprint to complement their domestic presence or systems from other regions hoping to claim more food spend both domestically and abroad.

Foodservice technology companies can make major gains, as their marginal costs are very low. Platforms like Uber Eats have a different set of challenges than brick-and-mortar operations. While the technology is already developed, they must still translate the concepts (and the front end) for the new market, sign up local restaurants, and win market share. But, compared to restaurant chains, time to launch is shortened.

Global Restaurant Sales Projected to Increase by $500b by 2025

It’s not just relatively low consolidation levels that make these emerging markets so attractive. With growth projected at more than double what mature markets will experience and a higher percentage of GDP going to restaurants, the size of the foodservice market in these economies could grow by an additional $130b by the end of 2020.

Meanwhile, the world economy is expected to add 1.8b new consumers by 2025, close to a 25% increase from 2017. This growth could potentially add another $500b for global restaurants to share. Much of this growth will come from fast-growing emerging economies.

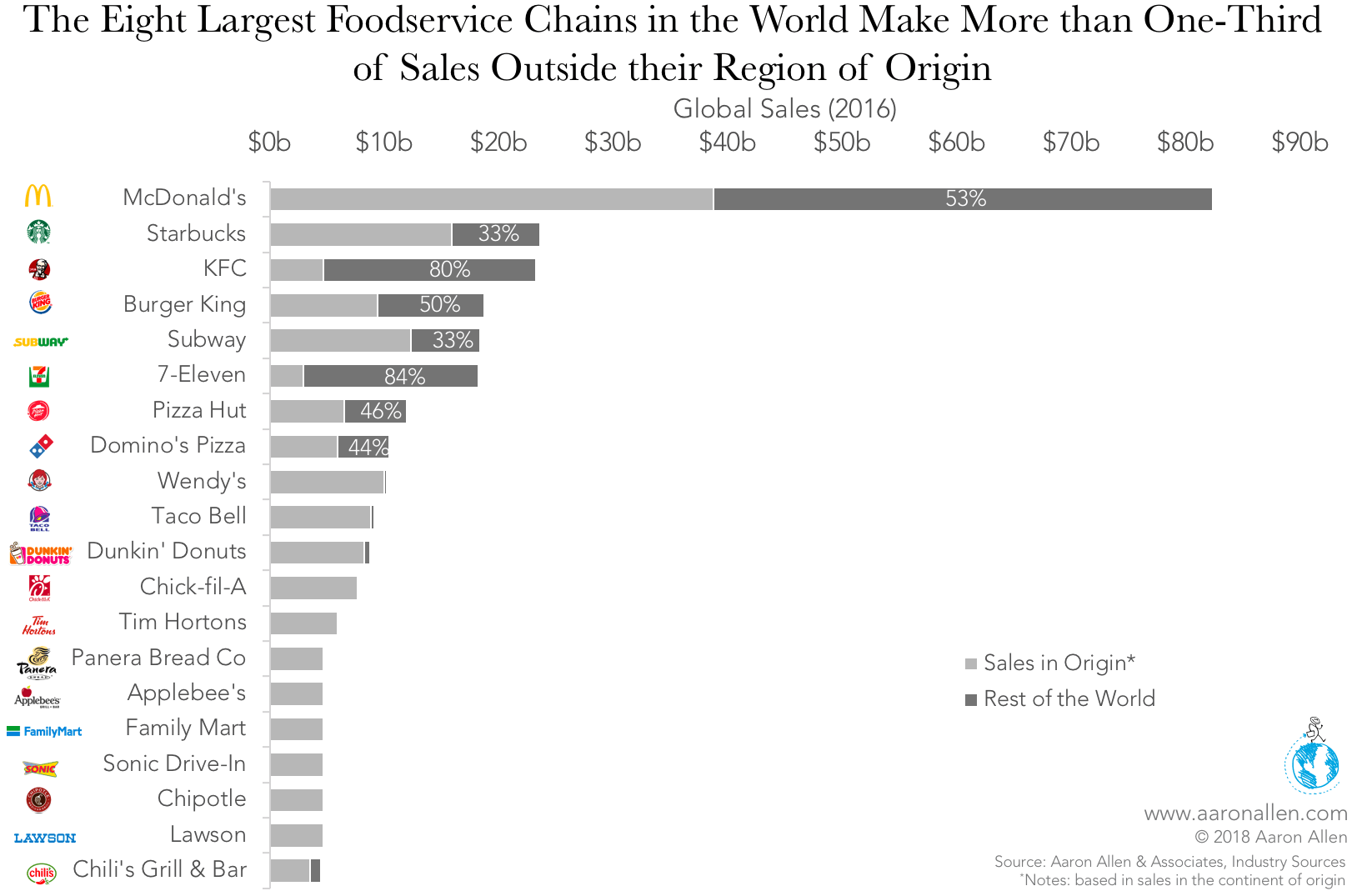

For organizations that have reached the limits of growth in domestic markets, international expansion can create new revenue streams. In fact, the eight largest foodservice operators rely on international sales for anywhere between 33% and a staggering 84% of their sales.

Successful Expansion Depends on Thorough Preparation

International expansion makes the most challenging aspects of adding new locations even more difficult. Establishing and maintaining the supply chain, QA/QC systems, and training procedures becomes harder when working across borders. This is why QSR brands have been so successful in terms of international expansion: they require relatively lower-skilled employees and can often ship necessary ingredients from a central commissary, rather than relying on local sources.

Alongside these logistical hurdles, operators must cope with the added complexity of translating their unique value proposition into a new culture, which may have radically different expectations for dining-out experiences than domestic market guests. International expansion initiatives can also run into problems including geopolitical considerations, macroeconomic conditions and forecasts, infrastructure, and local social factors.

Adopting the right strategy can ensure that a successful concept can maintain its leading position when expanding to a new market. Chains considering international expansion would benefit from asking why McDonald’s is in the top two globally while Burger King, KFC, Subway, and Starbucks fall in and out of the top three region-to-region.

Ask Better Questions to Get Better Answers

Before attempting to penetrate a new market, executive teams should seek out and be confident in their answers to questions like these:

- What are the geopolitical risks and opportunities?

- What regulations will have the most significant impact on restaurants? Have they changed recently? Are they likely to change in the future?

- What ongoing or proposed infrastructure investments could affect restaurants?

- How easy is to do business in the target market? What are the barriers for foreign investment? Any unique business burdens?

- What should we know about the economic conditions/environment? How was it before, how is it now, and what is expected to happen?

- What is the breakdown of consumer discretionary spending? How is this expected to change? What sectors are the biggest beneficiaries?

- How do consumers split their spending between food at home and food away from home? Is this ratio changing?

- How much of the economy is related to tourism?

How do commodity prices (food, utilities) compare to the domestic market? Any key ingredients increasing or decreasing in price?

- What is critical to get right in terms of the consumer, competitive proposition, cultural considerations, and business customs?

- Is population growth stable? How is the population distributed by gender, age, geographic region, and so on?

- How are factors like urbanization and immigration changing the nation’s demography?

- What emerging consumer, dining, entertainment, cultural, and lifestyle trends might influence restaurants?

- How much of the population has access to internet connection?

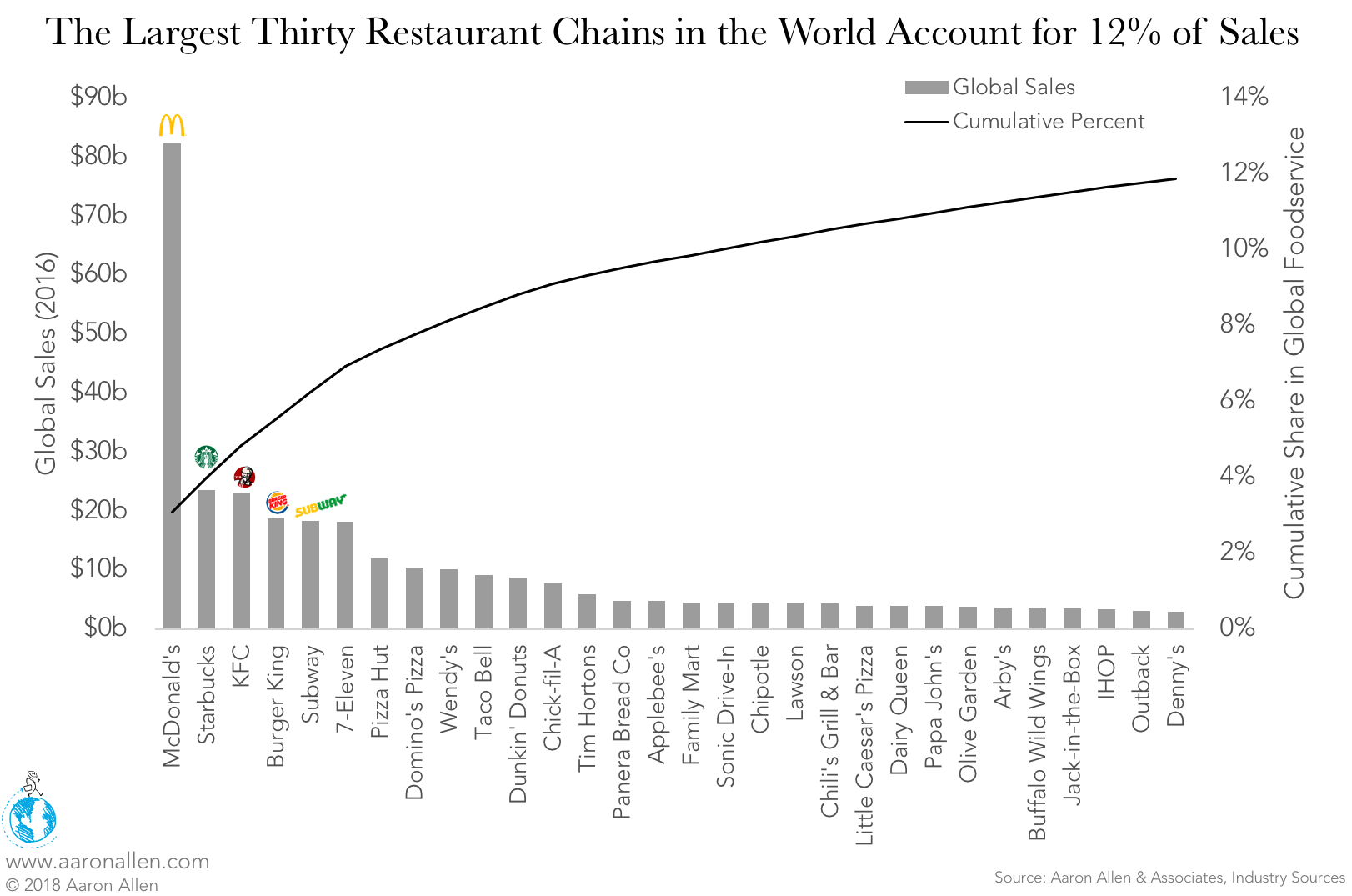

Largest Chains Claim One Tenth of Global Sales

The fact that this complexity hasn’t scared some of the most inspired foodservice leaders away from international expansion attests to its rewards.

The largest 30 chains claim 12% of all global food-away-from-home sales. Many of these concepts — including Wendy’s, Taco Bell, Dunkin’ Donuts, and convenience stores Family Mart and Lawson — don’t have large footprints in markets outside their region of origin. For these top-performing brands, international expansion could become their next initiative, as they find innovative ways to export and adapt their concepts, menu items, and systems. For concepts that haven’t yet reached this rank, going international could be the key to reaching ten figures in annual sales, especially in markets with low consolidation and saturation levels and 4.2 billion mouths to feed (80% of the world’s population live in emerging economies).

International expansion isn’t just for companies with physical footprints. All range of foodservice tech companies, manufacturers, suppliers, distributors, and investors can launch in new markets much more quickly than restaurants. Considering the incredible growth projected to take place in emerging economies, these markets could quickly become decisive in the battle for global market share.

While these companies may not face the same physical expansion challenges as restaurant chains, they must adapt to the same geopolitical and cultural differences. Market research is a key component to any international expansion plan, because it helps identify which aspects of the new market pose risks and which present opportunities.

Want to know more about where the industry, competition, consumer, and smart money are headed?

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help identify, size, and seize opportunities to drive growth, optimize performance, and enhance enterprise value. Our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business lifecycle.