The most effective restaurant CEOs take a holistic approach to running their operations: while they have a solid grasp on the most granular details, they contextualize this data within the business and its goals as a whole. Because of this unique perspective on the hospitality industry, the ideas that come up again and again among leaders give important insights into restaurant industry trends and developments.

Three topics seem to be capturing the most attention: technology, sustainability, and labor and food costs, demonstrating that executives are looking forward to a faster and better future without compromising their bottom lines.

Companies Investing in Customer-Centric Tech

Our fast-evolving era is driven by rapid and dramatic technological changes, which are having profound effects on the foodservice industry. Technology is no longer reserved for the back office, now becoming an integral part of customer-facing experiences.

Restaurant chains face ever-growing pressure to adopt mobile solutions, online ordering options, loyalty and rewards initiatives, and software that collects and analyzes the data generated by these innovations. Brands are becoming more and more digital and data-driven in efforts to enhance engagement and formulate strategies that improve service and operational efficiency.

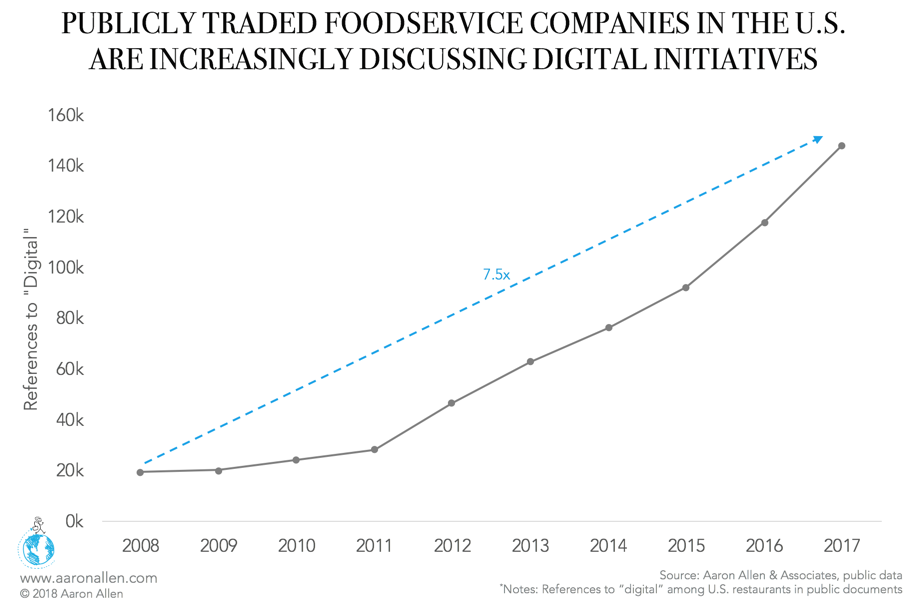

More than half of restaurant chains are expected to be focused on improving the digital customer loyalty experience, and, among public companies, discussion of digital initiatives has increased 7.5x since 2008.

Sustainability Positively Impacting Companies’ Returns and Margins

Another major discussion point among foodservice executives has been sustainability. As more consumers are making climate-conscious decisions, this will be one more component that will soon be making its way to a mandatories list. Many major U.S restaurants chains have been working to adopt more environmentally friendly processes, especially with regard to their ingredients and waste management practices.

In 2018, McDonald’s announced it was targeting two ambitious objectives by 2025. The first is to have all of its guest packaging sourced from renewable and recyclable sources. Second, it will install recycling options in all of its locations.

Midway through 2018, only 50% of the packaging is recyclable and just 10% of locations recycle. If Steve Easterbrook manages to complete these pathbreaking initiative, his company will set the tone for other global foodservice operations.

Chipotle has long embraced the ideals of sustainability and is now taking its commitment further. The company announced that it will redirect half of its waste from landfills by 2020. By that deadline, the chain has also promised to reduce the amount of food and packaging waste each location produces, to install recycling services to all its locations, and to enroll 80% of its stores in the “Harvest Program,” which donates leftovers to local communities.

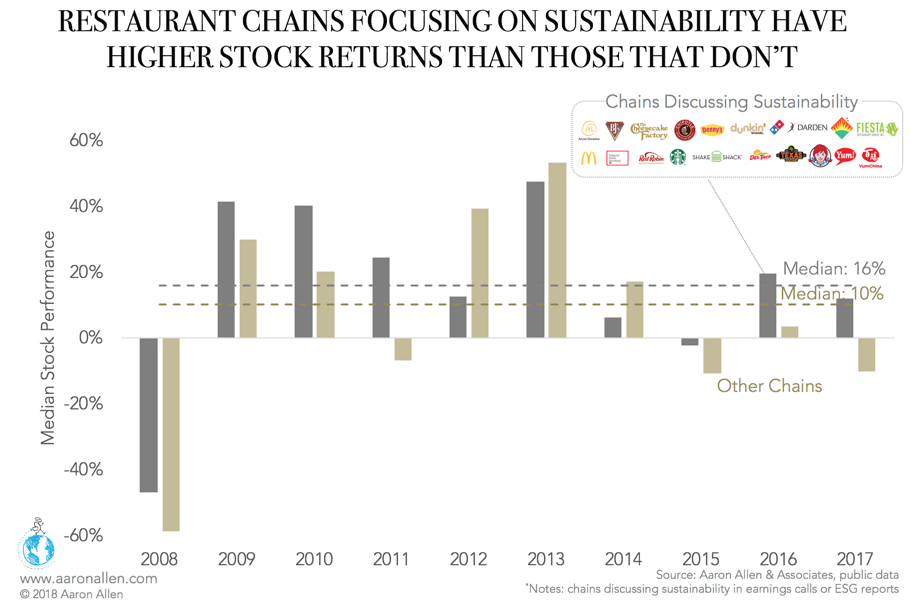

No one would dispute that these practices are great for the environment, but it may come as a surprise how good they are for business. Comparing the performance of sustainable companies against non-sustainable competitors shows that the more environmentally friendly group has consistently outperformed the rest for the past decade.

Socially responsible restaurants had an 11-year stock return of +13%, 3.5x the +4% median return for companies not engaging in socially responsible activities.

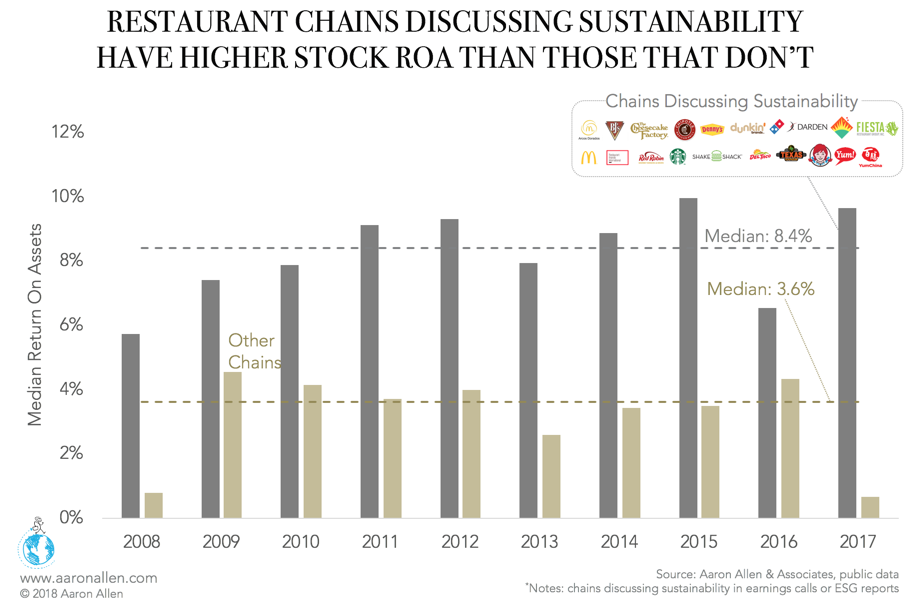

Socially responsible restaurants have also exhibited superior profitability metrics. The median return on assets and profit margin for socially responsible restaurants have consistently surpassed their less progressive counterparts every year since 2007.

The 11-year median ROA for sustainable companies is 7.9% which is twice the 3.5% median for the other group.

Wage Inflation and Fluctuating Commodity Costs Pressuring Restaurants’ Bottom Line

At the beginning of 2018, 18 states increased their minimum wages, providing about $5b in additional wages to 4.5m workers across the country. Labor cost is increasingly the highest operating cost for restaurants, and the margins in the industry are already tight. Many large chains, including Texas Roadhouse, Shake Shack, Chipotle and more, have suffered major setbacks owing to the 33% increase in wages over the last decade.

The upscale and casual-dining segments are facing another challenge in the form of rising ingredient costs.

Average wholesale food prices dipped abruptly in 2014, but since 2015, prices resumed their increase. The U.S. Producer Price Index for food wholesaling increased from 91.60 in the end of 2013 to 105.3 in 2018.

Food costs can change at a moment’s notice, driven by anything from the weather to politics. While large operations likely have contracts that lock in prices and hedge against volatility, smaller restaurants often don’t have that option in place.

No matter what leaders in your organization are discussing, there are opportunities to accelerate growth, optimize performance, mitigate risk, ensure relevance, and enhance enterprise value.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We help restaurant operators and investors make informed decisions, minimize risk, and maximize sustainable value. With experience on both the buy- and sell-sides of transactions, we have a robust understanding of trends and factors impacting restaurant chains and private equity funds around the world. We help protect, enhance, and unlock value throughout every phase of the investment lifecycle. Collectively, our clients post more than $200 billion in annual sales, span all 6 inhabited continents and 100+ countries, with tens of thousands of locations.