Pizza technology has been one of the leading segments when it comes to the introduction of tech to restaurants. From online ordering to kitchen automation and pizza delivery with drones, innovation continues to be an essential part of the future of the pizza industry.

Technology is Helping Pizza Chains But Killing Off Independents

In 2016 we published a viral hit on the state of the industry: How Tech is Killing Off Independent Pizzerias. And it’s about more than dough, sauce, quality ingredients, and toppings that make the difference for performance. Here, we’ll take a broader view of how things are shaping up for the global pizza market and some thoughts on where it is likely to head.

A few highlights of our findings:

- In the last decade, independent pizzerias in America have lost 21 percent market share in terms of sales and 19 percent market share in terms of units to chains. Put more plainly, that’s about 7,800 restaurants that have closed-up shop (and that’s before factoring in the impact of COVID-19).

- Digital and online ordering is growing 300 percent faster than dine-in ordering (again, this means billions of dollars in the U.S. alone will shift from dine-in to delivery in the years ahead).

- The gap between independent average unit volumes (AUVs) and chain AUVs correlates almost directly to the volume of sales that chains are processing on the digital platform – about $328,500.

- America’s three (3) largest pizza chains process nearly 15 percent of all revenue via their digital platforms (this equates to roughly one-third of the total industry market share shift that has occurred in the decade since the big guys first started processing orders online).

51 percent of all mobile searches on Google are for restaurants, yet by some estimates as few as five percent of restaurants have mobile-compliant websites.

Pizza Tech Startups Pushing the Envelope

These are some of the key startups and pizza tech that are being leveraged in the industry.

Slice Pizza

The startup is trying to bring big-chain technology to independents. Domino’s get’s three-quarters of sales from online channels; for independents, this is only 20%. Slice created an app and acquired a POS company (now “Slice Register”) to create a multichannel experience and help level the playing field for independents. Slice’s total funding to date (as of February 2022) is $125m. Slice is under the umbrella of MyPizza Technologies.

Pizza Vending Machines

PizzaForno is bringing its automated pizza ovens to the U.S. The machines cook 12-inch pizzas with convection technology in about 2 minutes. The company is using licensing to expand from Canada to the U.S.

Other companies in the Pizza Vending Machine segment are: Bake Xpress Machine — a food robot that cooks pizza, bread, and sandwiches; Basil Street; and Smart Pizza doing a final cook of pre-baked pies.

Piestro Pizza Automation

The company wants to eliminate labor costs in the process of making a pizza and has designed a robot in a contained unit like a vending machine that reaches a 48% profit margin. As of February 2022, Piestro had a $12m valuation and has raised capital via crowdfunding.

Picnic Pizza Robot

Picnic automates the pizza-making process and plans to install the technology in schools, public arenas, and restaurants.

Pizza Hut Investing in Artificial Intelligence

In 2021, Yum! Brands acquired Kvantum, Tictuk, and Dragontail. Dragontail is installed in about 1,500 Pizza Hut locations to improve pizza delivery.

Domino’s Nuro Self-Driving Car

Domino’s quest for driverless pizza delivery led it to partnering with Nuro, which develops autonomous vehicles. Customers in a neighborhood in Houston, Texas, can request their pizza is delivered by R2.

Drone Pizza Delivery

Pizza Hut is also starting the journey on drone pizza delivery. Dragontail Systems is integrating drones into their AI that also manages cooking and delivery. The drones can only land in certain areas, so last-mile delivery continues to be an issue.

Are You Looking for a Pizza Franchise?

If you’re interested in buying the best pizza franchise for your market, we would love to get in touch. Our firm works with leading reputable franchisors (global and regional) who are actively seeking committed franchisee partners.

How Pizza Technology Has Fueled Growth

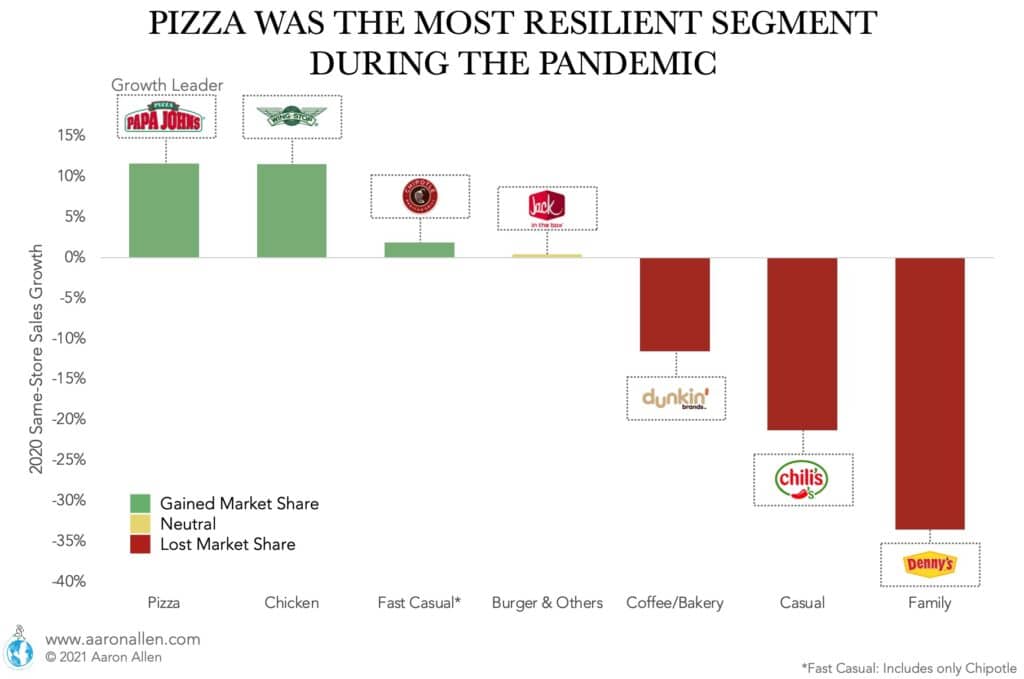

The big story over the past decade has been Domino’s pizza technology and rightly so: its turnaround was so successful, it contributed to the pizza segment’s industry-leading same-store sales (SSS) growth for much of the past 10 years and especially during COVID.

Pizza and Limited-Service Chicken were the strongest segments in the year of the pandemic. Pizza was up a median of 11.6% (considering U.S. chains with more than $1B in sales — but sales were also up for independent pizzerias). The impressive growth in digital sales and drive-thru sales (led by Domino’s years ago) is a case study for how new product and profit center innovations present an opportunity to lift average unit volumes.

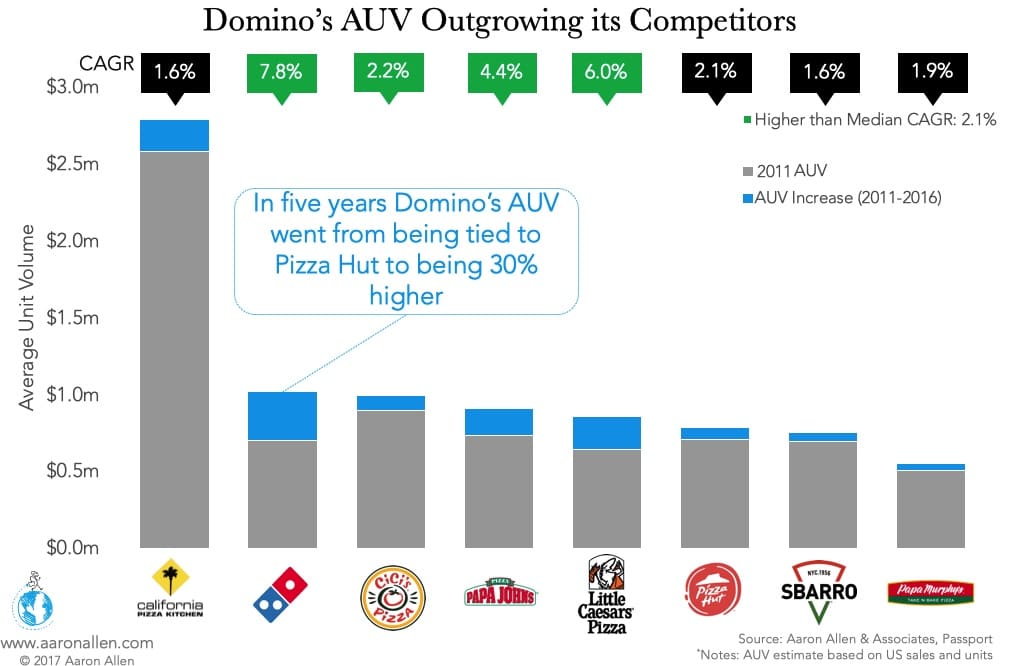

Back in 2011, Domino’s AUV was similar to that of Pizza Hut — actually, it was 1% lower. However, the product turn-around and the implementation of tech to improve convenience gained the chain such growth that Domino’s AUV is now 30% higher than that of Pizza Hut.

In 2016, sales from Domino’s digital channels were growing 13.8 times as fast as non-digital sales. Once consumers experience this greater convenience, it’s hard to go back. That force is reshaping market share, moving billions of dollars into new categories and channels. Domino‘s has fully committed to in-house digital development, investing over $100M into CAPEX in 2018 alone, which goes to both tech initiatives and central commissaries that ensure consistent quality across the heavily franchised system. In comparison, Papa John‘s and Pizza Hut are investing less than half that amount.

Public Companies that Have Embraced Technology Are Being Rewarded with Valuation Premiums

Through the 1990s and early 2000s, publicly traded pizza companies generally traded in line with their peers with enterprise value/EBITDA (EV/EBITDA) multiples in the low-double-digits and price/earnings (P/E) multiples in the high-teens. However, in the mid 2000s, pizza chains were some of the earliest players in the restaurant industry to move more aggressively to a franchised structure, with Domino’s moving to 99%, Pizza Hut going to 95%, Papa John’s moving to north of 80% (in North America). With CAPEX responsibilities shifting more to franchisees, these chains took on more debt — many moving to more than 5 times debt/EBITDA rations — and using proceeds to buy back shares (thus increasing the ownership stake of existing shareholders).

During the Great Recession of 2008–2009, this strategy worked against the publicly traded pizza chains and investors became more concerned about their high leverage positions. While the entire restaurant industry traded down amid concerns about consumer spending, pizza chains like Domino’s were hit disproportionately hard with shares trading for a few dollars per share in some cases.

Restaurant valuations recovered faster than other industries out of the 2008-2009 recession due to a combination of consumer stimulus packages, low interest rates (which allowed other restaurant franchisors to follow the pizza companies franchising and leverage playbook), and new approaches to value. By 2011, the pizza category was largely back to historical valuation multiples. However, as Domino’s and others accelerate their investment into digital ordering technologies—driving a rebound in transaction growth and franchisee returns—the market started rewarding many pizza operators with higher valuations because of their technology assets.

Instead of EV/EBITDA and P/E multiples in the low-double-digits, it was not unheard of for pizza companies to trade at EV/EBITDA multiples in the high-teens and P/E multiples greater than 30 times or more. Because pizza chains have generally remained ahead of the curve with respect to technology investments, the market has generally rewarded these chains with higher valuation premiums the past several years (especially as the coronavirus pandemic highlighted the importance of digital ordering and other delivery-focused technology assets).

The Domino’s Technology Turnaround

One of the best modern examples of tech enabling an epic foodservice company turnaround is that of Domino’s. Sure, some of the recent success stems from advantages of systemization, standardization, scalability and standard operating procedures (SOPs) — the processes, designs and training that enable rapid and profitable growth. Another element is brand recognition and awareness — with over 5,000 units and a series of tremendously successful publicity campaigns, Domino’s had an enviable platform from which to launch its turnaround.

With product improvements, a renewed and reinvigorated company culture committed to industry-leading innovations and strong leadership, Domino’s has restored its brand to one that everyone not only recognizes but has started to trust again; consumers and investors alike.

Technology was unquestionably at the heart of the Domino’s turnaround. The CEO went so far as to say, and I’m paraphrasing a bit here, ‘We don’t see ourselves as a pizza company. We’re a technology company that sells pizza.’ Domino’s put its money where its mouth is – and the results of this new mantra have grabbed enough market share to help them and a handful of other big chains to absorb an additional 11 percent of segment sales that were previously going to independents.

Domino’s pushed the limits on brand revitalization and started by acknowledging they had some problems. Between driverless vehicles and drone deliveries (at least one of which sounds like science fiction), the company made a commitment to not just to digital/social/mobile and other tech advances, they sought to instill the commitment to pursuing disruptive innovation into the company culture. It’s clear that the mandate wasn’t just to swing for the fences, but to fly a drone over it with a pizza attached.

Domino’s Top 10 Pizza Innovations

Since 2013, Domino’s stock (DPZ) has risen from $60 per share to more than $400 per share, an increase of more than 550%. Innovation, especially when it comes to cutting-edge delivery technology, has become the number one driver for a company that started with one shop in Ann Arbor, Michigan in 1960 and has grown to more than 14,000 locations in 85 countries.

More than anything, Domino’s success stems from a first-mover advantage. The company has proven time and again that it’s not afraid to introduce new innovations or take chances with its brand. If an idea doesn’t work, the chain pivots and tries something else; and when it does work, the pizza giant goes all in. Domino’s has become the leader that everyone else shadows.

Following are the top 10 innovations that have helped Domino’s grow to become America’s leading pizza chain.

Pizza Technology is Not the Only Element That Will Define the Future

For decades, restaurants grew accustomed to the notion that they were the convenient choice — stealing share from grocers and growing fat and happy in the process. In recent years, some grocers have redeemed that share and other, even more convenient options, have crept in, too. The speed and breadth of communication is such that the modern consumer has a need for instant gratification, leading to mounting pressures for restaurants to provide convenient delivery options and launch digital-ordering platforms.

For still-burgeoning concepts, success will start with defining a brand’s purpose and promise, and ensuring every touchpoint of service goes back to that purpose. Startups will be forced to confront a hard truth: Do they offer something that would put them among the top pizza news nationally, and a journalist would consider newsworthy? Even the most brilliant concept can fail, particularly if it tries to solve a problem that doesn’t exist, and lose simple truths of hospitality along the way.

As great as technology is (and as important as it will continue to be), a tech-heavy chain that doesn’t offer the most ingrained aspects of service — speed, convince, quality, etc. — won’t resonate with consumers. Even a single-location restaurant can attempt to microwave too much, too quickly, placing ego over EBITDA in the pursuit of quick success.

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims. We have helped clients with deep-dive corporate intelligence, portfolio optimization strategies, data-driven diagnostics, advanced analytics, and holistic approaches to business and brand strategy.

Our clients span six continents and 100+ countries, collectively posting more than $300b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.