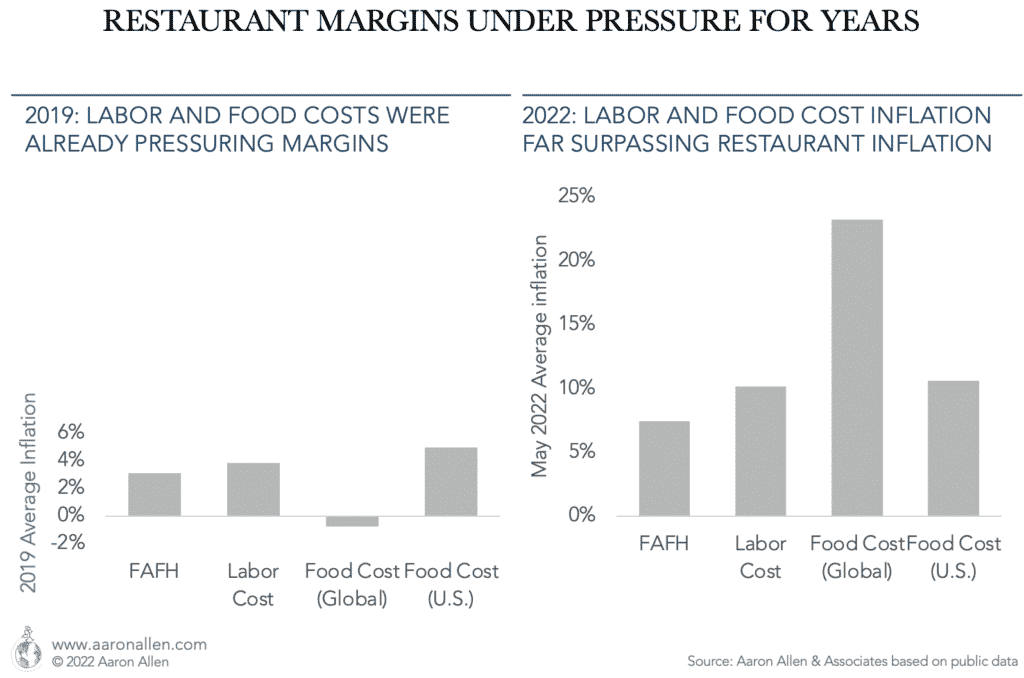

Restaurant inflation certainly been a challenge on margins over the last few years — even more so than usual. The pressure on profitability is certainly not new. Already in 2019, restaurants were not able to pass inflationary costs on to consumers (back then, the average restaurant price increase was 3.1% while labor cost was growing at 3.8% and food at 5.0%).

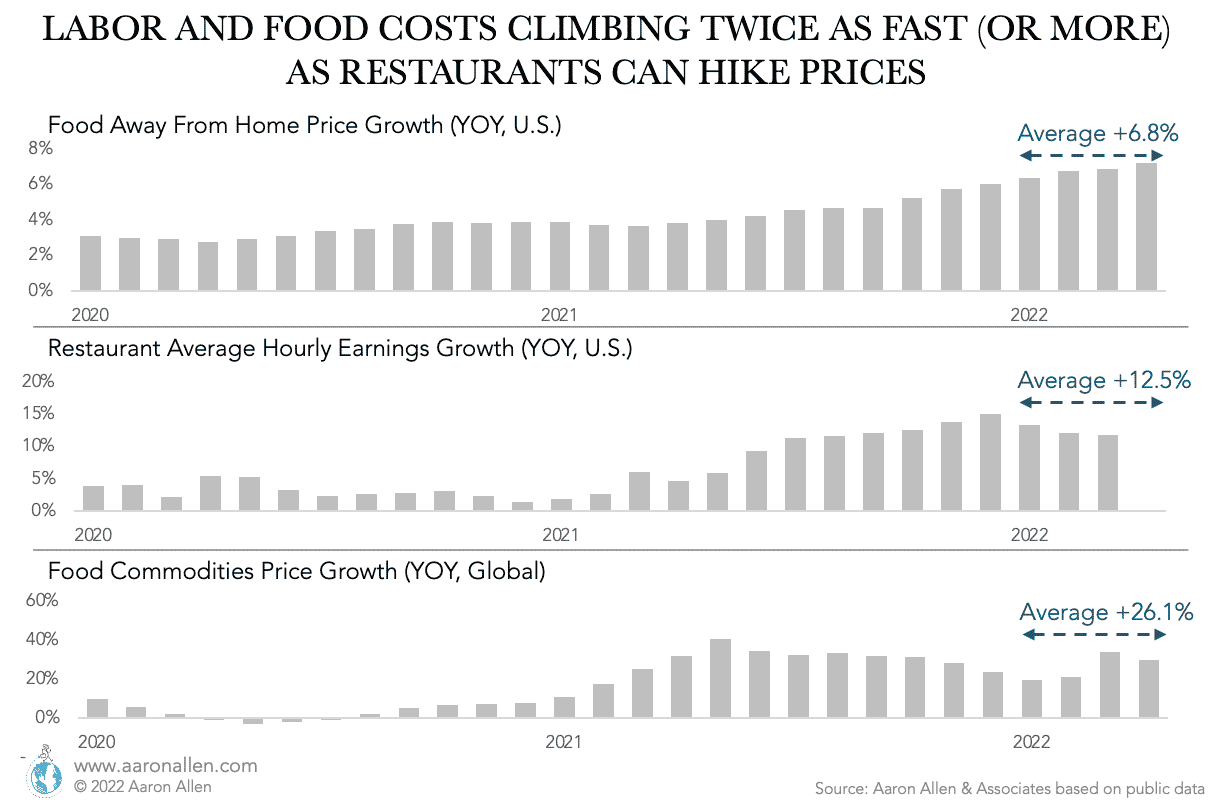

As of May 2022, the YOY growth in restaurant prices reached a record 7.4%, but labor costs grew by 10.1% and food costs by 10.6% (measured by a producer food wholesaling index). Supply chain challenges and the growth in global commodities prices do not seem to forecast a slowdown in the short term, either.

And restaurants’ labor cost increases are not going away either (in the U.S., restaurant hourly wages increased an average of 12.5% in 2022 in only four months) while restaurant inflation (menu price increases) averaged 6.8%.

The only way to work your way out of inflation is innovation.

This means investments in performance optimization, modernization strategy, delivery and drive-thru strategy, diagnostics, and more are requisite for companies to stay competitive, and profitable.

Revenue Maximization: What Ails Ails the Bottom Line Can be Cured with Top-Line Growth

It is an impossibility to simply price your way out of inflationary pressures. There are two paths to growing the top line: organic and inorganic growth. Each has its advantages.

Organic Restaurant Revenue Drivers

The lazy-man strategy of dragging all menu prices up some percentage (thereby generating restaurant inflation) to account for costs increasing is not going to solve the current inflationary trends. Food, labor, and other costs are increasing too quickly, and it’s just not possible to catch up.

There are two primary ways to grow organically: same-store sales and new openings.

Same-store sales can be grown by either increasing the number of transactions (increasing the frequency of existing guests or bringing new guests, which can be motivated by new profit centers, or even new day parts) or increasing the average check (which doesn’t have to be done by just increasing prices, it can also be done via menu engineering, with effective pricing strategies, with LTOs, and by promoting new products). Some questions that can help frame the problem of growing same-store sales far more than inflationary costs are:

- How do we leverage the menu to drive revenue and maximize profit?

- How do we reflect the brand at every touchpoint and build competitive-proof marketing strategies?

- What processes should we consider when sales are down?

- How can we improve throughput, speed of service, and drive traffic volumes?

- What geospatial insights can help explain growth variance between locations and what can we do about it?

- How do we prioritize top-line growth initiatives by format and planning horizon?

- How can we leverage culinary development to create lasting excitement and revitalize our menu?

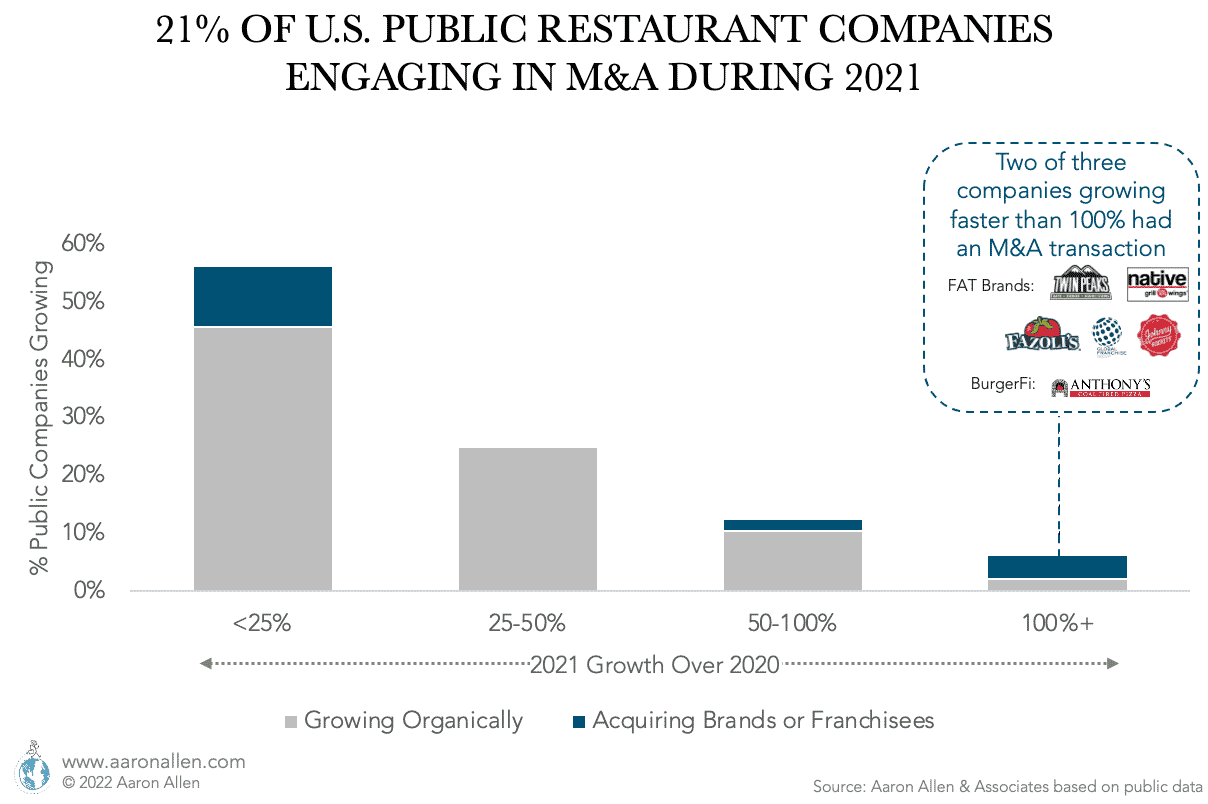

Inorganic Restaurant Revenue Drivers: Growing via M&A

In mature markets like the U.S. and Europe, it’s no secret that one of the fastest ways to grow is via acquisitions. Of publicly traded restaurants in the U.S., 21% closed deals in 2021 (including two divestitures). There were three companies growing more than 100% — two of which added brands to their portfolios. Companies growing below the 25% mark were also completing acquisitions, but some of these results will be seen in 2022 (for deals announced towards the end of 2021, like RBI’s acquisition of Firehouse Subs).

Whether looking for high-growth concepts, distressed assets, or foodservice tech investments, some questions that can help frame the opportunity for restaurant companies growing via M&A are:

- What’s the final ambition for the acquisitions?

- What markets should we get into? How do we set the M&A criteria?

- What’s the lowest risk way to approach acquisitions?

- What steps could be expedited? What steps can’t we skip to ensure a successful outcome?

Utilizing Corporate Venture Capital to Fight Restaurant Inflation

The race to improve margins while fighting inflation with modernized technology stacks has led to an increase in corporate venture capital dollars in the foodservice arena.

As an alternative to traditional M&A, some restaurant and hospitality brands are also considering this strategy — growing bolder than typical VCs and making their own bets on early-stage tech companies.

Interested in Growing Your Foodservice Enterprise?

Restaurant Cost Optimization

Cost-cutting and cost optimization are two different things. Cost optimization goes hand-in-hand with building the top line via re-engineering processes and reimagining the guest experience.

- What equipment and technology can we use to improve performance/visibility?

- How can we shift menu mix to optimize costs and improve unit-level profitability?

- What types of inventory management systems should we introduce to reduce waste?

- What training materials/standards need to be created at a unit/position level?

- How can we improve consistency, guest experience, and operational efficiency?

- Are we doing everything we can to reduce food costs?

- What kind of performance improvements can we expect from the new standards?

- How do we make it compatible so that labor cost optimization can be done while putting our people and associate engagement priorities first?

These illustrative questions are thought-starters for a thorough and holistic assessment of gap analysis that results in strategies to achieve greater control and consistency for operations performance across the system.

Challenges to the business must be overcome with fresh solutions that are more creative, innovative, bold, and inspired than the conditions that fostered them. Efforts trying solely to save costs or restaurant inflation constantly passing the bucket to the consumer, rather than investing to add sizzle to the brand and product offering, will backfire.

Innovating the Way Out of Restaurant Inflation

It’s clear that both companies and consumers agree restaurants (along with their crews, vendors, and stakeholders) should not fully shoulder the inflationary hit. Broadly speaking, consumers and non-industry types suggest they’d rather help pay the difference than have their favorite restaurant operators take it on the chin.

And, generally, industry execs agree that they can do more than ‘lazy man pricing’ increases. So investments in innovation sounds like a winner for all involved.

Innovation need not always be costly — done well, it delivers far more than the investment required (and can pay back as fast as price increases but with far more sustainability for brand value).

Some of the steps to take in the path to innovation are:

- Pressure-test the P&L to discover and define novel new improvement opportunities

- Identify opportunities in restaurant operations to impact franchisees’ P&L

- Leverage modernized methods of industrial engineering and efficiency design

- Size and prioritize improvement initiatives

- Assess the opportunity to grow via acquisitions

- Layout a logical and sequenced plan

- Consider getting help with menu innovation and culinary development

Yes, it can feel like a challenge. But, then again, so is everything worth pursuing. Knowing what it takes is one of the first steps.

About Aaron Allen & Associates

Aaron Allen & Associates is a global restaurant consultancy specializing in brand strategy, growth and expansion, and value enhancement. We have worked with a wide range of clients including multibillion-dollar chains, hotels, manufacturers, associations, and prestigious private equity firms.

We help clients imagine, articulate, and realize a compelling vision of the future, align and cascade resources, and engage and enroll shareholders and stakeholders alike to develop multi-year roadmaps that bridge the gap between current-state conditions and future-state ambitions. Learn More.

You May Also Like …

Restaurant P&L: It’s Time to Improve Your Margins

Every restaurant bleeds — it’s simply a question of where and how much. Just as banks and governments occasionally conduct stress tests to model scenarios

15 Super Helpful How-To Articles for the Restaurant CEO

We’ve worked with executive leadership teams of some of the most successful established and emerging foodservice and hospitality companies around the world, supporting with strategic

How to Reverse Margin Erosion with Menu Engineering

Margins are being compressed for restaurants and foodservice operators around the world. Nearly every geography, cuisine, and operating model is being hit with increased costs